MCAI Lex Vision: The Crypto ATM Regulatory Convergence

Why Federal Inaction Necessitates State Crypto-ATM Consumer Protection

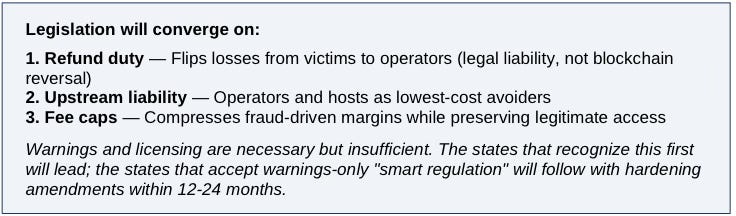

Legislation will converge on refund duty + upstream liability, because warnings and licensing do not break the scam-profit equation. Fee caps determine how hard the system snaps from extraction to prevention. Washington's 5% cap is the national test case.

EXECUTIVE SUMMARY

Federal crypto-ATM regulation remains structurally incapable of delivering timely consumer protection. The Crypto ATM Fraud Prevention Act (S.710) defers concrete safeguards to future rulemaking, while state legislatures have already enacted binding transaction caps, fee limits, and refund mechanisms. The analysis demonstrates that state action is not merely complementary to federal regulation—it is the primary correction mechanism available under current institutional constraints.

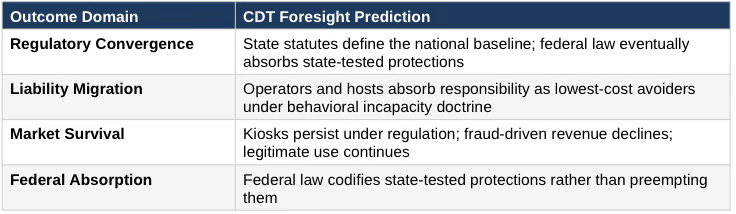

Using multiple Cognitive Digital Twin (CDT) foresight simulations grounded in law-and-economics, behavioral science, and institutional analysis, MindCast AI evaluates how liability migrates upstream from victims to operators, how incentives reshape fraud economics, and how legislative systems adapt under pressure. The findings predict continued state-led convergence around hard statutory protections, accelerated settlement dynamics for operators, and eventual federal absorption of state baselines rather than federal preemption.

The Problem

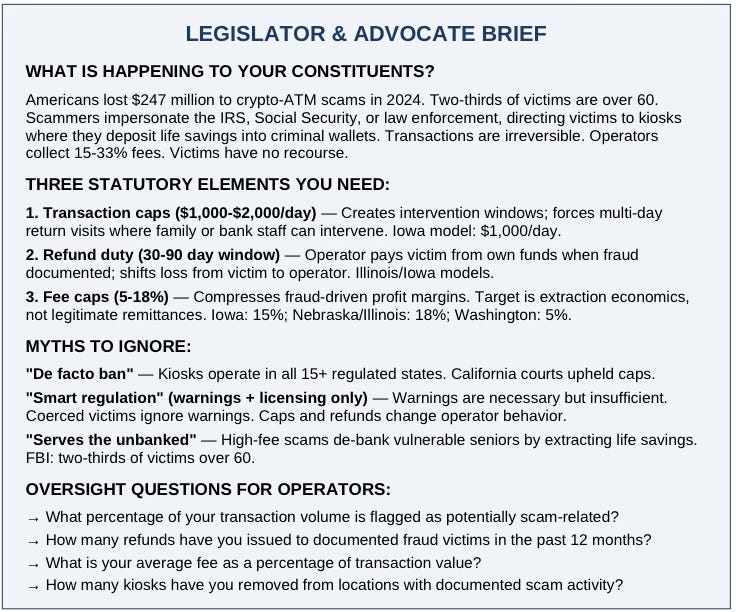

Americans lost $247 million to crypto-ATM scams in 2024. More than 11,000 victims filed complaints; two-thirds were over 60. The fraud pattern is consistent: victims receive calls from scammers impersonating the IRS, Social Security Administration, or law enforcement, are directed to crypto-ATM kiosks, and deposit their savings into wallets controlled by criminals. The transactions are irreversible. The operators collect fees of 15-33%. The victims have no recourse.

