MCAI Innovation Vision: From Theory-of-Mind Benchmarks to Institutional Behavior

A Behavioral Economics Bridge Using Cognitive Digital Twins

See also the MindCast AI series on Predictive Cognitive AI.

I. Why Behavioral Economics Bridges ToM and Institutions

Theory of Mind (ToM) research in large language models has rapidly evolved from testing child-like false-belief tasks to benchmarking complex social reasoning at scale.

Michal Kosinski’s working paper at Stanford Graduate School of Business (Theory of Mind May Have Spontaneously Emerged in Large Language Models, 2023) suggested emergent ToM in GPT-4, while

Gandhi, Fränken, Gerstenberg, and Goodman introduced BigToM in their NeurIPS 2023 paper (Understanding Social Reasoning in Language Models with Language Models, 2023), a structured benchmark that systematizes belief and action inference in LLMs.

MindCast AI’s prior paper (Stanford’s Big Theory of Mind: Institutional Intelligence through Predictive Cognitive AI, 2025) positioned these findings as micro-foundations for extending cognitive modeling to institutions through Cognitive Digital Twins (CDTs),

in parallel, Stanford HAI’s report (Generative AI: Perspectives, 2023) provided a broader interdisciplinary frame for the societal implications of generative AI.

Yet the missing link—how ToM mechanisms map onto the decision-making biases and heuristics studied in behavioral economics—remains underexplored.

This study addresses that gap by treating ToM signals not as abstract capabilities, but as behavioral primitives that influence organizational outcomes. Institutions rarely act as rational actors; instead, they are shaped by loss aversion, status-quo bias, reputational pressure, and present bias. By embedding these behavioral mechanisms into Cognitive Digital Twins (CDTs), we show how ToM-like reasoning increases predictive power for institutional foresight.

Behavioral economics provides the language and structure for connecting LLM social reasoning benchmarks to real-world organizational behavior.

Behavioral economics is the natural bridge between micro-level ToM results and macro-level institutional foresight. It grounds ToM in observable decision-making patterns, turning psychological constructs into organizational features. This positions predictive cognitive AI as a tool for simulating institutional choices with both rigor and relevance.

Contact mcai@mindcast-ai.com to partner with us in behavioral economics and predictive cognitive AI.

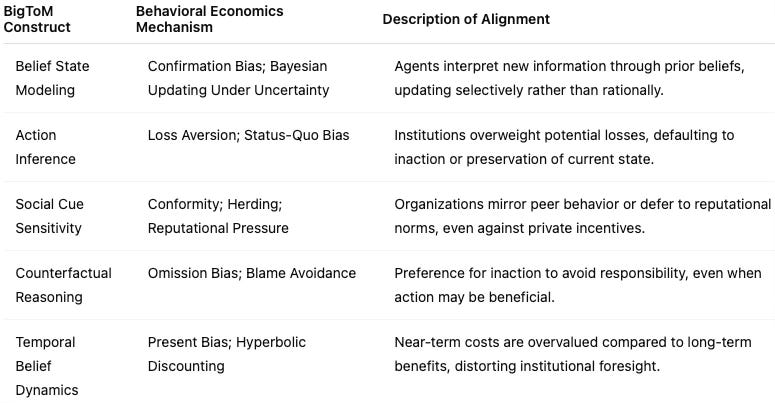

II. Construct Mapping: ToM Features into Behavioral-Econ Primitives

The BigToM benchmark, introduced by Gandhi et al. in their NeurIPS 2023 paper (Understanding Social Reasoning in Language Models with Language Models, 2023), identifies recurring inference patterns such as belief state modeling, action inference, and counterfactual reasoning.

Each of these aligns closely with well-established mechanisms in behavioral economics. Belief state modeling overlaps with confirmation bias and Bayesian updating under uncertainty. Action inference maps onto loss aversion and status-quo preference, while counterfactual reasoning connects to omission bias and blame-avoidance heuristics.

We provide a mapping table below that explicitly connects BigToM constructs to behavioral-economics primitives. This table functions as a translation layer, allowing ToM constructs to be operationalized within institutional CDT simulations.

