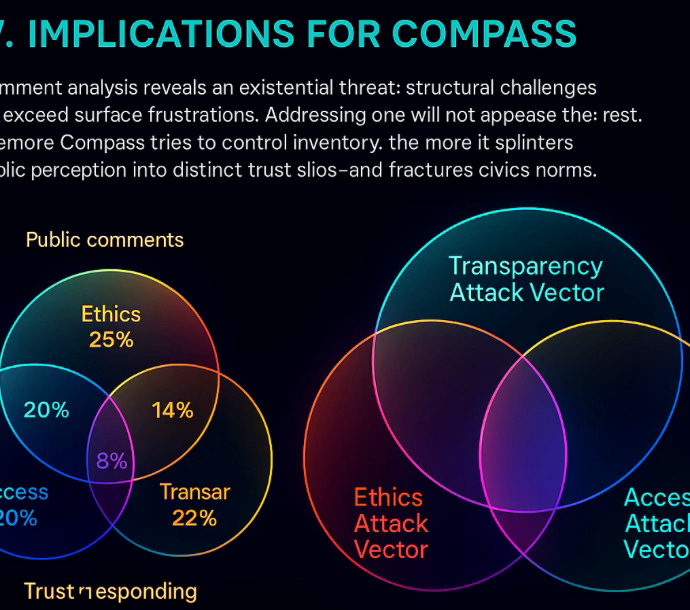

MCAI AI Narrative Vision: The Crowd Already Knew, What 160 Public Comments Reveal About Compass, Platform Abuse, and Trust Decay

How MindCast AI transformed a news comment section into a structural forecast model—mapping narrative fracture, platform distrust, and civic foresight in real time.

I. Introduction: Narrative Intelligence from Below

In the aftermath of The Seattle Times article on Compass’s “Private Exclusive” listing strategy, a different kind of insight surfaced; not from executives, lawyers, or journalists, but from the public. Over 160 reader comments revealed a coherent, sophisticated understanding of the structural problems Compass’s tactics have unleashed.

MindCast AI (MCAI) specializes in modeling reputation dynamics, narrative evolution, and institutional strength. We developed our system for large scale public narrative modeling of US DOJ and FTC proceedings. The Compass antitrust case presents a local case study to validate our technology.

In this writeup, MCAI uses public comments from The Seattle Times article as a diagnostic input layer to simulate how trust fractures in real time—before regulatory rulings or official statements are ever issued.

II. Method: How MCAI Analyzes Public Commentary

MCAI is built for more than legal diagnostics. It is a full-spectrum public narrative sensor—mapping perception, foresight, and systemic failure before the industry even detects trouble. In this report, MCAI leverages public comments from The Seattle Times article as its raw data layer, transforming what others might see as noise into structured, civic insight.

The analysis framework applied here is designed not simply to categorize opinion, but to reveal emergent architecture—patterns of collapse, inertia, or resistance across stakeholders and institutions.

This is public foresight. At speed. At scale.

📊 Narrative Signal Streams

🔵 Blue signals: Corporate defenders praising Compass’s sleek branding and so-called “seller control.” These voices often emerge from marketing insiders, brand-aligned agents, or policy-neutral technocrats. While seemingly positive, these endorsements recycle sanitized language around "choice" while obscuring the asymmetry embedded in Compass's listing policies. These signals function as external validators that smooth over internal contradictions and dull early warnings.

🟡 Yellow signals: Consumer confusion, missed listings, misinformed expectations. These signals originate from clients caught in the gap between Compass's promises and their actual experience—e.g., listings not appearing on Zillow or homes sitting stale off-MLS. They mark early cognitive dissonance where expectation management fails. Often, these voices are well-meaning but disoriented, and they lay the groundwork for red signal escalation.

🔴 Red signals: Structural harm—dual-agency conflicts, discriminatory visibility, platform capture. These signals reflect the most credible and dangerous form of narrative rupture: civic accusations grounded in law, ethics, and institutional memory. They include fair housing risk, insider favoritism, and the dual-agency incentives Compass quietly cultivates. Red signals don’t merely express outrage—they frame legal vulnerability.

