MCAI Lex Vision: Antitrust Scrutiny of the Compass–Anywhere Merger

State and Federal Scrutiny of Compass’s Expansion Strategy

See also MCAI Lex Vision : Letter to State Attorneys General on Compass-Anywhere Merger (Sep 24, 2024). MindCast AI I received acknowledgement from the WA State Attorney General’s office. Anyone with further info can submit to monopoly@atg.wa.gov, crc@atg.wa.gov; reference file number #703425.

I. Executive Summary

Compass’s $1.6 billion all-stock acquisition of Anywhere Real Estate will reshape the residential brokerage industry. If regulators approve it, Compass will combine its technology-driven exclusives with Anywhere’s established brands such as Coldwell Banker, Century 21, and Sotheby’s. Together, they will create the largest brokerage network in the country, giving Compass direct influence over listings, commissions, and consumer access.

The deal forces a central question: does this consolidation create efficiency or reduce transparency and consumer choice? Regulators, competitors, and investors see both opportunity and risk. This foresight simulation evaluates how regulators will approach the merger, how lawsuits already shape Compass’s credibility, how trust issues magnify pressure, and what long-term scenarios will define Compass’s future.

Key Takeaways:

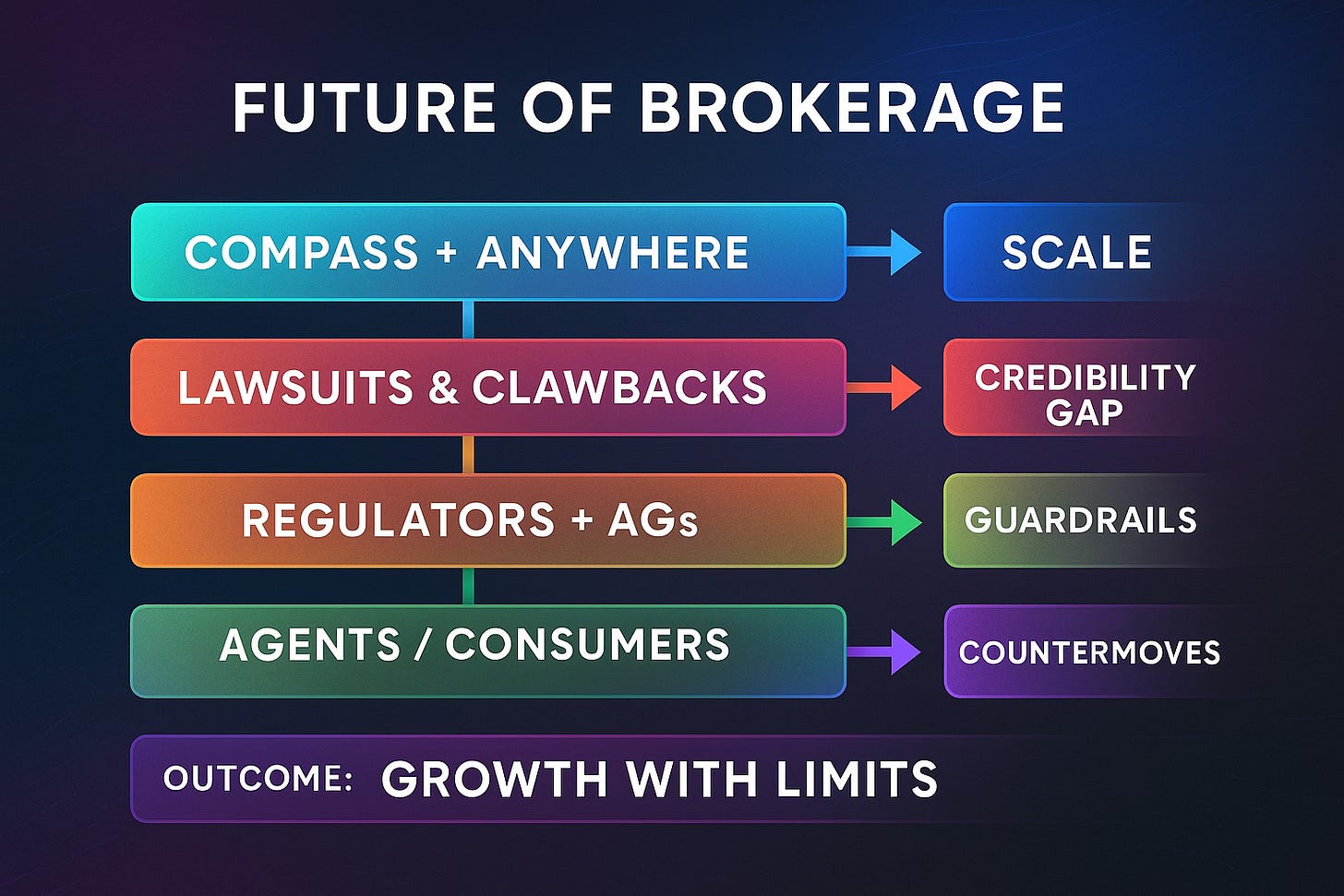

The merger delivers scale but invites scrutiny.

Lawsuits expose contradictions in Compass’s narrative.

Trust gaps make approval without conditions unlikely.

Most probable outcome: approval with transparency guardrails.

Methodology: This foresight simulation uses Cognitive Digital Twins (CDTs) to model the behavior of Compass, Anywhere, regulators, competitors, agents, and consumers. Each CDT captures incentives, constraints, and likely responses, allowing us to test how strategies play out under different conditions. By running these models through recursive scenario forecasting, we identify where contradictions in Compass’s posture create legal, reputational, or trust vulnerabilities. This methodology ensures the analysis goes beyond surface-level outcomes to anticipate systemic pressures that will shape the merger’s trajectory.

Contact mcai@mindcast-ai.com to partner with us on antitrust foresight simulation.

II. Baseline Regulatory Review

Every major acquisition triggers review, but Compass–Anywhere ensures a prolonged investigation. The merger involves more than 340,000 affiliated professionals, dozens of household-name brands, and billions in service revenue tied to transactions. Regulators cannot dismiss it as routine because it reaches into every major housing market and shifts competitive balance nationwide.

Compass adds complexity by suing the Northwest MLS and Zillow for anti-competitive practices. While it frames itself as a cartel challenger, it simultaneously consolidates into the largest brokerage in history. Regulators will ask directly whether Compass is breaking monopolies or building one.

