MCAI Market Vision: Private Equity & Patent Litigation in AI Data Centers (2026–2028)

Foresight on How Private Equity and Patent Litigation Will Reshape AI Infrastructure

I. Introduction: A Falsifiable Thesis

This vision statement stakes a falsifiable thesis: by 2028, control of AI infrastructure will likely consolidate around actors who integrate both capital deployment and IP protection. What follows is structured prediction, not proven fact—a framework for observing how capital and litigation converge in AI infrastructure, with specific signals we’ll monitor and report as they emerge or fail to materialize.

By 2028, the twin forces shaping the AI data center landscape will not be chips or models—but capital and control. Private equity’s deep liquidity and patent litigation’s defensive aggression are converging into a single architecture of dominance: whoever owns the infrastructure and the intellectual property behind it will likely own the market. This framework predicts a structural transition from compute competition to capital-juridical control, where financial and legal foresight define technological leadership.

The core argument is simple but consequential: capital formation and IP control are no longer separate markets. They are dual expressions of foresight. Actors who integrate both achieve the economic and cognitive moat in the AI infrastructure era.

MindCast AI will track and publicly report on the metrics outlined below through empirical updates as significant market activity emerges, creating a transparent record of prediction accuracy and model evolution. This is a research agenda with observable metrics to track through 2028, a commitment to transparent reporting on prediction accuracy, and a living document that will evolve as empirical data emerges. This document generates falsifiable predictions tracked through observable market activity—PE transactions, patent filings, power purchase agreement structures, and litigation intensity—with results reported in follow-up empirical analyses.

Each signal, scenario probability, battlefront prediction, and KPI threshold represents a commitment to track real-world data and report findings transparently. As market events unfold, MindCast AI will publish empirical updates measuring actual outcomes against these predictions, iteratively refining the cognitive modeling approach based on observed accuracy. We commit to tracking prediction accuracy and publishing scorecards showing where our foresight proved accurate, where it required updating, and where alternative explanations emerged.

Throughout the document, Cognitive Digital Twins (CDTs) function as analytical vocabulary for predictive modeling—representing simulated decision architectures that help forecast how stakeholders will respond to capital and IP pressures. CDTs are not deployed technology but conceptual tools for organizing foresight analysis.

Contact mcai@mindcast-ai.com to partner with us on AI market foresight simulations. See prior MindCast AI publications on AI data centers in our Markets | Technology section, and Quantum Computing Sovereignty, How Patent Ecosystems Will Shape the Future of Quantum-AI Data Centers (Oct 2025).

II. The Capital-IP Convergence Thesis

The AI data center economy is shifting from speculative build-outs to asset-backed foresight. Capital intensity, energy bottlenecks, and thermodynamic constraints are forcing operators to behave less like startups and more like sovereign utilities. AI workloads have made every megawatt and every cooling loop a financial instrument—and every innovation a potential liability if unprotected.

Private equity’s entry is not opportunistic; it’s gravitational. Funds are drawn to predictable yield curves and the ability to structure ownership across land, power, and IP. The convergence shows that both capital allocation and IP defense now operate with near-identical trust functions: each seeks reliable predictability in a volatile system. MindCast AI will track evidence that PE firms are pursuing vertical integration strategies that combine infrastructure ownership with IP protection mechanisms—cross-licensing agreements, freedom-to-operate opinions, defensive patent portfolios.

As capital intensity increases, the cost of deployment delays escalates proportionally. A single patent injunction can strand billions in infrastructure investment. This creates powerful incentives for pre-emptive IP acquisition and defensive portfolios, strategic litigation to slow competitors, and cross-licensing as a market stabilization mechanism. If capital and IP are truly converging as dual control mechanisms, the data should show PE infrastructure deals increasingly incorporating IP components, and litigation activity correlating with capital deployment intensity.

The economic logic is straightforward: the more you invest in physical infrastructure, the more vulnerable you become to IP disruption—and the more essential IP protection becomes to defending that investment. Understanding why this convergence is happening establishes the causal foundation for how it will manifest in observable signals.

