MCAI National Innovation Vision: AI Computing Is Now Federal Infrastructure

The DOE-FERC Shift that Reorders Power, Capital, and Geography

Executive Summary

What’s at Stake Without federal alignment of power and compute, the U.S. risks ceding AI infrastructure leadership to China’s centralized planning model and Europe’s coordinated grid architecture. America’s technological advantage depends on solving a problem tech companies cannot fix alone: access to firm power at scale. The October 23, 2025 Department of Energy (DOE) letter marks the moment Washington acknowledged this reality.

The Department of Energy’s October 23 directive to Federal Energy Regulatory Commission (FERC) marks a structural turning point: AI load is now treated as a federally governed economic force, not a retail utility customer. DOE invoked Section 403 to push FERC into regulating “large loads” exceeding 20 MW, formally elevating AI compute to the same jurisdictional tier as generation, standardizing interconnection rules nationally, and reframing hyperscale demand as strategic federal infrastructure. This is the moment AI load becomes a federally defined economic actor.

The shift completes the trajectory MindCast AI foresaw—where AI compute behaves like interstate commerce and must be governed as national infrastructure. This Vision Statement reframes the DOE letter into a streamlined narrative: why the federal shift was inevitable, how it restructures the power–compute nexus, and what it means for markets, utilities, CRE firms, and hyperscalers.

🔮 MindCast AI Insight: AI is now governed by energy policy, not tech policy. Interconnection is the first chapter; transmission and resource planning come next. Federalization is not the end state. It is the foundation.

The Predictive Foundation: Cognitive Digital Twins

MindCast AI operates on a predictive architecture built around Cognitive Digital Twins (CDTs)—high‑fidelity behavioral models that simulate how institutions, regulators, utilities, and markets respond under pressure. Unlike traditional forecasting that extrapolates trends, CDTs model how institutions actually behave when faced with constraint, power shifts, and structural change—not how they claim they’ll behave.

CDTs integrate legal incentives (what actions are rewarded or penalized), economic patterns (what’s physically and financially viable), organizational psychology (how bureaucracies react to stress), and structural constraints to generate foresight that behaves closer to real institutional decision‑making than traditional modeling. Through CDTs, insight becomes computable, allowing the system to project not only what actors can do, but what they are likely to do.

