MCAI AI Lex Vision: Inside the Collapse of Compass’s Public Trust Tower

MindCast AI’s simulation reveals how platform ambition, private exclusivity, and legal overreach fractured the narrative Compass tried to control

In the News: The Seattle Times article “Seattle real estate industry feuds over private home listings” (May 2025) didn’t just report on a lawsuit, it detonated a civic narrative. More than 150 readers flooded the comments with frustrations, personal stories, and systemic warnings. The response wasn’t polarized. It was coherent. A structural consensus emerged: Compass’s “Private Exclusive” strategy is not innovation—it’s extraction, exclusion, and controlled visibility branded as choice.

The article became more than coverage—it became a diagnostic tool for where public trust collapses under platform manipulation. It confirmed what MindCast AI had already modeled: Compass isn’t disrupting the industry. It’s building a private tower on civic infrastructure—and suing the people trying to keep the lights on.

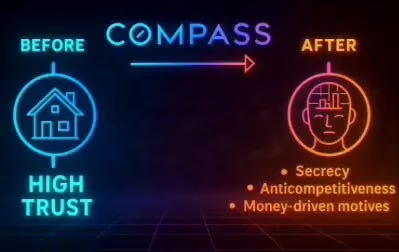

Core Theme: At the heart of this conflict is the collision between platform centralization and civic transparency norms. Compass isn’t simply stepping outside of those norms—it’s attempting to replace them with a branded, broker-gated version of reality.

MindCast AI ran structural simulations and analyzed the public reaction to Compass’s lawsuit against NWMLS. The patterns were unmistakable: sellers who felt misled, buyers who never saw inventory, agents boxed out, and trust that hemorrhaged across every layer of the system.

This is not market evolution—it’s infrastructural enclosure. And this report visualizes Compass’s reputational collapse using MCAI’s foresight engine, narrative signal analysis, and architectural insight.** The collision between real estate platform centralization and civic transparency norms. Compass isn’t simply violating those norms—it’s actively rewriting them in its favor.

🏛️ Visual Architecture: Imagine a futuristic, translucent urban skyline—not made of buildings, but of data towers. Each tower represents a node of trust, visibility, or exclusion. NWMLS stands as a shimmering, open-source tower pulsing with real-time data and cooperative access. Next to it, Compass looms like a dark mirror skyscraper: elegant, branded, but partially opaque, its interior lit by flickers of exclusivity, dual-agency incentive schemes, and shadow listings only visible to insiders.

What looks like design is actually extraction: the Compass tower is engineered to reflect transparency outward while shielding its internal pipelines from public accountability.

🔍 Civic Interface Layer: Comments, tweets, and disclosures swirl like dynamic holograms around the Compass tower. Each one is a public signal: allegations of gatekeeping, missed buying opportunities, commission manipulation, and algorithmic exclusion. These signals don’t just orbit Compass—they erode it.

MindCast AI nodes hover above the tower like civic satellites, mapping conflict density and recalibrating public narrative heat zones. As Compass’s control tightens, its coherence fractures.

📊 Narrative Signal Streams:

🔵 Blue signals: Corporate defenders praising Compass’s sleek branding and so-called “seller control.” These voices often emerge from marketing insiders, brand-aligned agents, or policy-neutral technocrats. While seemingly positive, these endorsements recycle sanitized language around "choice" while obscuring the asymmetry embedded in Compass's listing policies. These signals function as external validators that smooth over internal contradictions and dull early warnings.

🟡 Yellow signals: Consumer confusion, missed listings, misinformed expectations. These signals originate from clients caught in the gap between Compass's promises and their actual experience—e.g., listings not appearing on Zillow or homes sitting stale off-MLS. They mark early cognitive dissonance where expectation management fails. Often, these voices are well-meaning but disoriented, and they lay the groundwork for red signal escalation.

🔴 Red signals: Structural harm—dual-agency conflicts, discriminatory visibility, platform capture. These signals reflect the most credible and dangerous form of narrative rupture: civic accusations grounded in law, ethics, and institutional memory. They include fair housing risk, insider favoritism, and the dual-agency incentives Compass quietly cultivates. Red signals don’t merely express outrage—they frame legal vulnerability.

⚫ Grey signals: Institutional passivity and market resignation. These come from adjacent institutions—peer brokerages, regulators, or consumers—who remain silent or paralyzed despite growing awareness. The silence often reflects complicity, fear of retaliation, or structural fatigue. In MCAI analysis, grey zones are often the critical “pre-collapse” state: when silence allows abusive systems to metastasize.

