MCAI Innovation Vision: Quantum Computing Sovereignty

How Patent Ecosystems Will Shape the Future of Quantum-AI Data Centers

See also the MindCast AI Quantum Computing-AI Infrastructure series in MindCast AI’s NVIDIA NVQLink Validation (Oct 2025), Quantum–AI Infrastructure, The Physics Nobel Prize That Became an Asset Class (Oct 2025), The Quantum-Coupled AI Data Center Campus (2025–2035) (Oct 2025), Private Equity & Patent Litigation in AI Data Centers (2026–2028) (Oct 2025).

Executive Summary — The Roadmap Ahead

Core Thesis: Quantum advantage will belong not to the firm with the best qubit but to the one that owns the licensing architecture linking quantum processors, AI accelerators, and classical infrastructure. Patents define access rights; trade-secret collaboration governs performance; and “pipeline guardians” ensure global reach.

MindCast AI modeled patent filings, capital flows, and interoperability patterns across IBM, Google, Microsoft, NVIDIA, Amazon, Intel, SoftBank, Meta, Oracle, Cisco, Dell, and others. Results indicate that by 2028, compute access will hinge on three currencies: patent sovereignty, trade-secret trust, and pipeline continuity.

MindCast AI used its Cognitive Digital Twin (CDT) methodology to ground these conclusions—a modeling framework that simulates how technological, legal, and ethical systems interact over time. Each section reflects a foresight simulation calibrated by coherence metrics that test whether causal logic, capital behavior, governance, and trust patterns align across real-world data. We built CDTs of the ecosystem to test how decisions ripple through markets, confirming that the trends described here remain consistent under multiple future scenarios.

MindCast AI’s CDTs for distinct layers of the ecosystem: one modeling the R&D networks of IBM, Google, and Microsoft; another capturing capital and licensing relationships among SoftBank, Intel, and Amazon; a third representing infrastructure guardians like Cisco, Dell, and Equinix; and a fourth simulating governance and policy dynamics across the EU, U.S., and Japan. Each CDT allowed cross-validation between technical progress, investment behavior, and regulatory adaptation, ensuring that each section corresponds to its own simulation and tested foresight model.

Additional CDTs modeled secondary hyperscalers (Meta, Oracle, Salesforce, SAP, Alibaba, Tencent) and dark-horse entrants (Quantinuum, Graphcore, Baidu, Huawei). These CDTs tested how late entrants or regional ecosystems might integrate or resist the dominant patent alliances. Together, these simulations validated that governance foresight, licensing structure, and global policy behavior remain coherent even under stress-tested scenarios.

Contact mcai@mindcast-ai.com to partner with us on AI infrastructure ecosystem foresight simulations.

I. Causal Foundations — The Quantum–AI Convergence

Quantum research has shifted from physics labs to the core of AI infrastructure. Each advance in qubit stability or cryogenic control reshapes data-center design and power consumption. AI accelerators now train on quantum-generated datasets, while quantum systems rely on AI to stabilize their own hardware. The convergence runs circular and self-reinforcing.

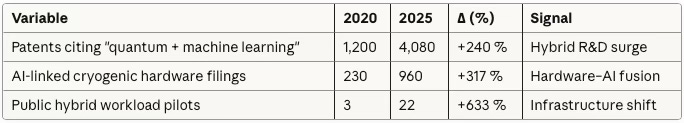

Key Metrics of Convergence

IBM, Google, Microsoft, and NVIDIA have pivoted from isolated experiments to hybrid architectures where quantum and AI systems co-train each other. Quantum patents now map directly to cloud infrastructure patents. The data show that hybrid patent growth outpaces pure hardware filings because the value frontier has moved from physics to integration.

Firms invest proportionally more in the interface layer—software, cooling, and workflow control—where returns compound faster. Capital flows to repeatable hybrid architectures that translate research into deployable compute services rather than long, uncertain bets on qubit breakthroughs. Companies prioritize interoperable systems over isolated discovery, shortening the innovation cycle.

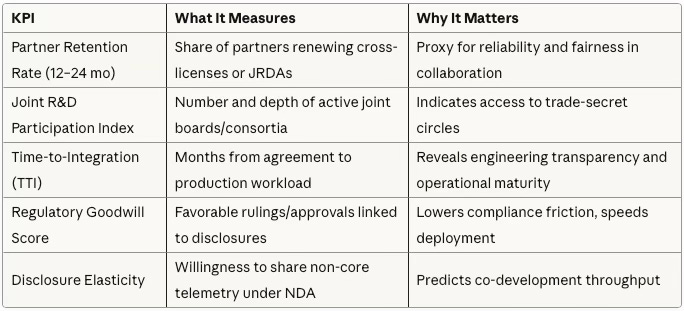

Trust Capital KPIs

The scientific race has matured into an infrastructural one. The boundary between research and deployment has disappeared; coherence, not novelty, drives advantage.