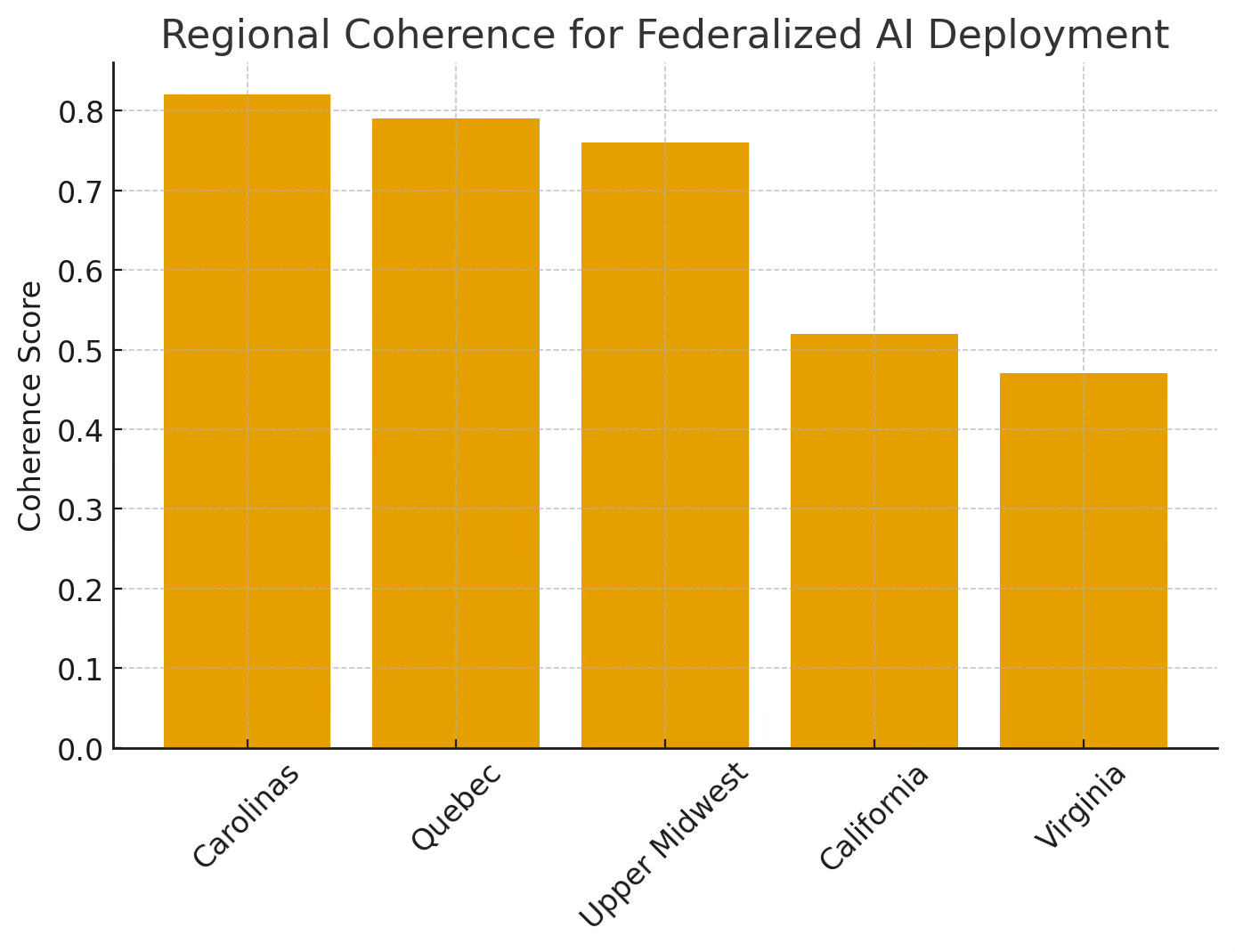

Key Metric — CSI (Causal Structural Integrity): Measures alignment between physical/economic reality and governance structures. A score of 0.80 or higher indicates structural inevitability within 18 months—policy will shift to match reality regardless of political resistance. Scores between 0.60 and 0.79 signal high likelihood contingent on political execution. Below 0.60, outcomes depend on contested variables.

This framework is the backbone of MindCast AI’s Predictive Cognitive AI and forms the behavioral‑economics engine that underlies every foresight simulation in this trilogy. This vision statement is the third installment in a developing trilogy that traces how AI infrastructure is transitioning from a private‑sector engineering problem to a federally governed national system. The first piece, The Commerce Clause as America’s AI Advantage (July 2025), established the constitutional and economic basis for federal jurisdiction over compute. The second piece, The Federal Unification of Intelligence, AI Preemption and the Rise of National Foresight (August 2025), mapped the governance trajectory from ethics and safety toward energy, infrastructure, and national industrial planning. This third installment shows that the anticipated shift has now occurred: compute has formally entered the domain of federal energy governance.

I. The Federal Trigger & Why It Was Inevitable

The federal shift did not emerge from a vacuum; it reflects the collision between exponential AI load growth and a grid architecture never designed for compute‑scale demand. As hyperscalers expanded, interconnection queues lengthened, and utility permitting cycles failed to keep pace, federal regulators faced an unavoidable choice: intervene or allow systemic fragmentation. DOE chose intervention, recasting AI load as a national interest.

MindCast AI causal analysis (CSI=0.82): The federal move was structurally inevitable. DOE acted not out of crisis, but anticipation—recognizing that state-level interconnection regimes cannot manage exponential AI demand. A CSI score of 0.82 means this outcome had greater than 80% structural inevitability eighteen months ago. DOE acted predictably, not reactively.

The federal move appears sudden only to those outside the energy-policy sphere. In reality, the economic and physical logic had been building for years: AI clusters transcend state lines, transmission is inherently interstate, and compute demand grows faster than any single jurisdiction can handle. When institutions face divergence between legal authority and physical reality, realignment becomes compulsory. AI clusters operate across states. Transmission is interstate. Compute flows ignore state borders. State commissions were misaligned with the physical and economic architecture of AI infrastructure.

Federalization was not a surprise. It was gravity.

MindCast AI Saw This Coming

In The Commerce Clause as America’s AI Advantage (July 2025), MindCast AI wrote: “Federal intervention becomes structurally inevitable when interstate power constraints collide with hyperscale load growth at a pace state regulators cannot process.” The October 2025 DOE letter repeats this logic almost verbatim, asserting federal jurisdiction over large-load interconnection. CDT Confidence Score at the time of prediction: 0.79. This direct alignment demonstrates that the predictive CDT architecture captured the causal pressure well before formal policy action.

The shift reflects federal regulators acknowledging reality rather than redefining it. National governance is the only framework capable of matching the scale, speed, and cross‑boundary nature of AI growth. The inevitability of this move provides stability for long‑range planning. With jurisdiction settled, the battle shifts to implementation: which interconnection projects move first, who pays for upgrades, and whether states accept or resist the new regime.

