MCAI Investor Vision: Overseas Investor Risk Intelligence

How MCAI identifies latent risks and foresight asymmetries in U.S. investment for overseas investors

I. Executive Summary

Foreign capital continues to fuel growth in critical sectors of the U.S. economy, especially real estate, energy, and infrastructure. Yet overseas investors operate at a systemic disadvantage: geographic distance, uneven information access, unfamiliar regulatory environments, the gatekeeping of high-reputation actors, all limit their visibility and leverage. Traditional legal and financial advisors are backward-looking—they can confirm what was disclosed, not foresee what is deteriorating. They cannot detect moral drift, institutional decay, or credibility erosion until the damage is done.

MindCast AI LLC (MCAI) was built to close this gap. As an AI law and economics simulation-forecasting firm, MCAI uses Cognitive Digital Twins (CDTs) to simulate how leaders, institutions, and ecosystems behave under pressure. It models trust before it breaks, risk before it’s measurable, and collapse before it becomes public.

Where due diligence ends, MCAI begins. While law firms and consultants assess compliance, MCAI detects the deeper misalignments between narrative, behavior, and trust. It reveals not what actors say they will do—but what they are cognitively and structurally primed to do next.

Insight: Traditional due diligence captures snapshots. MCAI simulates future trust and system integrity under stress.

II. MindCast AI Capabilities for Overseas Investors

For overseas investors, MCAI constructs CDTs, dynamic models of executives, regulators, media, and institutional actors in complex investment environments.

MCAI builds CDTs of:

🏗️ Institutions attracting foreign capital (regardless of geographic location, including real estate developers, fund managers, legal intermediaries, or syndicates offering U.S.-based investment opportunities)

🌏 Foreign investors (e.g., family offices, high-net-worth individuals, or participants in visa-linked investment flows)

🤝 Public trust dynamics, both U.S. based (regulators, press, domestic partners) and foreign-based (diaspora networks, home country oversight bodies, investor communities)

These CDT clusters simulate how trust, behavior, and alignment evolve over time—surfacing hidden risks, legal asymmetries, and narrative manipulation before crises emerge. The CDTs are analyzed using three proprietary metrics:

📏 Action–Language Integrity (ALI): Detects misalignment between public statements and operational behavior.

🔧 Cognitive–Motor Fidelity (CMF): Flags breakdowns between internal decision-making and external execution.

🔍 Cognitive Trust Signal Model (CTSM): Monitors erosion or compounding of trust across communication signals, silence, and response patterns.

MCAI dynamically routes each CDT through different simulation pathways based on the role the actor plays in the investment ecosystem.

🏗️ Institutions attracting foreign capital—such as developers, fund managers, or legal syndicates—MCAI applies Legal Vision to detect regulatory arbitrage, Causation Vision to map cascading risk logic, and other Vision modules to evaluate moral coherence and relationship integrity with stakeholders. These routes are essential to detect actors who maintain a surface-level image of compliance while degrading trust beneath the surface.

🌏 Foreign investors—including high-net-worth individuals, family offices, or visa-linked capital—MCAI activates Trust Vision, Causation Vision, and Investor Vision to model investor reasoning, simulate adaptive responses, and identify long-term foresight gaps. These CDT flows reveal how investors perceive risk, recalibrate trust, and respond to subtle cues missed by transactional advisors.

🤝 Public trust dynamics, U.S. based and international —such as media, regulators, or diaspora networks—MCAI engages Trust Vision module to test moral alignment, track betrayal and emotional backlash, and simulate how public coherence breaks down. These simulations are critical for anticipating reputational fallout, policy intervention, or systemic disillusionment.

III. Overseas Investment Scam Case Studies

The fact patterns in the following case studies showcase different kinds of investment oversight failure, trigger application of the MCAI due diligence metrics.

A. iCap Equity Real Estate Investment Fraud (Bellevue real-estate investment firm iCap faces bankruptcy, fraud allegations, Seattle Times, April 30, 2024. Source)

In this case, iCap Equity, a Bellevue-based real estate investment firm, attracted more than 150 investors and managed over $250 million in funds. The firm allegedly operated a Ponzi-like scheme, using money from new investors to pay returns to earlier ones. According to a court-appointed bankruptcy trustee, iCap concealed its deteriorating financial condition while continuing to solicit investments. Executives allegedly withdrew millions for personal use even as the company veered toward insolvency. The firm maintained public messaging about healthy growth and strong performance while its actual financials deteriorated, creating a trust and visibility gap that left investors misinformed.

