MCAI Investor Vision: Quantum–AI Infrastructure, The Physics Nobel Prize That Became an Asset Class

The Physics Breakthroughs That Rewrote AI Data Center Economics

See also the MindCast AI Quantum Computing-AI Infrastructure series: MindCast AI’s NVIDIA NVQLink Validation (Oct 2025), The Quantum-Coupled AI Data Center Campus (2025–2035) (Oct 2025), Quantum Computing Sovereignty (Oct 2025).

I. Executive Summary- From Quantum Discovery to Capital Discipline

A wave of commercial Quantum–AI data-center partnerships now connects Nobel-level physics with deployable infrastructure: Digital Realty–OQC–NVIDIA’s Quantum–AI hub in New York, Equinix’s European collaborations with Oxford Quantum Circuits, AWS Braket expansions integrating IonQ and Rigetti systems into the cloud, and Google Quantum AI’s hybrid cluster deployments. These initiatives demonstrate that what began as academic research has matured into a multi‑billion‑dollar build‑out of coherent compute across continents, framing the practical landscape for this foresight simulation.

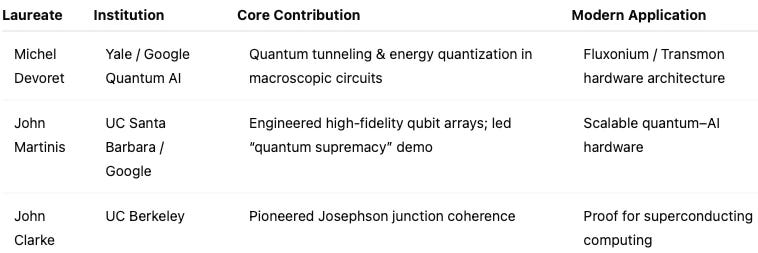

In October 2025, Michel Devoret, John Martinis, and John Clarke won the Nobel Prize in Physics for proving that macroscopic electrical circuits can behave quantum-mechanically. Their experiments turned Josephson junctions into controllable “artificial atoms,” establishing the foundation of superconducting qubits. As AI data centers hit thermal and spatial ceilings, this breakthrough introduces a new industrial variable—coherence as yield.

These circuits are manufacturable and calibratable; performance can be specified, insured, and financed. Their work bridged theoretical quantum mechanics and scalable industrial design, turning laboratory phenomena into tangible technology. It demonstrated that coherence—a fragile state once confined to physics experiments—can be harnessed, engineered, and measured at macroscopic scale, forming the cornerstone of every major quantum-computing platform today. Hybrid quantum–AI nodes convert frontier physics into predictable infrastructure where coherence—not heat—drives return on capital.

MindCast AI conducted this foresight simulation using its proprietary Cognitive Digital Twin (CDT) architecture. Each CDT models the causal relationships between physics, infrastructure, and capital formation, running iterative simulations that map coherence yield, capital thermodynamics, and trust signals over time. These digital twins allow MindCast AI to test strategic hypotheses under variable policy, market, and technological conditions, transforming foresight from narrative into measurable prediction.

Insight: Physics graduates to finance when coherence becomes measurable, repeatable, and rentable.

Contact mcai@mindcast-ai.com to partner with us on foresight simulations in AI infrastructure. See also MCAI Innovation-Investor-Market Vision: The Quantum-Coupled AI Data Center Campus (2025–2035), Executive Summary of MindCast AI Investment Series (Oct 2025), The Future of AI Data Center Reliability, Predictive Foresight for AI Infrastructure (Oct 2025), The Economics Nobel Innovation Continuum (Oct 2025), Predictive Cognitive AI and the AI Infrastructure Ecosystem (Oct 2025), The Bottleneck Hierarchy in U.S. AI Data Centers (Aug 2025).

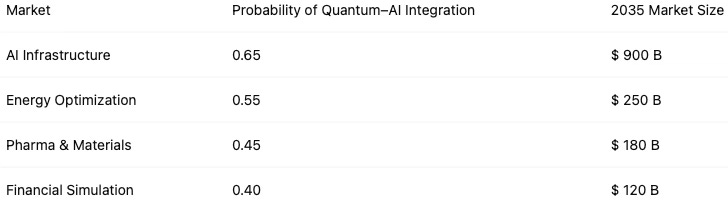

II. Market Inflection — From GPU Saturation to Quantum Hybridization

Major 2024–2025 transactions illustrate the scale of momentum: Digital Realty’s Quantum–AI hub in New York with OQC and NVIDIA; Equinix’s and Oxford Quantum Circuits’ European collaborations; AWS–IonQ partnerships integrating quantum compute into hyperscale cloud services; and government-backed facilities emerging in Japan and Germany. These projects demonstrate that hybrid quantum–AI campuses are shifting from research prototypes to commercially viable assets, anchoring the market inflection in tangible capital commitments.

