MCAI National Innovation Vision: The Federal-State AI Infrastructure Collision

Validation of MindCast AI Foresight When Federalization Meets Federalism

Executive Framing

On December 26, 2025, The Wall Street Journal (States See a Federal Power Grab in Clash Over AI Data Centers) reported what MindCast AI had modeled thirty-nine days earlier: the Trump administration’s push for federal control over AI data center grid connections had triggered exactly the institutional collision the November 16, 2025 foresight simulation predicted—state regulators citing the 1935 Federal Power Act, litigation warnings from former Federal Energy Regulatory Commission (FERC) officials, and counter-coordination moves from states like Florida.

Prior MindCast AI study, AI Computing Is Now Federal Infrastructure (Nov 16, 2025), forecasted the impact of the Department of Energy’s October 23 directive: what institutions would be forced to do next once hyperscale AI load crossed the federal jurisdictional threshold. The core claim: when exponential demand collides with fragmented state-level governance, federal acceleration and state resistance emerge as structurally inevitable responses—not political choices.

December 2025 developments, as reported by the WSJ, confirmed the MindCast AI foresight simulation. As a follow-on publication, this foresight simulation evaluates what is validated, identifies what remains pending, and projects forward using conditional, falsifiable foresight simulation branches.

Contact mcai@mindcast-ai.com to partner with us on National Innovation and AI Market | Policy foresight simulations.

I. Scope, Method, and Validation Posture

The November 2025 MindCast AI publication AI Computing Is Now Federal Infrastructure was not an energy‑policy commentary. It was a forward‑looking foresight simulation that modeled the institutional response trajectory triggered by a discrete jurisdictional event: the U.S. Department of Energy’s October 23, 2025 Section 403 “Large Loads” directive. That directive formally reframed hyperscale AI load as an interstate reliability concern, placing it within the gravitational field of federal authority.

The study’s object was not the Department of Energy’s intent. The study’s object was what institutions would be forced to do next once that threshold was crossed. The core hypothesis was structural: when hyperscale load growth outpaces state‑level processing capacity and collides with interstate transmission constraints, federal acceleration and state resistance emerge as inevitable system responses, regardless of political preference.

The current publication adopts a strict validation posture. It does not revise the original thesis. It evaluates it.

Specifically, this update performs three functions. First, it restates the precise predictions made in November 2025, including timelines, actors, and conflict domains. Second, it records what has validated as of January 2026 using publicly observable institutional behavior. Third, it identifies what remains unvalidated and sets forward checkpoints using falsifiable conditions. All forward analysis is framed conditionally: if the November 16, 2025 model holds, the following outcomes should be observed.

II. Original Foresight Simulation Outputs (November 2025 Baseline)

The AI Computing Is Now Federal Infrastructure publication produced a bounded set of foresight-simulation outputs modeling institutional response trajectories under defined constraints.

A. Foundational Prediction

The foundational prediction, first articulated in July 2025 and reaffirmed in November, was that federal intervention would become structurally inevitable once interstate transmission constraints collided with hyperscale AI load growth at a pace state regulators could not process. The November update assigned this prediction a Causal Signal Integrity (CSI) score of 0.82, indicating a high likelihood that institutional response would converge on federal acceleration regardless of political friction.

B. Phase‑One Timeline Predictions

From that foundation, the study predicted a specific early‑phase sequence:

Federal rulemaking activation. Federal regulators would be directed to open a rulemaking on interconnection standards for large loads—defined functionally as loads exceeding approximately 20 megawatts—on an accelerated timeline.

Early state resistance. A state‑led legal challenge would emerge quickly, with California identified as the most likely lead plaintiff due to its regulatory structure, environmental review overlays, and historical posture on federal preemption.

Market repositioning. Hyperscalers would begin exploring nuclear and other firm‑power co‑location strategies to bypass interconnection queues and litigation risk.

Cost‑allocation conflict. Transmission cost responsibility would become the dominant economic fault line, particularly in PJM and MISO regions.

C. Federal–State Conflict Model

The study predicted that the first major legal confrontation would center on a narrow but decisive question: whether federal authority over interconnection processes preempts state authority over generation siting, distribution service, and environmental review under the Federal Power Act. The most likely venue was identified as the Ninth Circuit. The study forecast an 18–24 month uncertainty window if the rulemaking moved faster than courts could absorb.

The most likely outcome was not full federal preemption. It was procedural federalization: federal control over queue discipline, readiness requirements, and interconnection mechanics, with states retaining authority over siting and retail impacts.