Contact mcai@mindcast-ai.com to partner with us on National AI Innovation Policy.

II. The New Architecture of American Compute

Once federal jurisdiction enters the picture, the entire compute‑energy stack reorganizes. Interconnection becomes the central constraint, flexibility shifts from experimental concept to operational requirement, and the siting hierarchy inverts around access to firm power. Hyperscalers begin transitioning from energy consumers to energy producers. This section maps the emerging architecture that will define U.S. computing capacity for the next decade.

MindCast AI long-range foresight (FSIM projections): A 2026–2032 cascade unfolds: interconnection reform triggers transmission reform, which forces resource planning reform. Hyperscalers evolve from customers into power developers. Nuclear anchors long-term compute.

Phase 1 Timeline: What to Watch (2025–2026)

Q4 2025: FERC opens rulemaking on interconnection standards for loads exceeding 20 MW. This is the formal regulatory machinery beginning to turn.

Q1 2026: The first state-level legal challenge emerges—most likely from California—contesting whether federal interconnection rules intrude on state authority over generation siting and distribution jurisdiction.

Q2 2026: The first hyperscaler–nuclear campus partnership is publicly announced, signaling that co-location has moved from concept to operational strategy.

Late 2026: Transmission cost-allocation fights escalate across PJM and MISO as private developers and utilities clash over who bears network upgrade expenses.

Five Structural Shifts

Federalization triggers five structural shifts that reshape how compute deploys in the United States:

1. Load Becomes Regulated

Data centers must meet readiness standards, financial deposits, curtailment penalties, and hybrid facility classification rules. This is no longer a utility customer relationship—it is a regulated infrastructure transaction. Load regulation accelerates well-capitalized hyperscalers who can meet federal thresholds, but may strand smaller data center operators unable to demonstrate financial and technical readiness.

2. Flexibility Becomes Required

Curtailment, dispatchability, and compute shifting move from “innovation ideas” to regulatory advantages. Operators who can demonstrate load flexibility—the ability to reduce or shift consumption during grid stress—gain interconnection priority. This transforms workload orchestration from an efficiency play into a compliance necessity.

3. Co-Location Becomes the Premium Strategy

Hybrid load + generation campuses—especially nuclear and gas—become the top-tier model. Behind-the-meter generation bypasses interconnection constraints entirely, positioning co-located facilities as the fastest path to deployment. The economic logic is straightforward: if the grid cannot deliver power at the pace AI scales, hyperscalers will produce their own.

4. Network-Upgrade Costs Flip

Self-funded upgrades weaken Investor-Owned Utilities (IOUs) rate-base power and accelerate private capital deployment. Utilities historically recovered transmission investments through ratepayer charges. When hyperscalers fund their own upgrades to bypass permitting delays, IOUs lose exclusive control over infrastructure investment returns. This only holds if utilities don’t successfully lobby FERC to shift costs back to ratepayers—a fight now underway.

5. Interconnection Becomes the First Siting Filter

Land, fiber, and cooling are secondary. Federal interconnection viability becomes the gating factor. Site selection now begins with the question: can this location access firm, dispatchable power under federal interconnection standards? Everything else—fiber latency, land cost, water availability—is subordinate.

Quantum Compute Alignment: The Coming Convergence

Quantum computing enters this architecture sooner than most expect. Its extreme power density, cryogenic loads, and sensitivity to electrical stability make it incompatible with fragmented state‑level governance. Quantum clusters will require proximity to high‑reliability, dispatchable power—most plausibly nuclear-backed campuses or federally coordinated transmission hubs. Federalization lays the groundwork for this by treating compute as critical infrastructure rather than discretionary commercial load.

🔮 MindCast AI Insight: The architecture of compute is now the architecture of power. Every strategic choice—siting, scale, capital planning—flows from interconnection and access to dispatchable energy. The new model sets the conditions under which U.S. AI capacity will grow.

III. Market Impact: Winners, Losers, and Capital Flows

Federalization reshapes incentives, which in turn reorders capital flows. Markets reward actors positioned to supply firm power, flexibility, and transmission upgrades, while penalizing institutions whose models depend on delay, decentralization, or exclusive control over interconnection. The transition produces clear beneficiaries and structural casualties.

MindCast AI capital calibration: Nuclear co-location ventures score 0.81, and flexibility platforms score 0.78—the strongest foresight-adjusted opportunity scores in the infrastructure landscape. Both are high-confidence opportunities, but nuclear holds a slight edge due to regulatory favorability and hyperscaler preference for firm baseload. IOUs show high obstruction risk as their rate-base models weaken under self-funded upgrade pressures.

