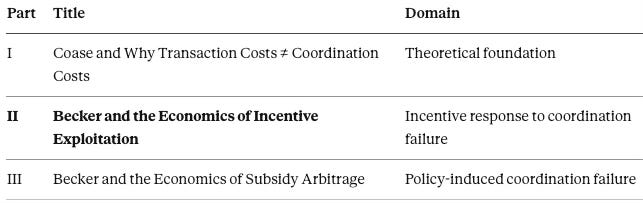

MCAI Economics Vision: The Chicago School Accelerated Part II, Becker and the Economics of Incentive Exploitation

Incentives After Coordination Collapse: Compass and the Economics of Litigation Driven Market Control

The MindCast AI Chicago School Accelerated series modernizes the Chicago School of Law and Economics with the integration of behavioral economics. We refer to the synthesized framework as the Chicago School of Law and Behavioral Economics. See Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics, Why Coase, Becker, and Posner Form a Single Analytical System (December 2025):

Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs

The Chicago School Accelerated Part II, Becker and the Economics of Incentive Exploitation

The Chicago School Accelerated Part III, Posner and the Economics of Efficient Liability Allocation

The Chicago School Accelerated Series Context

Chicago School Accelerated is MindCast AI’s theoretical framework series incorporating behavioral economics into the Chicago School of Law and Economics. The Chicago tradition— Ronald Coase on transaction costs, Gary Becker on incentive response, Richard Posner on common law efficiency—correctly identified that incentive architecture is determinative. Behavioral economics—Kahneman and Tversky on cognitive constraints, Thaler on bounded rationality, Schelling on focal points—specifies when and how incentives translate into outcomes.

The synthesis between Chicago School Law and Economics and behavioral economics (the Chicago School of Law and Behavioral Economics) reveals coordination costs as analytically distinct from transaction costs: Coase assumed parties could coordinate toward efficient equilibria; behavioral economics specifies when cognitive constraints, focal point failures, and trust deficits prevent coordination even at zero transaction cost. The result is predictive modeling that neither tradition achieves alone.

Part II assumes familiarity with Part I’s core insight: incorporating behavioral economics into Coasean analysis reveals that transaction costs and coordination costs are dimensionally independent. Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs (December 2025). Transaction costs measure friction within bargaining; coordination costs measure whether bargaining can engage at all. The Compass litigation complex provides the empirical proof case for the Beckerian extension.

I. Executive Summary

Controlling Insight. Once coordination constraints weaken, rational actors stop competing primarily on price or output and instead maximize expected value by exploiting opacity, delay, and fragmentation. Incentive exploitation becomes the dominant strategy, not a deviation.

Beckerian Definition (Platform Era). Beckerian economics explains behavior as a function of payoffs, not intentions. In modern, multi-institution markets, weakened coordination capacity reshapes the payoff matrix so that opacity, litigation leverage, and routing control dominate efficiency competition. Exploitation follows predictably from incentives.

Causal Mechanism. Degraded coordination lowers detection probability, discounts expected penalties through enforcement lag, and converts selective disclosure into surplus capture. Individually rational responses aggregate into collective coordination failure—a Beckerian tragedy of the commons in which no single actor bears the full cost of degradation.

Forward Implication. Absent payoff realignment, incentive exploitation is not a risk—it is the equilibrium. Markets converge toward higher search costs, opacity rents, and platform substitution unless institutions realign payoffs through joint evaluation and narrow protection for coordination-preserving governance.

Headline Prediction. Rational actors will keep attacking coordination architecture until institutions either raise the expected penalty through joint evaluation or remove the payoff via a safe harbor that immunizes coordination-preserving governance and routing from forced degradation.

Roadmap.

Section II establishes the analytical transition from Coase to Becker, grounding both in the behavioral economics synthesis.

Section III extends Becker’s classical framework to platform-era dynamics where coordination capacity itself becomes contestable.

Section IV presents the Cognitive Digital Twin methodology that operationalizes Beckerian predictions into measurable outputs.

Section V applies the framework to the Compass litigation complex as proof case.

Section VI synthesizes firm-level findings into system-level dynamics—the Beckerian tragedy of the commons.

Section VII bridges to Part III (Posner) and identifies where the framework generalizes beyond real estate.

Insight: Incentive exploitation is not a market failure requiring correction; under degraded coordination, it is the market working exactly as Becker predicts.

II. From Coase to Becker: The Analytical Transition

Part II builds directly on Part I, advancing from coordination architecture to incentive dynamics. The transition is analytical rather than factual—the same market actors and institutions persist; only the explanatory model advances. Becker does not replace Coase but extends him, modeling what happens after coordination fails.

II.A. What Coase Established

Part I demonstrated what happens when behavioral economics is incorporated into Coasean analysis: coordination costs emerge as analytically distinct from transaction costs. The synthesis established the precondition for efficient market outcomes—durable coordination capacity anchored in three interdependent mechanisms derived from behavioral economics. These mechanisms—focal-point availability (Schelling), trust density (behavioral game theory), and information completeness (bounded rationality constraints)—constitute the architecture on which efficient bargaining depends.

Focal-Point Availability. Markets require shared reference points where dispersed participants converge. Schelling’s focal point theory explains why: absent common knowledge structures, parties cannot coordinate even when coordination would benefit all. In residential real estate, the Multiple Listing Service (MLS) functions as this focal point—a common knowledge structure enabling buyers, sellers, and intermediaries to find each other without bilateral search.

Trust Density. Coordination requires that participants trust the information architecture. Behavioral economics demonstrates that trust is not binary but gradient—when inventory completeness becomes uncertain, participants discount the reliability of market signals and hedge through private channels.

Information Completeness. Efficient matching depends on comprehensive visibility. Bounded rationality means participants cannot search exhaustively; they rely on coordination infrastructure to reduce cognitive load. Selective disclosure fragments the market into informed and uninformed segments, degrading match quality and enabling surplus extraction.