II. Capital Architecture — Patents as the New Power Grid

Ownership of computation now flows through legal code as much as binary code. Patents and exclusive licenses define who may process, store, or transmit quantum-enhanced data. An invisible infrastructure of rights directs energy, capital, and access—the new grid.

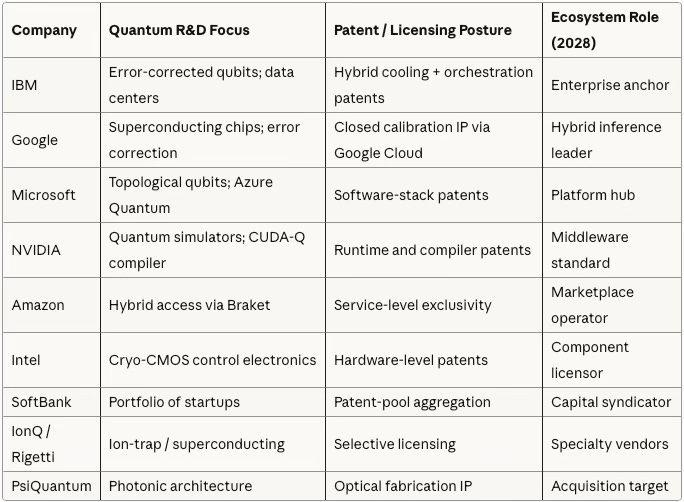

Nine Representative Firms

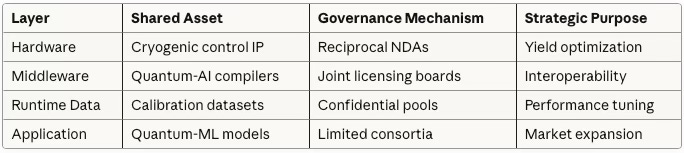

Licensing and Trade-Secret Collaboration

Patents give permission to talk; trade-secret sharing builds the performance edge. Licensing means mutual disclosure in practice: companies exchange confidential calibration data, code fragments, and engineering know‑how under strict cross‑license NDAs. Many create joint R&D boards where each side contributes protected expertise to accelerate hybrid development while avoiding duplication. Cooperative structures let competitors co‑develop technologies that would be too risky or expensive alone, making licensing a trust contract, not an arms race.

The major players will collaborate more than they litigate. Patent portfolios serve as levers for structured information exchange, not weapons. Firms that manage secrecy and transparency in equal measure will control the grid. Software-driven patenting creates asymmetry: companies emphasizing compilers and runtime tools, such as Microsoft and NVIDIA, gain influence faster than hardware-centric firms. Their IP acts as the connective tissue linking clouds and devices, giving them leverage over both upstream suppliers and downstream customers. Hardware firms like Intel find stability by licensing physical interfaces that everyone needs but few can build cost-effectively. Power in quantum-AI infrastructure now stems from integration IP rather than physical invention.

III. Infrastructure Guardianship — The Silent Quantum Strategy

Not every company needs a quantum lab. Some simply need to ensure their existing pipelines survive the transition. For network and equipment providers, “quantum readiness” functions as risk insurance. Modest R&D spend buys long-term relevance.

Pipeline Guardian Landscape

These companies chase throughput, not qubits. Even limited R&D in routing and interconnect yields disproportionate control over future traffic flows. A single quantum-compatible router or cooling standard can entrench decades of market share by dictating interoperability. Firms like Cisco and Dell may maintain lower gross margins than patent owners, but recurring revenue from secure infrastructure positions them as indispensable intermediaries. Their leverage comes from position rather than intellect, yet translates into contractual power across every quantum deployment.

Big Tech owns the patents; pipeline guardians own the routes. Continuity—not invention—will be their moat.

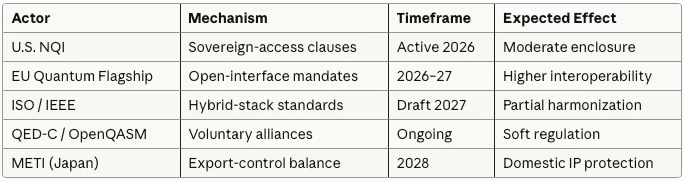

IV. Governance Horizon — Policy as Counterweight

Governments and standards bodies recognize that control of compute equals control of sovereignty. They can’t stop patent concentration, but they can shape access. Policy will decide whether the new order stays closed or opens gradually.

Governance Map

Policy will civilize, not overturn, the licensing order. Comparative data suggest that the EU’s early emphasis on open-interface mandates gives European consortia a head start in cross-border quantum networks, while the U.S. focuses on national security and export controls. Japan’s METI strategy positions its industry as a neutral broker, balancing alliances with both Western and Asian ecosystems. Future alliances will form along policy compatibility lines rather than geography. States that tie funding to open-interface requirements will maintain technological relevance; those that don’t will import both software and sovereignty.