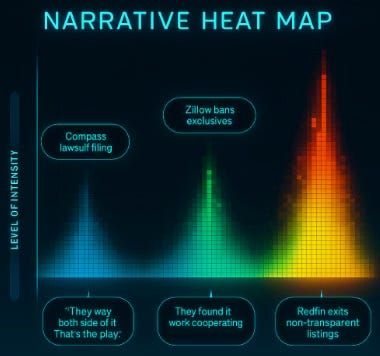

Narrative heat maps spike around Compass’s lawsuit filing, Zillow’s ban on exclusives, and Redfin’s platform exit from non-transparent listings. Each spike marks a breakdown in Compass’s brand story and a turning point in public trust modeling. around Compass’s lawsuit filing, Zillow’s ban on exclusives, and Redfin’s platform exit from non-transparent listings. Each spike marks a breakdown in Compass’s brand story.

🔌 Simulation Outcome Layer (MCAI Projection): MindCast AI's future-state modeling reveals a profound architectural paradox: the more Compass consolidates listing visibility inside its walled garden, the more it disconnects itself from the civic scaffolding that sustains trust-based marketplaces. MCAI simulations show that if Compass continues to redirect inventory into its closed-loop infrastructure while extracting benefits from public systems like NWMLS, its tower begins to fracture—not just reputationally, but structurally.

Crack 1: “Perception exceeds control.” The volume of public scrutiny, platform criticism, and consumer backlash outpaces Compass’s internal narrative management. They can’t shape what they no longer dominate.

Crack 2: “Narrative coherence collapse.” Internal inconsistencies—between branding, legal filings, agent behavior, and consumer experience—create unresolvable tension. Compass ceases to be legible to the market.

Crack 3: “Civic trust below sustainability threshold.” The system doesn’t need to collapse entirely. It only needs to lose public confidence. Once that happens, the structure can no longer operate at scale without legal intervention or reputational reengineering.

In contrast, MLS systems grow stronger through transparency, syndication, and shared accountability. They absorb friction and distribute innovation. Compass’s centralization, once positioned as a strength, becomes a bottleneck. The very scale it leveraged to dominate now isolates it from the public narrative grid. Its fortress becomes a silo. Its ambition becomes its cage. through distributed innovation. Compass’s dominance paradoxically becomes its vulnerability. Its scale no longer empowers—it isolates.

🚀 Strategic Insight Portal: MindCast AI isolates three accelerating collapse vectors in Compass’s public perception architecture—each driven not by market competition, but by Compass’s own self-reinforcing design logic:

Opacity Spiral: As Compass hoards inventory behind its “Private Exclusive” firewall, trust erodes in a nonlinear cascade. Buyers become skeptical. Sellers feel undersold. Agents outside the network lose access. Media pressure and peer commentary intensify. Compass’s messaging about seller “control” begins to sound like algorithmic deflection. This spiral triggers what MCAI calls the Visibility Credibility Inversion—when brand magnitude no longer signals strength, but secrecy, manipulation, and misalignment with market norms.

Litigation Loopback: Rather than addressing access inequality or demonstrating willingness to reform, Compass’s lawsuit against NWMLS exposes a deeper institutional aim: to codify platform-first discretion through legal coercion. The complaint reads not as a remedy to exclusion, but as an attempt to displace the authority of cooperative norms with discretionary branding. Compass is not litigating for access—it’s litigating against the principle of transparency itself. Each filing further documents Compass’s hostility toward structural accountability.

Signal-Gated Discrimination Risk: As Compass filters inventory through its internal listing architecture, access becomes increasingly contingent on agent network affiliation, data segmentation, and platform proximity. MCAI models a “signal privilege gap,” where consumers without internal referrals or platform loyalty are systematically delayed—or denied—inventory access. This is more than a legal risk. It’s a civil rights hazard wrapped in interface design.

Together, these vectors form a compound trust fracture—economic, institutional, and ethical. If left unchecked, MCAI projects Compass’s public brand will shift from “luxury disruptor” to “platform authoritarian” by Q4 2025—not because of external attack, but because it refused to course correct in the face of mounting, observable harm.

MCAI projects that if current conditions persist, Compass’s brand will shift from “luxury disruptor” to “platform authoritarian” by Q4 2025.

🌐 Public Perception Categories from Comment Analysis:

The Seattle Times article on Compass’s private listing controversy didn’t just spark conversation—it unlocked the crowd’s collective clarity. In hundreds of comments, readers articulated sharp, system-level insights typically reserved for expert panels and policy briefings. What emerged wasn’t anecdotal outrage—it was a granular map of how platform manipulation erodes trust, warps incentives, and fractures institutional norms.