D. Market and Geographic Predictions

The November publication further predicted a redistribution of advantage. Regions with cooperative utilities, firm‑power pipelines, and lower procedural friction—such as the Carolinas, the Upper Midwest, and parts of the Gulf Coast—would gain share of new hyperscale commitments. Regions with congestion, environmental overlays, and fragmented governance—California, the Pacific Northwest, and PJM East—would experience rising friction and slower deployment.

III. Validation Ledger (Status as of January 2026)

January 2026 reporting provides the first external validation layer for the November 2025 foresight simulation. The relevant question is not whether every predicted event has occurred. The question is whether institutional behavior is unfolding along the predicted axes.

A. Confirmed Validations

The primary external validation event for the November 2025 foresight simulation is December 26, 2025 reporting by The Wall Street Journal, which documents the exact federal–state conflict dynamics, accelerated timelines, and litigation risks forecast in the original study. This reporting serves as the first real‑world confirmation layer against which the foresight simulation can be evaluated.

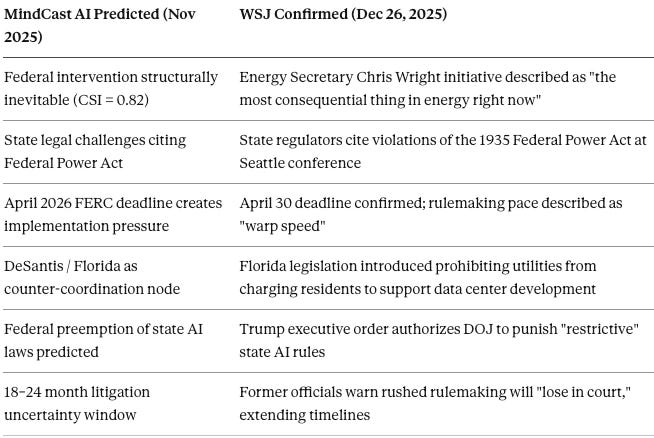

Foresight Simulation Outcome Validation Matrix (Nov 16, 2025 → Dec 26, 2025)

Lead Time: 39 days (November 16, 2025 publication → December 26, 2025 WSJ confirmation). Validation Rate: 6 of 6 institutional dynamics confirmed or actively materializing.

Result: All six institution-level predictions made on November 16, 2025 are independently corroborated by December 26, 2025 reporting or official action.

Several core elements have already validated.

First, federal acceleration is no longer theoretical. The Department of Energy’s directive to finalize a large‑load interconnection rule on an expedited timeline confirms the predicted move from analysis to execution.

Second, state regulators are invoking the Federal Power Act as anticipated. Public reporting documents state utility officials asserting that federal oversight of large‑load interconnection intrudes on the statute’s division of authority between federal and state regulators. That framing precisely matches the conflict domain modeled in November.

Third, litigation risk is being acknowledged by insiders, not critics. Warnings that rushed rulemaking could fail in court—and thereby delay AI infrastructure deployment rather than accelerate it—validate the predicted 18–24 month uncertainty window.

Fourth, state counter‑coordination is emerging beyond California. Florida’s legislative move to prohibit utilities from charging residents to support hyperscale data center development confirms the predicted spread of consumer‑protection framing as a state‑level response to federal acceleration.

Fifth, federal AI preemption posture is now explicit. Executive actions authorizing the Justice Department to challenge state AI laws deemed restrictive confirm that the interconnection fight sits within a broader federal effort to unify AI governance under national standards.

B. Live but Unvalidated Indicators

Several predictions remain live but unconfirmed. No major state has yet filed a formal challenge. No hyperscaler–nuclear campus partnership has been publicly announced. Transmission cost‑allocation disputes have not yet reached peak visibility. These items define the forward validation checkpoints addressed in subsequent sections.

C. Interim Assessment

At this stage, the November 16, 2025 model has validated on its core claim: once AI load crossed the federal jurisdictional threshold, the system produced accelerated federal action, state resistance grounded in statutory federalism, and early counter‑coordination behavior. The remaining question is not whether conflict exists. The remaining question is how it resolves, and where capital flows while it does.

D. What Remains Unvalidated (Tracking List)

The following items were explicitly forecast in the November 2025 study and remain pending validation. They define the forward foresight simulation checkpoints used in Sections V–VIII.

California‑led Ninth Circuit filing challenging federal interconnection authority.

First hyperscaler–nuclear campus partnership announcement.

