MCAI Lex Vision: The Architecture Semafor Found Was Already Published — A Live Nation Cognitive Digital Twin Foresight Simulation

Access Arbitrage, Judicial Discovery, and the Fourth Modality of Competitive Federalism

See also The Assefi Test- Can a New Antitrust Chief Reverse the DOJ’s Regulatory Capture?, How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It, Judicial Discovery, and the Fourth Modality of Competitive Federalism, The Shadow Antitrust Division, A Tri-Parte Bypass of the Rule of Law, Shadow Antitrust Division- The DOJ Credibility Threshold.

I. Executive Summary

On February 8, 2026, Semafor reported that Live Nation executives and lobbyists have been negotiating with senior US DOJ officials outside the Antitrust Division to avert a trial currently set for March 2, 2026. Former Trump campaign manager Kellyanne Conway and Trump ally Mike Davis have advised Live Nation on settlement talks, with Conway meeting recently with both Antitrust Chief Gail Slater and representatives from Deputy Attorney General Todd Blanche’s office. Five days earlier, on February 3, U.S. District Judge Casey Pitts in the Northern District of California ordered that state attorneys general may depose William Levi, Mike Davis, and Arthur Schwartz under oath as part of the Tunney Act review of the HPE-Juniper merger settlement.

The January 2026 MindCast AI publication suite — anchored by A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice (Jan 2026), Comparative Externality Costs in Antitrust Enforcement (Jan 2026), Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 2026), and Competitive Federalism as Market Infrastructure (Jan 2026) — modeled the architecture that makes both developments intelligible. The suite named the actor network, mapped the off-docket routing mechanism, quantified the consumer externality load, and described the institutional dynamics through which enforcement terminates at procedural sufficiency. The February developments confirm that the architecture operates as modeled.

The present publication extends that work by modeling a new variable the January suite could not yet observe: judicial process operating as a real-time constraint on settlement dynamics. Discovery has become contemporaneous with advocacy. Advisors shaping Live Nation’s defense now face sworn testimony obligations in parallel antitrust proceedings. The result is a fragile equilibrium in which political settlement pressure, state enforcement incentives, and judicial process integrity collide within a three-week window.

Core Claim: Live Nation’s antitrust exposure will not stabilize through settlement before the trial date currently set for March 2, 2026. Judicial-process escalation, advisor dual-exposure, and state AG leverage expansion have converted the pre-trial period from a negotiation window into a constraint-tightening phase. Procedural legitimacy — not market-definition disputes — has become the decisive variable.

MindCast AI is a predictive law and behavioral economics foresight firm. The firm models institutional behavior using Cognitive Digital Twin (CDT) simulations — computational frameworks that reconstruct each actor’s incentives, constraints, and available decision paths under real legal and political conditions, then identify the equilibrium behaviors where no actor can improve position through unilateral action. Rather than inferring intent or offering commentary, CDT simulations generate falsifiable predictions about enforcement termination, authority routing, and institutional substitution. Every publication in the MindCast AI series is a simulation output, not an opinion. Contact mcai@mindcast-ai.com to partner on foresight simulations.

II. Validation: What MindCast AI Published Before Events Confirmed

Validation establishes that the analytical framework produced specific, falsifiable outputs whose structural descriptions match subsequently observed behavior. Priority is demonstrated not by temporal sequence but by the framework’s capacity to name the architecture, identify the channels, and describe the failure mode (procedural sufficiency → capture) in terms that make the reported developments intelligible rather than surprising. The following mapping documents that correspondence across four structural elements.

1. The Access Arbitrage Actor Network

Published (January 2026): A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice (Jan 2026) identified Mike Davis, Arthur Schwartz, and Chad Mizelle as named nodes in the Access Arbitrage architecture. Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 2026) mapped the routing mechanism: Career Staff (Slater) → Political Appointee (Blanche) = Immunity. The Tirole study’s Lobbyist Influence and Forecast Matrix documented Davis’s role as an Access Arbitrage intermediary operating through Deputy AG Todd Blanche’s office, with Schwartz as a parallel channel and Mizelle as the process gatekeeper controlling agenda routing, memo timing, and staff escalation pathways.

