MCAI Market Vision: TSMC & NVIDIA, Architecture in Motion

How Two Chip Giants Are Rewiring Innovation, Power, and Trust in the AI Age

Executive Summary

In 2025, two of the world’s most influential tech firms—TSMC and NVIDIA—made bold moves that will reshape the future of semiconductors and AI. TSMC expanded into the U.S. to meet geopolitical pressure while protecting its innovation engine in Taiwan. At the same time, NVIDIA began relocating its headquarters to Taiwan to be closer to the source of leading-edge chip manufacturing. These moves are not reactive—they’re deliberate strategies in a world where trust, speed, and proximity now define advantage. TSMC’s most critical technologies include its 2nm and 3nm node fabs and advanced chip packaging platforms like CoWoS, which support the majority of the world’s cutting-edge chips used in smartphones, AI servers, and high-performance computing. For NVIDIA, key assets include its H100 and B100 AI accelerators (dominant in global data center training), the Omniverse simulation platform, and the Drive suite for autonomous vehicles. These technologies drive not only corporate growth but the architecture of tomorrow’s cognition and mobility systems. for TSMC, its 2nm and 3nm node fabs and advanced packaging platforms like CoWoS; for NVIDIA, its H100 and B100 AI accelerators, the Omniverse simulation ecosystem, and its Drive platform for autonomous vehicles.

This simulation explores the consequences of these strategic shifts through cognitive digital twins (CDT)—detailed behavioral models—of TSMC, NVIDIA, and the broader idea of Innovation. MindCast AI built these twins to assess how strategic actions ripple across ecosystems of trust, coordination, and foresight. The model reveals how institutions move under pressure and what happens when innovation is embedded in different structural alignments. Each actor’s evolving role—TSMC as steward, NVIDIA as accelerator, the U.S. as enforcer, and the global AI ecosystem as dependent—is visualized to track cascading effects. We then simulated the CDTs to generate the forecast. This process allowed us to examine not only strategic intent but also how each move ripples through systems of coordination, pressure, and innovation. The simulation reveals potential paths: a best-case scenario where innovation becomes symphonic and co-located, and a worst-case where fragmentation, overreach, and geopolitical stress degrade trust and capability. The forecast scenarios that follow were generated from this simulation—highlighting futures that hinge not just on technical outcomes, but on whether rhythm, role, and trust architecture stay aligned.

I. Context and Activation

This section sets the stage for a dual corporate realignment that may reshape the next decade of technological power. TSMC and NVIDIA are doing more than reacting to market shifts—they are reconfiguring global influence and production logic in real time. Their moves reflect deeper tensions between speed and sovereignty, coherence and expansion. Here, we outline what activated this simulation and why it matters.

In 2025, TSMC and NVIDIA initiated moves that ripple far beyond corporate boundaries:

🔧 TSMC expanded manufacturing into the U.S. to hedge against geopolitical risk and comply with strategic pressure from U.S. policymakers.

⚡ NVIDIA signaled intent to relocate its global headquarters to Taiwan, placing itself in proximity to the world’s most advanced chip ecosystem.

These moves triggered targeted strategic evaluations:

🔧 TSMC is assessed for how well it preserves internal coherence, manages geopolitical stress, and earns trust through strategic relationships.

⚡ NVIDIA is evaluated on how clearly it designs its relocation, how well it partners across boundaries, and whether its shift drives real innovation.

These decisions go beyond internal logic—they reflect the moral and structural stakes of strategic motion. TSMC and NVIDIA are not merely relocating assets; they are reauthoring the blueprint of trust in design. The consequences will ripple across AI, defense systems, and public infrastructure.

💡 Insight: Strategic motion today is no longer a response to risk—it’s a form of preemptive authorship over future trust.

📡 Signal: Track who initiates motion versus who reacts—this reveals future sovereignty centers.

II. Strategic Characters and Arcs

This section introduces the core players and the roles they play in shaping the emerging structure. These actors aren’t simply executing corporate strategies—they are altering how trust, innovation, and geopolitical logic evolve. Their choices generate arcs that illuminate deeper system shifts. These arcs anchor the simulation’s foresight momentum and emotional clarity.

🔧 TSMC: The Steward

Tasked with securing global chip stability. It must balance:

Innovation density at home

Political compliance abroad

Trust continuity across national boundaries

⚡ NVIDIA: The Accelerator

Seeks speed, intimacy with innovation, and long-term control of its AI hardware destiny. It is relocating:

Away from U.S. financial scrutiny

Toward direct co-creation with TSMC

🛡️ U.S. Government: The Enforcer

Demands onshoring of critical chip capabilities. It pushes TSMC to build on U.S. soil and scrutinizes NVIDIA’s shifting alliances.

🌐 Global AI Ecosystem: The Dependent

Relies on trust and performance of both firms to advance cloud computing, LLMs, robotics, and real-time cognition at scale.