⚫ Grey signals: Institutional passivity and market resignation. These come from adjacent institutions—peer brokerages, regulators, or consumers—who remain silent or paralyzed despite growing awareness. The silence often reflects complicity, fear of retaliation, or structural fatigue. In MCAI analysis, grey zones are often the critical “pre-collapse” state: when silence allows abusive systems to metastasize.

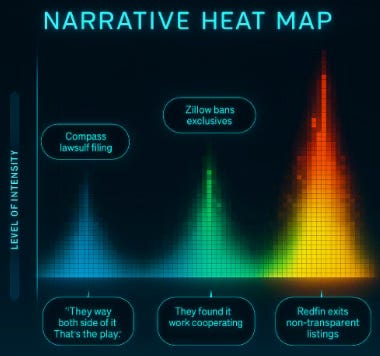

Narrative heat maps spike around Compass’s lawsuit filing, Zillow’s ban on exclusives, and Redfin’s platform exit from non-transparent listings. Each spike marks a breakdown in Compass’s brand story and a turning point in public trust modeling.

Rather than treating comment sections as noise, MCAI treats them as civic feedback networks. Using clustering, semantic extraction, and perception tagging, each comment is assigned to a signal category. Signal density, coherence, contradiction, and escalation are tracked over time.

Key techniques:

Signal vector modeling (red, yellow, blue, grey)

Category clustering across seven dominant themes

Quote-weighted narrative mapping

Perception escalation index (PEI) to measure loss of institutional trust

III. Findings: The Seven Civic Signal Clusters

This bar chart visualizes the distribution of public comments mapped to each of the seven civic signal clusters. It highlights where public perception is most concentrated—especially around seller regret, trust breakdowns, and fair housing concerns.

This radial visualization shows the proportional distribution of narrative categories across public commentary. It reinforces the balance of seller disillusionment, transparency concerns, and rising ethical scrutiny against Compass’s listing strategy.

