MCAI Market Vision: Predictive Cognitive AI and the AI Infrastructure Ecosystem

Anticipating Constraint Cascades in the AI Infrastructure Economy

I. Executive Summary

The infrastructure economy has become the foundation layer of AI. Every model, dataset, and accelerator is now constrained—or empowered—by energy, cooling, and connectivity.

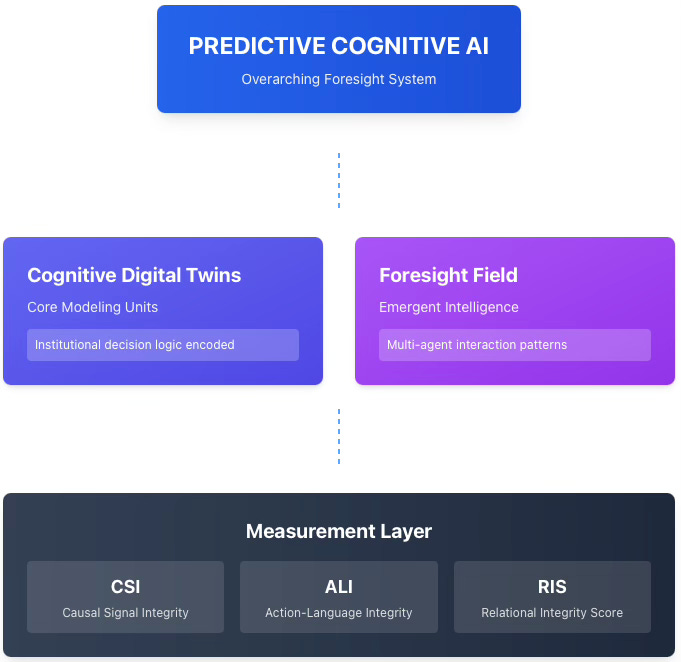

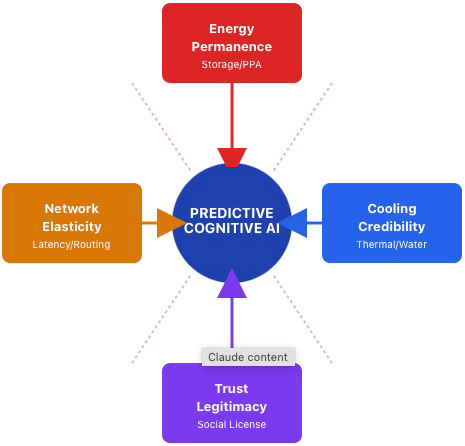

MindCast AI introduces a new class of intelligence for the AI infrastructure era: Predictive Cognitive AI, an overarching foresight system. Within the foresight hierarchy, Cognitive Digital Twins (CDTs) serve as the core modeling units representing key institutional actors; their interactions form the Foresight Field, an emergent intelligence that reveals causal dependencies and system-wide dynamics; and critical metrics operate as the measurement layer that evaluates reliability, governance clarity, and relational trust across simulations:

CSI (Causal Signal Integrity) measures the structural trustworthiness of inferred causal links within simulations, ensuring modeled relationships reflect real-world constraints.

ALI (Action–Language Integrity) evaluates whether institutional actions remain consistent with their stated intents across time and context.

RIS (Relational Integrity Score) quantifies the coherence and authenticity of trust signals among participating actors, revealing where collaboration strengthens or fractures.

Instead of optimizing within one silo—chips, data centers, or utilities—Predictive Cognitive AI models the causal interdependence between them. It encodes the decision logic of hyperscalers, grid operators, chip foundries, sovereign funds, and regulators, and simulates how their choices converge or collide across time. The result is not another analytics tool, but a structural foresight engine that converts physical constraints into actionable intelligence.

Ecosystem players engage MindCast AI to turn foresight into measurable advantage—reducing the risk of misallocated infrastructure, accelerating permitting through trust forecasting, and capturing billions in avoided downtime or stranded capital. By anticipating constraint cascades before they occur, clients secure first-mover access to energy-rich sites, optimize network resilience, and strengthen public legitimacy. Predictive Cognitive AI becomes their differentiator: a cognitive layer that transforms uncertainty into strategic control.

Contact mcai@mindcast-ai.com to partner with us on AI infrastructure foresight simulations.

II. The Infrastructure Crisis

AI infrastructure has reached its breaking point. Every layer—power, cooling, and network—faces stress levels unseen in previous industrial eras. The crisis is no longer theoretical: it is visible in the scramble for nuclear PPAs, the inflation of land and energy costs, and the geopolitical race for computational sovereignty. This section outlines how escalating demand has collided with physical and social limits, turning infrastructure from a support system into a strategic fault line.

