MCAI Economics Vision: Chicago School Accelerated — Integrated Application- Trust, Coordination, Narrative Power in Residential Brokerage

The High Trust Dependent Brokerage Market

Executive Summary

Compass’ strategic trajectory reveals an institution increasingly reliant on image and narrative coherence to compensate for degrading coordination capacity. As coordination weakens, incentives rationally re-optimize toward extraction, while legal intervention lags corrective capacity. Institutional non-plasticity under identity load increases the probability that Compass doubles down on scale, litigation, and narrative governance—producing the very trust erosion the organization seeks to prevent.

The MindCast AI Chicago School of Law and Behavioral Economics framework provides the explanatory framework for why Compass’ trajectory is rational, predictable, and non-moralistic. Classical Chicago School economics—associated with Coase, Becker, and Posner—assumes rational actors and efficient markets but lacks a methodology for modeling how agents update beliefs, when behavioral thresholds trigger action, and why institutional lag creates durable windows for harm. The Chicago School Accelerated series extends this tradition by integrating behavioral precision with predictive foresight capacity. Coase explains why coordination architecture matters independent of transaction costs. Becker explains why rational actors exploit coordination gaps once they emerge. Posner explains why legal correction lags systemic harm and may legitimize rather than repair it.

Four Cognitive Digital Twin (CDT) simulations converge on a unified conclusion: coordination degradation precedes financial distress, narrative governance substitutes for adaptive learning, and institutional non-plasticity converts defensive strategy into fate. The CDT methodology converts theoretical claims into scored foresight outputs that identify interaction points and optimal intervention targets.

Compass’ situation exemplifies a modern institutional failure mode applicable to any trust-dependent platform operating at scale: when narrative coherence becomes load-bearing, learning becomes betrayal, and defense becomes destiny.

How to Read This Simulation

The simulation proceeds in six stages.

First, Luxury Real Estate Economics establishes why thin margins and nonlinear risk make trust economically load-bearing—not a branding concern but an operational constraint.

Second, Framework Foundations introduces the Chicago School of Law and Behavioral Economics as a diagnostic sequence: Coase explains coordination architecture, Becker explains incentive exploitation, Posner explains why legal correction lags.

Third, Coercive Narrative Governance and Karenina Vision explain how institutions sustain themselves past the point of empirical correction and where moral architecture fails under pressure.

Fourth, Institutional Cognitive Plasticity explains when learning capacity collapses and doubling-down becomes internally rational.

Fifth, Factual Anchoring and Agent-Level Evidence ground the abstract metrics in documented conduct and observable behavior.

Sixth, Predictions and Falsification Contract convert the analysis into testable claims with explicit conditions for being wrong.

Readers primarily interested in Compass-specific findings may proceed directly to the Factual Anchoring section after reviewing the Executive Summary. Readers interested in the theoretical framework should follow the full sequence. Regulators and litigators will find the Predictions and Falsification Contract sections specify observable indicators and assessment windows for corroboration or refutation.

I. Core Thesis

Compass’ strategic trajectory illustrates a modern institutional failure mode: when an organization monetizes trust and image as primary assets, coordination breakdown triggers narrative reinforcement and scale escalation rather than adaptive learning. Institutions that rely on image for competitive positioning cannot easily revise that image in response to feedback without appearing to admit failure. The result is a path-dependent loop in which actions taken to preserve legitimacy accelerate the very trust erosion the institution seeks to avoid. Compass’s Coasean Coordination Problem Part II, the Litigation–Acquisition Monopolization Strategy (December 2025).

A clarification is necessary before proceeding. Compass is not ignorant of these dynamics. Compass is not irrational. Compass leadership understands luxury real estate economics, coordination infrastructure, and competitive positioning as well as any firm in the industry. The behavior documented in this simulation reflects rational optimization under structural constraints—not strategic error or moral failure. The problem is that rational optimization under these constraints produces outcomes that are systemically destructive. Compass can be simultaneously competent, rational, and harmful. The diagnosis is structural, not moral.

