MCAI Market Vision: How Trump’s Tariff Volatility Undermines AI Infrastructure Strategy

Prepared by Noel Le, Founder | Architect MindCast AI LLC

Executive Summary: The Cost of Uncertainty

Trump’s tariffs inject strategic volatility into the AI industry by destabilizing investment incentives, compressing planning horizons, and undermining infrastructure certainty. The AI industry depends on stable infrastructure, long-term capital investment, and globally coordinated supply chains. Trump-era tariffs, introduced as part of a broader trade war with China, put the AI industry on shaky ground. Though framed as bold and decisive, these policies exhibit a deeper paradox: the only consistent feature is volatility.

This white paper explores how the AI industry has become a strategic externality—not a direct target, but collateral damage in a broader ideological campaign. Trump’s use of tariffs extends beyond economic calibration and reflects a deeper pattern of “narrative shock governance”: policy actions used to enforce symbolic loyalty, control institutional behavior, and project power, even at the expense of operational coherence. As AI companies delay investments and global rivals offer more predictable alternatives, the cost of this volatility is compounding—structurally, strategically, and globally.

The development of AI infrastructure depends on long-term planning, stable capital investment, and predictable policy environments. Trump’s tariff regime is marked by abrupt imposition, selective exemptions, and shifting political rhetoric. While tariffs are often framed as tools of economic protectionism or industrial strategy, their ad hoc implementation under Trump functions more like a destabilizing force than a guiding signal.

Moreover, these actions are not merely economic—they are political theater. Trump's governance style prioritizes visible boldness over durable strategy, creating a climate in which the AI industry must interpret trade policy not through economic rationale but through political mood. This transformation of industrial policy into narrative enforcement makes volatility the new baseline.

I. MindCast AI Methodology

Traditional risk models rely on static indicators, historical correlations, and linear assumptions about behavior. While useful for measuring exposure or volatility, they fail to account for how actors actually perceive, interpret, and respond to shifting signals—especially in politicized or narrative-driven environments.

MindCast AI’s Cognitive Digital Twin (CDT) framework fills this gap by simulating:

Perceptual bias under stress (e.g., how availability bias alters infrastructure forecasting),

Strategic divergence between rhetoric and action (quantified through ALI scores),

Temporal incoherence in decision chains (captured via CMF misalignment),

Narrative reflex responses that force firms into symbolic alignment regardless of strategic fit.

This allows MCAI to predict not just what a firm can do, but what it is likely to do when confronted with performative policy environments like Trump’s tariffs. It models institutions as cognitive systems under narrative pressure, not just economic agents responding to market signals.

In short: MindCast AI doesn’t just simulate outcomes—it simulates belief, bias, and behavioral friction under uncertainty.

MindCast AI conducted this study using its proprietary simulation engine MarketVision designed to model complex decision ecosystems through CDTs of stakeholder institutions.

Unlike traditional risk models that rely on static indicators or linear forecasts, MCAI’s method simulates how actors perceive, interpret, and respond to change. Each CDT incorporates:

Action-Language Integrity (ALI) – measures consistency between stated intentions and implied behaviors under stress;

Cognitive-Motor Fidelity (CMF) – evaluates alignment between internal logic, communicative expression, and real-world action;

Cognitive Bias Layering – identification of the actor’s susceptibility to behavioral distortions (e.g., status quo bias, ambiguity aversion, availability bias);

Judgment Structure Encoding – modeling of decision heuristics and reasoning style;

Narrative Reflex Mapping – how agents internalize, comply with, or resist dominant public narratives.

To generate realistic scenario forecasts, we conducted recursive simulations under various policy and market stimuli, updating actor responses through Bayesian inference and qualitative trigger points. We then measured behavioral convergence, divergence, and signal entropy across each system.

This analysis involved five key stakeholder CDTs:

The AI Industry as a composite meta-agent with infrastructure exposure and regulatory sensitivity;

AI Investors, modeled through capital velocity and perceived risk elasticity;

AI Firms, with internal tensions between narrative loyalty and operational strategy;

Data Center Developers, balancing physical constraints and policy fluidity;

The Trump Administration, modeled as a narrative-maximizing, structurally inconsistent actor.

