MCAI Investor Vision: Executive Summary of MindCast AI Investment Series

How Foresight Integrity and Trust Define the Future of AI Investment and Wealth Stewardship

MindCast AI is already operating at Technology Readiness Level (TRL) 8—tested in operational settings. We are applying that mature capability to simulate and anticipate future predictive AI investment systems that don’t yet exist. There’s no contradiction—just the sophisticated use of an advanced tool to forecast and prototype what’s coming next.

I. Overview

The MCAI Investor Vision series comprises five interconnected studies published between April and September 2025 that examine how wealth institutions, investment archetypes, and capital allocation strategies are evolving in the AI era. Using MindCast AI's Cognitive Digital Twin (CDT) methodology and leveraging its prior research into Legacy Innovation and Markets | Tech, these studies move beyond traditional financial analysis to examine the behavioral, cognitive, and trust-based factors that determine institutional success and investor outcomes.

Core Thesis: The MCAI Investor Vision series provides investors and institutions with a distinctive advantage: the ability to treat foresight and trust as quantifiable assets in capital allocation. Unlike traditional due diligence that relies on backward-looking performance, these studies introduce metrics and simulation frameworks that anticipate how managers and institutions will behave under stress.

The value proposition is clarity and resilience—helping investors identify credible partners, avoid hype-driven misallocations, and design portfolios that adapt dynamically as institutions converge and evolve. For readers, the benefit is a structured playbook that turns abstract concepts into actionable decision tools, offering a forward-looking edge in navigating AI-driven markets.

The series addresses a fundamental shift in capital stewardship: in an environment defined by AI-driven volatility, regulatory uncertainty, and technological disruption, the ability to preserve trust and demonstrate foresight integrity has become more valuable than scale or historical performance alone. With 95% of corporate AI projects failing, traditional metrics of institutional evaluation are insufficient.

Contact mcai@mindcast-ai.com to partner with us on AI investment foresight simulations.

II. Methodology Innovation

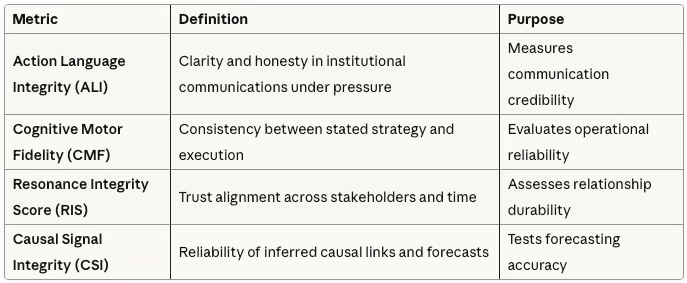

The studies introduce four quantitative metrics that make abstract concepts like "trust" and "foresight" measurable:

These metrics enable systematic comparison of institutional credibility and behavioral consistency across different stress scenarios.

III. Key Findings

Institutional Convergence: Traditional wealth management archetypes (scale platforms, heritage stewards, boutiques, alternatives, advisors, family offices) are breaking down as institutions borrow strengths from each other, creating hybrids that must be evaluated as evolving trajectories rather than fixed categories.

Trust as Survival Capital: In the AI economy, institutional credibility has become more decisive than balance sheet size. Once trust erodes, recovery is rare and costly because credibility cannot be engineered overnight.

Cognitive Fit Over Financial Metrics: Particularly in early-stage AI investing, alignment between investor cognitive patterns and startup needs often determines success more than traditional performance indicators.

Dynamic Allocation Requirements: Static portfolio construction methods fail when both markets and institutions are in constant flux. Success requires adaptive systems that rebalance based on behavioral signals and convergence patterns.

Practical Applications: The series provides frameworks for technology-enabled due diligence, dynamic portfolio construction, and implementation roadmaps scaled by assets under management. However, the authors explicitly acknowledge that these remain experimental concepts requiring empirical validation—no live systems currently exist.

Strategic Implications: For wealthy investors, institutions, and advisors, the research suggests that resilience requires constructing portfolios of institutional partners where different strengths compensate for inherent weaknesses. No single archetype suffices in an AI-driven environment characterized by complexity, opacity, and high failure rates.

IV. MCAI Investor Vision Series, Installments

The MCAI Investor Vision series spans five interrelated studies, each building on the last to create a full-spectrum analysis of how investors and institutions navigate AI-driven disruption.

Study 1 (Modeling Capital Cognition in the AI Market) establishes the CDT methodology and core metrics for measuring foresight.

Study 2 ( Legacy, Institutional Innovation, and the Future of Capital Stewardship) applies these tools to wealth stewardship archetypes, showing how trust preservation has overtaken performance as the central benchmark.

