MCAI Economics Vision: Chicago School Accelerated — Integrated Application- The Compass–Anywhere Merger, Coordination Capture, Labor Lock-In, and the Enforcement-Lag Window

Coordination Failure, Incentive Exploitation, and Enforcement Design in Residential Brokerage

I. Executive Thesis

The MindCast AI Chicago School of Law and Behavioral Economics framework modernizes classical Chicago theory by adding behavioral precision and predictive capacity to Coasean, Beckerian, and Posnerian analysis. Where traditional Chicago School economics assumes rational actors and efficient markets, the behavioral extension models how real agents update beliefs, how firms exploit coordination failures, and how institutional lag creates durable windows for harm. The Compass–Anywhere merger serves as the proof case.

The Chicago School Accelerated Series. Part I (Coase and Why Transaction Costs ≠ Coordination Costs) established that coordination failure is architecturally distinct from transaction friction—using the OpenAI governance crisis as proof case. Part II (Becker and the Economics of Incentive Exploitation) established that rational firms exploit coordination degradation through labor-side mechanisms when enforcement probability is low—using the Compass litigation complex as proof case. Part III (Posner and the Economics of Efficient Liability Allocation) established that legal institutions fail to self-correct when coordination collapse and incentive exploitation convert the legal system into a wicked learning environment—using the 42-state AG enforcement action against AI companies as proof case. The present document integrates all three pillars and applies them to a live transaction.

Controlling Insight. The Compass–Anywhere merger implicates all three Chicago pillars. Coase explains how the merger degrades coordination architecture by consolidating control over inventory, routing, and cooperative norms. Becker explains why rational actors exploit that degradation through labor‑side mechanisms such as clawbacks, compensation opacity, and mobility suppression. Posner explains why existing doctrine and enforcement timing cannot arrest harm once incentives and coordination collapse interact. The Cognitive Digital Twin (CDT) methodology converts these theoretical claims into scored foresight outputs that identify interaction points and optimal intervention targets.

Integrated Prediction. Agent defection risk is not cultural noise or merger anxiety; it is an ex ante signal that coordination costs are rising, incentives are being re‑optimized against labor, and enforcement lag makes exploitation privately rational. Economically active agents update expected value before integration begins, sorting away from firms where post‑merger bargaining power shifts structurally against labor.

Headline Prediction (Integrated Framework)

Prediction. If the Compass–Anywhere merger proceeds without merger-specific constraints that preserve coordination architecture and limit labor lock-ins, the combined entity will experience a measurable labor-market shock within 24 months post-announcement or post-close (whichever is later), characterized by agent churn materially exceeding baseline rates, expanded off-Multiple Listing Service (MLS) exclusivity windows, and standardized compensation lock-in across franchises.

Assessment Date: 24 months post-announcement (September 2025) or post-close (guided H2 2026), whichever is later—placing the assessment window in late 2027 to late 2028.

Falsification Rule: If 6 or more of the 10 registered predictions in Section XII fail to materialize by the assessment date, the integrated Coase–Becker–Posner framework is falsified for this transaction.

Contact mcai@mindcast-ai.com to partner with us on law and behavioral economics foresight simulations. See the MindCast AI verticals in Law | Economics, Markets | Technology and Complex Litigation.

II. The Coase Framework (Coordination Architecture)

Ronald Coase’s foundational insight was that transaction costs explain why firms exist and why markets sometimes fail to reach efficient outcomes. Part I of this series extended that insight: coordination costs are architecturally distinct from transaction costs. Transaction costs are the friction of exchange—search, bargaining, enforcement. Coordination costs are the prerequisites for exchange to occur at all—shared focal points, trust density, narrative alignment. When coordination architecture degrades, parties cannot reach the bargaining table regardless of how low transaction costs fall.

The Coase Extension. Markets require coordination infrastructure: shared reference points (focal points), mutual trust that signals will be interpreted cooperatively (trust density), and agreement on what is being negotiated (narrative alignment). Capture or degrade this infrastructure, and private ordering fails—not because bargaining is costly, but because bargaining cannot begin.

Why Real Estate Fits Coase. The Multiple Listing Service (MLS) system is coordination infrastructure. It provides the focal point (where listings appear), the trust mechanism (reciprocity norms, data standards), and the shared narrative (cooperative brokerage). The Compass–Anywhere merger consolidates control over this infrastructure. Section X operationalizes this analysis through the Cognitive Digital Twin (CDT) methodology.

III. The Becker Framework (Incentive Response)

Gary Becker’s economics of crime and rational choice provides the second pillar. Part I (Coase) established what coordination infrastructure is and how firms capture it. Part II (Becker) explains what rational actors do once that infrastructure weakens: they exploit it. The Incentive Shock Model specifies the mechanism—when coordination architecture degrades, three transitions occur: transparency becomes optionality, reciprocity becomes arbitrage, and governance becomes attack surface. Firms shift risk downward onto labor because the expected payoff from exploitation rises as detection probability falls and enforcement lags.

The Becker Rule. When coordination among workers weakens, rational firms maximize expected value by shifting risk downward—through compensation opacity, switching‑cost inflation, and information asymmetry—rather than by investing in productivity.