The Coase analysis demonstrated that the Compass litigation complex represents a deliberate degradation of all three mechanisms. Private Exclusives fragment the focal point. Multi-forum litigation erodes trust. Selective disclosure destroys completeness.

The result: bargaining cannot converge on efficient outcomes regardless of transaction costs. Part I thus established the why of coordination failure; Part II addresses the what next.

II.B. Where Coase Ends

Coase’s analytical contribution explains why efficiency fails when coordination architecture degrades. However, the Problem of Social Cost does not model adaptive behavior once coordination failure becomes the operating environment. This limitation defines the boundary between Coasean and Beckerian analysis.

The Problem of Social Cost assumes that parties either bargain to efficiency (when costs permit) or fail to do so (when costs prohibit). It does not explain how rational actors behave in the post-failure environment. Do they attempt to restore coordination? Do they exit the market? Do they exploit the chaos?

Coase’s framework cannot answer these questions because it treats coordination architecture as exogenous—a background condition against which bargaining occurs. The Compass case demonstrates that coordination architecture is endogenous—a competitive variable that actors can degrade for strategic advantage.

Here Coase ends and Becker begins. The Beckerian question is not whether coordination fails, but what rational actors do once it has.

II.C. What Becker Adds

Gary Becker extended rational-choice analysis to domains previously considered beyond economic modeling: crime, discrimination, family structure, addiction. The Beckerian insight is that behavior responds to incentive gradients regardless of domain, moral valence, or social expectation. Actors maximize expected utility given constraints; when constraints change, behavior changes predictably.

Applied to coordination failure, Becker generates a specific prediction: once coordination architecture weakens, the payoff matrix shifts such that exploitation dominates efficiency competition. Actors who previously competed on price and quality now compete on opacity, delay, and platform control—not because they are bad actors, but because the incentive gradient points toward extraction. The Beckerian model does not require malice or strategic genius; it requires only rational response to altered payoffs.

The Becker Question. How do rational actors maximize expected value once coordination signals weaken?

The Becker Question organizes Part II. The proof case tests whether observed conduct matches Beckerian predictions. The system-level synthesis models how individual responses aggregate to collective outcomes.

II.D. The Compass Case as Beckerian Laboratory

The Compass litigation complex provides an empirical test of the Beckerian prediction. If Becker is correct, Compass’s conduct should emerge as incentive-consistent behavior rather than anomalous aggression. The CDT analysis tests this hypothesis by measuring behavioral drift, incentive alignment, and adaptation velocity.

If Becker is correct, Compass should exhibit:

High Behavioral Drift Factor (deviation from price/output competition toward rent extraction)

Low Incentive Alignment Index (divergence between stated rationales and payoff reality)

High Institutional Update Velocity (rapid adaptation to exploit coordination weakness)

As documented in Section V, the Cognitive Digital Twin (CDT) analysis confirms all three predictions. Compass is not an outlier; it is the rational response to a post-coordination environment.

The Compass case thus serves as a Beckerian laboratory—a controlled environment for testing the incentive-exploitation prediction against observable conduct. The findings generalize beyond real estate to any market exhibiting coordination-dependent efficiency.

Insight: The Coase-to-Becker transition is not a change in subject matter but a change in analytical lens—from architecture to adaptation, from structure to behavior.

Contact mcai@mindcast-ai.com to partner with us on law and behavioral economics foresight simulations. See the MindCast AI verticals in Law | Economics, Markets | Technology and Complex Litigation.

III. Becker’s Framework: Incentive Economics in the Platform Era

Becker’s economics of incentive response is the second pillar of Chicago School analysis. Incorporating behavioral economics into Beckerian analysis reveals how coordination constraints—the focal points, trust gradients, and information architectures identified in Part I—shape the payoff matrices that drive firm behavior. The classical Beckerian model assumed stable constraints; behavioral economics specifies when and how constraints become contestable. Understanding these extensions is necessary for interpreting the CDT metrics and proof case that follow.

III.A. The Classical Beckerian Model

Becker’s foundational insight has traditionally been applied to individual decision-making, modeling behavior as a function of expected benefits and costs. The economics of crime provides the canonical example, but the logic extends to any domain where actors face choice under incentive constraints.

The economics of crime models criminal conduct as a function of expected benefits, probability of detection, and severity of punishment. Actors commit crimes when expected utility exceeds expected penalty. Reducing crime requires either reducing benefits or increasing expected costs. The optimal deterrence literature extends this insight to institutional design: when detection probability is low and sanctions are delayed, exploiting a shared resource becomes individually rational regardless of social harm. Institutions seeking to prevent exploitation must recalibrate payoffs—raising expected penalties or reducing expected gains—rather than relying on exhortation or assumed good faith.

The same logic applies to firm behavior, institutional strategy, and multi-actor market dynamics. Firms do not pursue strategies because they are “good” or “bad”; they pursue strategies that maximize expected returns given the payoff structure they face. When coordination architecture is intact, efficiency competition maximizes returns. When coordination architecture degrades, rent extraction maximizes returns.

The classical Beckerian model assumes a stable constraint environment within which actors optimize. Platform markets challenge this assumption by making constraint architecture itself contestable.

Methodological Note. Becker provides a first-order model, not a complete account. The framework has documented limits in handling elite corporate misconduct where detection probabilities and sanction levels remain deeply uncertain. Heterogeneity in firm culture, risk aversion, and reputational sensitivity means some actors resist exploitation even when expected monetary payoffs favor it. The analysis that follows treats Becker as establishing the directional pull of incentives—the attractor toward which behavior tends—while acknowledging that individual firms may deviate based on factors the model does not capture. The prediction is structural, not mechanical.