Key Takeaway: iCap’s case exemplifies how firms can exploit local reputation and surface-level credibility to hide deeper structural collapse—particularly dangerous for foreign investors relying on secondhand assurances and delayed disclosures.

🧭 MCAI Application and Simulation

📏 Action–Language Integrity (ALI) would have detected growing misalignment between stated investment objectives and actual capital deployment.

🔧 Cognitive–Motor Fidelity (CMF) would have flagged disconnects between supposed real estate activities and transactional data.

🔍 Cognitive Trust Signal Model (CTSM) would have mapped the decay in internal credibility—among staff, brokers, and local partners—indicating cascading trust failure.

🛑 MCAI Action: MCAI would have triggered a Cognitive Risk Drift Alert, prompting early investigation, risk containment, or capital withdrawal.

This case reinforces how MCAI protects overseas investors by forecasting internal trust collapse before external prosecution, preserving foresight over reaction. It also shows how traditional reputation-based heuristics can be exploited in localized U.S. markets. MCAI offers a system-level defense for investors unfamiliar with the internal dynamics of target firms.

B. Case Study – DOJ EB-5 Visa Investment Fraud (U.S. v. Zhang, No. CR21-0132-JCC (W.D. Wash. Apr. 3, 2024), USDOJ Release)

In this case, real estate developer Bo Zhang was sentenced to four years in federal prison for defrauding foreign nationals who invested in U.S. projects through the EB-5 visa program. Zhang misappropriated over $2 million from immigrant investors—funneling funds into personal luxury expenses while falsely representing compliance with job creation and development benchmarks. Investors were led to believe their funds were being used to create qualifying U.S. jobs under the EB-5 program, but in reality, the money was diverted with no oversight. Zhang maintained a façade of operational legitimacy through polished marketing and false filings. The breakdown between official narratives and actual capital usage undermined institutional trust and legal safeguards.

Key Takeaway: The Zhang case reveals how legal compliance and visa-based investment frameworks can be manipulated through performative legitimacy. Investors were not only misled financially but structurally disadvantaged by the lack of verification systems embedded in EB-5 processes.

🧭 MCAI Application and Simulation

📏 Action–Language Integrity (ALI) would have exposed divergence between public-facing project narratives and actual capital flow.

🔧 Cognitive–Motor Fidelity (CMF) would have flagged cognitive inconsistency between declared milestones and tangible outcomes.

🔍 Cognitive Trust Signal Model (CTSM) would have revealed eroding stakeholder trust through indirect communication signals.

🛑 MCAI Action: MCAI’s simulation would have generated a Risk Drift Alert, prompting deeper scrutiny or early investor withdrawal.

This case highlights the critical value of cognitive simulation and trust metrics in protecting overseas investors from narrative fraud embedded in legal form. It underscores the importance of simulating both legal design and operational reality. MCAI enables foreign investors to assess not only what is claimed but what is likely to unfold.

C. Case Study – North Texas Real Estate Appraisal Fraud (U.S. v. Henderson et al., No. 3:24-cr-00075, N.D. Tex. (2024), U.S. DOJ Press Release)

In this case, federal prosecutors charged multiple individuals for orchestrating a $26 million real estate investment fraud scheme in North Texas. The defendants inflated property values through falsified appraisals, forged legal documents, and fabricated due diligence materials. These actions enabled them to deceive lenders and investors about the underlying value of the properties. The scheme involved coordinated misrepresentation across multiple parties, with deliberate intent to exploit institutional blind spots. Investors—particularly those overseas—had no realistic ability to verify the manipulated valuations or uncover document fraud embedded in trusted channels.

Key Takeaway: The North Texas scheme illustrates how document falsification and collusion can undermine investor protection—even when legal and institutional processes appear intact. For foreign investors especially, trust in formal channels becomes a liability when fraud is embedded within them.

🧭 MCAI Application and Simulation

📏 Action–Language Integrity (ALI) would have flagged inconsistencies between public valuation narratives and transaction history.

