MCAI Innovation Vision: Cisco, the Critical Infrastructure of AI Infrastructure

Building the Power, Trust, and Network Spine of the AI Economy

MindCast AI created Cognitive Digital Twins to model Cisco as an evolving infrastructure leader, its hyperscaler, utility, and sovereign partners, and the broader AI ecosystem connecting power, compute, and regulation. The models show how decisions and innovations at each level drive energy efficiency, partnership formation, and market growth. Each section converts raw data and market evidence into predictive insights, linking Cisco’s technology strategy to economic, policy, and partnership outcomes.

I. Executive Summary — The Hidden Power Constraint of AI

AI growth collides with physics. Training and inference demand immense energy and bandwidth, turning power and interconnect into the new scarce resources of the digital economy. The next decade will be defined not by GPU ownership but by control over the flow of electrons and photons that power them.

Cisco sits at the center of this transformation. By uniting networking, energy management, and data-center design, Cisco provides the infrastructure backbone that allows AI to scale responsibly. The Silicon One P200 processor, 51.2 Tbps 8223 routing system, and modular UCS X-Series servers do more than advance technology—they create a distributed, power-aware nervous system for global intelligence.

The report forecasts Cisco’s emergence as the critical infrastructure provider of the AI economy, showing how its architecture converts energy constraints into competitive advantage. Subsequent sections outline the bottlenecks reshaping AI infrastructure, detail Cisco’s architectural breakthroughs, and highlight the rise of the energy-conscious edge. The analysis then explores emerging partnership archetypes—hyperscalers, utilities, and sovereigns—before modeling three potential futures for Cisco’s market dominance between 2026 and 2029.

Investors and partners should view Cisco as an active architect of AI’s physical foundation, not a legacy vendor. Aligning early with its energy-intelligent model offers control over bandwidth, resilience, and trust—the currencies of tomorrow’s AI economy. Cisco has positioned itself not to follow the AI boom but to determine how far and efficiently it can grow.

II. The Bottleneck Map — Power, Bandwidth, and Sovereignty

Cisco’s competitive moat rests on barriers that rivals struggle to cross. The company’s hardware and software already connect over 90% of enterprise data centers, making integration costs significantly lower than competitors can achieve. Two decades of trust with defense and financial institutions create vendor lock-in that new entrants cannot replicate quickly. Beyond scale, Cisco’s ability to coordinate networking, power, and security across thousands of distributed sites requires orchestration expertise and ecosystem relationships that Arista, Broadcom, or hyperscalers have yet to demonstrate. While Arista leads in AI datacenter switching with roughly 40% market share, its solutions lack integrated power orchestration and multi-site WAN fabric required for distributed AI clusters—capabilities Cisco uniquely combines.

Global data-center electricity demand could exceed 1,500 TWh by 2030, doubling in five years. Network backbones already consume 10% of global electricity. Latency, energy cost, and regulation now form a triple constraint that reshapes AI scalability.

Most competitors attack these problems vertically: bigger chips, denser racks, more cooling. Cisco works horizontally — integrating network, power distribution, and optical interconnect into a single adaptive system. Its 65% power-efficiency gain per Tbps gives the grid breathing room and lowers the marginal watt-per-AI-transaction cost by orders of magnitude.

Each additional dollar of AI compute now pulls an equal cost in energy and interconnect. Cisco’s horizontal architecture turns those costs into efficiencies, transforming a looming crisis into a moat. Investors and partners gain stronger margins, predictable returns, and reduced exposure to energy volatility. The shift redefines AI infrastructure valuation, rewarding systems that optimize power as well as compute.

Insight: Bandwidth and power no longer belong to separate industries; Cisco merged them.

Contact mcai@mindcast-ai.com to partner with us on AI market foresight simulations. See also MCAI Innovation Vision: The Quantum-Coupled AI Data Center Campus (2025–2035) (October 2025), Predictive Cognitive AI and the AI Infrastructure Ecosystem (Oct 2025), The Bottleneck Hierarchy in U.S. AI Data Centers (Aug 2025).