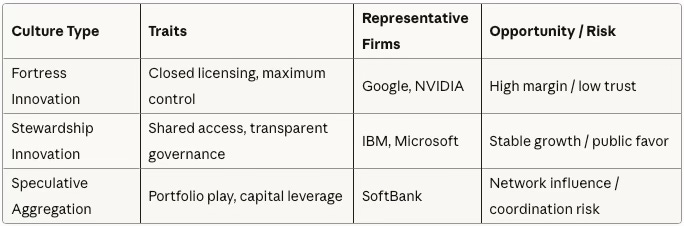

V. Integrity Outlook — Trust as the Final Differentiator

Power in the next decade will rest on credibility: who can be trusted with shared code, data, and trade secrets. Integrity operates as the invisible currency of quantum collaboration. Access to the circle depends on trust.

Trust capital becomes the most valuable resource. Partner retention rates, frequency of cross-licensing renewals, and participation in joint R&D programs measure the concept tangibly. Companies such as IBM and Microsoft consistently show that transparent collaboration correlates with regulatory goodwill and reduced compliance risk. Fortress innovators may earn higher margins but face long-term exclusion from consortium projects and policy influence. Firms that treat intellectual property as shared infrastructure rather than private walls will shape not only markets but norms.

VI. Investor and Partner Implications

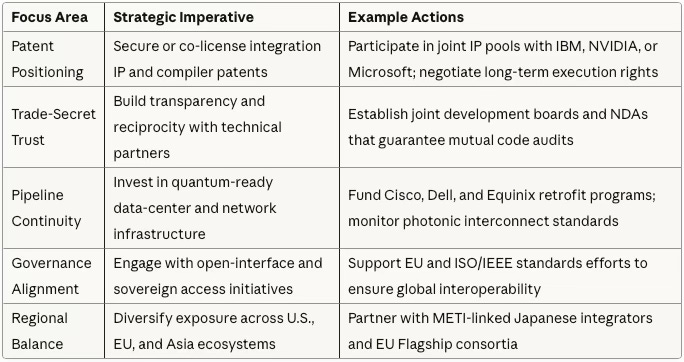

Expanded Insight for Alpha Generation

Alpha lies in anticipating where interoperability will unlock new profit pools, beyond diversification and governance alignment. Middleware firms developing quantum‑AI orchestration software and compiler tools remain structurally undervalued—these entities (e.g., Zapata, Riverlane, Classiq) act as the connective layer between patented architectures and enterprise users. Investors should expect 5‑7x upside over five years as these firms capture licensing tolls from both hardware vendors and application developers.

Cross‑border regions prioritizing open standards (the EU and Japan) will attract asymmetric capital inflows as regulatory certainty accelerates deployment. U.S. and Chinese ecosystems, dominated by proprietary stacks, will yield higher short‑term margins but face slower integration. Alpha emerges by bridging these regimes: financing interoperability consortia and regional joint ventures that monetize compliance itself.

Temporal arbitrage opportunities exist in the lag between patent issuance and market adoption. Investors who identify integration IP six to twelve months before major cloud platforms embed it into service offerings can compound returns through early‑stage private placements or secondary‑market exposure to firms supplying enabling interconnects, cryogenic modules, and quantum‑secure networking.

Strategic Priorities for 2025–2029

The investment frontier shifts from speculative hardware R&D to applied integration and licensing infrastructure. Early exposure to compiler patents, hybrid orchestration layers, and trade‑secret exchange networks will outperform standalone hardware bets. Partnerships structured around reciprocal data access and regulatory transparency offer the highest durability of returns. Investors who treat infrastructure guardianship—secure routing, cooling, and quantum‑ready servers—as a low‑risk utility play will gain steady yield as compute demand multiplies.

Capital now functions as the fourth form of governance in the compute order. The same coherence metrics that define technical success—alignment, integrity, and foresight—apply to capital deployment. Those who understand where trust, rights, and throughput intersect will not just invest in quantum computing; they will own the operating fabric of the next economy.

VII. Conclusion

Summary and Outlook

The journey from Vision Statements I through IV traces the evolution of MindCast AI’s foresight on the fusion of quantum computing and artificial intelligence. Vision Statement IV establishes the foundation of Quantum Compute Sovereignty—where patents, trade secrets, and trusted pipelines define the new equilibrium of power. Integration IP, transparency in collaboration, and governance alignment will shape not only commercial outcomes but the moral architecture of the digital economy.

Quantum computing will not arrive as a single breakthrough but as a cascade of licensed relationships, each demanding foresight and ethical design. Companies that treat innovation as a cooperative discipline will maintain stability and public trust; those that guard it as monopoly will find themselves isolated in a networked age. MindCast AI’s CDT simulations reveal that foresight integrity is measurable, and that coherent ecosystems outperform fragmented innovation cycles.

As the global infrastructure reconfigures, the guiding principle remains constant: coherence creates sovereignty. The institutions and investors who uphold coherence across patents, partnerships, and policy will anchor the era that follows.