MCAI Lex Vision: Private Equity, NIL, Antitrust, and the Firm-Formation Phase of College Athletics

Capital Reorganization Under Regulatory Stasis

Executive Summary

College athletics has entered a firm-formation phase driven by regulatory stasis rather than market enthusiasm. In early December 2025, the University of Utah approved the first private-equity minority stake in an athletics-affiliated commercial entity—Utah Brands & Entertainment—with a defined buyback window and university control safeguards. The transaction—reported at more than $400 million—creates a for-profit limited liability company to handle sponsorships, name-image-likeness activation, ticket sales, and commercial operations, while the university foundation retains majority ownership.

The deal arrived amid structural pressures that explain its timing. Utah athletics lost $17 million in fiscal 2024, spending $126.8 million against $109.8 million in revenue—a 15.8% deficit. Football generated $26.8 million in profit; men’s basketball added $2.6 million; the remaining 17 sports programs lost $21.2 million combined. As ESPN’s Dan Wetzel observed: “College athletics doesn’t have a revenue problem. It has a spending problem.”

Utah will not be alone. Ohio State athletic director Ross Bjork predicted at the SBJ Intercollegiate Athletics Forum that “you’ll see more announcements.” The Big Ten’s $2.4 billion proposal with UC Investments remains in a holding pattern after opposition from Michigan and USC. Other schools have explored similar structures without consummating deals. Capital is circling because the conditions now favor entry.

As Congress stalls on NIL and employment legislation and antitrust exposure remains unresolved after the House settlement, universities are reorganizing athletics into quasi-independent commercial entities capable of absorbing labor, litigation, and revenue volatility. Private equity is entering not as permanent ownership, but as transitional risk capital—pricing uncertainty during a five-to-seven-year interregnum while the post-amateurism regime stabilizes. The foresight simulation evaluates how capital architecture, rather than formal rules, will determine competitive stability, antitrust exposure, and athlete outcomes.

The simulation proceeds in twelve sections:

I–III establish why now: the conditions drawing PE into athletics, the LLC as the institutional mechanism, and congressional failure to provide coordination

IV–VI analyze structural effects: antitrust migration from horizontal to vertical, athlete outcomes under capital stratification, and regulatory constraints (Title IX, tax status)

VII–IX model divergence paths: institution-level vs. conference-level capital, scenario probabilities, and academic-first parallel equilibria

X–XII address feedback dynamics: labor-market monopsony risk, the compliance paradox, and how athlete agency compounds capital advantages

Methodology

MindCast AI conducted this foresight simulation by constructing Cognitive Digital Twins (CDTs) of the relevant parties—institutions, regulators, capital providers, and athlete labor markets—using publicly observable behavior, formal authority, incentive structures, and historical response patterns. Each Cognitive Digital Twin models how an actor perceives risk, updates strategy, allocates resources, and responds under stress. Rather than predicting outcomes directly, the simulation models decision architecture: how choices evolve when name, image, and likeness (NIL) cost volatility, labor uncertainty, and antitrust exposure increase simultaneously.

Institutional CDTs were parameterized using governance structure, revenue exposure, access to capital, legal constraints such as Title IX of the Education Amendments of 1972 and nonprofit tax posture, and demonstrated adaptation speed. Regulatory and legislative CDTs were parameterized around enforcement delay, procedural inertia, and public narrative signaling. Athlete labor markets were modeled as buyer–seller systems with differentiated risk tolerance, information asymmetry, and transfer optionality. Beyond Utah as the prototype adopter, the simulation modeled early adopters with existing commercial-entity scaffolding, credit-reliant programs, conference-level pooling pathways, and academic-first institutions as parallel equilibria.

The CDTs were run through a sequence of Vision Function foresight simulations—Causation Vision, Strategic Behavioral Cognitive Vision, Regulatory Vision, and MindCast AI’s Chicago School of Law and Behavioral Economics composite (see See Chicago School Accelerated — The Integrated, Modernized Framework (Dec 2025)—testing causal integrity, institutional adaptability, coordination breakdown, labor-market structure, regulatory response, and legitimacy. Outputs are normalized metrics that allow comparison across institutional archetypes and simulated time horizons; predictions are generated only when multiple Vision Functions converge on the same directional outcome and remain stable under stress testing.

The foresight simulation is explicitly falsifiable: predefined observable events—such as widespread employment classification of athletes or durable federal legislation governing college athletics—would invalidate key predictions, and the method prioritizes structural causation and timing over narrative extrapolation.

Falsification Triggers

Three observable events would invalidate the simulation’s core predictions:

Employment classification shock: Two or more federal circuit rulings finding athlete employment status, OR NLRB certification at five or more FBS programs within 36 months

Durable federal coordination: Comprehensive NIL/antitrust statute enacted and operative for 24 months without injunction, material amendment, or adverse appellate ruling

Capital model failure: Catastrophic failure at a Utah-style capitalized program that discredits the LLC + minority equity template

I. Why Private Equity Is Entering NCAA Athletics Now (Not Earlier)

The foresight simulation begins with the threshold question: why is private equity entering college athletics at this moment, rather than earlier or later?

Private equity is entering college athletics because traditional funding mechanisms cannot absorb NIL volatility, labor uncertainty, and litigation risk simultaneously—and because institutions have reached the limit of coordination-based governance. NIL-driven cost inflation, anticipated revenue-sharing obligations, and ongoing antitrust exposure have transformed athletics from a budgetary appendage into a high-variance operating platform. Booster funding lacks discipline and enforceability; debt magnifies fragility under uncertain revenue regimes. Minority equity capital, by contrast, prices variance and tolerates regulatory ambiguity.

Analysis

Private equity participation is not opportunistic arbitrage but a rational response to institutional stress. Importantly, Utah demonstrates that PE is entering as time-bounded, minority risk capital, not as permanent governance replacement—an architectural choice that minimizes political, tax, and antitrust backlash while providing balance-sheet relief.

The foresight simulation resolves the timing question—why now and not earlier—to three converging conditions:

Condition 1: Cost Structure Transformation. NIL compensation has converted athlete acquisition and retention from a relatively fixed cost (scholarships, facilities, coaching) into a variable cost with high variance and weak predictability. Programs report NIL expenditures ranging from under $1 million to over $20 million annually, with year-over-year volatility exceeding 100% at some institutions. Traditional budgeting cannot absorb this variance.

Condition 2: Booster Model Exhaustion. Donor-funded athletics operated through relational capital and reputational incentives. NIL demands transactional capital with contractual discipline. Boosters can provide large sums but cannot provide governance, documentation, or risk allocation. The collective model attempted to bridge this gap but introduced compliance exposure without solving the capital structure problem.