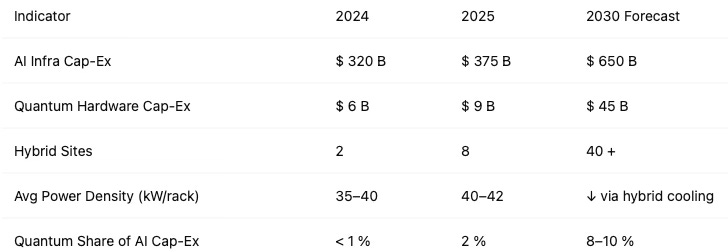

Global AI data-center capacity has passed 35 GW; each GPU rack draws 40 kW and delivers diminishing returns per watt. Quantum processors reverse that ratio by solving optimization and sampling tasks with minimal thermal cost. Evidence is localized but repeatable—pilots from Digital Realty × OQC × NVIDIA (New York) and LRZ Q-Exa (Munich) show cryogenic and network standards forming.

For early-stage capital, the inflection is opportunity density—patents, protocols, and teams coalescing where superconducting physics meets AI acceleration.

By 2028, a mid-sized pharma company will discover a cancer drug in 18 months instead of 8 years—not because they hired more scientists, but because a hybrid quantum–AI node in Munich eliminated 10,000 failed molecular simulations. That compression isn’t science fiction. It’s thermodynamics meeting software. A financial firm runs portfolio stress tests in real-time during a market crash instead of waiting hours for Monte Carlo results. A logistics network reroutes 10,000 trucks in three seconds instead of three hours.

Hybridization is a workload-routing strategy, not a replacement race. Engineers route AI workloads to quantum nodes the same way they balance cloud regions—except now they’re trading electricity for coherence. Where routing overhead stays bounded, GPUs gain headroom and TCO stabilizes. Investors capture multiple expansion when they move before PUE and $/token metrics reflect these efficiencies.

Insight: Every energy bottleneck is an investment signal when physics offers a lower-entropy alternative.

III. Investable Layers — Translating Physics into Capital

Recent infrastructure deals underscore the pace of deployment and investor traction: Digital Realty’s Quantum–AI data‑center project with OQC and NVIDIA in New York, OQC’s hardware colocations within Equinix facilities across Europe, and AWS’s integration of IonQ and Rigetti systems through Braket. These ventures provide the physical proof that hybrid infrastructure is shifting from concept to cash flow, giving investors direct exposure to operational quantum capacity.

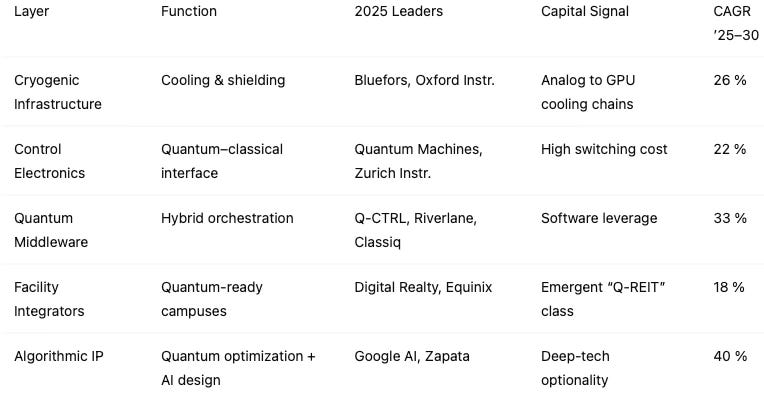

The quantum–AI stack creates five investable layers, each echoing how GPUs, networks, and cloud software became asset classes. What matters is not raw qubit count but interface control—the ability to translate coherence into cash flow.

Returns accrue first to interfaces and integration; vendors are valued by service yield (successful quantum calls per kWh) and calibration half-life, not headline qubit numbers.

For control investors, hybrid infrastructure converts complexity into defensible margin—own the integration and they own the yield. Risk migrates from hardware volatility to software and facilities. The next NVIDIA sells coherence capacity, not chips.

Insight: Control the interfaces, and you control the era.

