MCAI Economics Vision: The Chicago School Accelerated Part I, Coase and Why Transaction Costs ≠ Coordination Costs

A Foresight Simulation of OpenAI's Governance Breakdown and the Musk Multi-Entity Portfolio

The MindCast AI Chicago School Accelerated series modernizes the Chicago School of Law and Economics with the integration of behavioral economics. We refer to the synthesized framework as the Chicago School of Law and Behavioral Economics. See Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics, Why Coase, Becker, and Posner Form a Single Analytical System (December 2025):

Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs

The Chicago School Accelerated Part II, Becker and the Economics of Incentive Exploitation

The Chicago School Accelerated Part III, Posner and the Economics of Efficient Liability Allocation

MindCast AI Compass’s Coasean Coordination Problem series is part of our Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs (December 2025) framework, with sub-series:

Part I How Private Exclusives Reshape Competition and Threaten MLS Stability

Part III Coordination Costs, MLS Governance and the Compass Litigation

Part IV Platform Routing, Portal Power, and the Zillow Litigation

Series Prologue

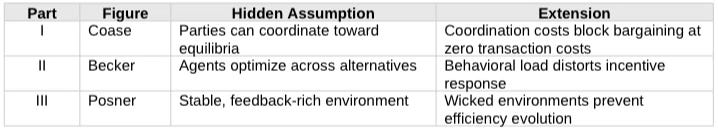

The Chicago School transformed law and economics through three foundational insights: Ronald Coase on transaction costs, Gary Becker on incentive response, and Richard Posner on common law efficiency. All three insights remain correct within their specified boundary conditions. This MindCast AI series examining each figure in turn—demonstrates that boundary conditions are narrower than Chicago scholarship made explicit, and provides formal architecture for predicting when those conditions hold versus when they fail.

MindCast AI’s National Innovation Behavioral Economics (NIBE) and Strategic Behavioral Coordination (SBC) frameworks extend the Chicago tradition by formalizing assumptions that Chicago scholarship left implicit. When NIBE and SBC metrics indicate favorable conditions, Chicago predictions hold. When the metrics indicate unfavorable conditions—as they increasingly do in high-velocity systems—coordination costs intervene and new analytical architecture is required.

Chicago law and economics is not wrong—Chicago law and economics is incomplete. The NIBE and SBC extensions preserve Chicago insights while specifying their domain of validity.

I. Executive Summary

The Issue

Ronald Coase won the Nobel Prize for demonstrating that private parties bargain to efficient outcomes when transaction costs are low. Coase, Ronald H., The Problem of Social Cost, Journal of Law and Economics, Vol. 3 (October 1960). For sixty years, Coase’s theorem has anchored law and economics: reduce friction—legal fees, search costs, information asymmetries—and efficient allocation follows. The theorem predicts that Elon Musk’s six-entity portfolio should be a model of resource optimization. Tesla, SpaceX, xAI, Neuralink, Boring Company, and X/Twitter share a single controlling decision-maker with complete information across all entities. Transaction costs are zero: Musk allocates capital, talent, and attention by personal decision with no search costs, no information asymmetry, and no legal barriers to related-party coordination.

Yet the portfolio exhibits the opposite of Coasean efficiency. xAI raised $6B while Tesla faced margin pressure. Tesla Dojo and xAI Colossus represent parallel AI compute investments with no announced integration. Entities bid against each other for the same engineers. Shareholders have filed derivative litigation alleging attention misallocation. Strategic drift is visible; portfolio coherence is absent.

Coase’s theorem appears to fail precisely where it should hold most strongly. The puzzle is not academic. If the world’s most transaction-cost-free multi-entity system cannot achieve efficient coordination, something is missing from the Coasean framework.

Who This Analysis Serves

The coordination cost framework developed in this paper provides decision-making insight for corporate boards assessing whether governance architecture matches organizational complexity; general counsels evaluating fiduciary exposure from coordination failures; private equity partners conducting due diligence on founder-controlled structures; institutional investors seeking vocabulary for governance risk beyond standard metrics; chief economists advising leadership on multi-entity coordination and restructuring; strategy consultancies designing governance transformation engagements; and regulators evaluating whether transaction cost reduction alone produces efficient outcomes. The paper offers diagnostic methodology for a category of systemic risk—coordination costs—that existing frameworks do not measure and existing governance structures do not address.