Each actor embodies a different aspect of institutional evolution—caretaker, catalyst, regulator, and dependent system. Their strategic arcs may intersect, clash, or converge based on how well their internal logic maps onto external change. Understanding their roles allows us to project second- and third-order consequences. These arcs are not routine decisions—they are signals shaping institutional evolution.

💡 Insight: These actors don’t just react—they redefine the rules of trust through motion.

📡 Signal: Misalignments between intent and emerging role reveal deeper system stress.

III. System Dynamics

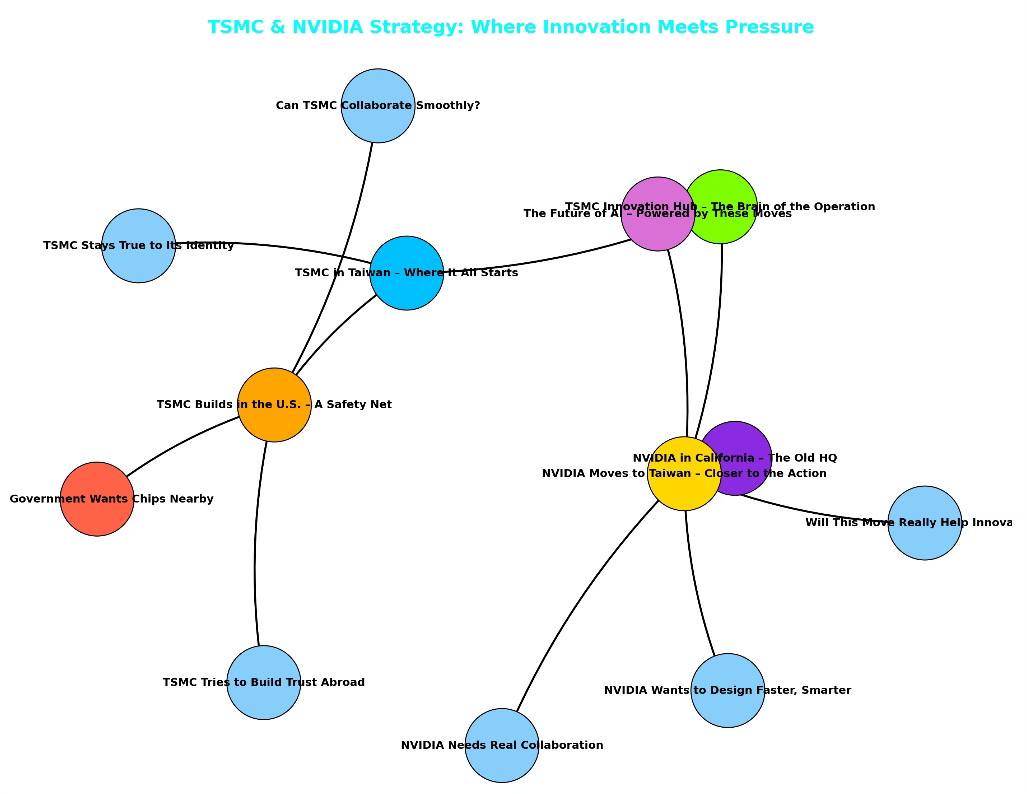

The visual architecture tracks how institutional moves shape interdependencies and long-term outcomes.

The simulation begins in Taiwan, where 🔧 TSMC anchors the world’s most advanced fabrication capabilities. From there, its innovation core radiates influence across the global AI supply chain. As it expands into the U.S., that move intersects directly with 🛡️ U.S. Government interests—strategic pressure, regulatory alignment, and geopolitical insurance. This expansion triggers a secondary flow: can TSMC build trust and coordination across sovereign systems without fracturing coherence?

Simultaneously, ⚡ NVIDIA initiates a bold relocation from California to Taiwan. The goal: accelerate chip design by embedding itself closer to TSMC’s innovation spine. But relocation alone doesn’t guarantee results. Its success depends on whether this geographic proximity activates design speed, real-time collaboration, and deeper integration with the fabrication lifecycle.

All arrows point toward the 🌐 Global AI Future, where both companies shape not only what is built—but how fast, how trusted, and how well systems evolve together. Key junctions—like "Can They Coordinate?" and "Will it Work?"—emerge as moral and structural checkpoints.

💡 Insight: Architecture is not location—it is rhythm, resonance, and coordination of trust.

📡 Signal: Monitor coordination failures between co-located actors—they are early indicators of system drag.

