MCAI Innovation Vision: The Quantum-Coupled AI Data Center Campus (2025–2035)

Owning the Connective Frontier Between Classical and Quantum Intelligence

See also MindCast AI publications on AI infrastructure: The Future of AI Data Center Reliability, Predictive Foresight for AI Infrastructure (Oct 2025), Predictive Cognitive AI and the AI Infrastructure Ecosystem (Oct 2025), The Bottleneck Hierarchy in U.S. AI Data Centers (Aug 2025).

Executive Thesis

By 2035, the world’s most valuable infrastructure won’t be shipping lanes or fiber backbones—it will be the corridors where AI computation meets quantum capability. The race is no longer about who trains the biggest model, but who builds the most coherent system: energy-anchored, quantum-coupled, and capital-aligned. These are the digital Suez Canals of the 2030s—and whoever controls the coupling layer controls the intelligence economy.

The competition is shifting from chip design to campus design. The winners will be those who create data center ecosystems that anticipate quantum integration, secure power as a strategic resource, and align capital with infrastructure foresight. By mastering the fusion of energy, intelligence, and quantum capability, they will define the next era of computational leverage.

I. Why This Matters Now: The Energy-Intelligence Collision

AI infrastructure is transforming into an energy-anchored, globally networked system. The convergence of capital, power, and policy reveals a clear causal chain: rising AI demand drives energy scarcity, which accelerates investment in fusion, Small Modular Reactors (SMR), and grid-scale solutions. Those energy corridors then attract capital consolidation and regulatory focus, creating the groundwork for quantum coupling.

Four forces are converging:

Capital Convergence: Microsoft, Amazon, and Google are investing simultaneously in AI campuses and quantum ecosystems—Helion fusion deals, AWS Braket quantum services, Google’s Willow quantum chip. This isn’t coincidence; it’s structural recognition that classical and quantum compute will share infrastructure and power resources.

Energy Scarcity: AI workloads may consume 5%+ of global electricity by 2030. Fusion, SMR, and geothermal adjacency become gating factors. The question is no longer if AI needs dedicated power—it’s who secures it first.

Network Scarcity: Quantum Key Distribution (QKD) and photonic fiber corridors determine metropolitan advantage. Low-latency, ultra-secure connections between quantum and classical systems will be as strategically important as submarine cables are today.

Policy Momentum: Governments funding post-quantum security and quantum networking are accelerating the shift toward quantum-ready regulation. Infrastructure built without quantum coupling in mind will face costly retrofits or obsolescence.

This convergence validates the core thesis: by 2035, competitive advantage flows to those who master quantum-coupled infrastructure as a unified system rather than separate layers.

Contact mcai@mindcast-ai.com to partner with us on AI data center infrastructure foresight simulations.

II. The Investment Logic: Three Capital Perspectives

Ownership of coherent, quantum-coupled infrastructure defines the next era of digital and economic leverage. Different capital structures see different opportunities in the same convergence:

Venture Capital Perspective Building orchestration software that connects classical and quantum compute creates entirely new value chains. The middleware layer—managing workload routing, latency optimization, and hybrid quantum-classical algorithms—represents a greenfield opportunity. Venture investors gain by enabling these hybrid systems rather than owning hardware, capturing margin in the connective tissue between compute paradigms.

Infrastructure and Energy Fund Perspective Quantum-ready campuses transform fixed assets into flexible systems with 15–25 year depreciation curves and embedded optionality. Every meter of dark fiber, every low-vibration foundation slab, every megawatt of fusion or SMR capacity becomes an upgradeable node in the quantum-classical mesh. Infrastructure funds gain through durable, adaptive assets that appreciate as quantum integration matures rather than depreciate as technology cycles accelerate.

Sovereign and Strategic Capital Perspective Nations controlling quantum-AI corridors secure algorithmic sovereignty. Quantum-linked campuses become digital Suez Canals of the 2030s—critical chokepoints where energy, intelligence, and governance intersect. Strategic capital recognizes that infrastructure advantage compounds: early movers set standards, shape regulation, and control the migration path for late adopters.