Study 3 (Archetypes in AI Investment ) explores how institutional DNA translates into AI bets, revealing instincts and vulnerabilities in adoption.

Study 4 ( AI Investment Institutions and Public Trust) examines credibility under pressure, defining trust as survival capital and highlighting archetype-specific vulnerabilities.

Study 5 (The Investor Guide to AI Investment Allocation) synthesizes the prior insights into practical frameworks for due diligence, portfolio design, and implementation.

Together, these studies form a coherent progression from methodology to institutional analysis to strategic application.

Study 1: Modeling Capital Cognition in the AI Market (Apr 2025)

Foundation: Methodology and Core Concepts

This foundational study establishes the technical foundation for the entire series by introducing MindCast AI's Cognitive Digital Twin (CDT) methodology. Rather than traditional financial analysis, CDTs model how investors and institutions make decisions under uncertainty, narrative pressure and cognitive bias.

Core Innovation: InvestorVision Framework The study introduces four key metrics that make abstract concepts measurable:

Action Language Integrity (ALI): Clarity and honesty in institutional signaling under pressure

Cognitive Motor Fidelity (CMF): Consistency between stated strategy and execution

Resonance Integrity Score (RIS): Trust alignment across stakeholders and time

Causal Signal Integrity (CSI): Reliability of inferred causal links and forecasts

These metrics turn vague narratives of "innovation" into measurable foresight signals, revealing not just speed of adoption but whether moves are authentic, coherent, and resilient.

The Buzz Market Concept Defines early-stage AI investing as occurring in a "Buzz Market" characterized by:

Low barriers to entry (open-source models, no-code tools)

High churn rates (12-18 month startup lifecycles)

Founder instability and inflated credentials

Manufactured virality through astroturfing

Capital swarm behavior following media cycles

This environment creates a challenge: extracting signal from noise requires cognitive discrimination, not just data volume.

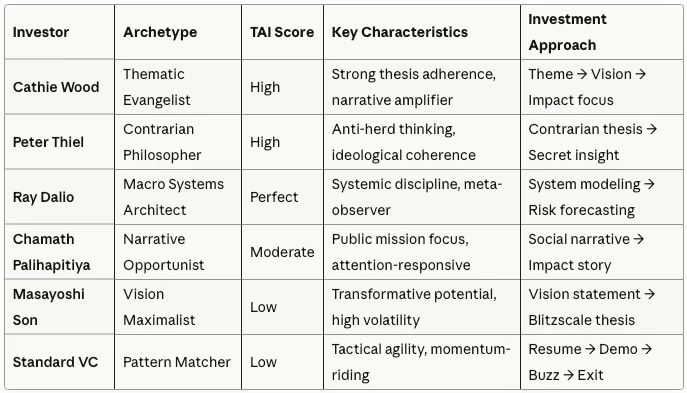

Investor Cognitive Profiling The study models six distinct investor types using behavioral metrics, revealing how different cognitive patterns shape investment decisions:

Key Finding: Early-stage investment success depends on cognitive alignment between founders and investors, not just capital availability or trend alignment.

Why Start Here: This study provides the methodological vocabulary and conceptual framework that all subsequent analyses depend upon. Without understanding CDTs and the four core metrics, the institutional analyses that follow would lack analytical rigor.

Study 2: Legacy, Institutional Innovation, and the Future of Capital Stewardship (Sep 2025)

Framework: Institutional Archetypes and Convergence

Building on the CDT methodology, this study applies structured analysis to wealth stewardship institutions, establishing that traditional performance metrics are insufficient in an era of systemic shocks and technological disruption.

Central Thesis: Trust Over Performance Following a decade of crises (2008 financial crisis, COVID liquidity freeze, AI acceleration), wealthy families have learned that the central question has shifted from "who delivers returns" to "who preserves trust and adaptability when the environment fractures."