Deterrence Logic. Expected payoff from exploitation increases as detection probability falls and enforcement lags. Fragmented oversight and slow regulatory throughput widen the exploitation window. Part II documented Compass at Behavioral Drift Factor (BDF) 0.78 and Institutional Update Velocity (IUV) 0.81—the firm identified the coordination-degradation opportunity faster than governance institutions could respond.

Why Real Estate Fits Becker. Residential brokerage exhibits high baseline churn and weak collective bargaining. Small incentive shocks therefore produce large behavioral responses. Part II used the Compass litigation complex as proof case; the present analysis extends that framework to the merger context.

IV. The Posner Framework (Enforcement and Institutional Learning)

Richard Posner’s law-and-economics tradition holds that common-law adjudication tends toward efficient rules over time: judges observe outcomes, update doctrine, and liability flows to the lowest-cost avoider. Part III of this series identified the conditions under which that mechanism fails. When the learning environment is “wicked”—long causal chains, delayed feedback, fragmented adjudication, and narrative manipulation by sophisticated actors—courts cannot observe the consequences of their rules within litigation timelines. Doctrine does not converge; self-correction stalls.

The Posner Extension. Efficient liability allocation requires that courts can (1) observe harm, (2) attribute causation, and (3) assign liability to the party who can prevent harm at lowest cost. When coordination collapse (Coase) enables incentive exploitation (Becker), all three conditions degrade. Harm disperses across millions of transactions; causation runs through behavioral channels courts rarely model; and the lowest-cost avoider (the firm) can frame disputes to avoid attribution.

The Behavioral Extension. Part III added a prior question to Posner’s lowest-cost avoider analysis: can the party adjust behavior at all? Agents facing take-it-or-leave-it compensation structures and no collective bargaining power are “non-avoiders”—they cannot adjust conduct regardless of price signals. Allocating risk to non-avoiders produces pure deadweight loss.

Why Real Estate Fits Posner. Real estate disputes silo across labor law, antitrust, contract, and consumer protection doctrines. No single court sees the unified strategy. Enforcement lags firm adaptation by years. Agents are behavioral non-avoiders. The Compass–Anywhere merger will generate litigation across 50+ jurisdictions without doctrinal convergence—exactly the wicked-environment conditions Part III identified. Section X operationalizes this analysis through the CDTmethodology, scoring Institutional Update Velocity (IUV), Doctrinal Fragmentation Score (DFS), Enforcement Lag Index (ELI), and Avoider Capacity Ratio (ACR).

V. Pre‑Merger Baseline: An Elastic Labor Market

Baseline labor-market conditions determine how severely the merger’s incentive shock will propagate. If agent mobility were low and switching costs high, Becker dynamics would operate slowly. Independent data reveals the opposite: real estate brokerage is a high-churn, high-mobility labor market where agents respond quickly to changes in expected payoffs.

10–13% of agents switch brokerages annually across large MLSs (Recruiting Insight & BoldTrail, 2025; DelPrete, 2024).

Recruiting pressure is constant: 74% of agents recruited within two months; 21% recruited weekly (Inman Intel, 2024–2025).

Interpretation. Coordination is already weak. Outside options are salient. Labor responds quickly to expected-payoff changes. A labor market this elastic will amplify any incentive shock the merger introduces.

VI. The Incentive Shock: Compass–Anywhere Integration

The merger introduces specific changes to coordination mechanisms and compensation structures that constitute the incentive shock Becker’s framework predicts. Practices already documented at Compass become durable and scalable when combined with Anywhere’s national franchise infrastructure.

A. Coordination Mechanisms That Weaken

The merger degrades three coordination mechanisms that currently enable efficient matching in residential real estate.

Commission transparency: Post‑Sitzer/Burnett restructuring uncertainty.

Inventory access norms: Expansion of Private / off‑MLS listings.

Cooperative brokerage rules: Mandatory submission under active litigation attack.

B. Exploitation Levers Documented at Compass

Compass has already deployed three exploitation mechanisms that the merger will standardize nationally.

Clawbacks and commission deferrals: Earned income rendered conditional; exit triggers asymmetric penalties.

Inventory gatekeeping: Private Exclusives reduce listing portability and agent outside options.

Lead and routing control: Firm‑mediated access substitutes for open coordination.

C. Why Anywhere Matters

Compass alone can experiment with these practices. Anywhere provides national scale—340,000 agents across 120 countries, 1.2 million annual transactions (NJBiz; Bisnow)—plus franchised enforcement channels, standardized agent agreements, and downstream routing. The merger converts localized tactics into durable incentive architecture.

The disclosed synergy target ($225–255M in annual cost savings) quantifies the extraction budget (PRNewswire; Westfair). In a brokerage merger with minimal operational overlap, labor-side compression is the primary savings source. The synergy figure is not incidental to the Becker analysis—it is the analysis, denominated in dollars.

The financial structure converts this extraction from strategic option to contractual obligation. Compass has arranged a $750M committed debt facility from Morgan Stanley (Paul Hastings; National Mortgage Professional) with a disclosed leverage target of ~1.5x net debt to adjusted Earnings Before Interest, Taxes, Depreciation, And Amortization(EBITDA) by 2028 (NJBiz). The synergy savings must materialize to service debt and delever on schedule. Additionally, the projected “$1B+ incremental revenue” depends on capturing transaction flow through Anywhere’s franchise, title, escrow, and relocation businesses—the downstream routing that coordination capture enables. The deal’s financial viability assumes the Coase and Becker dynamics succeed.