This investment logic reinforces the thesis: quantum coupling isn’t a retrofit—it’s a fundamental reframing of how compute infrastructure creates and captures value.

III. Proof in Capital

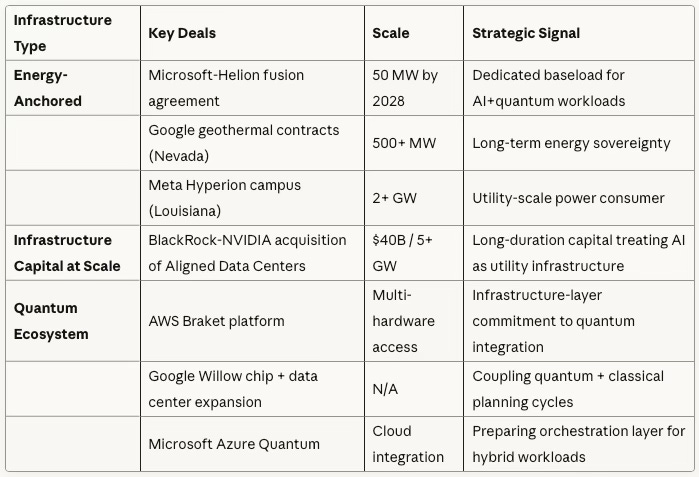

The quantum-coupling thesis is already being priced into infrastructure markets. Over the past 24 months, every major hyperscaler has made simultaneous investments in AI compute capacity and quantum capability—not as separate R&D bets, but as integrated infrastructure strategies. The pattern is consistent: energy procurement, network buildouts, and quantum partnerships move in lockstep. The capital deployment data below reveals why—because quantum and classical compute will share power, fiber, and orchestration layers by necessity, not by choice.

Infrastructure Capital at Scale Infrastructure capital now drives the fusion of finance, energy, and compute—treating AI infrastructure like regulated utility markets:

These deals confirm that AI data centers are evolving into utility-scale power consumers and quantum-ready platforms. Capital is flowing toward coherent systems—those that integrate energy security, network orchestration, and quantum readiness from day one. This pattern validates the thesis that campus design, not chip design, determines competitive positioning through 2035.

IV. Architecture Blueprint: How Quantum Coupling Works

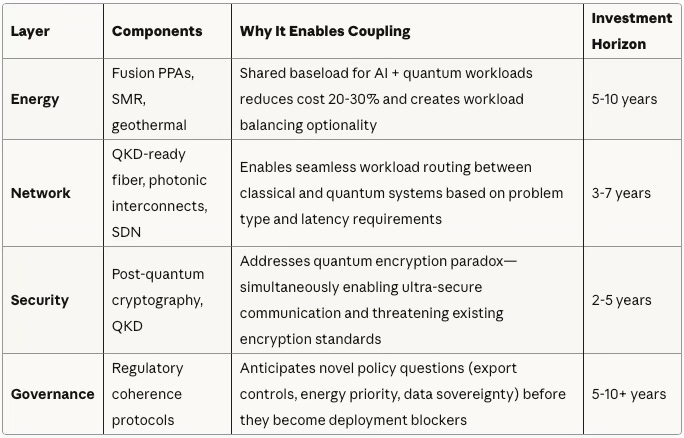

Quantum computing must connect with AI data centers through network-level orchestration rather than physical retrofitting. Quantum systems require cryogenic environments, vibration isolation, and magnetic shielding incompatible with standard data halls. Coupling through fiber, middleware, and photonic interconnects allows scalability, energy efficiency, and cost control while preserving the specialized environments each compute paradigm requires.

The architecture deploys across four integrated layers, each reinforcing the core thesis that coherence—not raw capacity—determines infrastructure value:

This four-layer architecture isn’t modular—it’s systemic. Energy decisions constrain network capacity; network topology shapes security requirements; security protocols influence governance complexity. The result is infrastructure that compounds advantage over time rather than requiring constant re-engineering. But architectural coherence on paper doesn’t guarantee coherence in execution. The next question becomes: how do operators verify that energy, capital, and governance decisions remain aligned as these systems scale? That’s where continuous measurement—tracking whether design intent matches operational reality—becomes the difference between infrastructure that performs and infrastructure that fractures under complexity.