III.B. Platform-Era Extensions

Four extensions adapt the classical model to platform-era dynamics. Each transforms a traditionally stable market feature into a contestable variable.

Coordination as Constraint. In traditional markets, coordination architecture is assumed—prices clear, information flows, matching occurs. The Beckerian model takes this architecture as a fixed constraint within which actors optimize. But in platform markets, coordination architecture is contestable. Actors can invest in degrading competitors’ coordination capacity rather than improving their own efficiency.

Opacity as Asset. When coordination degrades, information asymmetry becomes monetizable. The actor who controls visibility—who decides what information reaches which participants—captures rents that were previously competed away. Opacity is not a market failure to be corrected; it is an asset to be acquired.

Litigation as Instrument. In a high-coordination environment, litigation is a remedial mechanism—a way to correct deviations from agreed rules. In a low-coordination environment, litigation becomes a strategic instrument. Filing costs are fixed; potential payoffs scale with market disruption. Multi-forum strategies disperse risk while inflating defenders’ information costs.

Platform Substitution. Proprietary platforms gain value when shared coordination fails. If the MLS fragments, participants need alternative matching mechanisms. The platform that controls the substitute captures the coordination rents that were previously distributed. Platform power is endogenous to coordination breakdown.

The platform-era extensions position the Beckerian framework for modern application. Actors optimize not only within constraints but over the constraint environment itself.

Doctrinal Grounding. These extensions connect to established antitrust analysis. Courts and agencies have long treated information control, data access, and routing as competitive variables in platform markets. Essential facilities doctrine, refusal-to-deal analysis, and recent platform gatekeeping enforcement all recognize that controlling visibility can foreclose competition as effectively as controlling physical assets. The “opacity rents” and “platform substitution” concepts extend this recognition to coordination architecture: degrading shared information infrastructure is analytically equivalent to foreclosing access to an essential input. The framework is an application of familiar competition principles, not a departure from them.

III.C. The Incentive Shock Model

Coordination capacity functions as a shared constraint that disciplines behavior. The incentive shock model explains how constraint degradation triggers a phase transition in the payoff matrix, converting efficiency competition into rent extraction.

Mechanism.

Transparency → Optionality. Under high coordination, transparency is costless and expected. Disclosure is the default; withholding requires justification. Under low coordination, transparency becomes optional. Actors can choose what to reveal, when to reveal it, and to whom. This optionality is valuable—it enables price discrimination, timing arbitrage, and information-based negotiation leverage.

Reciprocity → Arbitrage. Under high coordination, reciprocity norms discipline behavior. Actors contribute to shared infrastructure because they benefit from others’ contributions. Defection triggers retaliation; cooperation sustains equilibrium. Under low coordination, reciprocity norms weaken. Actors can exploit others’ contributions without reciprocating—vest-pocketing inventory while benefiting from others’ listings, for instance. The payoff to defection rises while the cost of defection falls.

Governance → Attack Surface. Under high coordination, governance mechanisms enforce contribution requirements and disclosure standards. Mandatory submission rules, routing requirements, and data-sharing obligations maintain the coordination architecture. Under low coordination, governance mechanisms become attack surfaces. Litigation challenging governance rules is not primarily about the rules themselves; it is about weakening the coordination constraint that disciplines exploitative behavior.

The incentive shock model predicts that coordination degradation triggers a phase transition in firm behavior. Efficiency competition gives way to rent extraction—not gradually, but at a threshold where the payoff to exploitation exceeds the payoff to cooperation.

Insight: The incentive shock is not an external event but an endogenous market dynamic—actors who degrade coordination create the conditions that make exploitation rational.

IV. Vision Function Methodology

MindCast AI’s Cognitive Digital Twin (CDT) methodology operationalizes the Beckerian framework through structured analytical flows. The methodology translates theoretical predictions into measurable outputs, enabling empirical testing of the incentive-exploitation hypothesis. Each Vision Function models a specific dimension of incentive-behavior dynamics; together, they generate the measurements that evaluate actor conduct.

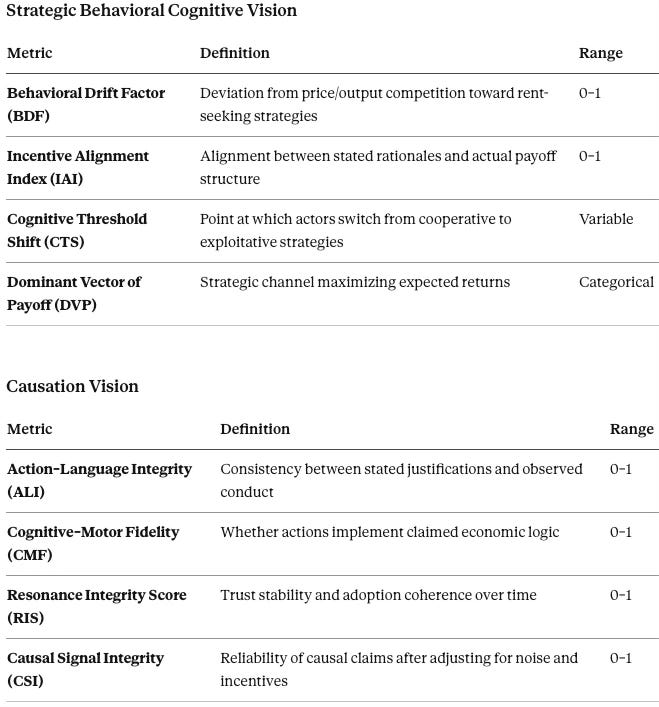

IV.A. Primary Flow: Strategic Behavioral Cognitive Vision

Strategic Behavioral Coordination (SBC) Vision models how incentives translate into observable behavior once institutional constraints weaken. It is the primary analytical flow for Part II, generating the metrics that track deviation from efficiency competition toward exploitation.