Condition 3: Litigation and Settlement Overhang. The House settlement imposes prospective revenue-sharing obligations while leaving employment classification unresolved. Programs face a planning horizon where costs are rising, revenue timing is uncertain, and liability exposure remains open-ended. Equity capital—unlike debt—absorbs downside without triggering default. Private equity enters NCAA athletics not to extract value from amateurism, but to finance its orderly unwinding during a legally unsettled transition.

Contact mcai@mindcast-ai.com to partner with us on NCAA NIL foresight situations. See also MCAI Economics Vision: Chicago School Accelerated — Integrated Application, the NCAA NIL Interregnum (December 2025), MCAI Lex Vision: SAFE vs. SCORE Act — Which Path Should Define NCAA NIL? (September 2025), MCAI Lex Vision: How the SCORE Act Codifies College Sports Inequality (August 2025).

II. Asset Partitioning and the Athletics LLC as the Economic Firm

With the conditions for PE entry established, the simulation turns to the institutional mechanism enabling capital access: the athletics LLC. The decisive institutional innovation is not NIL itself, but the legal partitioning of athletics into a financeable entity that concentrates economic risk while preserving university governance.

By separating athletics economics from university balance sheets, schools isolate NIL monetization, labor exposure, and antitrust risk inside an athletics-affiliated LLC. The entity becomes the locus of revenue control, capital discipline, and compliance infrastructure—functioning as the economic firm even if formal classifications remain unchanged.

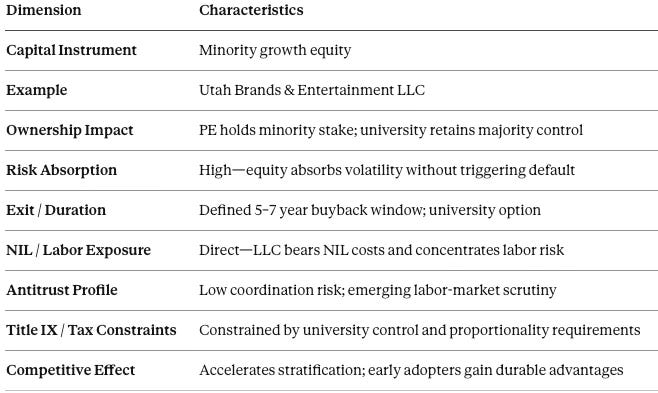

Utah Case Study: Utah Brands & Entertainment LLC

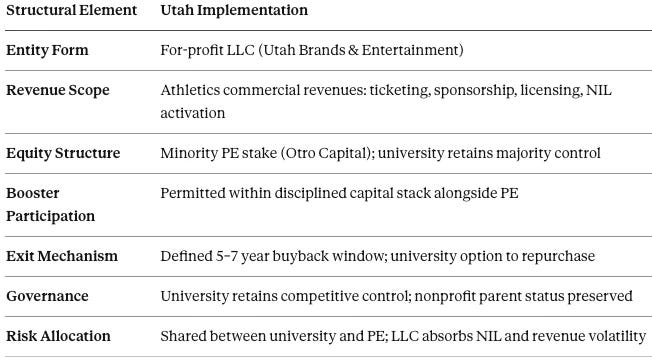

The University of Utah’s December 2025 announcement provides the first operational template for athletics asset partitioning with outside equity participation:

The Utah structure resolves two concerns that stalled prior PE explorations: (1) loss of institutional control, addressed through majority university ownership; and (2) exit pressure, addressed through defined buyback windows rather than open-ended equity positions.

De Facto Employment Risk

While athletes may remain formally designated as students, the economic-reality test under the Fair Labor Standards Act focuses on control and payment, not labels. As athletics LLCs coordinate compensation flows, NIL activation, and roster support, they accumulate the factual attributes of an employer:

Control: LLC coordinates athlete schedules, appearances, content obligations, and brand partnerships

Payment: LLC channels compensation through NIL agreements, revenue-sharing distributions, and support services

Integration: Athletic performance is integral to the LLC’s revenue generation

Economic Dependence: Athletes depend on LLC-mediated compensation for material support

Concentration of employer-like attributes does not guarantee employment classification, but it creates the evidentiary foundation for future labor litigation. The athletics LLC solves coordination problems while concentrating labor risk in a single entity—a trade-off that institutions must price explicitly. Once athletics is partitioned, capital follows—and labor risk concentrates. The athletics LLC is the bridge between NIL chaos and future employment clarity.

III. Congressional Stasis and the Collapse of Coordination-Based Solutions

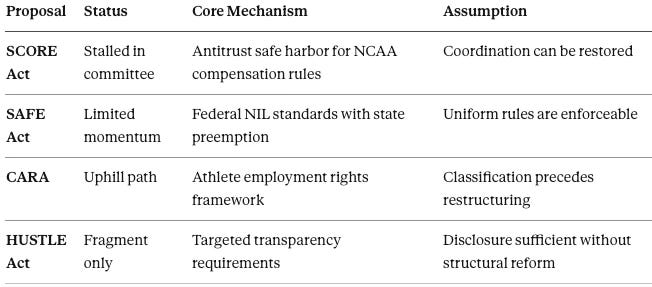

Asset partitioning and capital entry are accelerating precisely because the traditional source of governance—federal legislation—has failed to materialize. Proposed NIL and antitrust legislation assumes coordination can be restored just as institutions are abandoning coordination in favor of firm-level restructuring. Congressional proposals focus on safe harbors for collective rules on compensation and eligibility.

In practice, regulatory delay accelerates private ordering: institutions reorganize independently through capital structures rather than waiting for uniform federal standards.

Legislative Landscape (As of December 2025)

Each proposal assumes that federal intervention can stabilize a coordinated system. None addresses the possibility that institutions will restructure around coordination rather than wait for it.

Path-Dependency Risk

If a critical mass of programs adopts Utah-style LLC structures within the next 24 months, federal coordination standards may become backward-looking or unenforceable:

Backward-Looking: Legislation designed for traditional athletic departments may not fit LLC-structured programs with outside equity participation

Unenforceable: Coordination rules require collective buy-in; once programs reorganize as firms, they optimize independently rather than coordinating collectively

Lock-In: Capital commitments, governance structures, and contractual obligations create switching costs that persist regardless of subsequent legislation

The path-dependency window is approximately 18–24 months. After that threshold, legislative options narrow to disclosure, taxation, and labor classification—not coordination restoration. Legislation designed to stabilize a coordinated system risks arriving after the system has already fragmented into firms.

