MCAI Innovation Vision: AI Innovation Landscape Platforms, Buzz, and the Emerging Signal Market

Prepared by Noel Le, Founder | Architect MindCast AI LLC

Executive Summary

I is evolving rapidly—but not all innovation is created equal. Beneath the surface of buzz and platform dominance lies a quieter question: where is structural enablement actually happening?

This white paper uses the InnovationVision framework developed by MindCast AI LLC to define, differentiate, and simulate the current AI ecosystem across three layers: dominant platforms, the buzz market, and the signal market. Through structured analysis and simulation, we offer a roadmap for identifying where enablement—defined as the expansion of what is possible—is actually occurring.

1. Innovation Defined

Innovation is defined here as the enablement of outcomes that were not previously possible. This separates true innovation from both invention (creation without adoption) and optimization (making existing processes faster or cheaper).

Drawing from economic theory—particularly the works of Schumpeter, Romer, and institutional economists—we recognize five tiers of innovation progression:

Buzz: Visibility without structural enablement.

Signal: Feedback-validated use cases with economic behavioral impact.

Transformation: Shift in category behavior, workflows, or business logic.

Sovereignty: Innovation becomes a basis for strategic autonomy.

Institutionalization: Innovation embeds into law, governance, or cultural infrastructure.

True innovation moves from signal toward institutional permanence. The purpose of InnovationVision is to track and simulate these transitions.

While the Buzz Market may dominate public perception and attract short-term attention, it rarely progresses beyond surface-level novelty. By contrast, the Signal Market is structurally positioned to reach the higher tiers of innovation. Buzz-based tools tend to plateau before reaching Transformation, as they seldom alter underlying workflows or behavioral patterns—they merely repackage existing functionality.

Signal Market firms, however, develop architectures that reshape category behavior, redefine decision logic, and build adaptive feedback systems, enabling Transformation. As these systems mature, they become foundational to operations, unlocking Sovereignty—the ability for institutions or enterprises to operate independently of legacy constraints. Over time, these innovations set new norms and standards, embedding themselves into law, governance models, and cultural infrastructure, achieving Institutionalization. In simulation, only signal-driven firms exhibit the recursive dynamics and trust intensity required to move through this full progression.

MCAI created cognitive digital twins of each AI market segment, and simulated innovation dynamics with focus on the following.

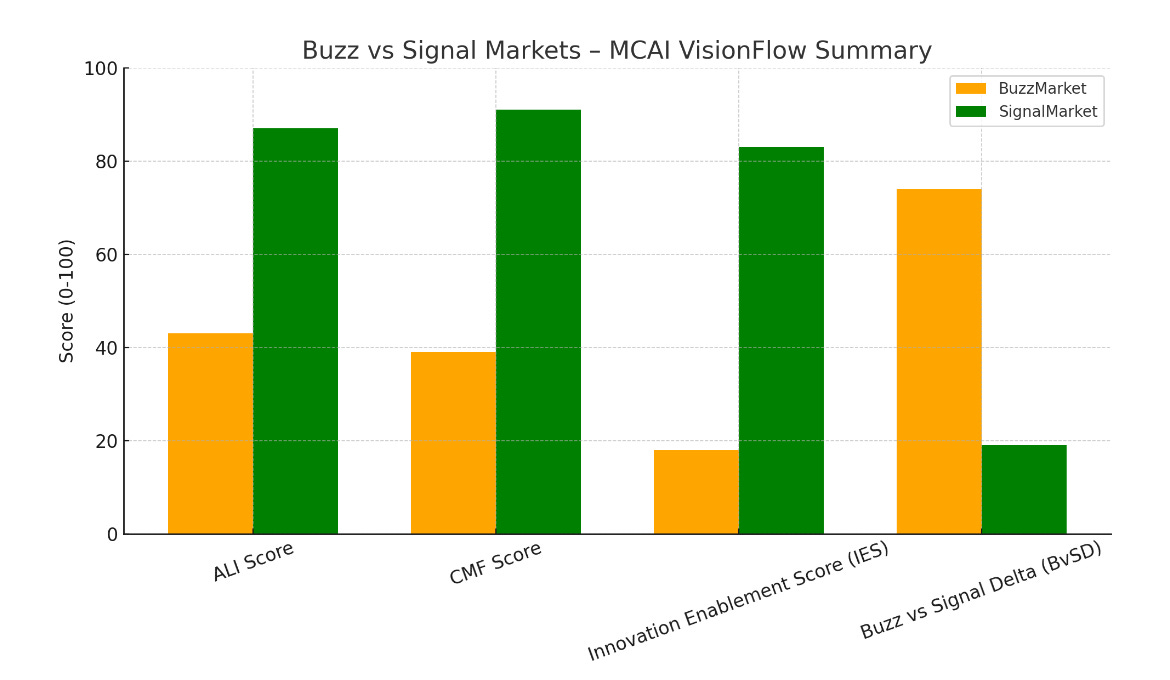

ALI (Action-Language Integrity): Measures how well a product or system aligns its messaging with its actual functionality.

