MCAI Lex Vision: James Comey Indictment and Market Consequences

A Foresight Simulation of Investor Confidence, Volatility, and Capital Flows

See also MCAI Lex Vision: James Comey, Coercive Narrative Governance, and the Weaponization of Prosecution, A Foresight Simulation of Trust, Causation, and Cultural Consequences (September 26, 2025).

Executive Summary: Market Implications of Political Prosecutions

Markets respond not only to fundamentals but also to perceptions of institutional stability. The indictment of James Comey highlights risks of politicized justice that ripple into investor sentiment, risk premiums, and capital allocation. MindCast AI uses Cognitive Digital Twins and Vision Functions to simulate how investors, regulators, and global capital markets react to prosecutions perceived as political. The result is foresight into volatility, trust erosion, and longer-term shifts in market behavior.

Economists provide essential framing for these dynamics. Milton Friedman emphasized that free markets depend on trust and voluntary exchange; when governance undermines neutrality, transaction costs rise. Ronald Coase showed that such transaction costs directly shape institutional efficiency and capital flows. Robert Shiller’s work on narrative economics highlights how stories—such as politicized prosecutions—drive markets as much as fundamentals. Behavioral economists Daniel Kahneman and Amos Tversky further demonstrated how investors overweight political shocks and uncertainty, amplifying volatility and risk premiums.

Contact mcai@mindcast-ai.com to partner with us on law and economics foresight simulations.

I: Trust as Market Currency

Investor confidence rests on the assumption of neutral and predictable governance. When prosecutions appear politically motivated, markets interpret this as an erosion of the rule of law. The immediate impact is widening risk premiums as investors demand compensation for greater uncertainty. Foreign investors, who place a premium on stability and transparency, often respond first by slowing capital inflows. This erosion of trust directly increases the cost of capital, weakening the resilience of domestic markets and reducing appetite for long-term investments.

Trust is not a static commodity; it is priced continuously. Each new headline about the Comey indictment adds incremental stress to valuations. MindCast AI simulations show how even without conviction, the mere existence of politicized prosecution narratives generates compounding distrust that affects not just equities but also credit spreads and currency flows.

Coercive narrative governance analysis highlights trust as the invisible infrastructure of markets. Drawing on Friedman and Coase, MindCast AI models show how narrative coercion increases transaction costs and reduces efficiency in capital allocation. Investors price this hidden tax into every decision, amplifying governance risk premiums across the economy.

II: Precedent and Cultural Signals

Prosecutions do not just resolve legal disputes; they also establish cultural precedents that ripple into investor psychology. Markets treat these signals as barometers of systemic strength or fragility, adjusting valuations accordingly. This section explains how precedent and cultural signals from the Comey indictment shape transparency, accountability, and ultimately capital formation.

Every high-profile prosecution sets precedents in culture as well as law. Markets interpret these signals as indicators of systemic fragility. When oversight candor narrows because testimony may carry legal risk, transparency declines. Investors are left to price assets with incomplete information, increasing volatility.

In sectors such as financials and technology—where valuations depend on consistent regulatory frameworks—the perception that institutions can be bent to political purposes is particularly damaging. MindCast AI forecasts show that repeated signals of politicized justice accumulate into cultural precedents that weigh down valuations over time. A governance environment perceived as punitive or arbitrary discourages innovation, reduces deal activity, and slows capital formation.

Prior coercive narrative governance analysis emphasizes timing and selective law enforcement as reinforcing signals. Indictments near elections or statutory deadlines amplify market sensitivity, producing volatility spikes tied more to optics than fundamentals. Likewise, when statutes are applied selectively, predictability erodes—undermining the regulatory clarity that investor models depend on.

III: Fear as Governance Currency

Fear operates as an unseen but powerful regulator within institutions. When prosecutions are used as tools of intimidation, the flow of information investors rely on for price discovery diminishes. This section explores how fear-based governance raises uncertainty premiums, distorts risk assessment, and embeds inefficiency into markets.

Fear functions as a silent regulator. The threat of indictment discourages whistleblowing, narrows internal dissent, and reduces the quality of information available to investors. Price discovery relies on transparency, but fear-based governance drives opacity. As reliable signals diminish, investors compensate by demanding higher returns, embedding inefficiency into financial markets.

MindCast AI foresight flows show how fear cascades through decision-making chains: boardrooms avoid controversial disclosures, agencies delay reports, and regulators temper enforcement for fear of reprisal. For investors, this results in distorted risk assessment and mispriced assets. Over the long term, fear as governance currency inflates systemic risk and amplifies market fragility.

Earlier MindCast AI coercive narrative governance work frames fear not just as a byproduct but as a designed mechanism of compliance. The credible threat of prosecution silences oversight, raising transaction costs and undermining transparency. Markets absorb this as reduced liquidity and heightened uncertainty premiums.

IV: Markets Mirror Governance

Financial markets mirror governance health more quickly than other institutions. When law appears weaponized, equities trade with a governance discount. Sectoral risk premiums rise, especially in industries exposed to regulation or political scrutiny. Capital shifts toward safer jurisdictions or asset classes, creating both domestic volatility and global spillovers.

