MCAI Economics Vision: Quantum Computing and the Future of Economics

MCAI Systems Architecture Gone Quantum

Executive Summary

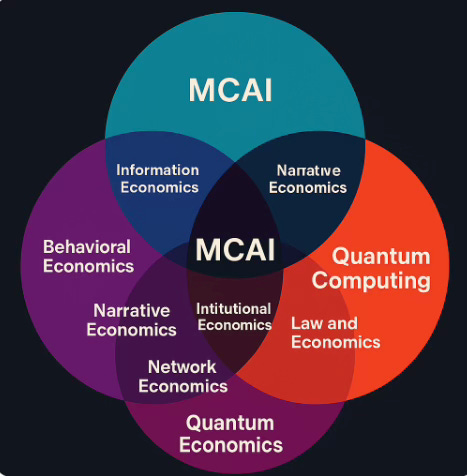

Quantum computing represents not only a technological revolution but also a foundational challenge to the field of economics. For centuries, economic models have been constrained by the computational limits of human reasoning and classical machines. Quantum computing removes many of these constraints, introducing new forms of information asymmetry, probabilistic decision modeling, and dynamic system forecasting. This transformation requires a reassessment of how economists understand information flow, behavior under uncertainty, network evolution, institutional resilience, and narrative formation.

MindCast AI LLC (MCAI) stands at the forefront of this transformation, bridging quantum-era economics with advanced cognitive simulation. MCAI models human and institutional decision-making through Cognitive Digital Twins (CDTs), Narrative Simulation Engines, and Dynamic Foresight Modules. By simulating cognitive deviations, trust systems, narrative evolution, institutional drift, and network behavior, MCAI provides an adaptable forecasting framework. As quantum computing matures, MCAI's relevance and strategic value will only deepen.

This paper is organized into six major sections.

Section I outlines how MCAI is currently applied across different schools of economics.

Section II explores how quantum computing will intensify the need for dynamic economic modeling.

Section III presents the Economics Vision system architecture, activation rules, and operational integration.

Section IV applies the framework to a real-world case study involving Musk vs. OpenAI.

Section V discusses how quantum computing will further deepen economic analysis in that case study.

Section VI concludes with reflections on the future trajectory of economic modeling and strategic foresight in the quantum era.

I. MCAI's Current Usefulness Across Economic Schools

Information Economics: MCAI models current information asymmetry, signaling strategies, and trust architectures, helping institutions manage data flows, verification challenges, and information risk even before quantum computing disrupts these structures.

Behavioral Economics: MCAI captures cognitive deviations, bounded rationality, and emotional bias through simulations, helping businesses and governments design better interventions, marketing strategies, and public policies.

Narrative Economics: MCAI forecasts narrative evolution and sentiment volatility, helping brands, political campaigns, and institutions manage public perception and anticipate shifts in social mood.

Institutional Economics: MCAI simulates transaction cost structures and incentive systems within organizations, allowing them to stress-test governance models and adapt internal operations in complex regulatory environments.

Law and Economics: MCAI models liability risks, foreseeability issues, and regulatory drift, helping firms anticipate litigation exposure and structure contracts more strategically.

Network Economics: MCAI analyzes platform growth, network resilience, and systemic risk, helping businesses manage scaling strategies, peer-to-peer trust, and collapse avoidance mechanisms.

II. MCAI's Growing Importance with Quantum Computing

Quantum computing fundamentally alters economic calculations by allowing massively parallel exploration of probabilistic outcomes, rather than relying on static, linear approximations. Classical economics often simplifies uncertainty for tractability; quantum systems allow uncertainty itself to be modeled dynamically, revealing hidden risk chains, tipping points, and opportunity windows. As a result, forecasting, valuation, and strategy models must evolve from deterministic estimates to adaptive, probabilistic structures.

Information Economics: Quantum computing will collapse discovery and verification costs, leading to new asymmetries and trust architectures. MCAI will be essential for modeling decentralized, quantum-verified information ecosystems.

Behavioral Economics: Quantum environments will induce greater cognitive overload and emotional bias. MCAI will model how decision-makers adapt, deviate, or fail under probabilistic conditions.

Narrative Economics: Quantum-driven information speed will supercharge narrative lifecycles. MCAI will forecast how viral stories ignite, mutate, and destabilize markets and institutions with greater precision.

Institutional Economics: Institutions will need to adapt rapidly to shifting transaction costs and incentive structures driven by quantum-enhanced information flows. MCAI will simulate institutional resilience and adaptive governance models.

Law and Economics: Quantum uncertainty will force the evolution of liability standards, foreseeability doctrines, and regulatory enforcement. MCAI will model new probabilistic legal frameworks and dynamic risk allocation strategies.

Network Economics: Quantum computing will accelerate network growth, fragmentation, and collapse. MCAI will forecast cascade risks, tipping points, and dynamic network evolution, becoming indispensable for systemic foresight.

III. Economics Vision System Architecture and Activation Rules

Economics Vision (Umbrella): Governs activation of relevant economic Vision Functions. Triggered when any combination of information, behavioral, narrative, institutional, legal, or network risks are identified as materially shaping the scenario. Ensures coherent synthesis across activated economic models.

