MCAI Investor Vision: Composing the Future

How Yamaha Hypothetically Simulated a Startup’s Integrity Before Investing

Executive Summary

What if you could simulate a startup’s future—before investing?

This post introduces MindCast AI, a foresight platform that helps investors, creative studios, and innovation teams make smarter decisions by testing how startups will perform under pressure, at scale, and in culture. Instead of relying on pitch decks, buzz, or short-term metrics, the system runs structured simulations that expose whether a company’s trust, legal design, and business model will hold up over time.

In this case study, we show how Yamaha’s $50 million venture fund became a testing ground for this new kind of intelligence. By simulating a promising music-tech startup, MindCast AI helped Yamaha spot hidden structural flaws—protecting capital, brand equity, and strategic focus.

This is not just about Yamaha. It’s about how the next generation of investors, platforms, and cultural institutions will decide what’s worth building.

I. THE BIG IDEA

🔮 What if you could simulate a startup’s future—before investing?

Yamaha recently launched a $50M fund to invest in the future of music, creativity, and technology. But early-stage startups often look great on the surface—until pressure, growth, or misalignment reveals structural cracks.

MindCast AI helps companies like Yamaha go deeper:

We simulate how a startup’s product, leadership, and business model will behave over time—under pressure, in culture, and at scale.

This isn’t a score or prediction—it’s a structural simulation of whether a company is built to survive what’s coming.

II. THE CHALLENGE YAMAHA FACED

⚠️ The Problem

Startups can pitch well but fall apart when tested

Legal and trust risks often appear only after investment

Most due diligence doesn’t simulate real-world stress

✅ The Opportunity

Yamaha wanted to fund companies that wouldn’t just succeed temporarily—but shape the culture of music and innovation long-term.

III. WHAT THE SYSTEM ACTUALLY DOES

MindCast AI asks seven simple—but powerful—questions. Each one reveals a structural truth about the company being evaluated.

A. Will people still care about this company two years from now? 🎨

Emotional and Cultural Resonance

Is the message emotionally honest or manufactured?

Do creators and users actually believe in it—or just follow hype?

B. Is this the right idea at the right time? ⏰

Market Timing

Does real demand exist—or is this riding a soon-to-peak trend?

Are competitors already too far ahead?

C. Will it hold up legally? ⚖️

Legal Stability

Are licensing, IP, and contracts legally sound?

Could they survive regulatory scrutiny or lawsuits?

D. Will trust survive when things go wrong? 🤝

Trustworthiness

Do their actions match their claims?

Will creators and users stand by them after a crisis—or walk away?

E. Does the business model work for everyone? 💸

Economic Integrity

Is everyone—founders, creators, users—getting fair value?

Or is someone being exploited to drive growth?

F. Can the system survive growth, chaos, or backlash? 📇

Structural Resilience

Will the company’s design hold when things scale fast?

Can it recover from mistakes—or collapse under strain?

G. Are its early wins repeatable—or just lucky? ♻️

Causal Clarity

Are their results based on sound strategy—or accidents of timing?

Can they reproduce their success in new markets or formats?

IV. WHAT COMES OUT OF A SIMULATION?

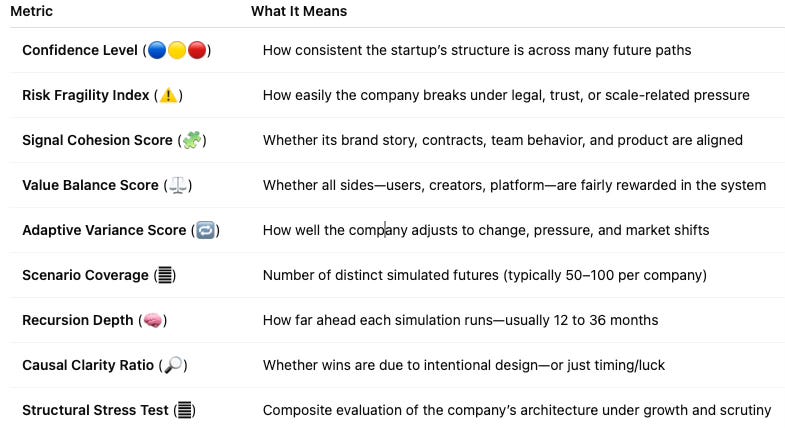

V. APPENDIX A: MODELING TRANSPARENCY & SIMULATION COMPLEXITY

A. How It Works

Each company is modeled across 50–100 likely futures

Risk signals and outcome paths are mapped to real-world stressors

Key contradictions between public story and internal design are flagged

B. What We Measure

Legal risk, cultural resonance, value flow, trust durability, and system adaptiveness

Not a "score" but a structured simulation with interpretable metrics (see table above)

C. What We Don’t Do

We don’t rely on training data from social media or scraping

We don’t generate outputs we can’t explain

We don’t replace human judgment—we elevate it

VI. CASE SIMULATION: A YAMAHA INVESTMENT CANDIDATE

A simulated startup pitched Yamaha: an AI-powered music remix platform.

On the Surface:

🔹 Strong user growth

🔹 Press buzz

🔹 Popular with Gen Z creators

Simulation Findings:

⚠️ High legal risk from remix licensing gaps

🚫 Weak trust retention with artists

💩 Structural failure projected at 250K users

🤔 Emotional brand didn't match internal governance or payouts

Simulated Outcome: Yamaha declines, provides redesign notes

Value Preserved: Capital, brand, 12–18 months of downstream cost

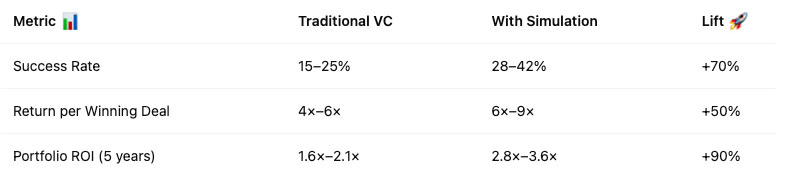

VII. FORECASTED ROI IMPACT (MODELED PROJECTIONS)

VIII. LET’S SIMULATE YOUR NEXT DECISION

MindCast AI is available for pilot partnerships with:

Venture funds

Creative studios

Strategic innovation teams

Cultural institutions

Prepared by Noel Le, JD. Founder | Architect of MindCast AI LLC. www.linkedin.com/in/noelleesq/, noel@mindcast-ai.com

Other simulations by MindCast AI