The Finding

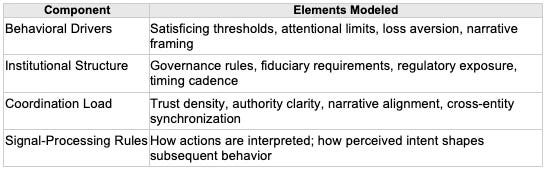

Transaction costs and coordination costs are analytically distinct categories. Zero transaction costs do not guarantee efficient outcomes when coordination architecture is absent. Coase’s theorem embeds a hidden assumption: parties can identify the efficient equilibrium and coordinate toward the equilibrium. The assumption holds for Coase’s canonical examples—the rancher and farmer share a stable environment, common problem understanding, and sufficient time to negotiate. The assumption fails in complex, high-velocity systems where three coordination requirements break down:

Narrative Alignment: Parties must agree what parties are negotiating about. When organizational identity or strategic frame is contested, no bargaining range exists. Focal Point Availability: Parties need shared reference points—what Schelling called focal points—to converge on “obvious” solutions. Without governance architecture providing reference points, convergence fails even when both parties prefer agreement. Trust Density: Trust determines signal interpretation. High trust means offers are understood as cooperative; low trust means identical signals are read as threats. Below a threshold (~0.40 on the Coordination Stability Score), cooperative bargaining becomes structurally impossible.

Coordination costs measure whether the bargaining mechanism can engage at all. Transaction costs measure friction within the mechanism. The categories are independent: a system can have zero transaction costs and catastrophic coordination costs.

The Framework

MindCast AI is a predictive cognitive intelligence firm specializing in law and behavioral economics. Traditional legal analysis describes what rules require. Behavioral economics examines how people actually respond to incentives, cognitive load, and pressure. MindCast AI integrates these two domains to model not only outcomes but the behavioral pathways that produce outcomes—how real actors behave under uncertainty, acceleration, institutional friction, and competing narratives.

MindCast AI’s National Innovation Behavioral Economics (NIBE) and Strategic Behavioral Coordination (SBC)frameworks formalize coordination cost measurement. MCAI Economics Vision: Synthesis in National Innovation Behavioral Economics and Strategic Behavioral Coordination, December 2025. NIBE operates at the macro-institutional scale, measuring whether governance bodies can process decisions at environmental velocity. SBC operates at the micro-behavioral scale, measuring whether actors can move from incentive to coordinated action. Cognitive Digital Twin (CDT)methodology integrates NIBE and SBC into predictive simulations, modeling specific actors as computational agents calibrated to real-world incentives, biases, and constraints.

The Evidence: OpenAI (Retrospective Validation)

The OpenAI governance crisis of November 2023 validates the coordination cost framework. On November 17, the board terminated CEO Sam Altman without warning. By every Coasean measure, transaction costs approached zero: the board possessed clear legal authority, all parties had complete information, principals occupied the same building with continuous communication access, and all parties sought organizational success. Efficient bargaining should have followed.

Instead, five days of paralysis ensued. Microsoft activated contingency planning. 700+ employees threatened mass departure. The commercial subsidiary explored independent reconstitution. Resolution came through credible threat of organizational dissolution—not through negotiated agreement.

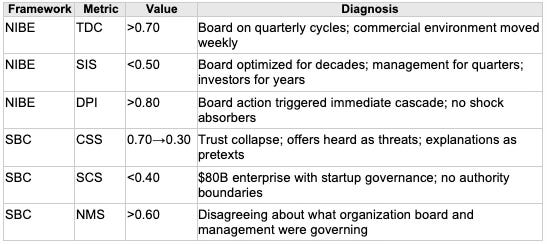

NIBE and SBC metrics explain the failure: CSS collapsed from ~0.70 to ~0.30 within 72 hours, pushing signal interpretation from cooperative to adversarial. SCS was below 0.40—an $80B enterprise operating with startup governance and no succession protocol. NMS exceeded 0.60—board and management were not disagreeing about strategy but about what organization board and management were governing. Transaction costs were zero; coordination costs were catastrophic.

The Evidence: Musk Portfolio (Prospective Test)

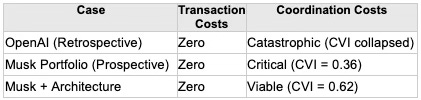

CDT simulation of the Musk multi-entity ecosystem quantifies coordination costs in a zero-transaction-cost system:

Baseline failure probabilities derived from CDT simulation: Strategic Drift 82%, Redundant AI Investment 76%, Crisis Cascade 74%, Capital Allocation Conflict 71%, Portfolio Coherence (Success) 14%.

Registered Predictions

Six specific predictions are registered for validation by Q4 2027, including: X/Twitter enterprise value below 50% of acquisition price; no Tesla-xAI integration announcement; additional derivative litigation; five or more C-suite departures citing inter-entity conflicts. Falsification criteria are explicit: if four or more predictions fail to materialize, Coasean logic is validated for complex multi-entity structures.

