MCAI Investor Vision: The Investor Guide to AI Investment Allocation

Turning Foresight into Actionable Capital Strategy

See also MCAI Investor Vision: Executive Summary of AI Investment Series (Sep 2025).

Prologue

The trilogy of MCAI Investor Vision studies established three foundations: how wealth institutions adapt under stress, how archetypes reveal their instincts in AI, and why public trust is the scarce currency of the AI era. This fourth installment moves from analysis to execution. It is not about categories, but about allocation. Wealthy families, sovereign funds, and advisory platforms now face a sharper question: how to design portfolios that integrate foresight integrity into AI allocation.

The Investor Guide provides a structured framework to make AI investment allocation measurable, dynamic, and scalable. It turns Cognitive Digital Twin (CDT) foresight simulations from theory into practice—embedding trust, convergence monitoring, and predictive triggers directly into investment decisions.

As reinforced in MCAI Investor Vision: Pioneering AI – Why Judgment-Simulation, Not Scale, Defines the Future of Capital Allocation (Sep 2025), investors must distinguish between incremental scaling bets and truly pioneering innovation. This insight validates why foresight-integrated allocation is essential: it aligns capital with durable innovation rather than hype. See also MCAI Investor Vision: Applying Cognitive Digital Twins to Capital Allocation (Sep 2025), which first operationalized foresight metrics (Action Language Integrity (ALI), Cognitive Motor Fidelity (CMF), Resonance Integrity Score (RIS), Causal Signal Integrity (CSI)) in simulations and provides the methodological foundation for this guide.

Together with the three September 2025 MCAI Investor Vision studies—

Legacy, Institutional Innovation, and the Future of Capital Stewardship

Archetypes in AI Investment: How Wealth Institutions Translate Their DNA Into AI Bets

AI Investment Institutions and Public Trust: From Archetypes to Credibility

—this guide completes a coordinated framework: from how institutions adapt under stress, to how they reveal instincts in AI, to why trust determines survival, culminating in a practical allocation playbook.

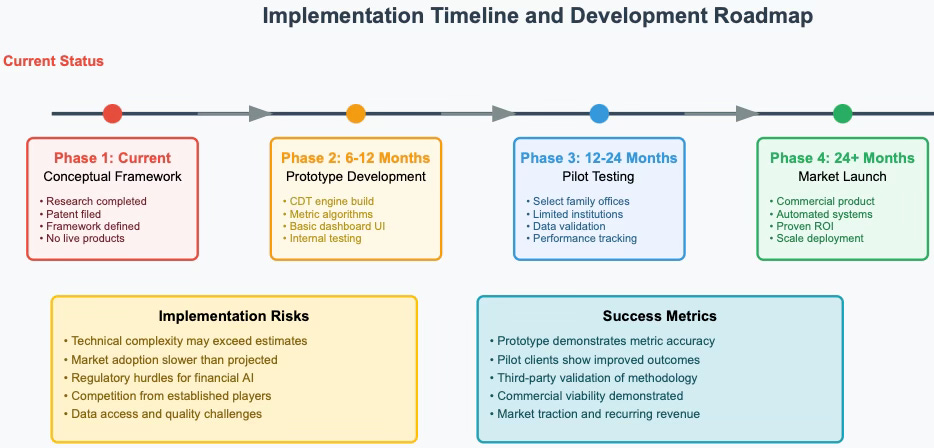

This guide acknowledges the experimental nature of foresight-integrated allocation and demands ongoing validation. Investors must require case studies and comparative analyses to demonstrate concrete advantages over existing due diligence methods. At present, investors should view this as a conceptual framework in development: no live products, dashboards, or automated systems exist.

Implementation details—such as how teams would gather, format, and input data into CDT simulations—remain under design and require additional development and third‑party validation. Treat statements like "early evidence" as hypotheses to test, not proven results. The value proposition lies in the potential to quantify trust and foresight more rigorously than conventional approaches, but cannot claim superiority without evidence and demonstration.

Contact mcai@mindcast-ai.com to partner with us on AI driven investment analysis.