Compass occupies a high-trust market position by design. The firm charges premium commission splits, attracts agents through brand cachet and technology positioning, and commands seller confidence through polished marketing and perceived market leadership. Unlike discount brokerages competing on price or traditional brokerages competing on local relationships, Compass competes on trust itself—the belief that its platform, brand, and agent network deliver superior outcomes. The entire value proposition depends on maintaining that trust premium.

Yet Compass’ strategic actions systematically degrade the coordination infrastructure on which trust depends. The NWMLS litigation attacks cooperative submission rules that enable transparent matching. Private Exclusives withdraw inventory from shared visibility, degrading information completeness for all market participants. Clawbacks and commission deferrals erode agent trust and inflate switching costs. The Anywhere acquisition concentrates market power while the public narrative claims expanded consumer access. Each action is individually defensible within competitive logic; collectively, they dismantle the trust foundation the business model requires.

The Chicago School of Law and Behavioral Economics, when properly integrated, explains why this outcome is rational, predictable, and non-moralistic. Coercive Narrative Governance explains how the system sustains itself past the point where empirical correction should occur. The Karenina Vision explains where moral architecture fails under pressure. The Institutional Cognitive Plasticity Vision explains when learning capacity collapses.

Convergent results across all four CDT simulations support a single integrated prediction: Compass will continue to prioritize narrative coherence and scale over coordination repair, regulatory scrutiny will intensify before formal enforcement, and public trust loss—when triggered—will manifest suddenly rather than gradually.

Contact mcai@mindcast-ai.com to partner with us on Chicago School of Law and Behavioral Economics foresight simulations. See complementary analysis, Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs(December 2025) framework, with sub-series:

Part I How Private Exclusives Reshape Competition and Threaten MLS Stability

Part III Coordination Costs, MLS Governance and the Compass Litigation

Part IV Platform Routing, Portal Power, and the Zillow Litigation

II. The Trust Paradox: Business Model Versus Strategic Conduct

Compass’ business model places the firm in a high-trust market position that its strategic conduct systematically undermines. Understanding this paradox is essential to understanding why the trajectory is self-inflicted rather than externally imposed. The damage emerges from the contradiction between what Compass sells and what Compass does.

Business Model: Trust as Product

Compass does not compete primarily on price or local market expertise. The firm competes on trust—the perception that its brand, technology platform, and agent network deliver superior outcomes for sellers and buyers. Premium commission splits depend on agents believing Compass affiliation increases their production. Seller engagement depends on consumers believing Compass listings receive superior marketing and exposure. Investor valuations depend on markets believing Compass can sustain differentiation in a commoditizing industry.

Trust is not incidental to Compass’ business model; trust is the business model. The firm’s market positioning, agent recruiting, and consumer branding all depend on maintaining a trust premium that justifies premium economics. Strip away the trust premium and Compass becomes an undifferentiated brokerage with above-market cost structure.

Trust Infrastructure: What Coordination Requires

The trust premium Compass monetizes does not exist in a vacuum. Trust in real estate brokerage depends on coordination infrastructure that enables efficient matching between buyers and sellers. MLS systems provide the focal point where listings appear. Cooperative compensation norms enable buyer representation. Information transparency allows consumers to compare options. Reciprocity expectations ensure agents collaborate rather than defect.

Compass benefits from this coordination infrastructure every time the firm recruits an agent who values MLS access, every time a seller chooses Compass expecting broad exposure, every time a buyer’s agent shows a Compass listing. The trust premium is not a Compass creation; it is a Compass extraction from shared infrastructure that all market participants maintain.

Strategic Conduct: Degrading the Foundation

Compass’ strategic actions degrade the coordination infrastructure on which its trust premium depends. The NWMLS litigation seeks to eliminate mandatory MLS submission requirements—the very rules that ensure listings reach the broadest possible audience and that Compass uses as a selling point to agents and sellers. Private Exclusives withdraw inventory from shared visibility, creating information asymmetry that benefits Compass in the short term while degrading market efficiency that benefits everyone including Compass in the long term.

Clawbacks and commission deferrals extract value from agents while eroding the agent trust that enables Compass to recruit and retain producers. The Anywhere acquisition concentrates market power in ways that invite regulatory scrutiny while the public narrative claims expanded consumer benefit. Each action extracts short-term value from coordination infrastructure while depleting the trust capital that makes future extraction possible.

