MCAI Lex Vision: Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage

The Federal Double Standard

I. Executive Summary

The events of January 2026 have established a dangerous regulatory precedent where outcomes depend on corporate architecture rather than economic effect. By banning RealPage from pooling private data on January 21 while simultaneously allowing Compass to merge with Anywhere on January 9, the Department of Justice has effectively decided that coordination is illegal for software vendors but permissible for consolidated giants.

The government inadvertently created a roadmap for the future of Exclusive Listings, validating a market structure where Private Exclusives replace the open MLS. However, this roadmap contains a hidden trap: the Compass Maneuver relied on a specific political bypass that was likely a non-replicable event. Subsequent exposure by the Wall Street Journal suggests the window for such Access Arbitrage is closing, leaving Compass with a permanent First Mover Advantage while followers face renewed scrutiny.

Access Arbitrage (sometimes described in prior literature as Advocacy Arbitrage or Tirole Advocacy Arbitrage) refers to the displacement of adversarial evidence by political routing. A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice (Jan 2026), The Geometry of Regulatory Capture at the U.S. Department of Justice Antitrust Division (Jan 2026).

January 2026 serves as the definitive point where American antitrust law fractured into two opposing realities based not on consumer welfare, but on corporate structure. On one side, the Department of Justice waged war against software coordination, ruling that RealPage’s algorithmic data pooling violated the Sherman Act. On the other, the same agency blessed structural coordination, permitting Compass and Anywhere to merge into a single entity designed to pool the exact same type of non-public listing data.

The Nash-Stigler equilibrium framework explains the disparity: modern antitrust enforcement operates as a Harm Clearinghouse, where agencies prioritize internal administrative risk mitigation over structural market correction. Procedural sufficiency—not consumer welfare—becomes the terminal condition. The result is that conduct-based settlements function as consumer-financed subsidies to monopoly power. The Dual Nash-Stigler Equilibrium Architecture (Jan 2026).

Forensic analysis of the DOJ’s decision routing reveals an Externality Load estimated at $37.5–47 billion, reflecting enforcement-termination variance across five-year consumer surplus loss scenarios (Compass, HPE, Live Nation).For Compass-Anywhere alone, the five-year consumer and market externality load is estimated at $12.5–15 billion. The transfer confirms that political access has displaced economic welfare as the primary determinant of merger outcomes. Comparative Externality Costs in Antitrust Enforcement: A Nash–Stigler Foresight Study of Federal Enforcement Equilibria (Jan 2026).

Note on terminology: References to market dominance in this analysis describe a legally immunized coordination position created by corporate structure, not a litigated market-definition finding under Section 2.

The specific mechanism used to secure Compass’s immunity—a direct channel between lobbyist Mike Davis and Deputy AG Todd Blanche—has effectively been burned by public exposure in the Wall Street Journal. Future firms attempting to replicate this Access Arbitrage will face a regulator desperate to prove its independence, meaning the window for easy approval has closed.

By approving the Compass-Anywhere merger, the DOJ transformed conduct it had just deemed illegal—pooling non-public, competitively sensitive data—into legally immunized behavior by placing it behind a single corporate boundary.

January 2026 matters because it is the first time federal antitrust enforcement produced opposite outcomes on identical economic conduct within the same month, under the same statute, by the same agency. That simultaneity collapses plausible deniability. The market can no longer treat these outcomes as noise, delay, or case-specific variance. The enforcement signal is now legible, durable, and investable.

This analysis does not assert that Compass violated antitrust law; it asserts that the enforcement geometry now rewards consolidation over coordination regardless of consumer impact.

Free-Market Clarification. The analysis is pro-competition and pro-market. Free markets depend on neutral rules that allow prices and services to compete openly. January 2026 marks the moment federal enforcement stopped letting markets clear on performance and instead cleared them on corporate structure. By penalizing coordination through software while insulating the same coordination through consolidation, the DOJ replaced competitive testing with regulatory insulation. That shift does not restrain markets—it distorts them. The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets (Jan 2026).

Foresight Predictions (Cognitive Digital Twin Simulation Outputs)

The following predictions represent falsifiable Cognitive Digital Twin (CDT) foresight outputs derived from institutional geometry, incentive constraints, and observed enforcement routing—not probabilistic estimates or normative recommendations.