IV. Antitrust After the House Settlement: From Horizontal Restraints to Capital Stratification

As coordination collapses and firm-formation proceeds, antitrust exposure migrates from familiar territory—horizontal wage restraints—toward less charted ground. Post-House antitrust risk migrates from horizontal wage restraints to vertical capital stratification that produces durable competitive and labor-market asymmetries without explicit collusion.

As NCAA-wide compensation limits dissolve, schools differentiate through access to equity capital rather than agreements. Capitalized athletics LLCs can smooth compensation, fund compliance, and absorb shocks—advantages that do not require exclusionary conduct but nonetheless narrow athlete choice sets.

The Antitrust Shift

Traditional Sherman Act analysis is calibrated to detect:

Coordination: Agreements among competitors to fix prices or allocate markets

Exclusion: Conduct by dominant firms that forecloses competition

Capital stratification does neither. Capitalized programs gain advantage not through agreement or exclusion, but through superior capacity to offer stable, compliant compensation. The competitive effect is real; the doctrinal fit is uncertain.

Chicago School Lens

The Chicago School of Law and Behavioral Economics composite illuminates why this antitrust migration is occurring:

Coase: Coordination capacity collapses when the focal point (NCAA/Congress) loses legitimacy. Transaction costs of inter-institutional agreement now exceed the costs of firm-level optimization.

Becker: Schools re-optimize around the new incentive structure. Capital stack arbitrage—choosing equity over debt, LLC over department—becomes the rational response to regulatory ambiguity.

Posner: Legal correction lags behavior. Labor and antitrust doctrines were built for coordination-based restraints; they chase firm-formation rather than anticipate it.

The result: antitrust exposure migrates faster than doctrine can follow.

Antitrust Blind Spot

The more salient risk may emerge through labor-market monopsony theories:

Buyer-Side Market Power: Capitalized athletics LLCs become the primary buyers of elite athletic labor; undercapitalized programs cannot compete effectively

Choice-Set Narrowing: Athletes face a constrained set of viable options—not because anyone excluded alternatives, but because capital capacity determines which programs can offer stable, compliant employment

Structural Advantage: The advantage compounds over time as talent sorts toward stability, generating performance advantages that attract more capital

The dynamic resembles buyer-side market power in labor economics but does not map cleanly onto existing antitrust doctrine. The exposure is real but the enforcement pathway is unclear. Antitrust doctrine lags the shift from rule-based coordination to capital-based competition, creating enforcement ambiguity rather than immunity.

V. Capital Capacity, NIL Compliance, and Athlete Outcomes

The antitrust shift described above has direct consequences for athletes. Capital stratification does not merely affect institutional competition—it reshapes athlete welfare and risk exposure. Athlete welfare is determined less by formal NIL rules than by the capital capacity of the entities administering compensation and compliance.

Equity-backed programs can fund documentation systems, legal compliance, and payment stability. Undercapitalized programs rely on informal arrangements, exposing athletes to higher individual risk even when nominal compensation is comparable.

The Compliance-Capital Nexus

Athletes at capitalized programs face lower individual risk even if nominal compensation is similar to undercapitalized alternatives. The risk differential includes:

Payment Risk: Will promised compensation actually arrive?

Documentation Risk: Will arrangements survive regulatory scrutiny?

Classification Risk: If employment status shifts, who bears back-pay liability?

Career Risk: Will compliance failures damage eligibility or reputation?

Athlete Leverage Trade-Off

The capital-stability relationship creates a trade-off:

Capitalized programs offer stability and compliance at the cost of bargaining leverage—structured systems leave less room for individual negotiation

Undercapitalized programs may offer higher headline compensation with greater volatility and legal exposure—informal systems allow more negotiation but less reliability

Sophisticated athletes (and agents) increasingly recognize this trade-off. The transfer portal enables arbitrage: athletes can move toward stability as their risk preferences and information improve. Capital architecture quietly governs athlete experience long before formal labor rules are written.

VI. Structural Constraints: Title IX, Tax Status, and Capital Limits

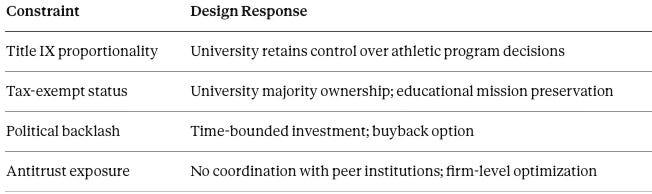

Capital restructuring offers significant advantages, but it does not operate without limits. Regulatory constraints shape how PE enters—and explain why the Utah model takes the form it does. Capital restructuring does not eliminate regulation; it reorganizes where regulatory constraints bind.

Key Constraints

Title IX: Proportionality Within the LLC

Revenue-sport monetization (football, men’s basketball) generates the commercial value that attracts PE capital. Title IX requires proportional participation opportunities and, under evolving interpretation, may require proportional benefit distribution.

The tension manifests inside the athletics LLC:

PE investors expect returns from high-revenue sports

Title IX requires cross-subsidy to women’s sports and Olympic sports

LLC governance must balance investor expectations with compliance obligations

Successful LLC structures will need explicit mechanisms for Title IX compliance—either internal cross-subsidy formulas or parallel funding streams for non-revenue sports.

Tax Risk: Nonprofit Status and Control

Universities maintain tax-exempt status partly through educational mission integration. Athletics LLCs create parent-subsidiary relationships that invite IRS scrutiny:

Control Test: Does the university retain sufficient control to treat the LLC as an integrated auxiliary?

Profit Allocation: Does profit distribution to PE investors exceed reasonable returns for services rendered?

Commercialization Threshold: Does the LLC’s commercial activity predominate over educational purpose?

The Utah structure addresses these concerns through majority university ownership and defined control provisions. More aggressive structures—majority PE ownership, unlimited profit participation, weak university governance—would face elevated tax risk.

Why Successful PE Entry Remains Constrained

These constraints explain the Utah structure’s design:

PE entry succeeds when it fits within these constraints. Structures that ignore them face regulatory, political, and legal exposure that may exceed the capital benefit. These constraints explain why successful PE entry remains minority, time-bounded, and governance-constrained.

VII. Institution-Level vs. Conference-Level Capital Paths

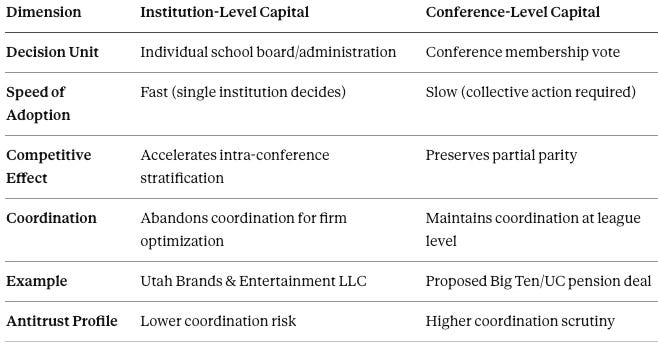

Given the constraints identified above, a strategic question emerges: should capital restructuring occur at the institution level or the conference level? The answer will determine whether divergence accelerates or is partially contained. Capital can reorganize college athletics at either the institution or conference level, producing different competitive equilibria.