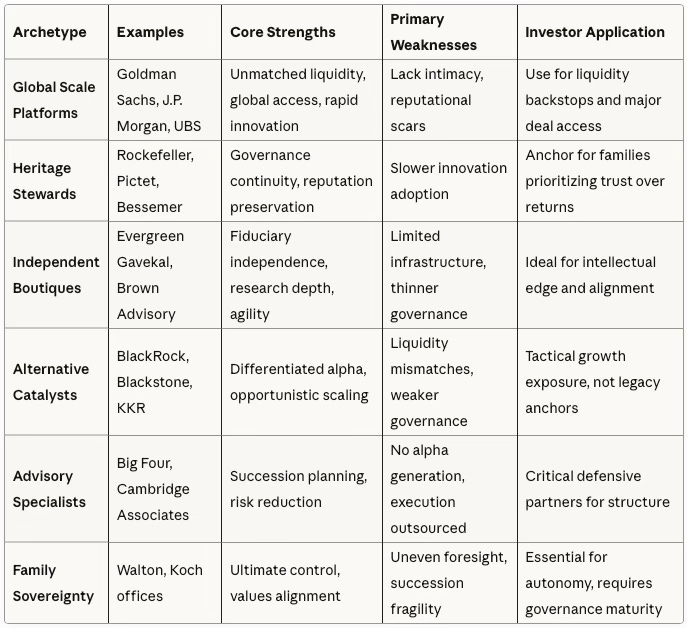

Six Wealth Stewardship Archetypes

The Convergence Transformation The study's key insight is that no archetype remains pure. Institutions are borrowing strengths from one another:

Scale platforms graft heritage credibility onto innovation engines

Heritage stewards adopt digital custody while preserving discretion

Boutiques scale without eroding client intimacy

Alternatives resolve liquidity mismatches through evergreen vehicles

Advisory firms digitize governance delivery

Sovereign offices professionalize through CIO hires and formal constitutions

Strategic Synthesis: No single archetype suffices. True resilience comes from constructing portfolios of institutional partners where strengths compensate for inherent weaknesses.

Progression Note: This study transforms the individual investor focus of Study 1 into institutional analysis, providing the structural framework for understanding how organizations (rather than individuals) process AI-driven change.

Study 3: Archetypes in AI Investment (Sep 2025)

Application: Institutional DNA in Technology Adoption

This study applies the established archetype framework specifically to AI investment behavior, revealing how each institution's fundamental "DNA" manifests when confronting disruptive technology.

AI as Instinct Revealer Every archetype approaches AI as an extension of its deeper instinct, mirroring how they reacted to prior innovation waves:

Convergence Acceleration in AI AI accelerates archetype breakdown as institutions borrow from each other:

Global platforms seek heritage credibility through governance specialists

Heritage houses cautiously embed digital tools without sacrificing trust

Boutiques grow toward institutional scale while preserving agility

Alternatives broaden toward wealth management channels

Advisory firms digitize to stay relevant

Family offices professionalize toward institutional standards

Strategic Framework for Balanced AI Exposure No single archetype captures AI's upside while managing volatility. Resilient portfolios require combining:

Scale for liquidity and access to major AI pipelines

Heritage for trust and governance depth

Boutiques for intellectual edge and narrative clarity

Alternatives for growth exposure in private AI markets

Advisors for defensive governance frameworks

Family offices for values alignment and selective moonshots

Progression Note: This study demonstrates practical application of the archetype framework to a specific technological disruption, validating the methodology's utility while revealing how institutional behavior patterns persist across contexts.

Study 4: AI Investment Institutions and Public Trust (Sep 2025)

Analysis: Trust as Survival Capital

This study focuses specifically on institutional credibility under AI pressure, establishing trust as the decisive factor in long-term survival rather than a secondary consideration.

Trust as Measurable Capital With 95% of corporate AI projects failing, the study argues that trust—not scale—has become the ultimate survival currency of the AI economy. Once trust erodes, recovery is rare and costly because credibility cannot be engineered overnight.

The Public Trust Dilemma Institutions face structural tensions that complicate trust preservation:

Transparency vs. Opacity: Markets reward clear foresight, yet legacy models prize secrecy

Narrative vs. Reality: Media framing accelerates trust cycles while projects fail beneath the surface

Legacy vs. Innovation: Connecting past credibility with future commitments versus severing traditional authority

Archetype-Specific Trust Vulnerabilities Each institutional type faces distinct risks to credibility:

Global Banks: Biggest risk is overstating AI capabilities in public communications—credibility collapses if bold forecasts aren't matched by execution

Family Offices: Risk is opacity and inconsistency—secrecy undermines trust if agility isn't backed by coherent action

Advisory Networks: Vulnerability is client disillusionment—pushing AI narratives without transparent adoption erodes trust quickly

Sovereign Funds: Greatest exposure lies in political visibility—failed AI allocations erode both returns and citizen legitimacy

CDT Stress Testing Framework The study runs Cognitive Digital Twin simulations under different scenarios:

Scenario A (2026-2030): Market correction with regulation tightening exposes institutions with weak execution

Scenario B (2025-2032): Gradual productivity gains reward institutions with consistent foresight integrity

Results show that institutions with high ALI/CMF scores (clear communication, reliable execution) sustain trust through volatility, while those with weak scores face credibility shocks and capital flight.

