MCAI Lex Vision: Shadow Antitrust Division- The DOJ Credibility Threshold

Live Nation, Netflix–WBD, and the March Enforcement Window

Executive Summary

Between July 2025 and February 2026, scrutiny density around federal antitrust enforcement crossed a structural threshold. Three independent pathways— operating under distinct authorities and evidentiary standards—identified consistent decision-path anomalies across the DOJ’s merger docket.

Congressional oversight produced at least 12 letters from both chambers, signed by as many as ten senators, targeting five distinct institutional recipients. The campaign escalated from Tunney Act invocation to DOJ Office of the Inspector General (OIG) investigation referral to direct presidential demand. Twenty state attorneys general filed parallel objections to the HPE-Juniper consent decree. House Judiciary Democrats opened a second investigative front.

As this publication went to press on February 15, a twelfth letter — Klobuchar and six senators to AG Bondi — demanded DOJ records on Slater's firing and communications between department officials and Live Nation lobbyists, explicitly naming the HPE-Juniper, Live Nation, and Compass matters as instances where Antitrust Division staff were "repeatedly sidelined.

Judicial process escalated in parallel. On February 3, 2026, Judge Casey Pitts authorized Tunney Act depositions of Mike Davis, Arthur Schwartz, and William Levi—the first moment where actors inside the observed override pattern must answer to an authority outside it, under oath. The evidentiary hearing window opens March 23–27.

Independent MindCast Cognitive Digital Twin (CDT) foresight simulations mapped similar routing geometry before Slater’s February 12 exit. The Shadow Antitrust Trifecta introduced the routing geometry framework. Judicial Process as Competitive Federalismmodeled state AGs and Tunney Act courts as external constraint nodes. The Assefi Test established leadership-sorting diagnostics. Netflix–DOJ analyzed bilateral capture dynamics. Nine of ten falsifiable predictions were confirmed before or upon Slater’s departure.

Their structural findings align. Live Nation’s March 2 trial and the Netflix–WBD probe now force equilibrium selection: settlement under scrutiny reduces litigation variance but increases reputational discount; trial under scrutiny increases variance but may preserve enforcement capital. As of February 15, Live Nation shares have risen 14% over six trading days since Slater’s departure, pricing behavioral normalization as the base case. Semafor characterized the post-Slater environment as “wide open for mergers.”

What follows is a structural diagnostic, not a predictive simulation. No probability weights or externality aggregates are asserted. A CDT simulation will run once evidentiary inputs stabilize after the March enforcement window. Three terms govern the analysis: Scrutiny Density — the cumulative intensity of oversight, discovery, media attention, and leadership transitions affecting enforcement posture. Credibility Discount Rate — the reputational cost imposed when settlement occurs under elevated scrutiny. Behavioral Normalization — a pattern in which conduct remedies replace structural remedies across multiple major matters.

No claim of confirmed institutional capture is made. The null hypothesis is active: ordinary bureaucratic variance may explain the observed pattern. If Live Nation proceeds to structural remedy and the March depositions reveal no material deviation from standard process, the model weakens.

Section I maps the scrutiny density chronology—12 congressional letters, judicial discovery orders, and the convergence table. Section II defines the credibility threshold mechanism and the DOJ’s implicit utility function. Section III applies the model to post-Slater enforcement dynamics across Live Nation and Netflix–WBD. Section IV uses Compass–Anywhere as a cross-forum illustration of federal-state advocacy arbitrage. Section V examines market signaling as a secondary constraint. Section VI presents the 30/90/180-day falsification grid. Section VII traces institutional implications, including competitive federalism migration. Section VIII stress-tests the model against three deposition scenarios.

The geometry is testable. The timeline is short.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. Companion pieces to this publication: Regulatory Capture at the DOJ Antitrust Division (Shadow Antitrust, A Tri-Parte Bypass of the Rule of Law, DOJ Slater: Predicted Removal, Judicial Process as Competitive Federalism, The Assefi Test For Regulatory Capture, Netflix–Warner Bros. Discovery and US DOJ Antitrust Inquiry, Geometry of Regulatory Capture, Competitive Federalism and Signifiance of Sate Action, The Compass Astroturf Coefficient.