The Comey indictment demonstrates how governance failures migrate into economic performance. MindCast AI simulations suggest that even absent conviction, narratives of political prosecution embed themselves into market psychology. Volatility becomes structural rather than episodic, undermining investor confidence in the long-term stability of U.S. markets. The result is a self-reinforcing loop: weaker governance leads to market instability, which in turn heightens political and institutional pressure.

Prior coercive narrative governance analysis points to global trust arbitrage: capital flees jurisdictions where narrative coercion undermines rule-of-law signals, flowing instead toward countries with higher institutional credibility. U.S. dysfunction thus becomes a competitive disadvantage, directly influencing cross-border capital flows and long-term investor positioning.

V: Scenario Modeling — Market Reactions

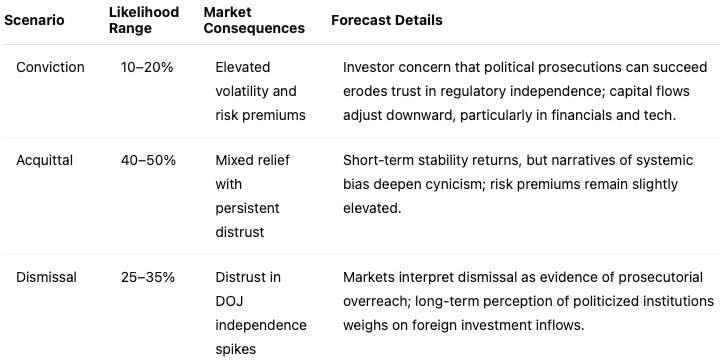

MindCast AI models three outcomes and their forward-looking market impacts. Likelihood ranges reflect earlier governance modeling calibrated for market sensitivity.

Reading the table. “Near-term” captures days-to-weeks price action; “3–12 month impacts” reflects positioning, issuance, and cross-border flows. Sector sensitivities: financials/fintech, platforms reliant on regulatory clarity, and defense/Intel-adjacent names most exposed.

Foresight Simulation

Conviction: Forecasts point to sustained volatility, higher hedging costs, and weakening trust in U.S. institutional independence. Long-term: potential decline in foreign direct investment.

Acquittal: Relief rally possible, but underlying distrust persists. Narrative of bias feeds political instability premiums embedded in valuations.

Dismissal: Markets react to DOJ credibility crisis; safe-haven assets gain, equities trade with a governance discount.

Mindcast AI Foresight Vision shows how investor psychology mirrors public trust dynamics. Loss of legitimacy in law translates directly into higher cost of capital and lower risk appetite.

VI. Conclusion: Investor Confidence as Collateral

The Comey indictment’s greatest impact on markets is not tied to verdicts but to the perception of political weaponization of law. Investors price in political risk by raising risk premiums, lowering valuations, and diverting capital away from uncertainty. Safeguarding market stability requires protecting institutional independence, as investor confidence is collateral in the contest of narrative governance.

Takeaway: Political prosecutions transmit governance risk into market signals—volatility, premiums, and capital flows—showing how investor confidence becomes collateral damage in narrative warfare.

Appendix:

References to Economic and Behavioral Economics Works

Milton Friedman, Capitalism and Freedom (University of Chicago Press, 1962). Argues that voluntary exchange and market efficiency rest on trust and predictable governance.

Ronald Coase, The Problem of Social Cost (Journal of Law and Economics, 1960). Introduces transaction cost theory, showing how governance structures and predictability shape efficiency and capital flows.

Robert J. Shiller, Narrative Economics: How Stories Go Viral and Drive Major Economic Events (Princeton University Press, 2019). Demonstrates how narratives influence investor behavior and macroeconomic cycles.

Daniel Kahneman, Thinking, Fast and Slow (Farrar, Straus and Giroux, 2011). Explores behavioral biases that affect decision-making under uncertainty, relevant to investor reactions to political shocks.

Daniel Kahneman and Amos Tversky, Prospect Theory: An Analysis of Decision under Risk (Econometrica, 1979). Establishes how individuals overweight losses and uncertainty, shaping market volatility responses to governance risk.

Prior MindCast AI Work on Coercive Narrative Governance

MCAI Lex Vision: James Comey, Coercive Narrative Governance, and the Weaponization of Prosecution, A Foresight Simulation of Trust, Causation, and Cultural Consequences (September 26, 2025). This publication explored how the Comey indictment exemplifies coercive narrative governance, reframing oversight into culpability and forcing defendants into costly battles. It modeled conviction, acquittal, and dismissal scenarios, emphasizing the fragility of the causal chain and the erosion of cultural trust. Vision Functions were applied to show how prosecutions reshape institutional legitimacy. The analysis concluded that outcomes mattered less than the cultural signal of weaponization.

MCAI Cultural Vision: The Tension Between Public Trust and Coercive Narrative Governance in Free Markets | Democrac, A Framework for Intervention Grounded in Institutional Simulation—Revealing the Fragility and Recoverability of Trust in Democracy Overwhelmed by Narrative Power (July 31, 2025). This publication framed trust as the invisible infrastructure of markets and democracy, drawing on Friedman and Coase to model transaction costs. It showed how narrative coercion undermines voluntary exchange, raises coordination costs, and fragments markets. Simulations traced trust degradation scenarios from collapse to resilience, emphasizing global trust arbitrage and capital flight. The report concluded with a framework for restoring the trust layer through narrative transparency, reciprocal legitimacy, and signal integrity enforcement.