MCAI Investor Vision: Legacy, Institutional Innovation, and the Future of Capital Stewardship

How Wealth Institutions Adapt, Converge, and Preserve Trust Under Stress

Also see MCAI Investor Vision: Executive Summary of AI Investment Series (Sep 2025) and companion studies Archetypes in AI Investment, How Wealth Institutions Translate Their DNA Into AI Bets (Sep 2025), AI Investment Institutions and Public Trust, From Archetypes to Credibility, Extending Wealth Management Futures (Sep 2025), The Investor Guide to AI Investment Allocation (Sep 2025).

Wealth stewardship is being redefined in real time. A decade of shocks—from the 2008 crisis, to the COVID liquidity freeze, to the acceleration of AI—has taught wealthy families that performance is not enough. The central question is no longer who delivers returns, but who preserves trust and adaptability when the environment fractures. Every institution, whether a global bank or a private office, is being tested against that standard.

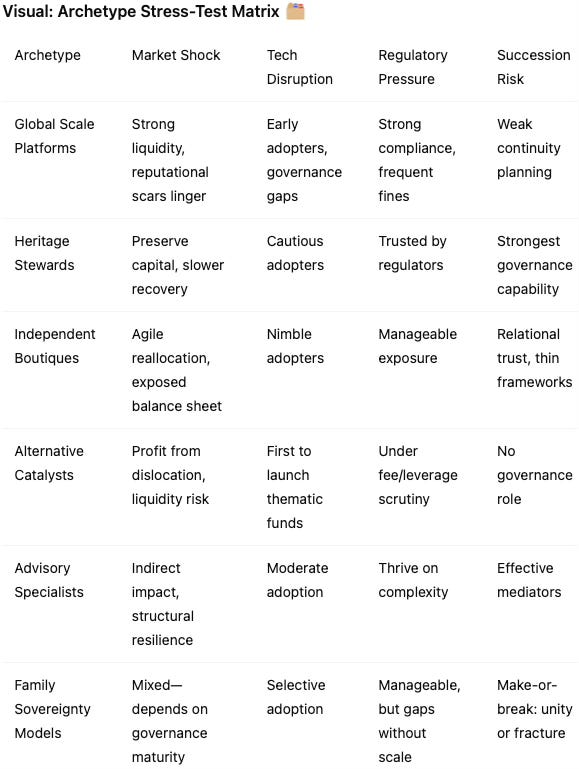

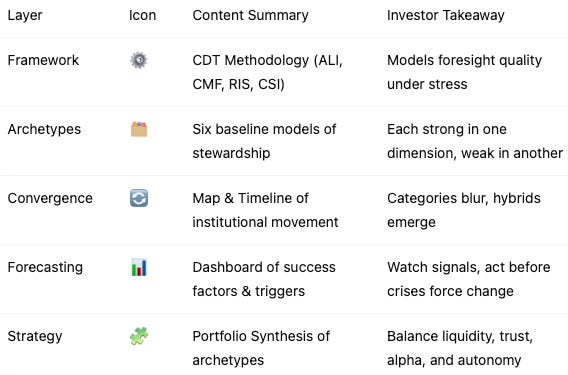

MindCast AI applies its Cognitive Digital Twin (CDT) methodology to model how different archetypes behave under stress. This approach moves beyond categorization, exposing how global platforms, heritage stewards, boutiques, alternatives, advisors, and family offices actually respond when markets seize up, regulations tighten, or succession looms. The analysis reveals not just differences in strengths and weaknesses, but the ways institutions are converging—borrowing from one another, sometimes reinforcing trust, sometimes eroding it.

For wealthy investors, the implications are urgent. Archetypes provide a baseline, but convergence is reshaping the field; the winners will be those who adapt before crises force change. The edge lies in anticipating institutional movement, identifying credible hybrids, and recalibrating partnerships before pressure points become failures.

Contact mcai@mindcast-ai.com to partner with us on AI driven investment analysis.

I. Framework and Methodology

MindCast AI is a predictive Cognitive AI system designed to run Cognitive Digital Twins of institutions, and markets. This analysis modeled Digital Twins of leading wealth platforms through historical and forward-looking stress scenarios, simulating how each firm adapts under market shocks, technology disruptions, regulatory changes, and succession crises.