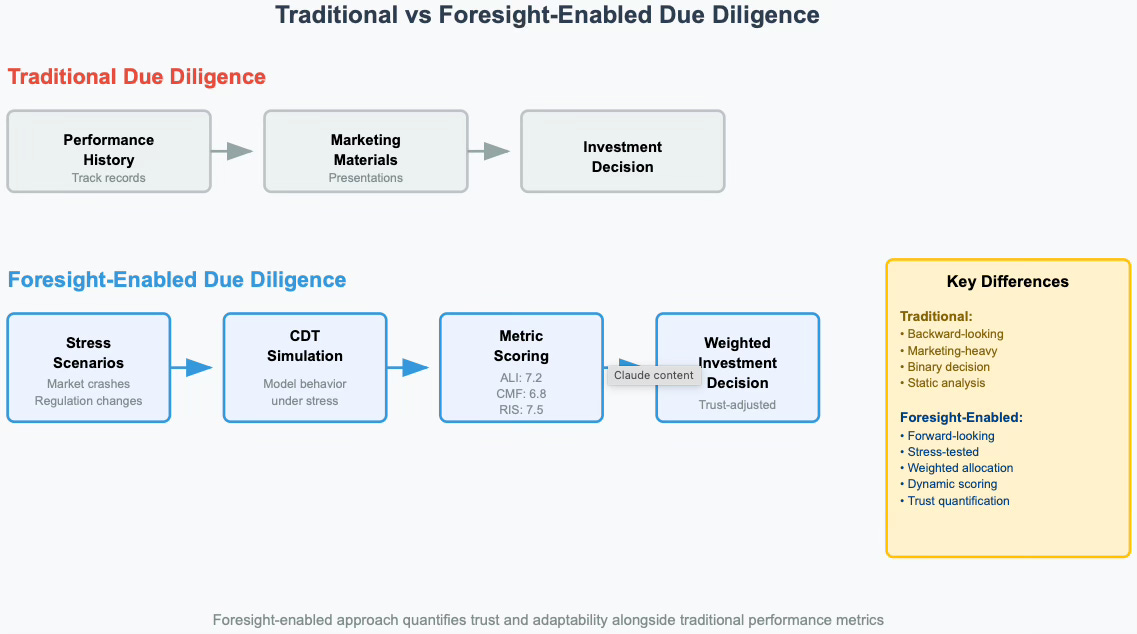

I. Technology-Enabled Due Diligence

Traditional due diligence methods are rooted in backward-looking performance and marketing narratives. In an AI-driven investment era, these methods often fail to capture whether a manager can adapt under future stress. MindCast AI transforms due diligence by embedding foresight signals into the selection process. CDT simulations and foresight metrics provide investors with a forward-looking lens that reveals how institutions will perform when conditions shift. This process requires selecting relevant stress scenarios (e.g., liquidity freeze, regulation shock), inputting manager strategy data into CDT models, and reviewing score outputs that quantify foresight integrity. An ALI score of 7.2 versus 6.8 indicates higher communication clarity and honesty under modeled stress, signaling greater confidence in that manager's ability to preserve trust and warranting stronger allocation weighting.

Cognitive Digital Twin Foresight Simulation: Investors model institutional behavior under stress before committing capital. CDT foresight simulations show family offices whether a manager sustains trust when markets seize, regulations tighten, or AI projects underperform.

Practical ALI/CMF Scoring:

Action Language Integrity (ALI): Measures whether managers communicate AI strategy with clarity and honesty.

Cognitive Motor Fidelity (CMF): Evaluates whether strategies translate reliably into execution. These scores push due diligence beyond glossy presentations, enabling investors to benchmark credibility alongside performance.

Predictive Forecasting Integration: Traditional diligence examines track records; MindCast AI adds foresight. Teams apply ALI/CMF/RIS/CSI metrics not only to past behavior but to modeled futures, revealing whether a manager adapts coherently when stress arrives.