IV. Investor Archetypes and Capital Sequencing

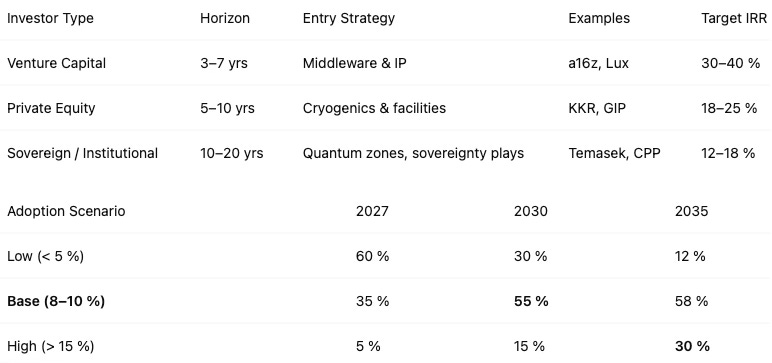

Investors navigate a spectrum of opportunities defined by time horizon and control appetite. Capital can enter through software, industrial infrastructure, or sovereign-scale initiatives; each path carries distinct risk, liquidity, and governance profiles.

Teams of engineers, financiers, and policymakers now work in coherent rhythm to turn superconducting theory into infrastructure. Financing requires mixed stacks—VC for software, PE for industrialization, sovereign for scale and security.

Sequencing matters: interfaces first, facilities second, algorithms last. Capital that positions to own these clocks captures the routing layer of intelligence. Yield follows coherence—not scale.

Insight: When foresight speaks each investor’s language but shares one moral grammar, markets hear a single future through three horizons.

V. Risk, Regulation, and Resilience

Quantum–AI campuses introduce new operational and regulatory exposures that serve as selective pressure on the market. These constraints aren’t bugs—they’re the filtering mechanism that separates credible players from vaporware. Quantum–AI infrastructure demands governance discipline, and that discipline becomes the moat.

Operational: Uptime tolerance < 0.2 %.

Cybersecurity: NIST quantum-safe encryption by 2030.

Regulatory: Dual-use controls on superconducting tech (U.S./EU).

Environmental: When quantum modules replace iterative loops, energy per solution drops within modeled bands contingent on error mitigation.

Labor: ≈ 7 000 qualified quantum engineers globally.

Assurance: Independent audits of cryogenic uptime and calibration cycles are emerging as standard.

By pricing cryogenic uptime and export-control friction into underwriting, investors turn constraints into barriers to entry. The same physics that demands coherence rewards governance discipline, transforming risk management into the architecture of trust and value creation.

Insight: These constraints are the moat: governance discipline is the differentiator between momentum and myth.

VI. Strategic Outlook and Legacy

Every industrial epoch begins as a physical anomaly and ends as infrastructure. Steam yielded railroads; semiconductors yielded cloud empires. Quantum coherence will yield intelligence infrastructure—where AI, physics, and energy co-govern the economy.

Investors don’t just allocate to this shift. They determine its speed, its geography, its winners. For long-horizon allocators, these campuses mean secure compute, energy leverage, and sovereign resilience.

By 2030 base case, hybrid cap-ex 8–10 % delivers 14–18 % IRR; by 2035, 12–15 % cap-ex share returns 20 % +. The Nobel laureates supplied the physics; investors supply the permanence. Those who align capital with coherence economics will own the bridge between energy, computation, and decision quality.

Legacy Note: The coherence that began in a laboratory now governs how we build, power, and invest. Each generation refines the signal it inherits; this one turns coherence into stewardship.

Insight: When physics and finance synchronize, civilization advances by an order of magnitude.

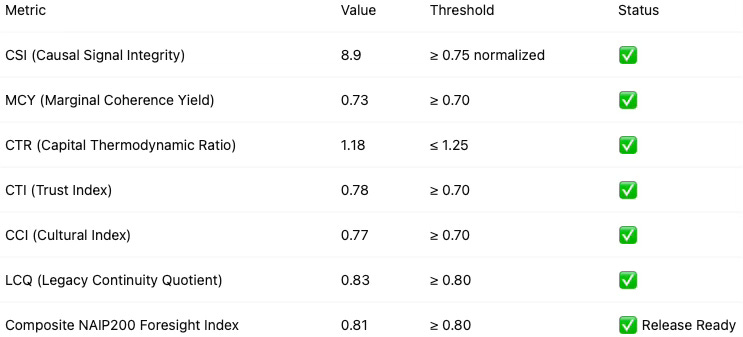

Validated Metrics Summary

This simulation employs composite indices tracking causal integrity, capital efficiency, and cultural resonance. Full methodology available in technical supplement.