The Implication: Coordination Architecture Is Designable

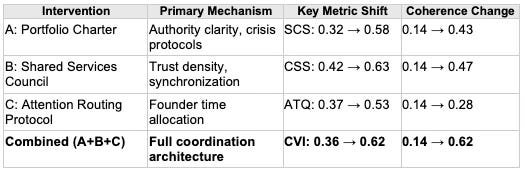

The baseline is not destiny. CDT simulation of three intervention scenarios—portfolio charter, shared services council, and founder attention routing protocol—demonstrates that coordination architecture investments produce measurable improvement:

The binding constraint is not transaction cost friction—the binding constraint is coordination architecture. Architecture can be built. The interventions are specific: governance charters that create Schelling focal points, narrative alignment processes that surface competing frames before conflict, trust-building cadences that maintain cooperative interpretation thresholds. Policy implications follow: regulators focused solely on transaction cost reduction address only one dimension of efficiency.

Roadmap

Sections I–II establish the Coasean framework and identify the hidden coordination assumption.

Section III introduces the NIBE and SBC measurement architecture.

Sections IV–VI apply the framework to the OpenAI crisis.

Section VII presents the extended efficiency formula with dimensional independence.

Sections VIII–X apply CDT simulation to the Musk ecosystem with registered predictions and intervention scenarios.

Sections XI–XII provide prescriptive architecture and preview Parts II (Becker/CHIPS Act) and III (Posner/Deepfake Liability).

Coase identified the right variable: friction matters. NIBE and SBC specify when friction determines outcomes—and when coordination costs intervene independently. The extended theorem: efficient bargaining requires low transaction costs, adequate institutional throughput, and robust coordination architecture. Failure in any dimension blocks the Coasean mechanism.

The problem of social cost is the problem of coordination design. Efficient bargaining requires not merely the absence of friction, but the presence of coordination capacity. Coordination capacity must be built before coordination capacity is needed.

Contact mcai@mindcast-ai.com to partner with us on law and behavioral economics foresight simulations. See the MindCast AI verticals in Law | Economics, Markets | Technology and Complex Litigation.

II. The Chicago Insight

Before extending Coase, Part I must establish what Coase actually demonstrated. The theorem is often invoked loosely; precision about the theorem’s claims is necessary for precision about the theorem’s limitations. Section I restates the core logic and explains why Coase transformed the field.

Coase’s theorem stands among the most elegant propositions in law and economics. Published in 1960, “The Problem of Social Cost” demonstrated that under certain conditions, private parties will negotiate to efficient resource allocation regardless of how law initially assigns property rights.² The rancher whose cattle trample crops and the farmer who suffers the damage will bargain to the welfare-maximizing arrangement whether liability falls on one party or the other.

Coase’s insight shifted the entire field. Legal rules matter not because rules determine outcomes directly, but because rules establish the starting point from which bargaining proceeds. Courts need not calculate efficient outcomes if courts can simply reduce friction and let negotiation work. The implications proved profound: reduce transaction costs—legal fees, search costs, information asymmetries, contract enforcement—and efficient outcomes emerge spontaneously.

Coase was correct. Under Coase’s specified conditions, the theorem holds with remarkable consistency. What Coase did not fully specify were the boundary conditions under which Coasean conditions actually obtain.

Insight: The Coase theorem is a conditional statement; the condition is more restrictive than the canonical examples suggest.

III. The Hidden Assumption

Every theoretical framework embeds assumptions. The most consequential assumptions are often the least explicit—the assumptions seem so obvious to the theorist that stating them appears unnecessary. Coase’s framework contains such an assumption, and making the assumption explicit reveals a new category of friction invisible to transaction cost analysis.

Coase’s framework embeds a critical assumption that canonical examples obscure: parties can identify the efficient equilibrium and coordinate toward the equilibrium. The cattle rancher and farmer operate in a stable environment with clear property boundaries, predictable damage patterns, and sufficient time to negotiate. Rancher and farmer share common understanding of the problem. Rancher and farmer can find each other, exchange information, and converge on agreement.

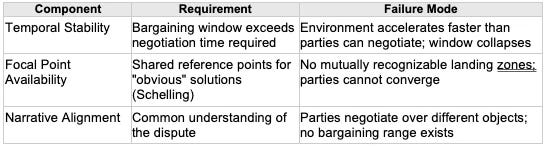

The coordination assumption decomposes into three components Coase left implicit:

When temporal stability, focal point availability, and narrative alignment hold, Coase’s prediction follows. When any component fails, a new category of friction emerges that transaction cost analysis cannot capture: Coordination Costs—the behavioral friction preventing parties from identifying and reaching efficient equilibria even when every mechanical barrier to negotiation has been removed.

The hidden assumption is now explicit: Coasean bargaining requires not merely the absence of transaction costs, but the presence of coordination capacity. Coordination capacity can be absent even when transaction costs are zero. The distinction is not semantic—the distinction has measurable consequences.

Insight: Transaction costs measure friction in the mechanism; coordination costs measure whether the mechanism can engage at all.