Comparative Dynamics

Path Selection Factors

Institution-level capital favors:

Programs with high revenue concentration and NIL pressure

Institutions with board/administration appetite for restructuring

Conferences already experiencing internal stratification

States with favorable subsidiary and public-private law

Conference-level capital favors:

Leagues prioritizing competitive balance

Conferences with strong collective governance traditions

Situations where individual programs lack restructuring capacity

Political environments hostile to institution-level commercialization

Current Trajectory

The Utah deal shifts momentum toward institution-level capital. Conference-level experiments (Big Ten/UC pension) have stalled on collective action problems—member institutions with different risk profiles and governance constraints cannot agree on shared capital structures.

As institution-level adoption accelerates, conference-level alternatives become harder to implement:

Early adopters gain advantages that late adopters cannot match through pooling

Conference pooling requires buy-in from programs that have already restructured independently

The coordination required for conference-level capital conflicts with the firm-formation logic driving institution-level adoption Which path dominates will determine whether divergence becomes permanent or partially mitigated. Current signals favor institution-level capital and accelerating stratification.

VIII. Scenario Matrix, Time Horizons, and Falsification

The preceding sections establish the structural conditions, institutional mechanisms, and competitive dynamics of capital-driven firm-formation. The foresight simulation now integrates these elements into probabilistic scenarios over defined time horizons. Capital-driven divergence becomes durable only if early signals compound faster than regulatory or collective counter-moves. The foresight simulation models three primary scenario classes with probability bands calibrated to observable indicators.

Scenario Classes (With Probability Bands)

Scenario 1: Equity-Stabilized Consolidation (45–55%)

Minority equity adoption spreads among revenue-exposed programs; capitalized athletics LLCs dominate competitive outcomes.

Characteristics:

10–15 programs adopt LLC structures with outside capital by T+36 months

Capitalized programs consolidate recruiting, retention, and compliance advantages

Transfer portal flows correlate with capital capacity

Legislative response limited to disclosure and taxation

Employment classification remains unresolved or resolved at firm level

Scenario 2: Debt-Strained Volatility (25–35%)

Programs relying on private credit or boosters experience fiscal stress, roster churn, and episodic retrenchment.

Characteristics:

Credit-dependent programs face refinancing pressure as interest rates and revenue uncertainty persist

Booster-funded programs experience donor fatigue or compliance exposure

Episodic program failures or dramatic retrenchments

Talent concentration accelerates as athletes flee unstable programs

Political pressure for intervention increases but legislation remains stalled

Scenario 3: Governance Collapse and Federal Intervention (15–25%)

High-profile failures or labor rulings force late-stage federal coordination.

Characteristics:

Employment classification ruling (circuit court or NLRB) disrupts existing structures

Major compliance scandal or institutional failure creates political catalyst

Congress acts under crisis conditions with less favorable terms than proactive legislation would have offered

Retroactive liability exposure for programs that operated under prior assumptions

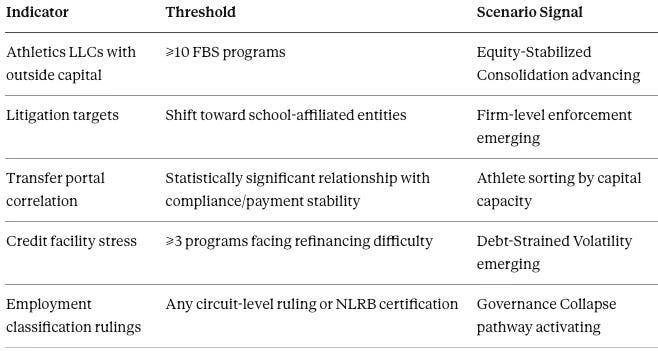

Early Indicators (By Year 3)

Falsification Thresholds

Employment Classification Shock: Two or more federal circuit rulings finding employment status, OR NLRB certification at five or more FBS programs within 36 months.

Effect if triggered: Firm-formation continues but labor costs and structures transform; Scenario 3 probability increases substantially; retroactive liability creates winners and losers based on prior structuring decisions.

Durable Federal Coordination: Comprehensive NIL/antitrust statute enacted and operative for 24 months without injunction, material amendment, or adverse appellate ruling.

Effect if triggered: Coordination-based governance restored; firm-formation advantages compress; early adopters may face restructuring costs to comply with new framework. Absent these thresholds, capitalized firm-formation is the dominant equilibrium.

IX. Academic-First Institutions and Parallel Equilibria

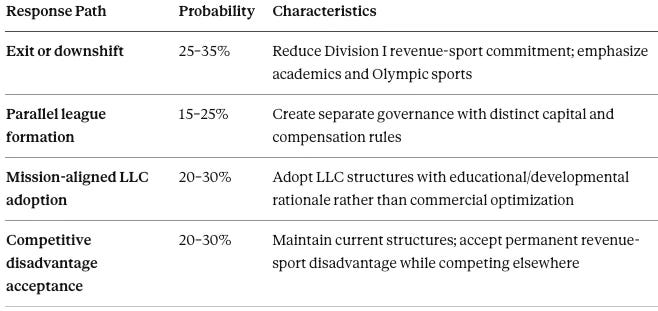

The scenarios above assume revenue-exposed institutions drive the competitive dynamic. But a significant cluster of programs—academic-first institutions—will respond differently, creating parallel equilibria rather than converging on capital-driven competition. Academic-first institutions do not prevent capital-driven divergence; they select into parallel competitive equilibria.

Response Path Probability Distribution

Institutional Archetypes

Ivy League and Academic Equivalents:

No athletic scholarships; NIL permitted but not institutionally coordinated

Strong mission alignment; low appetite for commercial restructuring

Likely path: Parallel league formation or competitive disadvantage acceptance

Service Academies:

Unique mission constraints; federal oversight

NIL complicated by military service obligations

Likely path: Competitive disadvantage acceptance with mission-based justification

Academic-Priority Power Conference Members:

Caught between conference commercial pressure and institutional mission

Face conference realignment risk if they resist capitalization

Likely path: Mission-aligned LLC adoption or exit to lower-intensity conference

Political Salience

Academic-first institutions exert disproportionate influence in certain congressional and policy circles:

Alumni networks include disproportionate share of legislative staff, executive branch officials, and policy influencers

Rhetorical authority on “what college athletics should be” shapes reform discourse

Coalition capacity to mobilize opposition to commercialization proposals

Such influence shapes the narrative of reform without controlling market outcomes. Academic-first institutions can slow legislation that would accelerate commercialization but cannot reverse firm-formation already underway at peer institutions. Normative resistance alters the narrative but not the trajectory of firm-formation.