🔧 Cognitive–Motor Fidelity (CMF) would have exposed operational incoherence across appraisals, legal filings, and asset control.

🔍 Cognitive Trust Signal Model (CTSM) would have picked up on fractured communication integrity between brokers, lenders, and regulatory entities.

🛑 MCAI Action: MCAI’s Causal Signal Integrity model would have elevated alerts for document-based deception loops.

This case strengthens the argument for simulation-driven foresight in identifying not just bad actors, but collusive patterns hidden within otherwise legitimate real estate channels. This case also reveals the limits of relying on legal documentation alone in high-trust sectors. MCAI gives investors a foresight tool to penetrate opaque alliances and evaluate structural trustworthiness.

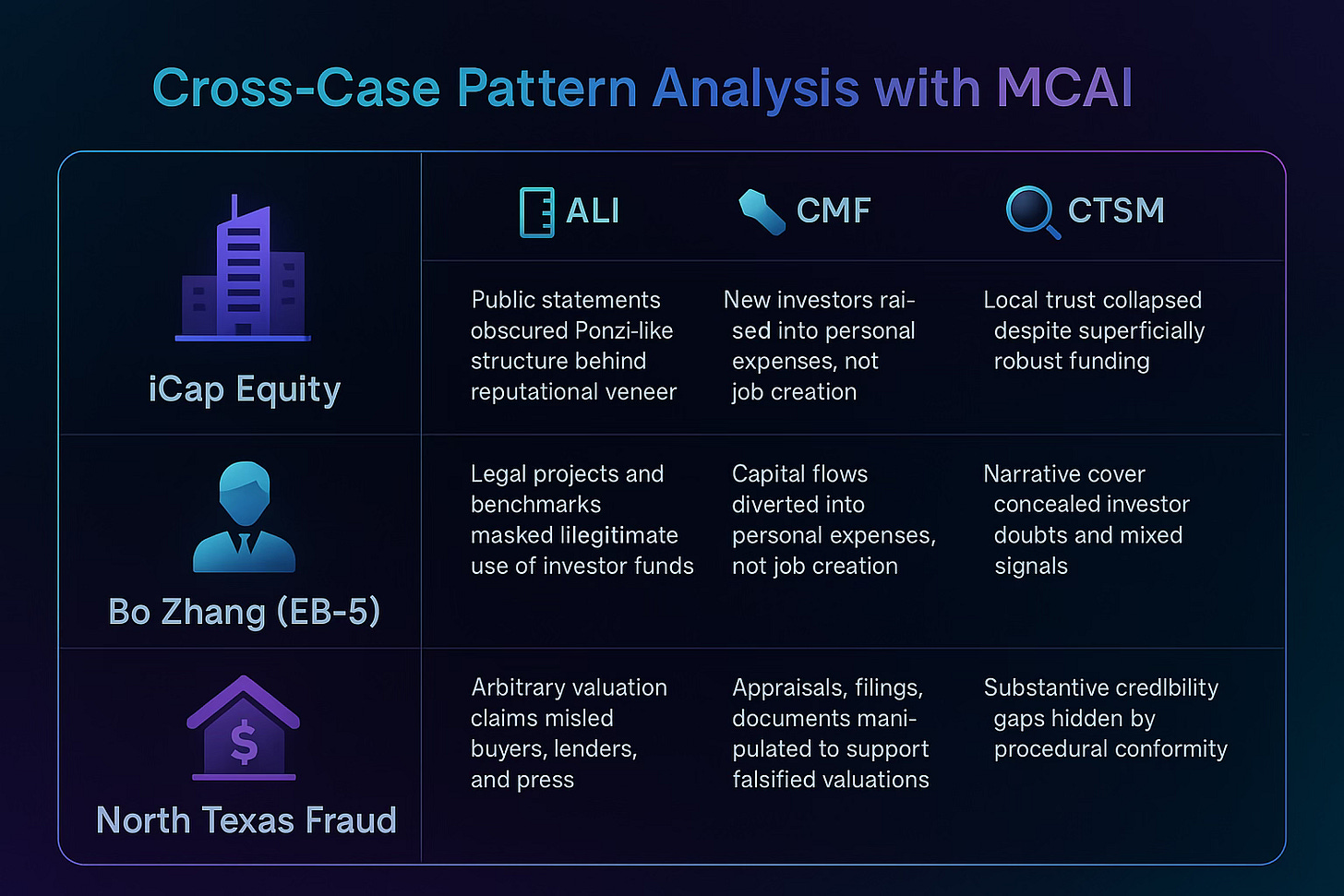

IV. Case Study Pattern Synthesis

Across all three case studies—iCap Equity, Bo Zhang’s EB-5 scheme, and the North Texas appraisal fraud—a consistent pattern emerges: institutional actors were able to maintain the appearance of compliance while concealing behaviors that would later result in collapse, fraud, or litigation. These actors exploited reputational lag, regulatory gaps, and investor distance to create narrative cover. In each case, the signals tracked by MCAI—particularly Action–Language Integrity, Cognitive–Motor Fidelity, and Cognitive Trust Signal Model—diverged well before any enforcement action occurred.

What these cases illustrate is that trust degradation is not random: it follows identifiable cognitive and behavioral trajectories that MCAI is designed to detect. The same metrics used to analyze institutional actors are also applicable to foreign investors and public trust ecosystems, revealing asymmetries in perception, reaction time, and foresight readiness.

While each actor type requires a different Vision Function routing, the failure points tend to cluster around three systemic weaknesses:

📏 Misalignment between stated intent and operational truth (ALI drift)

🔧 Erosion of execution credibility due to internal fragmentation (CMF breakdown)

🔍 Collapse in stakeholder trust as signals contradict outcomes (CTSM inversion)

These patterns highlight that institutional collapse is often preceded by detectable cognitive and moral drift—making MCAI’s foresight infrastructure not only diagnostic, but preventive.

V. Investor Foresight Framework