Clear Winners

Constellation Energy — Its fleet of large reactors sits in regions where federal interconnection rules and hyperscaler demand converge. Nuclear’s non-intermittent output and regulatory favorability position Constellation as the premier anchor for AI co-location. This is not speculative positioning; it is structural advantage embedded in the federalized regime.

NodeShift Energy — The company’s real-time load orchestration and multi-site workload routing aligns precisely with DOE’s call for curtailable and dispatchable demand. Flexibility platforms move from niche innovation to federally validated competitive advantage.

Microsoft — Already experimenting with nuclear PPA structures and behind-the-meter generation strategies, Microsoft stands ahead in adopting co-location and hybrid campus planning. Among hyperscalers, Microsoft’s energy strategy most closely mirrors the architecture federalization creates.

Additional winners include nuclear owners broadly (dispatchable, scalable, regulator-friendly), gas turbine and onsite power OEMs (bridge supply for the next decade), flexibility and orchestration platforms (federally validated), transmission innovators (new federal procurement opening), and energy-savvy CRE developers executing interconnection-first strategies.

Structural Losers

PG&E — Its service territory faces structural constraints: wildfire liabilities, transmission bottlenecks, and slow permitting cycles, all incompatible with federalized interconnection acceleration. The utility’s risk profile and operational constraints make it a poor fit for the speed federalization demands.

Northern Virginia (PJM East) — Hyperscale saturation with insufficient dispatchable supply creates an inelastic grid environment that federalization alone cannot rescue. Physics constrains policy. No amount of federal interconnection reform can conjure megawatts where generation capacity does not exist.

Additional losers include IOUs reliant on rate-base expansion (business models weaken when upgrades are self-funded), regions with no dispatchable capacity such as the Pacific Northwest and California (limited firm power unable to support AI clusters), states reliant on permitting delay as leverage (federal rules weaken local veto power), and hyperscalers expecting bespoke utility deals (standardized federal rules reduce customization).

The Utility Bifurcation: Adapters vs. Obstructors

The IOU category is not monolithic. Federalization creates a sharp divide between utilities that facilitate and utilities that obstruct. Those operating in high-coherence regions with nuclear or gas assets and cooperative regulatory cultures—Duke Energy in the Carolinas, Southern Company across the Gulf Coast, Entergy in Louisiana and Texas—are positioned to adapt by becoming hyperscaler partners rather than gatekeepers. These utilities understand that the rate-base model survives only if they accelerate deployment rather than delay it. Their nuclear fleets, gas capacity, and institutional willingness to structure bilateral deals position them as infrastructure enablers in the federalized regime.

Utilities burdened by structural constraints face a different trajectory. PG&E’s wildfire liabilities and transmission bottlenecks are not policy problems—they are physical and financial realities that federalization cannot fix. Utilities lacking dispatchable assets or operating in jurisdictions where state commissions resist federal authority face accelerating irrelevance. The distinction matters for capital allocation: invest in utilities capable of delivering firm power under cooperative governance frameworks, avoid exposure to utilities where structural friction compounds regulatory uncertainty.

Public Power: The Overlooked Opportunity

Public power entities—municipal utilities, public power districts, and federal authorities—represent an underpriced opportunity in the federalized landscape. Freed from shareholder profit mandates and quarterly earnings pressures, these entities can move faster than IOUs to structure hyperscaler partnerships. The Tennessee Valley Authority controls significant nuclear capacity and operates across the Southeast, a high-coherence region where federal interconnection standards integrate smoothly. TVA’s institutional flexibility and dispatchable asset base position it as a dark horse winner in AI infrastructure deployment.

Municipal utilities such as the Sacramento Municipal Utility District present a contrast to PG&E’s rigidity within the same state. SMUD’s governance structure allows faster decision-making and willingness to experiment with novel partnership models. Public power’s structural advantages—faster permitting, lower cost of capital, mission alignment with regional economic development—have been underestimated by investors focused exclusively on IOUs and independent power producers. As federalization accelerates, public power entities capable of delivering firm capacity will capture partnerships that slower-moving IOUs cannot.

These actors share a common pattern: winners deliver dispatchable power or flexible load—the two currencies of the federalized regime. Losers cling to legacy structures incompatible with the speed and scale federalization demands. Market power is shifting toward actors capable of delivering real power. Capital will follow this new gravitational field.

IV. The Supply Reality & Implementation Friction

Federal policy can accelerate interconnection, but it cannot conjure physical electrons. The United States faces a widening gap between rapidly rising AI-driven demand and the slow pace of firm‑power development. DOE’s move shifts responsibility for closing that gap to private industry—hyperscalers, IOUs, independent producers, and capital markets.