PJM/MISO cost‑allocation escalation tied to large‑load interconnection.

Follow‑on DOE action targeting generation siting or critical capacity if supply constraints persist.

Geographic redistribution of hyperscale commitments, with corridor regions gaining share and high‑friction coastal regions contracting.

IV. Unified CSI Scoring Rubric (Methodological Reference)

To avoid ad hoc confidence claims, Part II applies a single CSI rubric across federal agencies, state actors, and corporations. Each CSI score reflects the structural likelihood that an actor will behave as predicted, not normative desirability.

CSI = (Structural Incentive Alignment + Jurisdictional Authority + Execution Capacity + Political Constraint Tolerance) ÷ 4

Each component is scored on a 0–1 scale.

Structural Incentive Alignment Does the actor’s institutional incentive structure push it toward the predicted behavior?

Jurisdictional Authority Does the actor plausibly possess the legal or formal authority required to act as predicted?

Execution Capacity Does the actor have the operational, financial, or administrative capacity to execute?

Political Constraint Tolerance Can the actor absorb backlash, litigation, or reputational cost without reversing course?

Interpretation Bands

0.80–1.00: Structurally inevitable absent exogenous shock

0.65–0.79: Likely, but sensitive to timing or coordination failures

0.50–0.64: Plausible but contingent

<0.50: Speculative or weakly supported

V. Forward foresight simulation Branches (2026–2028)

The forward-looking branches below follow directly from the validated premises established in Sections I–III. Each branch is conditional, not speculative, and diverges only on a small number of hinge variables: rule scope, court posture, cost allocation, and physical supply constraints.

The purpose of these branches is not to predict a single outcome. The purpose is to identify which institutional equilibria are reachable, under what conditions, and with what consequences for capital allocation and national AI capability.

Branch 1: Federal Interface Capture

CSI Range: 0.75–0.80

CSI Rationale The original November 2025 CSI of 0.82 measured structural inevitability—the likelihood that federal intervention would be triggered once hyperscale AI load crossed the interstate threshold. The lower CSI range here reflects execution risk, not a reversal of that inevitability. Implementation requires timely rule finalization, judicial survival, and interagency coordination, each of which introduces non-trivial variance. The adjusted range therefore captures the distinction between structural pressure to act and the probability that action successfully translates into durable process control.

Trigger Condition FERC finalizes the large-load interconnection rule by or near the April 30, 2026 deadline with durable authority over interconnection process—including queue discipline, readiness requirements, standardized studies, and enforceable obligations for large loads.

Controlling Insight If federal regulators successfully standardize the interface between hyperscale AI load and the interstate transmission system, they need not resolve every federalism dispute to materially reshape outcomes. Control over process is sufficient to redirect capital.

Causal Mechanism Standardized interconnection procedures reduce bespoke state-level negotiation costs and compress development timelines. Hyperscalers respond by internalizing flexibility—curtailment, dispatchability, and self-funded upgrades—as technical features rather than regulatory concessions. Capital flows toward jurisdictions where these standardized processes can be executed cleanly and quickly.

Predicted Observables

Large-load interconnection agreements increasingly resemble generator interconnection agreements in structure, deposits, and penalties.

Curtailable or dispatchable load becomes a default design assumption for new hyperscale campuses.

Private funding of network upgrades accelerates, reducing IOU rate-base leverage.

New hyperscale commitments cluster in jurisdictionally coherent corridors with firm-power pipelines (ERCOT, Southeast, Upper Midwest).

Implications Federal actors capture the grid interface. Private capital captures the build. States retain siting and environmental review authority but lose de facto veto power embedded in interconnection friction.

Falsification Checkpoint Branch 1 fails if the final rule is reduced to non-binding guidance, or if enforceable process standardization does not materialize within 60 days of finalization.

Branch 2: State Delay and Jurisdictional Fracture

CSI Range: 0.60–0.70

Trigger Condition One or more states secure injunctive relief, or the final rule overreaches into hybrid facility classification or cost allocation in a manner that invites early procedural defeat in court.

Controlling Insight States do not need to defeat federal authority outright. States only need to delay and narrow it to preserve bargaining power and maintain control over local impacts.

Causal Mechanism Litigation uncertainty reintroduces dual-track approval requirements. Developers face ambiguity over whether federal or state processes will ultimately govern project viability. Capital responds by avoiding contested jurisdictions and concentrating in legally clearer regions.

Predicted Observables

Parallel federal and state approval strategies emerge for the same projects.

Projects in litigation-exposed jurisdictions experience 12–18 month delays.