This granular CDT approach allowed us to stress-test not only decisions, but the assumptions and narratives that drive them—offering a dynamic foresight tool calibrated to volatility itself.

CDI Analysis: Stakeholder ALI (Action-Language Integrity) and CMF (Cognitive-Motor Fidelity)

High ALI scores indicate Consistent alignment between speech and action. Actor does what they say—even when pressure increases. Low ALI scores point to gaps between what is said and what is done. Actor's language is performative or symbolic. High CMF scores show clear, consistent link between how the actor thinks, what they say, and what they do. Low CMF scores are a sign of jointed or erratic translation of cognition into action. Thought, speech, and behavior are misaligned.

1. AI Industry

ALI (Moderate): The AI industry broadly signals alignment with national reshoring and infrastructure narratives, but its actual investments lag. Public statements often emphasize domestic commitment, while execution slows due to cost, feasibility, and regulatory concerns.

CMF (Partial): Operational decisions only partially reflect internal intent. While the strategic logic supports infrastructure growth, logistical and geopolitical barriers fracture the connection between vision and action.

2. AI Investors

ALI (High): Investors maintain a clear and disciplined alignment between their public outlooks and internal decision-making. Caution expressed in interviews and forecasts matches their actual retraction from high-risk, hardware-intensive AI plays.

CMF (Strong): Capital behavior and communication are synchronized. Investment flows, deal pacing, and fund strategy reflect an accurate translation of investor sentiment into market behavior.

3. AI Firms

ALI (Low to Moderate): AI firms often overstate their alignment with reshoring or national infrastructure goals for reputational optics, while privately postponing or outsourcing execution. This creates a widening gap between intent and speech.

CMF (Weak): Execution consistently lags behind stated vision. Strategic ambitions are diluted by operational realities—supply dependencies, partner entanglements, and internal misalignment.

4. Data Center Developers

ALI (Moderate): Messaging around site selection, community engagement, and sustainability is generally credible and reflects actual development strategy. However, pressure from tariffs and energy politics creates tension in delivery timelines.

CMF (High): Execution is largely consistent with declared intent. Builders act within realistic constraints, and their decisions reflect what they communicate to regulators, communities, and investors.

5. Trump Administration

ALI (Low): The administration projects tariff policy as part of a strategic realignment, but the lack of follow-through, shifting exemptions, and political reversals undermine coherence. Messaging is performative rather than action-grounded.

CMF (Volatile): Real-world actions frequently contradict internal logic or public framing. Policy shifts often reflect reactionary motives or narrative tempo rather than coordinated strategy.

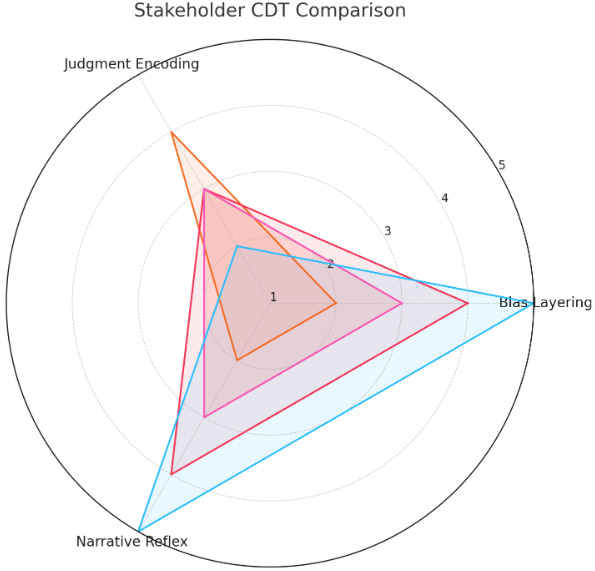

CDT Analysis: Stakeholder Cognitive Distortion, Decision Logic, Narrative Response

The central insight across all stakeholders is that Trump’s tariff regime functions less as economic policy and more as a narrative performance—and every actor must navigate this terrain by calibrating bias, reasoning, and symbolic alignment. Here's the distilled landscape:

AI Industry– Symbolically Aligned, Structurally Strained

The industry performs narrative compliance (e.g., reshoring talk) but is internally torn between strategic aspiration and infrastructure feasibility. Bias toward optimism creates risk of underestimating real-world friction.