IV. Framework Primer: National Behavioral Economics, Strategic Behavioral Coordination, Cognitive Digital Twins

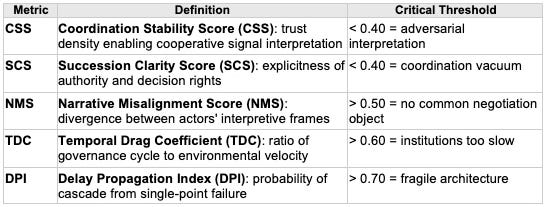

Having identified coordination costs as a distinct category, formal vocabulary is required to measure and predict coordination costs. MindCast AI developed two interlocking frameworks for measurement and prediction: NIBE for macro-institutional dynamics and SBC for micro-behavioral dynamics.¹ Cognitive Digital Twin (CDT) methodology operationalizes both frameworks into predictive simulation. Together, NIBE, SBC, and CDT provide the analytical architecture that Coase’s extension requires.

The methodology treats legal and organizational systems as environments where decisions emerge from bounded rationality, selective attention, satisficing behavior, narrative interpretation, and coordination constraints. Game theory provides the structural lens for interdependence—how each actor’s decisions alter the strategic environment for other actors—while behavioral economics remains the central engine. The result: predictions about when systems drift, fragment, stabilize, or converge on negotiated outcomes.

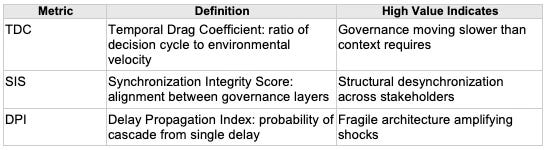

NIBE (National Innovation Behavioral Economics)

NIBE operates at the macro-institutional scale, modeling how organizations, agencies, and governance bodies process decisions relative to environmental velocity. The core NIBE thesis: innovation fails not because technology moves too slowly, but because institutions move too predictably—and too slowly—for the environments institutions inhabit.

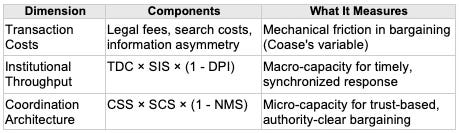

NIBE metrics aggregate into an Institutional Throughput Index (ITI) measuring macro-capacity for coordinated response.

SBC (Strategic Behavioral Coordination)

SBC operates at the micro-behavioral scale, modeling how actors move from incentive to action under cognitive burden and strategic ambiguity. The core SBC thesis: agents do not optimize globally—agents satisfice, searching for solutions meeting aspiration levels rather than maximizing expected utility.

SBC metrics aggregate into a Coordination Architecture Index (CAI) measuring micro-capacity for convergent bargaining.

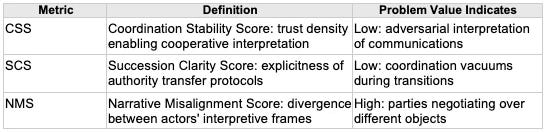

Cognitive Digital Twin (CDT) Methodology

MindCast AI’s proprietary Cognitive Digital Twin methodology operationalizes the NIBE and SBC frameworks into a predictive simulation engine. A CDT is a dynamic representation of how an actor perceives incentives, interprets signals, updates expectations, allocates attention, and responds under uncertainty. CDT methodology captures both macro-institutional and micro-behavioral layers simultaneously, revealing intervention points invisible to single-layer analysis.

Each CDT incorporates four component categories:

Game-theoretic structure enters where game theory clarifies interdependence—how one actor’s move reshapes another actor’s feasible choices—but behavioral economics remains the central engine. CDT methodology captures how coordination frictions, narrative divergence, and timing mismatches alter strategic behavior long before formal incentives break down.

When multiple CDTs interact—founders with boards, management with regulators, investors with agencies—the simulation produces emergent system-level patterns. Emergent patterns include drift, redundancy, shock cascades, failed negotiations, and conditions under which actors can or cannot coordinate toward efficient outcomes. CDT outputs include both diagnostic metrics (what is the current state?) and probability distributions (what outcomes does the current state predict?).

Additional Diagnostic Metrics

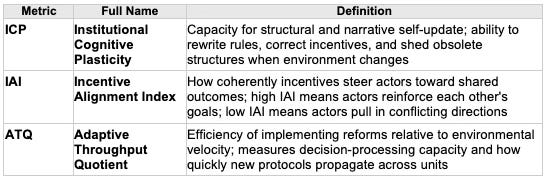

Beyond the core NIBE and SBC metrics, CDT simulation employs three supplementary indices that capture institutional adaptability and incentive coherence:

These metrics aggregate with NIBE and SBC indices into a master Coordination Viability Index (CVI) that classifies system state. CVI below 0.40 indicates Coordination Failure Zone; CVI above 0.55 indicates Coordination Viable.