The Race Outpaces the Grid

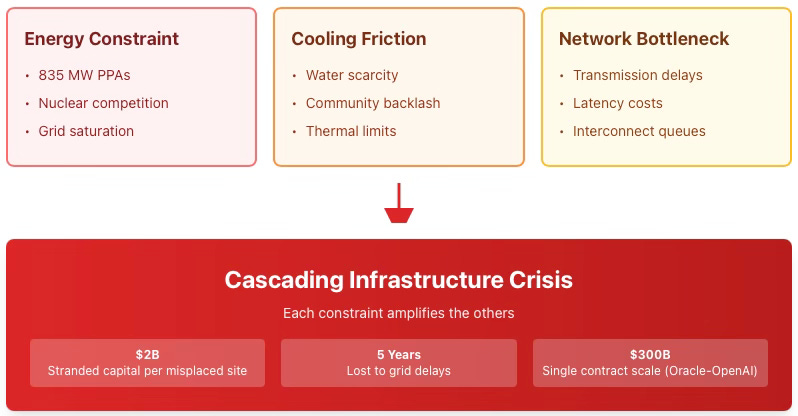

AI’s exponential appetite for compute now exceeds the physical limits of energy and cooling. Microsoft’s 835 MW Three Mile Island nuclear PPA, Oracle’s $300 B OpenAI contract, and the worldwide race for advanced cooling mark a fundamental inflection: infrastructure is now the binding constraint on intelligence itself.

Where the System Bends

Power grids strain under megawatt‑scale data centers. Water‑based cooling provokes community backlash. Transmission delays bottleneck national innovation. Each failure point compounds the next, turning technical friction into systemic drag.

When Mistakes Cost Billions

A misplaced data‑center site can strand $2 B in capital. Grid delays erase five years of capacity growth. Community resistance can freeze billion‑dollar campuses. The infrastructure layer has become both the enabler and existential limiter of AI progress—an active crisis of physics, policy, and public trust.

III. Why Traditional Approaches Fail

Despite mounting evidence of systemic strain, the industry still relies on incremental analytics and backward‑looking models. These frameworks optimize for efficiency but ignore the interdependence that defines modern AI infrastructure. This section introduces why traditional methods cannot anticipate compounding constraints—and why a predictive, cognitive approach is essential to navigate exponential growth.

Linear Tools in an Exponential World

Traditional analytics treat capacity growth as predictable and sequential. They excel at optimization after the fact but collapse when interdependencies collide in real time.

Blind Spots in Conventional Planning

Static models cannot anticipate how energy scarcity amplifies network latency, or how regulatory hesitation cascades into capital risk. They miss how community sentiment can become a structural bottleneck equal to grid congestion.

The Foresight Gap

AI’s growth curve is nonlinear; its constraints are entangled. Predictive Cognitive AI closes this foresight gap by simulating how those entanglements evolve—revealing fractures and opportunities before they surface.

Traditional models optimize for yesterday’s bottlenecks while tomorrow’s cascades accelerate unseen. Predictive Cognitive AI closes this foresight gap by simulating how those entanglements evolve—revealing fractures and opportunities before they surface.

IV. The Core Mechanism: Cognitive Digital Twins of Infrastructure Actors

MindCast AI builds Cognitive Digital Twins (CDTs) for every major node in the ecosystem—utilities, hyperscalers, chipmakers, telcos, and governments. Each twin embodies how its institution perceives constraint, opportunity, and risk.

Through recursive simulation, these twins interact across shared variables—energy, latency, capital, and trust—producing a multi-agent foresight field. This structure allows operators to test questions such as:

How will grid delays in Arizona reshape AI workload geography?

What happens when storage costs fall below $150/MWh?

When will custom silicon economics outcompete general GPUs?

How fast can edge nodes outscale central campuses before social license erodes?

Example in Practice: When Microsoft announced the Three Mile Island PPA in September 2024, traditional analysis focused on megawatt capacity and contract structure. Predictive Cognitive AI simulated cascading effects: nuclear permitting delays in other regions would accelerate as regulators responded to precedent; competitor responses would shift toward renewable PPAs with storage, driving VRFB costs below the $150/MWh threshold faster than consensus forecasts; and storage cost curves dropping would make edge computing economically viable 18–24 months earlier than expected. The system forecasted that within 12 months, edge computing would capture 25–30% of inference workloads in power‑constrained regions—a prediction that materialized in Eastern Washington and Quebec deployments by mid‑2025. This is foresight as infrastructure intelligence: seeing not just the direct move, but the entire chain reaction it triggers across the ecosystem.

