MCAI Market Vision: Tesla Brand Repair Forecast

A Forecast of Sales and Reputation Recovery

I. Introduction and Brand Damage Overview

Tesla faces a 6–42 month recovery window to restore its brand and sales trajectory. This report offers a strategic assessment based on behavioral modeling of stakeholder sentiment and public response patterns. We use simulated consumer and investor profiles to analyze how leadership behavior, narrative alignment, and market trust evolve over time.

The brand has fractured due to mixed messaging, high-profile leadership controversies, and perceived abandonment of core environmental values. Damage extends beyond public relations into structural contradictions between promises and actions. When narrative and conduct diverge, public memory intensifies. Repair depends on re-establishing coherence between mission, leadership, and institutional behavior.

Insight: Tesla’s reputational crisis reflects a breakdown between internal behavior and public expectation. Coherence—between what the company says, does, and stands for—is essential to rebuild trust. Brands that align performance with purpose gain durable influence. Recovery starts with reconnection to shared values.

Key Damage Signals:

Founder Polarization: Elon Musk’s political extremism and unpredictable communication

Mission Drift: Disconnection from the climate-focused brand promise

Trust Collapse: Withdrawal by ESG investors, reputational fallout, generational alienation

Narrative Confusion: Innovation claims conflict with internal governance behavior

II. Quantifying the Damage and the Recovery Path

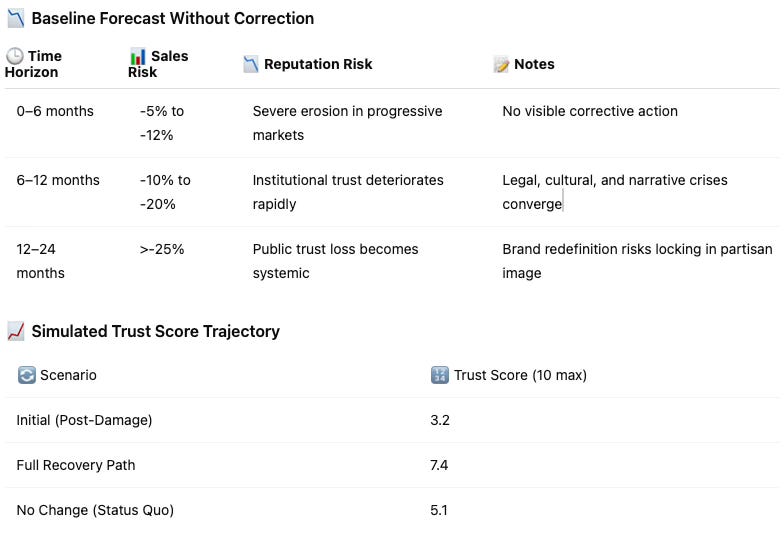

Trust and sales erosion is quantifiable based on recent market behavior, media sentiment, and institutional signals. Without reform, Tesla risks losing key customer segments and investor categories within 6–12 months. With reform, recovery is achievable, but contingent on early and visible structural changes. The timeline below reflects projected outcomes across a set of high-confidence scenarios.

These projections use weighted stakeholder sentiment data, historical recovery analogues, and scenario variance modeling. Public trust responds to perceived integrity, not intent. When credibility gaps widen, recovery requires more than rebranding—it demands proof of change. Timing, transparency, and tone set the conditions for reversibility.

Insight: Recovery becomes exponentially harder the longer the delay. Trust decays fast, rebounds slow. Alignment between values, voice, and visible change forms the foundation of reputational repair.

