MCAI Lex Vision: The Shadow Antitrust Division, A Tri-Parte Bypass of the Rule of Law

How Three Actors Replaced Evidentiary Doctrine with Off-Docket Enforcement Routing

See companion studies: The Assefi Test- Can a New Antitrust Chief Reverse the DOJ’s Regulatory Capture?, How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It, The Architecture Semafor Found Was Already Published — Access Arbitrage, Judicial Discovery, and the Fourth Modality of Competitive Federalism, Shadow Antitrust Division- The DOJ Credibility Threshold.

Executive Summary

On February 12, 2026, the Trump administration removed Assistant Attorney General Gail Slater from the Department of Justice Antitrust Division—three weeks before her Division was scheduled to try the landmark Live Nation case, joined by 40 state attorneys general seeking structural divestiture of Ticketmaster.

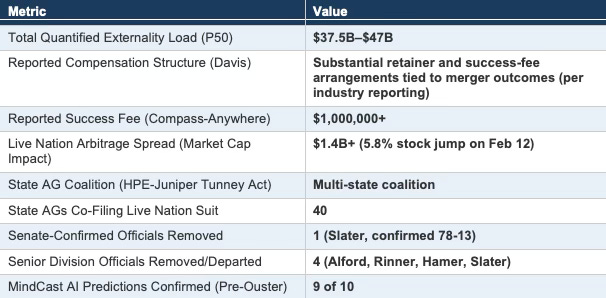

Off-docket channels bypassed the Antitrust Division’s evidentiary review and determined enforcement outcomes across three major matters: HPE-Juniper, Compass-Anywhere, and Live Nation. Three actors operated in structurally aligned roles throughout: Deputy Attorney General Todd Blanche (front-office decision authority), DOJ Chief of Staff Chad Mizelle (process gatekeeper), and private lobbyist Mike Davis (access intermediary and public narrative architect).

Public reporting by the Wall Street Journal, CBS News, Bloomberg, Reuters, Semafor, and The American Prospect supplies the evidentiary foundation, supplemented by timestamped social media posts and MindCast AI’s published analytical frameworks. Between January 21 and February 13, 2026, MindCast AI published eight analytical pieces—beginning with “Nash–Stigler Equilibria & Comparative Externality Costs” and culminating in “The Assefi Test” — that predicted the Slater ouster across four levels of analytical abstraction before the DOJ executed it. Nine of ten falsifiable predictions were confirmed by the events of February 12.

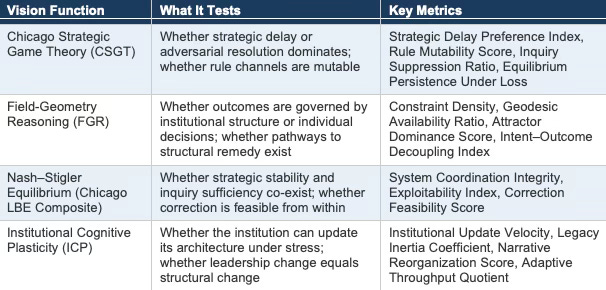

MindCast AI uses a predictive methodology called Cognitive Digital Twin (CDT) foresight simulation, which models institutions as decision systems shaped by their constraints, incentive structures, and internal routing architecture—rather than by individual personalities. Four diagnostic lenses, called Vision Functions, were applied to the current enforcement environment: Chicago Strategic Game Theory (which tests whether actors benefit more from delay than from resolution), Field-Geometry Reasoning (which tests whether institutional structure or individual intent better explains outcomes), Nash–Stigler Equilibrium (which tests whether the system can self-correct), and Institutional Cognitive Plasticity (which tests whether an institution can structurally update under stress). All four converge on the same finding: a delay-dominant equilibrium—a stable state in which enforcement weakening persists because no internal actor has incentive to disrupt it—has taken hold. Structural enforcement revival requires either judicially enforced discovery that compels transparency or measurable structural change within the Division inside a 30- to 45-day window.

A coalition of state attorneys general will take sworn testimony from Mike Davis in the upcoming phase of the HPE-Juniper Tunney Act proceedings before Judge Casey Pitts (N.D. Cal.). For that coalition and for the broader enforcement community, this memo provides four things: (1) a structural map of the tri-parte routing mechanism, (2) a forensic timeline of narrative contradictions available for deposition impeachment, (3) quantified externality estimates across all three matters, and (4) explicit falsification conditions.

Geometry Dominance Test

One question governs the analysis: do individual intent explanations (personnel disagreements, management failures) or structural routing explanations (institutional architecture that determines enforcement pathways independent of individual actors) better account for the observed outcomes? MindCast AI’s “Antitrust Regulatory Capture Geometry” framework (January 24, 2026) formalized the geometry dominance test: does the same outcome pattern persist across multiple cases, multiple actors, and multiple time periods?

The evidence satisfies geometry dominance. One routing mechanism—lobby the Deputy AG’s office to bypass the Antitrust Division—produced the same outcome (enforcement weakening) across three unrelated cases in different industries over seven months. The intent explanation—that Slater was removed for “personal agendas”—cannot account for a pattern replicated across enterprise networking, residential real estate, and live entertainment. The routing explanation can: the enforcement function was systematically bypassed by actors operating through a parallel channel, and the official who resisted that channel was removed. Intent–Outcome Decoupling is elevated throughout: stated institutional goals (consumer protection, affordability) decouple from observable enforcement outcomes (weakened settlements, bypassed reviews, removed enforcers).