Enforcement & Institutional Behavior (Sections III–VI)

Federal antitrust enforcement remains bifurcated: external coordination is sanctioned while internalized coordination through consolidation is immunized.

The January 2026 enforcement geometry is phase-locked through at least 2027 absent legislative intervention.

The Compass access-routing maneuver is non-replicable; post-exposure scrutiny collapses replication paths for followers without unwinding the original clearance.

Market Structure (Real Estate) (Sections VI–VII)

Private Exclusive and “Coming Soon” listings rise from ~10% to 30–35% of luxury inventory by 2027 (up to 40–45% in high-capture scenarios).

Inventory concentration skews toward first movers, while MLS systems degrade from coordination infrastructure into compliance artifacts.

Firm Strategy & Capital Allocation (Sections VII–VIII)

Consolidation outperforms interoperability as the dominant rational strategy under current enforcement geometry.

Third-party pricing and coordination software contracts or exits as firms internalize data to avoid Sherman Act §1 exposure.

Enforcement arbitrage becomes path-dependent, producing durable moats for incumbents and heightened downside risk for imitators.

Policy & Legal System (Sections VIII–IX)

Internal DOJ self-correction fails; State Attorneys General emerge as the only viable actors capable of reopening structural inquiry.

Legislative transparency targeting unconditional clearances is the most effective mechanism for disrupting Access Arbitrage without expanding antitrust scope.

Insight: The Stiglerian Subsidy is now delivered not by ignoring antitrust law, but by selectively enforcing it against third-party software while exempting consolidated firms.

Methodology: Cognitive Digital Twin Foresight

MindCast AI employs Cognitive Digital Twin (CDT) simulations to model institutional behavior. Rather than predicting outcomes based on stated intent or public positions, CDT foresight reconstructs each actor’s incentives, constraints, and available decision paths under current legal and political conditions. The simulation identifies equilibrium behaviors—stable configurations where no actor can improve their position through unilateral action.

The methodology integrates two Nobel Prize-winning frameworks as runtime constraints. Nash equilibrium (John Nash, 1994) governs behavioral settlement, determining when a conflict ends because no agent can gain by continued fighting. Stigler equilibrium (George Stigler, 1982) governs inquiry sufficiency, ensuring analysis stops when additional computation adds less integrity than cost. Neither framework can override the other; both must fire before the system commits to a prediction.

CDT outputs throughout this study—including Phase-Lock status, Geometry Baseline metrics, and Vision Functions—represent falsifiable claims about institutional behavior, not probabilistic guesses. Each prediction carries explicit falsification conditions that would invalidate the foresight if observed.

“Phase-Locked” denotes a state in which no institutional actor can alter the enforcement outcome through unilateral action under existing legal and political constraints.

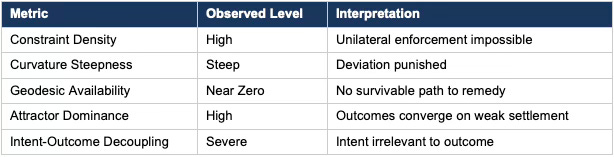

[CDT Simulation Status: Phase-Locked] The institutional geometry has stabilized—no actor can unilaterally shift the enforcement equilibrium without structural intervention. The Bifurcated Enforcement pattern (algorithms banned, mergers blessed) will persist absent legislative change.

II. The Players & The Geometry of Capture

Forensic Mapping of the Decision Nodes

Understanding the disparity in outcomes requires mapping the specific decision nodes through which each case traveled. The DOJ antitrust division does not operate as a monolith; it functions as a bifurcated system where career staff handle the evidence, and political appointees handle the access. The path a company takes through this geometry determines its fate.

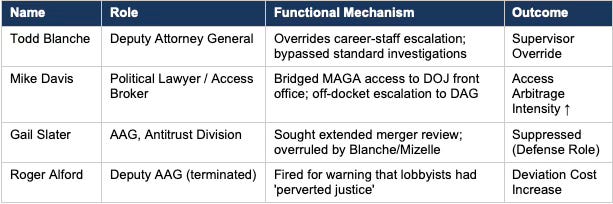

Master Player Grid: Key Decision Nodes

The Target: Compass-Anywhere (The Structure)

Compass, now merged with Anywhere (formerly Realogy), utilized a strategy we identify as Tirole Advocacy Arbitrage. Instead of submitting to the adversarial evidence process led by Antitrust Chief Gail Slater, lobbyist Mike Davis acted as an Access Broker to route the appeal directly to Deputy AG Todd Blanche. Blanche, operating as a Front-Office Decision Node, overruled the career staff to grant unconditional approval. Because this maneuver resulted in a clearance rather than a settlement, it triggered no Tunney Act review, effectively locking out State Attorneys General.

