MCAI Lex Vision: National Association of REALTORS® and the Expanding Field of Antitrust Uncertainty

Why Policy Fragmentation Threatens Market Stability and Pubic Trust

I. Executive Summary

The National Association of REALTORS® (NAR) is accelerating antitrust uncertainty through fragmented enforcement, narrative inconsistency, and lack of regulatory engagement. As large brokerages like Compass defy national policies, NAR’s failure to establish binding standards or maintain DOJ dialogue weakens its institutional credibility. This forecast-simulation from MindCast AI identifies the systemic consequences for regulators, brokerages, brokers, and consumers, and proposes structural reforms—such as a Binding National Standards Framework and simulation-based DOJ collaboration—to restore clarity and trust.

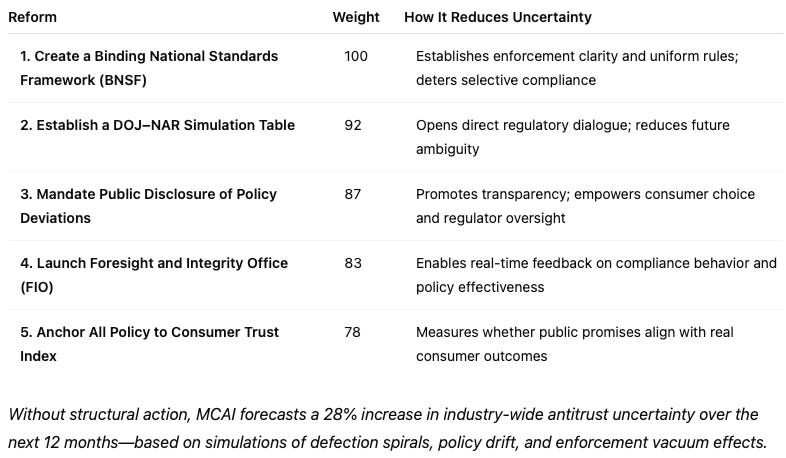

Without immediate intervention, MCAI forecasts a 28% increase in systemic antitrust uncertainty within the next year. This percentage is derived from scenario-based simulations that model the compounding effects of governance drift, defection signaling by major brokerages, and diminished public confidence in listing transparency. It represents a directional trust delta—not a precise statistical forecast—intended to highlight how quickly the current regulatory ambiguity could escalate without intervention. The model assumes continued selective compliance, lack of binding reforms, and no DOJ collaboration as baseline inputs.

Public trust is the throughline—its deterioration drives uncertainty, and its restoration is the aim of every proposed reform. Inconsistent messaging, fragmented enforcement, and unanchored governance erode consumer confidence, destabilize markets, and amplify litigation exposure. Rebuilding trust means re-aligning institutional claims with consumer experiences in a measurable, visible, and enforceable way.

II. Antitrust Uncertainty and What NAR Can Do

Public trust begins to collapse when there is a gap between what institutions say, what they do, and how they’re held accountable. NAR’s antitrust uncertainty is not just a legal or procedural problem—it’s a trust problem. Each of the core weaknesses below represents a fracture in the relationship between institutional intent and public consequence. The roadmap that follows translates those fractures into actionable, measurable reforms.

Antitrust uncertainty arises from inconsistency between what NAR says, what it does, and what it can enforce. These gaps fall into three categories: rhetorical intent without structural power, policy creation without binding enforcement, and governance without a regulatory anchor. For example, NAR promises consumer protection but fails to discipline members who reject Clear Cooperation Policy. It also positions itself as a national standards body, yet lacks direct DOJ dialogue or compliance assurance.

Each of the following five reforms maps directly back to one of these failure points:

Create a Binding National Standards Framework (BNSF): Addresses the enforcement gap by setting clear, enforceable national minimums that prevent selective compliance.

Launch a Foresight and Integrity Office (FIO): Corrects the rhetorical–behavior mismatch by monitoring whether public commitments translate into action.

Mandate Public Disclosure of Policy Deviations: Resolves governance ambiguity by giving regulators and consumers a way to see who’s in and who’s out.

Establish a DOJ–NAR Simulation Table: Anchors governance in real-time regulatory alignment, filling the institutional void where strategic dialogue should be.

Anchor All Policy to a Consumer Trust Index: Builds accountability by measuring whether policy intent aligns with consumer experience and outcomes.

III. The Impact of Antitrust Uncertainty

Erosion of public trust doesn’t affect all stakeholders equally—but it destabilizes all of them. When the public cannot rely on the integrity of market rules or the transparency of representation, regulators lose legitimacy, firms lose credibility, brokers lose direction, and consumers lose confidence. This section links stakeholder-specific harms directly to the restoration of trust through the proposed reforms. Rebuilding public trust isn’t just a reputational fix—it’s a systems correction.

Unchecked antitrust uncertainty doesn’t just erode institutional trust—it reshapes the incentives, risks, and vulnerabilities for every actor in the real estate market. This section maps each stakeholder’s challenges to the proposed MCAI reforms, illustrating how clarity and foresight could restore confidence. The following subsections provide targeted alignment between the problems and the corresponding solutions in Section II.