Investor Application: Replace static manager selection with foresight scoring. This approach ensures allocations follow not only scale or reputation, but demonstrable foresight integrity.

II. Dynamic Portfolio Construction

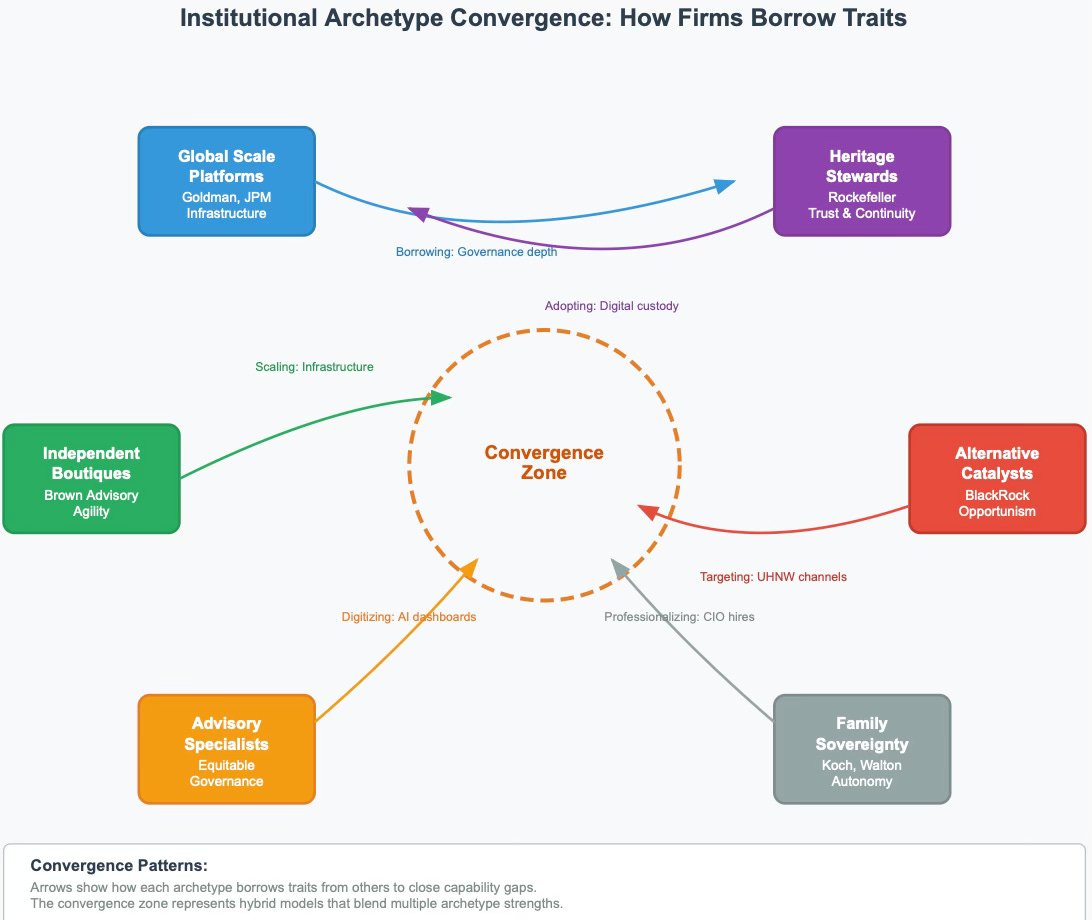

Resilient AI portfolios demand movement beyond static allocation models. Institutions no longer operate as fixed archetypes but evolve as hybrids, requiring portfolios that adjust in real time to reflect this motion. Dynamic construction integrates convergence monitoring, foresight-triggered alerts, and cross-archetype balancing to create living portfolios that adapt continuously. This approach ensures portfolios remain aligned with investor objectives as markets and institutions evolve.

Convergence Monitoring: Conceptually, portfolios will track when institutions drift—e.g., boutiques scaling too fast, or sovereigns resisting governance professionalization. Teams will use these shifts as early signals to rebalance.

