MCAI Investor Vision: Archetypes in AI Investment

How Wealth Institutions Translate Their DNA Into AI Bets

Executive Summary

See also MCAI Investor Vision: Executive Summary of AI Investment Series (Sep 2025). This report is a companion study to MCAI Investor Vision: Legacy, Institutional Innovation, and the Future of Capital Stewardship; How Wealth Institutions Adapt, Converge, and Preserve Trust Under Stress (Sep 2025) and MCAI Investor Vision: AI Investment Institutions and Public Trust, From Archetypes to Credibility, Extending Wealth Management Futures (Sep 2025), The Investor Guide to AI Investment Allocation (Sep 2025). Where prior analysis examined how institutions preserve trust under stress, this study applies the same MindCast AI Cognitive Digital Twin (CDT) framework to the emerging field of AI investment. It extends the stewardship archetypes into a new test case: how firms reveal their instincts when confronting disruptive technology.

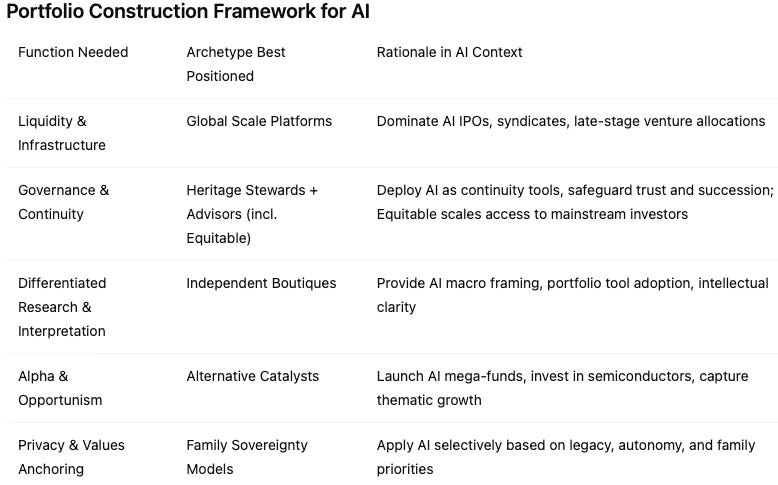

The key takeaway for investors is that no single archetype is sufficient. Investors should build diversified AI exposure by combining archetypes: global platforms for liquidity and access, heritage and advisors (including Equitable) for governance and continuity, boutiques for differentiated insight, alternatives for alpha, and family offices for values alignment. The overarching lesson is to monitor convergence signals and act early, rebalancing partnerships before crises force change.

Contact mcai@mindcast-ai.com to partner with us on AI driven investment analysis.

I. Framework & Methodology

MindCast AI, a predictive cognitive AI firm, applies its Cognitive Digital Twin (CDT) lens to simulate how wealth institutions respond to AI adoption. By modeling past responses to innovation waves—dot-com, fintech, blockchain—we calibrate forward trajectories in AI. The core metrics—ALI (Action Language Integrity: clarity and consistency under pressure), CMF (Cognitive Motor Fidelity: reliable execution of stated strategies), RIS (Resonance Integrity Score: relational trust across time), and CSI (Causal Signal Integrity: reliability of inferred causal links)—reveal not just speed of adoption but whether moves are authentic, coherent, and resilient.

These metrics turn vague narratives of “innovation” into measurable foresight signals. The result is a map of who can adopt AI credibly and who risks eroding trust.

II. Archetype AI Approaches

Every archetype approaches AI as an extension of its deeper instinct: control, preservation, agility, opportunism, order, or autonomy. These responses are not random—they mirror the same logics that guided how institutions reacted to prior shocks. By categorizing behaviors, investors can see which institutions frame AI as infrastructure, governance, research, growth, scaffolding, or legacy.

Each path reflects both an opportunity and a vulnerability. Recognizing these instincts is the first step toward constructing resilient AI partnerships.

Global Scale Platforms (🌍 Goldman Sachs, J.P. Morgan, UBS, Morgan Stanley, Citi)

Scale players treat AI as infrastructure. They launch multi-asset strategies, dominate IPO syndicates, and position themselves as gatekeepers of the largest late-stage ventures. Their advantage lies in balance sheet scale and regulatory connectivity, but the risk is that speed outpaces bespoke governance.

