MCAI Investor Vision: Capital Is the New Computing

Financing the Next Era of AI Infrastructure, 2025–2045

Executive Summary

Artificial Intelligence no longer expands at the speed of innovation—it expands at the speed of capital. Every megawatt of computing now depends on how quickly financing can be mobilized, recycled, and trusted. The same way energy permanence sustains hyperscale AI, capital permanence will determine who leads the next decade of infrastructure growth.

MindCast AI’s foresight simulations reveal a structural shift: capital has become a technical input to infrastructure, as essential as steel or power. The capacity to deploy, recycle, and trust capital now determines how far intelligence can scale.

Capital has transformed from a supporting element into the principal lever of AI infrastructure growth. When Microsoft announces 835 MW nuclear PPAs or Amazon secures 1.92 GW from Susquehanna, the financial architecture required to secure, insure, and syndicate those commitments is as complex as the engineering itself. Traditional project finance—designed for stable, government-backed infrastructure—cannot move at AI’s exponential pace. This mismatch creates both the constraint and the opportunity.

MindCast AI’s modeling extends beyond institutional behavior to quantify direct financial effects. Projects scoring 0.75+ on coherence metrics achieve 35–55 basis point reductions in bond spreads, close financing 40–60% faster, and complete 20–30% more reliably than peers. This transforms trust from reputation risk into measurable alpha—turning integrity into pricing efficiency and delivery certainty.

MindCast AI developed this publication as a full foresight simulation built on its proprietary Cognitive Digital Twin (CDT) framework. The system created digital twins of investors, data centers, utilities, innovation ecosystems and regulatory ecosystems to simulate their behavior under future energy, capital, and policy constraints. These models replicate how financial decisions interact with infrastructure deployment, producing quantitative foresight on where capital, energy, and trust will converge through 2045.

Contact mcai@mindcast-ai.com to partner with us on AI investment foresight simulations.

I. Why Capital Has Become Infrastructure

The digital economy faces an inflection point where financial architecture dictates technological possibility. As AI workloads multiply, data centers no longer expand according to technological limits alone. Instead, financial readiness—who can raise, deploy, and sustain capital—defines the new threshold of scale.

The global AI data center economy is entering a phase of super-scaling. By 2030, the world must invest $6.7 trillion in new capacity—$5.2 trillion tied directly to AI workloads. Power, fiber, and cooling remain physical bottlenecks, but projects now stall earlier: at the financing stage. Utilities demand upfront commitments; communities demand green bonds; developers need multi-phase liquidity. Capital is the gating variable of computing.

Yet capital intensity alone doesn’t explain the constraint. Hyperscalers have proven they can secure massive power commitments—Microsoft’s 20-year nuclear PPA, Amazon’s 1.92 GW agreements. The bottleneck emerges in three specific friction points:

Speed Mismatch: Traditional project finance operates on 18-36 month cycles. AI infrastructure demands 6-12 month deployment. When financing lags engineering readiness, capacity remains stranded.

Scale Mismatch: Individual projects now exceed $5-10B, surpassing traditional underwriting limits. Syndicating this scale across institutional investors requires new coordination mechanisms.

Duration Mismatch: AI infrastructure operates on 20+ year horizons. Standard commercial real estate financing (5-10 year terms) creates refinancing risk that undermines long-term planning.

In foresight terms, financing has become a governor of intelligence growth. Without ready capital, power cannot be secured, equipment cannot be ordered, and computing cannot expand. The hierarchy has inverted: money now determines physics. This inversion marks a paradigm shift: investment cycles, not chip cycles, will dictate who wins the infrastructure race.

II. Findings from the MindCast AI Research Library

Over the past year, MindCast AI has built a comprehensive foresight library exploring how energy, capital, and trust interact to shape AI’s future. The following studies provide the analytical foundation for this Vision Statement:

The Bottleneck Hierarchy in U.S. AI Data Centers (Aug 2025) — Defined energy, networking, and cooling as the three structural constraints of AI growth, establishing that competitive advantage flows not from GPU ownership but from coordinated mastery across infrastructure layers. This study revealed that projects stall when any single constraint binds, creating the foundation for understanding capital as the meta-constraint.