III. The Silicon–Power Nexus — Cisco’s Architectural Breakthrough

Cisco already connects over 90% of the world’s enterprise data centers, giving it a unique integration advantage competitors cannot easily duplicate. Its long-term vendor relationships across defense, finance, and public sectors create trust barriers that make replacement costly and slow. The company’s ability to coordinate networking, power, and security systems across thousands of global sites demonstrates integration complexity that few firms—if any—can manage at scale.

At its core, Silicon One P200—the first full-duplex 51.2 Tbps routing processor with deep on-die buffering—anchors Cisco’s new topology. Combined with AI-optimized optics and modular power delivery, it moves data as efficiently as electrons. The design enables distributed AI training to operate seamlessly across thousands of miles.

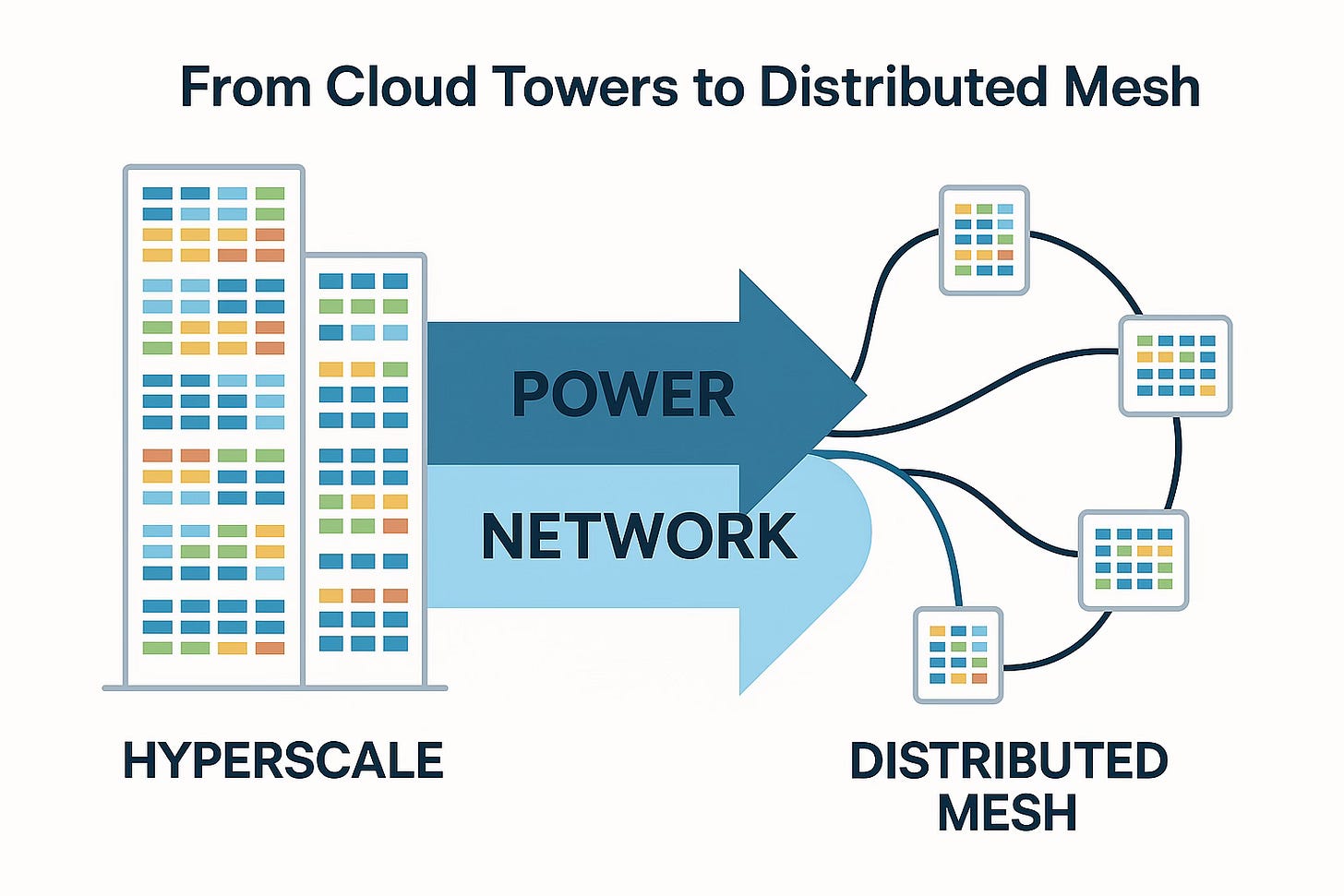

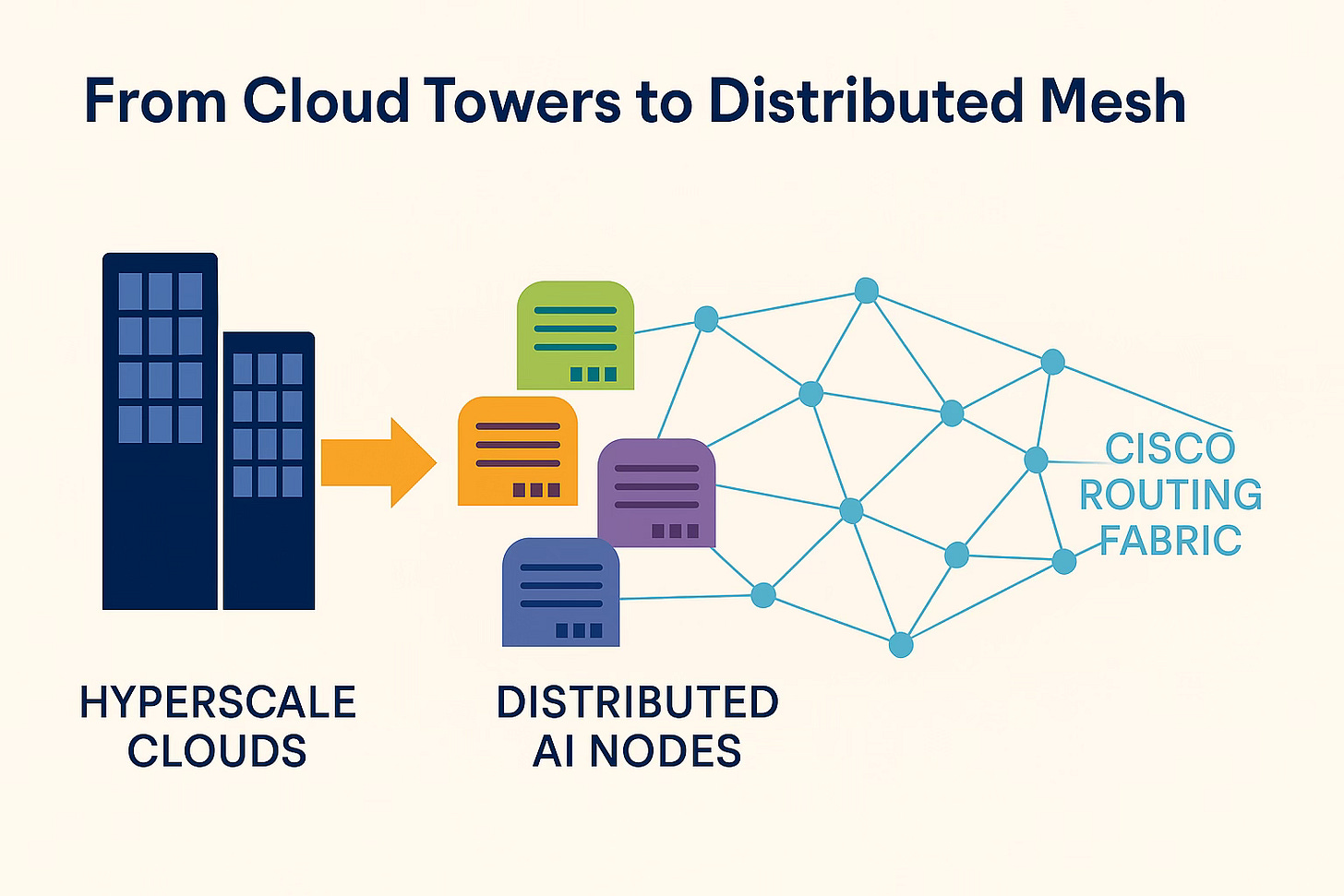

The “scale-across” capability changes how data centers are built. Operators can deploy regional clusters near renewable generation or cooling sources, connected by Cisco’s low-latency fabric. Physical and digital grids now converge, shifting from data-center to power-center.