Early Warning Signals (2025–H1 2026)

The early warning signs operationalize the thesis into specific market behaviors we’d expect to see if capital-IP convergence is accelerating. Roll-ups of regional colocation providers near power-dense corridors reveal a new form of vertical arbitrage—owning electrons before algorithms. Meanwhile, ITC filings over immersion cooling and optical fabric standards foreshadow the coming legal arms race. MindCast AI’s forecast identifies “signal convergence zones” where financial and legal activity overlap: securitized compute agreements, geothermal land acquisitions, and cross-licensing among data-center equipment OEMs.

MindCast AI will publish data on these signals through 2028. On the financial side, the tracking focuses on PE infrastructure deals near power corridors exceeding $2B annually, up from roughly $1.2B in 2024. Rated issuance volume of compute-backed securities is expected to cross the 70% threshold of projected issuance, and data center M&A incorporating IP licensing terms should exceed 40% of deals, compared to roughly 15% in 2024.

On the legal front, the forecast anticipates ITC investigations filed on cooling and interconnect technology to surpass 15 filings per quarter, compared to approximately 3 per quarter in 2024. Cross-licensing agreements among infrastructure OEMs should exceed 20 annually, up from around 8 in 2024. And freedom-to-operate opinions filed with SEC disclosures are expected to appear in more than 30% of infrastructure IPOs—a metric that barely existed before.

The convergence signals are perhaps most telling: PE deals explicitly citing IP defense in their investment thesis should exceed 50% by Q4 2026, and co-investment structures pairing infrastructure and patent portfolios should see more than $500M deployed. Each signal includes verification sources—specific court dockets through ITC EDIS and PACER, deal announcements via PitchBook and Crunchbase, regulatory filings in SEC EDGAR and Form S-1 documents, and public securitization data from Moody’s and S&P ratings.

If signals materialize at predicted intensity, it validates that capital and litigation are converging as dual control mechanisms. If signals remain below thresholds, it suggests either timing is delayed, alternative control mechanisms are emerging, or the thesis requires revision. Future empirical reports will measure actual signal intensity against these predictions with supporting documentation.

Each early signal strengthens the causal chain from capital intensity to legal assertiveness. The actors moving first—those who pre-position assets in these convergence zones—will likely control the tempo of market evolution within 18 months.

III. Three Pathways Forward

While the core thesis predicts capital-IP convergence, the method of convergence could follow different pathways. These scenarios represent hypothesis space that observable market behavior will select from. As sufficient market data emerges, MindCast AI will assess which scenario cone the market is entering.

MindCast AI assigns initial probabilities based on current signal intensity and structural incentives: PE Platform Hegemony at 45%, Standards & Truce at 30%, and Patent Proxy War at 25%. These probabilities will be revised as observed signal intensity and market trajectory provide new evidence.

PE Platform Hegemony (45% probability)

In this scenario, consolidation occurs around integrated capital-IP platforms. PE consortia achieve recursive optimization faster than competitors by integrating site acquisition, IP defense, and cross-licensing into unified platforms. Vertical integration across land, power, cooling, and IP creates defensible moats.

The observable indicators would include PE platforms acquiring both infrastructure and patent portfolios, cross-licensing agreements forming within PE-backed consortia, hyperscalers increasingly leasing from PE platforms rather than building, and litigation intensity remaining moderate as pre-emptive IP strategies succeed. This scenario represents the strongest validation of the capital-IP convergence thesis through direct ownership integration.

Standards & Truce (30% probability)

The Standards & Truce scenario envisions cooperative equilibrium through standardization. Industry actors reach agreement by standardizing cooling and network IP frameworks. Patent pools and industry consortia emerge to reduce litigation friction while enabling continued innovation.

Observable indicators would include formation of industry patent pools similar to MPEG LA or ONE Summit, joint ventures between PE firms and hyperscalers for IP sharing, declining ITC filing rates after an initial surge, and regulatory encouragement of standardization. This path still validates the convergence thesis but through cooperative rather than competitive mechanisms—capital still requires IP clarity, achieved through collaboration rather than consolidation.