Confirmed (February 2026): Semafor reported that Davis has advised Live Nation on settlement talks with the DOJ, operating through the identical Blanche channel MindCast AI identified. Judge Pitts ordered Davis and Schwartz to testify under oath about the routing mechanism MindCast AI described.

Assessment: Full structural confirmation. The actor network, the routing pathway, and the institutional counterparts match the published framework.

2. The Off-Docket Routing Mechanism

Published (January 2026): A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction (Jan 2026) defined Access Arbitrage Intensity as the marginal payoff of off-docket lobbying access relative to docketed adversarial advocacy. The framework predicted that enforcement outcomes would be determined by private access channels bypassing career staff, overriding evidentiary findings, and collapsing merit-based enforcement. Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 2026) documented how the Compass-Anywhere merger clearance was secured through a direct channel between Davis and Blanche that bypassed Slater’s Antitrust Division entirely.

Confirmed (February 2026): Semafor reported that Live Nation’s settlement talks have been conducted with “senior DOJ officials outside the antitrust division” and that some discussions have “sidelined” Slater. Conway has met with both Slater and representatives from Blanche’s office — confirming dual-channel access arbitrage operating simultaneously through and around the Antitrust Division.

Assessment: Full mechanism confirmation. Off-docket routing has moved from analytical inference to documented operational channel.

3. Competitive Federalism as Enforcement Corrective

Published (January 2026): Competitive Federalism as Market Infrastructure (Jan 2026) identified State Attorneys General as the structurally necessary corrective when federal enforcement terminates at procedural sufficiency. The framework predicted that distributed enforcer density — state AG coalitions operating with litigation autonomy — would function as the exit condition from the Advocacy Arbitrage Phase, as formalized in the Tirole study’s phase transition model.

Confirmed (February 2026): Semafor confirmed that a DOJ settlement “would not stop the [states] that have also sued Live Nation.” In the HPE-Juniper proceedings, a coalition of state attorneys general secured intervention rights and Judge Pitts authorized depositions that the DOJ itself had not pursued. State enforcement operates as an independent enforcement supplier, exactly as the framework modeled.

Assessment: Structural confirmation with extension. States are not merely filling a federal void — they generate enforcement outputs (discovery, depositions, procedural challenges) that the federal system actively resisted producing.

4. The Non-Replicability Prediction — Partially Challenged, Partially Confirmed

Published (January 2026): Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 2026) predicted that the Compass access-routing maneuver through Davis-Blanche was “non-replicable” because public exposure had functionally “burned” the channel. Subsequent firms attempting the same Access Arbitrage would face heightened scrutiny.

Confirmed and Extended (February 2026): Davis is back in the same channel advising Live Nation — partially challenging the non-replicability prediction. However, the HPE deposition order creates a constraint the January analysis could not yet model: Davis now faces sworn testimony obligations about the HPE routing mechanism while simultaneously deploying the identical mechanism for Live Nation. The channel is not closed, but operating under judicial observation changes the risk calculus fundamentally. The DOJ spokesperson’s warning that “anonymous attempts to alter markets or outcomes will not undermine the integrity of this process” suggests the exposure dynamics the non-replicability prediction anticipated are generating institutional friction, even if the channel itself remains open.

Assessment: Partial confirmation. The prediction identified the correct dynamic (exposure generating friction) but underestimated the willingness of intermediaries to operate through channels under active judicial scrutiny. The revised model must account for judicial discovery as a constraint that degrades channel reliability without fully closing it.

Prior MindCast AI validations: Super Bowl LX and Seahawks 2025–2026 Season Validation, Foresight on Trial, The Diageo Litigation Validation, Judicial Deconstruction of Compass’s Narrative Arbitrage v. Zillow.

III. New Variables: What Changed Since January

The January publication suite modeled Access Arbitrage, Nash-Stigler equilibrium dynamics, and competitive federalism as stable analytical frameworks. The February developments introduce three variables that alter the constraint environment without revising the underlying theory.