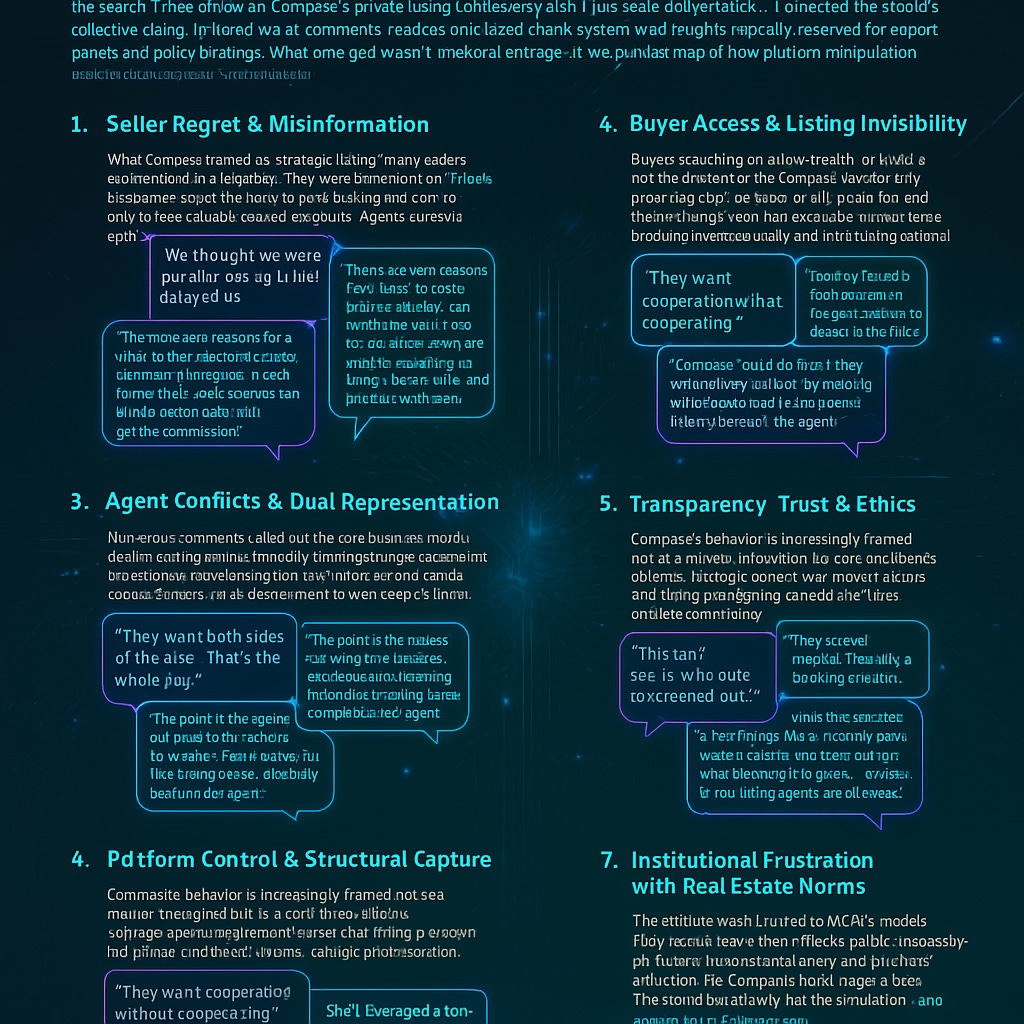

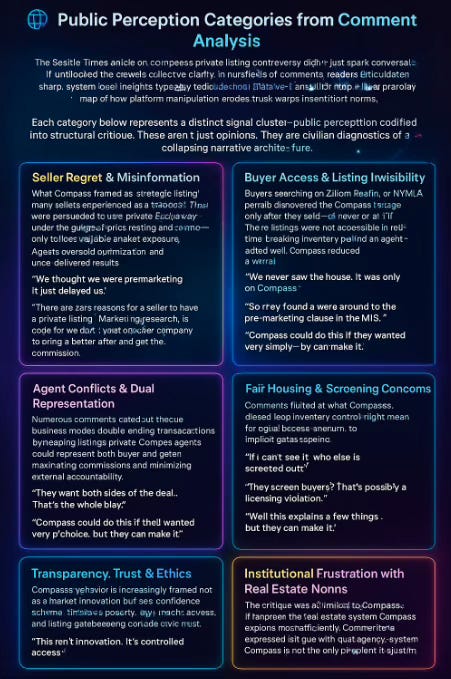

The Seattle Times article on Compass’s private listing controversy didn’t just spark conversation—it unlocked the crowd’s collective clarity. In hundreds of comments, readers articulated sharp, system-level insights typically reserved for expert panels and policy briefings. What emerged wasn’t anecdotal outrage—it was a granular map of how platform manipulation erodes trust, warps incentives, and fractures institutional norms.

Each category below represents a distinct signal cluster—public perception codified into structural critique. These aren’t just opinions. They are civilian diagnostics of a collapsing narrative architecture.

Seller Regret & Misinformation What Compass framed as “strategic listing” many sellers experienced as a trapdoor. They were persuaded to use “Private Exclusives” under the guise of price testing and control—only to lose valuable market exposure. Agents oversold optimization and underdelivered results. Sellers realized too late that they had signed away visibility for illusion.

“We thought we were pre-marketing. It just delayed us.” “There are zero reasons for a seller to have a private listing. ‘Marketing research’ is code for we don’t want another company to bring a better offer and get the commission.” “It should always be the choice of the seller, but it is the wrong choice. Seller beware.”

Buyer Access & Listing Invisibility Buyers searching on Zillow, Redfin, or NWMLS portals discovered the Compass listings only after they sold—or never at all. These listings were not accessible in real time, breaking the informational symmetry that real estate depends on. Compass reduced open market competition by burying inventory behind an agent-gated wall. The result: missed opportunities, distorted comps, and buyer distrust.

“We never saw the house. It was only on Compass.” “I also will say that my wife and I have bought several properties by looking at Zillow or MLS… so we would have missed the exclusive listed home.” “You’re gonna leave money on the table with the Compass model.”