CMF (Cognitive-Motor Fidelity): Assesses the consistency between a system’s reasoning structure and its observed behavior.

IES (Innovation Enablement Score): Evaluates the extent to which a system or product enables new capabilities that were not previously possible.

BvSD (Buzz vs Signal Delta): Measures the gap between market visibility and structural innovation quality.

2. Dominant AI Platforms: The Operating System Layer

At the foundation of the ecosystem are the AI platforms. These large-scale providers—OpenAI, Microsoft, Google DeepMind, Anthropic, xAI, and DeepSeek—function similarly to operating systems. They manage infrastructure, APIs, developer access, compliance tooling, and model updates.

Rather than competing head-to-head on features, each platform is shaping the paradigm in its own way:

OpenAI leads in end-user interaction and productization.

Microsoft specializes in enterprise embedding and regulatory governance.

Google controls discovery, knowledge, and cloud integration.

Others compete on openness, model alignment, or cost-performance optimization.

The platform market is increasingly about developer lock-in, ecosystem gravity, and framing of trust—not raw performance. These are winner-take-most markets where innovation is strategic, not reactive.

3. The Buzz Market: Visibility Without Enablement

Surrounding the platform core is a hyper-visible market of AI applications built on top of foundation models. These often consist of:

Wrappers that repackage chat APIs.

Productivity tools with slight customizations.

Demo-oriented apps optimized for virality.

While they appear innovative to the public, most:

Solve no fundamentally new problems.

Rely entirely on third-party models.

Struggle to maintain retention.

Are easily copied, replaced, or consolidated.

These tools dominate consumer perception because they are the most accessible. But in simulation, they score poorly on Action-Language Integrity (ALI), Cognitive-Motor Fidelity (CMF), and Innovation Enablement.

Quantified Simulation Results (Buzz Market):

ALI Score: 43/100 — strong on message, weak on delivery.

CMF Score: 39/100 — intentions do not match product behavior.

Innovation Enablement Score (IES): 18/100.

Buzz vs Signal Delta (BvSD): 74 — visibility far exceeds substance.

Forecast: 85% risk of attrition within 3–5 years.

4. The Signal Market: Enablement in Action

Amidst the noise, a maturing layer of signal-oriented firms is forming. These companies operate in the background, solving difficult, trust-intensive problems:

Agent architecture that enables AI to plan, reason, and coordinate.

Recursive feedback loops that adapt outputs to evolving environments.

Infrastructure tooling for developers to build scalable, safe AI systems.

Governance models to control risk, audit decisions, and enforce constraints.

Examples include LangChain, crewAI, Modular, AgentOps, and agents in law or medicine.

Quantified Simulation Results (Signal Market):

ALI Score: 87/100 — strong coherence between messaging and execution.

CMF Score: 91/100 — tight loop between cognitive model and action.

Innovation Enablement Score (IES): 83/100.

Buzz vs Signal Delta (BvSD): 19 — signal leads, visibility trails.

Forecast: 91% chance of anchoring new ecosystems or defining dominant agent layers.