While competitors chase chip density, Cisco built systemic coherence. It transforms geography into strategy, allowing AI compute to follow electrons rather than politics or real estate. The breakthrough opens immediate market opportunities as enterprises and hyperscalers redesign data centers for energy efficiency, generating near-term revenue through hardware refreshes and infrastructure partnerships. Cisco defines the frontier and positions itself for accelerated growth across the AI power economy.

Insight: Compute migrates to power; Cisco ensures it arrives synchronized.

IV. The AI-Ready Edge — Decentralization as Strategy

Edge computing unites Cisco’s strengths in networking and energy. Real-time inference, automation, and defense analytics require micro-latency and local autonomy. Cisco’s edge routers, UCS modules, and ThousandEyes telemetry equip small clusters to run as self-contained AI nodes tied to nearby microgrids.

Decentralization aligns with renewable localization and data-sovereignty policies. Each node operates as a secure, power-aware cell. Cisco’s design turns “edge” from logistics into resilience, creating performance and reliability advantages for partners and clients.

The edge is no longer peripheral; it forms the new operating surface of AI. Cisco’s infrastructure brings intelligence closer to power, users, and policy. Decentralization builds investor confidence by diversifying risk and boosting network resilience across revenue streams. Localized deployments attract utilities, telecoms, and industry partners. For Cisco, the edge strategy drives compounding growth built on trust and durable demand.

Insight: In Cisco’s design, the edge is not an endpoint—it’s a distributed origin of intelligence.

V. Partner Gravity Forecast — Where the Alliances Form

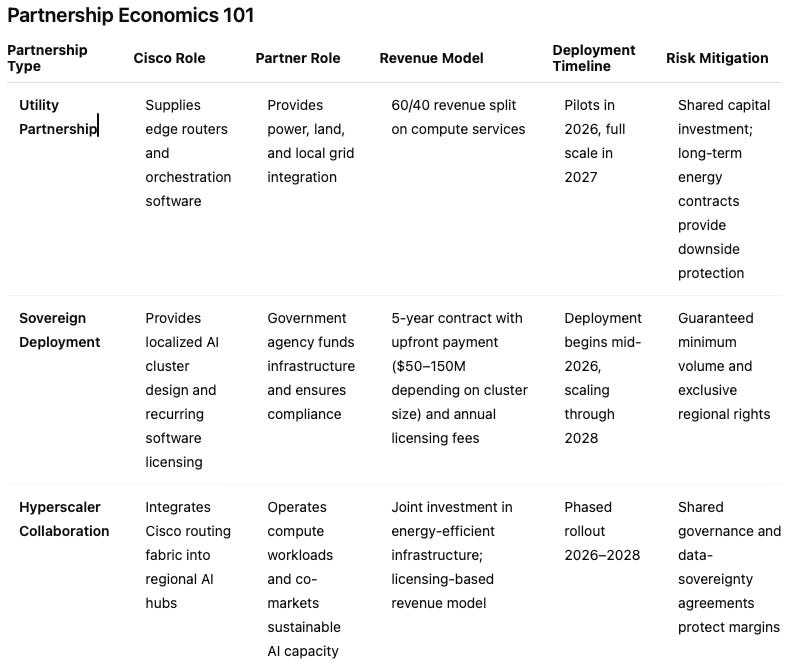

Cisco’s expanding infrastructure vision attracts diverse partners eager to align with its energy-aware network model. The convergence of power and compute forces technology firms, utilities, and sovereign institutions to cooperate in ways that redefine traditional value chains. Understanding where these alliances form reveals how Cisco translates its engineering advantage into durable ecosystems and recurring revenue.

MindCast AI identifies three major partnership forces around Cisco:

Hyperscalers (AWS, Google, Microsoft) need high-throughput, low-loss WAN fabric to expand near energy sites.

Utilities & Microgrid Developers need telemetry and secure control to merge compute with generation.

Sovereign & Regulated Buyers (defense, finance, healthcare) require localization, encryption, and resilience—Cisco’s historic advantage.

Partnership Economics 101

The next trillion-dollar AI alliances will revolve around power-network partnerships. Cisco’s architecture connects energy developers, governments, and clouds in shared value creation. Hyperscalers extend Cisco’s market reach, utilities deliver energy resilience and recurring revenue, and sovereign clients secure trust and regulatory continuity. Together they form a network of stability, scale, and policy legitimacy that compounds returns for Cisco and investors.