IV. Scenario Paths

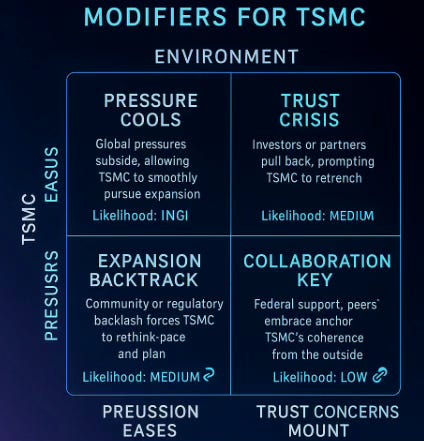

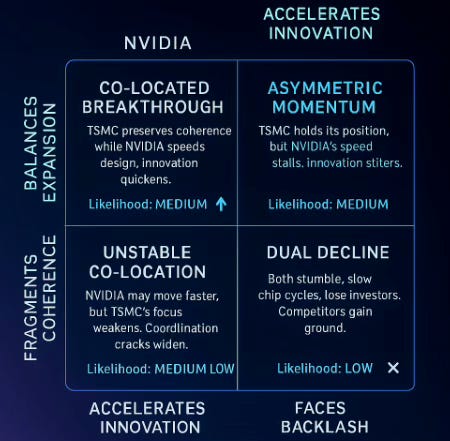

To account for the complexity of interaction between TSMC and NVIDIA, we model two distinct but interlinked scenario sets—each centered on one firm’s strategic trajectory. Rather than compress all outcomes into a single matrix, we simulate dual axes of pressure: one for TSMC’s ability to preserve integrity while expanding, and another for NVIDIA’s capacity to gain innovation speed from its relocation. Each outcome is marked by its likelihood and a charge-width icon representing strategic intensity.

🔧 TSMC stands at a crossroads between coherence and overextension. If it manages to expand globally without diluting its core innovation, it could secure chip sovereignty while reinforcing strategic alliances. But if its U.S. expansion fragments its engineering rhythm or introduces narrative drift, its global trust architecture may falter, weakening its influence over future chip ecosystems.

⚡ NVIDIA's relocation to Taiwan introduces a different threshold. If the move leads to faster chip iteration and tighter design–manufacture loops, it may become the new benchmark for AI–hardware integration. But if NVIDIA encounters regulatory resistance, cultural misalignment, or coordination gaps, the relocation could stall momentum and degrade its edge.

These unfolding paths aren’t theoretical—they’re already in motion. What remains uncertain is whether these companies can pair structural clarity with narrative coherence to maintain system-level trust as they evolve.

💡 Insight: Structure without narrative coherence fractures under pressure.

📡 Signal: Watch for over expansion or over compression—each breaks trust differently.

V. Modifiers and Catalysts

System-level shifts are never shaped by strategy alone—they are continuously exposed to catalytic forces. In this simulation, several live modifiers define the operating atmosphere. These aren’t shocks from outside the system; they are embedded variables that test timing, intent, and readiness.

Tensions in the Taiwan Strait cast a long shadow over every strategic choice. Escalation could freeze access, destabilize operations, or accelerate regional bifurcation. Meanwhile, U.S. export bans and regulatory scrutiny continue to reshape the permissible range of innovation collaboration. These pressures test NVIDIA’s agility and TSMC’s narrative positioning.

Local execution also matters. Labor shortages, culture gaps, or internal coordination failures—especially across geographies—could slow the very velocity these moves were meant to unlock. On the upside, a breakthrough in co-location strategy or packaging efficiency could validate proximity as a competitive engine, rather than a reputational risk.

Together, these catalysts form the actual gravity field in which strategy unfolds. No plan survives inert environments. Only adaptive architectures do.

💡 Insight: Catalysts test whether foresight was real or rehearsed.

📡 Signal: Look for which actor moves proactively as modifiers emerge—this reveals strategic maturity.

VI. Conclusion

This simulation reveals more than a logistical pivot—it marks a civilizational inflection point. The movements of TSMC and NVIDIA test whether institutions can scale, adapt, and co-evolve without losing coherence or compromising trust. In a world shaped by rapid recursion, AI dependency, and infrastructure interdependence, their ability to align—or misalign—will shape outcomes far beyond their immediate domains.

The stakes are real and tangible. TSMC’s leadership in 2nm and 3nm fabrication, along with its advanced chip packaging technologies, defines the competitive edge of smartphones, data centers, and AI accelerators. NVIDIA’s position in AI—via the H100 and B100 chips, the Omniverse simulation platform, and the Drive automotive suite—forms the computational fabric of tomorrow’s cognition and mobility. These product ecosystems don’t just require scale—they demand synchronized innovation.

TSMC powers nearly every flagship smartphone, high-performance server, and AI training pipeline globally, holding a dominant position in advanced node production. NVIDIA drives the AI backbone for companies like Amazon, Microsoft, and Google—and increasingly, the neural interface between virtual and physical systems. Their convergence doesn’t simply shape markets—it anchors the infrastructure of thinking.

💡 Insight: Institutional foresight isn’t about predicting the future—it’s about shaping the integrity of motion that gets us there.

📡 Signal: The most strategic actors will be those who synchronize trust, talent, and technology at the architectural level.

Prepared by Noel Le, Founder | Architect of MIndCast AI LLC. Noel holds a background in law and economics.