MCAI Policy Vision: Trump’s Gold Card Visa From Global Hype to Legal Hurdles, A Strategic Policy Assessment

Unlocking the Trump Gold Card Visa: Investment, Immigration, and Uncertainty

I. Executive Summary

The Trump Gold Card visa is a bold, high-stakes proposal: offer U.S. permanent residency to foreigners willing to invest $5 million, with a pathway to citizenship in five years. Announced with fanfare and supported by Commerce Secretary Howard Lutnick, the program has already generated more than 70,000 expressions of interest despite the absence of legal grounding. It aims to attract ultra-wealthy individuals and global corporations seeking safe, tax-advantaged U.S. residency.

However, the program's viability remains deeply uncertain, facing complex hurdles in law, taxation, national security, and international relations.

This policy vision statement evaluates the opportunity, assesses barriers, and forecasts the program's trajectory. We conclude that while demand is strong, legal and structural ambiguity must be resolved before the Gold Card can become a functioning visa category. Without Congressional authorization and a defined regulatory architecture, the initiative remains a political prototype—not a policy reality.

II. Market Demand and Target Demographic

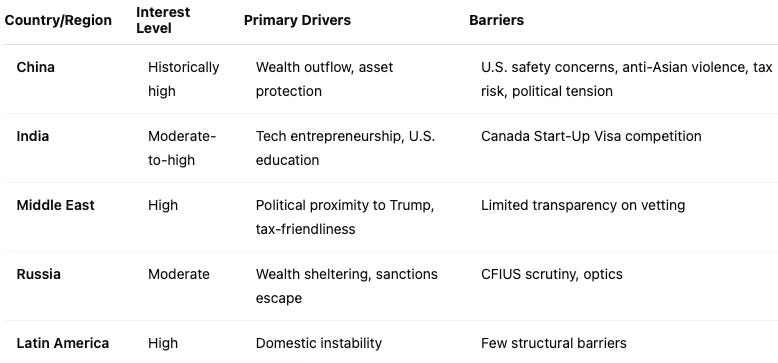

Even in its conceptual stage, the Trump Gold Card visa has sparked substantial global interest. Understanding where this demand originates—and why—is critical to gauging the policy’s viability. This section identifies the ideal investor profile and maps geographic appetite, highlighting both motivation and resistance. By analyzing country-specific drivers and barriers, we clarify the contours of the program’s true market potential.

A. Investor Profile

The target demographic includes individuals with at least $5 million in liquid, non-residential assets—roughly 1.5 million people globally. They are drawn to the U.S. for prestige, safety, education access, and long-term strategic mobility. Additionally, the program may appeal to corporations looking to relocate key executives and personnel swiftly.

B. Country-Level Demand Assessment

The early user base, though global, is skewed toward aspirational elites in emerging markets and family offices looking to hedge geopolitical and jurisdictional risk.

III. Program Structure and Legal Status

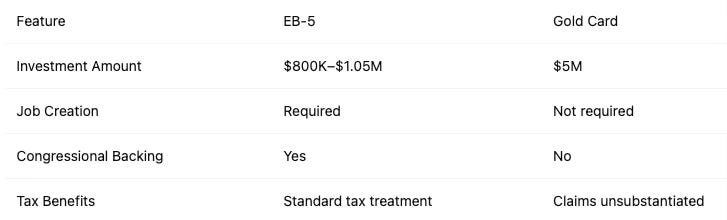

Though widely publicized, the Trump Gold Card remains a framework in flux. For it to transition from political concept to immigration policy, it requires both statutory foundation and administrative infrastructure. This section breaks down the proposed design, contrasts it with the established EB-5 model, and clarifies the legislative steps necessary for legitimacy. We also surface critical questions that have yet to be addressed.

A. Structural Overview

Investment: $5 million per applicant

Outcome: Permanent residency; path to citizenship in 5 years

No job creation requirement (unlike EB-5)

Tax benefit claims (no U.S. tax on non-U.S. income) are unsubstantiated without legislation

B. Legal Foundation and Path to Implementation

The Gold Card visa requires statutory authorization through amendments to the Immigration and Nationality Act (INA).

Proposed tax exemptions on non-U.S. income must also pass through Congress via formal changes to the Internal Revenue Code.

Executive authority alone is insufficient to establish permanent residency pathways or override U.S. taxation norms.

C. Comparison with EB-5 Program

D. Administrative Questions

What entity will oversee and vet applications?

How will funds be managed or escrowed?

Will country-of-origin exclusions apply?

What safeguards exist to prevent fraud or abuse?

IV. Key Uncertainties and Scenario Forecasting

While early interest in the Gold Card is strong, the program is suspended in legal and operational limbo. Its public visibility far exceeds its structural readiness. This section outlines the five most critical uncertainties that could shape the future of the program, from tax law and congressional action to national security and political optics. By evaluating each through scenario forecasting, we assess how close—or far—the Gold Card is from actual implementation.

1. Legislative Authorization

Uncertainty: Without amendments to INA and tax code, the visa cannot legally be issued.

Forecast: <30% chance of congressional passage in 2025; higher if Trump wins re-election.

2. Tax Treatment of Global Income

Uncertainty: The program claims tax exemptions that are not grounded in law.

Forecast: Likely litigated or blocked. May be rolled back or limited even if initially granted.

3. National Security and Vetting

Uncertainty: No clarity on whether applicants from high-risk countries (e.g., China, Russia) would be excluded.

Forecast: High likelihood of CFIUS-type screening or selective bans.

4. Program Design and Oversight

Uncertainty: No framework yet for investment channels, vetting rules, enforcement mechanisms.

Forecast: If built atop EB-5 infrastructure, could launch quickly post-election; otherwise delayed.

5. Political Sustainability

Uncertainty: Critics see it as “selling citizenship.” Public backlash may limit longevity.

Forecast: Viable as a niche elite program, but politically volatile.

V. Strategic Assessment and Recommendations

The Trump Gold Card visa is a bold idea—but boldness alone is not a strategy. Its promise of economic upside must be weighed against operational vagueness and legal fragility. This section offers a clear-eyed assessment of the program's opportunities and risks, along with actionable guidance for policymakers, investors, and stakeholders. Without structural clarity, even a well-marketed policy can quickly devolve into reputational and financial exposure.

Opportunities

Demand is clearly real: 70,000+ sign-ups in days

High-value entrants could boost U.S. capital inflows

Adds a premium migration channel that bypasses bureaucracy

Risks

Without legal foundation, the program is vaporware

Tax and security promises may violate existing law

Creates dual-class optics that may harm public trust

Recommendations

Monitor legislative movement: Watch for any bills modifying INA or U.S. tax code.

Engage legal counsel early: Investors should not allocate capital until the legal framework is finalized.

Benchmark against alternatives: Canada’s Start-Up Visa, Portugal’s Golden Visa, and Singapore’s GIP all offer clearer, lower-risk pathways.

Prepare for reputational volatility: Early adopters must weigh benefits against potential public scrutiny.

This recommendation aligns with MCAI’s prior analysis on cross-border investor risk patterns, which identified a recurring mismatch between political marketing and regulatory execution in high-capital migration programs (see full report).*

VI. Closing Insight

The Gold Card may generate $1 trillion in capital, but that future is speculative until the law catches up. A program of this scale can’t run on charisma and ambition alone—it needs Congressional legitimacy, administrative competence, and legal clarity. Until then, the Gold Card remains a promise—not a policy.