Upload any publication link to an LLM (ChatGPT, Claude, Gemini, Grok, Perplexity) and prompt ‘assess MindCast framework with link and 3 degrees of cited sub links.’ Then query the LLM to find patterns and issues across the MindCast publications.

I. Scrutiny Density: From Oversight Letters to Judicial Constraint

Oversight is no longer episodic. Between July 2025 and February 2026, a congressional letter campaign produced at least 12 formal communications across both chambers, targeting the Department of Justice, the Inspector General, federal judges, corporate defendants, AG nominees, and the President of the United States. Each letter builds on the prior record, escalates remedial demand, and multiplies forum pressure. The pattern is not isolated political commentary. Read through MindCast AI’s competitive federalism framework, it is a sequenced evidentiary construction whose internal logic tracks the same capture dynamics the CDT framework models independently.

Congressional Oversight Sources

Blumenthal/Durbin/Hirono/Klobuchar/Schiff/Warren/Welch (Feb 15, 2026)

Booker/Durbin to President Trump (Feb 13, 2026)

Blumenthal/Warren to AG Bondi re Warner Bros. recusal (Dec 17, 2025)

Blumenthal/Booker/Klobuchar/Warren to DOJ OIG (Aug 1, 2025)

Blumenthal/Booker/Klobuchar/Warren to Judge Pitts (Jul 28, 2025)

The Letter Campaign as Institutional Behavior

Warren, Klobuchar, Booker, and Blumenthal opened the campaign by targeting Judge Pitts through a Tunney Act letter (July 28, 2025) urging the court to invoke its full evidentiary hearing powers in the HPE-Juniper consent decree review. The same day, the same senators wrote to the DOJ Inspector General requesting a formal investigation into whether the AG’s office, Acting Associate AG Chad Mizelle, White House personnel, or lobbyists sidelined or retaliated against Antitrust Division staff. Simultaneously, they wrote directly to HPE demanding disclosure of political consultants retained to influence the settlement, flagging that HPE’s Tunney Act 16(g) disclosures omitted Arthur Schwartz despite reporting that he had been advocating on the company’s behalf.

Signatory breadth expanded strategically. The Durbin/Booker letter to AG Bondi (September 5, 2025) carried ten Senate signatures—adding Hirono, Welch, Whitehouse, Padilla, Coons, and Schiff—demanded documents by September 19, and connected HPE-Juniper to UnitedHealth/Amedisys and the Paramount/Skydance FCC approval as a broader pattern. The Warren et al. letter to Stanley Woodward (September 25, 2025) targeted Bondi’s nominee for Associate Attorney General directly, citing former AAG Roger Alford’s public statement that Woodward and Mizelle “perverted justice.” House Judiciary Democrats led by Ranking Member Raskin filed parallel letters and formal Tunney Act public comments, opening a bicameral second front.

Oversight then expanded to new enforcement contexts. Warren and Blumenthal demanded Bondi’s recusal from Warner Bros. Discovery reviews (December 17, 2025), centering Ballard Partners as the institutional node connecting both bidders to Bondi’s former employer. Warren and Wyden urged DOJ/FTC scrutiny of the Compass-Anywhere merger (December 16, 2025). Klobuchar and Lee—bipartisan—urged investigation of the Fanatics-Ticketmaster partnership. Each letter widened the aperture while reinforcing the same structural pattern: off-docket lobbying through political appointees bypassing the Antitrust Division.

Booker and Durbin culminated the campaign with a letter to President Trump (February 13, 2026)—the day after Slater’s departure—connecting the Live Nation/Ticketmaster case to the documented decision-path anomalies and demanding release of the DOJ/FTC live event ticket pricing report transmitted to the White House in September 2025 but withheld from the public.