Delegation Model context: Federal regulators often shift implementation burdens to private actors when direct intervention is politically costly. The DOE letter clears procedural barriers—standardizing interconnection rules—but delegates the hard part, building firm generation, to hyperscalers, IOUs, and independent producers. This is governance by redirection: federal authority creates the framework, private capital fills the gap.

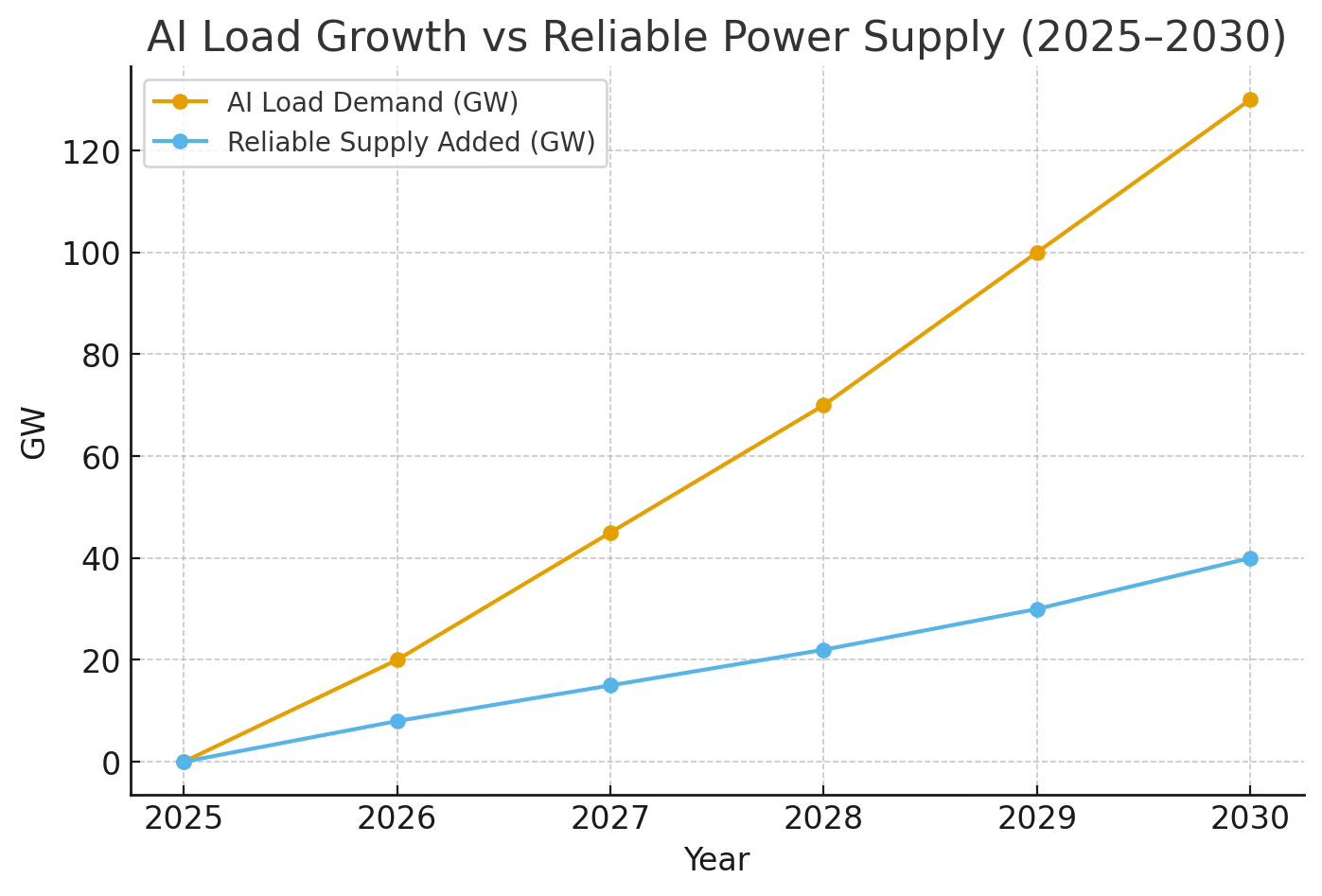

Demand growth projections range from 120 to 180 GW over the next decade. New reliable supply in the pipeline sits at approximately 45 to 55 GW. The shortfall—65 to 125 GW—massively exceeds available capacity. Federalization smooths process friction, not physics.

