MCAI Policy Vision: The Chilling Effect of Regulatory Hold, How Rigid Land Use Codes Stall Mixed-Use Development and Undermine Urban Vitality

Navigating the Chilling Effects of Regulatory Uncertainty with AI

MindCast AI (MCAI) is a strategic decision forecasting platform that simulates how key actors—such as developers, city councils, tenants, consumers, and residents—will behave under real-world constraints. By modeling stakeholder cognition through MCAI Proprietary Cognitive Digital Twins (MAP CDTs), MCAI simulates regulatory risk, alignment breakdowns, and activation pathways. Our proprietary system includes multiple patent-pending technologies that support urban decision-making, compliance discovery, and stakeholder simulation.

This study was undertaken to illuminate the growing mismatch between land use code frameworks and real-world behavior in fast-changing urban markets like Bellevue, Washington. Using MCAI’s simulation tools, this paper provides empirical insights and scenario modeling to help commercial real estate (CRE) stakeholders navigate entitlement risk, regulatory drag, and activation delays.

To conduct the study, MCAI customized its MAP CDT system to capture unique challenges in the commercial real estate market. Our new CodeVision simulation engine is a specialized Vision Function (algorithm) within the MCAI framework that forecasts how zoning codes, permitting pathways, public opposition, and administrative discretion affect real-world development outcomes.

MCAI CodeVision addresses

This white paper is designed to serve:

City Councilmembers and Planning Commissions who need a clear view of how regulatory drift impacts community outcomes and how reform can reinforce their stated planning values.

Commercial Developers and Project Sponsors who face opaque rules, inconsistent interpretations, and costly entitlement delays.

Economic Development and Planning Departments who are tasked with fostering vibrancy, resilience, and business diversity through code enforcement.

Tenant Advocates and Small Business Groups who see firsthand how rigid codes block inclusive, local-serving ground-floor use.

Investors, Brokers, and Lenders who need a transparent regulatory environment to confidently underwrite and support community-aligned development.

Introduction

While this paper focuses on ground-floor activation as a visible outcome, the deeper issue is regulatory ambiguity around intended use. When viable commercial, institutional, or service-based uses—such as labs, clinics, education centers, or hybrid office formats—require special approvals, developers face discretionary hold despite clear economic demand. These use conflicts are often embedded in outdated “active use” definitions or unresolved zoning overlays. The result is ground-floor space that remains vacant, not due to lack of interest, but because the intended tenant doesn’t fit a rigid or obsolete category. In this way, stalled activation is not a failure of leasing—it’s a downstream signal of upstream policy misalignment.

I. Regulatory Friction: Where Code Meets Concrete

Active Use Definitions

Bellevue’s Land Use Code (LUC 20.25A.020) limits ground-floor “active uses” to a narrow band of traditional retail and select personal services. This rigid definition excludes many viable, high-demand uses such as childcare centers, wellness clinics, education providers, and nonprofits. Developers must pursue Administrative Departures to activate spaces with non-listed uses—a process that introduces time, cost, and uncertainty.

Discretionary Approvals and Administrative Delay

Creative tenant types often trigger special reviews or case-by-case approval pathways. These include pop-up retail, food trucks, cultural uses, or mixed-format spaces that don’t fit cleanly into predefined categories. Developers are forced to front-load legal work and stakeholder engagement just to preserve optionality. In many cases, this risk is priced in through higher rents or passed over entirely, resulting in ground-floor spaces that remain empty for years.

For example, when a buyer acquires a property previously zoned for traditional office use and seeks to convert it to a medical lab or specialized facility, the change often requires additional approvals—even if the new use is economically aligned with city goals. This introduces uncertainty and delays, particularly when staff discretion overrides use logic embedded in zoning code. These friction points are increasingly common in buildings repurposed post-pandemic, where tech, biotech, and wellness uses collide with outdated entitlement assumptions.

