MCAI Lex Vision: Antitrust Enforcement at a Crossroads

Political Influence, DOJ Integrity, and the Foresight Gap

Executive Summary

Antitrust enforcement depends on trust in process. The Department of Justice’s sudden reversal on Hewlett-Packard Enterprise’s $14 billion merger with Juniper Networks now stands as a case study in politicization. The DOJ moved from litigation to settlement eleven days before trial, sidelining career officials and offering a divestiture remedy disconnected from the competitive concerns it had raised only months earlier.

Senators, state attorneys general, and former DOJ leaders have all sounded alarms. They argue that political access and partisan influence replaced transparent process. The Tunney Act’s safeguard of judicial review is now in question.

MindCast AI’s predictive cognitive simulations show that once institutions treat enforcement as political rather than legal, markets reorganize around access, not competition. That shift undermines innovation, corrodes institutional credibility, and signals to global rivals that U.S. competition law can be bent by influence.

Contact mcai@mindcast-ai.com to partner with us on antitrust law and economics.

I. The Immediate Signal

On January 30, 2025, the DOJ’s Antitrust Division sued to block the HPE–Juniper deal, arguing it would create a duopoly controlling over 70% of the enterprise-grade WLAN market. For months, career lawyers and economists prepared for trial.

Then, on June 28 — eleven days before the scheduled court date — the Department reversed course. Instead of litigating, it announced a settlement requiring HPE to divest a minor small-business WLAN unit, an asset irrelevant to the original competitive concerns.

The reversal raised immediate red flags:

Senate Judiciary Democrats led by Senators Dick Durbin and Cory Booker demanded answers from Attorney General Pam Bondi, citing politicization of enforcement.

Twenty Democratic state attorneys general, led by Colorado AG Phil Weiser, urged a Tunney Act hearing, warning that the settlement looked like a back-room deal.

Former Principal Deputy AAG Roger Alford alleged that the Antitrust Division had been compromised by “pay-to-play” lobbying, naming political operatives who influenced the decision.

Coverage spread across TicketNews, Reuters, Vox, Newsweek, and local outlets. The narrative converged: political influence had reshaped antitrust enforcement.