The Math Is Daunting

Closing a 65 to 125 GW supply gap over seven years requires 9 to 18 GW of new dispatchable capacity annually. To contextualize this scale: it is equivalent to building nine to eighteen large nuclear reactors per year, or 180 to 360 new gas peaker plants annually. For comparison, the United States has added an average of 2 to 3 GW of firm capacity per year over the past decade. The required pace represents a five- to six-fold acceleration in dispatchable generation deployment—a pace not seen since the immediate post-World War II infrastructure expansion.

SMRs will not arrive at scale before 2030. NuScale, X-energy, TerraPower, and other SMR developers project commercial deployment in the 2028 to 2032 window, assuming regulatory approval proceeds smoothly and construction timelines hold. These are optimistic assumptions. The bridge to 2030 is nuclear restarts, new gas turbine deployment, and demand flexibility.

If the private sector cannot deliver 9 to 18 GW of firm capacity annually, U.S. AI deployment either slows, migrates offshore to jurisdictions with excess dispatchable capacity, or fragments into whoever can secure power access first. Supply will determine who leads.

The supply constraint, not federal policy frameworks, will determine which hyperscalers scale and which stall.

Such pressure forces a private-sector supply response: onsite generation where hyperscalers produce their own power to bypass constraints; nuclear restarts where existing reactors become reactivated to meet rising load; SMR partnerships where small modular reactors emerge as long-term supply anchors; flexible compute architectures where workload shifting reduces strain on constrained grids; bilateral transmission funding where private capital fills gaps utilities won’t; and new gas plus pipeline alignments where near-term dispatchable supply expands through private deals.

The Renewable Integration Question

Renewables face a dispatchability constraint that federalization does not resolve. Wind and solar cannot serve as primary AI load anchors without storage at scale. Four-hour lithium-ion batteries address peak-load arbitrage—capturing afternoon solar and discharging into evening peaks—but do not provide the baseload reliability AI clusters require for 24/7 operation. Eight- to twelve-hour duration storage technologies—flow batteries, compressed air energy storage, green hydrogen—remain cost-prohibitive and unproven at grid scale. Capital costs for long-duration storage currently exceed $150 to $300 per kWh, compared to $20 to $40 per kWh for short-duration lithium-ion. Until these costs converge, renewables cannot anchor hyperscale AI infrastructure without firm backup capacity.

However, AI load flexibility creates a renewable integration pathway that traditional industrial loads cannot provide. If hyperscalers can shift training workloads to match renewable generation windows—running compute during high-wind overnight periods or midday solar peaks—intermittent resources become economically viable components of the energy mix. This requires orchestration platforms capable of real-time workload routing across geographic regions, contractual structures that reward curtailment and temporal flexibility, and compute architectures designed for interruptible operation. The Upper Midwest’s wind abundance positions it for this hybrid model, pairing variable renewable generation with AI loads engineered for flexibility. But deployment depends on whether hyperscalers accept the operational complexity and performance trade-offs that workload time-shifting imposes.

The baseload remains nuclear and gas. Renewables become supplemental capacity where load flexibility exists, not foundational infrastructure. This is not an ideological position—it is a physical constraint embedded in the duty cycle requirements of AI training clusters and the current economics of energy storage.

Federal-State Conflict: The Coming Legal Friction

Federal authority now governs interconnection. State authority still governs generation siting. The overlap creates friction. When federal authority expands into domains historically governed by states, conflict is inevitable. AI load now sits at the fault line between federal transmission jurisdiction and state generation authority. The DOE letter narrows state control without explicitly confronting it, creating a legal and political gray zone.

Most Likely Early Litigation Scenario: California Public Utilities Commission vs. FERC

The legal question at stake: Does federal interconnection authority under the Federal Power Act Section 201 preempt state jurisdiction over generation siting and distribution-level load?

The dispute will center on whether federal interconnection rules for large loads intrude on state authority over generation siting and distribution jurisdiction. Filed likely in the Ninth Circuit, the case would produce an 18 to 24 month uncertainty window.

Worst case for developers: The Ninth Circuit rules that hybrid facilities—co-located load plus generation—remain subject to state permitting, creating a dual-track approval process that adds 12 to 18 months to project timelines.

Most likely outcome: FERC wins on interconnection standards, but states retain environmental review authority. This creates procedural friction without full preemption—a middle ground that slows deployment without blocking it entirely.

For a hyperscaler planning a $10 billion AI campus in California, 18 to 24 months of litigation uncertainty is not an academic concern—it is a $2 to $3 billion capital reallocation decision. During that window, competitors building in the Carolinas or Gulf Coast gain 18 months of deployment lead time. Litigation doesn’t just delay projects; it redistributes competitive advantage to jurisdictions where legal clarity already exists.