Patent Proxy War (25% probability)

In the Patent Proxy War scenario, adversarial litigation between infrastructure providers escalates into prolonged conflict. Patent thickets emerge around critical technologies. Litigation costs and deployment delays increase but paradoxically raise valuations for IP-rich platforms.

The prediction is that ITC filing rates would exceed 20 per quarter by Q2 2027, multiple preliminary injunctions would be issued on cooling and interconnect systems, litigation costs would surpass 8% of infrastructure deployment budgets, and patent portfolio acquisitions would accelerate as defensive moves. This scenario validates the convergence thesis through an adversarial path—IP becomes more critical as weapon and defense, driving higher integration with capital strategies.

The Common Thread

Scenario modeling through proprietary MindCast CDT foresight simulation reveals how key market actors—private equity platforms, hyperscalers, regulators, and chipmakers—interact across legal, financial, and infrastructural fronts. Each CDT encapsulates the decision architecture of its domain: investment cadence, litigation strategy, energy procurement logic, and risk tolerance. When these CDTs interact in simulation, they generate emergent foresight patterns that mirror likely market trajectories, allowing MindCast AI to forecast where capital and conflict converge.

Across all scenarios, the strategic indispensability of foresight remains constant. Whether through investment, injunction, or cooperation, power accrues to those who integrate capital foresight, legal anticipation, and operational adaptability. Scenario diversity masks a singular truth: every future would suggest control of both capital flows and IP rights as the decisive axis of power. The method of control differs, but the logic of dominance does not.

IV. Where the Battles Will Be Fought

If capital-IP convergence is real, litigation shouldn’t emerge randomly—it should concentrate where capital intensity is highest and technical complexity creates patent exposure. Patent litigation will likely follow the heat map of energy density and design complexity. Cooling systems, optical interconnects, and power-sharing architectures have become the functional DNA of AI infrastructure, and each domain is a patent minefield.

Litigation Hotspots

Immersion cooling systems represent the first major battlefront. The thermodynamic bottleneck combined with multiple competing approaches and high integration costs creates perfect conditions for IP conflict. The forecast anticipates 5-8 ITC investigations through 2026, with each potential injunction capable of stranding $200M-$500M in deployed infrastructure.

Optical interconnects and AI fabrics form the second battlefront. These systems represent the critical path for training clusters, with evolving standards and semiconductor IP overlap creating dense patent thickets. The prediction is for 8-12 ITC investigations through 2026, with the potential to affect entire data center cluster deployment timelines.

Power distribution and grid integration constitute the third battlefront. Utility interface complexity, regulatory overlap, and energy storage integration create a legal minefield that extends beyond traditional patent law into public utility regulation. The expectation is 3-5 ITC investigations through 2026, with outcomes that could affect the ability to secure power purchase agreements altogether.

MindCast AI’s litigation foresight models show that disputes will cluster around thermodynamic interfaces—where physics, design, and IP collide. These are not lawsuits about ideas; they’re about capacity continuity. As system integration deepens, a single claim could freeze billions in capital. These litigation patterns would validate the thesis: capital without IP protection creates stranded asset risk, and IP without capital deployment is irrelevant. The winners will likely master both the physical and legal architectures of heat by Q3 2026.

