MCAI Lex Vision: The Assefi Test- Can a New Antitrust Chief Reverse the DOJ's Regulatory Capture?

The Live Nation Trial Window: 14 Days to Test Whether Federal Antitrust Still Functions

Companion piece to How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It, The Architecture Semafor Found Was Already Published — Access Arbitrage, Judicial Discovery, and the Fourth Modality of Competitive Federalism, The Shadow Antitrust Division, A Tri-Parte Bypass of the Rule of Law, Shadow Antitrust Division- The DOJ Credibility Threshold.

I. Executive Summary

On February 12, 2026, the Trump administration ousted Gail Slater as Assistant Attorney General for the Antitrust Division of the US DOJ. Slater, confirmed by the Senate 78-13 just a year earlier, had been pressing for trial against Live Nation Entertainment — the parent company of Ticketmaster — in a landmark antitrust suit joined by 40 state attorneys general. The lawsuit sought to force Live Nation to divest Ticketmaster, breaking up what the government alleged was an illegal monopoly over ticketing and live entertainment.

Three weeks before that trial was set to begin, Slater was removed. CBS News reported she had lost the trust of Attorney General Pam Bondi and Deputy Attorney General Todd Blanche — the senior DOJ official whose office became the primary channel for off-docket settlement negotiations that bypassed Slater’s Antitrust Division. Bloomberg confirmed the White House requested her resignation.

Live Nation shares jumped 5.8%. Mike Davis — the lobbyist who brokered back-channel settlement talks bypassing the Antitrust Division — posted “Good riddance.” Chad Mizelle — the former DOJ Chief of Staff who fired Slater’s two top deputies over the HPE-Juniper settlement and whom MindCast AI identified as the decision-node gatekeeper in the Geometry of Regulatory Capture — characterized Slater’s enforcement posture as “personal agendas and vendettas.” Davis reposted Mizelle’s statement. How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It

Between January 20 and February 10, MindCast AI published a suite of analyses — spanning the Nash-Stigler Externalities study (which quantified a $22 billion deadweight-loss baseline from federal enforcement failure across Live Nation and Compass-Anywhere), the Tirole Advocacy Arbitrage framework, the Geometry of Regulatory Capture, and Competitive Federalism as Market Infrastructure — that mapped the structural architecture producing this outcome.

The MindCast AI publications named the actors, identified the off-docket settlement channels bypassing the Antitrust Division, and predicted that enforcement-minded officials would be removed before structural reform could occur. Nine of ten falsifiable predictions were confirmed by the events of February 12. How MindCast AI Predicted the Slater Ouster, published within hours of Slater’s ouster, documented the full validation.

The analysis below does not restate those claims. It asks one question:

Does acting leadership change the topology, or only the tone?

Bondi and Blanche installed Omeed Assefi as Acting AAG for Antitrust — the same role he held at the start of the second Trump term before Slater’s confirmation. The Live Nation trial is scheduled for March 2 — eighteen days from now. Between today and that date, observable signals will either reinforce or weaken the phase-lock thesis: that federal antitrust enforcement has crossed the point at which outcomes are determined entirely by access rather than evidence, structural remedies are unreachable, and the system cannot self-correct from within.

The sections that follow define the diagnostic window, identify the signals, and establish the falsification conditions.

II. What Is Actually Variable

The public conversation around the Slater ouster risks collapsing into a personality story: Slater was tough, Assefi is compliant. That framing is wrong — not because Assefi’s individual posture doesn’t matter, but because it mistakes the soft variable for the hard one.

Hard variable: Routing authority. Who controls the settlement channel? The Geometry of Regulatory Capture publication established that no survivable geodesic exists from career-staff investigation to structural remedy — constraint density is high, curvature is steep, and geodesic availability is near zero. Under Slater, the Antitrust Division maintained — imperfectly, under increasing pressure — that settlement decisions should route through the Division’s evidentiary process. The Access Arbitrage coalition (Davis, Conway, the Blanche office) operated a parallel channel that bypassed the Division entirely. Mizelle operationalized this channel from the AG’s office: he overruled Slater on the HPE-Juniper settlement, fired Alford and Rinner when they resisted, and controlled the agenda routing and staff escalation pathways that determined which enforcement decisions reached the decision node. Semafor confirmed the same off-docket architecture on February 8 in the Live Nation context. CBS News confirmed Slater lost the trust of both Bondi and Blanche — the institutional endpoints of that parallel channel. The Master Player Grid published January 24 mapped this with precision: career staff hold formal authority over evidence development, yet their decision-node access is indirect and their override frequency is high.