X. Capital Stratification as Labor-Market Monopsony Risk

While academic-first institutions select into parallel equilibria, the revenue-sport core faces a different concern: capital stratification may produce labor-market effects that resemble monopsony without triggering traditional antitrust doctrine. Capital access reshapes athlete choice sets in ways that resemble buyer-side market power even without explicit exclusion.

Mechanism Specification

The foresight simulation models how the labor-market effect operates through structural advantage rather than agreement or exclusion:

Step 1: Capital Creates Compliance Capacity

Capitalized athletics LLCs can fund professional documentation systems, legal review, payment processing, and compliance monitoring

Undercapitalized programs rely on informal arrangements with higher variance and legal exposure

Step 2: Compliance Creates Stability

Athletes at capitalized programs receive reliable payments, clear contractual terms, and lower individual legal risk

Athletes at undercapitalized programs face payment uncertainty, documentation gaps, and elevated personal exposure

Step 3: Stability Attracts Talent

Athletes (and agents) rationally prefer stable, compliant arrangements over volatile, risky alternatives

The preference is especially strong for risk-averse athletes, athletes with professional prospects, and athletes with sophisticated representation

Step 4: Talent Concentration Compounds Advantage

Capitalized programs attract better athletes, generating better performance

Better performance generates more revenue, attracting more capital

The cycle compounds: Capital → Stability → Talent → Performance → Revenue → Capital

Doctrinal Exposure Paths

Traditional antitrust doctrine struggles to capture this dynamic because there is no agreement and no exclusion. Potential exposure paths include:

Buyer-Side Monopsony (Sherman Act §2):

Theory: Capitalized programs exercise labor-market power as buyers of athletic services

Challenge: Requires market definition and demonstration of market power; capital advantage alone may not suffice

Probability of successful claim: Low-Medium (20–35%)

Clayton Act §7 (Merger/Acquisition Scrutiny):

Theory: Capital-backed consolidation of athletic programs constitutes acquisition of competing buyers

Challenge: Athletics restructuring does not fit traditional merger analysis; no clear “acquisition”

Probability of successful claim: Low (10–20%)

State Unfair Competition Statutes:

Theory: Capital-mediated structural advantage constitutes unfair method of competition under state law

Challenge: Varies by state; requires showing of unfairness beyond competitive advantage

Probability of successful claim: Medium (30–45%) in favorable jurisdictions The antitrust exposure lies not in agreement or exclusion, but in capital-mediated constraint of feasible choice. Doctrinal pathways exist but face significant obstacles.

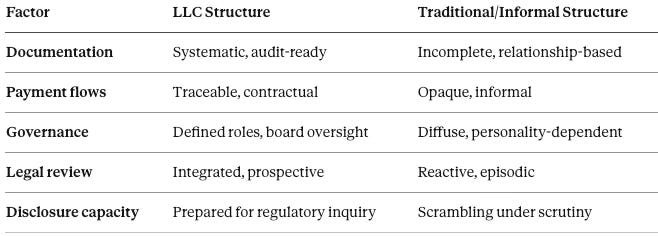

XI. Enforcement Visibility and Compliance Advantage

The monopsony risk described above operates at the labor-market level. At the regulatory level, a counterintuitive dynamic emerges: capital restructuring may reduce rather than increase enforcement risk. Asset partitioning may reduce enforcement risk by increasing auditability, documentation, and compliance density.

The Compliance Paradox

Conventional assumption: Commercialization increases regulatory scrutiny and enforcement risk.

Observed dynamic: Professionalized commercial structures may reduce enforcement risk compared to informal alternatives.

Hypothesis

Athletics LLCs with professional compliance infrastructure face lower enforcement risk than traditional departments reliant on informal booster and collective arrangements because:

Enforcement Actor Analysis

State Attorneys General:

Primary enforcement channel in current environment

Focus on consumer protection, nonprofit integrity, and political salience

More likely to target programs with documentation failures than programs with professional compliance

Political incentives may favor high-visibility enforcement against informal arrangements

Federal Agencies:

IRS: Focused on tax-exempt status and profit allocation; professional structures with clear governance fare better

DOL/NLRB: Focused on employment classification; LLC structure may concentrate liability but also clarify relationships

FTC: Limited current involvement; potential future role in NIL marketing practices

Conference Compliance Bodies:

Declining relevance as firm-formation proceeds

May evolve into certification or audit functions rather than enforcement Capital restructuring can confer both financial and regulatory advantage, accelerating stratification.

XII. Athlete Agency and Feedback Loops

The simulation has thus far modeled institutions, regulators, and capital providers. The final analytical layer addresses athlete agency: how athletes respond to capital stratification, and how their responses amplify or dampen divergence. Athletes are not passive recipients of capital structures; their choices amplify capital-driven divergence.

Strategic Athlete Responses

Preference Sorting:

Athletes increasingly evaluate programs based on compliance infrastructure and payment reliability

Recruiting conversations include explicit discussion of NIL systems, documentation quality, and institutional stability

Agents and advisors steer clients toward capitalized programs with lower individual risk

Transfer Portal Arbitrage:

The portal enables mid-career sorting based on updated information about program stability

Athletes at unstable programs can move toward capitalized alternatives

Portal activity increasingly correlates with compliance reputation and payment track record

Agent-Driven Optimization:

Professional representation expands among college athletes

Agents optimize for client risk-adjusted compensation, favoring stable structures

Agent networks share information about program reliability, accelerating reputation effects

The Feedback Loop

The foresight simulation identifies a self-reinforcing cycle that compounds capital advantages:

The feedback loop is self-reinforcing: capital advantages compound through athlete choice. Programs that establish early capital positions gain durable advantages that become harder to overcome as the cycle iterates.

Disruption Conditions

The feedback loop can be disrupted by:

Employment classification ruling that restructures compensation across all programs

Federal legislation that equalizes compliance requirements

Conference-level capital pooling that spreads advantages across members

Catastrophic failure at a capitalized program that damages the model’s reputation

Absent these disruptions, the loop compounds. Athlete agency converts capital asymmetry into competitive dominance over time.

XIII. Conclusion — Integrated Foresight Finding

The preceding twelve sections establish a coherent causal chain: regulatory stasis enables capital entry; asset partitioning creates financeable entities; capital capacity determines compliance infrastructure; compliance infrastructure shapes athlete welfare and choice; athlete choices compound capital advantages through feedback loops. The foresight simulation now consolidates these findings into integrated predictions.