I. The Tri-Parte Actors: Roles in the Routing Mechanism

A three-actor structure has redirected enforcement authority across the Antitrust Division’s entire docket—including Live Nation, HPE-Juniper, Compass-Anywhere, Google, Apple, and Netflix-WBD—overriding the Division’s historic insulation from political interference. MindCast AI’s “Tirole Advocacy Arbitrage” analysis (January 23, 2026) first identified the access-arbitrage channel through which private intermediaries convert political proximity into enforcement outcomes.

The Internal Architect: Chad Mizelle (DOJ Chief of Staff)

Role: Process Gatekeeper and Agenda Controller.

Mechanism: Mizelle functioned as the primary internal routing node, converting political access into enforcement outcomes through a process MindCast AI identifies as Agent Substitution—replacing the Division’s career decision-makers with political appointees at critical junctures. He overruled the Division’s career staff to approve the HPE-Juniper settlement. He fired Roger Alford (Principal Deputy Assistant Attorney General) and Bill Rinner (head of merger enforcement) when they resisted. He controlled the agenda routing and staff escalation pathways that determined which enforcement decisions reached the decision node. No DOJ trial attorneys signed the resulting HPE-Juniper consent decree papers—an unprecedented departure from standard practice.

Sources: CBS News (Feb 12, 2026); The Capitol Forum (Jul 24, 2025); The Hill (Aug 18, 2025).

The Executive Enforcer: Todd Blanche (Deputy Attorney General)

Role: Front-Office Decision Node.

Mechanism: Blanche’s office became the primary channel for off-docket settlement negotiations that bypassed Slater’s Antitrust Division. In the Compass-Anywhere merger, his office overrode the Division’s recommendation for a Second Request investigation after Davis lobbied directly to his office. A spokesperson for Blanche stated the DOJ “complied with its obligations”—while the merger closed without meaningful antitrust review despite combined market shares exceeding DOJ Merger Guidelines concentration thresholds in multiple high-volume metropolitan markets, including Manhattan (above 80%) and Washington, D.C., according to industry concentration analyses. In the Live Nation matter, Semafor confirmed that settlement talks were conducted through senior DOJ officials outside the Antitrust Division—the Blanche office.

Sources: Wall Street Journal (Jan 9, 2026); Bloomberg Law (Jan 9, 2026); CBS News (Feb 12, 2026); Semafor (Feb 8, 2026).

The Access Intermediary: Mike Davis (Private Lobbyist)

Role: Off-Docket Escalation Agent and Public Narrative Architect.

Mechanism: Despite holding no government title, Davis created an off-docket escalation path that bypassed the Assistant Attorney General entirely. He advised HPE on the Juniper settlement (reportedly earning million-dollar success fees), was hired by Compass to avert DOJ investigation of the Anywhere acquisition, and advised Live Nation on settlement negotiations conducted through the Blanche office. The American Prospect reported Davis earned at least $1 million facilitating the Compass-Anywhere clearance alone. Following Slater’s ouster, Davis orchestrated a twelve-hour public narrative campaign to reframe the removal as justified—deploying convergent messaging with Mizelle that is documented in Section II.

Sources: Wall Street Journal (Jan 9, 2026); The American Prospect (Aug 19, 2025; Feb 12, 2026); Semafor (Feb 8, 2026); Reuters (Feb 12, 2026).

The Escalation Sequence

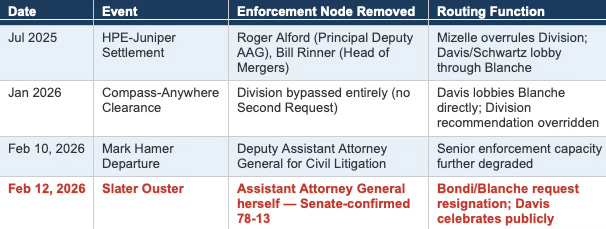

Each iteration eliminated enforcement resistance at a progressively higher level because the previous removal did not fully clear the path:

The escalation is visible: remove the senior officials → bypass the Assistant Attorney General → remove the Assistant Attorney General. Each iteration went higher because the previous removal did not fully eliminate the resistance node.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations.

II. The Narrative Architecture: February 12–13, 2026

Within a twelve-hour window on February 12, the tri-parte actors deployed convergent public messaging to reframe Slater’s removal. Every post below is timestamped, publicly available, and constitutes discoverable evidence for deposition proceedings. MindCast AI’s Coercive Narrative Governance (CNG) framework—a model for analyzing how institutional actors use public messaging to sustain captured enforcement structures—was first applied in “Judicial Process as Competitive Federalism” (February 10, 2026). CNG identifies four capture-sustaining mechanisms: boundary reclassification (redefining enforcement as misconduct), dehumanization (delegitimizing the enforcer), allegation amplification (escalating the narrative to criminal insinuation), and coalition policing (neutralizing internal dissent). The February 12–13 record activates all four simultaneously.