Key Outputs:

Behavioral Drift Factor (BDF): Measures deviation from price- and output-based competition toward rent-seeking strategies (opacity, litigation, routing control). Range: 0–1, where higher values indicate greater drift toward exploitation.

Incentive Alignment Index (IAI): Measures alignment between stated procompetitive rationales and the actual payoff structure facing the actor. Low IAI indicates that stated justifications diverge from incentive reality—a marker of pretextual positioning.

Cognitive Threshold Shift (CTS): Identifies the point at which actors switch from cooperative to exploitative strategies. The threshold depends on coordination integrity; as coordination degrades, the threshold for exploitation falls.

Dominant Vector of Payoff (DVP): Identifies which strategic channel maximizes expected returns for a given actor under current conditions. The four primary vectors are market competition, litigation, opacity, and platform leverage.

Strategic Behavioral Coordination (SBC) Vision outputs form the core of the proof case analysis. High BDF combined with low IAI indicates Beckerian exploitation; low BDF combined with high IAI indicates coordination-preserving behavior.

IV.B. Causal Validation: Causation Vision with Signal Integrity Gating

Causation Vision tests whether claimed causal links between conduct and welfare outcomes are trustworthy or pretextual. The Causal Signal Integrity (CSI) score functions as a gating mechanism, filtering actors whose stated rationales lack credibility.

Key Outputs:

Action–Language Integrity (ALI): Consistency between stated justifications and observed conduct.

Cognitive–Motor Fidelity (CMF): Whether actions actually implement the claimed economic logic.

Resonance Integrity Score (RIS): Trust stability and adoption coherence over time.

Causal Signal Integrity (CSI): Composite measure evaluating the reliability of causal claims after adjusting for noise, incentives, and disclosure timing. Threshold for credibility: CSI ≥ 0.50.

Actors failing CSI review have their stated rationales discounted in subsequent analysis. This gating function prevents the analytical framework from crediting pretextual justifications.

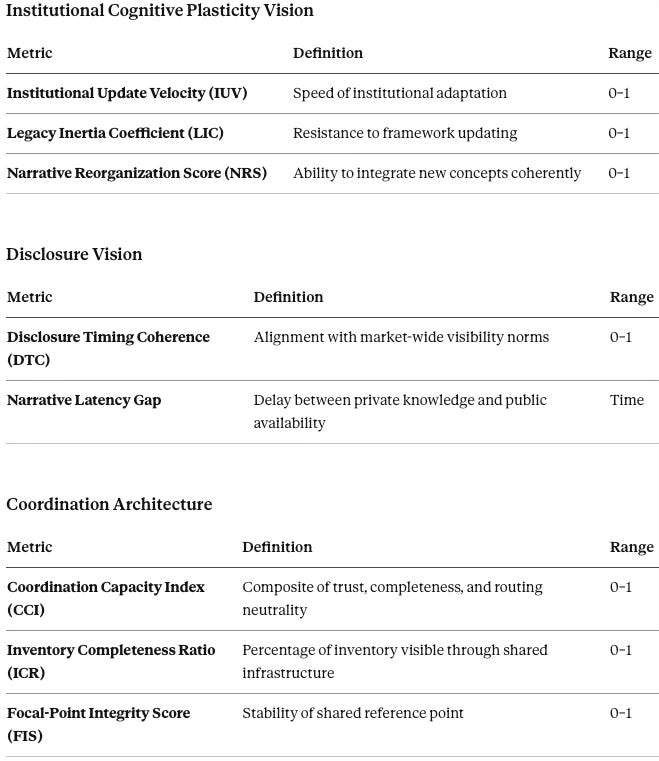

IV.C. Institutional Timing: Institutional Cognitive Plasticity Vision

Institutional Cognitive Plasticity (ICP) Vision evaluates how quickly institutions update their analytical and enforcement frameworks in response to new incentive structures. Institutions with low plasticity create exploitation windows; institutions with high plasticity close them.

Key Outputs:

Institutional Update Velocity (IUV): Speed at which an institution adapts its decision framework.

Legacy Inertia Coefficient (LIC): Degree to which past doctrine or practice resists updating.

Narrative Reorganization Score (NRS): Ability to integrate new economic concepts without internal incoherence.

Institutional Cognitive Plasticity (ICP) Vision explains differential adaptation rates across actors. Exploiting firms update fast; governance institutions update slowly; the gap creates exploitation windows.

IV.D. Mechanism Layer: Disclosure Vision

Disclosure Vision evaluates how information timing and selective visibility affect market welfare. It operates as a supporting flow, providing mechanism-level detail for SBC and Causation findings.

Key Outputs:

Disclosure Timing Coherence (DTC): Alignment between disclosure timing and market-wide visibility norms.

Narrative Latency Gap: Delay between private knowledge and public availability.

Disclosure Vision operationalizes the transparency-to-optionality transition identified in the incentive shock model. Low DTC indicates that an actor treats disclosure as strategic rather than normative.

The CDT stack translates Beckerian theory into measurable outputs. The proof case analysis applies these measurements to test the incentive-exploitation hypothesis.

Insight: The CDT methodology does not impose normative judgments; it measures alignment between stated rationales and observed conduct, letting the data reveal whether exploitation is occurring.

V. The Compass Proof Case

The Compass litigation complex provides the empirical test of the Beckerian prediction. If the incentive-exploitation hypothesis is correct, Compass should exhibit high behavioral drift, low incentive alignment, and rapid adaptation to exploit coordination weakness. The CDT analysis confirms all three predictions. The analysis below illustrates the Beckerian framework; it does not define it.

Strategic Context

Compass operates in a coordination environment weakened by industry-wide disruption. The NAR settlement restructured commission arrangements, creating uncertainty about traditional revenue flows. Portal competition intensified as Zillow, Redfin, and others expanded direct consumer engagement. Regional MLS systems faced governance challenges as national players sought to bypass local coordination mechanisms.