II. Commercial Development as Civic Infrastructure

Well-designed commercial projects are more than financial investments—they are cultural and civic infrastructure. In Bellevue, a series of major development projects demonstrate how thoughtfully executed mixed-use developments can enrich community life, attract foot traffic, and reinforce local identity:

West Main (Vulcan): Combines office, retail, and public open space with interactive art, establishing a high-density node of civic and commercial engagement.

Avenue Bellevue (Silverstein): Launched “Art on the Avenue,” transforming vacant retail bays into galleries and experiential spaces. This model builds cultural equity while supporting economic resilience.

Pacific Place (Seattle): Once an emblem of retail decline, it has repositioned itself with small business incubators and nonprofit installations, showing that adaptive reuse can re-anchor a struggling district.

Main Street Bellevue: Despite strong pedestrian appeal and income demographics, its ground-floor vacancies persist due to regulatory constraints—not lack of market demand.

These projects represent themes Bellevue aspires to: creative density, cultural layering, small business inclusion, and dynamic ground-floor activation. But where regulatory friction exists, these aspirations often stall.

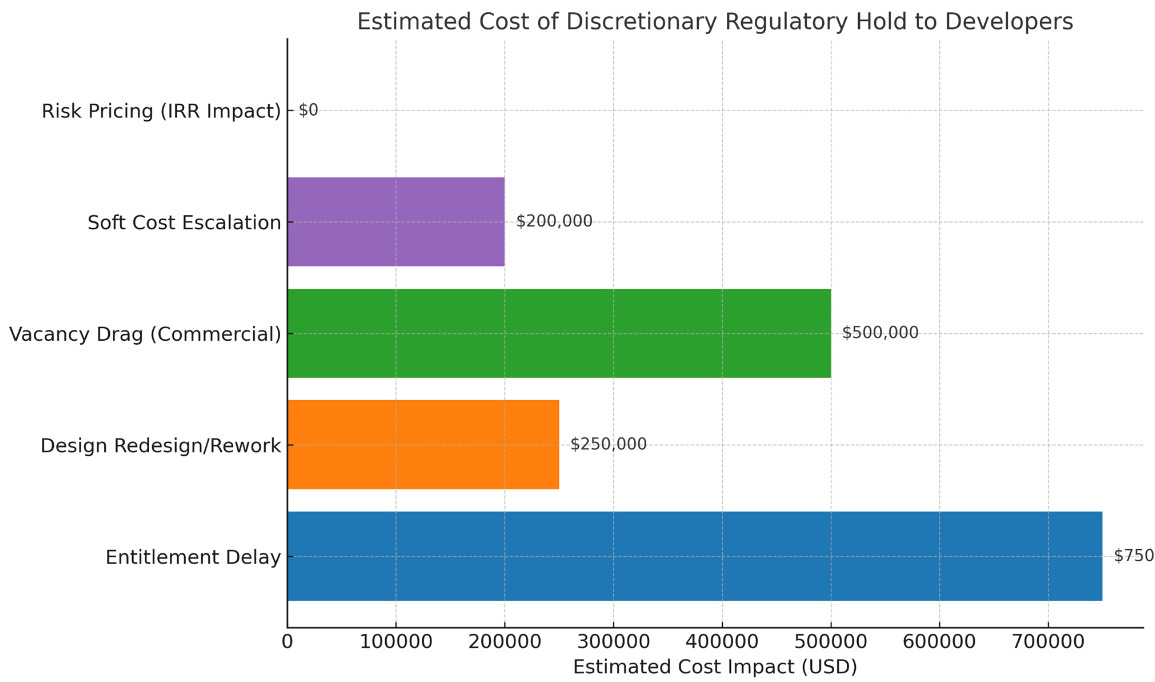

III. The Bottom-Line Impact of Delay and Friction

Stalled Absorption and Vacancy Drag

Bellevue’s Eastside office and mixed-use markets currently face a mismatch: supply is being delivered, but absorption is lagging. Tenants and community partners exist, but cannot occupy space quickly due to ambiguity in land use interpretation and permitting delays.