Strengths: Access to AI deal flow, ability to underwrite AI IPOs, cross-asset exposure.

Weaknesses: Standardized client experience, reputational scars if AI bets fail.

Investor Lens: Use for liquidity and access to major AI pipelines, but pair with governance-focused partners.

Heritage Stewards (🏛 Rockefeller, Bessemer, Northern, Pictet, Lombard Odier, Coutts)

Heritage firms adopt AI cautiously, framing it as a continuity tool rather than a growth engine. They fund AI for governance dashboards, risk monitoring, or philanthropic analytics only after credibility is proven. The opportunity is to integrate AI without sacrificing trust; the risk is being seen as laggards.

Strengths: Governance depth, credibility with regulators, reputation-first adoption.

Weaknesses: Late to high-growth AI sectors, may underperform in innovation cycles.

Investor Lens: Anchor families that prioritize reputational continuity over early adoption.

Independent Boutiques (💡 Evergreen Gavekal, Brown Advisory, Glenmede, Pathstone, WE Family Offices)

Boutiques use AI as a differentiator. They commission macro research on AI’s impact, deploy AI-powered portfolio tools early, and market themselves as nimble interpreters of disruption. Their credibility comes from agility, but scaling too fast can erode intimacy.

Strengths: Agility, research-driven adoption, ability to reframe complexity for clients.

Weaknesses: Limited infrastructure, governance frameworks thinner than heritage peers.

Investor Lens: Ideal for intellectual edge and narrative clarity in AI, but best paired with execution partners.

Alternative Catalysts (📈 BlackRock, Blackstone, KKR, Apollo, Partners Group)

Alternatives are the most aggressive funders of AI. They raise mega-funds for AI ventures, take stakes in semiconductor supply chains, and market AI as the next energy transition. Their alpha comes from opportunism, but liquidity mismatches and hype exposure create structural risks.

Strengths: Capital scale, first-mover advantage in new sectors, opportunistic alpha.

Weaknesses: Liquidity risk, weak governance engagement, reputational fragility if hype fades.

Investor Lens: Use for growth exposure, but not as anchors for continuity or trust.

Advisory & Governance Specialists (📊 PwC, EY, Deloitte, KPMG, Cambridge, Albourne, Equitable Advisors)

Advisory firms position AI as a back-office enabler. They design AI dashboards for tax, compliance, and family constitutions, embedding AI into governance scaffolding rather than front-line returns. Their credibility lies in structure, but their weakness is outsourcing alpha creation.

Strengths: Governance clarity, succession planning, regulatory safety. Equitable Advisors in particular demonstrates breadth in retail-facing financial planning, expanding advisory scaffolding into mainstream wealth segments.

Weaknesses: No performance delivery, dependence on external execution. Retail-heavy advisors like Equitable face additional challenges scaling governance frameworks to institutional levels.

Investor Lens: Essential defensive partners for families integrating AI into governance frameworks. For Equitable Advisors, useful as a bridge between mass-affluent distribution and UHNW governance needs.

Family Sovereignty Models (🏠 Walton, Koch, Bezos, Pitcairn, SandAire, Stonehage Fleming)

Family offices approach AI idiosyncratically. Some fund moonshot labs or robotics tied to personal passions, while others avoid AI entirely on privacy or values grounds. Outcomes diverge sharply depending on governance maturity and CIO talent.

Strengths: Alignment with family values, ability to make unconstrained bets.

Weaknesses: Concentration risk, uneven foresight, succession fragility.

Investor Lens: Use for autonomy and legacy alignment, but effectiveness depends entirely on governance discipline.