State legislatures adopt consumer-protection framing to block ratepayer subsidization of hyperscale infrastructure.

FERC narrows its posture on remand, preserving process standardization while conceding hybrid classification or cost allocation authority.

Implications AI infrastructure deployment continues, but geography fragments. The coordination tax rises in high-friction regions and is arbitraged away elsewhere.

Falsification Checkpoint Branch 2 weakens materially if no major state files suit within 120 days of final rule issuance.

Branch 3: Physics-Dominant Constraint

CSI Range: 0.80+

Trigger Condition Regardless of legal outcome, dispatchable generation, equipment supply, and skilled labor fail to scale at the pace implied by hyperscale AI demand.

Controlling Insight Procedural reform cannot manufacture electrons. Physical constraints ultimately dominate institutional design.

Causal Mechanism Even streamlined interconnection processes cannot overcome shortages of firm capacity, transformers, turbines, and trained labor. Reliability stress events convert abstract planning debates into emergency governance problems.

Predicted Observables

Regions without firm-power pipelines fail to realize gains from interconnection reform.

Natural gas remains the dominant bridge technology longer than public narratives acknowledge.

Grid stress events tied to AI load growth force ad hoc curtailments or emergency measures.

Federal authorities explore follow-on tools targeting generation siting and critical capacity.

Hyperscalers announce non-U.S. training campuses as strategic hedges.

Implications The limiting factor becomes supply, not jurisdiction. Institutional conflict recedes temporarily as reliability imperatives dominate.

Falsification Checkpoint Branch 3 weakens if AI load growth accelerates through 2027 without visible reliability stress or emergency intervention.

VI. The Most Likely Equilibrium: Partial Federalization with Persistent State Friction

The most probable outcome is not total federal consolidation or decisive state victory. It is a mixed equilibrium.

Controlling Insight Federal authorities are likely to win control over process, while states retain leverage over place and cost.

Causal Mechanism Federal standardization of interconnection mechanics creates a national baseline. State authority over siting, environmental review, and retail impacts continues to inject friction at the margins. Capital reallocates accordingly, favoring jurisdictions where the two layers align.

Predicted Structure of the Equilibrium

Federal agencies set the rules of engagement for large-load interconnection.

States shape outcomes through siting, cost allocation, and political resistance.

Markets route capital toward low-friction corridors and flexible infrastructure models.

Strategic Implication The United States does not lose the AI infrastructure race because of a single regulatory decision. It pays a coordination tax that other systems with unified command structures do not. Beijing’s ability to direct grid expansion, generation siting, and load allocation through centralized authority allows China to avoid this tax. The DOE–FERC intervention is an attempt to reduce the U.S. coordination penalty. If litigation fragments federal authority, that penalty increases precisely as the AI infrastructure race enters its decisive phase (2026–2030). The question is not whether the United States can build AI infrastructure. The question is whether it can build at the pace strategic competition requires.

The partial-federalization outcome reflects the Commerce Clause logic analyzed in AI, the Commerce Clause, and Federal Preemption (MindCast AI, 2025, https://www.mindcast-ai.com/p/aicommerceclause), which anticipated federal reliance on process control rather than direct siting authority.

VII. Actor-Specific Forward Forecasts (2026–2028)

The forward foresight simulation branches translate into actor-level behavior predictions below. Each forecast applies the unified CSI rubric and is expressed as a likelihood of observable action, not intent or preference. The purpose is to identify which actors can move the system rather than merely react to it.

A. Federal Actors

Federal Energy Regulatory Commission (FERC) Predicted Behavior: Finalizes a large-load interconnection rule by or near the April 30, 2026 deadline; asserts durable authority over interconnection process while narrowing hybrid facility classification to reduce litigation exposure. CSI: 0.78

Department of Energy (DOE) Predicted Behavior: Treats the interconnection rule as a first step; prepares follow-on intervention pathways if physical supply constraints persist, including renewed use of Section 403 authorities tied to generation criticality. CSI: 0.65

Department of Justice (DOJ) Predicted Behavior: Intervenes in litigation challenging federal authority, framing AI infrastructure as a national security and interstate commerce issue; coordinates with White House AI preemption efforts.CSI: 0.72

Congress Predicted Behavior: Avoids legislative intervention in 2026; begins exploratory hearings or draft language only if courts materially fracture federal authority by late 2026 or 2027. CSI: 0.58