In this environment, coordination architecture became contestable. The firm that moved first to exploit coordination weakness would capture rents unavailable to firms that continued competing on efficiency. Compass moved first.

The multi-forum litigation strategy reflects calculated exploitation of adjudication lag. By filing in Seattle (NWMLS) and New York (Zillow) simultaneously, Compass fragments judicial visibility into what is functionally a unified strategy. Each court sees a discrete dispute; neither court evaluates cross-case interdependence. The fragmentation is not incidental—it is the strategy.

Private Exclusives convert market information into proprietary advantage. Properties marketed through Private Exclusive channels remain invisible to the broader market during an exclusivity window. Compass captures information rents during this window—the 2.9% price premium identified in litigation represents wealth transfer from buyers who cannot see inventory to sellers (and Compass) who control visibility. When the exclusivity window closes and properties reach the MLS, Compass has already extracted the information premium.

Platform routing demands extend the strategy. Compass seeks remedies that would compel aggregators to display Private Exclusive inventory without MLS-first submission requirements. If successful, Compass would capture coordination infrastructure it helped degrade—forcing platforms to transmit inventory while preserving Compass’s ability to withhold that inventory from competitors.

Interpretation

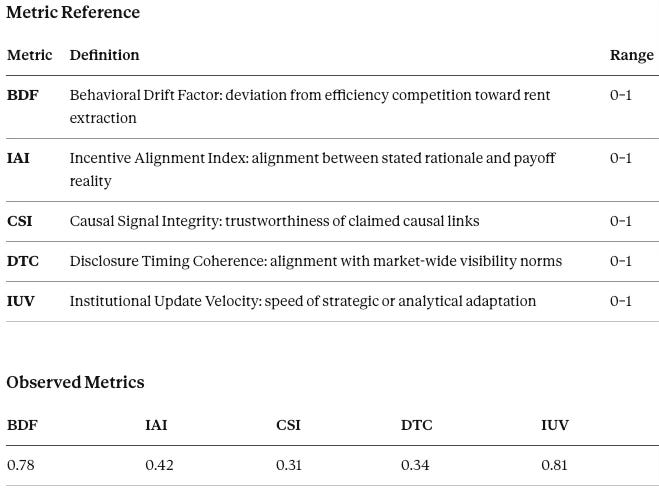

Compass exhibits extreme behavioral drift toward incentive exploitation (BDF 0.78). The firm has moved substantially away from price/output competition toward opacity-based rent extraction, litigation leverage, and platform routing demands.

Low Incentive Alignment (IAI 0.42) indicates that stated procompetitive rationales—”seller choice,” “consumer flexibility,” “innovation”—diverge materially from the actual payoff structure driving Compass’s conduct. The firm’s behavior optimizes for information asymmetry and coordination degradation, not consumer welfare.

Causal Signal Integrity fails the gating threshold (CSI 0.31). Compass’s claimed causal links between its conduct and welfare outcomes lack credibility after adjusting for incentive gradients and disclosure timing. Courts and regulators should evaluate the firm’s litigation positions as strategic instruments rather than good-faith remedial claims.

Low Disclosure Timing Coherence (DTC 0.34) confirms that Compass treats inventory visibility as a strategic asset rather than a market norm. Private Exclusives, delayed MLS submission, and selective portal routing all reflect optimization around information asymmetry.

High Institutional Update Velocity (IUV 0.81) indicates that Compass adapts rapidly to exploit coordination weakness. The firm identified the coordination-degradation opportunity faster than governance institutions could respond, and has sustained strategic pressure across multiple forums.

Metric Mapping Example

Consider Compass’s pre-marketing campaigns combined with subsequent NWMLS litigation. The firm markets properties through Private Exclusive channels—capturing information rents during the exclusivity window—then files litigation challenging mandatory submission rules that would close the window. The pre-marketing behavior generates high BDF (deviation from price competition toward opacity-based rent extraction) while the delayed or selective MLS submission produces low DTC (misalignment with market-wide visibility norms). The litigation itself, framed as expanding “seller choice,” exhibits low IAI because the payoff structure reveals that the actual objective is preserving opacity rents, not consumer welfare. Observable conduct maps directly to metric values.

Beckerian Narrative

Compass’s conduct is incentive-consistent. Given a coordination architecture weakened by industry-wide disruption (NAR settlement, commission restructuring, portal competition), the firm faces a payoff matrix where opacity rents exceed efficiency returns. Multi-forum litigation inflates defenders’ costs while fragmenting judicial visibility into the unified strategy. Private Exclusives convert market information into proprietary advantage. Platform routing demands seek to capture coordination infrastructure that Compass helped degrade.

The conduct follows from payoff structure, not corporate culture. Becker predicts exactly this behavior when coordination constraints weaken.

The Payoff Matrix. Under intact coordination, Compass would maximize returns by competing on service quality, agent expertise, and transaction efficiency. Opacity offers no advantage because all inventory is visible; litigation offers no payoff because governance rules cannot be profitably challenged; platform capture offers no value because coordination infrastructure is distributed.

Under degraded coordination, the payoff matrix inverts. Opacity becomes profitable because controlling visibility enables price discrimination and timing arbitrage. Litigation becomes profitable because challenging governance rules creates uncertainty that advantages first-movers. Platform capture becomes profitable because the actor who controls routing captures coordination rents that were previously distributed.

Compass’s observed conduct—high BDF, low IAI, high IUV—reflects optimization over the degraded payoff matrix. The firm did not cause coordination weakness (industry disruption preceded Compass’s strategy), but the firm identified the exploitation opportunity faster than competitors and has sustained strategic pressure to prevent coordination restoration.