Soft variable: Acting leadership discretion. An Acting AAG can adjust tone. He can emphasize different priorities in public statements. He can signal continuity. What he cannot do, structurally, is re-center routing authority within the Division if the AG’s office and the Deputy AG’s office have already claimed it. Acting status confers delegated authority, not independent political mandate. A Senate-confirmed AAG has a constituency (the senators who voted 78-13). An Acting AAG serves at the pleasure of the officials who installed him.

The question is not whether Assefi wants to pursue structural remedies. The question is whether the routing authority that determines enforcement outcomes has migrated back into the Antitrust Division — or whether it remains in the hands of the political layer that removed his predecessor.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. MindCast AI applies Cognitive Digital Twin (CDT) modeling to treat institutions as decision systems. This brief is a structural impact analysis, not legal advice. All predictions carry explicit falsification conditions.

III. Who Is Omeed Assefi

A brief structural profile — not to personalize the analysis, but to clarify what the installation tells us about the system’s intent.

Assefi is a career DOJ attorney whose trajectory runs through the White House Counsel’s Office (where he represented the Office of the President during the Mueller investigation), the Office of the Associate Attorney General (where he helped supervise the Antitrust and Civil Rights Divisions), and the U.S. Attorney’s Office in D.C. (where he prosecuted violent crime). He joined the Antitrust Division in October 2024 and served as Acting AAG from January to March 2025, before Slater’s confirmation. His substantive portfolio since then has been criminal enforcement — cartels, bid-rigging, the Division’s first $1 million whistleblower payment.

Three structural observations:

1. The “Acting Loop.” Assefi held this role once before, at the start of the second Trump term. His reinstallation effectively resets the Division to its pre-Slater configuration. The system tried an enforcement-minded Senate-confirmed appointee. The system rejected her. It reverted to the known default.

2. The criminal enforcement lane. Assefi’s public record is almost entirely in the one area of antitrust that is politically uncontroversial. Nobody defends price-fixing cartels. Criminal cartel enforcement does not threaten the market structure of Live Nation, Google, Apple, or Netflix-WBD. His track record is clean precisely because it avoids the territory where political routing operates.

3. Proximity to the Access Arbitrage network. The Washington Post reported on February 12 that Assefi is “close with Mike Davis.” The Tirole Phase Analysis identified Davis as a named Access Arbitrage node operating through the Blanche channel — the identical channel that produced the Slater ouster. A publicly available photograph shows Assefi moderating a DOJ panel alongside Davis, Steve Bannon, and others. Personal relationships do not determine institutional outcomes. But under the Tirole framework, the Access Arbitrage Intensity metric (the marginal payoff of off-docket lobbying access relative to docketed adversarial advocacy) is directly affected by the friction coefficient between acting leadership and the off-docket settlement channel. The friction that existed under Slater — the friction that produced the ouster — is structurally unlikely to replicate under Assefi.

None of this predicts what Assefi will do. It describes the constraint field in which he operates. The signals over the next fourteen days will tell us whether he navigates that field differently than the topology predicts.

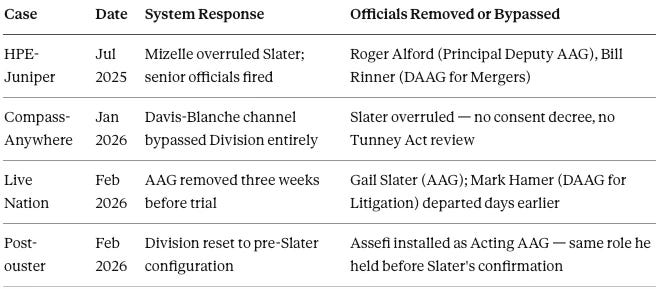

The Escalation Sequence

The Assefi installation is the fourth milestone in a seven-month pattern. Each iteration eliminated enforcement resistance at a progressively higher level because the previous removal did not fully clear the path.

IV. The Settlement Trap

Before the diagnostic signals arrive, one framing correction is necessary — because the dominant media narrative will get this wrong.