The Self-Inflicted Wound

The paradox is not accidental; it is structural. Compass faces competitive pressure to differentiate in a commoditizing market. Differentiation requires either genuine innovation that increases coordination surplus for all participants, or strategic maneuvering that captures coordination surplus from other participants. Compass has chosen the latter. The NWMLS litigation, Private Exclusives, clawbacks, and consolidation all represent coordination capture rather than coordination creation.

Coordination capture generates short-term advantage but long-term fragility. Each captured dollar of coordination surplus degrades the trust infrastructure that enables future capture. Each degradation of trust infrastructure undermines the trust premium that justifies Compass’ market position. Each erosion of market position increases pressure to capture more coordination surplus. The loop closes.

The self-inflicted nature of the wound explains why adaptive learning is unlikely. Admitting the problem requires admitting that Compass’ strategic success has undermined Compass’ market position. Identity defense prevents that admission. Narrative governance converts the admission from strategic revision to existential threat. Non-plasticity locks in the trajectory. Defense becomes destiny.

III. Luxury Real Estate Economics: Thin Margins, High Trust Dependence

Luxury residential real estate is widely misunderstood as a high-margin business. The default assumptions—that luxury deals generate huge commissions, that big brokerages operate with massive slack, and that high prices mean high margins—are wrong. In reality, net margins are thin and volatile, while risk increases sharply as prices rise. Costs scale with price: marketing, time, coordination complexity, and reputational exposure all compound at higher price points. The governing principle is straightforward: in luxury residential real estate, risk increases faster than price, while liquidity and margin reliability decrease. Above a certain threshold, outcomes depend more on trust, timing, and coordination than on valuation.

How Risk Scales Across Price Brackets

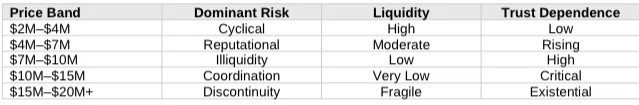

Risk structure varies systematically across luxury price brackets. Understanding these variations explains why trust becomes increasingly load-bearing as prices rise—and why Compass’ business model creates specific vulnerabilities at each tier.

$2M–$4M: Entry Luxury. Buyer pools remain broad, financing is widely available, comparable sales exist, and time-to-market is predictable. Primary risks are macro cycles (interest rates, inventory levels) and standard pricing error. Risk is contained because multiple substitutes exist, market clearing still works, and price discovery remains functional. Deals in this bracket behave like extensions of the upper mid-market. Risk is cyclical, not structural.

$4M–$7M: True Luxury Threshold. Buyer pools narrow materially, emotional attachment increases, marketing costs rise, and pricing precision matters. Primary risks shift toward overpricing to win listings, time-on-market stigma, and seller anchoring on unrealistic valuations. The structural shift at this threshold is significant: liquidity becomes sensitive to narrative confidence, not just price. Risk becomes reputational, not just financial. Trust begins to matter.

$7M–$10M: Illiquidity Crossover Zone. Buyer pools thin sharply, financing becomes selective, comparable sales lose predictive power, and carrying costs become salient. Primary risks include liquidity freezes after mispricing, failed marketing campaigns that signal weakness, and opportunity costs that compound quietly. Price elasticity drops; time becomes the dominant variable. Deals at this level survive on patience and coordination, not demand depth.

$10M–$15M: Ultra-Luxury. Buyer pools become episodic, deals depend on specific buyers rather than market depth, privacy and discretion matter, and market signals are sparse. Primary risks include buyer identity mismatch, external shocks (interest rates, geopolitics, tech sector liquidity), and reputational embarrassment from visible stagnation. The market no longer clears organically at this level. Coordination replaces competition. Trust is the economic stabilizer. Without it, sellers panic or stall—both outcomes that destroy value.

$15M–$20M+: Trophy Asset Zone. Buyer pools often shrink to single digits, transactions resemble private placements, public marketing can backfire, and time horizons become unpredictable. Primary risks are total liquidity collapse, narrative damage from public failure, seller refusal to adjust price, and compounding carrying and opportunity costs. Price discovery breaks down entirely. Assets in this bracket behave less like homes and more like illiquid status goods. Risk is nonlinear and discontinuous.