Multi-Forum Fragmentation. The litigation strategy deserves specific attention because it illustrates instrumental use of legal process. Filing in Seattle and New York simultaneously ensures that no single court perceives the unified strategy. Each court applies established doctrine to its assigned dispute. Each court issues remedies based on the record before it. The remedies may be internally coherent yet collectively harmful—compounding coordination degradation through well-intentioned but uncoordinated intervention.

The fragmentation is not incidental to the strategy; fragmentation is the strategy. Compass benefits from adjudication lag because harm accumulates before resolution. Compass benefits from procedural separation because cross-case visibility requires effort that procedural structure does not compel. Compass benefits from doctrinal inertia because courts default to familiar transaction-cost analysis that does not capture coordination dynamics.

The Beckerian model explains why this strategy succeeds: expected benefits (opacity rents, platform capture) exceed expected costs (litigation expense, reputational exposure) because detection probability (unified evaluation) is low and sanction timing (resolution) is delayed.

Registered Predictions

Compass continues multi-front litigation as long as adjudication lag keeps expected penalties low and fragmentation advantages high.

Compass seeks remedies forcing aggregation without routing discipline—compelling platforms to transmit Private Exclusive inventory without MLS-first requirements.

If Compass prevails in both NWMLS and Zillow cases, the “opacity institutionalized” pathway becomes the market default.

Settlement pressure intensifies as litigation costs accumulate for defendants; Compass benefits from asymmetric cost tolerance.

The Cooperation Counterfactual

If Becker is correct, the absence of exploitation should correlate with intact coordination constraints. The counterfactual illuminates the model’s predictive power.

Consider a firm facing the same market disruption—NAR settlement, portal competition, commission uncertainty—but operating under strong coordination constraints: mandatory disclosure enforced consistently, litigation against coordination-preserving rules dismissed promptly, and platform routing standards maintained uniformly.

Under these conditions, Becker predicts the firm would compete on efficiency rather than opacity. Price and service quality would dominate strategy because information asymmetry yields no advantage when coordination is intact. Litigation would be remedial rather than instrumental because challenging governance rules offers no payoff. The firm would contribute to shared infrastructure because defection offers no advantage when others can observe and retaliate.

The counterfactual is not hypothetical. Mainstream brokerages operating under stronger coordination constraints exhibit exactly this pattern—low BDF, high IAI, cooperation as dominant strategy. The contrast validates the model: behavior responds to incentive gradients, and intact coordination shapes gradients toward efficiency competition.

The Compass analysis confirms the Beckerian prediction. The firm’s conduct emerges from incentive gradients, not anomalous aggression. Compass is illustrative, not constitutive—any actor facing similar incentive gradients would behave similarly.

Insight: The proof case demonstrates that Beckerian exploitation is not a deviation from rational behavior but rational behavior under degraded coordination—the model predicts what actually occurs.

VI. System-Level Synthesis: Beckerian Tragedy of the Commons

The Compass proof case demonstrates incentive exploitation at the firm level. The system-level synthesis explains how individually rational strategies aggregate into collective coordination failure—the Beckerian tragedy of the commons. This aggregation dynamic is where the behavioral economics synthesis proves most powerful: it explains not just individual firm behavior but the emergent system properties that Chicago analysis alone cannot predict. Understanding this aggregation dynamic is essential for policy design.

VI.A. The Aggregation Problem

Individual rationality does not aggregate to collective welfare when coordination capacity is a shared resource. Each actor optimizes locally; local optimization produces collective harm.

The exploiting firm optimizes for opacity rents because fragmented forums and delayed enforcement raise expected returns. Multi-forum litigation is rational given adjudication lag; selective disclosure is rational given weak enforcement of completeness norms; platform routing demands are rational given coordination scarcity.

Governance institutions preserve rules to maintain completeness because system stability is their payoff. But preservation without adaptation creates vulnerability; exploiting actors move faster than governance responds.

Platforms defensively protect trust because user confidence drives demand-side engagement. But defensive posture cedes strategic initiative; platforms react to coordination degradation rather than preventing it.

Mainstream competitors maintain cooperation because, under intact coordination, efficiency competition pays. But cooperation conditional on others’ cooperation creates defection risk; once exploiting actors demonstrate that defection pays, cooperative actors face pressure to follow.

Courts adjudicate disputes as presented because procedural structure requires case-by-case evaluation. But case-by-case evaluation prevents visibility into coordinated strategies; procedural structure advantages fragmentation.

Each actor’s behavior is locally rational. Together, they produce collective failure.

VI.B. The Commons Structure

Coordination capacity is a shared resource exhibiting the structural features that generate tragedy-of-the-commons dynamics: non-excludability and a specific form of rivalrousness where exploitation by one degrades the resource for all.

No single actor bears the full cost of coordination degradation. The exploiting firm captures opacity rents while dispersing search-cost increases across all buyers. The wealth transfer is real—but the exploiting firm does not compensate those harmed by its strategy.

The externality structure is the Beckerian signature. Rational actors exploit commons when private benefits exceed private costs, even when social costs exceed social benefits. Preventing commons tragedies requires either privatizing the commons (infeasible for coordination capacity) or imposing collective constraints that realign private incentives with social welfare.

The commons structure explains why market correction does not occur spontaneously. No individual actor has incentive to restore coordination unilaterally; restoration is a public good that suffers from free-rider problems. Even actors who prefer cooperation cannot restore coordination without assurance that competitors will cooperate as well. The assurance problem requires institutional resolution.

VI.C. Institutional Asymmetries

Institutions respond to coordination degradation at different velocities, creating exploitation windows that strategic actors can identify and target.