NIBE, SBC, and CDT are not replacements for Chicago law and economics—NIBE, SBC, and CDT are extensions that specify boundary conditions. When metrics indicate favorable conditions, Chicago predictions hold. When metrics indicate unfavorable conditions, coordination costs intervene. The architecture provides the extension Coase requires: formal vocabulary for coordination costs and simulation methodology for predicting when coordination costs block efficient bargaining. Sections IV through VII apply the architecture to two cases—one retrospective, one prospective.

Insight: NIBE measures whether institutions can bargain in time; SBC measures whether parties can converge once bargaining begins.

V. Retrospective Case: OpenAI Governance Crisis (November 2023)

Theory requires empirical validation. The OpenAI governance crisis of November 2023 provides a natural experiment: a high-stakes negotiation where transaction costs approached zero but coordination failed catastrophically. The OpenAI case demonstrates that coordination costs are not merely theoretical—coordination costs produce observable, measurable dysfunction.

On November 17, 2023, OpenAI’s board of directors terminated CEO Sam Altman without warning. Within five days, the decision reversed. The episode offers a natural experiment in whether low transaction costs produce efficient bargaining.

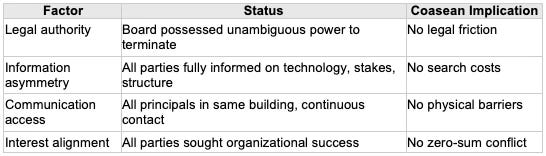

Transaction Cost Analysis

By Coase’s specified criteria, OpenAI should have been an easy case. All barriers to efficient negotiation were absent.

By every measure Coase specified, transaction costs approached zero. Efficient bargaining should have followed.

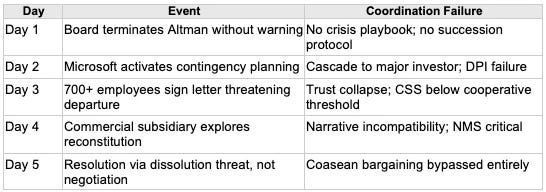

Crisis Timeline: What Actually Happened

Instead of efficient bargaining, five days of paralysis ensued. Each day brought escalating coordination failures as the system cascaded toward dissolution.

The denouement arrived not through Coasean negotiation but through existential threat: when 700+ employees made clear they would follow Altman to Microsoft, dissolution became credible. The board reversed course to preserve the organization, not because parties converged on efficient terms.

The theorem’s failure was not a failure of logic but a failure of preconditions. Every mechanical barrier to negotiation was absent, yet negotiation never occurred. The parties lacked the coordination infrastructure that Coase’s canonical examples take for granted: shared understanding of the dispute, mutual reference points for convergence, and trust sufficient for cooperative interpretation of signals.

Insight: Zero transaction costs are necessary but not sufficient for efficient bargaining; coordination architecture is independently required.

VI. The Breakdown Mechanism

Section IV established that coordination failed at OpenAI. Section V examines how coordination failed—the specific mechanisms that blocked Coasean bargaining despite zero transaction costs. Understanding breakdown mechanisms is necessary for designing interventions.

Three mechanisms drove the coordination failure, each mechanism representing a category of friction invisible to transaction cost analysis.

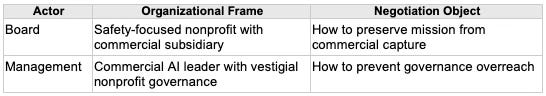

Narrative Incompatibility

Bargaining requires a common object—parties must agree what parties are negotiating about. When organizational identity itself is contested, no bargaining range exists.

Board and management positions were not positions on a shared continuum—board and management held competing definitions of what OpenAI was. No bargaining range exists when parties disagree about the object of negotiation.

Focal Point Collapse

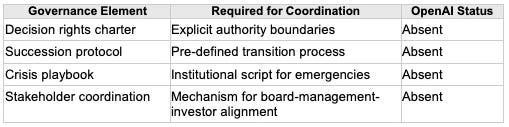

Even parties who want to coordinate need shared reference points—what Schelling called “focal points.” Organizations build focal points through governance architecture. OpenAI had not built governance architecture.

OpenAI had grown from research nonprofit to $80B+ enterprise without establishing coordination architecture that organizations of comparable scale require.

Trust Density Failure

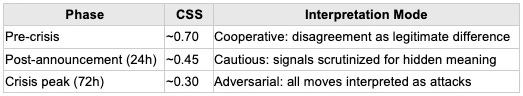

Trust determines how signals are interpreted. High trust means offers are understood as cooperative; low trust means the same signals are read as threats. The board’s surprise action collapsed trust below the threshold required for bargaining.

Once CSS dropped below ~0.40, cooperative bargaining became structurally impossible regardless of transaction costs.

Narrative incompatibility, focal point collapse, and trust density failure constitute coordination costs—coordination costs are analytically distinct from transaction costs. Each mechanism can block efficient bargaining independently; at OpenAI, all three mechanisms operated simultaneously.