B. State Actors

California (CPUC) Predicted Behavior: Leads or anchors a multi-state legal challenge asserting that federal interconnection authority improperly intrudes on state generation siting, environmental review, and distribution jurisdiction. CSI: 0.82

Texas (ERCOT) Predicted Behavior: Positions itself as a beneficiary of federal standardization; accelerates hyperscaler recruitment using speed, firm power, and regulatory clarity as advantages. CSI: 0.85

Florida Predicted Behavior: Advances consumer-protection legislation limiting ratepayer exposure to hyperscale infrastructure costs; becomes a template for other states seeking political cover while remaining growth-competitive. CSI:0.75

New York Predicted Behavior: Aligns with California in litigation while maintaining parallel negotiations to preserve optionality for AI investment under constrained conditions. CSI: 0.68

Carolinas (NC/SC) Predicted Behavior: Fully align with federal process reforms; cooperative utilities pursue nuclear and firm-power partnerships with hyperscalers. CSI: 0.80

C. Corporate Actors

Microsoft Predicted Behavior: First hyperscaler to announce a post-rule nuclear or firm-power co-location partnership; prioritizes behind-the-meter generation to reduce interconnection risk. CSI: 0.72

Google Predicted Behavior: Emphasizes flexibility-first architecture and selective interconnection exposure; limits dependence on congested regions. CSI: 0.70

Amazon Web Services (AWS) Predicted Behavior: Pursues geographic diversification to reduce regulatory concentration risk; reallocates growth away from high-friction coastal hubs. CSI: 0.75

Constellation Energy Predicted Behavior: Captures a disproportionate share of AI–nuclear partnerships due to fleet position and regulatory experience. CSI: 0.78

Investor-Owned Utilities (IOUs) Predicted Behavior: Experience margin pressure as self-funded network upgrades and behind-the-meter generation erode rate-base expansion opportunities. CSI: 0.65

VIII. Validation Scoreboard and Falsification Framework

Each item below represents a binary or bounded observable tied to the original November 2025 predictions and the forward foresight simulation branches. Failure to observe these outcomes within defined windows weakens the underlying model.

A. Near-Term Checkpoints (2026)

FERC Rule Finalization Checkpoint: Final rule issued by April 30, 2026 ± 60 days. Failure Condition: Missed deadline without court-ordered stay.

State Litigation Emergence Checkpoint: At least one major state files suit within 120 days of final rule issuance.Failure Condition: No coordinated legal challenge emerges.

Curtailable Load Adoption Checkpoint: Majority of new hyperscale announcements include explicit curtailment or dispatch provisions by Q4 2026. Failure Condition: Flexibility remains marginal or symbolic.

B. Medium-Term Checkpoints (2026–2027)

Geographic Redistribution Checkpoint: Jurisdictionally coherent corridors capture a majority of new >20 MW commitments announced in 2026–2027. Failure Condition: High-friction coastal regions retain dominant share.

Nuclear or Firm-Power Partnerships Checkpoint: At least one major hyperscaler–nuclear or equivalent firm-power partnership announced by Q4 2026. Failure Condition: No such partnerships materialize.

Cost-Allocation Conflict Visibility Checkpoint: PJM or MISO proceedings explicitly surface large-load cost allocation disputes by late 2026. Failure Condition: Cost allocation remains dormant.

C. Long-Term Checkpoints (2027–2028)

Reliability Stress Events Checkpoint: At least one publicly acknowledged grid stress or emergency curtailment linked to AI load growth. Failure Condition: Load grows without reliability incidents.

Follow-On Federal Action Checkpoint: DOE or Congress explores generation siting or capacity interventions tied to AI infrastructure. Failure Condition: No escalation despite persistent supply constraints.

International Hedging Checkpoint: Announcement of a major non-U.S. AI training campus as a strategic hedge.Failure Condition: All hyperscale expansion remains U.S.-centric.

D. Interpretation Rule

Validation is cumulative, not absolute. Partial confirmation across branches strengthens the core institutional thesis even if individual predictions fail.

E. Comprehensive Model Failure Condition

The November 2025 foresight simulation fails comprehensively if, by Q4 2026, all three of the following conditions are simultaneously observed:

Federal acceleration is reversed or indefinitely delayed without court-ordered injunction or adverse ruling.

No state mounts meaningful legal resistance to federal interconnection authority.

Capital allocation shows no geographic redistribution toward jurisdictionally coherent corridor regions.

The simultaneous absence of these dynamics would indicate that the model misread either institutional incentives or the binding physical constraints governing AI infrastructure deployment.