Each layer advances toward the thesis goal: infrastructure that integrates energy, classical AI, and quantum computing under unified orchestration, positioning owners to capture value as these systems converge.

V. How MindCast AI Measures Infrastructure Coherence

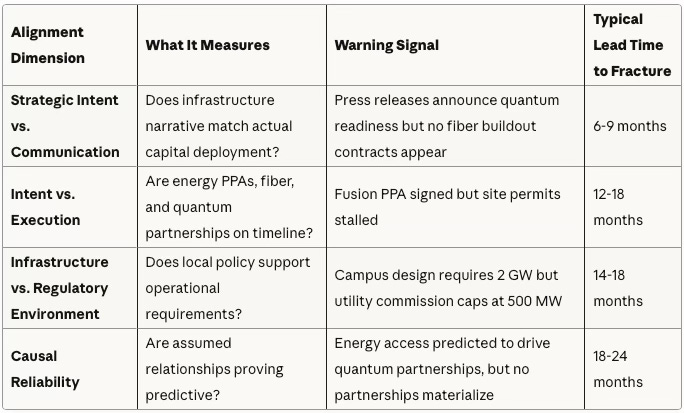

Rather than relying on abstract metrics, MindCast AI tracks whether energy, capital, and governance decisions remain aligned over time. The framework uses Cognitive Digital Twins (CDTs)—digital models of AI data center campus energy-network interactions—to simulate how infrastructure performs under varying power, latency, and regulatory conditions.

For example, a CDT of a 500 MW campus with planned fusion PPAs simulated a two-year policy delay scenario. The model predicted a 34% increase in grid-dependency costs and identified a 14-month window before alternative energy contracts became economically infeasible. This type of foresight enables operators to hedge regulatory risk before it materializes into capital loss.

The framework tracks alignment across four dimensions:

When alignment weakens—for instance, a mismatch between energy supply commitments and policy support—early warning indicators appear. This framework helps investors and operators anticipate instability and intervene before systemic stress escalates, directly supporting the thesis that coherence determines which campuses succeed.

MindCast AI will publish quarterly empirical updates tracking alignment metrics across major quantum-coupled infrastructure projects, documenting where the thesis is validated and where unexpected fractures emerge.

VI. Conclusion: The Architecture Is Clear—The Question Is Who Builds It First

All evidence reaffirms the core thesis: by 2035, control of AI infrastructure will hinge on who masters quantum coupling. Energy, capital, and intelligence are converging into a unified architecture—the quantum-ready AI campus—and competitive advantage flows to those who design for this convergence rather than retrofit toward it.

The shift from chip design to campus design is already underway. Microsoft, Google, BlackRock, and NVIDIA are deploying tens of billions in capital toward energy-anchored, quantum-anticipating infrastructure.

The opportunity is structural, not speculative. Venture capital can capture the orchestration layer. Infrastructure funds can own durable, upgradeable assets. Sovereign capital can secure algorithmic sovereignty. Each perspective converges on the same conclusion: quantum-coupled coherence is the next definitive infrastructure class.

MindCast AI will continue modeling alignment and causal stability across global projects, forecasting where integration succeeds and where capital, energy, or governance misalignment creates fracture risk. We will publish quarterly updates with concrete metrics: capital deployment velocity, energy PPA execution rates, quantum partnership announcements, and regulatory coherence scores.

The thesis is testable. The timeline is defined. The question is no longer whether quantum-coupled AI campuses will dominate—it’s who positions to own the coupling layer first.

By 2035, every trillion-parameter model will rely on infrastructure fluent in quantum interaction. The architecture is clear. The race has begun.

Thanks for writing this, it clarifies a lot. The Suez Canal analogy is so appt. What if this new coupling layer, while efficient, creates even deeper digital divides between nations? It's a critical new form of resource control. Access to this intelligence becomes a strategic battleground.