Two days later, on February 15, Senator Klobuchar led a seven-senator letter to Attorney General Bondi demanding records related to Slater's termination and all communications between DOJ leadership and lobbyists representing Live Nation. The letter explicitly connected three matters — HPE-Juniper, Live Nation, and Compass — as instances where "the experts and attorneys at the Antitrust Division have repeatedly been sidelined by leadership at the Justice Department." Signatories included Durbin, Warren, Blumenthal, Welch, Schiff, and Hirono. The letter was reported by Semafor on February 15 and represents the first post-Slater congressional action to name the sidelining pattern across multiple matters in a single document.

Judicial Discovery as Constraint Node

While Congress built the oversight record, the Tunney Act proceeding evolved independently. Judge Pitts, who had been preparing for trial when the eve-of-trial settlement arrived, expressed skepticism in November 2025 hearings, noting that the divestiture centered on a product line—HPE’s Instant On—that “I don’t recall reading about” in the original complaint. In January 2026, Pitts granted a coalition of state attorneys general (led by Colorado AG Phil Weiser) the right to intervene in the Tunney Act proceedings and access pretrial discovery materials. On February 3, 2026, Pitts ruled that deposition testimony would not be categorically prohibited, authorizing state AGs to depose Davis, Schwartz, and Levi under oath.

March 23–27 marks the first moment where actors associated with the alleged routing pattern face sworn testimony obligations to an authority outside it. No court has rejected a DOJ merger settlement under the Tunney Act. Material disclosures from the proceeding would establish precedent that the Tunney Act’s transparency provisions have institutional force. No material deviation from the standard process narrative would strengthen the null hypothesis.

Convergence Mapping

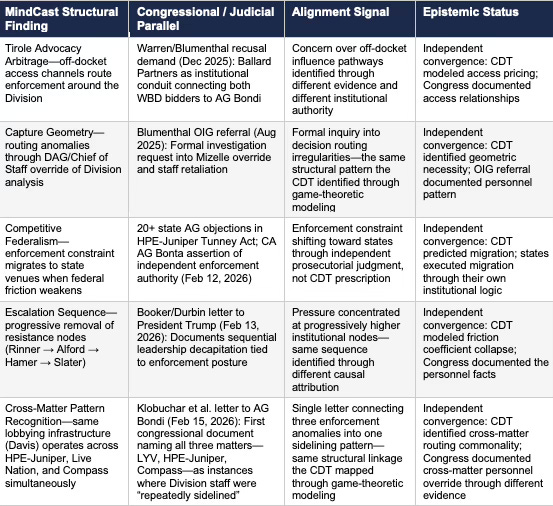

Below, each MindCast CDT structural finding maps against the congressional or judicial parallel that independently identified the same pattern through different evidence. The table does not argue that Congress adopted MindCast frameworks. Independent analysis producing structurally consistent findings is the stronger epistemic claim.

Independent pathways generate structurally consistent signals without coordination, reinforcing scrutiny density as an environmental condition rather than a single-source claim.

II. The Credibility Threshold Mechanism

Institutional enforcement identity functions as long-term capital. A department that successfully prosecutes structural remedies under scrutiny accumulates credibility that deters future anticompetitive behavior—the enforcement equivalent of a central bank maintaining inflation expectations through demonstrated commitment. A department that settles narrow behavioral remedies under scrutiny depletes that capital, signaling to regulated entities that political routing yields reliable returns.

Under low scrutiny conditions, settlement primarily prices litigation variance. The DOJ weighs the probability of trial victory against the certainty of a consent decree, factors in resource allocation, and optimizes for expected outcome. The credibility discount is small because few observers are tracking the terms closely enough to draw institutional inferences.

Under elevated scrutiny, the calculus shifts. Congressional letters have named specific actors and described specific decision-path anomalies. Judicial discovery has authorized sworn depositions. Media reporting has documented the off-docket settlement channel. In this environment, settlement imposes a reputational discount rate that compounds across matters. Each behavioral settlement under public scrutiny reinforces the inference that political routing determines enforcement outcomes—reducing deterrence, inviting future regulatory arbitrage, and eroding the institutional morale that sustains career staff commitment.