Measuring the Convergence

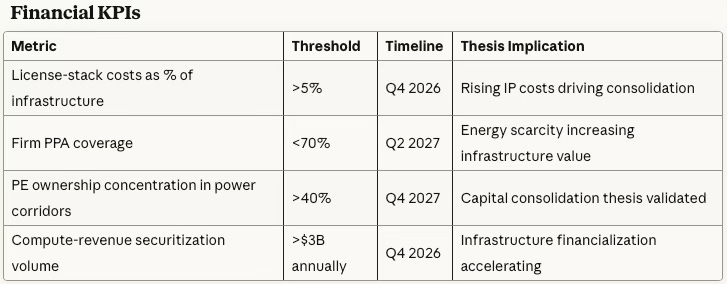

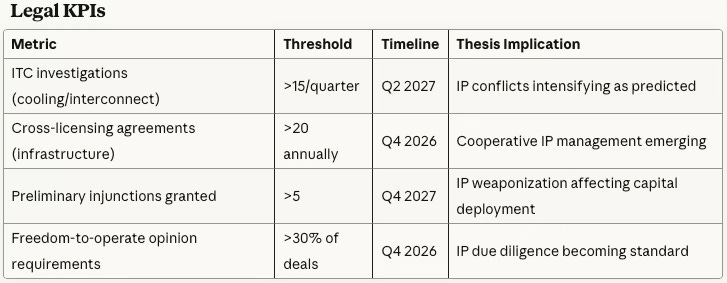

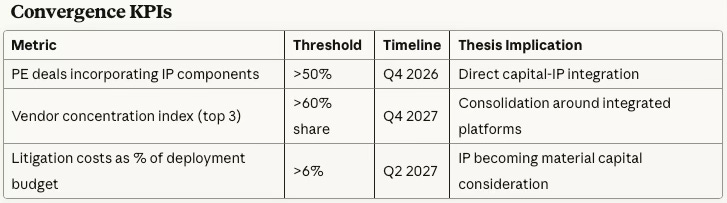

The following metrics translate the capital-IP convergence thesis into measurable outcomes across financial, legal, and convergence dimensions. The thresholds below are specific metrics we’ll quantify and report quarterly, drawing data from SEC filings for securitization structures, ITC dockets for litigation intensity, utility commission filings for PPA terms, and S-1 documents for ownership concentration.

The following metrics translate the capital-IP convergence thesis into measurable outcomes across financial, legal, and convergence dimensions:

Cognitive Digital Twins (CDTs) form the backbone of this KPI framework by continuously translating operational, financial, and legal data into foresight metrics. Each data center CDT functions as a living model of its host ecosystem—tracking Action-Language Integrity (ALI), Cognitive-Motor Fidelity (CMF), and Causal Signal Integrity (CSI) in real time to assess integrity, responsiveness, and causal coherence. ALI measures alignment between stated reasoning and action, CMF captures the level of precision between intent and execution, CSI signals trust calibration = (ALI + CMF + RIS) / DoC² (DoC = Degree of Complexity).

These CDTs aggregate telemetry from cooling efficiency, PPA stability, legal exposure, and capital flow timing to create a dynamic coherence map—a visual rendering of how foresight performs under load.

When CDTs detect divergence—license costs over 5% or firm PPA coverage below 70%—they trigger predictive alerts, allowing intervention before financial or legal coherence collapses. These metrics will be updated quarterly with empirical data drawn from filings and disclosures.

The tripwire logic is straightforward: if license costs remain below 3% through 2027, it suggests IP protection remains modular rather than integrated, weakening the consolidation thesis. If PPA firm coverage exceeds 85%, it indicates energy constraints are less binding than predicted, reducing infrastructure scarcity value. If litigation filings decline below baseline, it suggests cooperative or standardized approaches are succeeding, shifting scenario probability toward Standards & Truce.

MindCast AI will monitor ITC dockets, district court filings, and preliminary injunction outcomes, reporting on whether litigation clusters in predicted domains at expected intensity. If litigation remains diffuse or concentrated in unexpected domains, this would suggest the capital-thermodynamic-IP linkage is weaker than predicted, requiring thesis revision. Updates will include dashboards showing current metrics versus thresholds, with analysis of thesis implications.

V. Strategic Positioning and Risk Factors

If the capital-IP convergence thesis is correct, it generates specific strategic recommendations for different stakeholder groups. For private equity firms, the offensive strategy involves pursuing vertical integration—land acquisition near power sources combined with cooling IP and interconnect licensing. Structure deals with IP freedom-to-operate as a key due diligence component. Build patent portfolios defensively while maintaining cross-licensing optionality.