The Scapegoat: RealPage (The Algorithm)

RealPage, lacking a comparable Access Arbitrage channel, was forced through the traditional enforcement pipeline. The software provider faced the full weight of the career staff’s evidentiary review without the escape hatch of political intervention. The result was a Proposed Final Judgment explicitly banning the use of non-public data, confirming that for those without access, the law remains rigid.

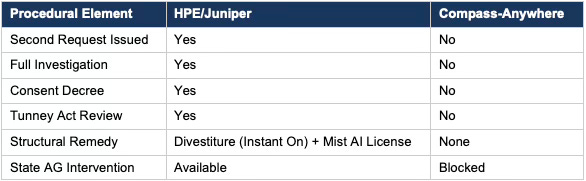

The Control Group: HPE / Juniper

The merger of HPE and Juniper Networks serves as the control group that proves the rule. The deal sparked a civil war inside the DOJ, where Roger Alford and Gail Slater openly objected to the weak settlement negotiated by Stanley Woodward. Despite the internal corruption and political pressure, the system still functioned enough to force HPE to divest its Instant On assets and license Mist AI. The fact that HPE paid a price while Compass paid nothing highlights the unique totality of the real estate sector’s capture.

Insight: The defining feature of the January Split is the specific geometry of the bypass: Career Staff (Slater) → Political Appointee (Blanche) = Immunity.

III. Case Study A: RealPage (The Algorithmic Ban)

Future legal historians will look to January 2026 as the moment the Department of Justice formally bifurcated its antitrust philosophy. Within a span of twelve days, the agency issued two rulings that appear legally irreconcilable. On January 9, it blessed the creation of a real estate behemoth; on January 21, it criminalized the software used by landlords. The discrepancy forces a re-evaluation of the Sherman Act: is the crime the coordination itself, or merely the failure to buy your competitors before doing it?

The Department of Justice’s judgment against RealPage represents a masterclass in modern Sherman Act enforcement. The filing attacks the Hub-and-Spoke conspiracy model, where the software sits at the center (Hub) and landlords feed it data (Spokes). Government attorneys successfully argued that the mere capacity for the algorithm to align prices constitutes an illegal agreement, regardless of whether the landlords communicated directly. RealPage allowed competitors to coordinate prices via a third-party algorithm, which the DOJ deemed a structurally unlawful coordination mechanism.

Crucially, the DOJ explicitly rejected RealPage’s defense that its software created operational efficiencies. The judgment establishes a strict liability standard for information sharing: if you pool non-public, competitively sensitive information, you are liable. The agency signaled that no amount of business utility can justify the risk of algorithmic alignment.

Insight: Information sharing = Coordination Capacity. The DOJ explicitly rejects the efficiency defense, focusing solely on the potential for coordination.

[CDT Validation] The RealPage investigation followed standard enforcement protocols. Career staff maintained evidentiary independence throughout, with no detected political override. The resulting judgment reflects genuine antitrust analysis—providing the baseline against which Compass’s treatment appears anomalous.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. See recent work: Federal Inaction Has Elevated State Authority on Consumer Protection, Antitrust, and Market Integrity (Jan 2026), MindCast AI Economics Frameworks (Jan 2026), Foresight on Trial, The Diageo Litigation Validation (Jan 2026), Windermere and Compass, Two Philosophies of Real Estate (Jan 2026).

MindCast AI publications are dense and cumulative, belonging to a series of themed instalments. To extract patterns across multiple pieces efficiently, consider pasting the URLs into a modern large‑language model (such as ChatGPT, Gemini, Claude or Perplexity) or viewing them in an AI‑enabled browser. These tools can help you query themes, trace recurring frameworks and see how individual publications accumulate into a larger analytical structure, reducing reading time while preserving the substance of the work.