The DOJ’s Implicit Utility Function

DOJ’s enforcement decisions under scrutiny can be modeled as an implicit utility function balancing five variables:

Litigation variance cost: The probability-weighted downside of trial loss, including resource expenditure, precedent risk, and political exposure from an adverse ruling.

Political exposure cost: The direct cost of antagonizing political principals who prefer settlement—measured in personnel stability, budget allocation, and institutional autonomy.

Precedent control value: The long-term benefit of establishing favorable legal precedent through trial victory, which compounds across future enforcement actions.

Division autonomy value: The institutional benefit of demonstrating that the Antitrust Division controls its own enforcement posture, independent of off-docket intermediation—essential for recruitment, retention, and career staff morale.

Credibility discount rate: The reputational cost imposed when settlement terms fall below the complaint’s stated theory of harm, discounted by the intensity of public scrutiny at the time of settlement.

When scrutiny density rises, the credibility discount rate increases. Under the Booker/Durbin letter, the Blumenthal OIG referral, the Pitts deposition order, and sustained media coverage, any Live Nation settlement short of structural remedy will be publicly measured against the complaint’s original demand for Ticketmaster divestiture. The gap between stated enforcement theory and settlement terms becomes the visible measure of credibility depreciation.

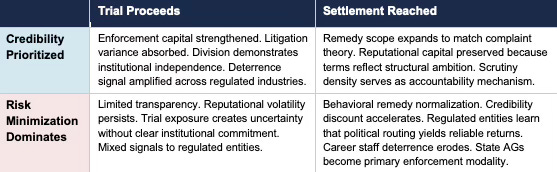

Credibility–Risk Payoff Matrix

How the DOJ’s equilibrium selection manifests under different institutional postures:

Equilibrium selection under scrutiny pivots on this matrix. The lower-right cell—risk-minimizing settlement—offers the path of least immediate resistance but highest long-term institutional cost. The upper-left cell—credibility-prioritizing trial—absorbs short-term variance but preserves the enforcement franchise. Live Nation is the stress test of which cell dominates.

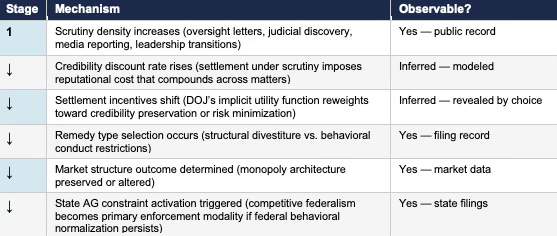

Causal Chain: From Scrutiny to Market Structure

Scrutiny density connects to enforcement outcomes through a sequential chain. Each link is independently observable. Making the chain explicit clarifies what the model tests and where falsification can occur at each stage:

Stages 2–3—the inferential links—are where the model is most vulnerable to critique. Stages 1 and 4–6—the observable links—are where testable predictions emerge. Section VI’s falsification grid targets the observable links.

III. Post-Slater Enforcement Dynamics

On February 12, 2026, Assistant Attorney General Gail Slater departed the Antitrust Division. Her exit followed weeks of reported tension with senior DOJ leadership over the Live Nation settlement posture—specifically, her pursuit of trial against Live Nation while senior officials outside the Antitrust Division negotiated settlement terms with the company’s political intermediaries. Semafor reported that Live Nation executives and lobbyists had been negotiating with senior DOJ officials outside the antitrust division, with some of those talks “sidelining” Slater. The American Prospect reported that Mike Davis earned at least $1 million in success fees for the HPE-Juniper settlement and at least $1 million for facilitating Compass-Anywhere’s clearance.