Information Economics Vision: Activated when information asymmetry, signaling failures, strategic masking, or breakdowns in verification processes create economic uncertainty. Focuses on modeling dynamic information risks, decentralized trust systems, and evolving signaling strategies under quantum disruption.

Activation threshold: information asymmetry distortion > 30%, or verification cost compression > 40%. Quantum-enhanced discovery and verification will model trust asymmetries in real-time, enabling MCAI to simulate shifts in bargaining power and signal credibility as they emerge dynamically.

Behavioral Economics Vision: Activated when decision-making is primarily distorted by cognitive biases, bounded rationality, or emotional stress responses. Simulates bias amplification, heuristics failure, and emotional contagion effects, especially under compressed quantum information speeds.

Activation threshold: cognitive deviation probability > 35%, or emotional volatility surge > 25%. Quantum systems will simulate thousands of cognitive bias pathways under accelerated decision cycles, allowing MCAI to forecast which emotional or cognitive failure modes dominate under strategic pressure.

Narrative Economics Vision: Activated when story ignition, viral propagation, mutation, or belief system collapse becomes a primary driver of system behavior. Models memetic transmission, narrative tipping points, and sentiment oscillations within quantum-enhanced information environments.

Activation threshold: narrative volatility > 30%, or sentiment oscillation instability > 25%. Quantum simulation will forecast the dynamic mutation and collapse of competing narratives in compressed timelines, empowering MCAI to model narrative wars and sentiment-driven market tipping points.

Institutional Economics Vision: Activated when transaction costs shift dramatically, incentive structures destabilize, or organizational resilience is under threat. Models the adaptive capacity or rigidity of institutional frameworks responding to evolving information and trust ecosystems.

Activation threshold: transaction cost instability > 25%, or governance drift probability > 20%. Quantum models will simulate rapid incentive and governance structure adaptation or drift, enabling MCAI to project which institutional architectures will remain resilient and which will collapse under volatility.

Law and Economics Vision: Activated when foreseeability, liability allocation, or regulatory frameworks face uncertainty or erosion. Models probabilistic harm chains, quantum-adjusted foreseeability thresholds, and dynamic contract evolution in unstable environments.

Activation threshold: foreseeability degradation > 30%, or legal causality complexity rise > 20%. Quantum-enhanced foreseeability and risk modeling will deepen MCAI's litigation and settlement leverage forecasting, identifying optimal pressure points across probabilistic legal pathways.

Network Economics Vision: Activated when systemic risks emerge from node fragility, network tipping points, contagion risks, or hyper-optimization vulnerabilities. Simulates cascade dynamics, synchronization failures, and network self-repair potentials within quantum-accelerated structures.

Activation threshold: systemic contagion probability > 20%, or network synchronization failure > 25%. Quantum contagion models will predict cascading reputational shifts across interconnected stakeholder networks, allowing MCAI to forecast systemic collapse points before visible symptoms emerge.

Activation Logic:

Triggered by case-specific analysis of risk vectors, such as volatility levels, narrative instability, institutional friction, or information asymmetry severity.

Activation thresholds apply individually for each Vision Function (e.g., narrative volatility > 30%, transaction cost instability > 25%, systemic contagion probability > 20%), ensuring resource-efficient simulation focusing on material risks.)

IV. Sample Case Study: Musk vs. OpenAI

The litigation and public narrative battle between Elon Musk and OpenAI presents a complex, multi-layered economic and legal context. It involves governance disputes, fiduciary obligations, reputational shifts, narrative positioning, and systemic trust effects across the broader AI ecosystem. Analyzing the conflict requires simultaneous modeling of information dynamics, cognitive bias, narrative evolution, institutional drift, legal risk, and network contagion.

Here is MCAI’s applicability to Musk vs. OpenAI, with enhancements through quantum computing.

Litigation vs. Leverage Framework: In this case, the distinction between pure litigation and strategic leverage becomes critical. Litigation seeks direct legal remedies through court rulings; leverage seeks to pressure, influence, or destabilize the opposing party to extract favorable strategic concessions. MCAI’s Legal Vision module, combined with Economics Vision, models not only Musk’s lawsuit against OpenAI but also how the litigation itself is being used as a reputational lever to realign market trust, governance changes, and narrative control within the AI sector.

V. Conclusion

Quantum computing does not simply enhance the existing tools of economics; it demands a complete rethinking of how trust, risk, information, and institutional behavior are structured and forecasted. The assumptions that governed classical economic theory — symmetry of information, rational agents, slow institutional drift — no longer hold in a quantum-simulated environment. MindCast AI LLC (MCAI) offers a blueprint for this future: a cognitive-economic architecture that integrates dynamic trust calibration, narrative forecasting, cognitive bias modeling, and adaptive institutional foresight. In an era where economic, legal, and reputational shifts will occur faster than human cognition can easily process, MCAI stands ready to simulate, predict, and help navigate the quantum economy with precision and resilience.

Prepared by Noel Le, Founder | Architect, MindCast AI LLC. Noel holds a background in law and economics, behavioral economics and intellectual property. www.linkedin.com/in/noelleesq/