Defensively, establish multi-vendor cooling and interconnect paths to avoid single-point IP exposure. Pre-file freedom-to-operate opinions before major capital deployment. Establish relationships with patent aggregators for defensive purposes. If PE firms following this playbook achieve greater than 25% IRR premium versus pure-infrastructure plays by 2028, it validates the capital-IP integration thesis empirically.

Hyperscalers face a different challenge—they must adapt to a market structure shifting away from their historical advantages. The counter-strategy involves forming joint ventures with PE platforms to retain partial control of critical PPAs, internalizing supply chains by acquiring cooling and power module vendors, and building defensive patent portfolios in thermodynamic management. If hyperscaler M&A shifts toward infrastructure component vendors rather than AI companies, exceeding $5B annually by 2027, this confirms defensive adaptation to capital-IP convergence.

Chipmakers must navigate vertical integration toward cooling solutions and power management, strategic partnerships with infrastructure providers to maintain influence, and IP cross-licensing to ensure design wins in a consolidated market. If chipmaker revenue from infrastructure components exceeds 15% by 2027, it validates the vertical expansion response to market consolidation.

What Could Prove Us Wrong

Good foresight requires acknowledging what could prove the thesis wrong. These aren’t just hedges—they’re falsification criteria that define the boundaries of the prediction framework.

Regulatory intervention represents the first major risk. If federal antitrust action blocks PE infrastructure consolidation through DOJ or FTC challenges to more than three major PE data center deals by 2027, it would invalidate the consolidation pathway. However, this might still validate IP importance—litigation could continue even without consolidation, just with different actors.

Technology disruption could undermine the thermodynamic bottleneck assumption. A breakthrough cooling technology achieving greater than 50% cost reduction with less than 18 months deployment timeline would reduce infrastructure scarcity value, weakening the capital thesis. IP battles might shift to the new technology, but the underlying capital intensity driver would be compromised.

Sovereign capital competition represents a third risk vector. National infrastructure initiatives from the US, China, or EU crowding out private capital with government spending exceeding $10B annually by 2027 would shift control from private equity to sovereign actors. This might intensify IP conflicts across jurisdictions but would invalidate the PE consolidation prediction specifically.

GPU oversupply constitutes the final major risk. Sustained compute oversupply with GPU utilization rates below 60% for more than six consecutive quarters would reduce the infrastructure urgency driving consolidation, weakening the entire thesis foundation.

Every foresight structure contains its own blind spots. Yet each risk also invites a mitigation that reinforces the system’s recursive intelligence: covenant design, modular retrofits, and aligned co-investment. The key is architectural agility—designing capital stacks and IP portfolios that evolve as fast as the technologies they host.

Each update will explicitly track these alternative hypotheses, reporting whether disconfirming evidence is emerging. If any falsification criterion is met, MindCast AI will publish a revised thesis incorporating new market reality. The risk matrix would validate the thesis through inversion: only systems unifying financial flexibility and legal foresight can withstand volatility.

VI. What We’re Tracking Next

The next 12-24 months will provide early validation or challenge to the thesis. These specific events represent near-term empirical tests that will shape scenario probability updates.

On the financial side, watch for PE-led acquisitions near hydro, nuclear, or geothermal corridors—the expectation is more than three deals exceeding $500M each through 2026. The first rated issuance of compute-revenue-backed notes should mark infrastructure’s transition to asset-backed securities. Data center REIT formations with explicit IP licensing components should signal that IP is becoming inseparable from infrastructure value.

Legal activity will be equally revealing. ITC investigations invoking Ethernet AI fabrics or immersion cooling should generate 4-6 new filings through 2026. The first preliminary injunction affecting data center deployment carries moderate probability but high impact—it would validate that IP conflicts can materially delay capital deployment. Industry patent pool formation discussions should indicate whether cooperative or adversarial dynamics are prevailing.

Regulatory developments provide the third tracking layer. State utility commission proceedings treating AI campuses as regulated infrastructure should emerge in three or more states, fundamentally altering the economic model. Federal guidance on compute-backed securities classification from SEC or OCC should arrive by Q4 2026, determining whether this asset class receives formal recognition. Antitrust review initiation of PE data center roll-ups carries low probability but high impact—it would trigger the regulatory intervention risk scenario.