Agent Conflicts & Dual Representation Numerous comments called out the core business model: double-ending transactions. By keeping listings private, Compass agents could represent both buyer and seller, maximizing commissions and minimizing external accountability. Consumers saw through it—and viewed it not as efficient, but exploitative.

“They want both sides of the deal. That’s the whole play.” “The point is the agents are lying to the sellers to convince them to do a listing arrangement that only benefits the agent.” “Almost to a certainty it’s a poor choice, but they can make it.”

Platform Control & Structural Capture Rather than building on shared infrastructure, Compass attempts to bend it. It uses NWMLS when it’s convenient, and sues when it’s not. Consumers recognize the inconsistency and call out the firm’s two-faced platform strategy. The language of disruption is used to mask entitlement to other people’s infrastructure.

“They want cooperation without cooperating.” “So they found a work around to the pre-marketing clause in the MLS.” “Compass could do this if they wanted very simply—by resigning from the NWMLS. But they want to be a member… and cheat.”

Transparency, Trust & Ethics Compass's behavior is increasingly framed not as a market innovation but as a confidence scheme. Strategic opacity, asymmetric access, and listing gatekeeping corrode civic trust. Consumers describe a system where power—not merit—determines who sees what, and when.

“This isn’t innovation. It’s controlled access.” “The idea that you can determine the value of a listing getting wide exposure by giving it limited exposure is absurd.” “These pocket listings only benefit the listing agent.”

Fair Housing & Screening Concerns Comments hint at what Compass’s closed-loop inventory control might mean for equal access: a return to implicit gatekeeping. If only agents within Compass can see certain listings first—or at all—what protections exist for marginalized buyers? The system begins to mirror discriminatory patterns even if no overt policy exists.

“If I can’t see it, who else is screened out?” “They screen buyers? That’s possibly a licensing violation.” “Well this explains a few things. We’ve recently seen homes for sale in our neighborhood that don’t show up on the MLS… curiously, the listing agents are all Asian.”

Institutional Frustration with Real Estate Norms The critique wasn’t limited to Compass—it targeted the real estate system Compass exploits most efficiently. Commenters expressed fatigue with dual agency, commission opacity, and weak enforcement of fiduciary standards. But they also acknowledged: Compass is not the only problem. It’s just the most concentrated version of it.

“The system is broken. Compass just made it obvious.” “The egos of guys pictured here are crazy. You get those guys who do it part time and have no clue what they’re doing… The more people who have access to the home, the better.” “It’s cheaper in the long run. Work with the best even if it costs a bit more.”

Each icon represents one of MCAI’s civic signal clusters, drawn from over 160 public comments. These categories reveal how public language organizes systemic collapse: not randomly, but with architectural clarity.

🔎 Insight: The comments don’t just confirm MCAI’s models—they exceed them. They reflect a public increasingly fluent in institutional decay and platform distortion. For Compass, the damage is done. The crowd has already run the simulation—and moved on to accountability.

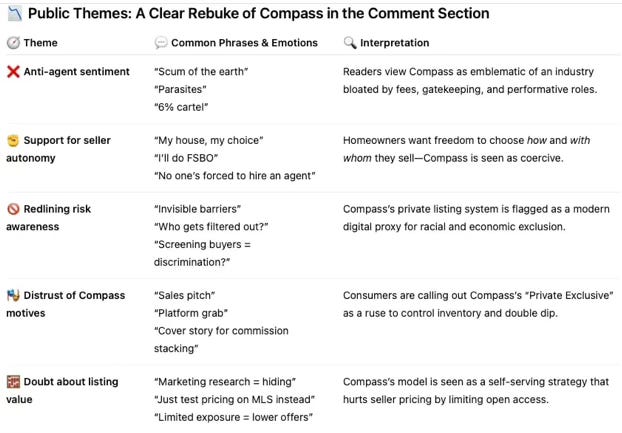

IV. Quote Map: The Crowd Diagnoses Collapse

MCAI doesn’t just track sentiment. It extracts structural intelligence from language in motion. In this section, direct quotes are used not to illustrate points—but to expose fractures in the trust scaffolding of a major real estate platform. Each quote is a microdiagnosis of a larger system failure.