Core Metrics Our CDT analysis employs four key measurements:

ALI (Action Language Integrity): How clearly and consistently an institution communicates under pressure

CMF (Cognitive Motor Fidelity): Whether stated strategies translate into reliable execution

RIS (Resonance Integrity Score): Relational trust and authenticity across time

CSI (Causal Signal Integrity): Reliability of inferred causal links in decision-making

Historical Foundation This work builds on earlier analyses, including

MCAI Investor Vision: Modeling Capital Cognition in the AI Market (July 2025), which showed how InvestorVision measures foresight quality in capital allocation during periods of hype and uncertainty,

MCAI Market Vision: Rebuilding Consulting in the Age of Predictive Cognitive AI (September 2025), which demonstrated how CDT analysis applies to consulting firms’ adaptability and client trust. Together, these works establish the foundation for evaluating foresight quality across institutional contexts and directly inform the wealth stewardship analysis here.

MCAI Legacy Vision: Legacy Innovation in Asian Cultures – Designing Continuity, Not Disruption (August 2025), which examined how Asian traditions of succession and governance frame legacy as continuity rather than disruption; this cultural insight enriches the analysis of heritage and sovereignty models in the present study.

Analytical Scope Rather than describing static categories, we created a comparative map of how institutions preserve or lose investor confidence under real stress. The analysis reveals differences in foresight, trust, and continuity that become visible only when conditions change.

II. Current State Analysis: Six Wealth Stewardship Archetypes

The first step in understanding the future of wealth stewardship is to establish a baseline. Each archetype—scale, heritage, boutique, alternatives, advisors, and sovereigns—has evolved distinct strengths and weaknesses. These models reflect how wealthy investors have historically chosen partners, and they provide a starting point for assessing resilience. But they are not destinations; they are present states that already show signs of blurring and convergence.

Global Scale Platforms (Goldman Sachs, J.P. Morgan, UBS, Morgan Stanley, Citi)

Global platforms are the indispensable pipes of global finance. They deliver liquidity when markets seize, offer exclusive deal flow, and deploy technology faster than almost any peer group. Yet their scale creates exposure: in 2008 they required government backstops to survive, and in 2020 they were criticized for privileging select clients in credit allocation. Wealthy investors rely on them for access, but rarely for intimacy.

Current Strengths: Balance sheet resilience, global structuring power, technology adoption.

Current Weaknesses: Reputational scars from past crises, continuity planning treated as standardized rather than bespoke.

Investor Lens: Use for liquidity and access, but pair with heritage or advisory partners to preserve trust and governance.

Transition: Their dominance explains present reliance, but also sets up the need for convergence analysis.

Heritage Stewards (Rockefeller, Bessemer, Northern, Pictet, Lombard Odier, Coutts)

Heritage stewards trade speed for reputation. Their value proposition is that they outlast storms by preserving trust, embedding governance, and maintaining discretion. During the 2008 drawdowns, Rockefeller and Bessemer held clients even as returns lagged peers; Northern Trust solidified its standing as a safe custodian for endowments. Swiss houses like Pictet still emphasize family governance and reputation first.

Current Strengths: Governance continuity, cultural credibility, regulatory trust.

Current Weaknesses: Slower to adopt innovation, sometimes underperform in bull markets.

Investor Lens: Best anchor for families and foundations where reputation preservation matters more than short-term outperformance.

Transition: Their stability highlights why categories blur as others adopt heritage traits.

Independent Boutiques (Evergreen Gavekal, Brown Advisory, Glenmede, Pathstone, WE Family Offices)

Independent boutiques build trust by aligning with clients as fiduciaries without product conflicts. They thrive on agility, open architecture, and research depth. Evergreen Gavekal differentiates through macroeconomic research that frames turbulence in language clients can trust. Brown Advisory and Glenmede have scaled considerably, proving independence need not mean smallness.

Current Strengths: Agility, fiduciary independence, intellectual credibility.

Current Weaknesses: Limited infrastructure, governance frameworks thinner than heritage peers.

Investor Lens: Useful as relational anchors and idea generators, best paired with institutions that can provide execution at scale.

Transition: Their agility shows why boutiques are converging upward toward institutional scale.

Alternative Catalysts (BlackRock, Blackstone, KKR, Apollo, Partners Group)

Alternatives promise differentiated returns by opening doors to private equity, credit, infrastructure, and thematic strategies. They thrive when markets fracture: Blackstone expanded dominance after 2008 by buying distressed assets, while KKR pivoted into infrastructure and tech. Yet their structures can create liquidity mismatches—Blackstone faced backlash for gating withdrawals in 2020. For wealthy families, they are tactical engines, not legacy custodians.

