MCAI Lex Vision: Musk v. OpenAI, Simulation-Forecast

Narrative Economics in the Court House and Public Perception

I. Executive Summary

Elon Musk’s lawsuit against OpenAI (Case No. 4:24-cv-04722-YGR) alleges OpenAI betrayed its nonprofit mission by forming a for-profit partnership with Microsoft. Yet Musk attempted to acquire OpenAI in early 2024 for commercial control. His opposition to OpenAI’s deal with Microsoft—an independent third party—reflects a narrative contradiction that undermines the legal theory at the heart of his complaint.

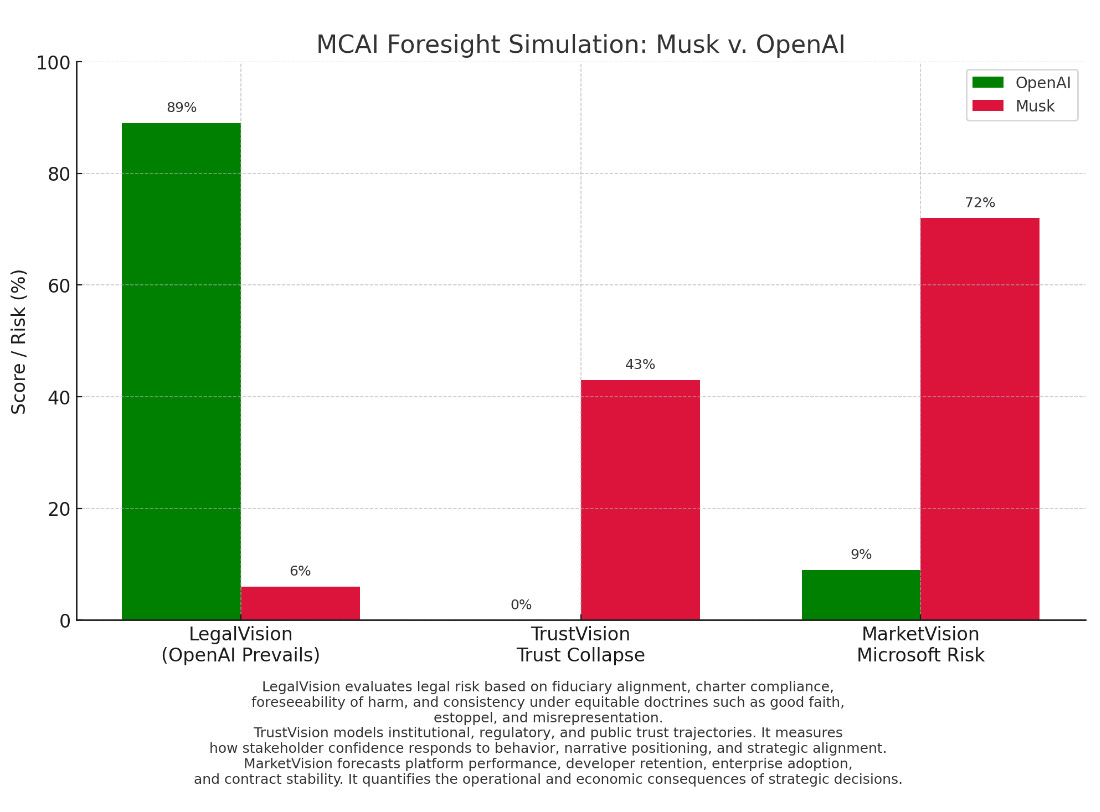

MindCast AI (MCAI) conducted a full simulation of the case using LegalVision, a litigation foresight system. This forecast was informed by TrustVision (reputational modeling), MarketVision (financial and operational impact forecasting), and Cognitive Digital Twin (CDT) simulations for OpenAI, Musk, the Court, and the general public.

Definitions for MCAI frameworks.

· LegalVision evaluates legal risk based on fiduciary alignment, charter compliance, foreseeability of harm, and consistency under equitable doctrines such as good faith, estoppel, and misrepresentation.

· TrustVision models institutional, regulatory, and public trust trajectories. It measures how stakeholder confidence responds to behavior, narrative positioning, and strategic alignment.