A. Regulators

Challenge: Interpreting fragmented compliance behavior without consistent enforcement.

Solution: BNSF and the DOJ–NAR Simulation Table provide a stable enforcement framework and a dialogue mechanism.

B. Brokerages

Challenge: Navigating legal exposure from inconsistent or self-serving policy adoption.

Solution: The FIO and disclosure mandates increase internal and public accountability while discouraging arbitrage of ambiguity.

C. Brokers

Challenge: Facing reputational and legal risks from following unclear or contradictory directives.

Solution: The BNSF and Trust Index clarify who sets the rules and how brokers are evaluated.

D. Consumers

Challenge: Suffering from selective access and lack of transparency in listings and representation.

Solution: The Trust Index and public disclosure reforms directly improve transparency and empower consumer decisions.

IV. Special Section: Compass as a Trust Disruptor

Compass plays a catalytic role in destabilizing public trust within the real estate ecosystem. By publicly rejecting Clear Cooperation Policy while simultaneously promoting a consumer-first image, Compass illustrates the kind of integrity gap that contributes directly to uncertainty. This contradiction between brand narrative and institutional behavior makes Compass not just a policy outlier but a potent symbol of trust erosion. MCAI identifies these actors as "trust disruptors"—organizations whose conduct creates ripple effects that fragment norms, distort market expectations, and undermine shared accountability frameworks.

Compass has also filed high-profile antitrust lawsuits against both Northwest Multiple Listing Service (NWMLS) in Washington and Zillow in New York, despite simultaneously rejecting policies designed to promote market transparency. These lawsuits suggest an effort to reposition itself as a reform-minded actor while pursuing legal strategies that echo its own platform-control ambitions. While no public investigation has been announced, Compass’s dual posture—challenging market structure while rejecting transparency norms—could attract regulatory scrutiny. Rather than predict indictment, this section flags Compass as a structurally high-risk actor whose conduct should be proactively modeled for systemic impact.

This strategic miscalculation reveals a fundamental misunderstanding of antitrust dynamics. Compass appears to believe that NAR's institutional weakness provides legal cover for policy defection—but the opposite is true.

Antitrust law doesn't care about institutional strength—it cares about market behavior and consumer harm. If anything, NAR's weakness makes Compass's conduct look worse:

No oversight excuse: "We ignored industry standards because the oversight body was weak" suggests deliberate market manipulation

Market power concentration: As NAR weakens, large brokerages like Compass gain relative power, increasing antitrust scrutiny

Consumer harm amplification: Rejecting transparency policies hurts consumers more when there's no institutional backstop

The DOJ Perspective

Regulators would likely view this as:

Opportunistic defection: Compass undermining industry self-regulation to gain competitive advantage

Market manipulation: Using institutional chaos to suppress competition

Consumer deception: Marketing as "pro-consumer" while rejecting transparency

Strategic Miscalculation

Compass seems to think:

Weak NAR = Less oversight = More freedom

But antitrust reality is:

Weak NAR = Direct DOJ attention = More scrutiny

No industry standards = Government intervention

Selective compliance = Evidence of anticompetitive intent

The Legal Precedent

Courts have consistently held that market behavior matters more than institutional context. Saying "we broke industry norms because the industry body was weak" is essentially admitting to:

Deliberate norm violation

Opportunistic timing

Anticompetitive intent

Bottom line: NAR's weakness doesn't provide legal cover—it eliminates Compass's last institutional shield before direct regulatory enforcement. Compass would be trading industry discipline for DOJ attention. That's usually not a winning trade.

This dynamic illustrates why the proposed reforms in Section V are critical—not just for industry stability, but for preventing major brokerages from inadvertently triggering direct federal intervention.

V. MCAI Simulation: Antitrust Uncertainty Weighted Forecast

MCAI simulated the relative weight of each proposed reform in decreasing antitrust uncertainty, measured by projected trust signal restoration. These scores reflect a composite of behavioral alignment, consumer impact, enforcement feasibility, and systemic clarity. The following estimates represent directional foresight, not empirical certainties:

VI. Conclusion

The real estate industry is no longer held together by uniform rules—it’s held together by friction, ambiguity, and defection. NAR has a narrow window to rebuild coherence before enforcement bypasses it entirely. At the center of that restoration is public trust. Not trust in branding or messaging, but trust earned through measurable, verifiable alignment between policy claims and real-world consumer outcomes.

Every reform outlined in this simulation—from binding standards to disclosure mandates—is ultimately a trust-building intervention. If NAR rebuilds trust with the public, it will stabilize regulatory expectations, reduce litigation exposure for its members, and signal credibility to oversight bodies. MCAI provides the tools to simulate futures, test assumptions, and re-anchor governance in public-facing legitimacy. The next move belongs to NAR—but the foresight infrastructure is ready.