Automated Rebalancing Triggers: Future systems will respond when ALI drops (narrative spin increases) or CMF falters (execution misses accumulate), alerting investors to reduce exposure. Conversely, rising RIS or CSI scores will trigger allocation expansion. No live systems exist today.

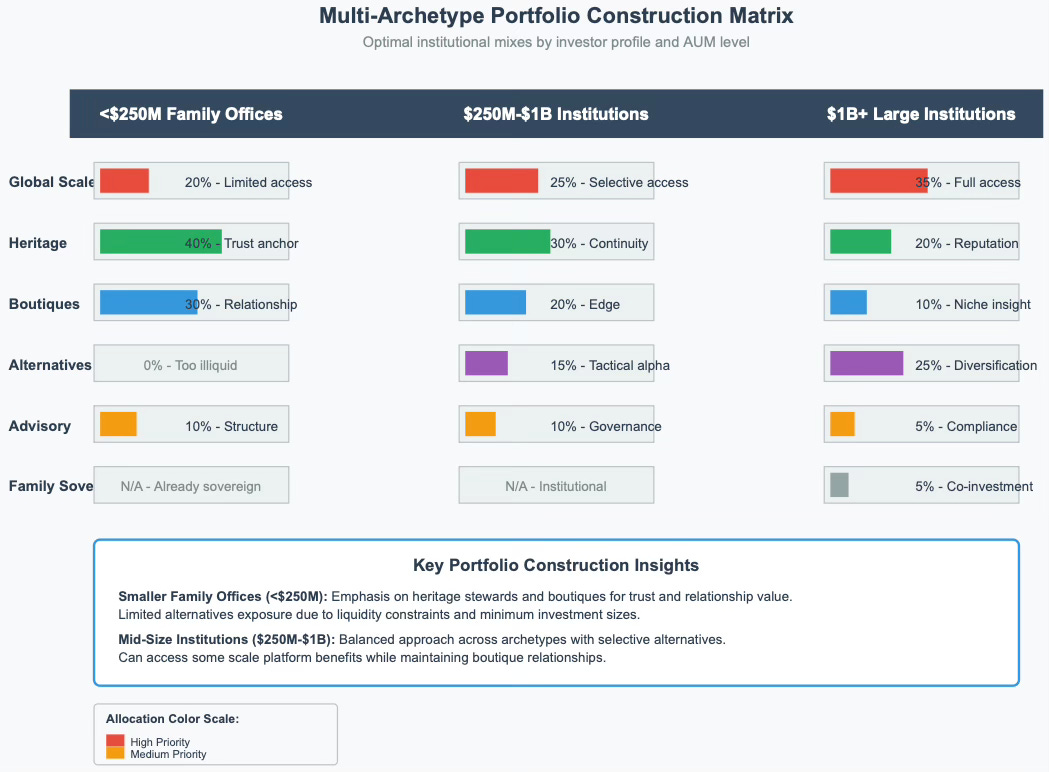

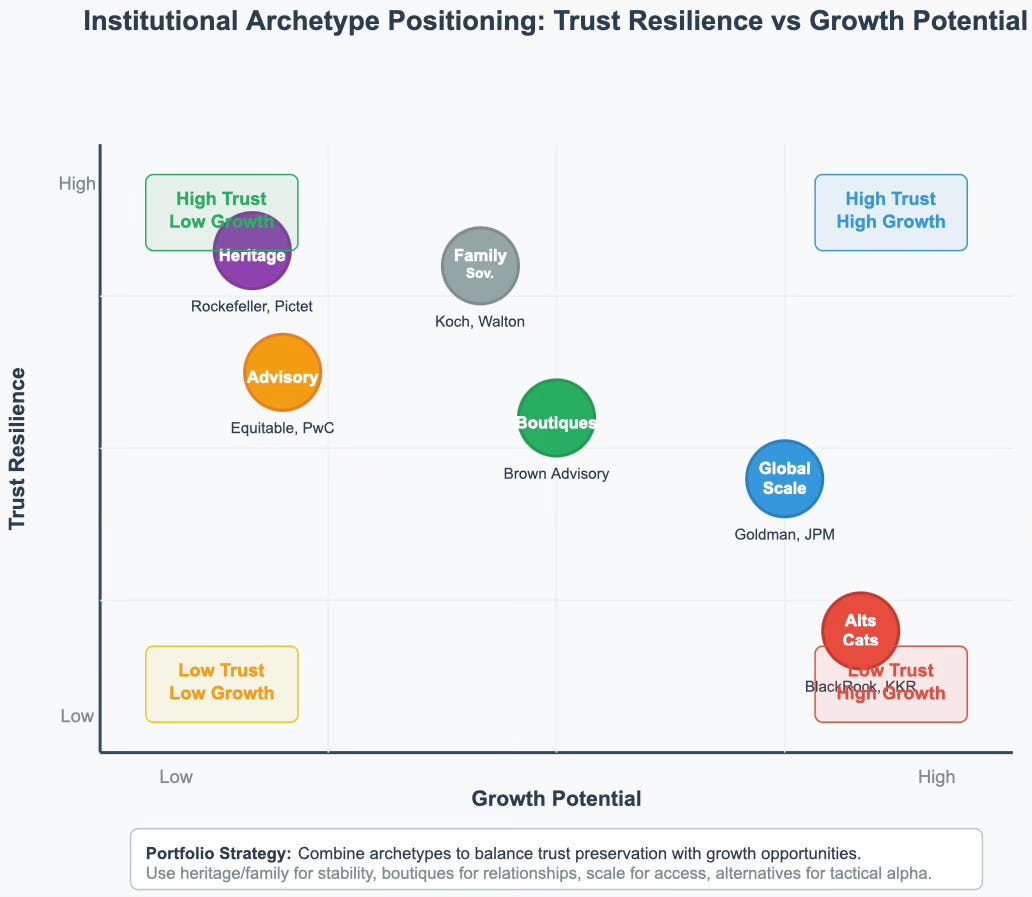

Multi-Archetype Optimization: No single archetype suffices. Scale provides liquidity, heritage preserves continuity, boutiques sharpen perspective, alternatives drive alpha, advisors secure governance, and sovereigns safeguard autonomy. MindCast AI models suggest optimal mixes across these archetypes will prove valuable, but they remain conceptual until teams test them in practice.

Investor Application: Readers should interpret this as a design vision: portfolios that evolve in real time may become feasible in the future, but current use remains theoretical.

III. Implementation Roadmap

Effective foresight frameworks demand embedding into daily practice. Read this implementation roadmap as guidance for future development rather than description of functioning products. Practical steps include designing ways to translate predictive metrics into investment committee language, prototyping workflows around foresight alerts, and tailoring adoption concepts to different organizational sizes.

Onboarding Technology: Teams will develop prototypes that integrate foresight metrics into traditional performance systems rather than deploy actual dashboards today.

Benchmarking Performance: Future research must answer whether foresight-driven portfolios sustain trust through volatility better than conventional approaches. This remains a hypothesis requiring data and validation.

Scaling Across AUM:

<$250M family offices: Teams will emphasize foresight-informed advisory and boutique partnerships.

$250M–$1B: Organizations will blend scale, boutique, and advisory approaches with convergence monitoring.

$1B+: Large institutions will integrate sovereign partnerships and custom predictive triggers into institutional-grade foresight portfolios.

Investor Application: This experimental roadmap offers a step-by-step conceptual design. Real-world application demands evidence, cost analysis, and validation.

Closing Perspective

Those who chase scale or cling to heritage will not win the future of AI investing. Victory belongs to those who integrate foresight into every allocation decision. Read the Investor Guide as a conceptual playbook: simulate behavior, measure trust, monitor convergence, rebalance dynamically, and benchmark outcomes in theory today, then execute in practice once teams build and validate systems.

The lesson endures: capital follows foresight. Those who adopt foresight-integrated allocation—once teams prove and operationalize it—will not only navigate the AI bubble but shape legacies that outlast it.