VRFB’s Role in AI Energy Infrastructure (Aug 2025) — Introduced the concept of energy permanence, showing how vanadium-flow batteries align with AI’s 20-year horizon. This principle directly informs capital permanence: just as VRFBs convert intermittent renewables into reliable power, long-duration financial instruments convert volatile capital markets into steady infrastructure funding.

AI Datacenter Edge Computing (Sept 2025) — Predicted that 25–60% of inference workloads would migrate to distributed “edge” nodes, establishing the logic for capital mobility and geographic liquidity. Edge deployment requires financing structures that can replicate across hundreds of sites—demanding standardized capital architectures.

NVIDIA’s Moat vs. Infrastructure-Customized Competitors (Aug 2025) — Demonstrated that infrastructure bottlenecks erode hardware monopolies, confirming infrastructure as the next locus of competitive advantage. When grid capacity constrains GPU deployment, financial agility becomes more valuable than chip access.

Predictive Cognitive AI and the AI Infrastructure Ecosystem (Oct 2025) — Validated MindCast AI’s simulation methodology for mapping constraint cascades across energy, capital, and policy. This study established the coherence metrics ALI/CMF/RIS/CSI* now applied to measure capital deployment quality.

MCAI Investor Vision Series (Apr–Sept 2025) — Established trust and foresight integrity as the key differentiators of institutional reliability. These studies demonstrated that clarity under pressure (ALI) and execution consistency (CMF) predict institutional resilience—metrics now applied to infrastructure capital allocation.

Collectively, these studies converge on a single structural insight: the physics of AI growth are inseparable from the flow of capital. Energy scarcity creates financing urgency. Edge distribution demands capital mobility. Infrastructure bottlenecks reward financial agility. Trust deficits freeze deployment. Energy, finance, and foresight now operate as one system, each reinforcing the other’s continuity and stability.

*Action Language Integrity (ALI) Measures whether words and actions align. It evaluates the coherence between stated intent (policy, strategy, or communication) and the actual behavior or capital deployment of an institution or system. Cognitive Motor Fidelity (CMF) Measures execution precision. It assesses how faithfully strategic intent translates into operational action—essentially, how well the “motor system” of an organization performs what its “cognitive” layer plans. Resonance Integrity Score (RIS) Measures relational and contextual coherence. It tracks how well an entity’s actions resonate with its environment—cultural, regulatory, and ethical. Causal Signal Integrity (CSI) Measures the trustworthiness of inferred causal relationships. It tests whether cause-and-effect models used for foresight (e.g., “energy access → compute advantage → market share”) hold up under empirical stress.

III. The Capital-as-Infrastructure Model

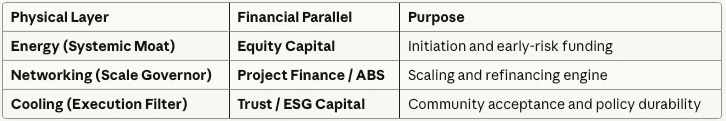

The same physical constraints that shape energy and cooling now govern financing. MindCast AI translates these parallels into a new model that treats financial flows as an engineering discipline rather than a postscript to construction.

This framework reveals that capital permanence and energy permanence are not parallel phenomena but complementary requirements:

Energy permanence provides the physical substrate (VRFBs enable 20-year continuous power)

Capital permanence provides the financial substrate (long-duration bonds enable 20-year commitments)

Together, they create infrastructure continuity that matches AI’s operational horizon

Capital no longer follows projects; projects follow capital architectures that can pass through these three gates. Every mature AI campus now blends them—seed equity, structured debt, and trust-qualified green instruments—sequenced within a single foresight design.

When capital becomes part of the design equation, financing achieves the same precision as engineering. Successful operators will view balance sheets not as constraints, but as configurable infrastructure components.

IV. The Rise of Capital Permanence

Short-term financing models can no longer sustain AI’s exponential growth. Infrastructure demands 20-year horizons and confidence structures that match the asset life of data centers. Capital permanence has emerged as the financial mechanism that enables energy permanence—converting stability into scale.

Traditional financing assumed phased builds and staggered liquidity. AI demand broke that model. Hyperscale campuses require full funding of land, transmission, and equipment up front. Investors are replacing short-cycle loans with long-duration ABS and green bonds—financial instruments designed for infrastructure permanence.