VII. Labor Evidence

The Becker framework generates testable predictions about agent behavior. If coordination capture and incentive exploitation are real, agents should: (1) update expected payoffs ex ante, before integration completes; (2) actually move, not just express dissatisfaction; and (3) cite the specific variables the framework identifies—compensation, coordination, support—not cultural factors. This section presents evidence across all three dimensions.

A. Ex Ante Survey Evidence

If the Becker framework is correct, economically active agents should already be updating expected payoffs in response to the anticipated merger—not waiting for integration to complete before signaling exit intent.

Zillow Survey (October–November 2025). Zillow surveyed 122 verified, active Anywhere agents (each closed ≥1 sale in prior year) during the second half of October 2025. (Zillow Press Release, November 6, 2025; methodology details via Real Estate News):

18% would definitely leave if the merger closes.

35% would consider leaving.

53% total open to defection.

23% expect a negative impact on their business.

~70% believe private listing networks are not in sellers’ best interest.

Zillow’s litigation posture creates sponsor incentives, but the relevant question is whether agent responses are incentive-consistent; baseline churn data and observed exits corroborate directionality.

Becker Interpretation. Agent responses reflect expected‑value updating before integration, not sentiment. Agents anticipate reduced autonomy and bargaining power.

Reconciling Other Surveys. Other polls report many agents “expect to stay,” reflecting heterogeneous responses and switching costs. Becker predicts sorting: high‑autonomy agents exit early; locked‑in agents remain.

B. Observed Mobility

Survey responses could reflect cheap talk or temporary anxiety rather than genuine expected-value updating. The test is whether agents actually move—and whether their stated reasons align with the coordination and compensation dynamics the Becker framework identifies.

Media‑documented departures from Compass:

Massachusetts mega‑team → eXp (Oct 2025): cited brokerage model and flexibility.

25‑agent Denver team → Your Castle (Apr 2025): cited better commission structure and support.

Seattle agents → Windermere (Jul 2025): cited transparency, collaboration, and fair‑housing alignment.

Agents cite the specific variables Becker identifies as defection drivers—compensation, support, and coordination quality—not cultural fit or brand preference.

C. Historical Corroboration

The exploitation levers described in Section VI have independent evidentiary grounding in California lawsuits filed between 2018 and 2022—years before the Compass–Anywhere transaction was announced and before current antitrust litigation.

California lawsuits (2018–2022) alleged:

bait‑and‑switch compensation promises,

clawbacks of earned commissions,

commission deferrals functioning as firm financing,

standardized contract terms suitable for class treatment.

These allegations pre‑date current disputes and independently document the same exploitation mechanisms now poised to scale nationally.

VIII. Two‑Tier Harm Architecture

Labor harm does not remain confined to agents. It transmits downstream to consumers through service quality degradation, reduced collaboration, and diminished listing exposure.

Tier 1: Labor‑Market Harm

The merger directly harms agents through three mechanisms.

Risk and volatility shifted to agents.

Switching costs inflated through inventory and compensation control.

Anticipated exploitation triggers rational defection.

Tier 2: Consumer Harm (Downstream)

Labor harm transmits to consumers through degraded service and reduced market efficiency.

Agent churn and income pressure degrade service quality.

Reduced collaboration and listing exposure harm matching efficiency.

Fair‑housing and transparency risks increase.

Labor exploitation transmits directly into consumer welfare loss. The merger is not merely a labor dispute—it is a consumer protection issue with labor dynamics as the transmission channel.

IX. Merger Theory of Harm (Chicago Integrated)

The preceding sections established coordination degradation (Coase), incentive exploitation (Becker), and the two-tier harm architecture linking labor and consumer effects. Integration produces a self-reinforcing harm cycle—not additive but multiplicative. Each framework amplifies the others.

Under an integrated Coase–Becker–Posner analysis, the Compass–Anywhere merger produces a self‑reinforcing harm cycle:

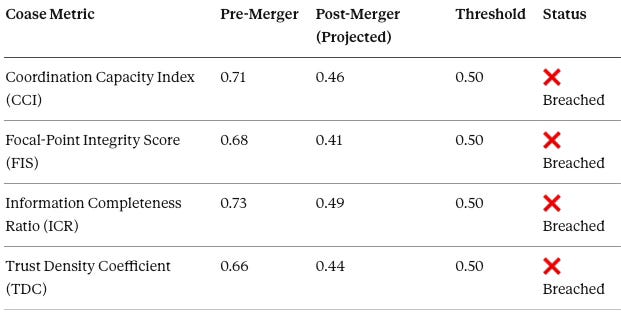

Coase (Coordination Failure): Vertical integration concentrates control over shared coordination infrastructure (MLS submission norms, listing visibility, routing). All four coordination metrics breach thresholds: Coordination Capacity Index (CCI) falls below 0.50 (coordination capacity degraded), Focal-Point Integrity Score (FIS) falls below 0.50 (focal points fragmented), Information Completeness Ratio (ICR) falls below 0.50 (information completeness degraded), and Trust Density Coefficient (TDC) falls below 0.50 (trust density collapses). The market enters a non-coordinating state where private ordering cannot converge.