Reduced Return on Public Investment

Public transit infrastructure, urban streetscapes, and walkability investments depend on active commercial edges. When ground-floor spaces remain vacant or generic, the full civic return on infrastructure investments is diminished.

Risk Pricing and Investor Skepticism

Institutional investors now anticipate prolonged lease-up periods and regulatory hold-ups, especially for community-focused or experiential tenant types. This introduces higher hurdle rates and often shifts projects toward less risky—but also less culturally beneficial—use types.

Financing Friction and Capital Loss

Many developers operate on tight timelines to secure favorable financing terms. When discretionary hold-ups delay entitlements or introduce unexpected review cycles, it can cause sponsors to miss their capital lock-in window. This forces them to accept higher interest rates or restructure deals—adding millions in long-term costs or causing projects to fall through altogether. These timeline-sensitive risks are often invisible in the code but felt acutely in the capital stack.

Innovation Deterrence

Emerging tenants—like local wellness brands, education start-ups, or arts collectives—often lack the legal capacity or capital runway to endure prolonged entitlement processes. They are systematically excluded from participating in the urban mix, despite high alignment with community goals.

This is not a market failure—it is a regulatory one. And it leads to muted street life, higher costs, slower lease-up, and ultimately, less vibrant and less inclusive cities.

IV. CodeVision CDT Simulation: Misaligned Incentives and Friction Points

A full MCAI CodeVision simulation reveals persistent friction across the ecosystem:

City Council CDT: Risk-averse and politically defensive, often using process as a buffer against decision-making accountability. Moderate Action-Language Integrity (ALI) and low Cognitive-Motor Fidelity (CMF).

Developer CDT: High alignment between strategic goals and execution (high ALI/CMF), but frequently blocked by unclear thresholds and discretionary interpretation.

Tenant CDT: Especially for small or service-based businesses, regulatory friction prevents entry even when demand exists.

Consumer CDT: High sensitivity to experiential vibrancy; disengages from sterile or vacant ground-floor spaces.

Resident CDT: Divergent values across demographics; older homeowners often resist change while younger renters seek more services.

This simulation reveals a fundamental misalignment between those who build and use space, and those who regulate it. Together, the projections offer an empirical basis for reform. They not only reflect behavioral alignment and incentive mapping across stakeholders but also model how faster, more transparent processes yield measurable gains in commercial vitality.

V. Simulation Forecast: Quantifying the Cost of Regulatory Friction

Powered by MCAI’s Forecast module, the following projections model how different reform scenarios affect vacancy, tenant diversity, and investment posture.

Key Forecast Insights

Expanding the Active Use definition reduces average lease-up time by 8–12 months in key districts.

Overlay Zones could triple small/local tenant occupancy in pilot areas within 12–18 months.

Transparent, tiered permitting would reduce developer-side soft costs by an estimated 10–15%, improving project-level ROI.

Elevated scrutiny of opposition filings is projected to shorten the average entitlement window by 90–120 days per project.

Together, these projections offer an empirical basis for reform. They not only reflect behavioral alignment and incentive mapping across stakeholders but also model how faster, more transparent processes yield measurable gains in commercial vitality.

VI. Recommendations for Code Reform and Structural Alignment

Expand the Definition of Active Use

Modernize the code to include a broader range of community-relevant uses—childcare, medical, nonprofit, educational, wellness, and civic-oriented tenants—as “active uses” by default, not exception.Make Exemptions the Rule When They Work

Codify successful departures as amendments to the base code. If a use or model proves beneficial—economically or culturally—it should not remain an exception. Cities must learn from what works.Create Transparent, Tiered Review Paths

Implement clear, time-bound approval tracks for common tenant types. Developers and tenants should know within 30–60 days whether their use is permitted outright, administratively allowed, or subject to discretionary review.Launch Activation Overlay Zones