If the DOJ announces a Live Nation settlement in the coming weeks, every headline will read some version of: “DOJ Cracks Down on Live Nation.” The settlement will feature large numbers — a nine-figure fine, behavioral restrictions, a compliance monitor, possibly a partial divestiture of some secondary asset. It will be marketed as accountability.

Under the MindCast AI frameworks, that outcome is not enforcement succeeding. It is the capture geometry producing its predicted output — what the Tirole Phase Analysis calls the Harm Clearinghouse: a settlement that clears the firm’s legal liability without fixing the market’s structural harm.

Forty states joined the DOJ in filing the Live Nation lawsuit to force divestiture of Ticketmaster. That was the structural remedy. A behavioral settlement — fines, monitors, conduct restrictions — preserves Live Nation’s monopoly market structure intact. The company pays a regulatory tax. The compliance monitor becomes the visible artifact of enforcement. The underlying market power remains untouched. The Nash-Stigler Externalities study calls that outcome Post-Consolidation Containment: behavioral standardization substitutes for structural unwind once the enforcement system treats procedural sufficiency as its stopping rule. Wall Street will price any settlement without Ticketmaster divestiture as confirmation that the monopoly is safe. The LYV stock jump on February 12 priced exactly that expectation.

The analytical question is not whether DOJ acts. It is whether the action changes market structure or ratifies it.

Establish the framing now, before the settlement drops. Afterward, it reads as complaint. Beforehand, it reads as diagnostic.

V. The 14-Day Geometry Test

The Live Nation trial is scheduled for March 2. The window between now and that date constitutes a real-time stress test of the phase-lock thesis. The following signals are observable, falsifiable, and time-bound.

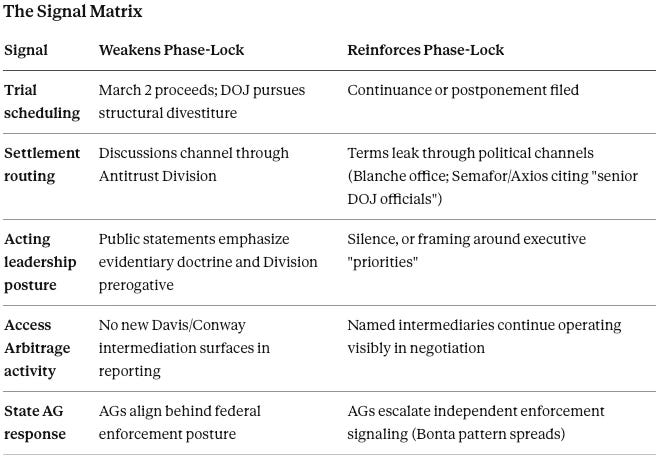

The Signal Matrix

Reading the Matrix

If the left column dominates over fourteen days, acting leadership is exercising independent institutional authority, the routing constraint has loosened, and the phase-lock thesis weakens. If the right column dominates, the routing-dominant geometry remains intact under new leadership, and phase-lock is reinforced.

The outcome is not a spectrum. The Live Nation case resolves in one of two structurally distinct ways:

Structural remedy: Ticketmaster divestiture, or a remedy that materially alters Live Nation’s vertical integration across ticketing, promotion, and venues. Achieving it requires the Antitrust Division to control the enforcement posture.

Behavioral settlement: Fines, monitors, conduct restrictions that leave the integrated monopoly intact. Consistent with — and predicted by — the routing-dominant capture geometry.

The gap between these two outcomes is not a matter of degree. It is the difference between enforcement that changes market structure and enforcement that performs accountability while preserving it.

VI. The State Veto

The most consequential reaction to the Slater ouster did not come from Washington. It came from Sacramento.

California Attorney General Rob Bonta stated on February 12: “While the federal government has abdicated its responsibility to look out for people’s economic wellbeing — in California, we never will. My office has led the nation in consumer protection and antitrust work for decades, and we will continue to do so.”

Bonta’s statement registers as the first direct signal under the Competitive Federalism framework, which identifies state AGs as competitive market entrants supplying enforcement that federal monopoly no longer delivers. The Exit Condition defined in the Tirole Phase Analysis specifies what forces transition out of the captured equilibrium: distributed enforcer density (state AG coalitions operating with litigation autonomy) must exceed the threshold at which the federal settlement attractor weakens and adversarial truth-discovery re-emerges. Below that threshold, state action is absorbed into the existing geometry; above it, phase transition becomes possible.