This is how the public becomes the simulation engine.

MCAI quote analysis begins below.

This section integrates direct quotes from over 160 public comments submitted to The Seattle Times article on Compass’s litigation against NWMLS. Each quote reveals not merely frustration, but a systemic literacy that anticipated Compass’s reputational collapse.

This grid highlights how MCAI maps direct public quotes to Compass’s systemic failures, sorted by narrative color: confusion (yellow), contradiction (blue), harm (red), and resignation (grey). It shows how the public didn’t just complain—they diagnosed collapse in real time.

This curve illustrates how public comments evolved from confusion to system-level critique, revealing a trajectory from blue/yellow (individual confusion) to red/grey (structural collapse and resignation).

This visualization maps the frequency, category overlap, and intensity of narrative signals from 160 public comments. It shows how confusion, frustration, and structural critique organically clustered into an architecture of collapse.

Additional visualizations forthcoming include:

Category frequency bar chart

Perception escalation index gradient

Quote cluster matrix

A tabular or visual format showcasing 2–3 quotes per category alongside MCAI’s reading of what that quote reveals about public foresight and structural clarity.

Example:

“We thought we were pre-marketing. It just delayed us.”

→ MCAI: Seller disillusionment with internal visibility systems. Indicates early erosion of platform trust.

V. MCAI Foresight Layer: Forecasts from the Comment Simulation

Based on narrative signal intensity, quote clustering, and perception trajectories, MCAI offers the following forecasts drawn directly from the 160-comment data environment:

Institutional Fracture Will Outpace Regulatory Response

Public trust has already broken. MCAI forecasts that courts and regulators will be reactionary—not leading the correction, but confirming what the public already sees. This lag will allow Compass to continue extracting market control while appearing compliant. Civic and platform-based actors (Zillow, Redfin) will act faster than formal institutions. Expect informal consequences (visibility bans, peer dissociation) to precede legal action.Civic Trust Will Not Recover Without Structural Transparency

Unless Compass reforms its listing structure, public sentiment will calcify into reputational resistance. Buyer wariness and agent attrition will expand. The longer opacity persists, the more deeply public users interpret it as intentional exclusion. Even if Compass wins in court, the platform will lose moral authority. Civic trust requires structural correction—not branding.Litigation May Trigger Antitrust Counteraction

MCAI forecasts DOJ scrutiny not because Compass sued—but because its behaviors post-lawsuit match textbook patterns of exclusionary dominance. Lawsuits that seek to dismantle cooperative norms while extracting platform value tend to attract regulatory review. MCAI anticipates investigative interest from watchdog groups even before official government action. Legal overreach can become the very grounds for enforcement.Dual-Agency Practices Will Face Renewed Scrutiny

Public comments repeatedly exposed double-ending. Expect legal, regulatory, and journalistic attention to revisit the ethics and mechanics of dual representation.

This issue is no longer technical—it’s symbolic of platform self-dealing. Consumers increasingly equate private listings with exploitative commissions. MCAI forecasts a push to mandate disclosure or limitation of dual-agency scenarios.MLS Models Will Be Recast as Civic Infrastructure

The public sees NWMLS not as a cartel—but as a trust scaffold. MCAI forecasts renewed institutional investment in shared visibility and access standards. This reframing positions MLS rules as consumer protections—not professional constraints. Public commentary has already begun to reframe the MLS as a digital commons. MCAI expects pressure to strengthen and codify equal-access norms at the policy level.

VI. Conclusion: The Crowd Simulated Compass Before MCAI Finished Its Brief

Compass underestimated not just its critics, but the perceptive power of its own market. These public comments show a civic layer that is narratively fluent, structurally literate, and no longer willing to confuse branding with transparency.

MCAI didn’t invent the diagnosis. It merely confirmed what the public already knew—and said out loud.

Prepared by Noel Le, Founder | Architect, MindCast AI LLC.