The Federal Gap

S.710, the Crypto ATM Fraud Prevention Act of 2025, remains stalled in Senate committee with a 2% passage probability. Even if enacted, S.710 would not set specific transaction caps, would not limit fees to defined percentages, and would not mandate refund windows. It defers these protections to future rulemaking—an indefinite timeline.

The State Response

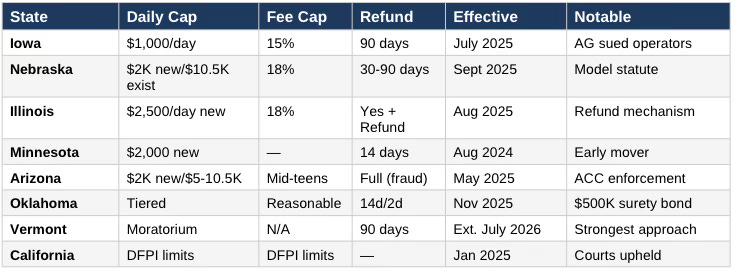

At least 15 states have enacted crypto-ATM consumer protection laws since 2024. Transaction caps range from $1,000/day (Iowa) to tiered systems ($2,000-$10,500). Fee caps range from 15% (Iowa) to 18% (Nebraska, Illinois). Refund windows range from 14 days (Minnesota) to 90 days (Iowa, Vermont). In every state that enacted protections, kiosks continue to operate. The “de facto ban” argument has been empirically falsified.

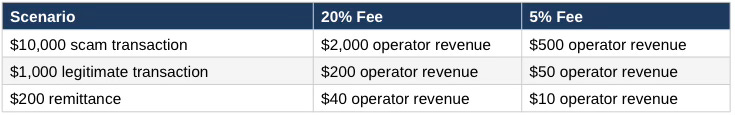

The Fee Cap as Margin Compression

Fee caps, not transaction caps, drive the fiercest opposition because they compress profit margins across all transaction volume—both legitimate and fraud-driven. A $10,000 scam at 20% generates $2,000 in operator revenue; at 5%, $500. The goal is not to eliminate crypto-ATMs but to make the current high-margin extraction model unviable while preserving legitimate low-cost access. Washington’s 5% cap is the national test case for whether states can force this business-model adjustment.

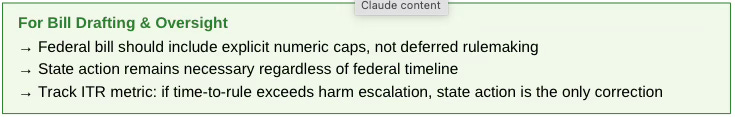

IMPLICATIONS FOR FEDERAL LAWMAKERS

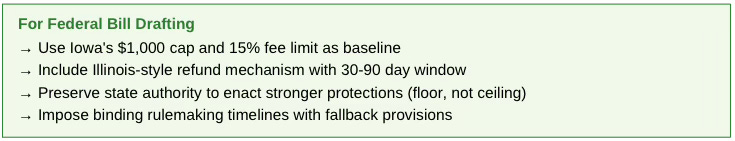

State experiments are ready-made templates, not substitutes for federal action. Federal legislation can accelerate protection by codifying what states have already proven works.

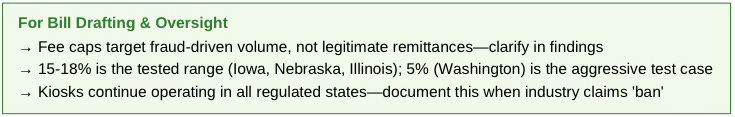

What an Improved Federal Bill Should Contain

1. Explicit transaction caps — Statutory $1,000-$2,000/day limits, not deferred to rulemaking. Iowa’s $1,000 cap is the tested model.

2. Explicit fee caps — Statutory 15-18% ceiling. Fee caps align crypto-ATM fees with traditional remittance services, not restrict markets.