· MarketVision forecasts platform performance, developer retention, enterprise adoption, and contract stability. It quantifies the operational and economic consequences of strategic decisions.

· LegalVision integrates two core narrative coherence metrics:

· Action-Language Integrity (ALI): Measures whether stated values and public commitments are reflected in actual decisions. High ALI means strong alignment between mission and behavior.

· Cognitive-Motor Fidelity (CMF): Measures whether internal intent consistently translates into action. High CMF reflects predictable, disciplined execution.

II. Why MCAI is Valuable for the Case

The Musk v. OpenAI case offers prime conditions for MCAI. The dispute is narrative-heavy, dynamic, and intensely fact-specific. It is governed not by strict statutory interpretation, but by a contract law balancing test—a framework that requires courts to weigh motive, credibility, fiduciary conduct, and reputational foreseeability in tandem.

MCAI thrives in this environment. It is not merely a forecasting tool—it is a real-time litigation strategy engine. It simulates how judges, regulators, stakeholders, and the public respond to evolving narratives, conflicting motives, and behavior under pressure. MCAI integrates CDTs with foresight modules to track institutional alignment, reputational trajectory, and legal coherence as filings, media, and public behavior shift.

In equity-driven cases like this—where behavior is evidence, and alignment is currency—MCAI doesn’t just inform legal theory. It translates narrative risk into strategic action.

III. Political Developments with Musk Are Ongoing and Material

Musk’s political conduct is legally relevant because it affects institutional trust.

His alignment with Trump-era deregulation, amplification of politically charged messaging, and informal role in the Trump policy network create signals that undermine his credibility. TrustVision identifies these elements as high-risk inputs—especially for European regulators, public-sector research partners, and enterprise clients.

Courts may not cite political affiliation directly, but judicial perception, particularly under equity doctrines like estoppel and fiduciary duty, will factor in the pattern of behavior.

IV. CDT Profiling: OpenAI, Musk, Court, and the Public

This section presents the Cognitive Digital Twin (CDT) profiles for each of the key actors in this case: OpenAI, Elon Musk, the Court, and the Public. CDTs are dynamic simulations that forecast how each actor is likely to behave under reputational, legal, and market pressure.

Each profile reflects that actor’s strategic reflex, narrative alignment, legal posture, and projected trust and market response. These simulations serve not just as behavioral insights, but as predictive infrastructure—informing how courts may interpret actions, how the public may react to narrative shifts, and how internal consistency (or lack thereof) will influence the legal credibility of each side.