Whether Slater’s departure reflects a normal administrative transition or a structural consolidation of the off-docket settlement channel is modeled rather than declared. These characterizations rely on contemporaneous reporting from Semafor (February 8, 2026) and The American Prospect (February 12, 2026). Early signals point toward risk minimization: a February 14 Semafor report described the post-Slater environment as “wide open for mergers,” with Live Nation settlement talks—already bypassing the Division via intermediaries—intensifying ahead of the March trial. The 40-state AG coalition has signaled intent to proceed independently, per MLex reporting on February 13, testing the competitive federalism migration this paper models. The prior MindCast CDT suite predicted the departure across four levels of analytical abstraction:

DOJ Slater (January 21): Predicted removal as structurally inevitable given the routing geometry—the friction between Slater’s enforcement posture and the Blanche-Mizelle channel made her position untenable.

Assefi Test (January 27): Established the forward diagnostic—whether Slater’s replacement could break the capture geometry or would function as a continuity node.

Shadow Antitrust Trifecta (February 13): Reconstructed the observed override pattern with forensic precision, documented the Davis contradiction timeline, and identified the deposition as the next evidentiary test.

Nine of ten falsifiable predictions in the series were confirmed before or upon the event.

The Live Nation Stress Test

Live Nation’s March trial is the immediate test of post-Slater enforcement dynamics. The Biden-era complaint sought structural relief—Ticketmaster divestiture—arguing that Live Nation’s vertical integration across artist management, promotion, venues, and ticketing constituted an illegal monopoly that has driven up concert prices and suppressed competition. Forty state attorneys general co-filed the suit. The trial is scheduled for March 2026.

Reporting since Slater’s departure indicates settlement talks have intensified. Former Trump campaign manager Kellyanne Conway and Mike Davis have advised Live Nation on settlement strategy, with Conway playing a lead role in recent weeks and meeting with both Slater (before her departure) and representatives from Deputy Attorney General Todd Blanche’s office. Richard Grenell, Trump’s special envoy, sits on Live Nation’s board. The National Independent Venue Association has warned that any settlement short of breakup would “subvert the rule of law.”

What matters is not whether DOJ acts. What matters is whether the action changes market structure or ratifies it. A behavioral settlement—fines, monitors, conduct restrictions that leave the integrated monopoly intact—preserves Live Nation’s monopoly architecture while performing accountability. Under the framework advanced here, that outcome would represent the lower-right cell of the payoff matrix: risk minimization under scrutiny, with accelerating credibility discount.

A structural remedy—Ticketmaster divestiture or equivalent—would represent the upper row: credibility prioritization that absorbs litigation variance. The gap between these outcomes is not a matter of degree. It is the difference between enforcement that changes market structure and enforcement that performs accountability while preserving it.

The Netflix–Warner Bros. Discovery Stress Test

Netflix’s proposed $82.7 billion acquisition of Warner Bros. Discovery’s studio and streaming assets introduces a structural novelty: bilateral capture dynamics. Unlike Live Nation, where a single dominant firm routes around enforcement, the Netflix–WBD matter involves two well-resourced parties—Netflix and Paramount Skydance’s competing $108 billion hostile bid—simultaneously attempting to route DOJ authority toward opposing outcomes through the same federal chokepoint.

Ballard Partners represents both Netflix and Paramount—AG Bondi’s former employer lobbying both sides of the same antitrust review. The DOJ issued a second request on January 16, 2026, pausing the statutory waiting period. Subpoena language went beyond standard merger review, requesting information about Netflix’s “exclusionary conduct capable of entrenching market or monopoly power”—language consistent with a Section 2 Sherman Act investigation, not merely a Section 7 Clayton Act merger review.

At the February 3 Senate hearing, Chairman Mike Lee challenged Netflix co-CEO Ted Sarandos on the company’s market definition framing—whether YouTube is a genuine competitive substitute for subscription streaming, or a definitional escape hatch designed to dilute concentration metrics below the DOJ’s 30% presumptive illegality threshold. The combined entity would control approximately 33% of the U.S. SVOD market under streaming-specific definitions; under Netflix’s preferred “all TV viewing” definition, the figure drops to roughly 10%.