3. Mandatory refund windows — 30-90 day operator liability for documented fraud. Illinois and Iowa have enacted this; operators continue serving those markets.

4. Floor preemption posture — Federal standards as minimum, not ceiling. Preserve state authority to enact stronger protections. S.710 already takes this approach; maintain it.

5. Binding timelines — If rulemaking is required, impose 12-month deadlines with automatic fallback provisions if agencies miss them.

Why State Action Is Not a Substitute

State-by-state regulation creates fraud corridors in unregulated jurisdictions (Oregon, Idaho, Nevada, Pennsylvania). Scammers direct victims to the nearest unregulated kiosk. Federal baseline protection closes these gaps while preserving state authority to go further.

HOW ADVOCACY ORGANIZATIONS CAN USE THE ANALYSIS

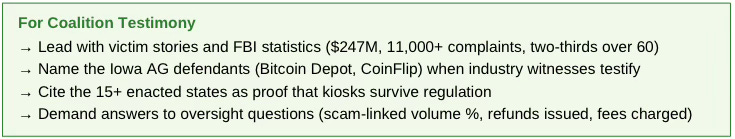

Consumer groups and senior coalitions can leverage this analysis for legislative scorecards, testimony, and coalition building.

Priority Actions

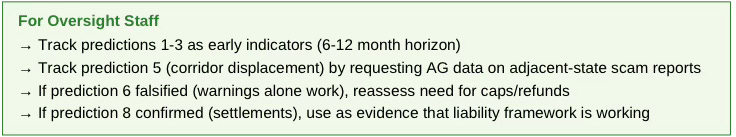

1. Prioritize fee caps in your scorecards. Fee caps generate the most industry opposition because they attack extraction economics. A legislator’s vote on fee caps is the clearest signal of consumer protection commitment versus industry capture.

2. Push for refund windows of at least 30-90 days. Refund duties shift loss from victims to operators, creating continuous incentive for fraud prevention. The Iowa 90-day and Illinois models are the strongest templates.

3. Press state AGs on settlement acceleration and host liability. Active enforcement cases (Iowa AG v. Bitcoin Depot/CoinFlip, D.C. AG, Florida civil litigation) create discovery exposure that accelerates settlement. Advocate for AG offices to pursue host liability (retail locations like Circle K) alongside operator liability.

4. Coordinate regionally to close fraud corridors. Oregon, Idaho, and Nevada are displacement risks for regulated Pacific states. Western regional advocacy teams should coordinate model bill language and press for simultaneous introduction in corridor states.

5. Counter the “financial inclusion” narrative directly. Industry claims kiosks serve the “unbanked.” The data shows the opposite: high-fee scams de-bank vulnerable seniors by extracting life savings. FBI data confirms two-thirds of victims are over 60. Frame your advocacy as protecting financial inclusion for seniors, not restricting it.

COGNITIVE DIGITAL TWIN FORESIGHT SIMULATION METHODOLOGY

MindCast AI runs CDT foresight simulations by constructing Cognitive Digital Twins of institutions, markets, and actors, then testing how incentives, constraints, and behavioral limits interact over time. Rather than predicting outcomes based on intent or rhetoric, CDT foresight simulations evaluate structural capacity: who can intervene, at what cost, and with what timing.

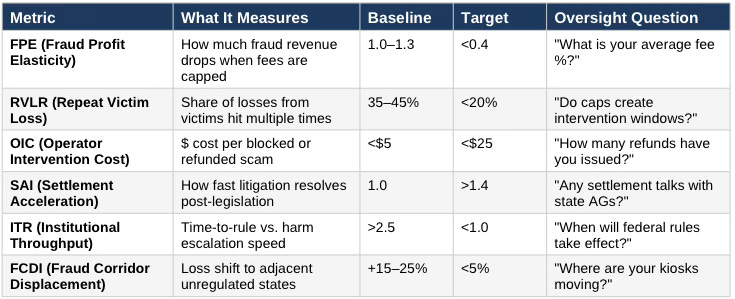

Global Metrics Dashboard

The following metrics convert statutory design into measurable outcomes. Values below target indicate ineffective protection; values above target indicate structural correction.