Bias Layering: Availability & optimism bias

Judgment Encoding: Blended logic: pragmatism vs. policy tension

Narrative Reflex: Public compliance with national narrative; internal doubt about feasibility

AI Investors – Risk-Aware and Reflexively Hesitant

Investors are clear-eyed: they model risk with high cognitive precision and resist jumping on politically driven narratives. They move cautiously, showing low narrative reflex and a strong bias toward stability.

Bias Layering: Status quo bias, ambiguity aversion

Judgment Encoding: Cautious, risk-model-driven decision-making

Narrative Reflex: Hesitant alignment with reshoring and trade narrative

AI Firms – Two-Faced Logic: PR vs. Planning

Firms echo nationalistic messaging but are operationally misaligned. Their public voice signals loyalty, while internal action hesitates—caught between branding needs and global dependencies. This creates narrative overcommitment with behavioral lag.

Bias Layering: Narrative reinforcement bias, loss aversion

Judgment Encoding: Split logic between brand signaling and operational realism

Narrative Reflex: Strong external compliance; internal divergence between talk and action

Data Center Developers – Pragmatists in the Shadows

Less politically vocal but deeply exposed to policy shifts, these actors engage only when narratives intersect with permitting or cost incentives. They adapt fast, but don’t try to shape the broader storyline.

Bias Layering: Present bias, influenced by regulatory framing

Judgment Encoding: Adaptive logic that responds to zoning, energy, and political constraints

Narrative Reflex: Engage selectively with narrative only when aligned with practical incentives

Trump Administration – Narrative Overdrive, Strategic Underdelivery

Governance is dominated by symbolism, conflict framing, and reactive storytelling. Strategic coherence is low, but rhetorical control is high. It generates system-wide volatility by forcing others to respond to performative cues rather than stable signals.

Bias Layering: Confirmation bias, overconfidence, salience bias

Judgment Encoding: Impulsive logic shaped by narrative timing and political drama

Narrative Reflex: Acts as the architect and enforcer of symbolic narrative frames

The trend across stakeholders is that Narrative Reflex outpaces rational coherence. All stakeholders must perform symbolic alignment to remain politically legible, even if that alignment is superficial or risky. Biases are activated differently, but the common constraint is that narrative reflex dominates strategy—forcing actors into roles in a political play, rather than letting them follow market logic alone.

II. Tariffs as Strategic Noise, Not Signal

Rather than reinforcing a coherent national AI strategy, Trump’s tariffs have become a source of mixed signals to the industry. Some components essential to AI infrastructure—like GPUs and semiconductors—have been temporarily exempted, while others—such as cooling units and server assemblies—have faced steep duties. This patchwork approach lacks consistency and forces companies to make high-stakes investment decisions without confidence in long-term cost structures.

Viewed through the lens of narrative control, this inconsistency may not be a flaw—it may be the feature. By keeping the rules fluid, the Trump administration asserts narrative dominance over strategic clarity. Companies are not merely responding to trade data—they are responding to a president who governs by momentum, disruption, and symbolic shock.

III. The Planning Horizon Problem

AI infrastructure investments often require multi-year commitments in site acquisition, permitting, hardware procurement, and labor planning. When tariff policy can swing drastically between administrations—or even within a single presidency—those planning horizons collapse. Businesses are forced into defensive stances, waiting for clarity rather than acting with conviction.

The problem is not just cost—it’s temporal incoherence. When firms can’t model five-year futures due to potential policy reversals, strategic vision shrinks. The result is a form of cognitive compression: companies no longer plan toward opportunity, but retreat from threat. And that threat isn’t China—it’s unpredictability at home.