Boundary Reclassification: Enforcement Reframed as “Vendettas”

X Post (Feb 12, 2026) — Chad Mizelle @chad_mizelle

“No one is entitled to work at DOJ. You must be willing to put aside personal agendas and vendettas to advance the President’s priorities and serve the American people. DOJ antitrust will continue protecting consumers and become an even stronger advocate for fair market dynamics.”

The Strategy: Mizelle’s post provides the institutional framing, characterizing adherence to antitrust enforcement doctrine as a “personal agenda.” The same official who fired Alford and Rinner, overruled Slater on HPE-Juniper, and controlled the routing mechanism now frames enforcement as “vendettas.” Davis reposted this statement, completing the signal chain: the process gatekeeper provides institutional cover; the access intermediary amplifies it.

Dehumanization and Narrative Reversal

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“Update: If you want a friend in Washington, get a dog. And not a (rabid) Irish terrier.”

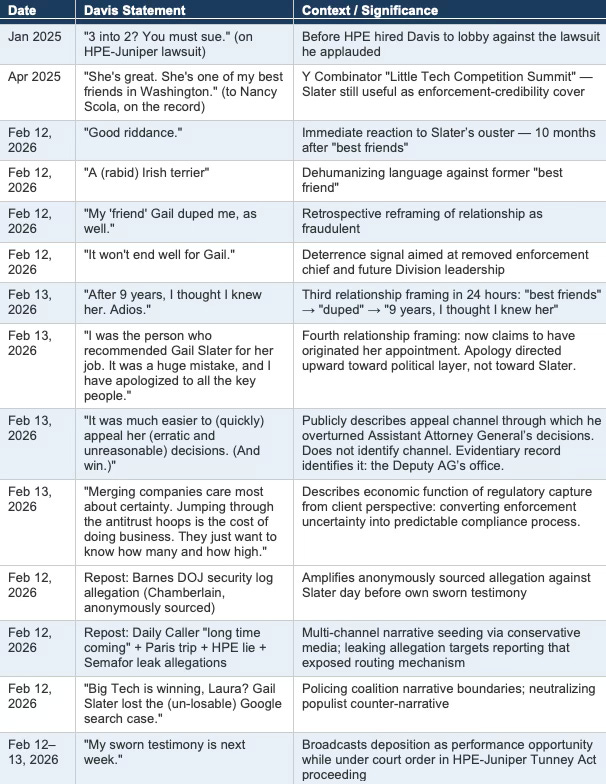

The Strategy: Davis deploys dehumanizing language against the enforcement chief he lobbied against—despite telling reporter Nancy Scola on the record ten months earlier (April 2025, Y Combinator “Little Tech Competition Summit”) that Slater was “one of my best friends in Washington.” This reversal is strategic, deployed precisely when the enforcement-minded actor has been removed and the narrative field is open for rewriting.

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“Sara’s back. Gail’s gone. Karma.”

The Strategy: Centers the story on a personnel dispute with Chief of Staff Sara Matar to distract from the substantive policy reversals occurring simultaneously. Slater tried to fire Matar but Bondi overruled her. The actors who constrained Slater’s authority over her own staff now cite the consequences of that constraint as justification for removing her.

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“Cheers to my friend Omeed Assefi, a longtime Trump loyalist and MAGA populist, on his elevation (again) as Trump’s Antitrust Division head. Omeed will deliver results for American competition and consumers. (With a lot more stability and less drama.)”

The Strategy: Davis publicly celebrates the installation of acting Assistant Attorney General Assefi—whom the Washington Post reports he is “close with.” The friction between the off-docket channel and the Division under Slater is structurally unlikely to replicate under Assefi.

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“It’s hilarious Gail Slater—who quite literally served as a corporate lobbyist for many years—convinced you she was on a mission to fight... lobbyists. Don’t worry: My “friend” Gail duped me, as well.”

The Strategy: Reframes Slater’s enforcement posture as fraudulent. The enforcer is not just reclassified as a problem but as a fraud who deceived her own allies.

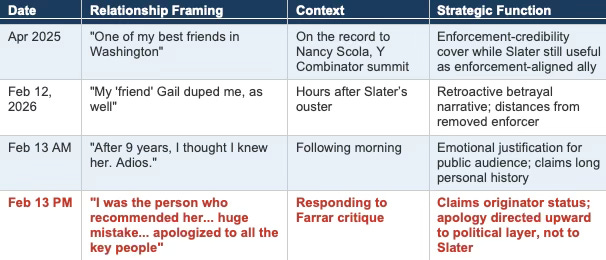

Narrative Fabrication: The Relationship Reconstruction

X Post (Feb 13, 2026) — Mike Davis @mrddmia

“There’s so much more. Power went straight to her head. I’m sorry and embarrassed I recommended her. After 9 years, I thought I knew her. Adios.”

The Strategy: A third distinct relationship framing within the same news cycle. April 2025: “best friends.” Earlier on February 12: “duped me.” Now: “After 9 years, I thought I knew her.” Each version constructs a different narrative calibrated to the moment—from endorsement when the enforcer was useful, to betrayal when she was removed, to sorrowful disavowal when the audience requires emotional justification. He claims a nine-year relationship he is publicly destroying in real time. This is not narrative reclassification. This is narrative fabrication across multiple posts.

