MCAI Lex Vision Summary Compass v. NWMLS Evaluating the Motion to Dismiss

Revelation of Compass Lawsuit Merits, Strategic Forecast for Brokers

I. Executive Summary

NWMLS has moved to dismiss Compass’s antitrust and tort claims. MCAI reviewed all filings and estimates NWMLS has a 75–85% chance of prevailing, either fully or with key claims dismissed. Compass’s case contains core weaknesses: vague market definitions, limited evidence of consumer harm, and misuse of precedent. NWMLS presents a legally sound, consistent defense grounded in established case law.

Legal narratives often mask strategic intent. MCAI’s analysis highlights how Compass’s litigation posture seeks structural concessions through the court, not a fair remedy. A ruling in this case could reshape how cooperative infrastructure withstands platform-driven legal challenges.

II. Case Context and Litigation Strategy

Understanding the core narrative strategies is critical to interpreting the legal tactics of each side. Compass positions itself as a disruptor challenging entrenched monopolies. NWMLS responds by emphasizing legal stability, equal enforcement, and Compass’s failure to show consumer harm. This contrast sets the stage for how the court will view fairness, intent, and credibility in the broader antitrust argument.

Contact mcai@mindcast-ai.com to partner with us on law and economics foresight simulations.

III. Legal and Strategic Assessment

Antitrust law is not just about competition—it is about protecting public trust in shared systems. Courts view MLSs as essential infrastructure requiring equal access. Antitrust law protects the competitive process itself, not just individual competitors' convenience. When one firm attempts to game that system while cloaking itself in antitrust language, it corrodes the very trust those laws were built to safeguard.

Compass’s legal arguments are unlikely to survive as filed. NWMLS gains strength from clarity, doctrine, and consistent conduct.

Compass: Weak Points

Inconsistent Market Definition Compass claims harm in Seattle while touting national reach for its Private Exclusives. Courts require clear market definitions. You can’t allege local injury while using national data to justify product value. This contradiction undermines credibility and legal sufficiency.

No Consumer Harm Alleged Compass’s alleged harm centers on its own business—not buyers or sellers. Courts look for evidence that consumers faced reduced choices, inflated prices, or distorted competition. Compass’s own complaint states its Private Exclusives raise prices by 2.9%. That may benefit sellers but cuts against consumer-focused antitrust arguments.

Misapplying PLS.com Compass cites PLS.com, where multiple MLSs conspired to shut out a rival. But Compass remains a full NWMLS member. It was not excluded—its IDX feed was paused due to rule violations. Courts treat internal enforcement differently than full exclusion of competitors.

Platform Strategy Framed as Legal Claim Compass seeks to benefit from NWMLS infrastructure while shielding its own listings. MCAI analysis shows this is a platform control strategy—not a legal effort to restore competition. Courts often reject attempts to reshape institutions through litigation without clear structural harm.

NWMLS: Strengths to Leverage

Rule Consistency and Equal Enforcement NWMLS enforces rules evenly across members. It only intervened after Compass withheld listings. Uniform enforcement tends to support legal defensibility.

Clear Legal Grounding NWMLS cites Trinko and linkLine—cases stating that even monopolies have no obligation to cooperate with rivals. This shields NWMLS from claims of duty-to-deal violations.

Procedural Discipline and Discovery Burden NWMLS seeks only a short discovery pause. Meanwhile, Compass made 51 sweeping requests. One demanded “All Documents and data concerning projected, estimated, planned or actual conditions in the markets for residential real estate and Real Estate Services”—with no time or geography limit.

Compass's inconsistencies and aggressive discovery posture weaken its standing. NWMLS’s legal posture is tighter, cleaner, and more aligned with precedent.

IV. Motion to Stay Discovery

Discovery timing reflects more than just efficiency—it reflects which party the court believes is acting in good faith. NWMLS requests a pause not to obstruct Compass, but to preserve institutional integrity while the court assesses the complaint's validity. Compass insists on urgency while leveraging antitrust law to selectively exempt itself from cooperative obligations. That tactic undermines the public trust that MLS rules depend on to function.