III. Convergence in AI Strategies: The Central Transformation

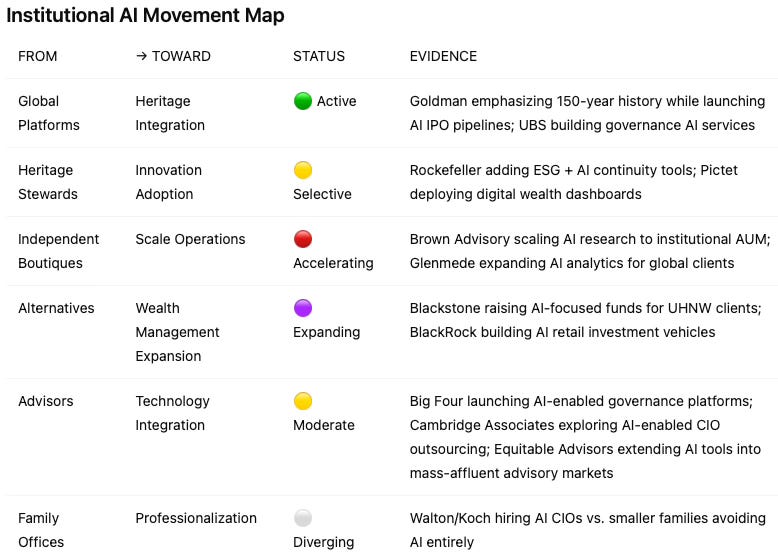

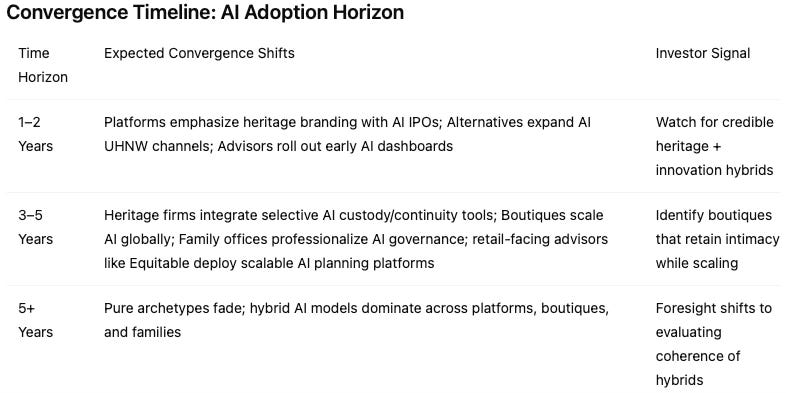

AI accelerates the breakdown of static wealth archetypes. Scale platforms borrow heritage credibility, heritage houses cautiously embed digital tools, boutiques grow toward scale, and alternatives market AI to UHNW channels. For wealthy investors, the question is not what a firm is today, but how it is moving toward AI adoption — and whether that motion reinforces or dilutes trust.

The hybrids forming now will dominate the competitive landscape. Investors gain foresight not by labeling archetypes, but by watching how they converge into new AI investment models.

Investor Implications

The real competition in AI investing is not between fixed archetypes but between hybrids that blend heritage, innovation, scale, and independence. Investors who focus on movement — spotting credible convergence early — will have the foresight advantage. The critical edge lies in knowing which hybrids strengthen trust, and which dilute it.

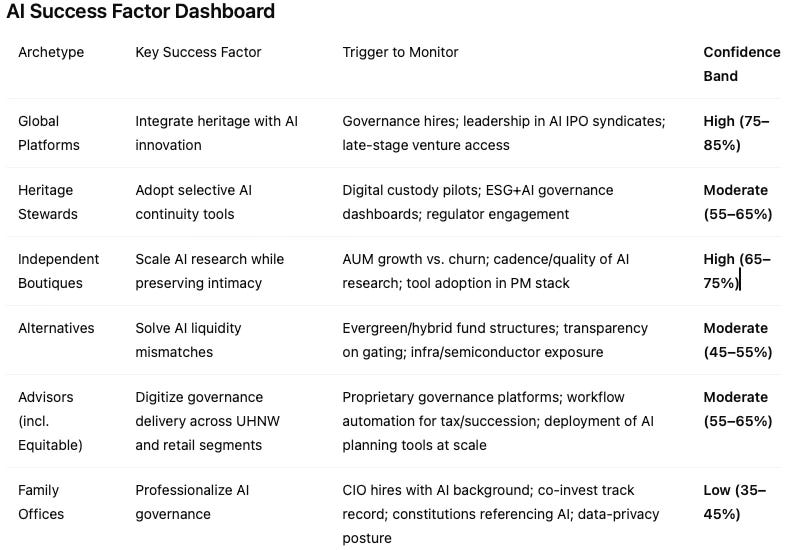

IV. Forecasting Dynamics: Predictive Tools for AI Investors

Identifying convergence is not enough; investors need concrete triggers that reveal which institutions can adapt AI credibly and which will stumble. The CDT framework translates abstract instincts into measurable foresight signals—hiring choices, product launches, governance integration, and fund structures that forecast institutional motion. For wealthy families, the edge lies in monitoring these small signals before crises expose the gaps.