Courts exhibit slow adaptation (IUV ~0.58). Federal district courts in real estate litigation have treated MLS rules, broker data-sharing agreements, and portal access as competition-relevant variables, applying standard horizontal-restraint and vertical-foreclosure analysis. What courts have not yet done is systematically integrate coordination-cost concepts—recognizing that rules preserving inventory completeness may be procompetitive precisely because they maintain coordination capacity. Courts require litigant-supplied frameworks to update doctrine; absent explicit coordination-cost analysis in briefing, judicial reasoning defaults to transaction-cost intuitions.

Agencies exhibit faster adaptation (IUV ~0.75). DOJ has focused on platform gatekeeping, information asymmetries, and coordination dynamics in digital markets—challenging mergers that would concentrate control over data flows and issuing policy statements treating visibility and routing as competitive levers. FTC has prioritized information asymmetry, algorithmic transparency, and data practices—areas where control over visibility directly affects competitive dynamics. The agencies’ enforcement posture is consistent with recognizing coordination capture as a pattern, even when individual courts see only single cases.

Exploiting firms exhibit fastest adaptation (IUV ~0.81). Compass identified the coordination-degradation opportunity faster than governance institutions could respond, and has sustained strategic pressure across multiple forums while institutions deliberate.

The differential creates exploitation windows. The window opens when exploiting firms identify the opportunity; the window closes when institutions respond effectively. The longer the window remains open, the more coordination degrades and the harder restoration becomes.

VI.D. The Phase Transition

The Beckerian model predicts a phase transition when coordination degradation crosses a threshold. Below the threshold, cooperation remains dominant; above the threshold, exploitation becomes dominant.

Threshold Markers:

Signal degradation: When market participants can no longer reliably distinguish credible claims from pretextual positioning, trust-based coordination becomes impossible.

Defection cascade: When mainstream actors begin adopting defensive exclusivity—not exploiting actors, but ordinary participants—the phase transition is underway.

Governance contestation: When litigation challenging coordination-preserving rules becomes routine rather than exceptional, governance institutions lose the stability assumption on which their authority rests.

Platform fragmentation: When portals segment display by verification status, creating tiered visibility markets, the unified focal point has already fractured.

The phase transition is discontinuous. Coordination capacity does not degrade linearly; it collapses at a threshold where the dominant strategy flips from cooperation to exploitation.

VI.E. Forward Implication

Without institutional intervention that realigns payoffs, the system converges on higher search costs, surplus transfer, and opacity as the stable outcome. Intervention requires either raising the expected penalty for exploitation (through joint evaluation and consistent enforcement) or removing the payoff (through safe harbors that immunize coordination-preserving governance from forced degradation).

Joint Evaluation. Courts evaluating related cases in isolation cannot perceive coordination-degrading strategies that span multiple forums. Joint evaluation—whether through consolidation, coordinated scheduling, or agency guidance—enables decision-makers to assess cumulative harm rather than discrete disputes. The coordination-cost framework provides the analytical vocabulary for joint evaluation; the question is whether institutions will adopt it.

Safe Harbor for Coordination-Preserving Governance. MLS mandatory submission rules, routing requirements, and disclosure timing standards all serve coordination-preserving functions. Litigation challenging these rules creates uncertainty that degrades coordination even before judicial resolution. A narrow safe harbor establishing that coordination-preserving governance is presumptively procompetitive would remove the payoff from strategic litigation while preserving challenges to genuinely anticompetitive rules.

Agency Guidance. DOJ and FTC can issue guidance clarifying that coordination capacity is a welfare-relevant variable in platform markets. Guidance would influence judicial reasoning, signal enforcement priorities, and provide focal points for private ordering. The agencies’ recent focus on platform gatekeeping and information asymmetry provides doctrinal foundation; explicit recognition of coordination costs would extend rather than depart from current trajectory.

Boundary Statement. The analysis does not turn on Compass, real estate, or litigation. The logic applies wherever coordination capacity constrains incentives—and wherever that constraint weakens. Platform markets, labor markets, financial markets, and information markets all exhibit coordination-dependent efficiency. The Beckerian tragedy generalizes.

Insight: The tragedy of the commons is not a metaphor for coordination failure; it is the structural explanation. Coordination capacity is a commons, and Beckerian actors will exploit it unless constraints prevent them.

VII. Bridge Forward

The bridge forward connects Part II’s proof case to Part III’s completion of the synthesis. Incorporating behavioral economics into Chicago School analysis reveals coordination costs as a general category—applicable wherever cognitive constraints, focal point failures, and trust deficits shape incentive response. The Beckerian framework generalizes beyond any single market to any domain where coordination constraints weaken.

VII.A. What Compass Demonstrates

The Compass litigation complex demonstrates that coordination-degrading strategies are Becker-rational under current conditions. The firm’s conduct emerges predictably from an incentive structure that rewards opacity over efficiency.

The finding generalizes. Any market exhibiting coordination-dependent efficiency faces the same vulnerability. Rational actors will attack coordination architecture when expected returns from fragmentation exceed expected returns from competition—unless institutional constraints realign incentives. The Compass case provides the proof; the framework stands independent of it.

VII.B. Where Becker Scales

The incentive dynamics identified in this analysis appear wherever coordination constraints weaken. The logic is portable across domains where the structural conditions for exploitation exist.

Conditions for Beckerian exploitation:

Subsidies reshape payoffs without altering productive capacity

Enforcement lag changes risk calculus

Fragmented oversight prevents unified evaluation

Information asymmetry enables rent extraction

The conditions describe platform markets, industrial policy regimes, labor markets, and financial markets. The framework applies wherever these conditions obtain.

Platform Markets. Digital platforms exhibit coordination-dependent efficiency: marketplaces match buyers and sellers, social networks coordinate communication, search engines coordinate information access. When platform coordination degrades—through data hoarding, algorithmic opacity, or interoperability refusal—the Beckerian dynamics replicate. Actors exploit information asymmetry, capture routing control, and use strategic litigation to preserve coordination advantages. The FTC’s platform enforcement and DOJ’s antitrust initiatives address symptoms of this pattern; the coordination-cost framework identifies the underlying dynamic.