Why Trust Is Economic Infrastructure

In this environment, economic outcomes depend less on pricing efficiency than on trust-mediated coordination among sellers, buyers, and brokers. Sellers cannot verify agent quality ex ante. They rely on brand, image, and perceived sophistication as quality signals. Trust preserves patience when liquidity is thin—keeping sellers committed through extended marketing periods without panic price cuts that destroy value. Image prevents embarrassment when outcomes lag expectations—allowing agents to manage seller psychology without losing the listing. For any brokerage operating in luxury markets, image gets the listing and trust keeps it alive. Loss of either destroys economic value.

Risk increases faster than revenue in luxury real estate, and trust determines whether that risk is survivable. Time-on-market damages both price and reputation. Sellers anchor emotionally and resist price cuts even when market conditions warrant adjustment. Buyer pools collapse at higher price points, converting pricing errors into extended illiquidity. Carrying costs and opportunity costs compound quietly while listings age. The nonlinearity is critical: a $20 million listing is not twice as profitable as a $10 million listing—it is often less profitable on a risk-adjusted basis because the probability of timely close declines faster than the commission increases.

Application to Compass

Because Compass’ core business operates across brackets where liquidity is fragile and risk is reputation-sensitive, public image and trust function as economic infrastructure rather than marketing—and failures in trust propagate faster than pricing errors. Brand coherence functions as an entry mechanism for listings, while trust preserves seller patience, broker cooperation, and deal velocity under illiquidity. Compass understands these margin and liquidity dynamics better than almost any brokerage, which is precisely why the firm’s increasing reliance on narrative coherence over adaptive learning is economically rational—and systemically dangerous.

Reputational threats trigger defensive escalation rather than adaptive learning because retreat signals brand weakness that directly impairs listing acquisition. Narrative coherence becomes a substitute for structural correction once coordination stress emerges because the alternative—public acknowledgment of strategic error—would accelerate the very trust erosion the firm seeks to prevent. The margin-trust dependency reframes Compass from powerful aggressor to structurally constrained actor. Litigation does not signal strength; it signals that coordination alternatives have narrowed. Consolidation does not signal efficiency; it signals that organic trust-building has failed. Narrative governance does not signal confidence; it signals that feedback absorption has collapsed.

The economics make the behavioral trajectory predictable. Luxury real estate is not safer because it is expensive. Risk increases faster than price. Trust determines whether risk is survivable. Institutions operating at scale must manage coordination, not just branding—and Compass’ strategic posture reveals an organization that has substituted the latter for the former.

The preceding section established the economic context: thin margins, nonlinear risk, and trust as load-bearing infrastructure. The analysis now shifts from industry economics to institutional diagnosis. The frameworks that follow—Coase, Becker, Posner, and their behavioral extensions—explain why Compass’ trajectory is structurally determined rather than strategically chosen, and why the outcome is predictable independent of intent or competence.

IV. Framework Foundations: The Chicago School of Law and Behavioral Economics

The Chicago School is often mischaracterized as indifferent to power or coordination. In fact, its core insight is that institutions matter because incentives respond to structure, not intent. When extended beyond price effects to coordination architecture, the Chicago framework becomes a predictive engine for institutional behavior. The present analysis applies the Chicago School as a dynamic sequence—Coase to Becker to Posner—rather than a static doctrine.

Coase: Coordination Capacity Precedes Efficiency

Ronald Coase’s central contribution was not that markets are frictionless, but that coordination requires institutions. Where coordination infrastructure exists, actors can bargain, match, and cooperate. Where coordination degrades, efficiency collapses even if transaction costs appear manageable. Part I of the Chicago School Accelerated series established that coordination costs are architecturally distinct from transaction costs—using the OpenAI governance crisis as proof case.