The mapping reframes ToM benchmarks as predictive levers in institutional decision-making. By encoding these mechanisms, CDTs can better anticipate when organizations will deviate from rational models due to behavioral distortions. It creates a testable framework for aligning emergent ToM signals with measurable behavioral-econ principles.

III. Institutional Vignettes: Applying Behavioral-ToM in Practice

To demonstrate how ToM and behavioral economics converge at the institutional scale, we develop a series of vignettes. Each vignette captures a recognizable organizational dilemma where beliefs, biases, and social pressures shape outcomes. These scenarios draw from regulatory delay, court sequencing, and corporate disclosure—domains where MCAI has previously modeled strategic foresight, as in the MindCast AI prior publication (Stanford’s Big Theory of Mind, 2025).

The vignettes serve as testbeds for comparing baseline CDT models with those enhanced by ToM-behavioral features.

Regulator Deferral Case: Agency defers action despite evident harm due to blame avoidance and reputational risk.

Court Sequencing: Forum-shopping dynamics framed as institutional conformity and precedent heuristics.

Corporate Disclosure Timing: Present bias and reputation management drive delayed disclosures despite incentives for transparency.

These vignettes illustrate how ToM-aligned behavioral features explain real deviations from rational-choice models. They also provide practical scenarios for testing CDT accuracy gains. The result is a bridge from benchmark constructs to institutional foresight grounded in behavioral economics.

IV. A/B Foresight Check: Measuring Predictive Lift

To assess whether embedding ToM-behavioral features increases institutional foresight accuracy, we run A/B simulations. Model A represents baseline CDTs, which encode incentives, history, and constraints. Model B integrates ToM-behavioral mappings such as loss aversion, conformity, and reputational pressure. Comparing the two models across vignettes reveals whether ToM-behavioral embedding improves predictive reliability.

The A/B test records hit rates and rank-ordering accuracy of institutional actions. Where Model B consistently outperforms, we attribute the gain to ToM-behavioral features. Where no gain is observed, we note that policy constraints or structural incentives outweigh behavioral mechanisms.

The A/B check isolates the contribution of ToM-behavioral features. It demonstrates not only when foresight accuracy improves, but also when ToM adds noise rather than clarity. This method provides empirical footing for claims about behavioral economics as a bridge for institutional modeling.

V. Failure Modes: Where ToM Overfits

Not all ToM features improve institutional foresight. In some cases, embedding ToM-like reasoning overfits narrative patterns, producing false positives. For example, attributing belief asymmetry to an agency may mislead if legal mandates strictly determine outcomes. Understanding these limits is as important as identifying where ToM adds value.

We catalog common failure modes: over-weighting narrative coherence, neglecting structural policy constraints, and mistaking individual biases for institutional rules. These failures highlight the boundaries between psychology and governance. They also prevent overgeneralization of ToM benchmarks.

Failure modes remind us that institutions are partly behavioral, partly structural. ToM improves foresight when behavior dominates; it misleads when hard rules or incentives override. Recognizing limits ensures ToM-behavioral CDTs remain credible tools.

VI. Behavioral Economics Takeaways

The publication demonstrates how ToM benchmarks, once mapped into behavioral economics, extend naturally into institutional foresight. By treating ToM constructs as behavioral primitives, we align them with mechanisms economists already use to explain real-world decisions. This translation produces clear rules of thumb about when ToM adds value. It also provides a framework for regulators, courts, and firms to understand their own decision biases.

Key takeaways: ToM constructs = behavioral primitives; CDTs enhanced with these features show predictive gains in domains dominated by bias and reputation; limits occur where rigid rules dominate. These findings advance MCAI’s argument that predictive cognitive AI operationalizes behavioral economics at scale.

As Stanford HAI’s report (Generative AI: Perspectives, 2023) emphasized, AI’s societal impact requires frameworks that cross law, economics, and culture—precisely the domains where MindCast AI CDTs apply.

Behavioral economics transforms ToM from a cognitive curiosity into a predictive asset. It shows that foresight simulations are not abstract theory but grounded in the very biases that drive institutional behavior.