Allegation Amplification

X Post (Feb 12, 2026) — Mike Davis (repost of Will Chamberlain) @willcha...

“Update from a source: Robert Barnes was listed in the DOJ security log as a visitor to Gail Slater. She said she canceled that meeting, when confronted by supervisors after Barnes received illegal leaks of sensitive DOJ information. But Gail admitted to sharing case information with Barnes.”

The Strategy: Davis amplifies an anonymously sourced allegation of criminal information-sharing—escalating the narrative from management dysfunction to potential criminality. The access intermediary who operated the off-docket routing mechanism is now amplifying unverified allegations against the enforcement chief he lobbied against—the day before his own sworn testimony. Chamberlain’s post cites no named sources. Davis’s repost completes the signal chain: anonymous allegation → amplification by the intermediary who benefits from the enforcer’s removal.

Multi-Channel Narrative Seeding

X Post (Feb 12, 2026) — Mike Davis (repost of Reagan Reese) @reaganree...

“Gail Slater’s firing was a long time coming, sources tell @DailyCaller. There were some issues + lost trust between her and Bondi... Slater went on an expensive, unapproved Paris trip... The admin believed she lied while handling the HPE case... Slater was suspected of leaking, specifically to @semafor.”

The Strategy: Davis reposts a Daily Caller report seeding three simultaneous justifications through conservative media: the Paris trip, an allegation she lied about intelligence community consultation on HPE, and suspected leaking to Semafor. The narrative architecture now operates across three channels: institutional (Mizelle’s “vendettas” tweet), personal attack (Davis’s own posts), and media sourcing (Daily Caller via anonymous “admin officials”). Three channels, one narrative, convergent amplification. Notably, the leaking allegation targets the reporting that exposed the routing mechanism itself—the Semafor stories about off-docket settlement talks published February 8.

Coalition Narrative Policing

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“Big Tech is winning, Laura? Gail Slater lost the (un-losable) Google search case.”

The Strategy: Davis preemptively neutralizes the one critique that could come from the MAGA populist flank. When Laura Loomer frames Slater’s removal as a Big Tech victory, Davis asserts that Slater “lost the (un-losable) Google search case,” using that claim to reframe removal as accountability rather than capitulation. The closed loop isn’t just operating internally—it is policing its own coalition’s narrative boundaries to prevent counter-narratives from gaining traction.

Deterrence Signal

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“Eager to tell this story. It won’t end well for Gail.”

The Strategy: A deterrence signal aimed at the removed enforcement chief and at anyone who might follow Slater’s enforcement path. The statement communicates to future Division leadership that resistance to the routing mechanism carries personal consequences.

Relationship Escalation: The Recommendation Claim

X Post (Feb 13, 2026) — Mike Davis @mrddmia

“This is a dumb and partisan take, @DouglasLFarrar. I was the person who recommended Gail Slater for her job. It was a huge mistake, and I have apologized to all the key people for this. Gail was not up to the job. But President Trump’s populist antitrust enforcement continues, with all-star @AFergusonFTC, @BrendanCarrFCC, Omeed Assefi, and many others.”

The Strategy: A fourth distinct relationship framing in under 36 hours. April 2025: “best friends.” February 12: “duped me.” February 13 morning: “After 9 years, I thought I knew her.” February 13 afternoon: “I was the person who recommended her.” Each iteration escalates his claimed proximity—and therefore the scale of the betrayal narrative. He now claims to have originated her appointment, a claim that positions him as the principal whose judgment was betrayed. His apology runs upward toward power (“all the key people”—Bondi, Blanche, the political layer), not laterally toward the person he called a “best friend” ten months earlier. He also names the approved populist enforcers (Ferguson, Carr, Assefi) to define who belongs inside the coalition—and who does not. Slater is excluded. The message: the routing mechanism is the populist enforcement program.

The Relationship Fabrication Sequence: Four framings in 36 hours, each calibrated to the moment. Deposition counsel can place all four in front of Davis under oath and ask: which one is true?

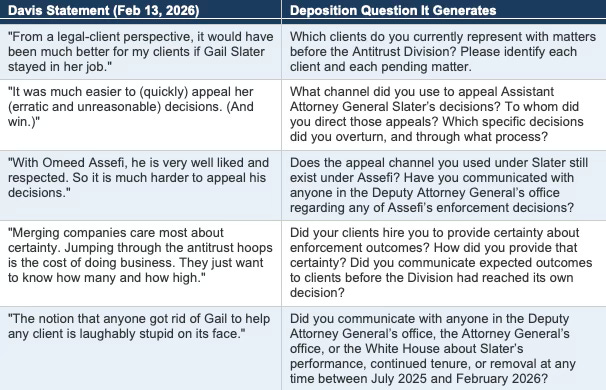

The Routing Admission

X Post (Feb 13, 2026) — Mike Davis @mrddmia

“Important: From a legal-client perspective, it would have been much better for my clients if Gail Slater stayed in her job. She torched her credibility, with her erratic behavior. So it was much easier to (quickly) appeal her (erratic and unreasonable) decisions. (And win.) With Omeed Assefi, he is very well liked and respected. So it is much harder to appeal his decisions. And he is much more aggressive (and politically smarter) than Gail with antitrust enforcement... So this notion that anyone got rid of Gail to help any client is laughably stupid on its face... Merging companies care most about certainty. Jumping through the antitrust hoops is the cost of doing business. They just want to know how many and how high.”