Full CDT simulation methodology and detailed metrics are provided in Appendix A.

THE REGULATORY GAP

The crypto-ATM industry operates in a regulatory environment where federal frameworks provide process without protection. The gap creates a structural opportunity for state action.

Federal Law: The Limits of S.710

What S.710 Does

The Crypto ATM Fraud Prevention Act of 2025 (S.710) establishes a framework for crypto-ATM regulation: risk-based limits via rulemaking, “unfair or abusive” fee constraints via CFPB/Treasury, BSA financial institution treatment, and standardized warnings. Senator Durbin introduced the bill in February 2025 citing FBI data on $247M in 2024 losses.

What S.710 Does NOT Do

S.710 does not set specific dollar caps ($1,000, $2,000, etc.). It does not cap fees at specific percentages (15%, 18%, etc.). It does not mandate specific refund windows (14 days, 90 days, etc.). And critically, it does not preempt stronger state laws.

The Structural Problem

Deferred rulemaking means indefinite delay. FinCEN guidance is advisory only. Even if passed, S.710 provides framework without concrete protections. The bill’s current status—2% passage odds per GovTrack—reflects both partisan gridlock and industry lobbying that has successfully characterized caps as restricting innovation.

Primary metrics implicated: ITR (Institutional Throughput Ratio)

Contact mcai@mindcast-ai.com to partner with us on law and behavioral economics foresight simulations.

II. STATE LAW: THE EMERGING CONSENSUS

While federal action stalls, states have created a de facto regulatory framework through independent legislation. The pattern reveals convergence toward specific protective mechanisms.

Enacted States (15+)

Practical ask: If your state is not in this table, you are behind the national consensus. Use Iowa ($1,000 cap, 15% fee, 90-day refund) as your drafting template.

The Bipartisan Signal

Red states enacted protections: Oklahoma, Nebraska, North Dakota, Arkansas. Blue states enacted protections: California, Illinois, Minnesota, Vermont, Rhode Island. Consumer protection is market integrity, not partisan intervention.

Primary metrics implicated: RVLR (Repeat Victim Loss Rate), FCDI (Fraud Corridor Displacement)

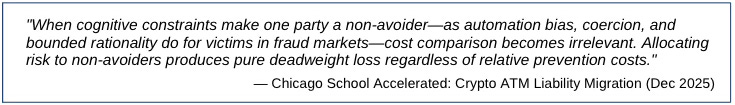

III. THE LIABILITY MIGRATION FRAMEWORK

MindCast AI’s Chicago School Accelerated analysis establishes the theoretical foundation for why liability must migrate upstream from victims to operators.

Classical Posner vs. Behavioral Extension

Classical Posner: “Who can prevent harm most cheaply?”

Behavioral Extension: “Who can prevent harm at all?”

Victims under live coercion are non-avoiders by behavioral incapacity. Operators controlling transaction architecture are lowest-cost avoiders. Liability allocation answers itself once behavioral evidence enters the record.

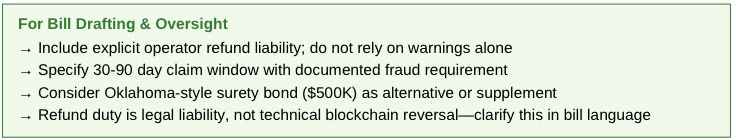

Refund Duty as Equilibrium Shift

The decisive legislative move is mandatory refunds. Refund duty is not a technical reversal of blockchain transactions—crypto transactions remain irreversible. Rather, the refund duty is a legal liability requiring operators to compensate victims from the operator’s own funds when fraud is documented.

How It Works Mechanically

1. Victim documents fraud (police report, bank statement, scam communication records)

2. Victim submits claim to operator within statutory window (30-90 days)

3. Operator reimburses victim from operator funds, not from blockchain recovery

4. Operator bears loss — creating continuous incentive to prevent fraud at point of transaction

The mechanism functions like a consumer guarantee or surety bond requirement. Oklahoma’s $500,000 surety bond is a related model: operators post capital that can be accessed for victim compensation. The Iowa and Illinois refund windows create direct operator liability without requiring bond posting.