During litigation, developers face uncertainty over whether to proceed under federal or state compliance pathways. Operational impacts include deferred upgrade approvals and strategic relocation of hyperscaler expansion plans from California toward the Carolinas, Gulf Coast, or Upper Midwest.

Additional conflict zones include disputes over load versus distribution jurisdiction (who controls interconnection rights), hybrid facility classification (how co-located generation is regulated), cost allocation (who pays for network upgrades), eminent domain and transmission siting (whether federal authority overrides state barriers), environmental overlays (permitting friction tied to state-level review layers), and IRP preemption (states resisting federal influence over resource planning).

MindCast AI institutional coherence analysis: PJM East shows elevated conflict likelihood due to narrative and institutional fragmentation. Fragmented governance structures struggle to absorb federal mandates quickly.

The Next Federal Move: Generation Siting Authority

Interconnection federalization establishes a template. If DOE concludes that state-level generation permitting blocks national AI infrastructure deployment at the pace strategic competition demands, Section 403 could be invoked again—this time targeting “critical generation” supporting large loads. This would federalize nuclear plant restarts, SMR facility approvals, and potentially gas plant siting in jurisdictions where state public utility commissions obstruct or delay projects tied to AI infrastructure.

Precedent exists for federal override of state generation authority. The Defense Production Act has been invoked to accelerate energy projects deemed critical to national security. PURPA Section 210 granted FERC authority to mandate utility purchases from qualifying facilities, overriding state resistance. FERC’s transmission backstop authority under the Energy Policy Act of 2005 demonstrated federal willingness to preempt state siting barriers when interstate commerce is impeded. The structural logic that justified interconnection federalization applies equally to generation: if state permitting creates bottlenecks that fragment national AI capacity, federal intervention becomes inevitable.

Whether DOE moves in this direction depends on how severe the supply gap becomes and whether cooperative federalism succeeds or fractures. If states integrate interconnection standards smoothly and generation projects advance without prolonged delays, federal generation siting authority remains dormant. If litigation stalls deployment and the 65 to 125 GW supply gap widens, expect DOE to assert jurisdiction over generation permitting for facilities tied to federally regulated large loads. Litigation risk is high—states will contest any federal encroachment on generation siting as aggressively as they contest interconnection authority—but the causal pressure is building. Federalization of generation siting is not certain, but it is no longer speculative.

Federalization clears procedural obstacles but leaves the central challenge—firm generation—unresolved. The next decade will depend on how quickly private actors build real capacity. Supply, not policy, will determine the ceiling of U.S. AI growth. The federal–state power boundary is entering a period of renegotiation, and the outcome will shape whether AI infrastructure grows smoothly or becomes a battleground of jurisdictional competition.

V. The New Geography of Compute (2030 Outlook)

Federalization ensures that regions with dispatchable supply and institutional coherence rise while capacity‑constrained or politically fragmented regions fall behind. Compute clusters will migrate toward jurisdictions capable of aligning regulatory structures, grid capacity, and private‑sector investment. Geography is no longer a function of land price or fiber routes—it is a function of firm power availability and cooperative governance.

Regional economic development authorities understand what’s at stake. The Carolinas are aggressively marketing nuclear co-location capacity to hyperscalers, packaging Duke Energy’s reactor fleet with streamlined state permitting as an integrated value proposition. Quebec is positioning cross-border transmission as the fastest path to firm, clean power for Northeast data centers, leveraging Hydro-Québec’s surplus capacity and established interconnection infrastructure. The Upper Midwest is coordinating MISO transmission planning with regional wind resources to offer hybrid renewable-plus-flexibility deployments.

These are not passive industrial trends—they are active competitive strategies by states and utilities recognizing that tens of billions in hyperscaler capital investment will flow to jurisdictions that align governance speed, grid capacity, and regulatory cooperation. The regions moving fastest to demonstrate federal compliance and dispatchable supply will capture commitments that lock in advantages for the next decade.

MindCast AI institutional coherence analysis: High‑coherence regions—the Carolinas, Quebec, and the Upper Midwest—are positioned to integrate federal standards quickly, while fragmented regions such as the Pacific Northwest, California, and PJM East struggle to adapt. Institutional coherence measures how well regulatory frameworks, utility incentives, and political structures align to execute policy shifts. High coherence accelerates deployment; low coherence creates friction.

Rising Corridors

The Carolinas possess strong nuclear presence and cooperative utilities. Duke Energy’s nuclear fleet and regulatory relationships position the region as a natural AI infrastructure hub.