Current Strengths: Alpha in dislocation, innovation in new asset classes, scale in alternatives.

Current Weaknesses: Liquidity mismatch, weaker governance and succession engagement.

Investor Lens: Integrate tactically for growth, but not as anchors for trust or continuity.

Transition: Their opportunism illustrates how alternatives are broadening toward wealth management models.

Advisory & Governance Specialists (PwC, EY, Deloitte, KPMG, Cambridge, Albourne, Equitable Advisors)

Advisory specialists reduce risk of fragmentation by designing structures that protect families across generations. Their capital is intellectual and legal rather than financial. Big Four firms were indispensable during 2017 tax reform, guiding restructuring of trusts and charitable entities. Cambridge Associates has long served endowments by providing governance clarity in times of turbulence.

Current Strengths: Succession design, tax and governance optimization, reputational safety.

Current Weaknesses: Do not deliver alpha, execution outsourced to partners.

Investor Lens: Critical defensive partners; best combined with institutions that deliver performance.

Transition: Their role as architects of governance explains why advisory firms are digitizing to stay relevant.

Family Sovereignty Models (Walton, Koch, Bezos, Pitcairn, SandAire, Stonehage Fleming)

Sovereign family offices represent the ultimate expression of control. Some, like Walton Enterprises or Koch Industries, professionalize into institutional-grade operations rivaling Wall Street. Others remain lean, prioritizing privacy but sometimes lacking resilience. Succession is their critical vulnerability: some families strengthen through governance constitutions, others splinter without mediation.

Current Strengths: Privacy, autonomy, alignment of values and capital.

Current Weaknesses: Uneven foresight capacity, concentration risk, succession fragility.

Investor Lens: Essential for autonomy, but effectiveness depends entirely on governance maturity and professionalization.

Transition: Their uneven foresight underscores why sovereigns are professionalizing toward institutional standards.

Comparative Analysis

Taken together, the six archetypes illustrate the spectrum of wealth stewardship models. Scale platforms provide unmatched liquidity and access but lack intimacy; heritage stewards preserve reputation and governance but sacrifice speed; boutiques offer independence and agility but struggle with scale; alternatives deliver opportunistic alpha but little continuity; advisors protect structure but outsource execution; sovereign offices safeguard privacy but reveal uneven foresight. Each fills a distinct role, but none are sufficient on their own.

The comparative lesson is that wealthy investors cannot rely on a single archetype. Each model reveals both a capability and a blind spot, and the true test is how those traits interact when stress arrives. This recognition sets the stage for convergence: institutions are already borrowing from one another, attempting to close gaps and present as hybrids. Investors must therefore shift from static choice to dynamic monitoring of movement.

These comparative differences explain the present, but the real transformation lies in motion. The next section examines convergence—the blending of archetypes that is reshaping the competitive field and redefining what wealthy investors must watch. This sets up the flow into forecasting, where convergence patterns are converted into practical tools and triggers investors can act upon.

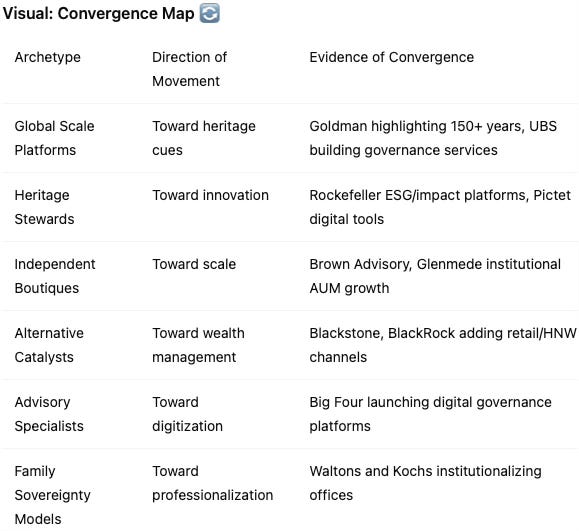

III. Convergence Dynamics: The Central Transformation

Convergence is the hinge point of the analysis. Having established how the six archetypes function today, it is clear that no model remains pure. Institutions are borrowing strengths from one another, blending identities to close gaps and meet client demands. For wealthy investors, the risk is not misunderstanding what a firm is, but failing to see what it is becoming.