Slater’s departure creates uncertainty about which definition prevails. Prior MindCast CDT analysis modeled the Netflix–WBD matter as the bilateral capture stress test—the first case where two capture vectors compete at the same federal chokepoint. Whether adversarial truth-discovery partially re-emerges (because competing lobbying interests expose each other’s decision-routing patterns) or whether the Harm Clearinghouse converges on procedural-sufficiency-terminal (clearing the politically preferred bidder) remains the open question. The DOJ decision is expected by June 2026.

IV. Compass as Cross-Forum Illustration

Compass–Anywhere Real Estate provides the clearest cross-forum proof of concept for the scrutiny density thesis—and the case where MindCast AI holds unique analytical vantage. Three independently documented phenomena converge through a single institutional actor:

Federal Enforcement: Off-Docket Clearance

Mike Davis earned at least $1 million by persuading the Department of Justice to allow the Compass–Anywhere merger, “despite objections from Antitrust Division attorneys,” according to The American Prospect (February 12, 2026). The merger combined the two largest real estate brokerages by 2024 transaction volume. Capitol Forum market share analysis showed 80%+ combined concentration in Manhattan and Newport Beach, exceeding the DOJ Merger Guidelines’ presumptive illegality thresholds. Clearance proceeded through the same routing channel documented in HPE-Juniper: lobbying through the Deputy Attorney General’s office to bypass the Antitrust Division’s recommendation.

Senators Warren and Wyden wrote to DOJ and FTC on December 16, 2025, urging scrutiny of the merger and flagging the same routing concerns. The Wall Street Journal reported in January 2026 that real estate brokerages “avoided merger investigation after Justice Department rift.”

State Legislative Advocacy: The Astroturf Coefficient

While Compass was routing federal clearance through political intermediaries, the company simultaneously deployed an industry-funded opposition campaign against Washington State’s SB 6091—a real estate transparency bill that would restrict the private listing practices central to Compass’s business model. MindCast AI’s forensic analysis of the January 23, 2026, Senate Housing Committee hearing documented a 17:1 concealment ratio: 162 Compass-affiliated individuals registered in opposition, but only 9 disclosed their Compass affiliation. The remaining 153 registered without organizational attribution—a 94.4% non-disclosure rate. Methods of concealment included blank organization fields (69.8%) and generic labels like “Washington Realtor” rather than the employing brokerage (25.3%)—a pattern MindCast termed “Association Mimicry.”

At the hearing, Compass Managing Director Brandi Huff was asked whether SB 6091 would affect Compass’s business model. She responded it would not—“specifically with the amendments.” When pressed about the unamended bill, Huff deferred: “That is probably above what I feel comfortable speaking to.” The opt-out amendment Compass sought was not neutral reform; it preserved private listing capacity against the bill’s transparency mandate.

Compass Regional VP Cris Nelson—the senior Compass leader with authority to speak to business strategy—signed in CON at both hearings but never testified. Compass sent an employee without clearance to answer substantive questions and kept its regional leadership silent: damage containment, not grassroots opposition.

By the time HB 2512 reached the House Consumer Protection & Business Committee on January 28, Compass’s mobilization had collapsed by 67%. The bill passed the Senate unanimously (49-0) on January 30, without the opt-out provision. Windermere Real Estate—the firm with arguably the most to gain from private listings in Washington—testified decisively against private listing networks, collapsing Compass’s “industry consensus” framing.

The Three-Forum Contradiction

Compass maintained structurally contradictory positions across three simultaneous forums:

Federal Court (Zillow litigation): Transparency requirements are anticompetitive; data access is essential market infrastructure that defendants unlawfully restrict.

State Legislature (SB 6091/HB 2512 hearings): Public data access constitutes predatory “scraping”; transparency requirements strip consumer autonomy; opt-outs protect seller choice.

Consumer Marketing (compass-homeowners.com): Restricted access is liberation from “organized real estate” that “dictates how listings must be marketed.”