College athletics is no longer governed primarily by coordination among institutions, but by firm-formation under regulatory stasis. Private equity enters as transitional risk capital, enabling athletics LLCs to absorb NIL volatility, labor uncertainty, and litigation exposure. As capitalized programs gain both compliance and competitive advantages, stratification accelerates beyond the reach of coordination-based legislation and traditional antitrust doctrine.

The foresight simulation generates five integrated predictions with confidence bands and falsification conditions:

Integrated Predictions

Prediction 1 — Diffusion Curve

≥10 athletics LLC formations (including expansions) by T+24 months

≥3 minority-equity experiments by T+24 months

Confidence: 70–80% (LLC formations); 55–65% (equity experiments)

Falsified if: <5 LLC formations by T+24 months despite continued regulatory stasis

Prediction 2 — Stratification Hardening

A tier of 10–15 capitalized programs consolidates stability advantages by T+36–60 months

Advantages manifest in recruiting, retention, compliance, and facilities

Confidence: 60–70%

Falsified if: Capitalized programs do not demonstrate measurable recruiting/retention advantages by T+36 months

Prediction 3 — Antitrust and Labor Shift

Post-House disputes focus on labor-market structure and employer-like entities, not NCAA-wide compensation caps

Litigation targets shift from NCAA/conferences toward school-affiliated LLCs

Confidence: 65–75%

Falsified if: Post-House litigation continues targeting NCAA/conference coordination rather than entity-level structures through T+36 months

Prediction 4 — Legislation Becomes Backward-Looking

Congressional safe-harbor designs arrive after firm-formation is substantially advanced

Policy options narrow to disclosure, taxation, and labor classification rather than coordination restoration

Confidence: 60–70%

Falsified if: Comprehensive federal legislation enacted and operative before ≥10 LLC formations

Prediction 5 — Compliance as Competitive Moat

LLC adoption confers dual advantage: financing capacity + regulatory positioning

Enforcement risk decreases for capitalized entities with professional compliance; increases for informal ecosystems

Confidence: 55–65%

Falsified if: Enforcement actions disproportionately target LLC-structured programs rather than informal arrangements

Key Watchlist (Observable Signals)

Number of athletics LLCs with centralized NIL activation and documentation systems

Public disclosure of buyback windows, control provisions, and profit allocation terms

Transfer-portal sorting correlated with payment reliability and compliance stability

Circuit-level employment rulings or NLRB certifications involving revenue-sport athletes

Conference experiments with pooled capital vehicles

State attorney general enforcement patterns by program structure type

The Central Policy Question

The central policy question is no longer whether to permit private equity in college sports, but whether capital-driven divergence will be shaped deliberately—or allowed to harden into the new operating system of collegiate athletics.

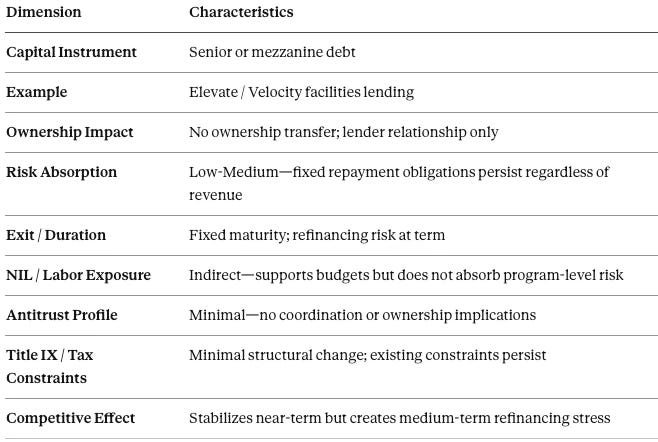

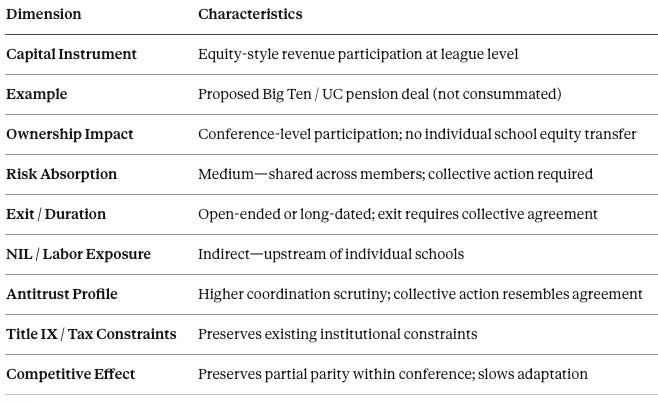

Appendix A — Comparative Capital Structures

The following appendix provides reference materials supporting the foresight simulation’s analytical framework. Appendix A compares three capital structure archetypes; Appendix B offers a decision framework for institutional leaders; Appendix C presents the detailed CDT simulation outputs.

Archetype 1: Utah-Style Minority Equity (Athletics LLC)

Archetype 2: PE-Backed Private Credit

Archetype 3: Conference-Level Capital Pooling

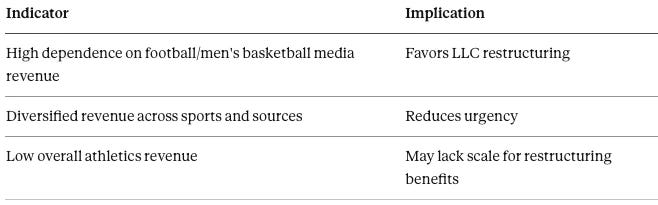

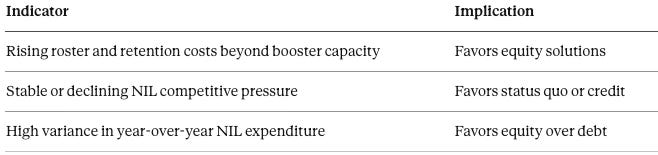

Appendix B — Decision Framework for Boards and CFOs

The foresight simulation outputs translate into a decision framework for institutional leaders evaluating capital restructuring.

Governing Question

Should the institution restructure athletics economics into a financeable entity to absorb NIL and labor uncertainty, or rely on existing coordination and funding models?