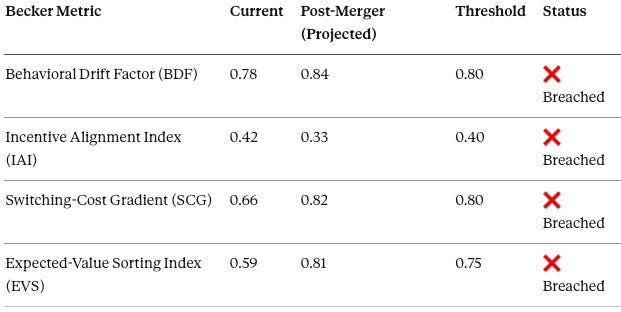

Becker (Incentive Exploitation): Firms rationally exploit the degraded coordination environment. All four incentive metrics breach thresholds: BDF exceeds 0.80 (exploitation dominant), Switching-Cost Gradient (SCG) exceeds 0.80 (switching costs lock in agents), Incentive Alignment Index (IAI) falls below 0.40 (stated rationales are pretextual), and Expected-Value Sorting Index (EVS) exceeds 0.75 (agent sorting accelerates). High-autonomy agents defect ex ante; locked-in agents face systematic extraction.

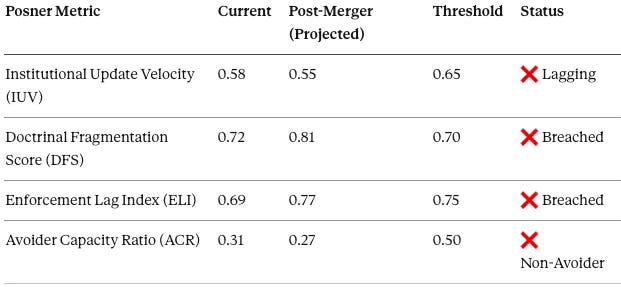

Posner (Enforcement Limits): The legal system becomes a wicked learning environment. All four common-law stalling conditions obtain: wicked environment (long causal chains, diffuse harm), delayed feedback (Enforcement Lag Index / ELI above threshold), fragmented adjudication (Doctrinal Fragmentation Score / DFS above threshold), and enforcement lag exceeding firm adaptation speed (IUV below threshold). Avoider Capacity Ratio(ACR) analysis confirms agents are non-avoiders (ACR 0.27)—they cannot adjust behavior regardless of incentives—while the merged firm has high prevention capacity.

Design lever: Merger conditions that limit labor lock-ins and preserve coordination-preserving governance reduce BDF and SCG (exploitation metrics), raise IAI (incentive alignment), stabilize CCI and TDC (coordination capacity) above thresholds, and restore FIS (focal point integrity) by protecting MLS coordination norms.

Predictable labor‑market harm, amplified by merger scale, translates into downstream consumer harm. Agent defection risk is probative, not speculative. Coordination capture enables incentive exploitation; enforcement lag allows exploitation to harden; merger scale makes all three dynamics national and durable.

X. Cognitive Digital Twin Foresight Simulation

Classical Chicago analysis identifies rational incentives but does not model how actors update beliefs, when behavioral thresholds trigger action, or where institutional responses lag firm adaptation. The Cognitive Digital Twin (CDT) methodology fills that gap by simulating actor-level decision processes under varying coordination, incentive, and enforcement conditions.

CDT does not replace legal or economic analysis—it disciplines it. By assigning scores to coordination capacity, incentive alignment, and enforcement velocity, the methodology identifies where Coase, Becker, and Posner frameworks interact and where intervention would be most effective. Scores are NAIP200-normalized foresight outputs (0–1 scale) derived from structured behavioral modeling, designed to surface inflection points.

Threshold definitions. On the Coase layer, Coordination Capacity Index (CCI), Focal-Point Integrity Score (FIS), Information Completeness Ratio (ICR), and Trust Density Coefficient (TDC) all have thresholds at 0.50—breach indicates coordination architecture failure. On the Becker layer, Behavioral Drift Factor (BDF) and Switching-Cost Gradient (SCG) have thresholds at 0.80—breach indicates exploitation is the dominant strategy; Incentive Alignment Index (IAI) has threshold at 0.40—breach indicates pretextual positioning; Expected-Value Sorting Index (EVS) has threshold at 0.75—breach indicates accelerated agent sorting. On the Posner layer, Institutional Update Velocity (IUV) has threshold at 0.65—below indicates institutional lag; Doctrinal Fragmentation Score (DFS) has threshold at 0.70—breach indicates doctrine cannot converge; Enforcement Lag Index (ELI) has threshold at 0.75—breach indicates enforcement arrives too late; Avoider Capacity Ratio (ACR) has threshold at 0.50—below indicates the party is a behavioral non-avoider who cannot adjust conduct regardless of incentives.

A. Coase Layer — Coordination Architecture

The Coase layer models whether market participants can still coordinate after the merger captures key infrastructure.

Question asked: Can agents, consumers, and platforms still coordinate toward efficient matching once the merger captures key coordination infrastructure?

Modeled coordination assets: MLS focal-point integrity, inventory visibility and disclosure timing, routing norms and reciprocity expectations, trust density among cooperating agents.

Actors modeled: Compass, Anywhere, MLS governance, portal platforms, agents

Narrative interpretation. The merger consolidates control over MLS-adjacent routing, disclosure timing, and inventory access. Once focal points and trust density fall below stability thresholds, bargaining cannot reliably engage—even with near-zero transaction costs. Agents no longer share a common interpretive frame for listings; cooperation collapses; private ordering stops converging. Coordination failure, not pricing, drives this outcome.