The Strategy: The single most significant post in the February 12–13 record. Davis explicitly acknowledges that he has clients with matters before the Antitrust Division, describes an “appeal” channel through which he challenged and overturned the Assistant Attorney General’s decisions, and states that he won. He does not identify the channel. The evidentiary record identifies it: the Deputy Attorney General’s office. State AG deposition counsel should place this post in front of Davis under oath and ask three questions: What channel did you use to “appeal” her decisions? Who did you appeal to? How did you “win”?

His description of the post-capture equilibrium is equally significant. Assefi’s decisions will be “harder to appeal”—meaning the off-docket channel may face more friction, but Davis does not say it ceases to exist. The architecture persists; the friction coefficient changes. His final observation—“Merging companies care most about certainty. They just want to know how many and how high”—describes the economic function of regulatory capture from the client’s perspective: converting enforcement uncertainty into predictable compliance process. His denial (“the notion that anyone got rid of Gail to help any client is laughably stupid”) addresses intent, not structure. The geometry dominance test does not require intent. It requires only that the routing mechanism produced enforcement weakening across the docket—which Davis’s own description of “appealing” and “winning” confirms.

The Appeal Channel: Deposition Questions Generated by Davis’s Own Words

The Deposition Preview

X Post (Feb 12, 2026) — Mike Davis @mrddmia

“My sworn testimony is next week.”

The Strategy: Hours after the convergent narrative campaign documented above, Davis broadcasts his upcoming sworn testimony in the HPE-Juniper Tunney Act proceedings as a performance opportunity rather than a legal exposure. State AG deposition counsel will enter the room with the full record of Davis’s February 12 posts—including the Nancy Scola contradiction—as testable evidence against whatever he states under oath about his relationships with DOJ officials and his role in the routing mechanism.

Forensic Contradiction Timeline

The following table documents publicly available statements by Mike Davis that create direct impeachment opportunities under oath:

Every entry is discoverable evidence available to state AG deposition counsel. The contradiction between the April 2025 on-the-record statement and the February 12–13 posts creates direct impeachment opportunities under oath. Davis’s February 13 posts introduce additional evidentiary material: his public description of an “appeal” channel through which he overturned the Assistant Attorney General’s decisions, his acknowledgment of clients with matters before the Division, and his characterization of enforcement certainty as the primary value proposition for merging companies. The escalation from narrative reclassification to allegation amplification to a public description of the routing mechanism itself—conducted by the same actor who operated that mechanism, in the hours surrounding his own sworn testimony—demonstrates the full CNG architecture operating across institutional, personal, media-sourcing, coalition-policing, and now self-incriminating channels simultaneously.

III. Case Evidence & Quantified Externality Load

Three unrelated matters in different industries expose the same routing mechanism. MindCast AI’s “Nash–Stigler Equilibria & Comparative Externality Costs” (January 21, 2026) quantifies the consumer harm; “Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage” (January 27, 2026) documents the bifurcated enforcement pattern across the Division’s merger docket.

Externality Methodology

Externality estimates are derived from the MindCast AI Nash–Stigler framework using a 10-year harm window reflecting average merger-to-structural-correction cycles in concentrated markets. Discounting assumptions are conservative and fall within the range typically presented in federal regulatory analysis; sensitivity ranges are available upon request. Market share persistence assumptions are calibrated to post-merger Herfindahl-Hirschman Index (HHI) levels—the standard measure of market concentration used by federal antitrust enforcers—in the relevant markets. HPE-Juniper estimates reflect a 3-to-2 market structure in enterprise wireless local area networking (WLAN) with 70%+ combined share. Compass-Anywhere estimates reflect combined residential brokerage dominance exceeding DOJ Merger Guidelines thresholds (30%+ combined share) in multiple major metropolitan areas. Live Nation estimates reflect sustained vertical integration across ticketing, promotion, and venue operations in a market where the DOJ’s own complaint alleged illegal monopoly maintenance. Full methodology is available in “Nash–Stigler Equilibria & Comparative Externality Costs” (January 21, 2026).

1. HPE-Juniper Settlement (The Routing Blueprint)

The Process Irregularity: The DOJ sued to block the $14 billion merger in January 2025, alleging it would give two companies control of 70% of the enterprise-grade WLAN market. Twelve days before trial, Mizelle overruled Slater and the Division’s career staff to approve a settlement that the Division’s own experts considered inadequate. No trial attorneys signed the consent decree. Alford and Rinner were fired for opposing the process. Alford subsequently stated publicly that Mizelle and Woodward “perverted justice and acted inconsistent with the rule of law.”

Estimated Externality Load: $3B–$6B in consumer harm from market concentration in enterprise WLAN.

Oversight Questions: The coordination has raised significant oversight questions among industry observers regarding potential conflicts of interest. Specifically, critics point to the temporal alignment between Davis’s public advocacy for the judicial promotion of Judge Kathryn Kimball Mizelle and her husband Chad Mizelle’s subsequent decisions to overrule the Antitrust Division on settlements favoring Davis’s clients. State AG deposition counsel should pursue this line of inquiry to determine whether the appearance of a conflict of interest affected the integrity of the Division’s decision-making process.