Why Refund Duty Changes Operator Behavior

Warnings function as liability shields—operators can point to disclosures while collecting fees. Refunds create a continuous, auditable loss channel that forces prevention investment. High-scam venues become liability exposure, not profit centers. Expect: tighter KYC for first-time users, longer cooling-off periods before large transactions, fewer kiosks in scam-heavy locations, and faster settlement dynamics in pending litigation.

Primary metrics implicated: RVLR (Repeat Victim Loss Rate), OIC (Operator Intervention Cost), SAI (Settlement Acceleration Index)

IV. THE FEE CAP AS MARGIN COMPRESSION

Fee caps, not transaction caps, drive the fiercest opposition because they compress profit margins across all transaction volume—both legitimate and fraud-driven. The goal is not to eliminate crypto-ATMs but to make the high-margin extraction model unviable while preserving legitimate low-cost access.

Why Fee Caps Matter

Transaction caps slow extraction by limiting per-session losses. A victim can still lose $1,000/day indefinitely.

Fee caps compress unit economics across the entire business:

The insight: High fees make fraud-driven transactions disproportionately profitable. Fee caps compress margins on alltransactions, but the largest impact falls on high-dollar fraud. Legitimate small remittances ($50-200) remain viable at lower fee percentages—they are not the target.

The “De Facto Ban” Claim

Industry argues that low fee caps (5-10%) make operation “impossible.” The argument is an admission that the current business model depends on high margins. The response: if 5% fees cannot support operation, what does that reveal about which transactions are driving profitability? Kiosks operate in all 15+ regulated states. California courts upheld DFPI limits against constitutional challenge. The “de facto ban” claim is empirically falsified.

The Free Market Framework

Industry frames fee caps as “anti-free market” or “government overreach.” The framing inverts economic reality. Free markets require informed consumers making voluntary transactions in fraud-free exchanges. Crypto-ATM scams involve none of these conditions.

Coercion: Victims operate under live scam scripts (”IRS will arrest you,” “your grandchild is in jail”). Voluntary choice is absent.

Information asymmetry: Victims cannot see real-time exchange rates or calculate true fees at point of transaction. Informed consent is absent.

Fraud: The transaction itself is the fraud vehicle. Market integrity is absent.

Consumer protection enables markets—fraud destroys them. Securities markets have the SEC. Banking has the FDIC. Traditional ATMs have fee disclosure requirements. Crypto-ATM regulation applies the same framework that allows other financial markets to function. Red states (Oklahoma, Nebraska, North Dakota, Arkansas) enacted protections alongside blue states. The bipartisan pattern confirms: market integrity is not partisan intervention.

The “Financial Inclusion” Counter-Narrative

Industry claims kiosks serve the “unbanked.” The data shows the opposite: high-fee scams de-bank vulnerable populations by extracting life savings. FBI data confirms two-thirds of crypto-ATM fraud victims are over 60. Fee caps protect financial inclusion for seniors; they do not restrict it. A 5-15% fee cap still allows operators to serve legitimate remittance customers—it simply prevents 25-33% extraction from coerced victims.

The Circle K / Bitcoin Depot Evidence

Per ICIJ/CNN investigation: Circle K managers warned Bitcoin Depot about scams repeatedly. Internal communications documented the issue at corporate level. Machines stayed in high-scam locations because revenue-sharing math worked at 20%+ fees. Fee caps change that math—for hosts and operators. Public enforcement records and SEC filings document these patterns.

Primary metrics implicated: FPE (Fraud Profit Elasticity), OIC (Operator Intervention Cost)

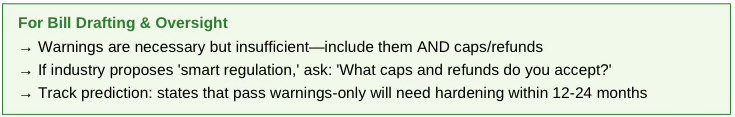

V. THE “SMART REGULATION” PATTERN

Industry’s most effective tactic is to concede visible warnings + licensing while fighting caps and refunds. The “smart regulation” bundle preserves core extraction economics through compliance theater.