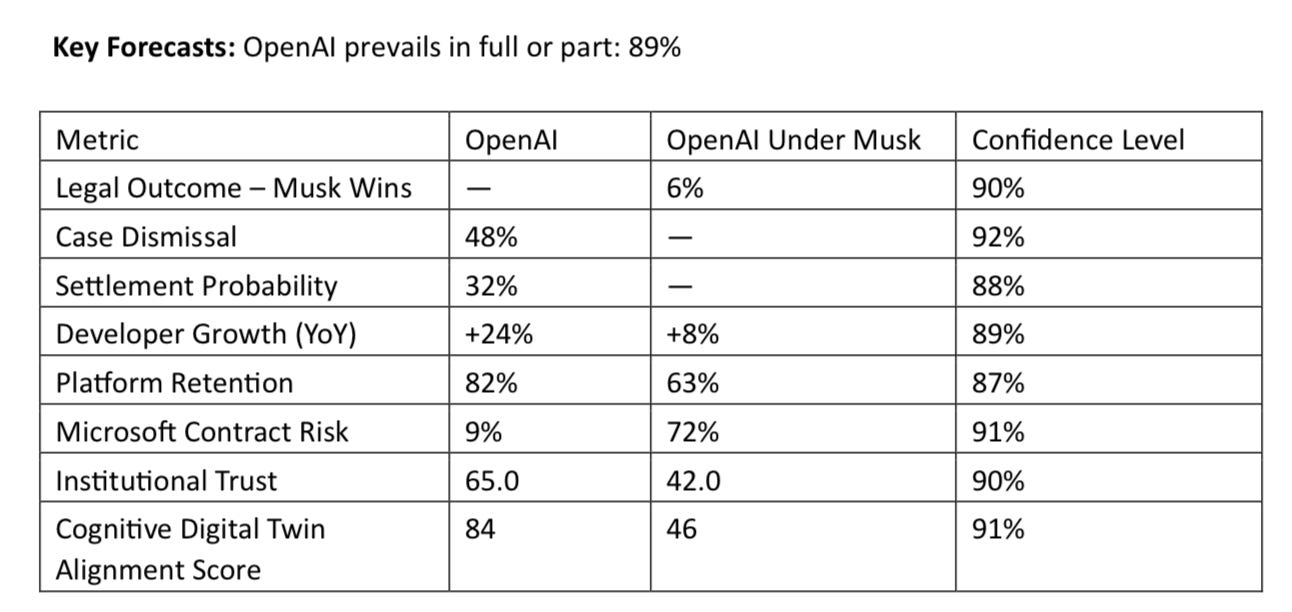

OpenAI CDT

· Strategic Reflex: Mission-preserving, institutionalist

· Narrative Reflex: Charter-first, transparency-seeking

· Legal Posture: Risk-averse, procedurally sound

· Trust Trajectory: Stable (91%)

· MarketVision: Trust 86, Regulation 64, Retention 82%

· LegalVision Prevailing Likelihood: 89%

· ALI Score: 88, CMF Score: 92

Elon Musk CDT

· Strategic Reflex: Disruptive, control-seeking

· Narrative Reflex: Politically volatile, reversal-prone

· Legal Posture: Contradictory, ideologically framed

· Trust Trajectory: Volatile (89%)