Unconditional approval is improbable. Regulators will dig into Compass’s strategies, its handling of listing access, and how consumers could lose transparency.

III. Impact of Compass’s Antitrust Lawsuits

Compass’s lawsuits against the Northwest MLS and Zillow serve as a backdrop to the merger. On paper, they paint Compass as a challenger to entrenched monopolies. In reality, they complicate its credibility because they coincide with a bid to consolidate unprecedented power.

Regulators see contradiction. Compass calls others collusive while pursuing a structure that resembles a monopoly. This weakens Compass’s consumer-benefit narrative and strengthens arguments for merger conditions or outright blockage.

California Compass broker lawsuits make the stakes tangible. Agents alleged fraud, breach of contract, and labor law violations tied to signing bonuses, marketing budgets, and stock options. They claimed Compass lured them with incentives only to impose restrictive contracts, commission deferrals, and clawback provisions that may violate wage laws. Discovery in these cases could surface evidence damaging to Compass’s merger defense.

These lawsuits also carry discovery risks beyond California. Internal documents may expose Compass’s motives and reinforce the argument that exclusivity harms transparency. Instead of supporting its case, these legal battles may supply regulators with proof of bad faith.

IV. Legal Forecast

Legal review will play a decisive role in the fate of this merger. Regulators must determine whether Compass’s claimed benefits outweigh the risks of reduced competition. On one side, Compass argues the deal creates $225 million in annual savings and positions the firm to invest more in technology and agent support. On the other, regulators see a structure that could foreclose rivals, limit consumer access to listings, and consolidate unprecedented bargaining power.

The lawsuits against MLSs and Zillow will weigh heavily here. Instead of proving Compass as a reformer, they highlight contradictions: Compass criticizes others for anti-competitive practices while pursuing a consolidation strategy that looks similar in scale and effect. This credibility gap makes regulators more likely to impose conditions or pursue litigation.

Three paths stand out:

Most likely (65%) – Approval with conditions. Regulators require MLS participation, cap Compass’s use of exclusives, and restrict bundling of ancillary services to prevent foreclosure.

Less likely (20%) – Full blockage. Regulators sue to stop the deal outright, arguing Compass’s contradictions and foreclosure risks outweigh any efficiency claims.

Unlikely (15%) – Clean approval. Compass clears the deal without concessions, though this outcome runs against current enforcement trends.