Coase Finding. The market enters a non-coordinating state. All four coordination metrics breach the 0.50 threshold. Causal statement: Merger captures coordination infrastructure → focal points fragment → trust density collapses → private ordering cannot converge to efficient outcomes regardless of transaction costs.

B. Becker Layer — Incentive Exploitation and Sorting

The Becker layer models firm and agent strategy once coordination collapses.

Question asked: Given coordination collapse, what strategies maximize expected value for firms and agents?

Modeled incentive channels: Compensation clawbacks and deferrals, inventory lock-in via Private Exclusives, lead and routing control, switching-cost inflation.

Actors modeled: Compass management, Anywhere franchise network, individual agents

Narrative interpretation. Once coordination collapses, exploitation becomes the dominant strategy. Firms rationally shift risk downward and monetize opacity; agents rationally sort based on expected value. High-autonomy, portable producers exit first; locked-in agents remain. Sorting occurs ex ante—before integration completes—because agents update expectations, not outcomes.

Becker Finding. Labor defection is predictive evidence, not protest. Exploitation and exit are equilibrium behaviors under the new payoff matrix. All four incentive metrics breach thresholds: BDF and SCG exceed 0.80 (exploitation dominant), IAI falls below 0.40 (stated rationales diverge from payoff reality), EVS exceeds 0.75 (agent sorting accelerates). Payoff matrix: Post-merger expected value of staying falls for high-autonomy agents; rises for firm; outside options increase for rivals. Observable thresholds: Churn ≥25% (baseline +15pp), exclusivity windows ≥7 days, clawback adoption ≥80% of franchises.

C. Posner Layer — Enforcement, Learning, and Remedy Boundary

The Posner layer models whether legal institutions can correct the inefficient equilibrium before harm locks in.

Question asked: Will common-law or regulatory feedback correct the inefficient equilibrium in time?

Modeled institutional variables: Adaptation speed vs. firm strategy speed, doctrinal fragmentation, enforcement timing and lag, behavioral avoidance capacity.

Actors modeled: Courts, Department Of Justice (DOJ), Federal Trade Commission (FTC), state regulators

Narrative interpretation. The legal system becomes a wicked learning environment. Harm delays, disperses, and silos across labor, antitrust, and contract doctrines. Agents and consumers cannot cheaply prevent harm—they are behavioral non-avoiders. Firms, by contrast, have high prevention capacity. Posner’s efficiency-through-selection mechanism fails not due to judicial error but due to informational and temporal insufficiency.

Posner Finding. Self-correction does not occur before incentives lock in. Remedy must target the upstream actor with prevention capacity. Learning environment checklist: ✅ Wicked environment (long causal chains, diffuse harm) ✅ Delayed feedback (ELI 0.77 exceeds threshold) ✅ Fragmented adjudication (DFS 0.81 exceeds threshold; 50+ jurisdictions, antitrust/labor/contract silos) ✅ Enforcement lag exceeds firm adaptation speed (IUV 0.55 vs. firm speed). Avoider capacity: ACR 0.27 confirms agents are non-avoiders—they cannot adjust behavior regardless of incentives; risk allocation to agents is categorically inefficient. Remedy boundary: Disclosure/conduct remedies fail because they cannot realign payoffs; structural conditions targeting the merged firm (upstream) are required because prevention capacity resides there.

D. Integrated Loop — Closed-Form Foresight Result

The CDT simulation runs the Coase–Becker–Posner sequence as a causal chain. Each framework enables the next; the integrated loop explains why harm is durable rather than transient.

Loop Sequence:

Coase: Coordination capacity collapses (CCI, FIS, ICR, TDC < 0.50)

Becker: Payoff matrix flips (BDF, SCG > 0.80; EVS > 0.75) → labor sorting begins

Posner: Enforcement lag exceeds adaptation speed (ELI > 0.75; DFS > 0.70; ACR < 0.50)

Outcome: Durable labor-market exploitation + downstream consumer harm

Step 1 → Coase: Merger captures coordination architecture; coordination capacity falls below stability thresholds.

CCI collapses to 0.46 (coordination capacity breached)

FIS falls to 0.41 (focal points fragmented)

ICR falls to 0.49 (information completeness degraded)

TDC falls to 0.44 (trust density below cooperation threshold)

Result: Private ordering cannot converge; bargaining mechanism disabled.

Step 2 → Becker: Payoff matrix flips; exploitation dominates; agents sort and defect.

BDF rises to 0.84 (exploitation is dominant strategy)

SCG rises to 0.82 (switching costs lock in agents)

IAI falls to 0.33 (stated rationales diverge from payoff reality)

EVS rises to 0.81 (agent sorting accelerates)

Result: High-autonomy agents defect ex ante; locked-in agents face systematic extraction.

Step 3 → Posner: Courts and regulators lag; doctrines silo; harm persists long enough to lock in.

IUV at 0.55 (institutional adaptation lags threshold)

DFS rises to 0.81 (doctrinal fragmentation blocks convergence)

ELI rises to 0.77 (enforcement lag exceeds threshold)

ACR at 0.27 (agents are non-avoiders)

Result: Common-law evolution stalls; self-correction fails; upstream intervention required.