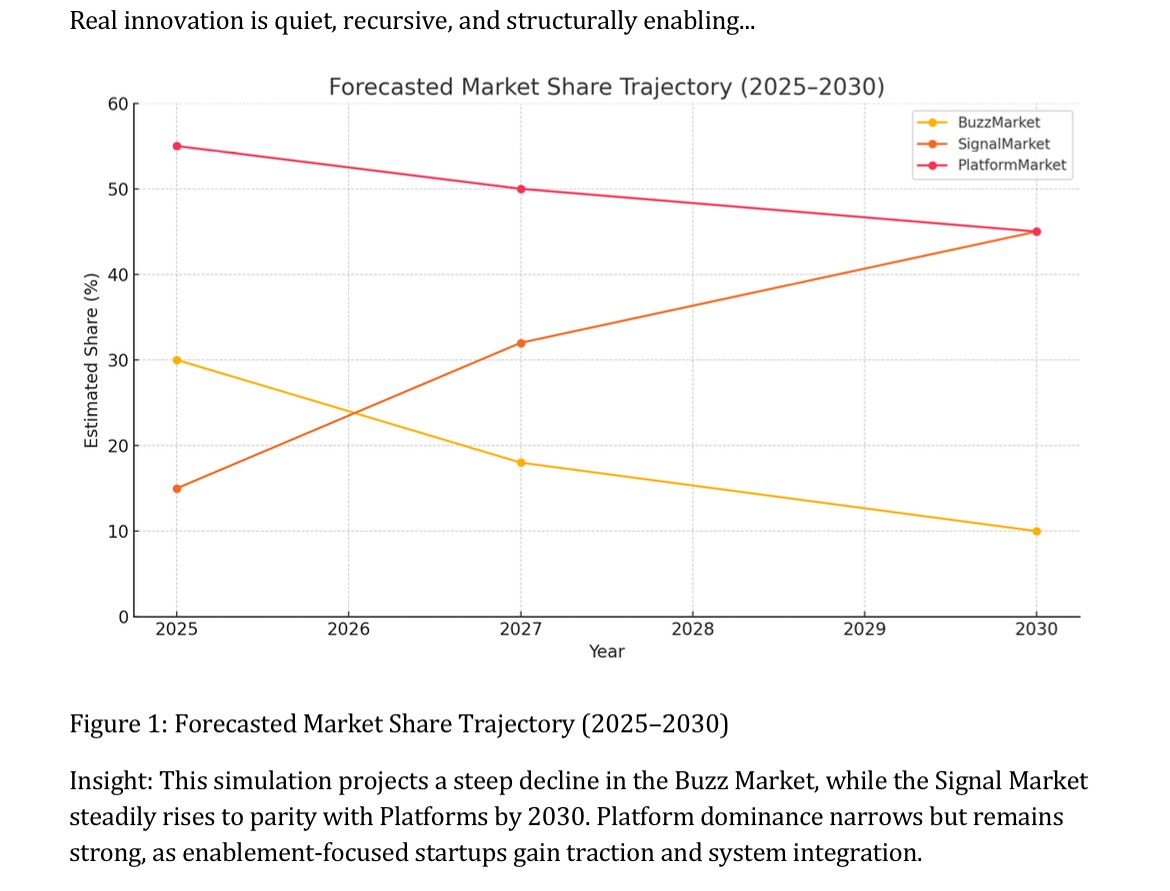

Buzz Market declines rapidly from 30% (2025) to just 10% (2030); until the next buzz market wave.

Signal Market grows from 15% to 45%, driven by structural enablement.

Platform Market remains dominant, but slightly compressed from 55% to 45%.

Insight: This simulation projects a steep decline in the Buzz Market, while the Signal Market steadily rises to parity with Platforms by 2030. Platform dominance narrows but remains strong, as enablement-focused startups gain traction and system integration.