Compass must prepare for remedies and a drawn-out review. Efficiency claims alone cannot override the credibility gap created by its litigation posture and exclusivity strategy.

Compass’s acquisition of Anywhere will not clear without conditions. Regulators have signaled skepticism toward consolidation in real estate, and Compass’s own lawsuits reinforce doubts about its intentions. Transparency requirements, limits on exclusives, and restrictions on bundling services will almost certainly accompany any approval. Rivals will keep pressure high, and investors will continue to question Compass’s ability to achieve sustainable profitability.

V. Trust Forecast

Trust will be a decisive factor in how regulators, agents, and consumers respond to the Compass–Anywhere merger. Compass has built a reputation for fast growth without consistent profitability, creating doubts about its long-term resilience. Anywhere, by contrast, has cultivated credibility through legacy brands that emphasize stability and reliability. The merger threatens to weaken that credibility if Compass imposes its exclusivity model.

Agents expect Compass to deliver privileged access to listings, but regulatory intervention could strip away that promise, leading to frustration and defections. Consumers already suspect that Compass limits transparency through private exclusives, a perception advocacy groups can amplify. Investors are wary too—the stock’s decline after the deal announcement reflects skepticism about Compass’s profitability and the risks of integration.

These trust gaps do more than damage reputation; they compound the legal and regulatory pressure. Without a visible commitment to transparency, Compass cannot persuade regulators, agents, or consumers that the merger serves the public interest.

VI. Cause-and-Effect Forecast

Regulators will not only examine outcomes; they will test whether Compass’s explanations for its actions hold up. Compass claims its lawsuits against MLSs and portals improve fairness, while its merger with Anywhere is framed as an efficiency play. These assertions invite close scrutiny.

The weak claim is that suing MLSs directly benefits consumers. There is little evidence that litigation of this sort lowers fees or increases transparency. The stronger and more obvious conclusion is that the merger consolidates dominance and risks foreclosure of smaller competitors. Regulators will prioritize this stronger case and may use Compass’s internal documents to show the gap between rhetoric and reality.

Compass’s narrative of consumer benefit cannot survive under this level of examination. Regulators are far more likely to conclude that the real consequence of the merger is reduced choice and weaker competition.

VII. Integrity and Reputation Forecast

Reputation shapes how decision-makers interpret Compass’s intent. Regulators and courts look beyond financial claims to whether a company appears honest, consistent, and aligned with consumer interests. Compass undermines itself by presenting one story in litigation and another in merger negotiations.

In Washington courts, Compass casts itself as a victim of monopolies that stifle competition. In Washington, D.C., however, it seeks approval to create the largest brokerage conglomerate in history. This contradiction exposes Compass to charges of hypocrisy, making its public message vulnerable.

Competitors will emphasize these inconsistencies. Compass attacks rivals for collusion while advancing exclusives that limit transparency. It promotes hidden listings as consumer-friendly, a framing that regulators and media can easily invert to show harm. Advocacy groups can use these stories to argue that Compass erodes fairness in housing access.

The damage is not only rhetorical. Reputational weakness reduces Compass’s leverage in negotiations with regulators and in retaining agents. Agents may question whether aligning with Compass damages their own standing with clients. Consumers may avoid Compass if it is seen as manipulating access to inventory.

Integrity gaps compound legal risks. The more Compass appears inconsistent or deceptive, the easier it becomes for regulators to justify harsh remedies or block the deal. Reputation thus becomes both a legal vulnerability and a market liability.

VIII. Long-Term Scenarios

Long-term scenario planning highlights how today’s regulatory decisions will shape Compass’s trajectory for years to come. Each scenario shows not just whether the merger closes, but how agents, consumers, and competitors respond over time. These futures provide a framework for understanding both the scale of Compass’s ambitions and the limits regulators are likely to impose.

Path 1 (60%) – Approval with conditions. Compass achieves national scale but must operate under transparency obligations. Regulators could require MLS participation and limit exclusives, reducing Compass’s ability to market hidden inventory. Agents may lose promised leverage, but consumers gain confidence in open access. Rivals adapt but cannot match Compass’s national footprint.

Path 2 (25%) – Blocked merger. Regulators stop the deal outright, weakening Compass after months of costly defense. Agents grow restless, seeing uncertainty in Compass’s model, and defect to more stable firms. Consumers continue to benefit from open MLS systems. Anywhere seeks new alliances, while rivals capitalize on Compass’s reputational damage.