Step 4 → National Lock-In: Labor lock-ins and downstream consumer harm scale before correction.

Anywhere’s franchise network converts localized tactics into durable incentive architecture

Consumer harm (search friction, inventory incompleteness) becomes observable only after structure locks

Institutional response arrives post-hoc, consistent with Posner’s wicked-environment prediction

Registered prediction. Absent merger-specific constraints that preserve coordination architecture and limit labor lock-ins, the Compass–Anywhere merger locks the market into an inefficient equilibrium within 24 months post-announcement or post-close, characterized by: agent churn exceeding baseline by ≥15 percentage points, Private Exclusive windows averaging ≥7 days in top metros, standardized clawback adoption across ≥80% of franchises, and observable consumer search-friction increases.

Single-pillar analysis sees fragments: Coase sees coordination failure; Becker sees incentive response; Posner sees enforcement lag. The integrated loop reveals the causal chain: coordination capture enables incentive exploitation, enforcement lag allows exploitation to harden, and merger scale converts all three into national and durable harm.

XI. Merger Impact Assessment

The integrated framework alters how agencies, courts, counterparties, and investors should evaluate the deal. It converts agent behavior into merger-effects evidence and narrows the remedy space across six dimensions.

1. Regulatory Impact — Expanded Theory of Harm. The merger is no longer framed solely as horizontal consolidation. It becomes analyzable as (i) coordination capture (MLS focal points and routing), (ii) labor‑market power over agents as an input, and (iii) downstream consumer harm via service degradation. DOJ, FTC, and state attorneys general gain a wider set of viable enforcement theories.

2. Evidentiary Impact — Agent Defection as Probative Signal. Agent exits and survey responses rise from anecdote to evidence. Under Becker, ex ante defection is an expected‑value response to anticipated bargaining‑power shifts. Regulators and courts can credit defection risk as a leading indicator of labor‑market harm.

3. Remedy Impact — Narrowed Viability of Conduct Fixes. Because harm is structural and incentive‑driven, light conduct remedies (voluntary policies, internal guardrails, post‑closing assurances) cannot realign payoffs. Arguments for merger‑specific conditions, structural remedies, or delay gain force.

4. Litigation Impact — Increased Delay and Friction. The framework provides a unified theory that third parties (MLSs, platforms, labor plaintiffs, amici) can deploy consistently. Parallel challenges become more probable, coordination among challengers increases, and timelines extend.

5. Transactional Impact — Higher Risk Premium. Regulatory uncertainty, evidentiary salience of labor harm, and skepticism toward behavioral remedies raise deal risk and timeline cost. Valuation, financing terms, and closing conditions face pressure even absent immediate enforcement.

6. Institutional Impact — Frame Adoption Effect. Once coordination capture → incentive exploitation → enforcement lag becomes the dominant explanatory frame, subsequent arguments must respond to it. The merger discussion shifts from “efficiencies vs. speculation” to “payoff realignment vs. durable harm.”

XII. Registered Predictions (Quantified and Falsifiable)

A framework that cannot be falsified is not a framework—it is rhetoric. The Coase–Becker–Posner integration generates time-sequenced predictions tied to observable indicators with quantified thresholds. Each prediction follows directly from CDT threshold breaches identified in Section X. If predictions fail to materialize, the methodology is wrong. If they materialize, the Chicago School of Law and Behavioral Economics is corroborated.

Assessment Date: 24 months post-announcement (September 2025) or post-close (guided H2 2026), whichever is later—placing the assessment window in late 2027 to late 2028.

Near-Term Predictions (0–6 months)

These predictions should materialize during or immediately after deal announcement as agents update expected payoffs.

P1. Elevated Agent Churn.

Prediction: Agent churn at the combined Compass–Anywhere entity exceeds baseline annual churn (10–13%) by ≥15 percentage points, measured across top 20 metros.

Observable: MLS membership changes, franchise disclosures, agent roster changes.

Threshold: ≥25–28% annualized churn.

CDT basis: BDF above 0.80 and SCG above 0.80 indicate exploitation is dominant strategy; EVS above 0.75 signals accelerated agent sorting as high-autonomy producers exit before lock-in.

P2. Recruiting Shock.

Prediction: Competing brokerages report a ≥30% increase in targeted recruiting outreach to Compass/Anywhere agents in top metros.

Observable: Inman Intel surveys, brokerage recruiting disclosures, industry press.

P3. Expansion of Private Exclusive Windows.

Prediction: Average Private/Off-MLS exclusivity windows reach ≥7 days in at least 10 of the top 20 U.S. metros.

Observable: MLS listing timestamps, brokerage marketing disclosures.

CDT basis: FIS below 0.50 indicates focal point degradation; exclusivity windows lengthen as coordination architecture fragments.

Mid-Term Predictions (6–18 months)

These predictions should materialize as integration proceeds and exploitation mechanisms standardize across the combined platform.

P4. Workforce Bifurcation.

Prediction: A two-tier agent structure emerges: a stable, lower-mobility core and a high-churn perimeter with ≥2× the baseline exit rate.

Observable: Tenure distributions, team departures, production concentration metrics.

CDT basis: Persistent BDF above 0.80 and SCG above 0.80 reflect incentive structure that locks in compliant agents while churning independents.

P5. Service Quality Dispersion.