The Pattern

Opposition testimony follows a consistent script: (1) “We support the intent of this bill...” (2) Praise for warnings, disclosures, licensing requirements. (3) Attack on caps and fee limits as “unworkable” or “de facto bans.” (4) Proposal of “smart regulation” alternative. The pattern appeared in Washington (SB 5280), Iowa, Vermont, Nebraska, and federal testimony.

Why Warnings and Licensing Are Necessary But Insufficient

Warnings are necessary: They provide legal notice and contradict scam scripts at point of transaction. The “government agencies do not demand payment via crypto” warning directly addresses 60-70% of elder scams.

Warnings are insufficient: Coerced victims operating under live scam scripts cannot process warnings rationally. Licensing creates barriers to entry but does not change incumbent behavior. Compliance paperwork exists; enforcement is complaint-driven. The Iowa AG found >50% of Bitcoin Depot’s Iowa volume was scam-linked despite claimed compliance.

The result when warnings alone pass: Legislators can claim action; operators preserve margins; victims continue losing.

The Two-Wave Pattern

Prediction: In close votes, lawmakers pass “smart regulation” versions first. Then: AG enforcement actions reveal continued harm, media investigations document operator knowledge, victim stories accumulate, and the second wave adds caps/refunds. Timeline: 12-24 months from “smart regulation” to hardening amendments.

Evidence from State Records

Vermont: Industry-backed bill sought to lift moratorium; defeated after regulator reported reduced fraud under caps.

Iowa: Operators testified for “smart regulation”; legislature passed $1,000 cap + 15% fee limit + 90-day refunds anyway.

Washington: Opposition proposed “licensure, robust compliance programs, visible warnings” as alternative to caps.

Primary metrics implicated: ITR (Institutional Throughput Ratio), RVLR (Repeat Victim Loss Rate)

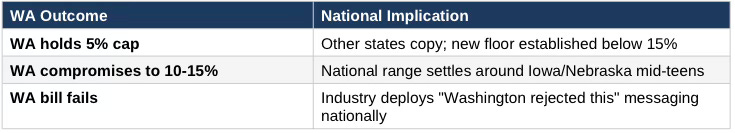

VI. WASHINGTON AS BELLWETHER: THE 5% TEST

Washington’s 5% fee cap functions as a national test case for whether states can force a business-model adjustment toward lower margins and reduced fraud tolerance.

Current Status

SB 5280 is on third reading as of January 13, 2026. Floor vote imminent. Bill provisions unchanged: $1,000 cap, 5% fee, warnings, receipts. No Washington legislators on record opposing. Opposition exclusively from industry witnesses.

PRO Testimony on Record

Senator Claudia Kauffman (Prime Sponsor); Detective Timothy Schwering (Spokane Police Department)—testified on fraud losses, imposter scams, pig-butchering scams, multiple local suicides; Cathleen MacCaul (senior advocacy coalition); Glen Simecek (Washington Bankers Association); Drew Bouton (WA Department of Financial Institutions)

CON Testimony on Record

Kevin Lolli (CoinFlip)—defendant in Iowa AG enforcement action; Ethan McClelland (Bitcoin Depot)—defendant in Iowa AG enforcement action, with >50% of Iowa transaction volume alleged to be scam-linked per AG complaint; Arry Yu (Cascadia Blockchain Council)—crypto industry policy advocate

The Stakes

Local Context

Spokane: On June 17, 2025, Spokane became the first city in Washington to ban crypto ATMs. The City Council voted unanimously after testimony documented funds flowing to foreign adversaries and multiple local suicides linked to crypto-ATM scams.

Coinme Enforcement: On December 30, 2025, Washington DFI issued a cease-and-desist against Coinme, the Seattle-based operator and largest in Washington, citing mishandling of $8 million in unclaimed customer funds.