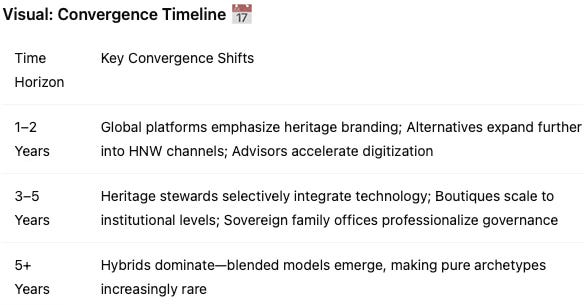

This convergence map illustrates how static categories are breaking down. Each archetype borrows traits from others, creating hybrids that wealthy investors must evaluate as evolving trajectories rather than fixed types.

This timeline highlights when convergence shifts are likely to reshape the field and provides investors with a sense of urgency about when to anticipate meaningful change.

IV. Forecasting Dynamics: Predictive Tools for Investors

Forecasting takes the convergence story and turns it into a practical playbook. Wealthy investors want more than categories—they want to know what signals to watch, when to act, and how to reposition partnerships before crises make the choice for them. By simulating institutional behavior under stress, MindCast AI’s CDT framework highlights concrete triggers that foreshadow adaptation or vulnerability.

Global scale platforms succeed when they graft authentic heritage onto their innovation engines. If you see Goldman or UBS hiring governance specialists or building bespoke ESG offerings, it signals credible movement. Heritage stewards thrive if they adopt digital custody or impact platforms without eroding discretion; the trigger is selective technology launches that preserve trust. Boutiques like Evergreen Gavekal scale successfully only if AUM growth doesn’t erode client intimacy—investors should watch retention metrics as closely as performance. Alternatives must resolve liquidity mismatches; evergreen vehicles or hybrid structures are the telltale signs. Advisory firms advance when they digitize governance delivery, while sovereign family offices endure only if they professionalize through CIO hires or formal constitutions.

Investor Guidance: These triggers provide advance warning. If scale platforms double down on heritage or boutiques lose intimacy while scaling, it is time to recalibrate. If alternatives fail to fix liquidity or sovereign offices resist governance, investors should diversify away. The key is not to wait for stress to expose weaknesses, but to act when early signals surface.

V. Strategic Synthesis: The Future of Wealth Stewardship

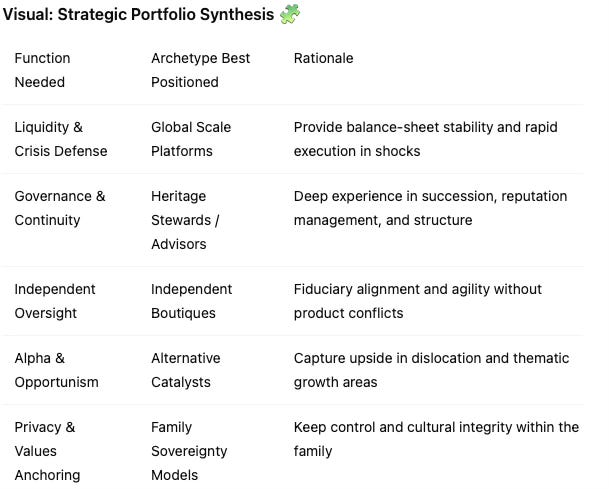

Strategic synthesis is where analysis becomes action. No archetype alone can safeguard wealth across generations. Families that rely only on scale gain liquidity but lose intimacy; those that cling to heritage preserve reputation but may lag in innovation. True resilience comes from constructing an ecosystem of partners that complement one another.

Wealthy investors increasingly treat stewardship as portfolio design. Scale firms are selected for liquidity backstops; heritage stewards or advisors are engaged for governance depth; boutiques provide independence and sharper perspective; alternatives are included tactically for alpha; and sovereign models anchor values and privacy. The art lies in balancing these elements so that strengths cover weaknesses, and foresight gaps are closed before stress tests them.

Investor Application: For a $500 million family office or a global foundation, the synthesis principle is the same: diversify not just assets, but institutional relationships. Use scale for liquidity, heritage for trust, boutiques for alignment, alternatives for growth, and sovereign models for autonomy. Done well, the portfolio of partners functions like a diversified investment portfolio—resilient across market cycles and succession events.