Industrial Policy. Government subsidies reshape payoff matrices by reducing private costs while maintaining private benefits. When enforcement is fragmented across agencies, verification is delayed, and compliance narratives substitute for productive outcomes, rational actors optimize around the subsidy rather than the underlying productive activity. The CHIPS Act, Inflation Reduction Act, and related industrial policy initiatives create exactly these conditions—the Beckerian framework predicts firm and state behavior under subsidy-induced coordination degradation.

Labor Markets. Labor coordination depends on information completeness (job availability, wage rates, working conditions) and matching efficiency (workers to positions). When platforms intermediate labor markets, they can degrade coordination for rent extraction—capturing information rents through opacity, using algorithmic control to prevent worker coordination, and leveraging enforcement lag to maintain advantageous terms. Gig economy dynamics reflect Beckerian exploitation of labor-market coordination.

Financial Markets. Financial coordination depends on price discovery, information disclosure, and settlement infrastructure. When coordination degrades—through dark pools, payment-for-order-flow, or selective disclosure—Beckerian dynamics emerge. High-frequency trading strategies exploit millisecond coordination advantages. Meme stock dynamics reflect coordination collapse enabling manipulation. The framework applies wherever financial coordination constrains incentives.

VII.C. Transition to Part III

Chicago School Accelerated — Part III completes the synthesis by incorporating behavioral economics into Posnerian analysis. Where Part I addressed Coase (coordination costs) and Part II addressed Becker (incentive exploitation), Part III addresses Posner’s thesis that common law evolves toward efficient rules through litigation selection pressure.

The Posner Question. Posner argued that inefficient legal rules are litigated more frequently than efficient ones, creating evolutionary pressure toward efficiency. The mechanism assumes a “kind” learning environment: stable domains, clear feedback, repeated interactions where courts can learn from outcomes.

The Behavioral Economics Extension. Incorporating behavioral economics reveals that Posner’s mechanism operates only under specific conditions. In “wicked” environments—novel contexts, delayed feedback, adversarial signal manipulation—efficiency evolution stalls or reverses. The same cognitive constraints that generate coordination costs also prevent courts from learning which rules produce efficient outcomes.

Wicked Environment Markers:

Signal Calibration Time (SCT): When feedback delay exceeds institutional memory, courts cannot connect rules to outcomes

Narrative Misalignment Score (NMS): When competing interpretive frames prevent consensus on what efficiency means

Contract Elasticity Factor (CEF): When adaptation capacity cannot keep pace with environmental change

Test Cases. Part III applies the framework to legal domains where efficiency evolution faces structural barriers: emerging technology regulation (AI liability, platform governance), cross-jurisdictional coordination (where fragmentation prevents learning aggregation), and rapid-cycle commercial contexts (where litigation timelines exceed market cycles).

The Series Arc. Part I established that behavioral economics reveals coordination costs as distinct from transaction costs. Part II demonstrated that coordination failure reshapes incentive gradients toward exploitation. Part III will show that coordination failure also prevents the common law learning mechanism Posner identified—completing the synthesis of behavioral economics and Chicago School analysis.

Insight: The three Chicago pillars—Coase, Becker, Posner—all assume coordination capacity that behavioral economics reveals to be contingent. The synthesis does not reject Chicago; it specifies when Chicago predictions hold and when they fail.

VIII. Conclusion

Incorporating behavioral economics into Chicago School analysis transforms Becker’s incentive framework from descriptive economics into predictive science. The synthesis reveals that incentive exploitation is not anomalous behavior requiring special explanation—it is the rational response to coordination failure, predictable from first principles once behavioral constraints are specified.

What Part II Establishes. Becker correctly identified that behavior responds to incentive gradients. Behavioral economics specifies the coordination architecture—focal points, trust density, information completeness—that shapes those gradients. When coordination is intact, efficiency competition dominates. When coordination degrades, exploitation dominates. The transition is not gradual but discontinuous: a phase transition triggered when the payoff to defection exceeds the payoff to cooperation.

What Compass Proves. The Compass litigation complex validates the Beckerian prediction. The firm exhibits high Behavioral Drift Factor (0.78), low Incentive Alignment Index (0.42), and high Institutional Update Velocity (0.81)—exactly the metric profile the framework predicts for a rational actor exploiting coordination weakness. Compass is not an outlier; it is the proof case. Any actor facing similar incentive gradients would behave similarly.

What the Framework Enables. The CDT methodology translates Beckerian theory into measurable outputs with registered predictions and falsification criteria. Courts and agencies can apply the framework to distinguish coordination-preserving governance from anticompetitive restraint. Policy designers can identify intervention points where payoff realignment prevents exploitation cascades. The framework is not case-specific but theoretically general—applicable wherever coordination capacity constrains incentives.

The Updated Theorem. Rational actors will exploit coordination architecture when expected returns from fragmentation exceed expected returns from efficiency competition—unless institutional constraints realign payoffs through joint evaluation, safe harbors for coordination-preserving governance, or agency guidance that recognizes coordination capacity as welfare-relevant.

The problem of incentive exploitation is the problem of coordination design. Preventing exploitation requires not merely identifying bad actors but understanding the payoff structures that make exploitation rational. That understanding is what incorporating behavioral economics into Chicago School analysis provides.

Appendix: Metric Definitions

Note: A comprehensive CDT Metrics Reference document accompanies the Chicago School Accelerated series. Below are definitions for metrics used in Part II.

Chicago School Accelerated Series

Part I: Coase and Why Transaction Costs ≠ Coordination Costs

Part II: Becker and the Economics of Incentive Exploitation

Part III: Posner and the Efficiency Boundary Problem