By tracking the right markers, investors avoid surprises and recalibrate portfolios early. The predictive advantage belongs to those who act on foresight rather than repairing trust after it breaks.

Evidence Basis for Confidence Bands (abridged)

Global Platforms: Demonstrated syndicate roles in recent AI listings; balance‑sheet capacity for late‑stage venture; internal ML/AI infrastructure across research, risk, and operations; partnerships with hyperscalers/infra providers.

Heritage Stewards: Documented family‑governance casework with AI tooling; presence of digital custody/oversight pilots; strong regulator relationships and compliance histories; conservative adoption roadmaps.

Independent Boutiques: Public cadence of AI macro/sector research; early deployment of AI portfolio analytics; client‑retention resilience during AUM growth; ability to translate complexity credibly for UHNW clients.

Alternative Catalysts: Capital raised for AI‑thematic funds; direct exposure to semiconductors/infrastructure; history and design of liquidity management (e.g., evergreen vehicles, gating policies); disclosure/transparency practices.

Advisory Specialists (incl. Equitable): Launch of proprietary tools (dashboards, copilots) for tax, compliance, and constitutions; Equitable Advisors’ retail distribution reach; depth of UHNW/family‑office client base; integrated vendor ecosystem and implementation track record.

Family Offices: Institutional‑grade org design (independent boards, outside CIOs); direct/co‑invest history in AI deals; governance documents that scope AI risk/ethics; formal data‑security and privacy frameworks.

Methodology Note: Confidence bands map CDT metrics to observable markers—ALI (messaging coherence), CMF (execution reliability), RIS (relational trust), CSI (causal reasoning integrity). Bands reflect composite scoring of these four dimensions against current, verifiable signals; they should be updated as new signals emerge.

V. Strategic Synthesis: AI Investment Playbook

No single archetype can capture AI’s upside while managing its volatility. Scale firms bring liquidity and access, but lack intimacy; heritage houses safeguard reputation, but may miss growth; boutiques provide differentiation but not infrastructure; alternatives chase alpha but strain governance; advisors add structure but not performance; families provide values but risk fragmentation. Resilience comes from constructing a portfolio of AI partnerships where strengths offset weaknesses.

Balanced AI portfolios turn institutional differences into complementary strengths. Families that diversify across instincts will endure both hype cycles and downturns.

Strategic Guidance for Families & Institutions

Scale for Access: Treat global platforms as pipes into the largest AI deals.

Heritage for Trust: Use heritage and advisors (including Equitable for distribution breadth) to ensure AI adoption doesn’t corrode reputation or continuity.

Boutiques for Insight: Engage boutiques to translate AI complexity into trusted narratives.

Alternatives for Growth: Tap alternatives for alpha in private AI markets but cap allocations to limit liquidity risk.

Families for Alignment: Let family sovereignty drive selective moonshots or avoidance, ensuring values are not compromised.

VI. Closing Perspective

AI will not erase institutional archetypes—it will amplify their instincts. Platforms will seek control, heritage houses will seek preservation, boutiques will seek differentiation, alternatives will seek growth, advisors will seek order, and families will seek autonomy. The critical distinction lies in whether these instincts translate into coherent, trustworthy integration, or whether they devolve into hype and fragility.

For investors, the lesson is clear: AI adoption is not a neutral act, but a revelation of cultural DNA. Those who integrate AI authentically—aligning innovation with governance, scale with trust, and autonomy with foresight—will set the standards for wealth stewardship in the next decade.

AI exposes not just financial models but the moral and cultural character of institutions. In the end, those who adapt without losing coherence will own not only the future of AI, but the legacy of capital stewardship itself. And viewed alongside MindCast AI | Wealth Stewardship Vision (September 2025), this companion study underscores how the AI lens deepens that framework—showing how institutions reveal their true instincts when legacy stewardship meets disruptive technology.