VI. How Archetypes Approach AI Investments

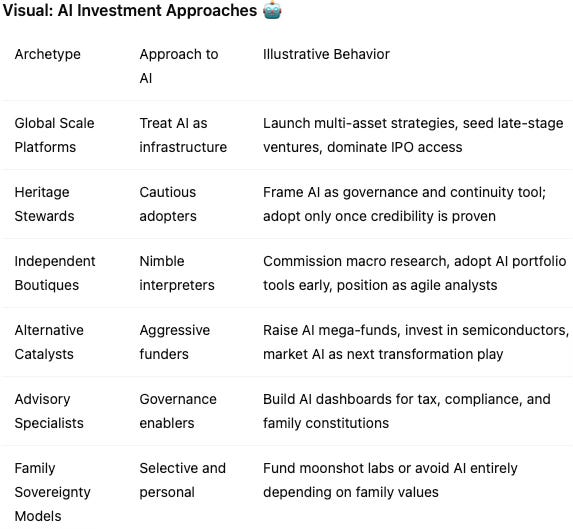

Having examined how institutions behave under stress, converge, and can be forecast, we now consider how each archetype instinctively approaches AI investing—a test case that reveals their deeper instincts.

Global Scale Platforms: Treat AI as infrastructure. Launch multi-asset strategies, seed late-stage ventures, and position themselves as gatekeepers to the biggest AI IPOs and private equity deals.

Heritage Stewards: Approach AI cautiously. Frame it as a tool for continuity—investing in AI-enabled governance, risk monitoring, or philanthropic analytics only after credibility is proven.

Independent Boutiques: Use AI as a differentiator. Commission research on AI macro impacts, adopt AI-powered portfolio tools early, and present themselves as nimble interpreters of disruption.

Alternative Catalysts: Go all in. Raise massive AI-focused private equity and venture funds, acquire stakes in semiconductor supply chains, and sell AI as the next energy transition play.

Advisory Specialists: Integrate AI into governance design. Develop digital dashboards for family constitutions, tax planning, and compliance monitoring—making AI a back-office enabler.

Family Sovereignty Models: Selective and idiosyncratic. Some families might fund moonshot AI labs or robotics ventures tied to personal passions, while others avoid it entirely, citing privacy and values.

Takeaway: AI is a lens through which each archetype reveals its instincts—scale seeks control, heritage seeks preservation, boutiques seek edge, alternatives seek growth, advisors seek order, and sovereigns seek autonomy.

VII. Closing Perspective

Wealthy investors face an environment defined by volatility, regulation, and technological acceleration. The archetypes described here are useful starting points, but real advantage comes from watching how institutions move and converge. The predictive edge is to act on early signals rather than wait for crises to make choices inevitable.

MindCast AI’s CDT methodology offers a forward-looking lens: it highlights who adapts authentically, who borrows traits without credibility, and who risks diluting their identity. The lesson for families, foundations, and institutions is clear: resilience requires a portfolio of partners that balance liquidity, governance, independence, alpha, and values. The future of stewardship belongs to those who invest not in categories, but in trajectories.

Insight: The question is no longer who manages the money—it is who preserves trust when everything else fractures. Investors who answer that well will shape legacies measured not in quarters, but in generations.

The analysis comes full circle: wealthy investors do not simply choose managers, they design systems of trust. Archetypes give structure, convergence shows motion, forecasting provides tools, synthesis creates balance, and AI reveals instinct. The Investor Playbook ties them together as a practical guide. The final lesson is enduring: those who anticipate adaptation will own the future of stewardship.

In an age of shocks, the rarest asset is foresight paired with trust. That is the benchmark by which every institution should now be judged.

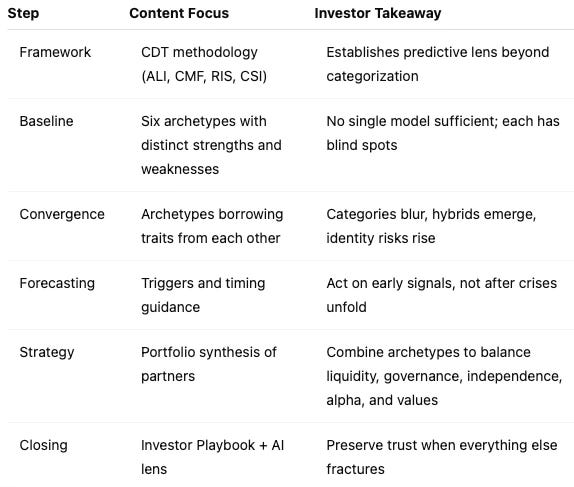

VIII. Investor Playbook (Visual Overview)

Investor Guidance: This playbook integrates the entire analysis into a single schematic. It shows how static categories lead to convergence, how forecasting reveals triggers, and how strategic synthesis creates resilience. Use it as a reference to align partnerships with both present needs and future trajectories.