Insight: Coordination costs have three independent components: narrative alignment (shared object), focal points (convergence infrastructure), and trust density (signal interpretation).

VII. MindCast AI National Innovation Behavioral Economics and Strategic Behavioral Economics Extensions

Section V described the breakdown mechanisms qualitatively. Section VI applies the NIBE and SBC frameworks quantitatively, demonstrating that coordination failures produce measurable signatures. Measurable signatures enable diagnosis before crisis.

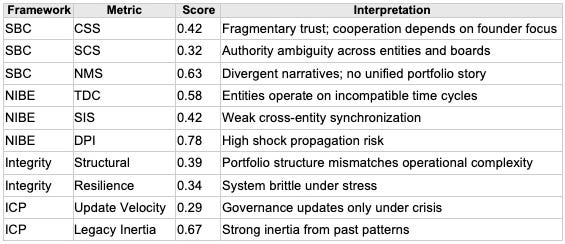

The frameworks reveal conditions that foreclosed bargaining before bargaining could begin:

NIBE metrics measure whether the institutional environment permits bargaining to occur at all. SBC metrics measure whether parties can converge once bargaining begins. Both NIBE and SBC must indicate favorable conditions for Coasean efficiency. At OpenAI, both NIBE and SBC indicated unfavorable conditions.

Insight: Coordination costs are measurable before crisis through NIBE and SBC metrics; early detection enables preventive intervention.

VIII. The Updated Formula

The preceding analysis enables a formal extension of Coase’s theorem. Where Coase identified one category of friction, the extended formula identifies three. Where Coase offered a binary condition (low vs. high transaction costs), the extended formula offers a multi-dimensional assessment. Section VII presents the extended formula and demonstrates analytical independence across dimensions.

Original Coase

Efficient outcome = f(low transaction costs, clear property rights)

NIBE + SBC Extension

Efficient outcome = f(transaction costs, institutional throughput, coordination architecture)

Dimensional Independence

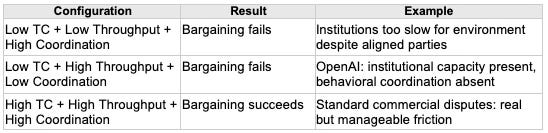

The three dimensions are analytically independent—each dimension can fail while other dimensions succeed. Dimensional independence is what makes coordination costs a distinct category, not merely a subset of transaction costs.

The third row is particularly important: the high-TC success case explains why most commercial bargaining succeeds despite non-trivial transaction costs.

The extended theorem: Parties will bargain to efficient outcomes when transaction costs are low, institutional throughput is adequate, and coordination architecture is robust. Failure in any dimension blocks the Coasean mechanism. The extended formula is not merely conceptual—the formula is measurable through CDT simulation.

Insight: Coasean efficiency requires all three dimensions; most bargaining succeeds because coordination architecture compensates for transaction costs.

IX. Forward Foresight Case: Musk Entity Coordination Problem

Retrospective validation is necessary but insufficient for scientific frameworks. Prediction of unresolved outcomes is the stronger test. The Musk Entity Coordination Problem provides the stronger test: a zero-transaction-cost system where the extended formula predicts coordination failure. Section VIII presents CDT simulation results and derives specific, falsifiable predictions.

The OpenAI case validated NIBE + SBC retrospectively. The Musk ecosystem tests NIBE + SBC prospectively.

The Configuration

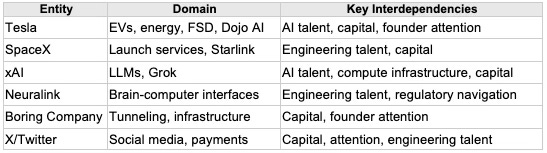

Elon Musk controls six major entities with overlapping strategic interests, shared talent pools, and competing capital requirements. The Musk portfolio creates a natural experiment in multi-entity coordination.

Each entity has different investors, different boards, and different fiduciary obligations—yet all six entities depend on the same founder’s attention, same talent pool, and same AI capabilities.

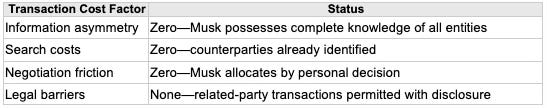

The Purest Coase Test

The Musk configuration eliminates every form of transaction cost Coase identified. If Coase’s theorem is complete, efficient resource allocation should follow automatically.

If Coase is complete, the Musk entity portfolio should optimize across units seamlessly. The extended formula predicts the Musk portfolio will not optimize.

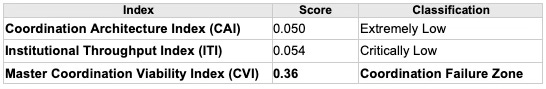

CDT Simulation: Baseline Metrics

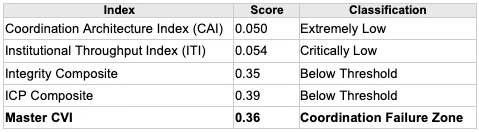

MindCast AI ran a full CDT simulation on the Musk multi-entity ecosystem, activating five vision functions: SBC, NIBE, Integrity, Institutional Cognitive Plasticity (ICP), and Causation. CDT results reveal coordination architecture failure despite zero transaction costs.