Every such simulation is measured against three reliability standards: Causal Signal Integrity (CSI) for reliability, Action-Language Integrity (ALI) for governance clarity, and Relational Integrity Score (RIS) for community trust.

V. Intelligence at the Infrastructure Layer

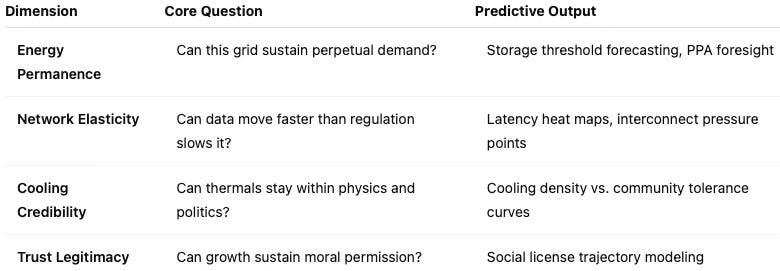

Predictive Cognitive AI acts as the nervous system for the AI infrastructure economy. It unifies the four structural dimensions that determine long-term advantage:

Together, these layers enable investors, policymakers, and operators to anticipate where capacity will emerge, where friction will appear, and where advantage will compound.

The four dimensions interact dynamically rather than independently. Energy scarcity (Dimension 1) doesn’t merely constrain capacity—it amplifies network costs as clusters migrate to suboptimal sites (Dimension 2), forcing architectural trade-offs that increase cooling loads (Dimension 3), which erode community trust when water usage spikes (Dimension 4).

Predictive Cognitive AI maps these feedback loops in real time, revealing which interventions compound advantage versus which merely shift bottlenecks between layers. The hyperscaler that secures firm power gains not just energy access, but network flexibility, cooling credibility, and trust velocity—a compounding advantage that linear models cannot capture.

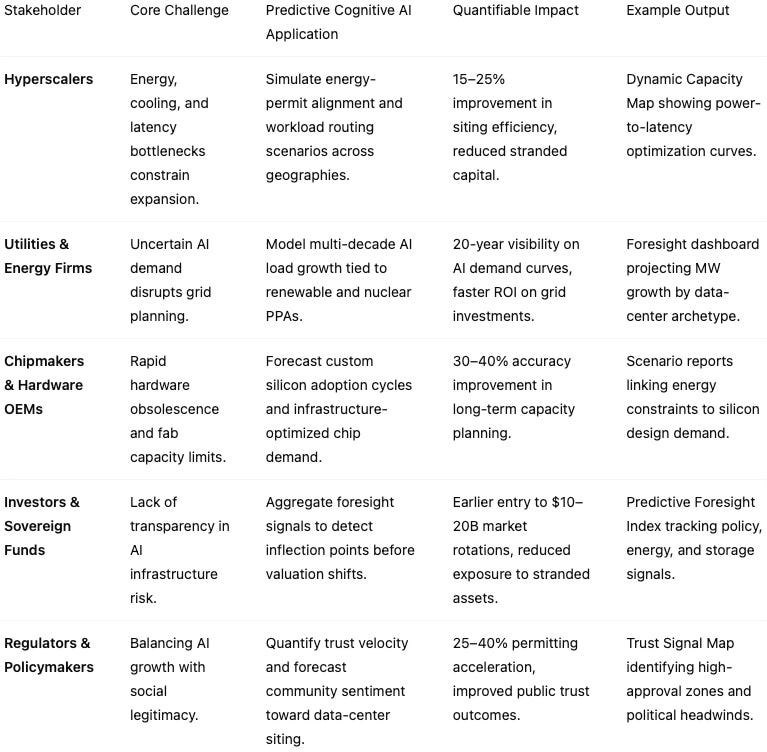

VI. Market Application Spectrum

The market for AI infrastructure spans hyperscalers, utilities, chipmakers, investors, and regulators—each facing distinct constraints but converging on the same foresight challenge. Predictive Cognitive AI serves as the connective intelligence linking their decisions into a shared structural map. It translates technical, financial, and political complexity into foresight that can be acted on before bottlenecks arise.

The convergence is striking: every stakeholder faces the same meta-challenge—converting physical constraints into strategic advantage before competitors do. Hyperscalers compete on siting speed; utilities compete on load predictability; chipmakers compete on architecture timing; investors compete on inflection-point detection; regulators compete on trust velocity.

