MCAI Innovation Vision: National Innovation Policy, Putting Bayh-Dole Patents at a Crossroads

Trump Risks Decades of Innovation in Attack on Harvard Patents

A foresight simulation conducted by MindCast AI, a predictive Cognitive AI firm. Unlike commentary or retrospective analysis, this simulation models forward-looking behavior by running Cognitive Digital Twins of universities, industry, agencies, and courts. The result is a scenario-based forecast that tests how institutional actors are likely to respond under stress, and how those responses will reshape the national innovation system. See companion study The Rule of Law Under Coercive Narrative Governance in Trump v Harvard Patents; How Presidential Power Bypasses Equal Protection and Rewrites Innovation Policy in Real Time (Aug 2025), and prior study The Tension Between Public Trust and Coercive Narrative Governance in Free Markets | Democracy; A Framework for Intervention Grounded in Institutional Simulation—Revealing the Fragility and Recoverability of Trust in Democracy Overwhelmed by Narrative Power (Jul 2025).

I. The Core Conflict

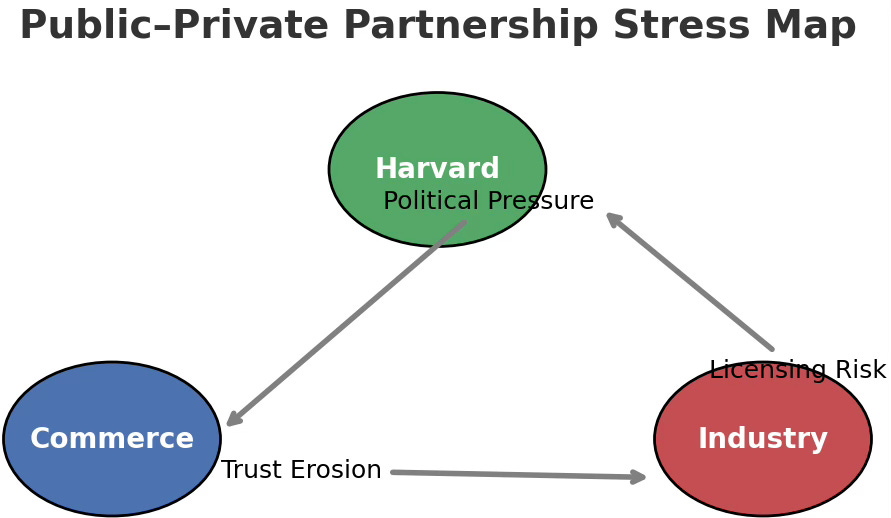

The Commerce Department’s probe into Harvard’s patent portfolio is not an isolated dispute. It cuts at the foundation of the Bayh-Dole Act, the central compact underpinning the U.S. innovation ecosystem since 1980. By threatening to exercise march-in rights across an entire portfolio, Commerce shifts the tool from a case-specific safeguard into a political weapon. The immediate conflict therefore doubles as a stress test of national innovation policy and the durability of public–private partnership.

MindCast AI’s Cognitive Digital Twins of universities, licensees, regulators, and judges reveal a common thread: uncertainty erodes trust in commercialization pathways. A portfolio-wide march-in attempt, unprecedented in Bayh-Dole’s history, signals to industry that federal licenses are contingent on politics rather than clear statutory standards. This destabilizes the “triple win” Bayh-Dole created: taxpayers funding research, universities owning inventions, and industry commercializing them. If political discretion overtakes statutory predictability, licensing risk premiums rise, slowing translational research.

This conflict is not about Harvard alone, but about whether the government remains a partner or becomes a destabilizer. The structure that powered U.S. biotech and advanced tech growth is at risk of selective enforcement. The entire innovation economy hangs on whether predictability or politicization prevails.

Contact mcai@mindcast-ai.com to partner with us on regulatory policy modeling and market foresight simulations. See our other national innovation policy work at www.mindcast-ai.com/s/national-innovation.

II. Historical Foundation

Before Bayh-Dole, federally funded inventions were often abandoned—labeled “contaminated” and left to die on the shelf. The Act transformed this dead capital into an engine of growth by giving universities title and incentivizing licensing. The results speak for themselves: university patents surged, creating billion-dollar industries from gene therapy to Honeycrisp apples. Harvard’s 5,800 patents are one node in a system that transformed U.S. science into global leadership.

The simulation of historical policy shows how incentives reshape behavior. Federal dollars—$60 billion annually—provide the backbone of U.S. university R&D, but without clear ownership, firms once refused to commercialize discoveries. Bayh-Dole turned licensing into a standard practice, sparking venture-backed industries and public–private clusters. The patent curve from 1976 (294 patents) to 2024 (6,700 patents for the top 100 universities) illustrates exponential growth.

This historical evidence confirms that Bayh-Dole is not a broken system in need of replacement—it is a proven success. To destabilize it now would reverse four decades of learning curves. The foundation of national competitiveness lies in keeping this framework intact.