Variable 1: Judicial Discovery as Contemporaneous Constraint

Judge Pitts’s February 3 order authorizing depositions of Levi, Davis, and Schwartz converts the Tunney Act from a procedural formality into an active discovery engine. The ruling’s significance extends beyond HPE-Juniper: sworn testimony about access-routing mechanics in one proceeding becomes potential evidence in parallel proceedings involving the same actors.

For Live Nation, the implication is direct. Davis is advising Live Nation’s settlement approach while facing court-ordered testimony about the same approach deployed for HPE. Narrative consistency across forums — federal settlement discussions, state AG litigation, and Tunney Act proceedings — becomes a binding constraint. Statements made under oath in San Jose will be available to the coalition of states and DC prosecuting Live Nation in the Southern District of New York.

Variable 2: The Conway Access Channel

MindCast AI’s January actor matrix identified Davis, Schwartz, Mizelle, and Blanche as the principal nodes in the Access Arbitrage architecture. Conway’s emergence as the “lead role” in Live Nation’s settlement advocacy introduces a structurally distinct access channel that warrants formal classification.

Davis operates through legal-regulatory revolving door proximity — former Senate Judiciary counsel leveraging institutional relationships into consulting access. Conway operates through campaign-era electoral debt — a currency denominated in political loyalty rather than institutional knowledge. The distinction matters because the two channel types carry different constraint profiles under escalating scrutiny. Davis faces judicial compulsion (deposition orders, potential Tunney Act disclosure requirements). Conway faces reputational-political exposure but no current judicial obligation. Prediction 4 in this simulation (Access-Node Behavioral Divergence) reflects this asymmetry.

Variable 3: Slater’s Authority Erosion

The January publications treated Slater as a constraint node — a career-aligned appointee whose presence preserved some evidentiary integrity within the federal enforcement architecture. Semafor reported on February 6 that Slater was prevented from ending or declining to renew her chief of staff’s detail after Attorney General Bondi intervened to extend the arrangement. The episode demonstrates that Slater’s constraint function has degraded further than the January framework modeled. Bondi’s direct override of division-level staffing decisions compresses the Agent Substitution Rule toward completion: political leadership controls not only enforcement outcomes but internal personnel arrangements, limiting the Antitrust Division’s capacity for autonomous institutional resistance.

Semafor’s report that settlement talks have “sidelined” Slater grounds the Institutional Cognitive Plasticity finding (low DOJ short-term plasticity) empirically. DOJ cannot present a unified, doctrinally coherent settlement posture when the official responsible for antitrust doctrine has been functionally bypassed on both substance and personnel.

IV. The Fourth Modality of Competitive Federalism: Judicial Discovery

The Competitive Federalism as Market Infrastructure vision statement (January 2026) identified three modalities through which state enforcement restores competitive integrity when federal capacity collapses: executive enforcement action, legislative substitution, and regulatory convergence across domains. The HPE-Juniper Tunney Act proceedings reveal a fourth modality that the January framework did not explicitly theorize.

Judicial discovery as competitive federalism operates when state attorneys general use court-authorized proceedings to forensically document the access-routing mechanisms that produced captured federal enforcement outcomes. The mechanism does not require states to win on the merits at trial. Discovery itself generates enforcement value by producing sworn testimony, compelling disclosure of non-written communications, and creating an evidentiary record available to parallel enforcement proceedings.

Judge Pitts’s ruling articulated the judicial rationale in terms that map directly onto the off-docket thesis: “I think that, at the very least, deposition testimony would be necessary to get a fuller picture of any non-written interaction.” Non-written interaction is precisely the medium through which Access Arbitrage operates — off-docket meetings, phone calls, and private channels that leave no formal evidentiary trail. By authorizing discovery into non-written communications, the court pierces the informational asymmetry that sustains the Access Arbitrage equilibrium. State attorneys general now have a federal judge’s own language establishing that sworn testimony is the appropriate tool for examining the gap between formal proceedings and actual decisional inputs.