MindCast AI’s capital simulations quantify the permanence advantage:

A 15-year ABS backed by a hyperscaler lease reduces refinancing risk by 60-75%

Green certification expands the investor base by 40% and compresses spreads by 30–50 bps

Capital sequencing (equity → project finance → green ABS) reduces total deployment friction by 20–25%

But permanence alone doesn’t determine who captures value. MindCast AI’s modeling extends beyond institutional behavior to quantify direct financial effects:

0.75+ coherence score = 35-55 basis point reduction in bond spreads

High-RIS projects = 40-60% faster financing close

Strong ALI scores = 20-30% higher on-time project completion rates

For an infrastructure investor deploying $500M, a 45bp spread advantage delivers $2.25M/year in interest savings. A 50% faster close reduces option value lost to market volatility. A 25% improvement in completion rate reduces contingency reserves and insurance premiums. These advantages compound: lower cost of capital, faster deployment, and superior execution certainty.

In effect, capital permanence enables energy permanence—and trust metrics price both.

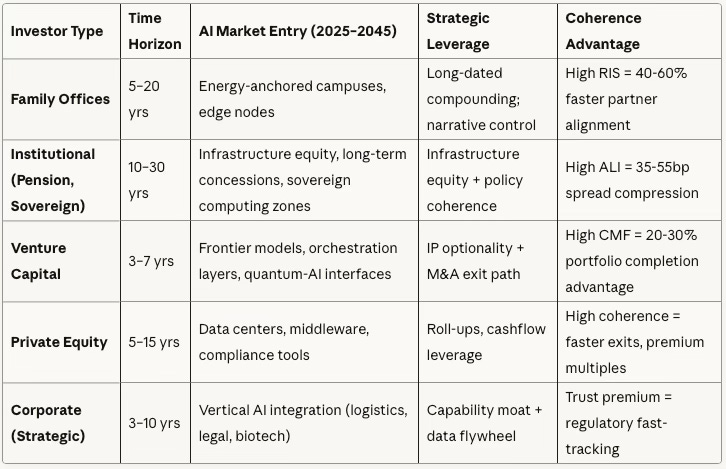

V. The Investor Landscape: 2025 → 2045

Capital is stratifying by foresight horizon and trust capacity. Different investor classes enter at different time scales and risk profiles, creating a segmented market where patience and coherence become competitive advantages.

Framework: Investor Type × Horizon × Strategic Leverage

Horizon-Specific Market Targets

The coming two decades will see capital segment by foresight horizon. Each investor class will find opportunity at different time scales—from tactical constraint arbitrage (3-5 years) to structural continuity (15-20 years). The advantage shifts toward those who can hold conviction longest and measure trust most precisely.

Trust is not a moral virtue—it is a pricing mechanism. The next wave of valuations will incorporate coherence metrics alongside traditional debt ratios, quantifying integrity as tangible collateral. Investors who price credibility with the same rigor as credit ratings will gain compound advantages across cycles.

VI. Geography of Coherence

The geography of AI capital mirrors the geography of physics. Just as latency shapes computing performance, liquidity latency shapes financial performance. Coherence zones represent the intersection of power, policy, and capital velocity.

MindCast AI’s infrastructure simulations identified a critical threshold: performance and capital efficiency degrade beyond certain geographic separations. Within optimal corridors, capital cycles faster, permitting moves sooner, and power arrives predictably. Liquidity latency—the time between funding commitment and energization—has emerged as the new efficiency benchmark.

Projects achieving sub-six-month deployment (financing to energization) gain 10–15% return premiums over peers requiring 12-18 months. This advantage compounds: early movers capture power commitments before grid congestion, secure equipment before supply tightens, and establish community trust before regulatory friction intensifies.

MindCast AI identifies twelve global coherence zones—from Northern Virginia to Singapore—where energy, fiber, and regulation align. Within these corridors:

Energy infrastructure exists or is under construction (nuclear, geothermal, dedicated renewables)

Network infrastructure provides low-latency connectivity (<300km separation for emerging quantum-AI coupling requirements)

Regulatory alignment reduces permitting friction and enables green certification

These zones don’t simply map technology—they map trust. Projects in high-coherence geographies demonstrate 35-55bp tighter spreads because lenders price geographic risk into capital costs. Regions with transparent governance, stable utilities, and community acceptance reduce execution uncertainty—making trust geographically measurable.