To respond to the structural asymmetries revealed in Section IV, investors need a decision-making framework built on simulation, not only compliance. MCAI supports this through a layered foresight architecture:

Signal Integrity Filters – Automatically evaluate the credibility of disclosures, filings, and statements using Action–Language Integrity (ALI), Cognitive–Motor Fidelity (CMF), and Cognitive Trust Signal Model (CTSM) metrics. These filters serve as a cognitive firewall—spotting contradiction, narrative manipulation, and intention masking before due diligence frameworks catch up. They help investors distinguish between structurally sound operators and actors masking risk through polished presentation.

Cognitive Risk Drift Alerts – Provide early warnings when patterns of misalignment emerge across leadership, finance, or legal domains. These alerts are driven by a multi-metric threshold system that detects behavior under stress, false reassurance, or decaying alignment. Investors can act months before financial symptoms become visible, preserving capital and influence.

Vision-Guided Scenario Modeling – Forecast narrative manipulation, reputational exposure, and institutional fragility using Vision Function pathways. This function allows investors to simulate cascading events—regulatory fallout, whistleblower emergence, public trust shifts—before they unfold. It gives shape to what conventional advisors cannot see: the behavioral trajectory behind the balance sheet.

Trust Gap Indexing – Quantify the delta between institutional self-representation and stakeholder perception over time. This tool measures the narrative credibility drift that leads to investor exit, litigation, or loss of license to operate. MCAI’s indexing system helps anticipate not just risk—but public narrative shifts that change market positioning.

Exit and Escalation Pathways – Simulate options for safe disengagement, risk containment, or pre-emptive intervention. Investors receive structured choices: stay and reshape, trigger internal checks, or prepare for strategic withdrawal. This moves foresight from observation to action, backed by simulation-tested outcomes.

By adopting MCAI’s foresight model, investors move beyond transactional risk management into systemic resilience. The outcome is not just capital preservation, but deeper market understanding—and strategic clarity in unfamiliar terrain.