III. Strategic Levers for Recovery

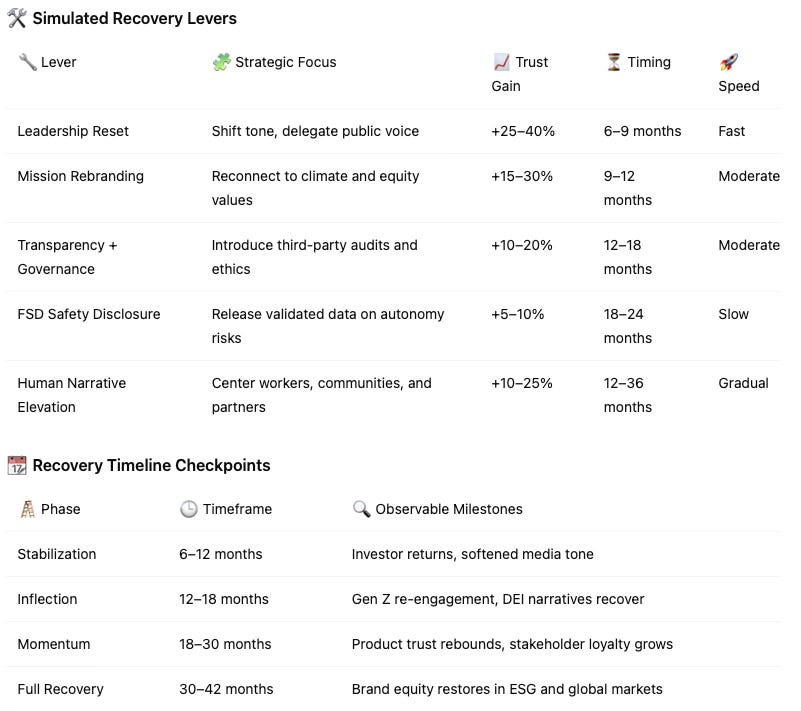

Repair begins with clear signals: recalibrated leadership tone, renewed commitment to the original climate mission, operational transparency, and credible engagement with critics and employees. Structural reforms restore early momentum. Cultural alignment sustains the turn.

Each action must show not only intention but follow-through. Investors and consumers track how the company protects workers, honors values, and adjusts its public face. Recovery is not a communication strategy—it’s a systems strategy. The table below quantifies potential trust gains across coordinated interventions.

Insight: Recovery compounds when action and narrative reinforce each other. Cultural repair is a force multiplier, not a soft asset. Authentic leadership and public proof outperform spin. Brands recover when communities believe again.

IV. Contingency Risks and System Feedback Loops

Failure to evolve the leadership voice or mission coherence locks Tesla into narrative instability. Every quarter without correction calcifies reputational damage. The market reads silence as strategy. Brand erosion becomes embedded.

Contradictions between innovation goals and cultural dissonance generate long-tail risks. Without new cultural signals, even product breakthroughs struggle for traction. Reputation operates as a trust economy—losses compound, and rebuilds require systemic investment.

Insight: Decisive leadership action is the only way to reverse the feedback loop of brand distrust. When perception ossifies, performance loses influence. Reputational capital must be actively rebuilt, not assumed.

If Musk remains central without counterbalance:

Brand stagnates in high-cost, low-trust segments

Regulatory and institutional scrutiny intensifies

Cultural markets and younger consumers disengage long-term

V. Strategic Recommendations and Outcome Scenarios

Tesla must choose between reputation recovery and reputation attrition. The current window still allows a positive arc—if leadership coherence, product integrity, and stakeholder inclusion converge. Market trust responds to truth, not claims.

To rebuild enduring equity, Tesla should:

Install governance firewalls between CEO persona and product strategy

Reaffirm climate and equity pillars as operating principles

Publish quarterly transparency reports on progress and missteps

Give internal voices—engineers, women, workers—center stage

Align compensation and incentives with cultural and mission metrics

Insight: The future of Tesla depends not on vision but verification. Stakeholders await not another promise, but proof. Recovery begins when the company speaks less and listens more—and when what it shows earns back belief.

Prepared by Noel Le, Founder | Architect of MindCast AI LLC. www.linkedin.com/in/noelleesq/, noel@mindcast-ai.com

Appendix: Cognitive Digital Twin Analysis

Tesla the Brand (CDT: Institutional Architecture)

Core Identity Markers: Sustainability innovator, autonomy pioneer, brand-as-visionary

Observed Drift: Leadership voice overshadows product narrative, ESG divergence, cultural misalignment

Behavioral Signals:

Frequent leader-centered media cycles

Resistance to regulatory norms

Inconsistency between stated mission and internal governance

Predicted Evolution Without Repair:

Locked perception as volatile tech personality brand

Persistent regulatory scrutiny and mission skepticism

Brand equity concentrated in politically aligned or cult-driven consumer groups

Repair Path Activation:

Recenter engineering team in media and product communication

Establish governance buffer between public statements and brand

Reintroduce sustainability goals with third-party validation and public reporting

The Public (CDT: Consumer-Investor Culture)

Primary Segments:

Climate-driven consumers (Gen Z, EU buyers)

Institutional ESG investors

Middle-market skeptics

Trust Fracture Symptoms:

Emotional dissonance between values and leadership tone

Perceived betrayal of equity, labor, or transparency principles

Disengagement from younger consumer cohorts and European regulators

Cognitive Feedback Patterns:

Reactivity to leadership behavior outweighs appreciation of product roadmap

Narrative volatility triggers brand distancing

Stakeholders demand coherence before recommitment

Trust Rebuild Triggers:

Authentic inclusion of community voices and frontline workers

Measurable governance reform (e.g., board transparency, whistleblower protections)

Aesthetic and narrative reset led by engineers, not executives

Conclusion: The CDT analysis highlights systemic misalignment between Tesla’s internal identity and the cultural field it depends on for legitimacy. Rebuilding trust requires not only narrative consistency but also behavioral evidence that reinforces stakeholder values across every major public touchpoint.