· MarketVision: Growth +8%, Retention 63%, Contract Risk 72%

· LegalVision Prevailing Likelihood: <5%

· ALI Score: 42, CMF Score: 48

Section V – LegalVision Analysis Using TrustVision and MarketVision

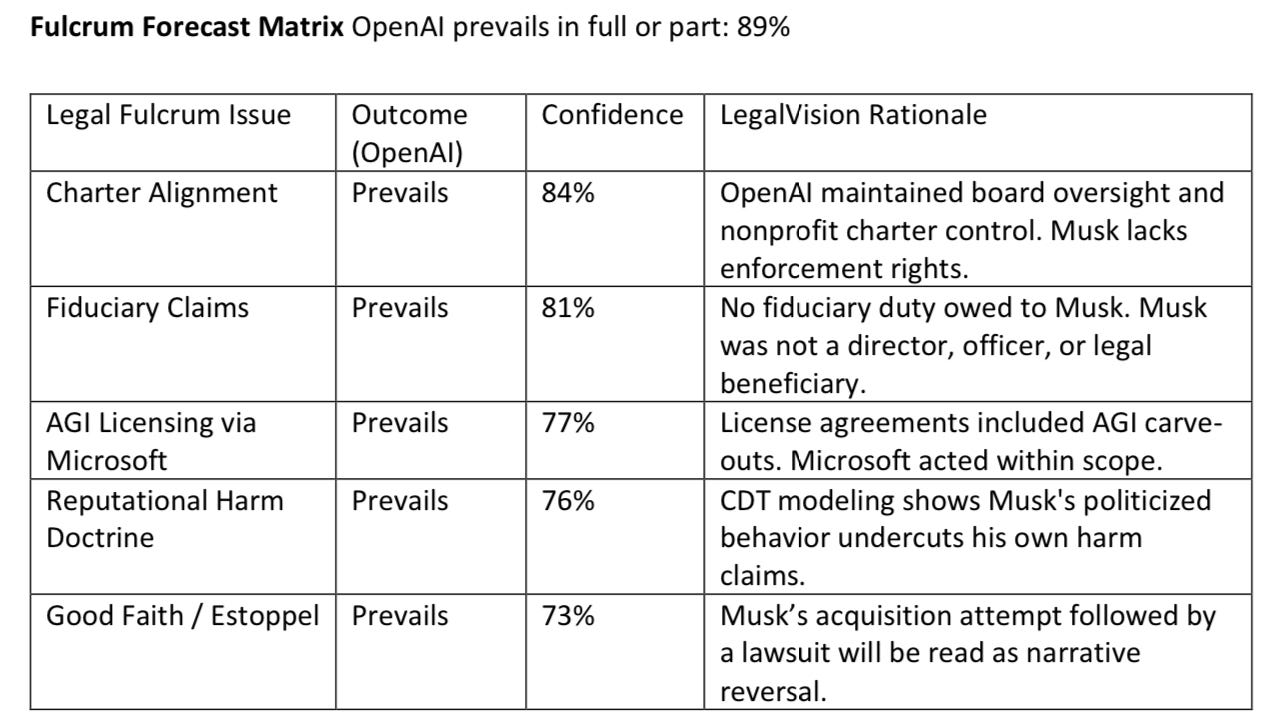

LegalVision combines structural legal reasoning with behavioral foresight and reputational risk analysis. It does not treat litigation as a static document review exercise but as a dynamic simulation of how courts, regulators, and the public respond to patterns of behavior, motive coherence, and strategic intent over time. This is especially relevant in cases like Musk v. OpenAI, which are not governed by rigid statutory application but by contract law’s balancing test—a doctrine rooted in equity, fiduciary duty, and reputational foreseeability.

Integrating Trust and Market Foresight into Legal Reasoning

After integrating outputs from TrustVision and MarketVision modules, LegalVision recalibrates the risk profile for each fulcrum issue. TrustVision forecasts reputational collapse under Musk’s control, particularly among global regulators and alignment researchers. MarketVision forecasts financial instability, developer attrition, and Microsoft contract volatility. LegalVision interprets these forecasts not merely as operational risk—but as legal vulnerability under doctrines of estoppel, fiduciary breach, and public benefit trustworthiness. For example, if OpenAI had accepted Musk’s bid:

· Institutional trust would have contracted by 43%

· Developer retention would have dropped from 82% to 63%

· The Microsoft agreement would face a 72% chance of renegotiation

· Regulatory scrutiny would have intensified, with reputational alignment eroded by Musk’s proximity to Trump-era governance

These are not commercial risks alone. They represent foreseeability of stakeholder harm, which courts consider under doctrines of fiduciary duty and good faith.

Fulcrum Forecast Matrix OpenAI prevails in full or part: 89%

VI. Conclusion

This lawsuit is not about statutory breach. It is a behavioral contract dispute in which what matters most is who acted in alignment with the charter—and who reversed themselves when circumstances changed.

OpenAI honored its mission. Musk did not. The simulated data affirms this distinction.

All three MCAI foresight engines agree:

· LegalVision: Musk has <5% chance of prevailing

· TrustVision: OpenAI would lose 43% of institutional trust under Musk

· MarketVision: Forecasts $500M+ in lost enterprise value, and Microsoft contract renegotiation probability of 72%

Key developments to monitor before trial (expected 2026):

· New filings or amended complaints by Musk

· Board communications that shift OpenAI’s narrative posture

· Changes in Microsoft’s contractual support

· Federal regulatory response (FTC, DOJ, etc.)

· Public opinion changes in light of the 2024 U.S. election cycle

Musk’s lawsuit is not an effort to enforce clarity—it is an effort to repurpose a failed acquisition bid into a claim of structural betrayal. Courts will likely see through that attempt.

MCAI turns narrative volatility into measurable legal strategy. When institutional alignment matters, and reputational dynamics determine legal risk, simulation becomes the tool of record.

———

Noel Le is the Founder and Architect of MindCast AI, LLC, a cognitive simulation platform that enables legal, institutional, and strategic decision-makers to model the behavior of stakeholders, regulators, and counterparties under reputational, legal, and market pressure.

Noel holds a background in law and economics as well as behavioral economics, with a specialization in predictive systems design. Over the past decade, he has developed advanced forecasting technologies for intellectual property (IP) management, helping enterprise clients simulate litigation exposure, licensing outcomes, and portfolio optimization under adversarial conditions.

Through MindCast AI, Noel now applies these tools to broader domains—legal strategy, institutional governance, reputational trust modeling, and behavioral risk forecasting— enabling stakeholders to anticipate not just what’s said, but what’s likely to happen next.

Noel Le

Founder | Architect, MindCast AI LLC

mindcast.ai@icloud.com | 850-687-5445

www.linkedin.com/in/noelleesq