For Live Nation, the fourth modality creates a specific constraint. Any DOJ settlement would trigger Tunney Act review. The HPE-Juniper order demonstrates a judicial willingness to authorize process-integrity inquiry in settlement review — including depositions of advisors involved in negotiating terms. A coalition of states seeking to intervene in a Live Nation Tunney Act proceeding would point to the Pitts order as evidence that courts are prepared to examine non-written interactions between settlement advisors and government officials. Tunney Act review practice varies across districts, and intervention and discovery are not automatic; however, the HPE-Juniper precedent establishes a concrete basis for requesting comparable process-integrity scrutiny. The Compass-Anywhere merger avoided Tunney Act exposure because unconditional clearance (no consent decree) does not trigger judicial review. A Live Nation settlement — which necessarily involves some form of consent decree — cannot replicate that evasion.

The fourth modality reranks enforcement power. States exercising Tunney Act intervention rights gain discovery tools that federal enforcement leadership chose not to deploy. Courts treating state scrutiny as complementary rather than obstructive amplify the competitive federalism dynamic. Judicial process becomes market infrastructure.

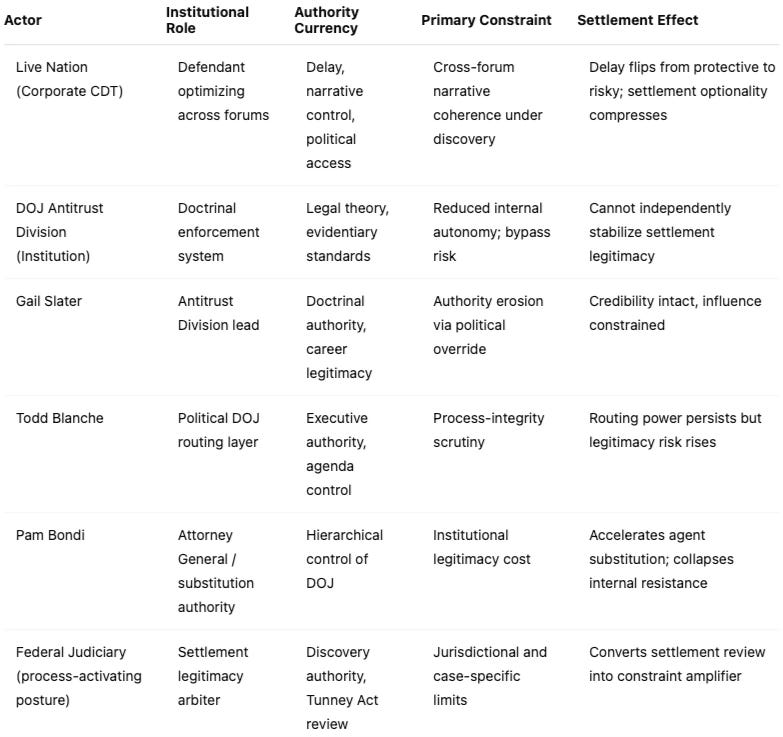

Table A — Federal and Judicial Architecture

This table captures actors who shape outcomes through formal authority, doctrine, and process legitimacy.

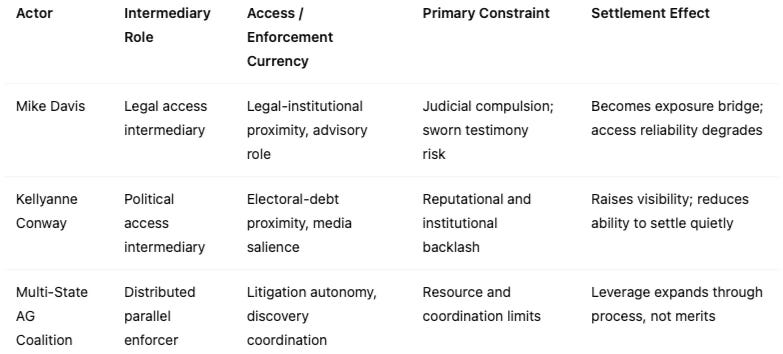

Table B — Access and Enforcement Intermediaries

This table captures actors whose influence operates through access compression, discovery leverage, and exposure dynamics rather than formal doctrine.