How the court rules will signal its trust in the credibility and structure of each party’s claim. Compass wants discovery to proceed. It claims urgency and cites prior court orders. NWMLS requests only a temporary stay. It points to Compass’s burdensome discovery requests and Compass’s failure to seek an injunction as evidence that delay causes no real harm.

This dispute over timing reflects deeper issues about the case’s underlying strength.

V. Timeline of Key Events

Procedural history gives structure to legal strategy. Tracking each key action helps brokers anticipate turning points. Court milestones also signal how quickly each side must adapt its messaging and compliance posture.

April 25, 2025: Compass files complaint

June 16, 2025: Joint status report filed

June 20, 2025: Court issues scheduling order (trial in June 2026)

June 24, 2025: Compass serves discovery

July 21, 2025: Compass opposes stay of discovery

July 24, 2025: NWMLS replies in support of stay

July 28, 2025: NWMLS replies on motion to dismiss

August–September 2025: Expected ruling on motion

Expect a key ruling by early fall. Discovery will only proceed if the motion is denied or narrowed.

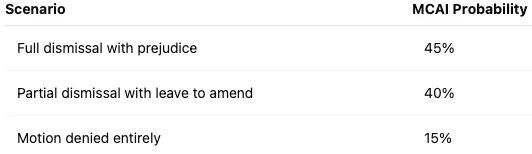

VI. MCAI Forecast: Likelihood of NWMLS Success

Forecasting outcomes helps brokers and legal teams prepare for scenario-based planning. NWMLS's legal strategy centers on structural precedent, while Compass's claims lean on narrative framing. MCAI evaluates dismissal probability using a blend of legal precedent, argument clarity, and institutional behavior. The model simulates how courts respond to platform disputes involving membership integrity and market power.

Estimated Overall Success for NWMLS in Current Stage of Litigation: 75–85% This projection uses MCAI’s proprietary modeling: a combination of legal precedent alignment, procedural posture, narrative coherence, and structural institutional signals. Our system has benchmarked similar antitrust scenarios in real estate, healthcare, and platform governance.

VII. What This Means for Your Listings

Legal battles like this one create ripple effects in how brokers operate day-to-day. Listing rules, client expectations, and platform access are shaped by how courts interpret fairness and innovation. Brokers need clarity not only on who prevails—but on what new norms emerge. Outcomes in this case could shift the balance between platform flexibility and infrastructure compliance.

A decision in favor of NWMLS would validate uniform listing enforcement. Brokers should continue to comply with existing rules. If Compass succeeds in part, the MLS framework could face adjustments. Office exclusives might gain more legal cover—but only if implemented with transparency and without undermining platform norms.

The case outcome will influence how platforms and brokerages interact over listing control.

VIII. Recommendations for Brokers

Strategic clarity is more valuable than ever in contested market environments. The Compass–NWMLS case gives firms a moment to audit risk, realign messaging, and test listing compliance. MCAI recommends proactive alignment with whichever legal framework remains standing. Lessons here apply to platform players and traditional brokers alike.

If You’re Not with Compass: Support procedural fairness and transparency. NWMLS’s stance helps preserve listing reliability and open cooperation.

If You’re with Compass: Prepare for delays. Courts may dismiss or limit claims. Consider offering Private Exclusives only in jurisdictions that explicitly permit them. Use this moment to audit your listing agreements and ensure compliance with MLS protocols.

Being proactive now reduces risk later.

IX. Final Takeaway

Power struggles over infrastructure don’t always appear as innovation debates. In this case, Compass challenges the integrity of cooperative rules in favor of selective platform control. NWMLS defends shared norms as necessary for trust, transparency, and equal broker access. Courts will decide whether legal disruption earns exemption—or proves too risky to institutional trust.