Sources: Wall Street Journal (Jul 29, 2025); CBS News (Jul 16, 2025; Feb 12, 2026); The Hill (Aug 18, 2025); Roger Alford, “The Rule of Law Versus the Rule of Lobbyists,” Aspen Institute (Aug 2025).

2. Compass-Anywhere Clearance (Access Over Adversarial Advocacy)

The Process Irregularity: The $1.6 billion merger of the nation’s two largest residential brokerages closed without a Second Request or Tunney Act review. Slater and career staff recommended an in-depth investigation. Davis lobbied Blanche’s office directly, arguing the deal didn’t require extended scrutiny. Blanche’s office overrode the Division. The combined entity now controls dominant market shares in multiple major metropolitan areas, exceeding the DOJ’s own Merger Guidelines threshold of 30% in numerous markets.

Estimated Externality Load: $12.5B–$15B in housing market consumer harm from reduced competition and transparency degradation.

Cross-Forum Significance: Davis’s deployment of the identical routing mechanism—lobby Blanche’s office to bypass the Antitrust Division—across HPE-Juniper, Compass-Anywhere, and Live Nation constitutes a pattern that state AG deposition counsel can explore under oath. Sworn testimony about the mechanism in any one case creates cross-forum evidentiary exposure in all three.

Sources: Wall Street Journal (Jan 9, 2026); Bloomberg Law (Jan 9, 2026); HousingWire (Jan 10, 2026); The American Prospect (Feb 12, 2026).

3. Live Nation-Ticketmaster (The Arbitrage Spread)

The Process Irregularity: Slater’s removal three weeks before the March 2, 2026 trial—joined by 40 state attorneys general seeking Ticketmaster divestiture—occurred after Semafor confirmed that Live Nation lobbyists were negotiating with senior DOJ officials outside the Antitrust Division. Davis and Kellyanne Conway reportedly advised Live Nation on settlement strategy through the Blanche channel. Live Nation shares jumped as much as 5.8% on the announcement, pricing the enforcement chief’s removal as a direct reduction in antitrust risk.

Estimated Externality Load: $22B–$26B in deadweight loss from sustained ticketing monopoly.

The Arbitrage Spread: Under MindCast AI’s Tirole Advocacy Arbitrage framework, the enforcement gap between independent Division control and front-office routing is quantifiable. Foresight simulations estimate the probability of structural divestiture (Ticketmaster separation) under independent Division authority at approximately 45–55%. Under the current routing-dominant structure with acting leadership, that probability has fallen to approximately 26%. The spread—the difference between enforcement under independent versus captured authority—represents the economic value of the routing mechanism to Live Nation. The 5.8% stock price jump ($1.4B+ in market capitalization) on Slater’s ouster is the market’s real-time pricing of this spread.

Sources: Semafor (Feb 8, 2026); CBS News (Feb 12, 2026); NBC News (Feb 12, 2026); Fox Business (Feb 12, 2026); Deadline (Feb 12, 2026).

IV. The Closed Political Loop

No internal error-correction mechanism exists within the tri-parte routing structure. The same actors lobby, decide, remove the objectors, narrate the removal, and install the replacement.

Trace the loop: Davis lobbies Blanche’s office to bypass Slater on HPE-Juniper. Mizelle overrules Slater and fires her deputies. Davis lobbies Blanche’s office again on Compass-Anywhere. Davis and Conway conduct Live Nation settlement talks through Blanche’s office, bypassing Slater a third time. Bondi overrules Slater on her own chief of staff. Slater is removed. Mizelle provides institutional justification (“personal agendas and vendettas”). Davis provides the public attack (“rabid Irish terrier,” “good riddance”). Davis celebrates the installation of someone he is close with. Davis issues a deterrence signal against the person who was removed. And Davis is about to sit for depositions about the mechanism he operated across all three cases.

No external check exists anywhere in that loop. The person who benefits from the outcome tells the public what the outcome means. The person who provides institutional cover fired the deputies who resisted. The actors who constrained Slater’s authority now cite the consequences of that constraint as justification for removing her.

The participants do not appear to perceive the loop as dysfunctional. Davis is posting victory laps. Mizelle is posting institutional platitudes. The actors present accountability narratives while the mechanism that removed the accountability function remains structurally intact. Every feedback channel runs through the same nodes.

Under MindCast AI’s Institutional Cognitive Plasticity framework—which measures whether an institution can structurally adapt under stress or merely relabel existing dysfunction—this distinction is critical: narrative reclassification does not equal architectural reform. Mizelle’s characterization of the post-Slater Division as “an even stronger advocate for fair market dynamics” is narrative reclassification. Unless routing authority actually migrates back to the Division—unless the Antitrust Division controls its own settlement posture, staffing decisions, and escalation pathways—the architecture remains captured regardless of what the new leadership says.

Why the Narrative Field Clears: Payoff Asymmetry

Aggressive narrative escalation from the tri-parte actors and near-silence from potential defenders does not indicate that the allegations against Slater are correct. Asymmetric payoff structure produces this equilibrium condition.