How to read the split matrix

Table A shows where formal authority resides and how it is being constrained.

Table B shows how access and enforcement leverage propagate under judicial scrutiny.

Together, the tables explain why the system has entered a judicial‑process‑dominated phase and why settlement stability is deteriorating despite intensified political negotiation.

V. Cognitive Digital Twin Foresight Simulation: Live Nation Judicial-Process Dynamics

Simulation Scope and Method

The present simulation is a targeted foresight simulation isolating the new variables introduced by the February developments. Prior Nash-Stigler equilibrium dynamics, externality quantification ($22–26B Live Nation five-year consumer harm, as established in Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria (Jan 2026)), and Tirole Advocacy Arbitrage mechanics remain operative as baseline constraints. Foundational frameworks carry forward without re-derivation; the simulation extends them into a judicial-process-dominated phase.

Vision Functions Activated (in routing order):

Causal Signal Integrity (CSI): Validates whether new causal links (judicial discovery → settlement dynamics) pass threshold for inclusion.

Chicago Strategic Game Theory Vision (CSGT Vision): Models strategic interaction under contemporaneous judicial constraint.

Regulatory Vision (Judicial-Process Sub-Mode): Evaluates court behavior as an active enforcement variable.

Disclosure Vision: Assesses information-release pressure from parallel proceedings.

Institutional Cognitive Plasticity Vision (ICP Vision): Models DOJ adaptive capacity under compound institutional stress.

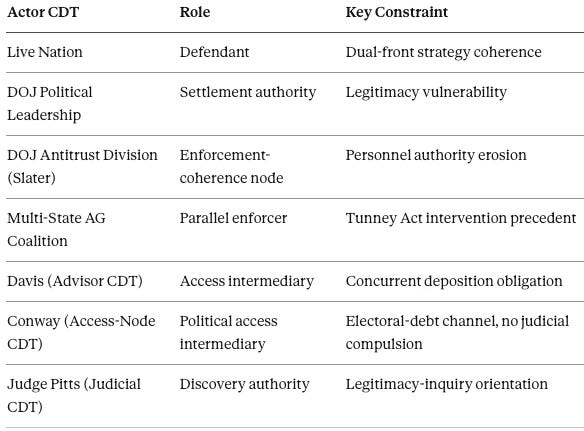

Actors Modeled:

Vision Function Outputs

1. Causal Signal Integrity (CSI)

Finding: New causal links pass CSI thresholds. Judicial discovery now directly constrains settlement timing and advocacy posture. Advisor exposure is no longer exogenous to the settlement negotiation — sworn testimony obligations in the HPE proceeding create endogenous risk for the same actors advising Live Nation. CSI routes the simulation away from incentive-only modeling toward judicial-process dominance.

Implication: Prior equilibria based on delay or narrative management are unstable. Settlement terms must now account for discoverable contradictions between what advisors testify to under oath and what they communicate in off-docket Live Nation advocacy.

2. Chicago Strategic Game Theory Vision (CSGT Vision)

Finding: The environment is delay-dominant but no longer delay-safe. Live Nation’s rational strategy is to arbitrage between political settlement channels and state enforcement risk — extending negotiations to avoid trial while preserving optionality. However, judicial scrutiny converts delay into cumulative exposure rather than advantage. Each week before the currently scheduled March 2, 2026 trial date that settlement remains unresolved increases the probability that HPE deposition outputs generate spillover evidence available to the multi-state Live Nation coalition.

Equilibrium Classification: Delay-dominant → collapsing.

Implication: Strategic stalling increases rather than decreases expected downside. The trial date currently set for March 2, 2026 functions as a constraint that compresses the delay-arbitrage window.

3. Regulatory Vision (Judicial-Process Sub-Mode)

Finding: Courts are treating antitrust settlement review as a legitimacy inquiry rather than a procedural formality. Judge Pitts’s authorization of depositions into the HPE settlement process — over DOJ objections — signals judicial willingness to examine the access-routing mechanisms that produced the consent decree. The judicial posture extends beyond HPE: any Live Nation settlement reaching Tunney Act review will face a judicial environment primed to scrutinize process integrity.