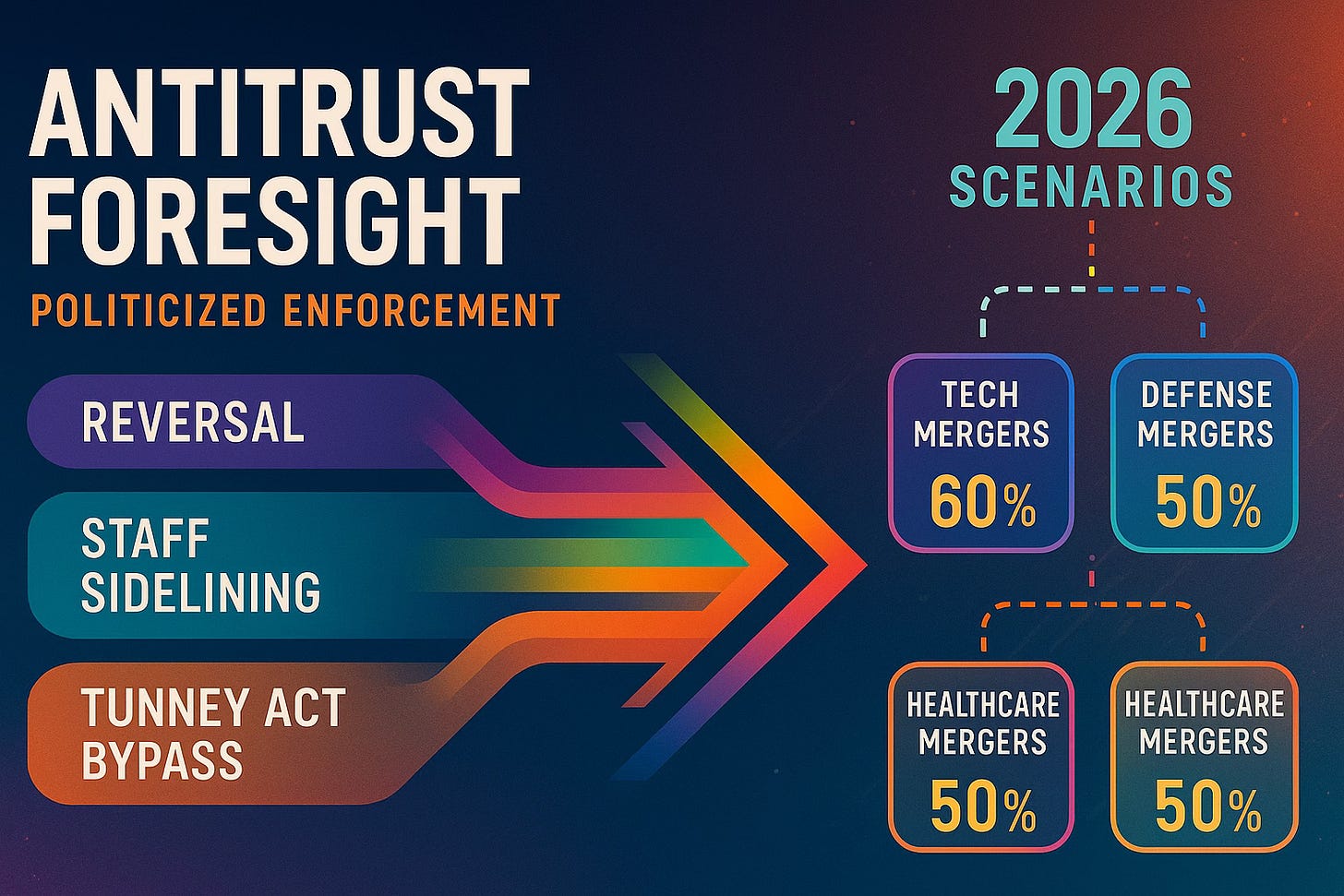

II. The Pattern MCAI Detects

MindCast AI evaluates not just single cases but systemic signals. The Hewlett-Packard–Juniper reversal fits a recurring “coordination by capture” sequence:

Abrupt Reversal

– Enforcement posture flips at the eleventh hour, with no transparent economic rationale.Staff Sidelining

– Career officials who opposed the settlement (including Gail Slater, Roger Alford, Bill Rinner) were reassigned or removed from decision loops.Process Bypass

– The Tunney Act’s disclosure and judicial review, designed to ensure transparency, risk being reduced to a rubber stamp.

These markers are not random. They form a playbook: litigate to signal toughness, then reverse under political pressure once lobbying channels mature. The net effect is a merger approval process that rewards access, not analysis.

III. Why the Stakes Extend Beyond One Merger

The risk is not simply a flawed settlement. The deeper consequence is how markets adapt to signals.

Market Distortion

Companies will model lobbying as a higher-yield strategy than innovation. If enforcement can be purchased, capital shifts from R&D to political expenditure.Institutional Trust Decay

Courts, regulators, and the public lose confidence that enforcement decisions reflect economic law. Once credibility erodes, even sound actions are discounted as political.Global Competitive Cost

Foreign governments gain leverage. If U.S. antitrust is perceived as politicized, allies and rivals can discount its rulings or weaponize inconsistency in trade negotiations.

MindCast AI’s foresight models show that these costs scale faster than the apparent benefit of a single merger settlement. A compromised process today creates recursive adaptation tomorrow — every firm and every regulator recalibrates behavior around capture.

IV. Distrust as a Systemic Signal

In Distrust as a Structural Signal in Corporate–Nation Governance (MindCast AI, May 2025), MindCast AI argued that once institutional trust erodes, actors pivot from compliance to narrative and influence strategies. The Hewlett-Packard–Juniper reversal fits this foresight model precisely.

The DOJ’s abrupt reversal signals to markets that political access may matter more than evidence.

Sidelining of career staff mirrors the institutional fracture lines predicted in the Distrust FSIM.

The Tunney Act’s potential weakening exemplifies how formal safeguards lose credibility when actors expect them to be bypassed.

This event is therefore not just a legal irregularity but a trust rupture in U.S. antitrust enforcement. MCAI foresight projected such ruptures would migrate from corporate litigation (e.g., multi-forum manipulation) to regulatory enforcement, reshaping the strategic environment for both firms and institutions.

V. The Foresight Imperative

The issue is not whether the HPE–Juniper merger should be approved. Reasonable minds can differ on market structure. The issue is how decisions are made.

The Tunney Act was enacted to prevent precisely this kind of opaque settlement. It requires courts to review antitrust consent decrees to ensure they serve the public interest. If courts treat that review as perfunctory, the statute’s safeguard collapses.

For foresight purposes, the Hewlett-Packard reversal is a stress test:

Can judicial review force disclosure of political influence?

Can Congress and state AGs restore transparency in process?

Can DOJ rebuild trust by showing that settlements reflect competitive reality, not lobbying power?

MindCast AI’s analysis suggests that without intervention, enforcement credibility may degrade into a two-tiered system: adversarial litigation for weaker firms, negotiated access for the politically connected.

VI. From Courtroom to Enforcement: The Same Capture Pattern

Earlier this year, MindCast AI published Complex Litigation: How Multi-Forum Campaigns Game Judicial Process(MindCast AI, Apr 2025). That foresight simulation showed how corporate actors bend litigation procedure through three moves:

Venue Fragmentation — scattering claims to dilute oversight.

Evidence Suppression — constraining factual record to shape judicial outcomes.

Sequential Escalation — leveraging partial victories to normalize structural advantage.

The Hewlett-Packard–Juniper merger controversy reveals the same architecture, but in a different domain: enforcement capture rather than litigation capture.

Venue Fragmentation finds its parallel in staff sidelining: career DOJ officials removed from the decision loop.

Evidence Suppression echoes in the Tunney Act bypass: a consent decree structured to avoid substantive scrutiny of the original economic record.

Sequential Escalation manifests in the abrupt reversal: litigation initiated, then abandoned to create a precedent of “settlement through access.”