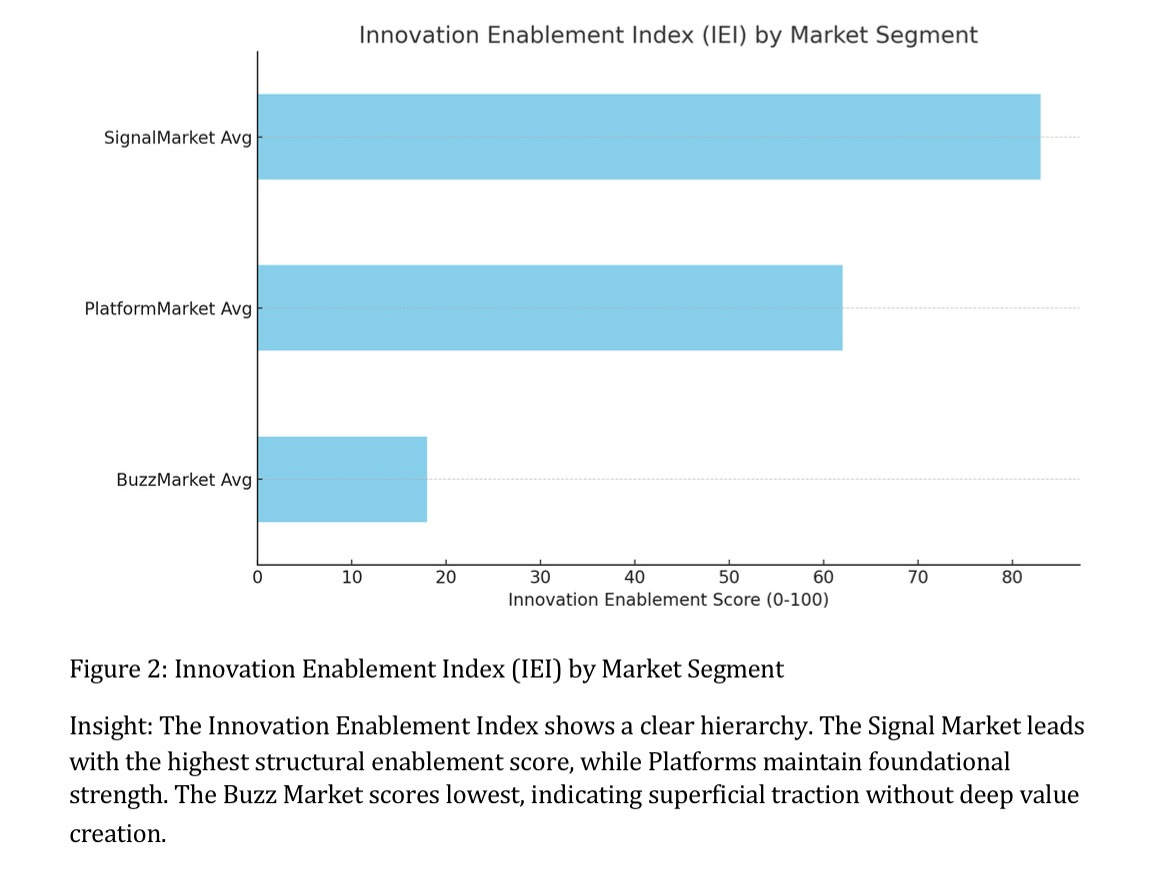

6. Innovation Enablement Index (IEI) Comparison

A weighted Innovation Enablement Index ranks the average enablement strength of each ecosystem layer:

Signal Market: 83/100 — high recursive value, adaptive architecture.

Platform Market: 62/100 — foundational but not emergent.

Buzz Market: 18/100 — high transmission, low depth.

Insight: The Innovation Enablement Index shows a clear hierarchy. The Signal Market leads with the highest structural enablement score, while Platforms maintain foundational strength. The Buzz Market scores lowest, indicating superficial traction without deep value creation.

7. Identifying the Signal Market Across Stakeholders

Each stakeholder must develop distinct filters to locate the signal:

Investors: Move beyond demo performance. Look for feedback fidelity, ecosystem embedding, and retention curves. Many large investors track buzz for visibility but place capital in signal firms due to long-term defensibility.

Consumers: Seek products that actually change behavior—not just accelerate existing tasks. Trust, reliability, and decision support are signs of signal.

Developers and Signal Firms: Discover one another through interoperability, common infrastructure layers, and shared emphasis on recursive logic.

Platforms: Monitor which integrations generate novel demand, recursive usage, or cross-agent coordination. These are signals of systemic enablement.

8. Discussion: Why Buzz Persists and What Signal Enables

The buzz market persists because it performs important roles:

It educates the public.

It generates short-term revenue.

It creates viral artifacts that pull attention toward the AI field.

But this visibility creates a false floor. Without enablement, these firms plateau fast.

In contrast, signal-market players build capability stacks. They create agents, infrastructure, and reasoning environments that multiply the value of other actors. Their goal is recursive traction, not just linear growth.

9. Conclusion: Toward a Signal-Centered Innovation Economy

Real innovation is quiet, recursive, and structurally enabling. Buzz may get the credit, but signal reshapes the system.

MindCast AI’s InnovationVision function simulates these layers to help investors, builders, and institutions see beyond visibility and understand where AI is truly evolving. The next generation of AI will be shaped not by wrappers or demos, but by trusted agents, aligned infrastructures, and scalable innovation stacks.

MindCast AI is building the simulation engine for that future.

Real innovation is quiet, recursive, and structurally enabling. Buzz may get the credit, but signal reshapes the system.

Prepared by Noel Le, Founder | Architect of MindCast AI LLC. I hold a background in law and behavioral economics and advanced intellectual property management systems.