CDT Simulation Summary

To simulate how key actors respond under volatile tariff pressure, MCAI’s MarketVision engine provided the following per stakeholder:

Volatility—not cost—is the dominant stressor. Tariff uncertainty functions as a governance variable, reducing planning horizons and narrative stability. The AI sector emerges as strategic collateral in a broader narrative war.

IV. Investment Paralysis in AI Infrastructure

Major players in cloud and AI infrastructure, including Microsoft and Amazon, have already signaled delays or reconfigurations in their data center plans due to rising construction costs tied to tariffs. Meanwhile, startups and hardware-intensive ventures face increased uncertainty in securing components and forecasting unit economics. Venture capital firms, sensitive to unpredictable margin structures and geopolitical exposure, become more risk-averse.

But this paralysis has a narrative dimension as well. In an environment governed by symbolic compliance, firms are not just responding to costs—they are navigating political expectations. To invest boldly in U.S. infrastructure may appear patriotic now, only to become economically ruinous if tariffs vanish in a post-Trump regime. The signal is not investment—it’s obedience.

V. Narrative Chaos and Market Sentiment

Beyond economics, tariffs shape narratives—and narratives drive capital. In the AI sector, market sentiment is shaped by how clearly stakeholders can interpret policy direction and anticipate downstream effects. Trump’s tariff oscillations introduce interpretive chaos. Wall Street analysts, global suppliers, and tech executives are left second-guessing whether protectionism is here to stay or merely performative.

This is not accidental. Trump governs not through predictable systems, but through emotional tempo. The uncertainty itself becomes a form of control, forcing firms, journalists, and investors to constantly recalibrate around him. When the president is the volatility vector, no spreadsheet can model risk.

VI. Comparative Policy Certainty Abroad

While the U.S. wavers between tariff regimes and political cycles, global competitors are moving with greater clarity. China and the European Union have implemented structured industrial strategies to support AI infrastructure through targeted subsidies, long-term buildout plans, and consistent trade treatment of key components.

In this landscape, volatility becomes an American export disadvantage. Talent, capital, and infrastructure flow not just toward capability, but toward predictability. In that contest, the U.S. risks falling behind—not for lack of innovation, but because it insists on governing with shock instead of structure.

VII. Narrative Shock Governance: The AI Industry as Strategic Collateral

Trump’s tariffs are best understood not as industrial policy—but as performative control mechanisms. They create moments of symbolic rupture: a headline, a rally line, a show of strength. Yet their real impact lands elsewhere—often unpredictably, and often on sectors like AI that were never the intended battlefield.

This is a form of Narrative Shock Governance. Under this model, economic instruments like tariffs are deployed not for optimization, but for enforcing narrative conformity. If companies shift behavior—reshore manufacturing, delay projects, abandon China—it’s a victory for the performance, not the policy. The AI industry becomes strategic collateral: an externality that must absorb costs in order for political identity to be projected outward.

What makes this so dangerous is its temporal fragility. If tariffs are reversed under a future administration, firms who aligned too early may be left with stranded investments. Those who waited may be rewarded. In such a world, obedience is costly, and hesitation is rational.

This is not how great infrastructure is built. Nor how strategic industries thrive.

VIII. Conclusion: The Real Risk Is Not Tariffs—It’s Whiplash

Tariffs themselves are not inherently damaging. Used strategically and predictably, they can encourage domestic capacity, secure supply chains, and counter foreign market manipulation. But when applied erratically—without continuity, planning, or bipartisan support—they become a source of strategic whiplash.

Trump’s boldness is not a compass—it is a tremor. And in the AI sector, where infrastructure scale, capital alignment, and long-term vision are essential, this tremor disrupts more than trade flows. It fractures foresight itself.

Prepared by Noel Le, Founder | Architect of MindCast AI LLC. Noel holds a background in law and economics, and behavioral economics. He spent his career developing advanced technologies for intellectual property management.