Implication: Procedural integrity has become a first-order enforcement variable. Settlement terms that would have survived Tunney Act review in a pre-HPE environment now face heightened legitimacy scrutiny.

4. Disclosure Vision

Finding: Advisor testimony risk accelerates information-release pressure across proceedings. Davis faces deposition about HPE access routing while advising Live Nation through the identical channel. Levi and Schwartz face parallel exposure. Narrative consistency — maintaining coherent accounts across federal settlement discussions, state AG litigation, Tunney Act proceedings, and public reporting — becomes a binding constraint that increases with each additional forum of disclosure.

The Semafor report functions independently as a disclosure event. DOJ’s response — that “anonymous attempts to alter markets or outcomes will not undermine the integrity of this process” — acknowledges the reporting’s institutional impact without denying the underlying facts. Public disclosure of the settlement-channel architecture constrains the channel’s future utility even without closing the channel entirely.

Implication: Settlement discussions face disclosure-driven volatility. Each new disclosure event (deposition transcript, reporting, state AG filing) narrows the range of settlement terms that all parties can accept without contradiction.

5. Institutional Cognitive Plasticity Vision (ICP Vision)

Finding: DOJ exhibits low short-term plasticity. Internal divergence between political leadership and the Antitrust Division remains unresolved. The Bondi-Slater staffing intervention demonstrates that the divergence extends beyond enforcement philosophy to operational control of division personnel. DOJ cannot simultaneously (a) present a unified settlement posture to the court, (b) maintain Slater’s credibility as the lead antitrust enforcer, and (c) accommodate political settlement channels that bypass her authority. External pressure from courts and states outpaces DOJ’s internal update velocity.

Implication: DOJ is unlikely to present a unified, durable settlement posture before the currently scheduled trial date. Any settlement announced under current conditions carries internal contradictions that states and courts can exploit through procedural challenge.

VI. When Process Governs Strategy: How Judicial Scrutiny Reorganizes the Settlement Landscape

Live Nation has entered a judicial-process-dominated phase. Market-definition debates and remedy bargaining no longer control outcomes. Exposure generated by discovery, advisor overlap, and process legitimacy now governs strategic behavior.

Live Nation’s dual-front advocacy strategy — federal political engagement combined with state-level legislative resistance — creates internal inconsistencies that become discoverable under judicial scrutiny. Advisors previously treated as insulated intermediaries now function as constraint nodes, transmitting risk rather than absorbing it. Davis cannot testify under oath about how access routing operated in the HPE proceeding while simultaneously deploying the same mechanism for Live Nation without generating discoverable inconsistencies. Conway, operating through a different channel type (electoral-debt rather than legal-regulatory proximity), faces reputational rather than judicial exposure — but the Semafor report has already activated that exposure by naming her role publicly.

For DOJ leadership, settlement no longer offers clean closure. Any agreement reached under conditions of live discovery and state skepticism risks judicial skepticism and downstream challenge. The multi-state coalition retains independent litigation authority regardless of federal settlement terms. The Tunney Act provides a judicial review mechanism through which states can challenge process legitimacy — and Judge Pitts has already demonstrated willingness to authorize precisely that inquiry.

For states, the environment favors escalation rather than deference. Procedural tools — Tunney Act intervention, deposition coordination, discovery requests — amplify state leverage without requiring full trial victories. The HPE precedent provides a replicable template. Judicial allies are emerging: courts increasingly view state scrutiny as complementary, not obstructive, to federal enforcement.

VII. Remedies Trajectory: What Judicial-Process Dominance Does to Remedy Shape

Judicial-process dominance does not determine whether Live Nation faces behavioral or structural remedies. Process dominance determines which remedies hold.

A quiet conduct decree — the outcome Live Nation’s settlement advocacy is designed to produce — becomes less stable as process-integrity scrutiny increases. Conduct decrees depend on perceived legitimacy: courts approve them, states defer to them, and markets price them in because the process that produced them appears sound. When the process itself is under examination — advisor depositions, disclosure challenges, state intervention — a conduct decree carries downstream vulnerability even if its substantive terms are defensible. States retain independent authority to challenge terms, courts retain Tunney Act review power, and the evidentiary record produced by discovery may contradict the decree’s foundational assumptions.