Every metric indicates coordination architecture deficiency. The Musk system has zero transaction costs and severe coordination costs.

Composite Indices

Individual metrics aggregate into composite indices that classify system state:

System Classification: Zero-Transaction-Cost / High-Coordination-Cost System with pronounced structural drift.

The CDT simulation confirms the extended formula’s prediction: zero transaction costs do not produce efficient allocation when coordination architecture is absent. The Master CVI of 0.36 places the Musk system in the Coordination Failure Zone. Section IX derives specific failure probabilities and registered predictions from the baseline metrics.

Insight: Unified control eliminates transaction costs but does not create coordination architecture; the Musk ecosystem demonstrates dimensional independence empirically.

X. Baseline Failure Probabilities and Predictions

CDT simulation generates not only diagnostic metrics but probability distributions over outcomes. Section IX presents baseline failure probabilities, documents already-visible coordination failures, and registers specific predictions for validation. Scientific frameworks must be falsifiable; the registered predictions provide falsification criteria.

Failure Probabilities (No Intervention)

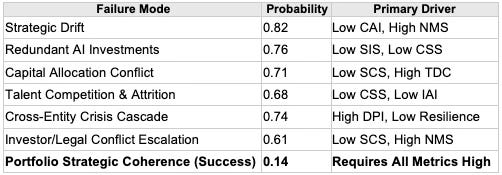

The baseline metrics generate probability distributions for specific failure modes. Each probability derives from metric interactions documented in CDT methodology.

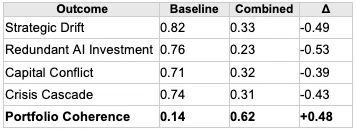

The baseline shows 82% probability of strategic drift and only 14% probability of portfolio coherence.

Observable Failures (Already Visible)

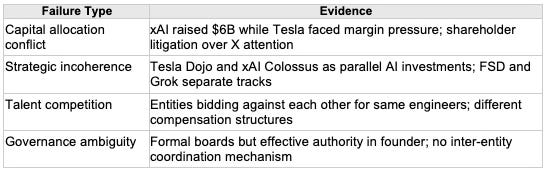

The predictions are not merely forward-looking. Several coordination failures are already observable, providing partial validation of baseline probabilities.

Observable failures are consistent with baseline probabilities and provide confidence in forward predictions.

Registered Predictions

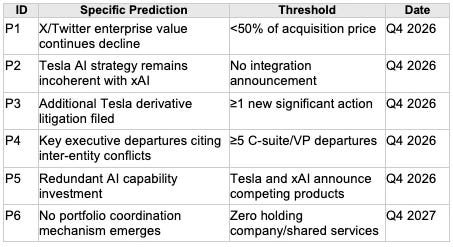

The following predictions are registered for validation. Each prediction includes a specific threshold and assessment date. The conventional (Coasean) prediction is stated for contrast.

Conventional (Coasean) Prediction: Musk’s unified control eliminates transaction costs; resource allocation will optimize based on highest-value use; apparent conflicts reflect strategic sequencing outsiders cannot observe.

NIBE + SBC Predictions:

Falsification Criteria

Scientific frameworks must specify conditions under which the frameworks would be falsified. The NIBE + SBC prediction fails if by Q4 2027:

(1) Musk entities demonstrate coordinated allocation through announced portfolio strategy; (2) Tesla AI and xAI announce integration or clear division of responsibilities; (3) Shareholder litigation resolved without adverse fiduciary findings; (4) Four or more specific predictions above do not materialize.

Under the falsification conditions, Coasean logic would be validated even for complex multi-entity structures.

Predictions registered December 2025. Validation assessment: Q4 2027. The specific, quantified nature of registered predictions distinguishes scientific framework testing from post-hoc rationalization.

Insight: Prediction registration with explicit falsification criteria is what separates scientific frameworks from unfalsifiable theory.

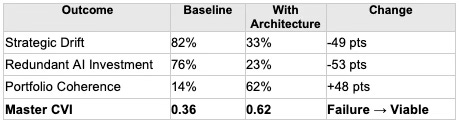

XI. Intervention Scenarios

Diagnosis without treatment is incomplete. If coordination costs are the binding constraint, coordination architecture should be designable. Section X presents CDT simulation results for three intervention scenarios and the combined effect, demonstrating that baseline probabilities are not fixed—baseline probabilities respond to specific architectural investments.