IV. Case Study B: HPE / Juniper (The Control Group)

Every experiment requires a control group. The HPE/Juniper merger provides exactly that—a contemporaneous deal that traveled through the same DOJ, faced the same political appointees, and employed the same Access Arbitrage tactics. Yet HPE paid a structural price while Compass paid nothing. The difference reveals where the system bent versus where it broke entirely.

The HPE/Juniper merger acts as the experimental control group, demonstrating what happens when Access Arbitrage meets Institutional Resistance. Unlike Compass, HPE was not granted unconditional immunity; it was forced to settle. The settlement required the divestiture of the Instant On business and the licensing of Mist AI, proving that the DOJ usually demands a pound of flesh even from politically connected firms.

The Procedural Contrast

The settlement’s weakness triggered a rare Tunney Act Rebellion. A coalition of 13+ State Attorneys General, led by New York and California, filed a Motion to Intervene, explicitly citing the firing of DOJ officials as evidence of corruption. The Tunney Act provided a statutory hook for the legal system to check the political deal—a transparency mechanism that Compass managed to avoid entirely.

The simulation detected significant Litigation Cost Inflation (LCI) during this review. The internal firing of Roger Alford and the sidelining of Gail Slater created a high-friction environment where the final outcome—a weak settlement—was a Compromise Equilibrium. The system bent, but it did not break completely as it did in the real estate sector. Under Nash-Stigler logic, enforcement reached Procedural Sufficiency Terminal (PST): the agency checked enough boxes to defend the outcome administratively, but stopped short of structural correction.

Insight: Even in a compromised process, traditional industries typically pay a tax in divestitures. Real Estate paid nothing, proving the uniqueness of the Compass channel.

V. Case Study C: Compass-Anywhere (The Structural Loophole)

If RealPage represents the law as written and HPE represents the law as compromised, Compass represents the law as nullified. The same agency that banned algorithmic coordination and forced divestitures in networking blessed the creation of a 340,000-agent data-pooling network without so much as a Second Request. Understanding how requires examining both the legal doctrine exploited and the political channel that made exploitation possible.

The approval of the $1.6 billion Compass-Anywhere merger represents the apex of Access Arbitrage. By consolidating approximately 340,000 agents under one roof, the new entity creates a Private Exclusive network larger than many local MLS systems. The DOJ’s approval relies on the Single-Entity Doctrine, which holds that a company cannot conspire with itself. Coordination that would be a felony between two brokerages becomes synergy when they merge.

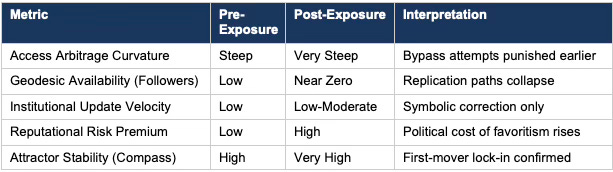

The Non-Replicability of the Model

The Compass Maneuver bears the hallmarks of a one-time heist rather than a repeatable strategy. The channel used—lobbyist Mike Davis routing appeals directly to Deputy AG Todd Blanche—relied on obscurity. The subsequent exposure by the Wall Street Journal has burned this route. Future applicants attempting to bypass Gail Slater will find the political cost has risen exponentially, effectively pulling up the ladder behind Compass.

Delta CDT: Post-Exposure Geometry Shift

Forensic analysis reveals a total collapse of the evidentiary process. The Access Arbitrage Intensity spiked to a critical level exceeding 0.85, causing the Tirole Mechanism to fire. Under this condition, the volume of political access completely displaced the adversarial evidence load. The decision was not made on the merits; it was made on the phone. The Nash-Stigler equilibrium stabilized around procedural closure without structural inquiry—a Harm Clearinghouse outcome where the agency exported competitive costs to consumers rather than correcting market architecture.

Insight: The DOJ has implicitly adopted a new standard: Coordination is illegal unless it occurs behind a corporate boundary large enough to render consent meaningless.

VI. Synthesis: The Trajectory of Exclusive Listings

The three case studies converge on a single strategic conclusion: the January 2026 enforcement pattern has created a new playbook for real estate market structure. The January 2026 split teaches the market a single lesson: data coordination is punishable across firms but protected inside them, structurally forcing inventory into consolidated private systems.