What appears as five distinct markets is actually one integrated foresight challenge. Predictive Cognitive AI serves as the shared intelligence layer that makes constraint-aware decision-making systematic rather than ad hoc, turning infrastructure bottlenecks from existential threats into sources of durable competitive advantage.

VII. Implementation Pathway: Bridging Foresight to Action

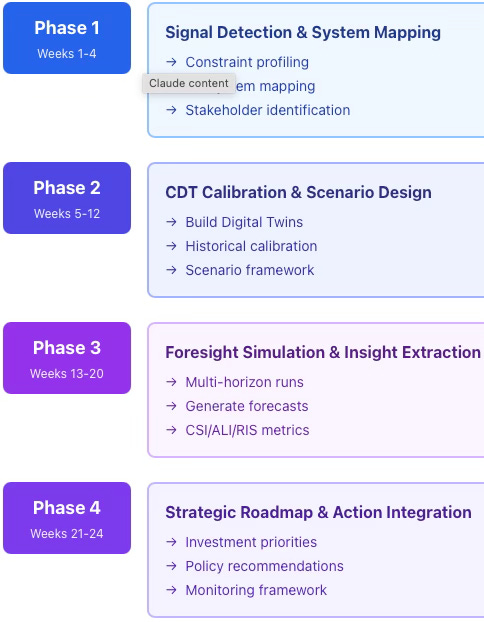

MindCast AI delivers foresight as a structured engagement process, not a static product. Implementations follow a four-phase pathway:

Phase 1: Signal Detection & System Mapping (Weeks 1–4)

Identify the client’s specific constraint profile—energy bottlenecks, network limitations, cooling friction, or trust deficits—and map institutional decision logics across the relevant ecosystem (utilities, regulators, competitors, communities).

Phase 2: CDT Calibration & Scenario Design (Weeks 5–12)

Build Cognitive Digital Twins for key actors in the client’s strategic environment, calibrate them against historical decisions and resource allocation patterns, and design scenario tests addressing the client’s highest-uncertainty questions.

Phase 3: Foresight Simulation & Insight Extraction (Weeks 13–20)

Run multi-horizon simulations across energy, network, cooling, and trust dimensions. Generate predictive outputs: capacity emergence timelines, friction-point forecasts, and advantage compounding curves. Deliver CSI, ALI, and RIS metrics quantifying forecast reliability.

Phase 4: Strategic Roadmap & Action Integration (Weeks 21–24)

Translate foresight insights into investment priorities, siting decisions, partnership strategies, or policy positions. Establish an ongoing monitoring framework for early warning signals as the ecosystem evolves.

This approach ensures that predictive insight transitions into operational action—helping clients convert uncertainty into infrastructure advantage measured in accelerated deployment timelines, avoided stranded capital, and first-mover positioning in energy-secure geographies.

VIII. The Cognitive Shift: From Optimization to Foresight

The AI era rewards those who see bottlenecks before they bind. Predictive Cognitive AI upgrades infrastructure strategy from reactive optimization to proactive simulation. It converts data into narrative, narrative into causality, and causality into foresight.

This represents a fundamental shift in how infrastructure decisions are made. Traditional planning asks: “How do we optimize for known constraints?” Predictive Cognitive AI asks: “Which constraints will bind next, how will they interact, and what interventions today prevent cascading failures tomorrow?” The difference is the difference between managing the present and shaping the future.

The system’s goal is simple: to make the physical architecture of AI as intelligent as the models it supports. When the grid, the network, and the community act as one cognitive organism, the infrastructure ecosystem itself becomes self‑aware.

IX. Conclusion

The infrastructure wars of 2025–2030 will not be won by those with the deepest pockets, but by those with the clearest sight. When Microsoft secures nuclear PPAs years ahead of grid strain, when Oracle locks manufacturing capacity before custom silicon demand peaks, when edge operators site in renewable‑rich zones before competitors recognize the shift—these are not lucky guesses. They are foresight advantages worth billions in avoided stranded capital and accelerated market access.

Predictive Cognitive AI exists to democratize that advantage: to make the physical architecture of AI as intelligent as the models it supports. The next decade will decide whether AI infrastructure scales sustainably—or fractures under its own weight. The choice facing every infrastructure player is binary—build faster, or build wiser.

In an age where a single misplaced data center can cost $2 B in stranded capital, where a delayed PPA means five years of lost capacity, where community pushback can halt billion‑dollar campuses—wisdom is the only moat that matters. Where others see constraints, MindCast AI sees causality. Where others see chaos, we see patterns. Where others see risk, we see the infrastructure of trust.