The CDT simulation models three intervention scenarios and the combined effect:

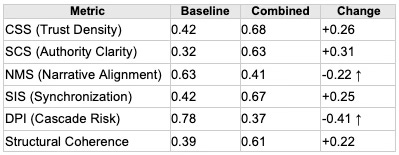

Combined Scenario: Full Metric Shifts

Applying all three interventions simultaneously produces the highest systemic improvement. The following table shows full metric movement from baseline to combined scenario.

The combined intervention moves every metric above threshold, shifting the system from Coordination Failure Zone to Coordination Viable.

Outcome Probability Comparison

Metric shifts translate to probability shifts. The following table shows baseline versus combined scenario for each outcome.

Strategic drift drops from 82% to 33%; portfolio coherence rises from 14% to 62%. The system becomes viable.

The binding constraint is not transaction costs—the binding constraint is coordination architecture. The interventions are designable; the outcomes are measurable; the improvements are substantial. Coordination costs are not inevitable; coordination costs are addressable through architectural investment.

Insight: Coordination architecture is designable infrastructure; the baseline is not destiny.

XII. Prescriptive Architecture

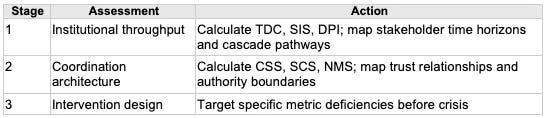

Sections II through X established what coordination costs are, how to measure coordination costs, and what effect addressing coordination costs produces. Section XI translates the analysis into actionable protocol: how to diagnose coordination capacity and what interventions address specific deficiencies.

Diagnostic Protocol

Coordination architecture assessment follows a three-stage protocol. Each stage produces specific metrics that inform intervention design.

The diagnostic protocol produces a coordination capacity assessment that identifies specific intervention targets.

Intervention Mechanisms

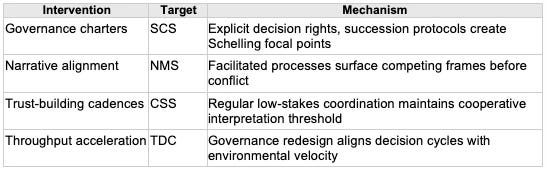

Each intervention targets specific metrics through defined mechanisms. The following table maps interventions to targets and mechanisms.

Interventions must be matched to specific metric deficiencies; generic governance reform does not address targeted coordination costs.

Policy Implications

The analysis has implications beyond individual organizations. Regulators focused on reducing transaction costs address only one dimension. In complex organizational environments, coordination architecture may be the binding constraint.

Legal frameworks mandating governance clarity, succession protocols, and stakeholder coordination mechanisms could prevent coordination failures that transaction cost reduction cannot reach.

Coordination architecture is infrastructure. Like physical infrastructure, coordination architecture must be built before the architecture is needed. Crisis is too late. The diagnostic protocol and intervention mechanisms provide the blueprint; implementation requires investment before coordination failures materialize.

Insight: Coordination architecture must be built before crisis; coordination architecture cannot be improvised during bargaining.

XIII. Series Framework: Parts II and III

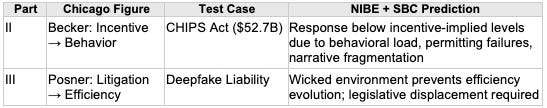

Part I has focused on Coase. The coordination cost category extends across the Chicago School. Parts II and III apply the same analytical approach to Becker and Posner respectively. Section XII previews the extensions to establish the series architecture.

The coordination cost category extends across Chicago frameworks:

The unified argument across three parts: Chicago law and economics correctly identified that incentive structure determines outcomes. NIBE and SBC specify when incentive structure actually translates to behavior—and when coordination costs, behavioral load, or environmental wickedness intervene. Together, Parts I through III complete the Chicago School by specifying boundary conditions.

Insight: Chicago law and economics identifies the right variables; NIBE and SBC specify when those variables actually determine outcomes.

XIV. Conclusion

Part I has demonstrated a single core proposition: transaction costs and coordination costs are analytically distinct. Zero transaction costs do not guarantee efficient outcomes when coordination architecture is absent. The proposition has been validated retrospectively (OpenAI) and tested prospectively (Musk ecosystem) with registered, falsifiable predictions.

Coase transformed law and economics by demonstrating that efficient outcomes emerge when transaction costs are low. The NIBE + SBC extension reveals that Coasean efficiency also requires coordination capacity: institutional throughput permitting bargaining to occur, and behavioral architecture enabling parties to converge on agreement.

The extended theorem: Parties will bargain to efficient outcomes when transaction costs are low, institutional throughput is adequate, and coordination architecture is robust. Failure in any dimension blocks the Coasean mechanism.

The problem of social cost becomes the problem of coordination design. Efficient bargaining requires not merely the absence of friction, but the presence of coordination capacity. Coordination capacity must be built before coordination capacity is needed.

Insight: The problem of social cost is the problem of coordination design; friction removal is necessary but insufficient.