Primary metrics implicated: FPE (Fraud Profit Elasticity), SAI (Settlement Acceleration Index)

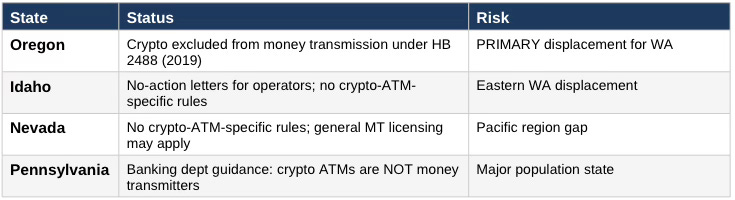

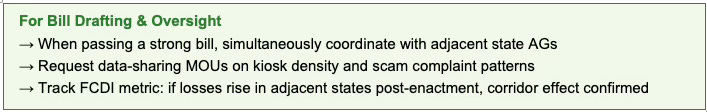

VII. FRAUD CORRIDORS AND REGIONAL COORDINATION

Strong-state protections displace activity into weak-state corridors—especially bordering states with no specific kiosk rules—until regional blocs coordinate.

States Without Protection

Practical ask: If your state looks like Oregon, Idaho, Nevada, or Pennsylvania in this table, you are the next fraud corridor unless you legislate. Scammers will direct victims to your kiosks once neighboring states regulate.

The Corridor Effect

Operators optimize routing and placement toward low-friction access points. Scammers direct victims to nearest unregulated kiosk. Cross-border arbitrage becomes standard operating procedure.

Current dynamics: California regulated → Nevada becomes Pacific gap. Washington moving toward regulation → Oregon/Idaho become escape valves. Arizona regulated → Nevada pressure increases.

Regional Compact Recommendation

Isolated state action protects in-state residents but creates displacement. The solution is coordinated regional action:

1. Pacific Compact: Washington, Oregon, California coordinate model bill language. California already regulated; Washington pending; Oregon is the critical gap.

2. Western AG Data-Sharing: State Attorneys General share kiosk density data, scam complaint patterns, and enforcement intelligence through formal MOUs.

3. Advocacy Coalition Coordination: Western regional consumer advocacy teams press for simultaneous introduction in corridor states, preventing industry whack-a-mole.

Primary metrics implicated: FCDI (Fraud Corridor Displacement Index)

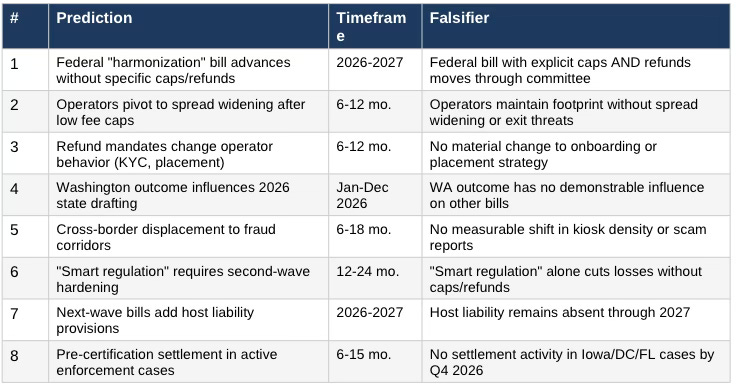

VIII. FALSIFICATION FRAMEWORK

The Foresight Simulation makes specific, testable predictions. Oversight staff can track these predictions as early indicators of whether the analysis is holding.

Simulation Validity Assessment

Strong confirmation: 6+ predictions validated without falsification

Partial confirmation: 4-5 predictions validated; 1-2 falsified (model recalibration required)

Weak confirmation: 2-3 predictions validated; multiple falsifications (framework revision required)

Falsification: Majority of predictions fail; core thesis invalid

IX. CONSOLIDATED FORESIGHT OUTCOMES

The Convergence Endpoint

APPENDIX A: COGNITIVE DIGITAL TWIN SIMULATION METHODOLOGY

MindCast AI runs CDT foresight simulations by constructing Cognitive Digital Twins of institutions, markets, and actors, then testing how incentives, constraints, and behavioral limits interact over time. Each CDT foresight simulation integrates legal doctrine, behavioral economics, and empirical enforcement data to identify which actors can realistically prevent harm and how systems correct when harm persists.