The Bonta statement is not commentary — it is an assertion of independent enforcement authority by a state AG who co-filed the Live Nation suit. It positions California as a structural counterparty to federal settlement authority.

The 40-state coalition’s posture over the next two weeks is now the second-most important variable in the Live Nation case, behind only the trial scheduling itself. Under the Competitive Federalism framework, a federal settlement does not end the litigation — it shifts the enforcement center of gravity to states that refuse to join it.

What to watch:

Does Washington State AG Nick Brown issue a parallel statement? (Washington is a co-filing state.)

Do state AGs coordinate a public letter or statement asserting independent enforcement posture?

Does any state AG explicitly condition cooperation on structural remedy requirements?

Do state AGs accelerate discovery coordination between the HPE-Juniper Tunney Act proceedings and the Live Nation case?

If Bonta’s statement is an isolated reaction, the state enforcement density remains below threshold. If it triggers coordinated multi-state signaling within two weeks, enforcement authority has migrated — and the phase-exit path through competitive federalism becomes structurally viable.

The February 10 Judicial Process publication identified a fourth modality of competitive federalism: judicial discovery as enforcement migration. The HPE-Juniper depositions — where Davis, Schwartz, and Levi must testify under oath about the routing mechanism deployed across HPE, Compass, and Live Nation — create a cross-forum evidentiary record that state AGs can use across all proceedings simultaneously. Discovery coordination between HPE-Juniper and Live Nation is where the state enforcement vector gains institutional leverage that individual AG statements cannot provide alone.

VII. The Juniorization Clock

The Slater ouster does not operate in isolation. It is the terminal event in a seven-month sequence that has removed, in order: Roger Alford (Principal Deputy AAG), Bill Rinner (DAAG for Civil Enforcement and Mergers), Mark Hamer (DAAG for Litigation and Civil Enforcement), and now Slater herself.

The routing-dominant settlement channel has now consumed every senior official who resisted it. The Division’s institutional memory on the Live Nation, Google, and Apple cases is now concentrated in career staff who watched each departure. The Geometry of Capture identified four Coercive Narrative Governance (CNG) mechanisms that sustain captured systems. The mechanism of Boundary Reclassification — where enforcing professional standards gets reframed as insubordination — is now operating preemptively. Mizelle’s characterization of Slater’s enforcement posture as “personal agendas and vendettas” is textbook Boundary Reclassification: the enforcer who asserted professional boundaries was reclassified from defender of institutional integrity to institutional problem. Staff do not need to be fired to be captured. They need only to observe the consequences of resistance.

The deeper risk is not immediate compliance. It is delayed institutional degradation. Senior DOJ economists and litigators — the people who build structural cases requiring years of technical work — face a binary: self-censor or exit. The exits will not be dramatic. They will be LinkedIn posts about “returning to private practice” or “pursuing new opportunities.” The Division will continue to function. It will file motions. It will issue press releases. But the technical capacity to prosecute complex structural cases will erode through quiet departure, and that erosion is irreversible on any policy-relevant timeline.

Foreseeable indicator: Watch for senior career departures from the Antitrust Division over the next 60-90 days. Private-sector antitrust practices, state AG offices, and academic institutions will absorb the outflow. Each departure reduces the Division’s capacity to mount structural cases — independent of who leads it.

VIII. Falsification Summary

One core claim drives the analysis: the phase-lock thesis will be tested, in real time, by observable signals over the next fourteen days.

The thesis weakens if:

The March 2 trial proceeds with DOJ pursuing structural divestiture.

Settlement discussions route through the Antitrust Division, not the political layer.

Acting leadership issues public statements asserting doctrinal independence.

State AGs align behind a federal enforcement posture rather than asserting independent authority.

The thesis is reinforced if:

The trial is continued or postponed.

Settlement terms narrow to behavioral remedies without structural divestiture.

Off-docket intermediation by named Access Arbitrage actors continues or accelerates.

State AGs escalate independent enforcement signaling.

Both outcomes are foreseeable, trackable, and falsifiable. The geometry now faces its first real-time stress test.