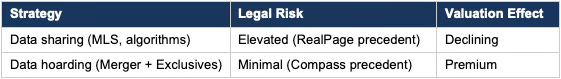

Real estate operators have received the message loud and clear: sharing data carries legal risk, while hoarding it carries a valuation premium. The RealPage judgment makes participation in open, shared data pools legally toxic. The Compass approval makes the creation of closed, proprietary data pools financially lucid.

From a free-market perspective, this outcome reflects enforcement failure, not market failure. When regulators selectively terminate inquiry at procedural sufficiency, markets reorganize around the enforcement signal rather than consumer demand. Firms do not compete to offer better prices or broader access; they compete to internalize coordination behind corporate boundaries. That is a Stiglerian equilibrium—where regulatory termination, not rivalry, determines the market outcome.

We view the Private Exclusive not just as a listing type, but as a financial derivative of the regulatory environment. It functions as the structural equivalent of the algorithmic pricing model—a mechanism to align price and control inventory—shielded by the corporate veil. The newly merged entity is structurally compelled to move inventory into this safe harbor to monetize its scale.

Integrated Foresight Predictions

As of February 2025, approximately 35% of Compass listings operate in Private Exclusive or Coming Soon status. CDT simulations project that under the extractive equilibrium, the Market Fragmentation Index rises to 0.38—meaning over one-third of luxury inventory becomes invisible to public coordination mechanisms by 2027. First movers capture disproportionate share as MLS influence contracts structurally.

The simulation does not predict universal merger approval; smaller or poorly routed transactions without access channels remain vulnerable to standard enforcement.

Insight: The Trajectory of Exclusive Listings is no longer about market competition; it is about regulatory evasion.

VII. The Enforcement Arbitrage Playbook (and Its Risks)

For investors and strategists, the January Split clarifies a free-market distortion: firms now earn excess returns not by outperforming competitors, but by acquiring them to escape competition. Companies that pool data externally face existential legal risk; companies that internalize the same data through acquisition enjoy legal immunity. The playbook that follows is not advocacy—it is a description of the rational response to the incentive structure the DOJ has created. But it comes with a critical caveat: the window is closing.

Investors must treat Enforcement Arbitrage as a primary valuation factor. The playbook is simple:

Don’t Share: Never pool data across firm boundaries. External coordination is reachable by Sherman Act §1.

Do Acquire: If you need competitor data, buy the competitor. Internal coordination is protected by single-entity doctrine.

Internalize: Move data processing from third-party vendors to proprietary internal platforms.

Rebrand: Call the resulting coordination corporate strategy rather than market insight.

Insight: Treat enforcement arbitrage as a one-time capture. Assign moat value to the incumbent; aggressively discount replication optionality for followers.

Warning — The Closing Window: The Compass Maneuver was a path-dependent event that relied on a specific configuration of DOJ personnel now under siege. The Reputational Risk Premium for attempting a similar bypass has spiked. Treat enforcement arbitrage as a non-scalable event. The first mover takes the spoils; the followers take the subpoenas.

VIII. Policy Proposal: The Tunney for Clearances Act

Federal enforcement has failed. The Compass clearance demonstrates that unconditional approvals—deals that never reach a consent decree—operate entirely outside public accountability. The Tunney Act was designed to provide judicial oversight of antitrust settlements, but it has no application when the DOJ simply declines to investigate. State legislatures can fill this gap with targeted transparency requirements that force daylight onto backroom clearances.

A Legislative Concept for State Lawmakers

The Problem

State Lawmakers face a critical gap in federal antitrust statutes. The Tunney Act (APPA) only mandates judicial review for Consent Judgments (settlements). It does not apply to Unconditional Clearances. When the DOJ simply drops an investigation, the public and State Attorneys General have no statutory right to review the evidence or the reasoning, leaving the backroom deal completely opaque.

The Solution: State-Level Merger Transparency Acts

States should not wait for a paralyzed Congress to act. Lawmakers in key jurisdictions—New York, California, Washington, Illinois—can pass state-level legislation that fills this void.

Draft Provisions

Trigger: Any merger involving >$1B in state-specific assets where the post-merger HHI exceeds 2,500.