Path 3 (15%) – Clean approval. Compass consolidates without restrictions, but the move fuels backlash from state attorneys general and consumer advocates. Agents initially enjoy perceived exclusivity, but consumers question fairness when listings remain hidden. Rivals and policymakers push new lawsuits or legislation, creating turbulence that undercuts Compass’s apparent victory.

The most probable future is Path 1. Compass grows but under compliance guardrails. Scale delivers efficiencies, yet exclusivity strategies face real limits, and every stakeholder—from agents to consumers—will feel the trade-offs.

Looking forward, the most probable outcome is growth with compliance guardrails. Compass will gain scale and some efficiency, but it will do so under strict rules that constrain its freedom to reshape the industry. Even if Compass integrates Anywhere successfully, compliance burdens, reputational baggage, and ongoing scrutiny will define its trajectory. The merger is both an opportunity for expansion and a trap of regulation: scale achieved, but independence and credibility sacrificed.

IX. Strategic Outcomes for Compass

Strategic outcomes translate high-level scenarios into practical implications for Compass’s operations. Each outcome captures how the company might experience growth, face constraints, or absorb reputational damage depending on how regulators, agents, and consumers react. These outcomes make clear that even apparent victories come with trade-offs.

Compass must define success realistically. Scale is possible, but unchecked dominance is not. Each strategic outcome reflects a different balance of growth, compliance, and credibility.

Efficiency Victory: Integration succeeds, costs fall, and MLS access continues. Investors relax, but Compass cannot rewrite market rules. Consumers see more stability but little innovation.

Transparency Compromise: Compass grows but exclusivity shrinks. Agents stay engaged but cannot rely on hidden inventory. Consumers benefit from open access, forcing Compass to compete on service quality and technology.

Litigation Drag: Prolonged battles sap morale and push agents to rivals. Investors lose patience, and consumers watch uncertainty play out in service disruptions.

Blocked Merger: Compass loses momentum and credibility while Anywhere seeks alternatives. Agents defect, rivals gain share, and consumers remain wary of Compass’s promises.

Clawback Pressure: Strict clawbacks on bonuses and incentives may backfire. If agents leave en masse or regulators target contracts, Compass may soften terms. California lawsuits alleging wage law violations and clawbacks intensify this risk, undermining retention and public trust.

Even in success, Compass faces compliance limits. Its ambition to rewrite real estate collides with regulatory boundaries.

For agents, the merger raises uncertainty about exclusives and clawbacks. Some may defect if Compass enforces restrictive contracts too aggressively, especially as regulators scrutinize these terms. Consumers stand to benefit if regulators preserve open MLS access, but they will remain cautious about Compass’s intent. Rivals will use the merger to paint Compass as monopolizing rather than innovating.

X. Competitor and Regulator Responses

Competitor reactions will heavily influence both regulatory perception and public opinion. Zillow, MLSs, and independent brokerages each have direct incentives to challenge Compass’s consolidation and frame it as a threat to transparency. Their efforts will help regulators justify strong conditions or even litigation to block the deal.

Rivals will act forcefully. Zillow, MLSs, and independent brokerages all have reasons to resist. Their campaigns will shape narratives regulators hear.

Zillow will label Compass monopolistic and claim consumer loyalty. MLSs will defend open access, linking transparency to affordability. Independent brokerages will spotlight consumer harm, including families shut out of hidden inventory. Advocacy groups and media will amplify these themes.

Competitors will cast Compass as monopolizing, not innovating. That story will resonate with regulators, legislators, and state attorneys general, and may ultimately shape the conditions attached to the deal.

State attorneys general, particularly in housing-sensitive states like New York, California, and Washington, may also intervene by launching parallel investigations or joining federal suits. These state actions can add political weight and extend the scope of remedies imposed on Compass.

XI. Conclusion: The Path Forward

The MindCast AI analysis ties together the regulatory, legal, and reputational pressures that shape this merger’s fate. Compass aims to secure scale, but contradictions in its litigation strategy and exclusivity model guarantee scrutiny. Agents, consumers, and rivals will all respond in ways that magnify the challenges Compass faces.

The contradiction between lawsuits and consolidation defines the core risk. Regulators will view this as evidence of bad faith. Compass cannot argue for fairness in court while simultaneously creating a structure that limits transparency. That tension ensures regulators will impose guardrails.