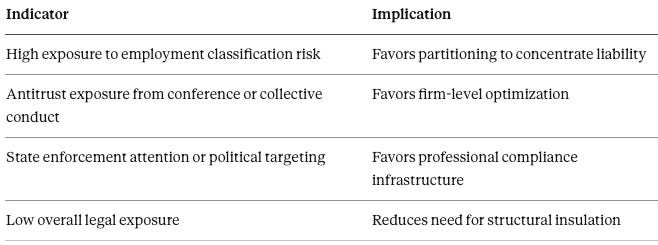

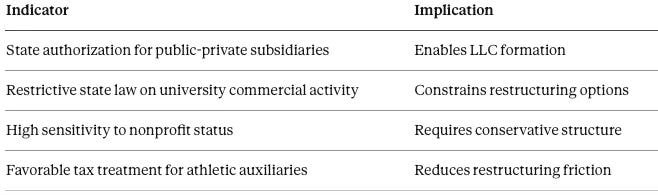

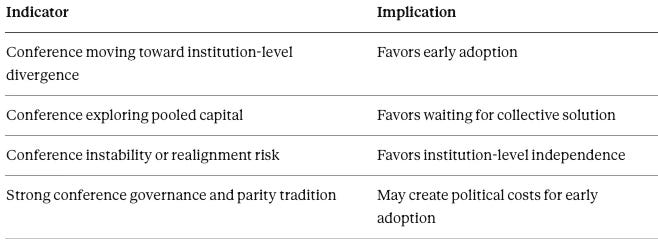

Threshold Assessment Factors

Factor 1: Revenue Concentration

Factor 2: NIL Cost Trajectory

Factor 3: Legal and Litigation Exposure

Factor 4: State Law and Tax Posture

Factor 5: Conference Dynamics

Strategic Path Selection

Path A: Adopt Athletics LLC + Minority Equity

Appropriate for: Revenue-exposed institutions seeking flexibility and risk absorption

Prerequisites: Board appetite for restructuring; state law authorization; institutional capacity for professional compliance

Timeline: 12–18 months for structure; 6–12 months for capital raise

Path B: Use Private Credit as Bridge

Appropriate for: Short-term stabilization with refinancing tolerance

Prerequisites: Identifiable capital needs (facilities, NIL fund); creditworthy profile

Timeline: 3–6 months for facility arrangement

Risk: Refinancing pressure if revenue uncertainty persists

Path C: Advocate Conference-Level Capital

Appropriate for: Parity-oriented institutions prioritizing coordination

Prerequisites: Conference governance capacity; member alignment on risk and return

Timeline: 24–36 months minimum for collective negotiation

Risk: Collective action failure; early adopters gain advantages during negotiation

Path D: Maintain Status Quo

Appropriate for: Institutions where NIL, labor, and litigation pressures remain contained

Prerequisites: Stable booster funding; low competitive pressure; favorable state/conference environment

Timeline: Ongoing monitoring required

Risk: Competitive disadvantage compounds if peer institutions restructure

Board-Level Decision Rule

If NIL-driven cost volatility, litigation exposure, and competitive pressure exceed the institution’s tolerance for fixed obligations and informal funding, capital restructuring becomes a governance decision—not merely a financial decision.

The question is not “Can we afford restructuring?” but “Can we afford not to restructure while peer institutions gain capital-driven advantages?”

Appendix C — FSIM Run Results: Multi-Party CDT Foresight Simulation Outputs

Scope and Parties Modeled

The foresight simulation treats Utah as the prototype and models diffusion across early-adopter, latent-adopter, and coordination actor sets.

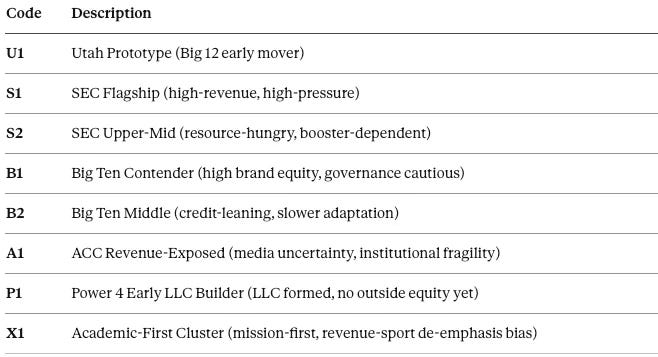

Institutional Archetypes (Anonymized)

Coordination / Regulation / Capital Actors

NCAA Central

Power Conference Offices (SEC/B1G/B12/ACC aggregate)

Congress (NIL/antitrust safe-harbor legislative channel)

State Attorneys General (enforcement channel)

IRS / Tax oversight (structural constraint channel)

PE Minority Equity Archetype (Utah-style)

Private Credit Archetype (facility lending)

Conference Capital Pooling Archetype (league-level revenue participation)

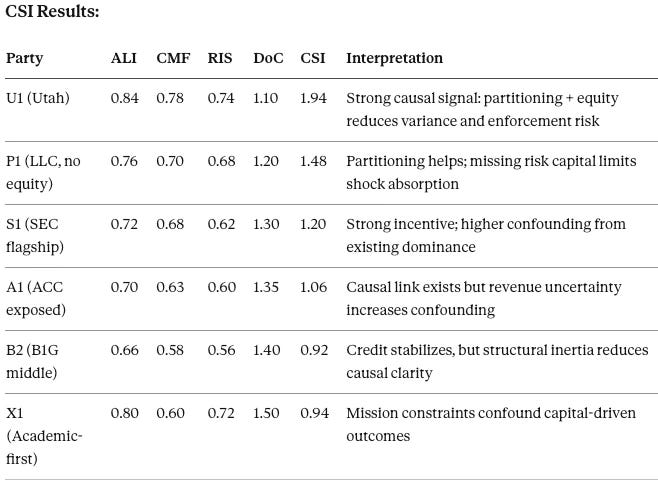

Scoring Conventions

Scores normalized 0.00–1.00 unless noted.

ALI: Action–Language Integrity

CMF: Cognitive–Motor Fidelity

RIS: Resonance Integrity Score

DoC: Degree of Confounding (higher = more confounded)

CSI: Causal Signal Integrity = (ALI + CMF + RIS) / DoC²

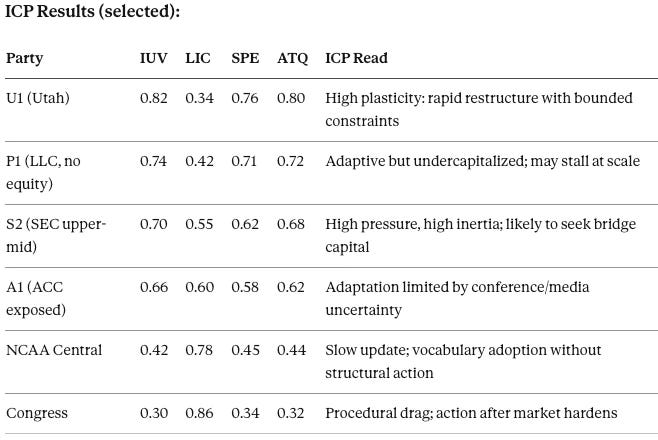

ICP Vision: IUV (Institutional Update Velocity), LIC (Legacy Inertia Coefficient), IAI, NRS, SPE, ATQ (Adaptive Throughput Quotient)

Chicago Composite: Coordination Capacity Index (Coase), Exploitability Index (Becker), Correction Feasibility Score (Posner)

Simulation 1 — Causation Vision (CSI-Gated): “Does Capital Architecture Cause Stability?”