CDT Simulations Applied

1. Causation Vision

Objective: Identify which legislative mechanisms causally reduce crypto-ATM fraud.

Finding: Transaction caps, fee caps, and refund mandates demonstrate direct causal linkage to reduced fraud profitability. Disclosure-only regimes show no reliable causal effect once live scam coercion is present.

Prediction: By Q4 2026, states with fee caps ≤10% and refund windows ≥30 days will show materially lower repeat-victim losses than disclosure-only states.

2. Chicago Law & Behavioral Economics Composite

Objective: Determine liability allocation under behavioral incapacity.

Finding: Classical Coasean coordination fails under live coercion. Posnerian correction migrates liability upstream to operators as the only actors capable of preventing harm.

Prediction: Courts and legislatures will increasingly treat operators and hosts as joint lowest-cost avoiders.

3. Institutional Cognitive Plasticity (ICP)

Objective: Predict which institutions adapt and which stagnate.

Finding: State legislatures exhibit high update velocity due to direct constituent harm signals. Federal institutions exhibit high legacy inertia.

Prediction: At least 6–10 additional states will enact hard crypto-ATM protections in 2026–2027 before federal rulemaking produces binding safeguards.

4. Regulatory Vision

Objective: Map enforcement throughput and regulatory effectiveness.

Finding: State AG enforcement operates faster and with clearer statutory hooks than federal advisory guidance.

Prediction: State AG actions will set the effective national enforcement baseline through coordinated investigations and settlements.

5. Field-Geometry Reasoning (FGR)

Objective: Determine whether outcomes are governed by structure rather than intent.

Finding: Live scam coercion creates near-zero geodesic availability for victims, rendering warnings ineffective. Outcomes are governed by system geometry, not individual choice.

Prediction: Legislative focus will continue shifting from education to architecture-based controls.

Cognitive Digital Twin Simulation Falsification Contracts

Causation Vision: If states with hard caps do not show reduced repeat-victim loss within 12–18 months, revise causal assumptions.

Institutional Plasticity: If federal agencies impose binding protections faster than states, revise institutional plasticity model.

Field-Geometry: If operators exit regulated states en masse, reassess incentive geometry.

APPENDIX B: PRIOR PUBLICATIONS

Crypto ATM Settlement Trigger Dynamics (Dec 2025)

Class Action, Pre-Certification Resolution Under Discovery, Legislation, and Self-Regulation Pressure

Models when crypto ATM operators will settle class actions based on discovery exposure, legislative baselines, and failed self-regulation. Applies Cognitive Digital Twin simulations to predict settlement timing as the primary signal of liability migration, with falsification criteria tied to active Iowa, D.C., and Florida enforcement cases.

Chicago School Accelerated — Integrated Application (Dec 2025)

Crypto ATM Liability Migration, Operator Accountability Under Behavioral Incapacity

Establishes the analytical framework for liability allocation in crypto-ATM fraud. Classical Posner asks “who can prevent harm most cheaply?” The behavioral extension asks “who can prevent harm at all?” Demonstrates that victims under coercion are non-avoiders by behavioral incapacity, making operators the necessary liability bearers.

AI Hallucinations, AI Copyright, and Crypto ATMs (Dec 2025)

Liability Migration Under Behavioral Incapacity

Connects the behavioral incapacity framework across three domains: AI hallucination liability, AI copyright allocation, and crypto-ATM fraud. In each case, the party with architectural control bears liability when the other party cannot self-protect due to cognitive constraints.

Field-Geometry Reasoning (Dec 2025)

A Unifying Framework for Structural Explanation in Law, Economics, and Artificial Intelligence

Establishes the theoretical foundation for understanding outcomes as governed by system structure rather than individual intent. When constraints create near-zero geodesic availability for one party—as live scam coercion does for crypto-ATM victims—warnings become ineffective and architectural controls become the only viable intervention. Applied in this simulation to explain why disclosure-only regulation fails.