Prediction: Variance in time-to-sale and list-to-sale ratios increases by ≥20% in Compass-heavy metros relative to matched controls.

Observable: MLS transaction data, days-on-market distributions.

P6. Persistent Forum Fragmentation.

Prediction: No single enforcement action resolves labor or coordination issues; instead, ≥3 parallel proceedings (labor, antitrust, contract) persist without consolidation.

Observable: Docket tracking, agency filings, litigation timelines.

CDT basis: DFS above 0.70 and ELI above 0.75 indicate doctrinal fragmentation and enforcement lag; all four common-law stalling conditions obtain; remedies arrive late and case-by-case.

Long-Term Predictions (18–36 months)

These predictions should materialize as the lock-in effects become durable and downstream consumer harm becomes observable.

P7. Standardization of Labor Lock-Ins.

Prediction: ≥80% of Anywhere franchises adopt standardized clawback or deferred-compensation provisions aligned with Compass templates.

Observable: Franchise agreements, agent contract disclosures, litigation exhibits.

CDT basis: Anywhere scale converts localized tactics into durable incentive architecture.

P8. Measurable Consumer Harm.

Prediction: Inventory completeness ratios decline by ≥10% in Compass–Anywhere–dominant markets relative to pre-merger baselines.

Observable: MLS active-listing counts vs. historical averages, off-MLS inventory estimates.

P9. Delayed Institutional Convergence.

Prediction: Coordination-cost reasoning appears in enforcement rhetoric only after labor and consumer harm metrics cross thresholds above.

Observable: DOJ/FTC speeches, AG complaints, amicus briefs, judicial opinions.

CDT basis: Institutional IUV (0.55) below threshold while ELI (0.77) exceeds threshold; harm locks in before correction occurs, consistent with Posner’s wicked-environment prediction.

Counterfactual (Intervention-Sensitive)

The final prediction tests whether merger-specific constraints can prevent harm by preserving coordination architecture.

P10. Payoff Realignment Scenario.

Prediction: If merger conditions cap clawbacks, preserve MLS-first routing, or otherwise constrain switching-cost inflation, then:

agent churn remains within ±5% of baseline, and

Private Exclusive windows remain <3 days on average.

CDT counterfactual: CCI stabilizes above 0.55, FIS recovers above 0.55, TDC rises above 0.55, BDF falls below 0.70, SCG falls below 0.70, IAI rises above 0.50.

Interpretation: Failure of harm to materialize under these conditions validates the framework’s remedy prescription.

Framework Falsification Rule

If 6 or more of the above predictions fail to materialize by the assessment date, the integrated Coase–Becker–Posner framework is falsified for the Compass–Anywhere transaction. Partial materialization (≤5 predictions failing) indicates incomplete coordination capture or successful payoff realignment rather than framework failure.

XIII. Conclusion

The Compass–Anywhere merger is not merely a transaction to be approved or blocked. It is an empirical test of whether classical Chicago School economics—rational actors, efficient markets, self-correcting institutions—adequately explains coordination capture in labor-intensive service markets.

The Chicago School of Law and Behavioral Economics extends the classical tradition by adding what it lacked: a methodology for modeling how agents update beliefs, when behavioral thresholds trigger action, and why institutional lag creates durable windows for harm. The Cognitive Digital Twin (CDT) framework operationalizes that extension. The Compass–Anywhere transaction provides the proof case.

Registered Predictions:

Agent churn at the combined entity exceeds 25% annualized (baseline +15pp).

Competing brokerages report ≥30% increase in recruiting outreach to Compass/Anywhere agents.

Private Exclusive windows average ≥7 days in at least 10 of the top 20 U.S. metros.

A two-tier workforce emerges: stable core plus high-churn perimeter at ≥2× baseline exit rate.

Time-to-sale variance increases ≥20% in Compass-heavy metros relative to controls.

≥3 parallel proceedings (labor, antitrust, contract) persist without consolidation.

≥80% of Anywhere franchises adopt standardized clawback or deferred-compensation provisions.

Inventory completeness declines ≥10% in Compass–Anywhere–dominant markets.

Coordination-cost reasoning appears in enforcement rhetoric only after harm metrics cross thresholds.

Counterfactual: If constraints preserve coordination architecture, churn stays within ±5% of baseline and exclusivity windows remain <3 days.

Falsification rule: 6+ predictions failing = framework falsified. Assessment window: Late 2027 to late 2028.

What remains is observation—and, for those with decision authority, the choice of whether to intervene before harm locks in.

Appendix: The Chicago School Accelerated Series

Foundational Pillars

Part I: Coase and Why Transaction Costs ≠ Coordination Costs (MindCast AI, December 2025)https://www.mindcast-ai.com/p/chicagoseriescoase

Part II: Becker and the Economics of Incentive Exploitation (MindCast AI, December 2025)https://www.mindcast-ai.com/p/chicagoseriesbecker

Part III: Posner and the Economics of Efficient Liability Allocation (MindCast AI, December 2025)https://www.mindcast-ai.com/p/chicagoseriesposner

Related Compass Analysis

Compass’s Coasean Coordination Problem — Part II, The Litigation–Acquisition Monopolization Strategy(MindCast AI, 2025) https://www.mindcast-ai.com/p/compass-anywhere-antitrust

The Real Victims of Compass’s Antitrust Gambit: Brokers, Not Brokerages (MindCast AI, 2025)https://www.mindcast-ai.com/p/compassrealvictims

Vision Functions & Metrics Reference

Definitions for CDT Flows (Coase, Becker, Posner, Chicago Law & Behavioral Economics)

Purpose

This one‑page reference defines the Vision Functions, metrics, and acronyms used throughout MindCast AI foresight simulations and Cognitive Digital Twin (CDT) flows. It is designed to provide a single, authoritative lookup for legal, economic, and policy audiences without requiring traversal of the full analytical document.