Key Insight: Trust is not a byproduct of performance but the foundation of institutional survival. Firms that integrate foresight integrity into operations compound credibility over time.

Progression Note: This study deepens the analysis from institutional behavior patterns to survival mechanisms, establishing why trust measurement is essential for long-term capital allocation success.

Study 5: The Investor Guide to AI Investment Allocation (Sep 2025)

Implementation: From Analysis to Execution

The capstone study synthesizes all prior insights into actionable frameworks, moving from theoretical analysis to practical allocation strategies while acknowledging the experimental nature of proposed systems.

Technology-Enabled Due Diligence Traditional due diligence methods are backward-looking and fail to capture whether managers can adapt under future stress. The study proposes:

CDT Foresight Simulation: Model institutional behavior under stress before committing capital

ALI/CMF Scoring: Measure whether managers communicate with clarity and execute reliably

Predictive Integration: Apply foresight metrics to modeled futures, not just past performance

Dynamic Portfolio Construction Static allocation models are insufficient when institutions evolve as hybrids. The framework introduces:

Convergence Monitoring: Track when institutions drift from core strengths

Automated Rebalancing: Respond when ALI drops or CMF falters with allocation adjustments

Multi-Archetype Optimization: Blend scale, heritage, boutique, alternatives, advisory, and sovereign models

Implementation Roadmap by AUM Scale

<$250M Family Offices: Emphasize foresight-informed advisory and boutique partnerships

$250M-$1B Organizations: Blend scale, boutique, and advisory with convergence monitoring

$1B+ Institutions: Integrate sovereign partnerships and custom predictive triggers

Critical Acknowledgments The study explicitly states its experimental nature:

No live products, dashboards, or automated systems currently exist

Implementation requires data gathering and formatting processes not yet developed

Claims about effectiveness require validation through real-world testing

Framework should be viewed as conceptual foundation requiring empirical development

Progression Note: This study completes the logical arc from methodology through analysis to implementation, providing practical frameworks while maintaining intellectual honesty about experimental limitations.

V. Integrated Framework and Meta-Themes

Across all five studies, several overarching insights emerge:

1. Trust as Structural Advantage In an AI-driven economy characterized by complexity and high failure rates, the ability to maintain credibility becomes more enduring than quarterly returns. Institutions demonstrating measurable foresight integrity compound advantage over time.

2. Convergence Over Categories Static institutional archetypes are breaking down. Competitive advantage lies in monitoring how institutions evolve and whether their convergence strengthens or dilutes core capabilities.

3. Foresight as Measurable Asset The series makes abstract concepts like "trust" and "foresight" quantifiable through specific metrics (ALI, CMF, RIS, CSI), enabling systematic comparison across institutions and opportunities.

4. Dynamic over Static Allocation Traditional portfolio construction methods fail when both markets and institutions are in flux. Success requires adaptive systems that rebalance based on behavioral signals and convergence patterns.

5. Cognitive Fit as Investment Criteria Particularly in early-stage AI investing, alignment between investor cognitive patterns and startup needs often determines success more than traditional financial metrics.

6. Institutional DNA Persistence Despite convergence, core institutional instincts persist across technological disruptions. Understanding these patterns helps predict behavior under new stresses.

Future Research Directions: The series establishes a promising foundation for further development in:

Expanding cognitive modeling beyond public information to incorporate broader behavioral datasets

Developing empirical validation studies for the proposed trust metrics across different market conditions

Building quantitative databases to support convergence pattern analysis with statistical rigor

Creating pilot implementations to test theoretical frameworks in controlled investment environments

Conducting comparative studies against existing institutional analysis methodologies

VI. Conclusion

The MCAI Investor Vision series argues that the future of wealth stewardship belongs to those who can integrate foresight integrity into every aspect of institutional behavior and investment decision-making. In an era where 95% of AI projects fail and narrative often outpaces substance, the rarest asset is foresight paired with trust.

The series provides both a diagnostic framework for evaluating institutional credibility and a strategic playbook for building resilient portfolios. The progression from methodology through analysis to implementation follows sound academic structure and establishes clear pathways for empirical development. The authors appropriately acknowledge the experimental nature of their proposals, positioning this work as conceptual foundation for future validation and testing.

For wealthy investors, institutions, and advisors, the key takeaway is clear: in an age of shocks and disruption, those who can measure, monitor, and maintain trust while adapting to technological change will shape legacies measured not in quarters, but in generations. The natural reading order reveals a disciplined approach to building complex analytical frameworks while identifying specific areas where empirical research could transform these theoretical constructs into practical investment tools.