MCAI Innovation Vision Brief: Cognitive Artificial Intelligence

Going Beyond GPTs/LLMs and Buzz to Simulate Real Foresight

Executive Summary

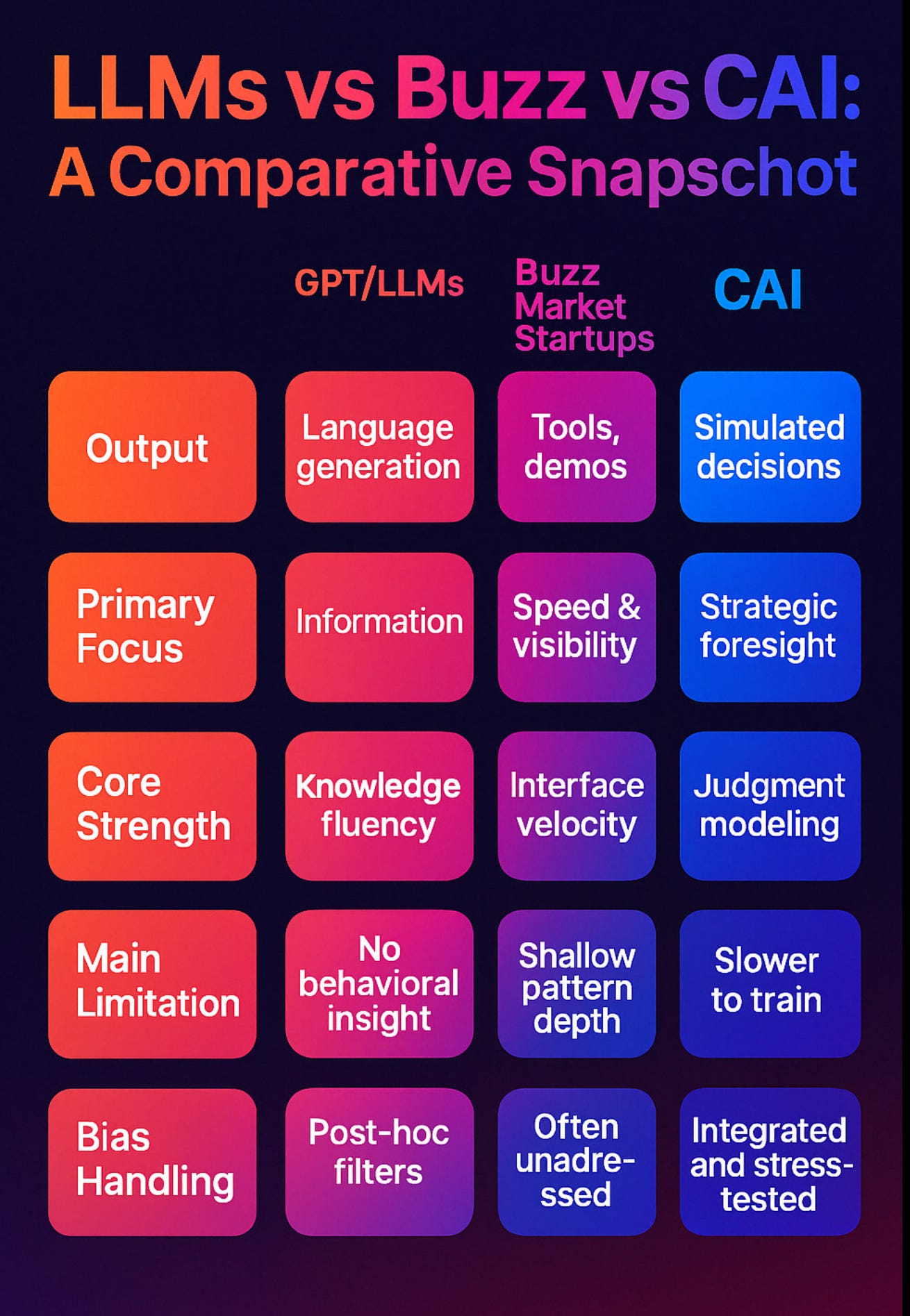

Artificial Intelligence is advancing fast—but not all systems solve the same problems. Large Language Models (LLMs) like GPT deliver fast, fluid responses. Buzz market geared startups build innovative tools, experiment quickly, and move ideas into play. These approaches have value—but they don’t simulate how people actually think, assess risk, or make decisions.

Cognitive Artificial Intelligence (CAI) defines a new category. CAI systems don’t generate language; they simulate judgment. They model how founders, investors, regulators, and institutions behave under uncertainty, pressure, and change. This paper introduces CAI, compares it to LLMs and buzz tools, and offers a real-world example of how each system handles high-stakes investment decisions.

What Makes CAI Different?

Cognitive AI focuses on strategic cognition. Instead of predicting the next word or launching fast demos, it models how humans make decisions. It tracks moral filters, institutional incentives, emotional drivers, and reputational risks.

MindCast AI LLC (MCAI), a pioneer in CAI, uses:

Cognitive Digital Twins (CDTs) to simulate how specific people or roles make decisions

Action-Language Integrity (ALI) to test whether speech aligns with real behavior

Cognitive-Motor Fidelity (CMF) to measure whether thinking, choices, and actions form a consistent chain

Evolving Structure to update the simulation as new signals, conditions, or narratives emerge

One Decision, Three Approaches

A venture capitalist is deciding whether to invest in two AI startups. One has a polished pitch deck and recent media buzz. The other has minimal traction but offers a differentiated product and a founder with deep domain focus.

GPT/LLM: Generates a summary of both startups, compares market trends, and drafts an investment memo. It organizes knowledge but doesn’t assess founder credibility or strategic risk posture.

Buzz Market Startup: Provides metrics dashboards, founder video pitches, and sentiment scoring. It enhances visibility and streamlines access—but stops short of simulating investor judgment or founder resilience.

Cognitive AI (MCAI): Simulates both founders as CDTs. It forecasts how each will perform under pressure, respond to feedback, pivot under market shifts, and align with the VC’s thesis. It models narrative risk, moral integrity, and long-term strategic fit—before a single dollar is committed.

CAI doesn’t just summarize data. It predicts behavior and simulates outcomes.

The Predictive Engine Behavioral Economics Always Needed

For decades, behavioral economics has mapped how people deviate from rational choice—through loss aversion, present bias, overconfidence, and dozens of other patterns. But it lacked a predictive engine. It could describe behavior, not simulate it.

MCAI changes that. CAI introduces a behavioral foresight layer that models how real agents act under stress, how they justify their choices, and how those patterns evolve over time. Using integrated bias modeling, scenario forecasting, and Action-Language Integrity, MindCast AI delivers the mechanism (patent pending) behavioral economists have long sought: a system that doesn’t just explain decisions after the fact—but anticipates them.

By providing this predictive mechanism, MCAI bridges behavioral economics and law and economics. The latter modeled predictive frameworks for decades—from Coasean transaction cost logic to Posnerian efficiency models. Behavioral economics long acknowledged the need for such mechanisms (see Thaler, 2015; Mullainathan & Shafir, 2013; Camerer & Loewenstein, 2004; Shiller, 2019) but lacked the system-level infrastructure. CAI fills that gap.

If you’re navigating complex decisions and want to simulate behavior before it unfolds, reach out.

Noel Le

Founder | Architect, MindCast AI LLC

www.linkedin.com/in/noelleesq

https://substack.com/@mindcastai

MindCast.AI@icloud.com