Three risks confront the tri-parte actors if they remain silent: routing exposure through the upcoming depositions, legitimacy challenge from the 40-state AG Live Nation coalition, and judicial scrutiny through the Tunney Act evidentiary record. Narrative escalation reduces all three—reframing removal as incompetence rather than routing bypass, pre-loading alternative explanations before testimony, and increasing the reputational cost for future dissenters. In strategic terms, the actors minimize expected enforcement volatility by saturating narrative channels.

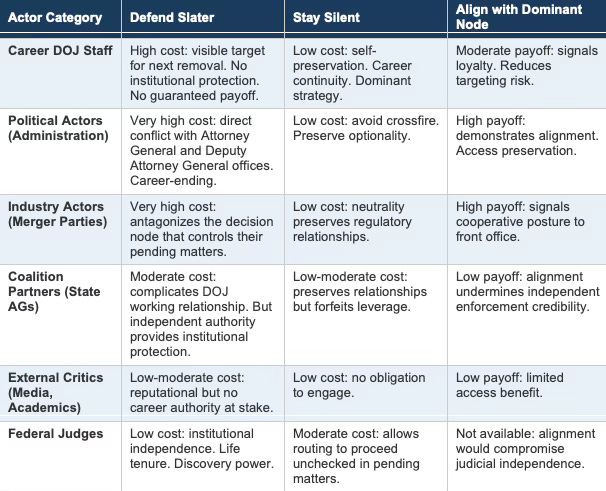

For most other actors, the incentive structure runs in the opposite direction:

Silence dominates for every actor inside the routing mechanism’s gravitational field. When enforcement leadership has been removed at progressively higher levels, replacement is complete, and career risk is visible, defense becomes irrational regardless of belief in its merits. No conspiracy is required to explain why the narrative field clears—only incentive topology. MindCast AI’s “A New Era of Competitive Federalism” (January 28, 2026) identified this dynamic as the structural precondition for enforcement migration to state venues.

The critical question is therefore not “Why isn’t anyone defending Slater?” but “Does anyone with independent institutional authority have incentive to challenge the routing mechanism?” Only two actor categories meet that test: state attorneys general, who possess independent litigation authority and for whom alignment undermines enforcement credibility, and federal judges, who possess life tenure and discovery power and for whom alignment is structurally unavailable. Every other actor faces a payoff landscape where silence or alignment dominates.

The only actors structurally outside this loop are state attorneys general operating with independent litigation authority and federal judges exercising discovery power in proceedings the loop’s participants cannot control. The HPE-Juniper depositions before Judge Pitts represent the first moment where actors inside the loop must answer to someone outside it, under oath, about how the loop actually functions.

V. The Assefi Indicator: 30-Day Diagnostic

MindCast AI’s “The Assefi Test: Can a New Antitrust Chief Reverse the DOJ’s Regulatory Capture?” (February 13, 2026) posed the conditional question: can new leadership reverse the capture geometry, or does acting status within the existing routing structure preclude independent enforcement authority? Foresight simulations across all four Vision Functions converge: replacing leadership alone does not constitute structural change. When a new leader inherits the same routing architecture, the same incentive structures, and the same political relationships that produced the capture, the institution’s tendency toward inertia dominates. Transformation requires structural reform, not just personnel change.

Early Signals Confirming Routing Continuity (Within 14 Days)

• Trial continuance or postponement filed in the Live Nation matter.

• Settlement terms leak through political channels (Blanche office, Semafor/Axios citing “senior DOJ officials”) rather than the Antitrust Division.

• Assefi’s public statements frame Division posture around executive “priorities” rather than evidentiary doctrine and Division prerogative.

• Named Access Arbitrage intermediaries (Davis, Conway) continue operating visibly in reporting on enforcement negotiations.

Early Signals Weakening the Capture Thesis (Within 14 Days)

• March 2 trial proceeds with DOJ pursuing structural divestiture.

• Settlement discussions channel through the Antitrust Division rather than the political layer.

• Assefi issues public statements asserting doctrinal independence and Division prerogative over enforcement posture.

• No new Davis/Conway intermediation surfaces in reporting.

Market Pricing Signal

MindCast AI’s game-theory simulations predict that market actors price lower enforcement volatility absent discovery shocks. If the upcoming depositions produce no routing evidence, appreciation in Live Nation’s stock (ticker: LYV) and reduced enforcement risk premiums across the docket will confirm that the market has absorbed capture equilibrium as the base case. Conversely, deposition-driven discovery breakthroughs that establish routing architecture under judicial record would materially raise enforcement volatility and reprice arbitrage spreads across all three matters.

Institutional Degradation Indicator (60–90 Days)

Game-theory simulations further predict that public internal dissent declines under the current structure as exits and reassignments substitute for open resistance. Senior career departures from the Antitrust Division over the next 60–90 days will serve as the operational indicator. Private-sector antitrust practices, state attorney general offices, and academic institutions will absorb the outflow. Each departure reduces the Division’s capacity to mount structural cases—independent of who leads it. If significant departures materialize, temporary capture converts to permanent institutional degradation through what MindCast AI calls juniorization: the loss of technical depth required to prosecute complex structural matters even if future leadership demands them.

VI. Falsification Conditions

Five observable conditions within 30 days would weaken or falsify the capture thesis:

1. The Live Nation trial proceeds on March 2 as scheduled with the DOJ pursuing structural divestiture under Assefi’s leadership without material scope reduction.