For hyperscalers, utilities, investors, and governments, the question is no longer whether to invest in foresight—but whether they can afford not to. MindCast AI is the bridge between physics and foresight, turning megawatts into meaning and latency into leverage—where intelligence anticipates constraint, and foresight becomes the infrastructure of trust.

Appendix: MCAI Infrastructure Vision Series

1. MCAI Market Vision: AI Datacenter Edge Computing — Ship the Workload, Not the Power

Subtitle: AI Datacenter Edge Computing as the Adaptive Outlet for Infrastructure Bottlenecks

Date: September 2025

URL: https://www.mindcast-ai.com/p/edgeaidatacenters

This vision statement forecasts the decentralization of compute workloads as power, cooling, and community constraints limit traditional data center expansion. MindCast AI projects edge inference rising to 25–30% of workloads within 12 months, showing that mobility and modularity are the next frontiers of AI infrastructure. The piece details energy economics, trust geography, and the competitive implications for hyperscalers. It frames edge as not an experiment but a structural inevitability.

2. MCAI Market Vision: The Bottleneck Hierarchy in U.S. AI Data Centers

Subtitle: Predictive Cognitive AI and Data Center Energy, Networking, and Cooling Constraints

Date: August 2025

URL: https://www.mindcast-ai.com/p/aidatacenters

This study defines energy, networking, and cooling as the three decisive bottlenecks shaping AI’s future. MindCast AI uses predictive cognitive modeling to rank Microsoft, Amazon, Google, Meta, Apple, Oracle, and NVIDIA on structural advantage. It demonstrates how coordination across these physical layers—rather than GPU count—determines leadership. The hierarchy reframes data centers as ecosystems of constraint, not simply compute warehouses.

3. MCAI Market Vision: VRFB’s Role in AI Energy Infrastructure

Subtitle: Perpetual Energy for Perpetual Intelligence — Aligning Infrastructure Permanence with the Age of AI

Date: August 2025

URL: https://www.mindcast-ai.com/p/vrfbai

This publication introduces vanadium redox flow batteries (VRFBs) as the cornerstone of “energy permanence” for AI infrastructure. It contrasts VRFBs with diesel, lithium-ion, and hydrogen solutions, arguing that only VRFBs align with AI’s perpetual demand curves. The foresight model positions VRFBs as the resilience layer connecting renewables and nuclear, ensuring 20+ year energy continuity. It concludes that VRFBs transform fragile generation into dependable intelligence power.

4. MCAI Market Vision: Nvidia’s Moat vs. AI Datacenter Infrastructure-Customized Competitors

Subtitle: How Infrastructure Bottlenecks Could Reshape the Future of AI Compute

Date: August 2025

URL: https://www.mindcast-ai.com/p/nvidiachallenges

This foresight simulation reframes Nvidia’s dominance through the lens of physics, not market share. It shows how grid strain, cooling limits, and network saturation expose vulnerabilities beyond CUDA lock-in. MindCast AI forecasts a bifurcated market by 2030—general-purpose GPUs versus infrastructure-customized silicon. The piece also outlines early warning signals investors can use to detect disruption before earnings reflect it.

5. MCAI Market Vision: Oracle’s AI Supercluster Advantage

Subtitle: Oracle’s Binary Future — Structural Power in AI Infrastructure

Date: September 2025

URL: https://www.mindcast-ai.com/p/oracleopanai

This analysis explores Oracle’s $300 B OpenAI contract as a catalyst redefining hyperscaler competition. MindCast AI simulates dual trajectories: a “Doubling Down Path” toward supercluster dominance and a “Status Quo Path” of regression to niche provider. It integrates insights from energy, cooling, and trust foresight to show how Oracle could evolve into the TSMC of AI compute. The conclusion: structural power in AI will hinge on specialization, not scale.

6. MCAI Market Vision: Broadcom’s Cataclysmic $10 B OpenAI Deal

Subtitle: Forecasting the Custom AI Silicon Wave (2025–2030)

Date: September 2025

URL: https://www.mindcast-ai.com/p/broadcomscataclysmic

This report models how Broadcom’s $10 B OpenAI partnership triggers a cascade of custom-silicon deals projected to reach $75–100 B annually by 2030. It outlines the transition from general-purpose GPUs to workload-optimized chips and maps the supply-chain stress that follows. MindCast AI’s foresight method extrapolates from one transaction to a full industrial wave. The result is a roadmap for investors, manufacturers, and policymakers preparing for the custom-silicon era.