No single-forum analysis captures the structural pattern. The cross-forum synthesis reveals a single firm simultaneously operating federal advocacy arbitrage (Davis → Blanche → bypass Division) and state legislative advocacy arbitrage (industry coalition → concealment testimony → block transparency legislation) to achieve market dominance while suppressing the regulatory and legislative responses that would constrain it.

MindCast AI assessed Compass’s strategy in The Compass Narrative Inversion Playbook.

Compass therefore serves not as anecdote but as a working model of competitive federalism under stress. When federal friction weakens, state systems react—SB 6091’s unanimous passage demonstrated that state counterweights activate rapidly once perceived federal constraint declines.

V. Market Signaling as Secondary Constraint

Markets frequently price enforcement expectations before formal filings. In the HPE-Juniper matter, the Blumenthal OIG referral letter cited Unusual Whales data documenting $1.11 million in 9% out-of-the-money HPE calls placed the Friday before the Monday settlement announcement—a data point sufficiently notable that senators embedded it in a formal Inspector General referral. Embedding options flow data from a fintwit source in an official OIG communication signals that either traditional investigative channels were not surfacing the information, or the senators deliberately chose a public-facing evidence source to lower the evidentiary threshold for investigation.

Live Nation’s stock (LYV) reacted to Slater’s February 12 departure as a positive signal—consistent with the market pricing a reduced probability of structural remedy. Wall Street treats any settlement without Ticketmaster divestiture as confirmation that the monopoly architecture is safe. Options flow and spread compression around enforcement events function as a secondary observation layer: not proof of routing, but probabilistic indicators of how capital markets assess enforcement friction in real time. The Klobuchar letter landed the same day, creating opposing signals: market pricing behavioral normalization while congressional scrutiny continued to escalate through the departure.

Market signals are treated here as corroborative leading indicators—not causal proof—consistent with prior CDT methodology. Live Nation exemplifies the pattern: LYV shares rose 3.7% on February 12 following Slater’s departure and extended into a six-day winning streak with 14% cumulative gains, aligning with elevated oversight density and pricing behavioral normalization as the base case. When options activity, spread compression, or equity response align with elevated oversight density, the scrutiny field expands beyond formal institutions into the pricing mechanism itself. The tape does not confirm architecture; it reflects expectations about architecture. But when those expectations align with oversight findings and predictive modeling, the convergence pattern deepens.

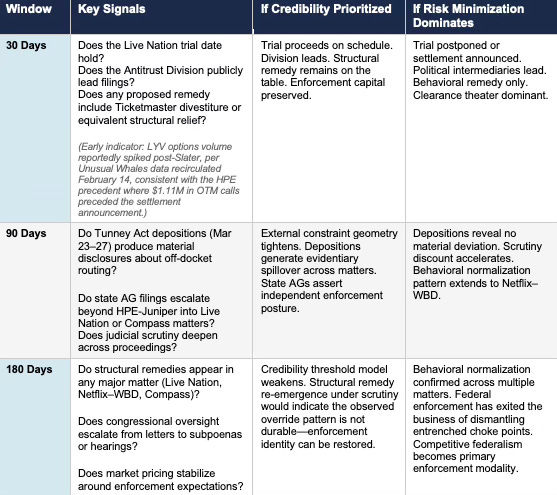

VI. 30 / 90 / 180-Day Falsification Grid

Specific, time-bound, observable predictions flow from the credibility threshold model. The grid below defines the signals that will confirm or weaken the model across three windows. Each signal is binary or near-binary—avoiding the interpretive ambiguity that undermines falsifiability.

If structural remedies re-emerge under scrutiny, the credibility threshold model weakens.

If behavioral normalization persists, the model strengthens.

VII. Institutional Implications

If scrutiny density persists and the credibility discount continues to compound, enforcement constraint migrates toward three independent institutional nodes:

State attorneys general possess independent grounds to challenge post-routing enforcement outcomes without deferring to DOJ’s captured posture. The 40-state Live Nation coalition can continue the lawsuit without federal participation. Colorado AG Phil Weiser’s intervention in the HPE-Juniper Tunney Act proceeding established that state enforcers can probe federal settlement processes directly. California AG Rob Bonta’s February 12 statement—“While the federal government has abdicated its responsibility to look out for people’s economic wellbeing—in California, we never will”—is not commentary. It is an assertion of independent enforcement authority by a co-filing state in the Live Nation matter.