For underperforming corridors, allow temporary or semi-permanent activation overlays that suspend certain use and parking restrictions in favor of experimentation, especially for arts, community, and local businesses.Raise the Evidentiary Standard for Discretionary Regulatory Opposition

Opposition to code-compliant development proposals—by councils, agencies, or community stakeholders—should require documented planning rationale, not general sentiment. Elevating this threshold reduces performative delay and protects project viability.Streamline Access to Public Records and Council Deliberations

Developers and stakeholders must have prompt access to meeting minutes, staff correspondence, and public comment responses. Cities should provide a searchable, up-to-date public repository to increase transparency and reduce soft-cost delays.Modernize Intended Use Classifications Across Zoning Tables

Cities should proactively audit and update their zoning tables to reflect the diversity of today’s commercial and service-based tenants. Many high-demand uses—such as labs, wellness clinics, education hubs, and hybrid office formats—fall into outdated or ambiguous categories that trigger unnecessary review cycles or outright rejection.

Where these uses are consistently granted exemptions or administrative departures, code should be amended to formalize them as permitted uses. In addition, cities should develop published review frameworks that guide staff discretion with clear criteria, reducing interpretive drift and legal uncertainty. This will align zoning code with economic reality, reduce entitlement risk, and ensure that viable tenants are not excluded by obsolete classifications.

VII. Conclusion

The findings and forecasts in this report are driven by MCAI’s proprietary Foresight engine. Through the use of MCAI CodeVision Forecast simulations, MCAI offers a behavioral, data-grounded view of urban complexity. It enables planners, developers, and civic leaders to see not just where friction exists—but what it costs, who it impacts, and how to fix it.

MCAI’s framework is not just a lens—it is a strategic engine for reform, activation, and resilience.

What MCAI Offers Developers, Brokers, and Investors

MCAI enables developers, brokers, and capital partners to operate with foresight—translating political risk, code ambiguity, and stakeholder behavior into actionable strategy.

Built on patent-pending simulation technology, MCAI uses Cognitive Digital Twins (CDTs) to model how key players—city planners, councilmembers, public commenters, and tenants—are likely to respond to a specific project, petition, or use. This includes dynamic scenario modeling and public data discovery to anticipate challenges before they surface.

For Developers

Forecast entitlement risk and permitting delays tied to zoning, use, and discretion

Model activation timelines and leasing velocity for pro forma and phasing accuracy

Strategically position use exemptions, overlay zone asks, and narrative framing

Analyze public comments, hearing patterns, and opposition history to strengthen filings and testimony prep

For Brokers

Assess tenant mix viability under local zoning interpretation and political posture

Support leasing strategy by aligning proposed uses with community response modeling

Provide clients with informed risk narratives on stalled space, use conversion, or opposition trends

Extract and summarize public records (council meetings, planning staff reports) to support deal positioning

For Investors

Quantify how discretionary regulatory hold affects IRR, lease-up, and cap rate forecasts

Identify entitlement-sensitive sites through behavioral and public data analysis

Use CDT modeling to compare jurisdictional velocity, predict public resistance, and benchmark confidence

Integrate discovery of permitting patterns and political timelines into underwriting

MCAI delivers not just prediction—but strategic leverage. It turns publicly available signals and behavioral foresight into a capital advantage.

About MindCast AI LLC

Noel Le (www.linkedin.com/in/noelleesq/) established MCAI in 2025 after years of research on predictive mechanisms in behavioral economics. Noel is the Founder | Architect of MCAI, and the creator of the proprietary MCAI architecture, which combines cognitive simulation, behavioral modeling, and decision forecasting. With a background in law and economics and behavioral economics, he spent two decades developing advanced predictive technologies for intellectual property management and regulatory intelligence. He was drawn to study the CRE market after observing that market assessments predominantly came from the perspective of law and economics, and excluded insights from behavioral economics.