III. Institutional Reactions

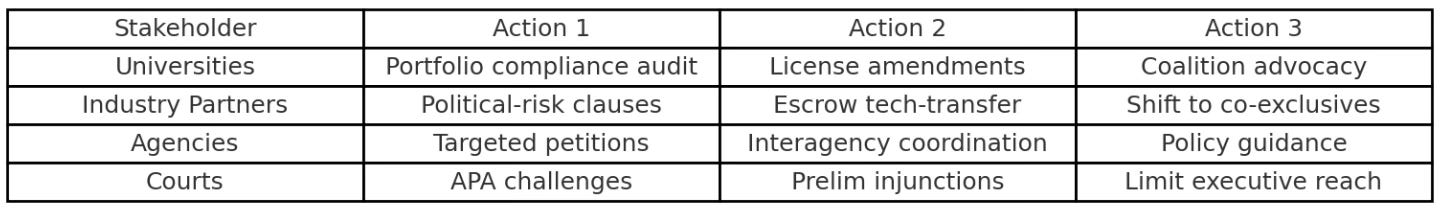

Each stakeholder is already moving. Universities are scrambling to audit licenses, industry is inserting political-risk clauses, and agencies are debating whether Commerce has exceeded its remit. Courts, meanwhile, are positioned as the final arbiter of how far march-in authority can reach. MindCast AI’s simulations show alignment around one theme: the need to preserve predictability in order to avoid a chilling effect on research commercialization.

Universities: triage their exclusive licenses, tighten compliance with U.S.-manufacturing rules, and prepare APA-based litigation.

Industry partners: demand escrowed tech packages and contingent sublicenses to survive a march-in order, while hedging through co-exclusive deals.

Agencies: wrestle with interagency politics—NIH and DOE wary of precedent, Commerce pressing for control.

Courts: primed for injunctions on the grounds of agency overreach, especially since march-in has never been used despite multiple petitions (e.g., Xtandi).

Stakeholder Action Grid- Response to Bayh-Dole Stress

Every stakeholder is defensive, but all converge on the desire for clarity. The more Commerce escalates, the more likely courts are to impose procedural limits. Institutional foresight shows the partnership can hold—but only if legal boundaries are enforced.

IV. Scenarios and National Consequences

The path forward is not singular but contingent. MindCast AI’s foresight modeling mapped four possible outcomes with probabilities attached. At one end, Commerce claims victory with a negotiated compliance cure; at the other, courts freeze its ambitions and Congress re-enters the debate. Between lie targeted march-in attempts and incremental chilling effects that reshape licensing norms.

Audit & Cure (45%): Harvard delivers compliance; oversight tightens but Bayh-Dole remains intact.

Targeted March-In (20%): Agencies pick 1–3 high-profile patents (likely biotech) for test cases.

Judicial Freeze (25%): Harvard sues; courts enjoin Commerce’s portfolio-wide move as ultra vires.

Policy Rewrite (10%): Congress uses the controversy to alter Bayh-Dole, codifying new factors such as pricing.

The most likely outcome is a compliance-driven standoff, not a wholesale dismantling. Yet even the probability of march-in, once unthinkable, shifts perceptions of U.S. innovation security. America’s edge depends on whether this moment reinforces trust—or seeds long-term doubt.

Closing Perspective

This foresight simulation demonstrates how MindCast AI provides more than legal or policy commentary. By modeling Cognitive Digital Twins of universities, industry partners, regulators, and courts, it anticipates how each actor’s incentives and constraints interact over time. This method surfaces second-order effects—such as a chilling of university licensing or a judicial reassertion of procedural boundaries—that static analysis often misses. The Harvard probe is therefore not just a headline, but a systemic stress test. Its resolution will determine whether America strengthens the innovation partnership that Bayh-Dole built, or fractures it under political weight.

Appendix

🔹 Pre–Bayh-Dole (before 1980) — Ad hoc, often stalled commercialization

Penicillin (1940s): Discovered earlier in academia, but mass-produced during WWII through partnerships between U.S. government labs and pharmaceutical firms (Merck, Pfizer).

Transistor (1947): Invented at Bell Labs, but federal R&D contracts (military and NASA) accelerated adoption into defense and space systems.

Polio Vaccine (1950s): Jonas Salk’s research was federally funded; mass distribution required both public health infrastructure and private pharmaceutical scaling.

ARPANET → Internet (1960s–70s): Funded by DARPA; built by universities and defense contractors; later commercialized by private firms.

Space Race Technologies (1960s): From integrated circuits to satellite communications, NASA and DOD procurement programs subsidized early semiconductor and aerospace industries.

MRI (Magnetic Resonance Imaging) (1970s): Early discoveries at academic labs, funded by NIH/NSF, later licensed to GE and other imaging companies.

📌 Problem pre-Bayh-Dole: Inventions funded by the federal government were often considered “government-owned” and left to languish — universities held thousands of patents that companies wouldn’t touch due to unclear rights and lack of incentives.

🔹 Post–Bayh-Dole (after 1980) — Structured commercialization through universities

Biotechnology Revolution (Genentech, Amgen, Biogen): Fueled by university patents (often NIH-funded) on recombinant DNA and monoclonal antibodies.

HIV/AIDS Therapies (1990s–2000s): Stanford, Columbia, and NIH discoveries licensed to pharma, forming backbone of antiretroviral therapies.

Google Search Algorithm (1996–1998): PageRank was developed with NSF funding at Stanford; Stanford licensed it to Google in exchange for equity.

CRISPR Gene Editing (2010s): UC Berkeley and Broad Institute discoveries, NIH- and DARPA-funded, licensed broadly to biotech startups and Big Pharma.

mRNA Vaccines (2020 COVID-19 response): NIH and university patents (UPenn, Moderna collaborations) under Bayh-Dole licensing directly enabled rapid vaccine rollout.

Honeycrisp Apples (1991 release): Developed at University of Minnesota with USDA support, commercialized through licensing to growers worldwide.

Semiconductors & Nanotech (1990s–2000s): NSF- and DOE-funded university labs generated patents licensed to Intel, IBM, and startups.

📌 Impact of Bayh-Dole: Instead of inventions sitting on the shelf, universities could license them — creating an entire technology transfer industry and fueling thousands of startups.