Requirement: If the federal DOJ clears such a deal without a settlement, the merging parties must file a Public Interest Statement with the State AG explaining why the concentration does not harm local competition.

Review Period: A 60-day State Review Period replicating the Tunney Act’s public comment mechanism.

Goal: Force the logic of the clearance into the public record.

Legislative Rationale

The delta CDT flow establishes that exposure does not unwind completed clearances—it only hardens future access channels. The result is a durable asymmetry: first movers retain immunity while followers face heightened scrutiny. Absent statutory intervention, the pattern repeats: one-time exploits create permanent market distortion. A narrowly tailored state-level review mechanism restores symmetry without expanding antitrust scope.

Insight I: Under the Nash-Stigler equilibrium, conduct-based settlements function as consumer-financed subsidies to monopoly power. State-level structural review is the only mechanism capable of breaking the Harm Clearinghouse cycle.

Insight II: Sunshine is the only disinfectant for Access Arbitrage. If the DOJ won’t explain its decision to a federal judge, state law should force it to explain it to the taxpayers.

IX. Primary Sources

The RealPage Judgment (January 21, 2026)

Federal Register: United States v. RealPage, Inc. — Proposed Final Judgment and Competitive Impact Statement

https://www.federalregister.gov/documents/2026/01/21/2026-01009/united-states-of-america-et-al-v-realpage-inc-et-al-proposed-final-judgment-and-competitive-impact

The Compass-Anywhere Merger (January 9, 2026)

Realtor.com: Compass Closes $1.6 Billion Merger

https://www.realtor.com/news/real-estate-news/compass-anywhere-merger-acquisition/

The HPE/Juniper Settlement

Network World: HPE-Juniper deal clears DOJ hurdle, but settlement requires divestitures

https://www.networkworld.com/article/4014283/hpe-juniper-deal-clears-doj-hurdle-but-settlement-requires-divestitures.html

Internal DOJ Conflict

Wall Street Journal: Top Justice Department Antitrust Officials Fired Amid Internal Feud

https://www.wsj.com/us-news/law/top-justice-department-antitrust-officials-fired-amid-internal-feud-0c98d57c

DOJ Internal Rift on Compass

Wall Street Journal: Real-Estate Brokerages Avoided Merger Investigation After Justice Department Rift

https://www.wsj.com/us-news/law/real-estate-brokerages-avoided-merger-investigation-after-justice-department-rift-e846c797

MindCast AI Framework Publications

Dual Nash-Stigler Equilibrium Architecture: https://www.mindcast-ai.com/p/nash-stigler-equilibria

Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria: https://www.mindcast-ai.com/p/nash-stigler-livenation-compass

Tirole Advocacy Arbitrage: https://www.mindcast-ai.com/p/tirole-advocacy-arbitrage

Antitrust Regulatory Capture Geometry: https://www.mindcast-ai.com/p/antitrust-regulatory-capture-geometry

Appendix A: CDT Foresight Validation

I. Series Position

Prior MindCast AI work established three settled inputs: Capture Presence (Stigler)—enforcement supply is systematically acquired by regulated beneficiaries; Stabilization Mechanism (Nash)—once capture exists, outcomes converge regardless of intent; Truth Collapse Mechanism (Tirole)—access arbitrage displaces adversarial evidence. The January Split advances the series from diagnosis to reachability, confirming that January 2026 constituted a phase-locking event in federal antitrust architecture.

II. Geometry Baseline

III. Vision Functions Fired

Tirole Advocacy Arbitrage: Successfully fired in the Compass case. The Access Broker (Davis) bypassed the Information Gatekeeper (Slater).

Nash Stabilization: The system stabilized the HPE conflict by ejecting the Noise Agents (Alford/Slater) to preserve the political equilibrium.

Truth Collapse: Causal Signal Integrity (CSI) dropped below critical threshold (0.15) for the Compass merger, indicating a decision made independent of economic evidence. CSI collapse reflects evidence displacement by access routing, not evidentiary weakness.

IV. Falsification Conditions

The foresight is negated if, by Q4 2027:

• Sherman Act §1 is applied to intra-firm agent coordination

• Structural remedies are imposed on brokerage mergers

• Judicial narrowing of single-entity doctrine for platform-like firms occurs

• Private exclusive inventory share remains below 20% in top-10 luxury markets