This continuity matters. It demonstrates that what appears as isolated controversy is actually the migration of a capture playbook across institutional boundaries. First courts, now regulators. Tomorrow, other oversight agencies.

MindCast AI’s foresight framework predicted this migration: once coordination signals succeed in one arena, they replicate in adjacent forums. The DOJ reversal is not a surprise. It is the next move in a structural sequence already modeled.

VII. What Needs to Happen Next

Judicial Scrutiny

– Courts must exercise full Tunney Act review, requiring disclosure of internal deliberations and lobbyist influence.Legislative Oversight

– Congress should demand testimony from sidelined DOJ officials and require sworn answers from political appointees.Process Anchoring

– DOJ must recommit to transparent, economically grounded remedies, not symbolic divestitures.

These steps are not about punishing one merger. They are about re-anchoring the rule of law in competition enforcement.

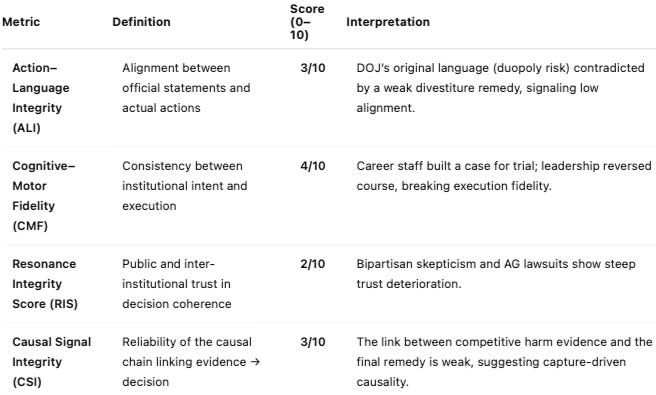

VIII. Foresight Metrics: DOJ–HPE Reversal

MindCast AI applies its integrity metrics to assess the structural signals of the DOJ’s decision:

Foresight Outlook: With an average integrity signal in the 3/10 range, MCAI projects that absent corrective action, similar reversals will be attempted in at least two additional high-stakes tech or infrastructure mergers by 2026. The credibility of the Tunney Act review process itself is the next institutional variable under stress.

IX. Antitrust Foresight: 2026 Scenarios

MindCast AI extends the analysis beyond the Hewlett-Packard–Juniper case to model likely pathways in upcoming enforcement battles. Three domains stand out for 2026:

Technology – MCAI projects at least two major attempted consolidations among cloud infrastructure or semiconductor firms. If the DOJ’s reversal holds as precedent, political lobbying will become the decisive variable in whether these mergers clear, reducing the weight of competitive analysis.

Defense and National Security – With increased geopolitical tension, defense contractors may test whether political necessity can override antitrust concerns. MCAI foresight signals a high likelihood of at least one defense-sector merger framed as a national security imperative, forcing courts to weigh competition law against executive discretion.

Healthcare and Pharma – Escalating healthcare costs make this sector ripe for consolidation. MCAI predicts attempts at horizontal mergers among insurers and hospital systems, where the precedent of regulatory leniency could embolden aggressive strategies.

Projected Outcome Bands:

High risk (60–70%): Repeat of “coordination by capture” playbook in tech/defense mergers.

Medium risk (40–50%): Tunney Act review diluted, courts accept weak remedies.

Low but rising risk (25–30%): Spillover of politicized enforcement into financial regulation or energy markets.

X. Conclusion

The Hewlett-Packard–Juniper case is not an isolated controversy. It is a warning flare. Political influence in antitrust enforcement corrodes markets, institutions, and trust.

MindCast AI’s foresight models show how quickly such patterns metastasize: once enforcement credibility is compromised, every actor — from corporations to courts to consumers — recalibrates behavior around capture.

The future of antitrust depends not on who wins a single merger dispute, but on whether enforcement remains a transparent, law-anchored process. If political convenience becomes precedent, the loss will be larger than any one deal: it will be the erosion of institutional foresight itself.

References

TicketNews (2025). Senators, AGs Sound Alarm Over Political Influence in DOJ Antitrust Enforcement. Published September 9, 2025. https://www.ticketnews.com/2025/09/senators-ags-sound-alarm-over-political-influence-in-doj-antitrust-enforcement/

Office of U.S. Senator Dick Durbin (2025). Durbin, Booker Lead Judiciary Democrats in a Letter to Attorney General Bondi on Politicization of Antitrust Enforcement Activity at DOJ. Press release, September 5, 2025. https://www.durbin.senate.gov/newsroom/press-releases/durbin-booker-lead-judiciary-democrats-in-a-letter-to-attorney-general-bondi-on-politicization-of-antitrust-enforcement-activity-at-doj

MindCast AI (2025). Complex Litigation: How Multi-Forum Campaigns Game Judicial Process. Published April 2025. https://www.mindcast-ai.com/p/complexlit

MindCast AI (2025). Distrust as a Structural Signal in Corporate–Nation Governance. Published May 2025. https://www.mindcast-ai.com/p/distrustcng