2. Davis’s deposition testimony produces no evidence of off-docket routing through the Blanche office—meaning the bypass channel thesis lacks sworn evidentiary support.

3. Assefi publicly asserts Division control over settlement architecture and rejects off-division negotiation channels within his first 14 days as acting Assistant Attorney General.

4. The HPE-Juniper evidentiary hearing (March 23–27) produces no evidence of process irregularity in the settlement routing.

5. At least one active antitrust matter resolves through structural remedy rather than behavioral settlement under Assefi’s leadership.

Partial occurrence does not falsify. The model predicts settlement convergence, routing-dominant capture continuity, and enforcement migration to state venues as the dominant trajectory. MindCast AI will publish updated assessments as each condition is tested by observable events.

VII. Conclusion: Quantified Stakes

Between July 2025 and February 2026, a private lobbyist with no government title operated an off-docket channel through the Deputy Attorney General's office that bypassed the Antitrust Division across three unrelated matters in three different industries. Career officials who resisted were fired. The Senate-confirmed Assistant Attorney General who objected was removed. The lobbyist publicly celebrated her replacement, issued a deterrence signal against her, and — in a post published hours before his own sworn testimony — described in his own words an "appeal" channel through which he overturned her decisions and won. He then told the public what his clients value most: certainty. The table below quantifies what that certainty costs the American consumer.

Process irregularities determined enforcement outcomes across three unrelated matters in different industries over seven months. One routing mechanism operated throughout: lobby the Deputy Attorney General’s office to bypass the Antitrust Division. Senior officials who resisted were removed at progressively higher levels—deputies first, then the Senate-confirmed Assistant Attorney General herself. The access intermediary who operated that mechanism now broadcasts his upcoming sworn testimony as a performance opportunity.

Externality estimates in this memo represent order-of-magnitude structural impact assessments, not precise damage calculations. Whether the aggregate figure is $20 billion or $50 billion, the directional claim holds: enforcement failures of this magnitude carry consumer harm measured in tens of billions across concentrated markets where the Division’s own complaints alleged anticompetitive conduct.

Mike Davis will testify before the coalition of state attorneys general in the upcoming Tunney Act proceedings. Under MindCast AI’s Nash–Stigler framework, those depositions represent the primary mechanism through which the system’s capacity for self-correction can be restored. Sworn testimony that establishes the routing architecture under judicial record creates the evidentiary foundation for state enforcement independence—materially increasing the probability that external actors can disrupt the capture equilibrium. Without that judicial leverage, the current structure stabilizes. With it, structural change becomes viable.

The evidentiary hearing window opens March 23–27. The Live Nation trial is scheduled for March 2. Thirty days will determine whether the structural accountability mechanisms that remain—state enforcement authority, judicial discovery power, and sworn testimony—can produce the transparency that the routing mechanism was designed to prevent.

Appendix: CDT Foresight Simulation Methodology

MindCast AI’s Cognitive Digital Twin (CDT) foresight simulations treat institutions as decision systems governed by constraints, routing architecture, incentive exposure, and rule mutability. “How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It” (February 12, 2026) documented the full simulation output. Four Vision Functions serve as structural diagnostics rather than personality inference:

Dominance tests determine whether outcomes are better explained by strategic delay, structural geometry, or incentive optimization. Forward predictions are conditional and falsifiable within defined windows. P50 ranges reflect calibrated probability bands derived from previously published structural models and current observable signals. The evidentiary record documented in Sections I–III—sourced from public reporting, court filings, and timestamped social media posts—stands independent of the CDT framework. The Vision Functions provide interpretive structure for the evidence; they do not generate it. Full CDT simulation outputs are published separately at mindcast-ai.com.

IX. Publication Cross-Reference

The analytical frameworks underlying this memo were published with timestamps and explicit falsification conditions before the events they describe. All predictions were published on Substack before the events they forecast; readers can verify publication dates independently. Of ten falsifiable predictions in the January–February 2026 suite, nine were confirmed by the events of February 12. The tenth—that Slater would be removed via a public termination rather than a requested resignation—was not confirmed; the administration requested her resignation rather than firing her outright. MindCast AI tracks and reports misses as part of its commitment to falsifiable analysis.

• How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It (Feb 12, 2026) — mindcast-ai.com/p/doj-slater

• The Assefi Test: Can a New Antitrust Chief Reverse the DOJ’s Regulatory Capture? (Feb 13, 2026) — mindcast-ai.com/p/assefi-test

• Judicial Process as Competitive Federalism (Feb 10, 2026) — mindcast-ai.com/p/judicial-process-competitive-federalism

• A New Era of Competitive Federalism (Jan 28, 2026) — mindcast-ai.com/p/new-era-federalism

• Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 27, 2026) — mindcast-ai.com/p/usdoj-mergers

• Antitrust Regulatory Capture Geometry (Jan 24, 2026) — mindcast-ai.com/p/antitrust-regulatory-capture-geometry

• Tirole Advocacy Arbitrage (Jan 23, 2026) — mindcast-ai.com/p/tirole-advocacy-arbitrage

• Nash–Stigler Equilibria & Comparative Externality Costs (Jan 21, 2026) — mindcast-ai.com/p/nash-stigler-livenation-compass