Core Causal Links Tested:

Athletics LLC partitioning → compliance stability (documentation, auditability)

Minority equity capital → volatility absorption (NIL + roster + settlement)

Private credit → short-term stability but refinancing risk

Conference pooling → parity preservation but slower adaptation

Causation Output Class:

“Forward for Action” (CSI ≥ 1.20): U1, P1, S1

“Explore” (0.95–1.19): A1

“Store / Monitor” (0.75–0.94): B2, X1

Narrative Interpretation: Causation Vision finds a high-integrity signal that asset partitioning is the primary stability lever, and minority equity is the highest-fidelity volatility absorber. Private credit improves near-term survivability but increases medium-term fragility.

Foresight Prediction (from CSI): By T+36 months: ≥10 programs adopt athletics LLC structures; ≥3–5 experiment with minority-equity variants.

Simulation 2 — ICP Vision: “Who Can Update Fast Enough?”

Narrative Interpretation: ICP predicts institutional update velocity concentrates at the school level, not at NCAA or Congress. Programs with LLC scaffolding can prune legacy constraints; coordination bodies cannot.

Foresight Prediction (from ICP): Early adopters widen lead: U1/P1-class programs consolidate compliance and recruiting stability before legislative alignment.

Simulation 3 — Chicago LBE Composite (Coase→Becker→Posner): “Coordination, Exploitation, Correction”

Narrative Interpretation: The system behaves like a coordination-collapse environment: actors re-optimize rather than wait. Correction arrives after harm windows, increasing path dependence.

Foresight Prediction: By T+5 years: firm-formation becomes the de facto governance model; “coordination restoration” becomes rhetorically popular but operationally marginal.

Simulation 4 — SBC Vision (Labor/Antitrust): “Buyer-Side Power Without Collusion”

Narrative Interpretation: SBC predicts the next labor conflict is structural monopsony pressure, not cartel wage caps. Capitalized programs reduce athlete risk and increase stability, narrowing practical choices without explicit exclusion.

Foresight Prediction: Litigation theory shift: claims migrate toward employer-like entities (LLCs) and labor-market choice-set arguments.

Simulation 5 — Regulatory Vision + Disclosure Vision: “Delay, Selective Enforcement, and Disclosure Timing”

Regulatory Outputs (high-level):

Congress: High Temporal Drag; high Narrative Latency Gap; action depends on catalytic scandal or court shock

State AGs: Opportunistic enforcement bursts; higher salience in states with political opposition to PE

IRS channel: Low frequency, high impact; threshold-based scrutiny if control or profit allocation appears excessive

Foresight Prediction: By T+36–60 months: enforcement attention shifts from NCAA-wide rules toward entity-level structures where money and control concentrate.

Simulation 6 — Cultural Vision: “Legitimacy vs. Operating Reality”

Cultural Outputs (summary):

X1 (Academic-first): High Karenina/Moral coherence; high Goethe relational legitimacy; low appetite for revenue-sport capitalization

Power programs: Legitimacy narratives fragment; public commitments to education coexist with firm behavior

Foresight Prediction: Academic-first resistance shapes rhetoric and some policy pressure but does not stop firm-formation; it produces segmentation.

Sources and Prior MindCast AI Work

The foresight simulation builds on the analytical foundation established in prior MindCast AI publications on NCAA NIL governance:

2025 Publications

Group 1: Congressional Legislative Analysis

MCAI Lex Vision: SAFE vs. SCORE Act — Which Path Should Define NCAA NIL? (September 2025) https://www.mindcast-ai.com/p/ncaasafeact

MCAI Lex Vision: How the SCORE Act Codifies College Sports Inequality (August 2025) https://www.mindcast-ai.com/p/scorecantwellletter

MCAI Lex Vision: Foresight Simulation of the SCORE Act and NCAA Settlement (July 2025) https://www.mindcast-ai.com/p/scoreact

These publications evaluate competing congressional approaches to NIL legislation, analyzing the structural differences between the SCORE Act and SAFE Act frameworks and their implications for institutional compliance. The series introduced conditional safe harbor as a legislative design principle and identified structural brittleness in static compliance frameworks.

Group 2: Settlement and Antitrust Foundations

MCAI Lex Vision: The NCAA NIL Settlement, Foresight Realized (June 2025) https://www.mindcast-ai.com/p/ncaasettlement

MCAI Lex Vision: Restructuring the NCAA Name-Image-Likeness Settlement (May 2025) https://www.mindcast-ai.com/p/ncaa-nil

MCAI Lex Vision: US DOJ Participation in Zeigler v. NCAA, Strategic Impact (June 2025) https://www.mindcast-ai.com/p/zeiglerdoj

MCAI Lex Vision: AI-Era Anticipatory Antitrust for NCAA NIL Compliance (July 2025) https://www.mindcast-ai.com/p/ncaaai

These publications traced the dismantling of amateurism through litigation, modeled the House v. NCAA settlement structure, and analyzed federal enforcement posture shifts—including DOJ signaling toward institutional deference. The series revealed structural antitrust risks hidden from conventional legal reporting and established the analytical foundation for understanding settlement-based governance.

Group 3: Institutional Governance and Compliance

MCAI Lex Vision: Executive Foresight and the New Era of NCAA Institutional NIL Legitimacy (July 2025) https://www.mindcast-ai.com/p/ncaaeo

MCAI Lex Vision: Navigating the NCAA NIL Compliance Matrix — University of Washington Analysis (July 2025) https://www.mindcast-ai.com/p/uwnil

MCAI Lex Vision: National Name-Image-Likeness Simulation Framework (July 2025) https://www.mindcast-ai.com/p/ncaaantitrustsnapshot

These publications applied Cognitive Digital Twin methodology to specific institutional contexts, evaluating universities across tiered risk matrices and simulating how executive action and settlement requirements interact with university governance strategies. The series demonstrated how foresight simulation translates system-level dynamics into institution-specific compliance guidance.

Group 4: Interregnum Analysis

MCAI Economics Vision: Chicago School Accelerated — Integrated Application, the NCAA NIL Interregnum (Dec 2025) https://www.mindcast-ai.com/p/ncaa-nil-interregnum