Each category below represents a distinct signal cluster—public perception codified into structural critique. These aren’t just opinions. They are civilian diagnostics of a collapsing narrative architecture.

1. Seller Regret & Misinformation

What Compass framed as “strategic listing” many sellers experienced as a trapdoor. They were persuaded to use “Private Exclusives” under the guise of price testing and control—only to lose valuable market exposure. Agents oversold optimization and underdelivered results. Sellers realized too late that they had signed away visibility for illusion.

“We thought we were pre-marketing. It just delayed us.”

“There are zero reasons for a seller to have a private listing. ‘Marketing research’ is code for we don’t want another company to bring a better offer and get the commission.”

“It should always be the choice of the seller, but it is the wrong choice. Seller beware.”

2. Buyer Access & Listing Invisibility

Buyers searching on Zillow, Redfin, or NWMLS portals discovered the Compass listings only after they sold—or never at all. These listings were not accessible in real time, breaking the informational symmetry that real estate depends on. Compass reduced open market competition by burying inventory behind an agent-gated wall. The result: missed opportunities, distorted comps, and buyer distrust.

“We never saw the house. It was only on Compass.”

“I also will say that my wife and I have bought several properties by looking at Zillow or MLS… so we would have missed the exclusive listed home.”

“You’re gonna leave money on the table with the Compass model.”

3. Agent Conflicts & Dual Representation

Numerous comments called out the core business model: double-ending transactions. By keeping listings private, Compass agents could represent both buyer and seller, maximizing commissions and minimizing external accountability. Consumers saw through it—and viewed it not as efficient, but exploitative.

“They want both sides of the deal. That’s the whole play.”

“The point is the agents are lying to the sellers to convince them to do a listing arrangement that only benefits the agent.”

“Almost to a certainty it’s a poor choice, but they can make it.”

4. Platform Control & Structural Capture

Rather than building on shared infrastructure, Compass attempts to bend it. It uses NWMLS when it’s convenient, and sues when it’s not. Consumers recognize the inconsistency and call out the firm’s two-faced platform strategy. The language of disruption is used to mask entitlement to other people’s infrastructure.

“They want cooperation without cooperating.”

“So they found a work around to the pre-marketing clause in the MLS.”

“Compass could do this if they wanted very simply—by resigning from the NWMLS. But they want to be a member… and cheat.”

5. Transparency, Trust & Ethics

Compass's behavior is increasingly framed not as a market innovation but as a confidence scheme. Strategic opacity, asymmetric access, and listing gatekeeping corrode civic trust. Consumers describe a system where power—not merit—determines who sees what, and when.

“This isn’t innovation. It’s controlled access.”

“The idea that you can determine the value of a listing getting wide exposure by giving it limited exposure is absurd.”

“These pocket listings only benefit the listing agent.”

6. Fair Housing & Screening Concerns

Comments hint at what Compass’s closed-loop inventory control might mean for equal access: a return to implicit gatekeeping. If only agents within Compass can see certain listings first—or at all—what protections exist for marginalized buyers? The system begins to mirror discriminatory patterns even if no overt policy exists.

“If I can’t see it, who else is screened out?”

“They screen buyers? That’s possibly a licensing violation.”

“Well this explains a few things. We’ve recently seen homes for sale in our neighborhood that don’t show up on the MLS… curiously, the listing agents are all Asian.”

7. Institutional Frustration with Real Estate Norms

The critique wasn’t limited to Compass—it targeted the real estate system Compass exploits most efficiently. Commenters expressed fatigue with dual agency, commission opacity, and weak enforcement of fiduciary standards. But they also acknowledged: Compass is not the only problem. It’s just the most concentrated version of it.

“The system is broken. Compass just made it obvious.”

“The egos of guys pictured here are crazy. You get those guys who do it part time and have no clue what they’re doing… The more people who have access to the home, the better.”

“It’s cheaper in the long run. Work with the best even if it costs a bit more.”

🔎 Conclusion: The comments don’t just confirm MCAI’s models—they exceed them. They reflect a public increasingly fluent in institutional decay and platform distortion. For Compass, the damage is done. The crowd has already run the simulation—and moved on to accountability.

🔎 Implications for Policy and Enforcement:

If Compass’s lawsuit is successful, the precedent set could threaten cooperative listing systems nationwide. MCAI recommends that regulatory bodies and policy stakeholders treat this litigation as a structural power grab disguised as legal reform. At a minimum, this case warrants independent antitrust scrutiny and civic watchdog attention.