VI. Quantified Impact of MCAI Overseas Investment Due Diligence, Monitoring

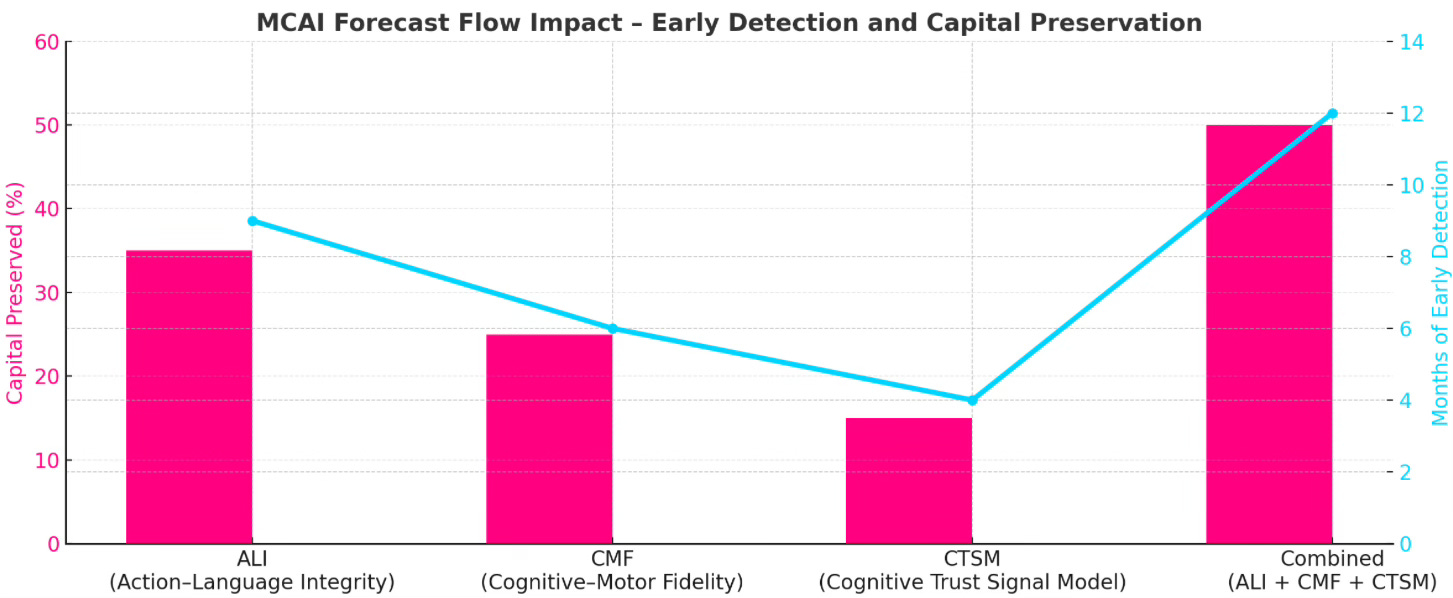

This chart visualizes how much earlier each MCAI metric can detect risk in cross-border investments—and how much capital could be preserved by acting on those insights. Action–Language Integrity (ALI), Cognitive–Motor Fidelity (CMF), and Cognitive Trust Signal Model (CTSM) each reveal distinct signal breakdowns. Their combined use offers the highest leverage in both foresight and capital preservation.

Figure: MCAI Forecast Flow Impact – Early Detection and Capital Preservation

Key Insights:

📏 Action–Language Integrity (ALI) alone can detect narrative divergence up to 9 months early.

🔧 Cognitive–Motor Fidelity (CMF) identifies execution breakdowns approximately 6 months in advance.

🔍 Cognitive Trust Signal Model (CTSM) tracks stakeholder trust shifts 4 months ahead of crisis visibility.

🧭🛑 Full integration improves both lead time and capital preservation exponentially.

This tool can inform investors of timing advantages in risk containment, trust diagnostics, and capital reallocation.

VII. Conclusion

The U.S. investment landscape remains one of the most dynamic and opportunity-rich in the world—but it is also increasingly shaped by narrative warfare, legal camouflage, and moral drift. For overseas investors, the greatest risk is not missing information, but misunderstanding intent.

MindCast AI equips investors with a new layer of defense—one that goes beyond what legal, financial, or compliance teams can offer. By simulating trust decay, behavioral inconsistency, and foresight asymmetry, MCAI doesn’t just evaluate what is seen—it reveals what is likely to unfold.

In a world where reputational optics can be manufactured and regulatory silence can be weaponized, MCAI enables investors to act not on reassurance, but on reason. The future of investment risk is cognitive—and the future of foresight is already here.

see also The Innovation Penalty, How Visa Restrictions Undermine America's Competitive Edge

Prepared by Noel Le, Founder | Architect, MindCast AI LLC. Noel holds a background in law and economics. noel@mindcast-ai.com, www.linkedin.com/in/noelleesq/