All metrics are NAIP200‑normalized foresight outputs (0–1). They are not empirical measurements. Their function is threshold detection, interaction analysis, and prediction registration, not point estimation.

I. Coase Vision — Coordination Architecture

Definition

Coase Vision evaluates whether a system possesses sufficient coordination capacity for rational actors to bargain, match, and cooperate toward efficient outcomes, independent of transaction costs. It activates when transaction costs are low or declining yet bargaining fails due to focal‑point collapse, trust degradation, or information incompleteness.

Core Metrics

Coordination Capacity Index (CCI)

Composite measure of a system’s ability to coordinate across actors. Values below 0.50 indicate a non‑coordinating state in which efficient bargaining cannot reliably engage.Focal‑Point Integrity Score (FIS)

Measures the stability of shared reference points (e.g., MLS centrality, routing norms). Low values indicate focal‑point collapse and interpretive fragmentation.Information Completeness Ratio (ICR)

Measures the proportion of timely, shared information available to all participants. Low values predict opacity rents and adverse selection.Trust Density Coefficient (TDC)

Measures the probability that actors interpret signals cooperatively rather than adversarially. Values below 0.50predict breakdown of reciprocal coordination.

Output

Classification of system state: Coordinating vs. Non‑coordinating

Identification of captured or degraded coordination infrastructure

Early‑warning thresholds for coordination collapse

II. Becker Vision — Incentive Exploitation & Sorting

Definition

Becker Vision evaluates how rational actors re‑optimize behavior once coordination capacity weakens. It models exploitation, exit, and lock‑in as expected‑value responses to altered payoff matrices rather than as moral or cultural deviations.

Becker Vision activates after Coase Vision detects coordination degradation.

Core Metrics

Behavioral Drift Factor (BDF)

Measures the degree to which actors shift from efficiency competition to exploitative strategies. Values above 0.80indicate exploitative equilibrium dominance.Incentive Alignment Index (IAI)

Measures alignment between stated narratives and actual payoff structures. Low values signal pretextual justification.Switching‑Cost Gradient (SCG)

Measures the cost imposed on exit or mobility (financial, informational, or contractual). Values above 0.80 predict durable lock‑in.Expected‑Value Sorting Index (EVS)

Measures anticipatory exit by high‑autonomy actors before harm fully materializes. High values predict early defection.

Output

Dominant strategy identification (cooperate vs. exploit)

Sorting forecasts (who exits first, who remains)

Ex‑ante behavioral predictions tied to payoff shifts

III. Posner Vision — Institutional Learning & Remedy Feasibility

Definition

Posner Vision evaluates whether legal and regulatory systems can learn and correct inefficiencies within the time window required to prevent harm. It distinguishes kind learning environments (self‑correcting) from wicked ones (informationally hostile).

Posner Vision activates after Becker Vision identifies exploitation dynamics.

Core Metrics

Institutional Update Velocity (IUV)

Measures the speed at which courts or regulators adapt frameworks in response to harm signals. Low values indicate lag relative to firm adaptation speed.Doctrinal Fragmentation Score (DFS)

Measures the degree of siloing across legal regimes (antitrust, labor, contract). High values prevent causal visibility.Enforcement Lag Index (ELI)

Measures the delay between harm emergence and corrective intervention. Values above 0.75 indicate lock‑in risk.Avoider Capacity Ratio (ACR)

Measures the ability of harmed parties to prevent harm at reasonable cost. Values below 0.50 indicate non‑avoider status.

Output

Classification of learning environment: Kind vs. Wicked

Remedy feasibility assessment and timing windows

Upstream liability targeting guidance

IV. Chicago Law & Behavioral Economics Vision — Integrated System

Definition

Chicago Law & Behavioral Economics Vision integrates Coase Vision, Becker Vision, and Posner Vision into a single closed‑loop foresight system. It evaluates how coordination architecture, incentive response, and institutional learning interact over time to produce stable or unstable equilibria.

Integrated Logic

Coase Vision determines whether coordination capacity is intact

Becker Vision determines how actors re‑optimize once coordination weakens

Posner Vision determines whether law can correct the resulting inefficiency in time

Failure at all three layers predicts durable harm and lock‑in.

Composite Metrics

System Coordination Integrity (SCI) — Aggregates CCI, FIS, ICR, TDC

Exploitability Index (EI) — Aggregates BDF, SCG, IAI, EVS

Correction Feasibility Score (CFS) — Aggregates IUV, DFS, ELI, ACR

Output

End‑to‑end equilibrium classification (Efficient, Exploitative, Locked‑in)

Time‑sequenced foresight predictions with thresholds

Explicit falsification criteria for future observation

Usage Note

This reference is intended to be appended to or incorporated into all future MindCast AI CDT analyses to ensure definitional clarity, metric consistency, and institutional legibility.