The next year will separate narrative positioning from operational foresight. Policy acceleration, particularly in state utility commissions, will act as the signal catalyst—transforming AI campuses into quasi-regulated infrastructure. Litigation intensity will then rise in proportion to asset maturity, confirming MindCast AI’s recursive model: foresight breeds value; value attracts litigation; litigation demands deeper foresight.

MindCast AI will track these events using M&A data, litigation activity and market intelligence. Each source will share CDTs of market players and dynamics. Empirical reports will measure how reality aligns with predictions as sufficient data emerges.

How to Engage

This framework succeeds through transparent testing, not assertion. MindCast AI invites validation, challenge, and independent tracking.

Organizations should deploy parallel tracking—monitor the same signals, measure the same KPIs, test whether the patterns we predict actually emerge. Independent validation strengthens collective intelligence. In the near term, over the next 30-90 days, assess current IP exposure across infrastructure deployments. Evaluate whether capital strategies incorporate IP due diligence. Establish monitoring processes for relevant ITC dockets and PE transactions. Stress-test assumptions about power availability and cooling scalability.

Medium-term positioning over 6-18 months involves building dual-path vendor relationships to avoid single-point IP exposure. Incorporate IP freedom-to-operate analysis into capital deployment decisions. Develop cross-licensing strategies appropriate to your market position. Prepare for scenario divergence based on observed signal intensity.

For analysts and researchers, track with MindCast AI—follow the empirical updates, validate findings independently, and publish alternative interpretations. Good forecasting improves through public scrutiny. Collaborative opportunities include independent validation of signal intensity data, alternative causal models for observed patterns, competing scenario frameworks, and peer review of methodology and measurement approaches.

Investors should evaluate positioning using this framework to assess how portfolio companies are positioned for capital-IP convergence, regardless of which scenario materializes. Enhance due diligence by requesting IP freedom-to-operate analysis for infrastructure investments. Assess vendor concentration and alternative technology paths. Evaluate management understanding of patent landscape. Stress-test capital deployment timelines against litigation scenarios.

MindCast AI commits to empirical reports measuring actual outcomes versus predictions, public prediction scorecards showing accuracy across signal categories, scenario probability updates based on observed market trajectory, framework revisions when evidence requires thesis refinement, and transparent acknowledgment of forecast errors and model limitations.

VII. Conclusion

The AI infrastructure race is no longer about who builds first—it’s about who predicts the constraints that decide who builds last.

This vision statement stakes a clear thesis: by 2028, control of AI infrastructure will likely consolidate around actors who integrate capital deployment and IP protection. MindCast AI has translated this thesis into specific, trackable predictions about PE consolidation patterns, litigation intensity, infrastructure ownership structures, and market dynamics.

What makes this framework actionable is its commitment to falsifiable predictions with quantitative thresholds and timelines, observable signals that can be tracked through public sources, transparent validation through quarterly empirical reporting, scenario probabilities that will be updated as data emerges, and alternative hypotheses that could invalidate the thesis.

The next 24-36 months will test this framework empirically. Capital and litigation activity will either validate the convergence thesis, require its revision, or reveal alternative control mechanisms not yet anticipated. MindCast AI commits to reporting those findings transparently, updating the framework based on observed accuracy, and building credibility through accountability rather than assertion.

The thesis is clear. The metrics are defined. The timeline is set. Now the tracking, measurement, and learning begins. By 2028, the market will reveal whether those who unified capital foresight and IP defense truly achieved the dominant position predicted—or whether the market found another path entirely.

The CDT framework itself evolves as these predictions are tested—creating a recursive loop where market observation refines the predictive architecture that generated the observations. Confidence levels vary across predictions: PE consolidation in power corridors carries high confidence at 75%, litigation timing and intensity moderate confidence at 60%, specific scenario pathway low confidence at 45%, and overall capital-IP convergence thesis high confidence at 70%.

Control of capital and IP is control of foresight itself. The transformation is already underway. The question is whether your organization will lead it or follow it.