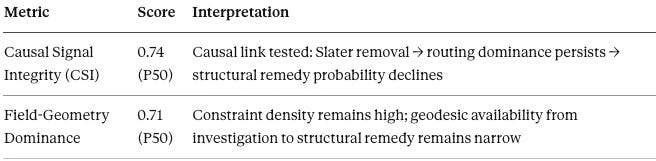

Appendix A: CDT Foresight Simulations — Post-Ouster Live Nation Routing Test

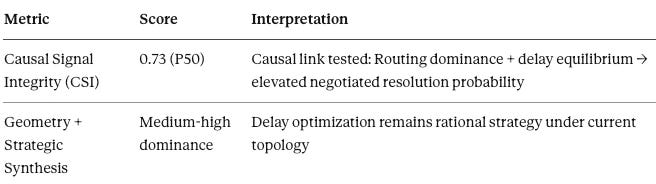

CDT foresight simulations were run on three institutional actors to quantify the structural analysis above. Results indicate continued geometry dominance and delay-optimized strategic posture across all modeled actors.

A1. DOJ Antitrust Division (ATR)

Acting leadership has not yet produced observable signals indicating routing re-centralization. Absent structural posture reinforcement (trial continuity, divestiture emphasis), ATR remains geometry-constrained.

ATR 14-Day Prediction:

Structural divestiture posture maintained: 0.28 (P50)

Negotiated behavioral pathway remains primary attractor: 0.60 (P50)

Falsification trigger: DOJ files aggressive pretrial motions consistent with Ticketmaster separation and rejects continuance pressure.

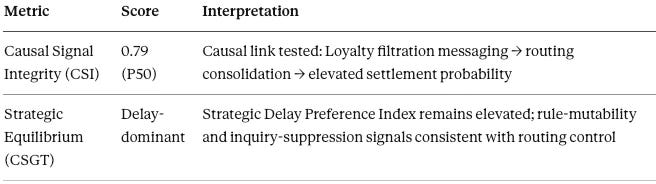

A2. DOJ Political Routing Layer (DOJ-PRL)

The political routing layer maximizes risk control through negotiability rather than adversarial exposure. Trial carries evidentiary volatility; settlement contains narrative.

DOJ-PRL 14-Day Prediction:

Trial continuance or softening of structural posture: 0.55 (P50)

Direct political settlement shaping prior to March 2: 0.48 (P50)

Falsification trigger: Acting leadership publicly asserts Division control over settlement architecture and rejects off-division negotiation channels.

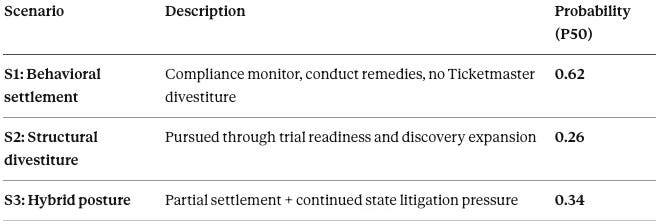

A3. Live Nation (Flagship Defendant)

Live Nation Scenario Matrix (14-Day Window):

Behavioral settlement remains the dominant attractor under routing-dominant geometry. Structural divestiture requires an observable shift in authority topology — not a tone adjustment.

Falsification trigger: Structural remedy language sustained publicly and procedurally through discovery expansion and trial confirmation.

Cross-Actor Consequence

The dominant systemic consequence of the Slater ouster is not immediate resolution but routing equilibrium hardening. Acting leadership modifies surface tone; topology determines the outcome pathway. Without routing re-centralization, settlement convergence probability remains elevated across flagship matters. The Live Nation case functions as a real-time geometry diagnostic — not a single-case controversy.

Publication Cross-Reference:

How MindCast AI Predicted the Slater Ouster (February 12, 2026)

Judicial Process as Competitive Federalism (February 10, 2026)

A New Era of Competitive Federalism (January 28, 2026)

Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (January 27, 2026)

Antitrust Regulatory Capture Geometry (January 24, 2026)

Tirole Advocacy Arbitrage (January 23, 2026)

Nash–Stigler Equilibria (January 21, 2026)

Comparative Externality Costs in Antitrust Enforcement (Nash-Stigler Foresight Study) (January 2026)