Moreover, if Compass uses the legal victory to expand internal exclusivity, restrict public visibility, and deepen asymmetrical access, the resulting pattern of market conduct should trigger antitrust investigation by the U.S. Department of Justice. MCAI identifies this trajectory not as hypothetical—but as structurally forecastable.

🌌 Conclusion: This visualization draws directly from findings in MindCast AI’s amicus brief, to be filed in the Compass v. NWMLS case to model how litigation strategy, platform control, and public trust interact.

Compass isn’t pioneering the future of real estate. It’s parasitizing the past, draining public trust while branding itself as reform. It is no longer a participant in real estate. It is now a threat to the very ecosystem it inhabits. And the public? They’re not confused. They’re already reading the blueprint.

See prior MindCast AI research on the Compass v. NWMLS case:

Brief of MindCast AI LLC as Amicus Curiae in Support of Defendant NWMLS

Compass v. NWMLS, Weaponizing Antitrust — for Profit, Not Consumers

Other antitrust AI law and economics analysis by MindCast AI:

Prepared by Noel Le, Founder | Architect of MindCast AI. Noel holds a background in law and economics. www.linkedin.com/in/noelleesq/, noel@mindcast-ai.com

Letter and call for action sent to WA state regulatory and industry leaders. https://substack.com/@mindcastai/note/c-116903049. Dear King County Executive's Office, Seattle King County REALTORS®, Washington REALTORS®, King County Council, Bellevue City Council, and the Washington State Attorney General’s Office, Washington and Bellevue Chambers of Commerce,

As a 45-year resident of Bellevue, where I run my AI firm MindCast AI LLC. I hold a background in law and economics.

I’m reaching out to elevate an urgent structural issue unfolding in Washington’s real estate market—one that’s visible to the public, corrosive to trust, and now ripe for coordinated civic response.

Compass, a New York-based brokerage platform, has effectively entered Washington’s real estate market as an outsider with an aggressive playbook. It is suing NWMLS both directly and through its Washington subsidiary, using litigation not to protect consumers—but to gain market share and squeeze out local competitors.

In a region where firms like Windermere and John L. Scott have deep local roots, Compass feels the pressure to deliver returns on its recent real estate acquisitions.

Compass has chosen the path of abusive antitrust litigation, aiming to extract concessions that would let it weaponize its infrastructure and crowd out rivals. This is a form of narrative inversion in broad daylight: Compass positions itself as a victim of anti-competitive behavior while simultaneously engaging in exclusionary practices that distort the market and corrode consumer trust.

This inversion hasn’t gone unnoticed. In the Seattle Times’ recent reporting (https://www.seattletimes.com/business/real-estate/seattle-real-estate-industry-feuds-over-private-home-listings/) on the private listings feud, over 150 public comments poured in—many roasting Compass’s strategy as extractive, elitist, and fundamentally deceptive. The public sees it clearly: this isn’t innovation; it’s exploitation. See: Inside the Collapse of Compass’s Public Trust Tower (https://noelleesq.substack.com/p/distrustcompass)

Compass’s antitrust lawsuit against NWMLS wasn’t filed to protect consumers—it was filed to gain market share through litigation leverage. But in doing so, Compass may have walked into its own trap. If it succeeds in getting concessions that weaken MLS transparency or undermine collective standards, it opens the door for government antitrust enforcers to indict Compass itself for the same anti-competitive outcomes it falsely accused others of enabling. See: Compass v. NWMLS: Weaponizing Antitrust—for Profit, Not Consumers(https://noelleesq.substack.com/p/mindcast-ai-antitrust-vision-compass )

This is a textbook a failure of moral coherence and structural integrity—an incoherent public posture cloaked in legal strategy, now unraveling in public view.

As the founder of MindCast AI, I’ve been running public-facing simulations that model how unchecked platform dominance affects civic trust, market behavior, and regulatory response. These simulations illustrate how platforms that centralize power and manipulate public narratives often collapse under scrutiny—if public institutions respond in time.

MindCast AI is preparing to submit an Amicus Brief in Support of NWMLS (https://noelleesq.substack.com/p/brief-of-mindcast-ai-llc-as-amicus )in the U.S. District Court, providing structural and narrative analysis of Compass’s tactics and their anticompetitive implications.

Additionally, the Bellevue Chamber has an opportunity (https://noelleesq.substack.com/p/nwmlschamber ) to file its own amicus brief in support of a fair and transparent housing market—one that prioritizes community-wide access over litigation leverage.

I believe your offices—spanning public leadership, professional ethics, and legal enforcement—are uniquely positioned to:

Recommended Actions by Party (see https://substack.com/@mindcastai/note/c-116903049)