Insight: When compute turns geopolitical, Cisco becomes diplomatic infrastructure.

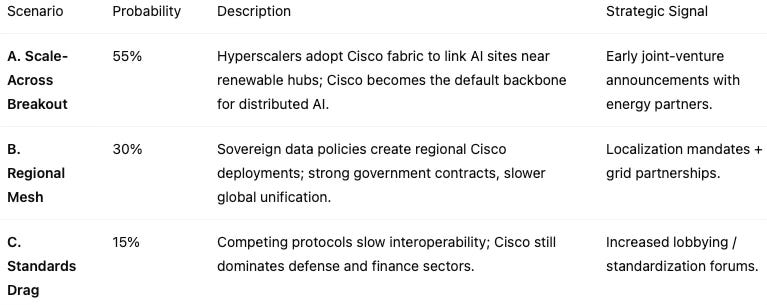

VI. Scenarios — Outlook for 2026–2029

Predicting Cisco’s trajectory requires examining multiple futures shaped by energy availability, regulation, and adoption speed. Scenario analysis allows investors and partners to evaluate timing, risk, and opportunity across a shifting AI-power landscape. The following outcomes illustrate how Cisco’s architecture adapts under varying global and policy conditions.

Across all plausible futures, Cisco captures the connective layer of AI infrastructure. The key variable is speed of convergence, not direction. Investors can expect early ROI from joint ventures in 2026–2027 under Scenario A, steady regulated growth under Scenario B, and defensive stability under Scenario C. Market timing depends more on policy cycles than hype cycles.

Insight: Every credible AI future runs through Cisco’s network fabric—it’s the constant across all variables.

VII. Risk Factors — Transparency Builds Credibility

Acknowledging potential challenges reinforces Cisco’s credibility with sophisticated investors. Three major risks shape the company’s path forward:

Regulatory Risk: As Cisco’s architecture evolves into critical infrastructure, governments may demand open standards or impose rate-of-return oversight similar to utility regulation.

Technology Risk: Distributed AI training remains unproven at full scale; if physics or economics favor re-centralization, hyperscalers could bypass the distributed model entirely.

Execution Risk: Coordinating across technology, energy, and government sectors requires synchronization of timelines and incentives. Partnership complexity could delay adoption or dilute margins.

Investors should view these disclosures not as weaknesses but as evidence of rigorous foresight and strategic realism. Cisco’s long history of managing global regulatory environments and complex ecosystems offers a buffer against these risks, but transparency about their potential impact builds lasting trust.

Insight: Transparency about risks strengthens Cisco’s credibility; its foresight and ecosystem experience convert potential vulnerabilities into long-term trust advantages.

VIII. Conclusion — The Quiet Power Behind Intelligence

Cisco spent two decades perfecting reliability in silence. That discipline now converts to leverage. While competitors chase attention, Cisco controls the unseen domain: power, light, and trust that sustain large-scale intelligence.

For investors and partners, the story centers on infrastructure sovereignty. Cisco’s distributed, energy-aware design defines how nations, enterprises, and clouds will compute, communicate, and comply throughout the next decade.

Insight: Cisco doesn’t chase AI revolutions; it builds the ground they stand on.

Call to Action — Partnering for the Next Phase

Investors and partners should engage now while Cisco’s distributed infrastructure ecosystem enters its acceleration phase. Identify verticals—utilities, sovereign infrastructure, hyperscaler edge, or telecom—where Cisco’s architecture can embed early to capture first-mover advantages. Cisco’s roadmap through 2026 includes pilot programs for energy-aware data centers and sovereign AI deployments; co-investment and licensing partners will define the standards of distributed AI infrastructure.

Next Steps:

Investors: Evaluate capital exposure and participation in Cisco-aligned power and network joint ventures.

Utilities and Energy Firms: Propose grid-to-compute pilot projects leveraging Cisco routing and orchestration layers.

Sovereign and Institutional Partners: Initiate localization frameworks and long-term service contracts with Cisco as the backbone integrator.

Cisco has built the architecture; partners and investors can now shape its global rollout.