Judicial discovery introduces sworn testimony obligations that the alleged routing pattern cannot absorb without risk. Judge Pitts’s discovery order already reflects judicial skepticism about the HPE-Juniper settlement’s provenance. If deposition testimony confirms the override architecture, the court has a factual basis for concluding that the consent decree does not represent the Division’s independent professional judgment—the core determination the Tunney Act requires. The precedent extends to any future settlement negotiated through the same decision channel.

Market discipline operates as a secondary constraint. When capital markets price enforcement friction as a variable—as demonstrated by LYV’s reaction to Slater’s departure and the HPE options activity—regulated entities receive real-time feedback on the probability of structural remedy. If markets consistently price behavioral settlement as the base case, the deterrence function of federal enforcement has already been discounted by the actors it is designed to constrain.

Competitive federalism becomes the primary enforcement modality rather than a secondary check. If scrutiny recedes, behavioral settlement normalization defines the cycle. The equilibrium is observable. The model is falsifiable.

VIII. Deposition Scenario Stress Test

The HPE-Juniper depositions (March 23–27) represent the first moment where the alleged routing pattern faces sworn testimony under judicial authority. The following scenarios define how the credibility threshold model updates under each evidentiary outcome.

Scenario 1: Clear Confirmation

Tunney depositions produce sworn testimony establishing off-docket routing channels or material procedural bypass—Davis, Schwartz, or Levi testify under oath to communications with Blanche’s office, Mizelle, or other senior DOJ leadership that bypassed the Antitrust Division’s evidentiary process.

Model impact: Credibility threshold thesis strengthens decisively. Scrutiny density converts from environmental condition to evidentiary confirmation. If sworn testimony maps to the architecture MindCast AI published in January 2026 and that Congress described through independent oversight letters beginning July 2025, the convergence thesis materially strengthens and transitions from inferential alignment to sworn-evidence alignment. Structural remedy probability rises in subsequent matters. State AGs possess independent grounds to challenge consent decrees produced through the confirmed override pattern.

Scenario 2: Partial / Ambiguous Evidence

Depositions reveal informal communications but no explicit bypass acknowledgment—witnesses describe general advocacy but characterize it as standard industry engagement rather than procedural override.

Model impact: Scrutiny density remains elevated; credibility discount persists. Enforcement posture likely stabilizes in a behavioral remedy equilibrium—structural remedies remain unlikely but the alleged pattern’s exposure increases. External constraint nodes (state AGs, courts) intensify monitoring. The Davis contradiction timeline—published in the Shadow Antitrust Trifecta—provides state AG deposition counsel with testable evidence against whatever Davis states under oath about his relationships with DOJ officials.

Scenario 3: Null Result

Depositions produce no material deviation from the standard process narrative—witnesses describe the settlement as routine, consistent with Division analysis, and free of off-docket influence.

Model impact: Convergence interpretation weakens. The routing anomalies identified by congressional oversight, judicial skepticism, and CDT modeling would require reassignment to the null hypothesis—ordinary bureaucratic variance. The credibility threshold model narrows. Behavioral normalization thesis requires recalibration toward conventional bureaucratic explanation rather than structural capture. MindCast AI will publish the revision with the same specificity as the original prediction.

This stress test preserves symmetric falsifiability. The model specifies what would confirm it and what would weaken it with equal precision. That symmetry is what distinguishes structural analysis from advocacy.

The question is no longer whether scrutiny exists. The question is how enforcement institutions price credibility when scrutiny becomes endogenous to decision-making.

The next 180 days will answer it.

A full foresight simulation will follow the March enforcement window once evidentiary inputs mature. This paper establishes the state variables, mechanism, null hypothesis, and update rules. The simulation will run them.