Structural remedies (divestiture of Ticketmaster) become relatively more stable under process scrutiny because structural outcomes reduce the ongoing enforcement burden. A structural remedy, once implemented, does not require the same sustained monitoring, compliance oversight, or good-faith institutional cooperation that conduct remedies demand. For state attorneys general evaluating remedy preferences, the practical implication is that judicial-process dominance biases the durability calculus — not necessarily toward structural outcomes, but away from the long-term stability of conduct-based alternatives.

VIII. Foresight Predictions

Prediction 1: Settlement Instability

Before the currently scheduled March 2, 2026 trial date, settlement discussions will fluctuate or stall rather than conclude cleanly. Terms will narrow, reset, or face delay due to exposure concerns tied to advisor testimony in parallel proceedings. A settlement announced under current conditions will carry legitimacy vulnerabilities that distinguish it from a stable resolution.

Prediction 2: State Attorney General Leverage Expansion

State attorneys general will increase procedural pressure — discovery coordination, deposition requests, public signaling, or Tunney Act intervention preparation — rather than pause in anticipation of a federal settlement. The HPE deposition precedent provides operational authority; the multi-state coalition provides scale.

Prediction 3: Department of Justice Re-Coordination Stress

DOJ will face a binary choice: re-center authority within Antitrust Division doctrine or proceed with a politically driven settlement vulnerable to judicial skepticism. A blended posture — claiming Slater is “very much involved” while conducting settlement talks that sideline her authority — will not hold under the combined pressure of reporting, state litigation, and judicial scrutiny. The Bondi intervention overriding Slater on her own chief of staff’s detail demonstrates that internal coherence is already compromised.

Prediction 4: Access-Node Behavioral Divergence

Political access intermediaries will exhibit divergent behavior based on their constraint profiles. Davis, facing judicial compulsion (deposition orders in HPE, potential Tunney Act exposure in Live Nation), will reduce visibility or modify advocacy posture. Conway, facing reputational-political exposure but no current judicial obligation, may sustain activity but with diminished effectiveness as public reporting constrains the channel’s utility. The net effect is declining Access Arbitrage Intensity — the marginal payoff of off-docket access relative to docketed advocacy — without complete channel closure.

IX. Predictions of Particular Relevance to State Attorneys General

Procedural Leverage Outpaces Substantive Risk. States can extract concessions or influence outcomes through process integrity challenges even without immediate trial victories. The Tunney Act, deposition authority, and discovery coordination provide enforcement tools that operate independently of market-definition litigation.

Federal Settlement Does Not Foreclose State Power. Any DOJ agreement reached under current conditions will carry legitimacy vulnerabilities exploitable by states. Unconditional clearance (the Compass evasion) is structurally unavailable in the Live Nation context — a consent decree necessarily triggers Tunney Act review under the Antitrust Procedures and Penalties Act. Judge Pitts’s February 3 order in the HPE-Juniper proceeding demonstrates judicial willingness to authorize process-integrity inquiry in settlement review, including depositions of lawyers, consultants, and political intermediaries involved in negotiating terms. Tunney Act review practice varies across districts, and intervention and discovery rights are not automatic. However, states seeking to intervene in a Live Nation Tunney Act proceeding would point to the Pitts order as a concrete basis for requesting comparable scrutiny — using Pitts’s own rationale that deposition testimony is necessary to examine “non-written interactions” between advisors and government officials.

Discovery Coordination Is High-Return. Aligning deposition timing and information requests across the HPE-Juniper and Live Nation proceedings maximizes spillover pressure on defendants and advisors. Davis’s concurrent role in both matters creates a discoverable information bridge that states can exploit through coordinated litigation strategy.

Judicial Allies Are Emerging. Courts increasingly view state scrutiny as complementary rather than obstructive. Judge Pitts’s authorization of depositions — over DOJ objections — signals a judicial posture treating process integrity as independently reviewable. Any Live Nation Tunney Act proceeding would operate in that precedential environment.