Quebec to the Northeast corridor benefits from hydro surplus and cross‑border transmission potential. Quebec’s excess capacity and willingness to export create opportunities for U.S. developers to access firm, clean power.

The Upper Midwest combines wind abundance with federal transmission momentum. MISO’s transmission planning and regional wind resources position this corridor for hybrid renewable-plus-storage and AI co-location.

The Gulf Coast offers industrial‑grade gas and flexible utility models. Entergy and other Gulf utilities operate in regulatory environments comfortable with large industrial loads and private capital partnerships.

Strained Regions

The Pacific Northwest faces flat hydro capacity and limited dispatchable expansion. Bonneville Power Administration’s hydro resources are fully utilized, leaving little room for exponential AI load growth.

California confronts peak‑load dynamics and slow permitting cycles. CPUC’s environmental review processes and grid congestion create structural barriers to rapid AI deployment.

Virginia experiences hyperscale saturation with insufficient firm supply. Dominion Energy’s service territory already hosts massive data center loads, but additional dispatchable generation lags behind demand growth.

PJM West sees coal retirements accelerating congestion. As coal plants retire without replacement dispatchable capacity, transmission constraints tighten across the western PJM footprint.

The geography of U.S. compute is consolidating around regions capable of delivering reliable power under a federalized regime. States and utilities that embrace the new structure will attract the next wave of AI investment, while those resisting it will face stagnation. The regional hierarchy emerging now will shape national competitiveness for the next decade.

VI. What This Means & What Comes Next

The shift is more than a regulatory event—it is a structural reframing of what AI represents in the national economy. AI is no longer governed by tech‑sector norms but by energy‑sector architecture, signaling an era where compute becomes inseparable from power policy. Institutions will be judged not by rhetoric but by adaptive capacity and integrity under pressure.

MindCast AI adaptive integrity analysis: Hyperscalers retain high adaptability scores as they pivot toward energy developer roles. IOUs exhibit moral incoherence under pressure—a pattern we term ALI-CMF divergence, where stated commitments to clean energy (Claimed Moral Framework) conflict with adaptive behavior that prioritizes rate-base preservation (Adaptive Logic Index). This divergence signals institutional fragility when external pressure mounts.

The DOE–FERC action signals a national shift: AI is governed by energy policy, not tech policy. Interconnection is the first chapter; transmission and resource planning come next. The moment marks the convergence of compute and energy governance into a single strategic domain. Institutions capable of aligning their operational, regulatory, and capital strategies with this new reality will define the next era of American technological growth. Those that resist will find themselves increasingly peripheral as national‑scale alignment accelerates.

Federalization marks the beginning of a new infrastructure era. AI load is now a national priority asset. Market behavior, capital allocation, regional development, and state-federal dynamics will reorganize around this reality. The architecture MCAI predicted—federalized load, interstate governance, private-sector supply response, and a bifurcated geography of compute—has arrived.

The next decade begins here.

VII. Conclusion: Strategic Implications for Decision-Makers

The federal shift does more than redefine jurisdiction—it resets the strategic landscape for every actor in the compute ecosystem. The institutions that adapt to this power‑centered architecture will drive the next generation of American innovation. Those that fail to evolve will be left behind as the nation reorganizes around firm power, federal standards, and national‑scale compute planning.

For investors—family offices, institutional allocators, VCs, and private equity: Capital flows toward actors delivering dispatchable power (nuclear owners, gas turbine OEMs) and load flexibility platforms. Avoid exposure to IOUs dependent on rate-base expansion or regions with inadequate firm supply. The full investment taxonomy requires granular analysis of transmission plays, orchestration platforms, and energy-first CRE strategies.

For hyperscalers: Interconnection viability is now the first siting filter. Co-location with nuclear or gas generation bypasses grid constraints. Behind-the-meter strategies and bilateral transmission funding accelerate deployment. Bespoke utility deals lose viability under standardized federal rules. The operators who move first on hybrid campus models will capture the premium sites.

For the AI infrastructure ecosystem: Flexibility, curtailment capability, and dispatchability transition from innovation concepts to regulatory requirements. Operators demonstrating load orchestration gain interconnection priority. Quantum compute integration will require federal coordination and proximity to high-reliability power sources.

The Operational Playbook

This vision statement establishes the structural shift. The operational playbook—which specific regions to enter, which partnerships to pursue, how to navigate federal-state conflict, and where capital flows over the next 36 months—requires institutional-specific analysis. MindCast AI provides detailed market taxonomies, regional coherence scoring and site selection frameworks, federal-state litigation tracking and timeline projections, and CDT-powered scenario modeling for institutional decision-making.