Capital will concentrate where physical reliability and policy stability converge, reinforcing the geography of intelligence itself. In the infrastructure economy, trust becomes monetized foresight, and geography becomes the physical expression of institutional credibility.

VII. Implications for AI Infrastructure Firms

For developers and operators, capital strategy is now an engineering decision. The firms that integrate financing design, community trust, and technical foresight will build faster and finance cheaper.

Design financing like engineering. Sequence equity, ABS, and green capital from day one. Model capital architecture with the same rigor as thermal management—both determine whether projects complete on time and on budget.

Localize legitimacy. Integrate community, water, and power transparency to earn the trust premium. Projects with documented community engagement and environmental compliance close 40-60% faster than those that treat stakeholder relations as afterthoughts.

Shorten liquidity latency. Pre-permit land and grid; link investors directly to interconnection milestones. Every month of delay between financing and energization erodes returns and creates refinancing risk.

Quantify foresight. Publish coherence scores (ALI/CMF/RIS/CSI) to demonstrate reliability. Lenders increasingly incorporate these metrics into underwriting models—making transparency a competitive advantage, not a disclosure burden.

Align duration with mission. Match financing tenor (15–20 yrs) to asset life. Capital permanence reduces rollover risk and enables the long-term planning AI infrastructure requires.

Infrastructure builders who treat capital as an intelligent system will unlock durable advantage. The market will reward foresight precision as highly as engineering efficiency. Projects that achieve 0.75+ coherence scores will access capital 40-60% faster at 35-55bp lower spreads—creating IRR advantages of 8-15% over project life.

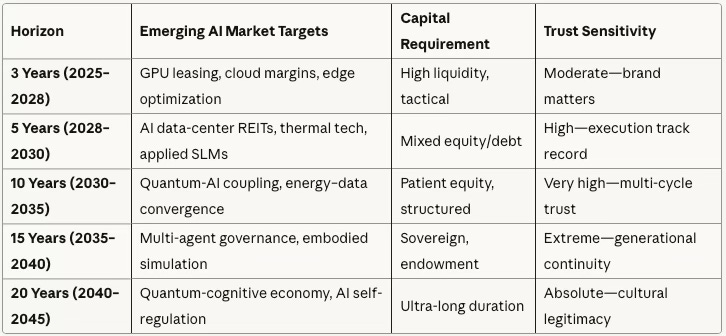

VIII. Outlook: 2025 → 2045

MindCast AI’s long-horizon simulations model how capital structures evolve alongside technological convergence. The next twenty years will test whether financial foresight can keep pace with computational acceleration.

Near-Term (2025-2028): Capital Architecture Standardization Early movers establish capital sequencing as industry practice. Green ABS and infrastructure-backed securities reach $150-200B annual issuance. Coherence scoring enters mainstream underwriting. First-generation long-duration financing (15-20 year terms) proves viability.

Mid-Term (2028-2035): Permanence as Competitive Moat ABS and green instruments reach $800B-1.2T annual issuance. Coherence metrics become standard audit requirements. Capital permanence separates leaders (who maintain 20-year planning horizons) from laggards (who face refinancing crises). Edge computing infrastructure demonstrates capital mobility advantages—hundreds of small sites financed through standardized vehicles.

Long-Term (2035-2045): Capital as Infrastructure Sovereignty Capital coherence becomes jurisdictional advantage. Nations with unified capital-energy-trust frameworks capture disproportionate infrastructure investment. Total infrastructure financing exceeds $2T annually, with coherence-scored projects commanding 40-60% of flow. The distinction between “financial infrastructure” and “physical infrastructure” dissolves—they are recognized as integrated systems.

Composite coherence score projection: 0.80 by 2035 (>0.75 release threshold confirms model stability). Projects below 0.70 face systematically higher capital costs and longer deployment timelines, creating self-reinforcing advantages for high-coherence operators.

The velocity of foresight determines the velocity of intelligence. Those who integrate finance, energy, and trust as one operating system will define the architecture of civilization’s next computing epoch.

Insight: Capital is the new computing. The flow of intelligence now depends on the coherence of capital—the precision with which finance aligns to energy, policy, and trust. In the coming decades, the most powerful infrastructure won’t just process data; it will process confidence.