The Fourth Modality Operates Now. Judicial discovery as competitive federalism has moved beyond theory. States generate enforcement outputs — sworn testimony, disclosure obligations, procedural challenges — through judicial channels that federal enforcement leadership chose not to activate. The modality supplements executive enforcement, legislative substitution, and regulatory convergence as a fourth pillar of competitive federalism.

X. Falsification Conditions

The foresight simulation would be falsified if all four of the following occur:

DOJ finalizes a settlement before the currently scheduled March 2, 2026 trial date that survives initial state challenge and Tunney Act review without procedural escalation.

No overlapping advisor discovery creates spillover exposure between HPE-Juniper and Live Nation proceedings.

State AGs publicly align behind the federal settlement without independent procedural escalation.

Access intermediaries (Davis, Conway) maintain or increase advocacy activity without constraint modification.

Partial occurrence does not falsify. The model predicts settlement instability and state escalation as the dominant trajectory — not settlement impossibility.

XI. Closing Frame

Competitive markets cannot survive under monopolized enforcement. When enforcement authority concentrates and stabilizes at procedural sufficiency, economic rivalry yields to access arbitrage and political mediation. The January 2026 MindCast AI publication suite explained why the structure produces these outcomes. The February 2026 developments confirmed the explanation while introducing a variable the January work could not yet model: judicial process operating as a real-time constraint on the same access-routing mechanisms the framework identified.

Competitive federalism operates as fact, not abstraction. State attorneys general, armed with Tunney Act intervention rights and coordinated discovery strategies, generate enforcement outputs that federal institutions chose not to produce. Courts treat process legitimacy as independently reviewable. Advisors previously insulated by the gap between formal proceedings and off-docket advocacy now face sworn testimony obligations that collapse that gap.

The trial date currently set for March 2, 2026 functions as more than a scheduling milestone. Every actor’s strategy is being tested against that constraint — and so are the predictions in this simulation.

Appendix A: MindCast AI Publication Cross-Reference

A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice (January 2026). Named the Access Arbitrage actor network, defined the Tirole Advocacy Arbitrage Phase, and modeled access-node routing through Davis and Blanche.

Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria (January 2026). Anchored Live Nation at $22–26B in five-year consumer externality load and established conduct-based settlement as consumer-financed subsidy to monopoly power.

Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (January 2026). Documented bifurcated enforcement geometry, mapped HPE as control group, and predicted non-replicability of access channel (partially confirmed by February developments).

Competitive Federalism as Market Infrastructure (January 2026). Established three modalities of competitive federalism, identified state attorneys general as structurally necessary corrective. The present simulation extends the framework to a fourth modality: judicial discovery.

The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets (January 2026). Foundational capture theory explaining why monopolized enforcement produces capture as equilibrium.

The Dual Nash-Stigler Equilibrium Architecture (January 2026). Explains why enforcement terminates at procedural sufficiency and governs the settlement-as-termination dynamic now observable in Live Nation.

Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (December 2025). Integrated analytical framework treating competitive federalism as market infrastructure under real institutional constraints.

Appendix B: Technical Validation and Vision Functions

Causal Signal Integrity. Validates new causal links. Judicial discovery passes threshold as a direct constraint on settlement dynamics, routing the simulation toward judicial-process dominance.

Chicago Strategic Game Theory Vision. Models strategic interaction under contemporaneous judicial constraint. Output: delay-dominant equilibrium collapsing; strategic stalling increases rather than decreases expected downside.

Regulatory Vision (Judicial-Process Sub-Mode). Evaluates court behavior as an active enforcement variable. Output: legitimacy inquiry replaces procedural formality; courts treat state scrutiny as complementary.

Disclosure Vision. Assesses information-release pressure from parallel proceedings. Output: parallel depositions create cross-forum narrative consistency constraint that narrows viable settlement terms.

Institutional Cognitive Plasticity Vision. Models DOJ adaptive capacity under compound institutional stress. Output: low short-term plasticity; unified settlement posture unlikely before the currently scheduled trial date.