Compass’ litigation posture and consolidation strategy shift the firm from participant to partial defector within shared brokerage infrastructure. Multiple Listing Service (MLS) systems are not vendors; they are focal-point institutions. The NWMLS litigation attacks mandatory MLS submission rules that enable cooperative matching. Private Exclusives expand off-MLS inventory, reducing listing portability and degrading information completeness. These actions weaken the coordination scaffolding that enables efficient matching—even where transaction costs remain low.

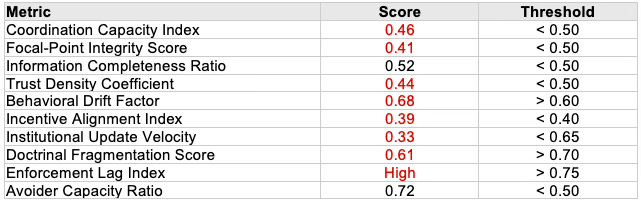

Coase Vision metrics capture this degradation: Coordination Capacity Index (CCI) measures the system’s ability to coordinate across actors. Focal-Point Integrity Score (FIS) measures the stability of shared reference points. Information Completeness Ratio (ICR) measures the proportion of timely, shared information available to all participants. Trust Density Coefficient (TDC) measures the probability that actors interpret signals cooperatively. Values below 0.50 on any metric indicate a non-coordinating state.

Coase Vision reframes Compass’ conduct from competitive rivalry to coordination disruption. Even pro-consumer claims fail if they weaken the institutional scaffolding that enables cooperation.

Becker: Incentives Exploit Coordination Gaps

Gary Becker demonstrated that behavior follows incentives relentlessly. When coordination weakens, actors do not wait for moral clarity; they re-optimize. Part II of the Chicago School Accelerated series extended Becker’s incentive theory beyond price competition to include extraction, selective cooperation, and margin protection when shared infrastructure weakens—using the Compass litigation complex as proof case.

As coordination trust declines at Compass, rational actors sort predictably. Elite agents preserve optionality by maintaining outside relationships and portable production capacity. Mid-tier agents face incentive pressure toward short-term extraction or quiet disengagement. Cooperative surplus declines because the expected payoff from cooperation falls while the expected payoff from defection rises. Exploitation is not a moral deviation; it is the rational response to altered payoff matrices.

Becker Vision metrics capture incentive re-optimization: Behavioral Drift Factor (BDF) measures the degree to which actors shift from efficiency competition to exploitative strategies (values above 0.80 indicate exploitation dominance). Incentive Alignment Index (IAI) measures alignment between stated narratives and actual payoff structures. Switching-Cost Gradient (SCG) measures the cost imposed on exit or mobility. Expected-Value Sorting Index (EVS) measures anticipatory exit by high-autonomy actors before harm fully materializes.

Becker Vision explains why trust erosion accelerates once coordination slips. Exploitation is not opportunism—it is the expected equilibrium response.

Posner: Legal Correction Lags Systemic Harm

Richard Posner’s law-and-economics tradition holds that common-law adjudication tends toward efficient rules over time: judges observe outcomes, update doctrine, and liability flows to the lowest-cost avoider. Part III of the Chicago School Accelerated series identified the conditions under which that mechanism fails—when the learning environment becomes ‘wicked’ with long causal chains, delayed feedback, fragmented adjudication, and narrative manipulation by sophisticated actors.

Compass’ legal victories, even if successful, cannot restore lost coordination trust. Courts optimize disputes—not systems. When harm is diffuse and infrastructural, legal remedies arrive late and imperfectly. The real estate litigation landscape fragments across labor law, antitrust, contract, and consumer protection doctrines spanning 50+ jurisdictions. No single court sees the unified strategy. Worse, legal victories may legitimize conduct that accelerates systemic decay.

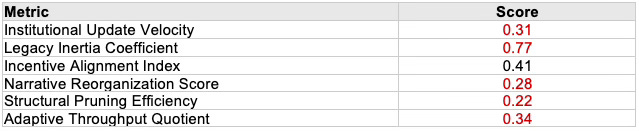

Posner Vision metrics capture institutional learning capacity: Institutional Update Velocity (IUV) measures the speed at which courts or regulators adapt frameworks in response to harm signals. Doctrinal Fragmentation Score (DFS) measures the degree of siloing across legal regimes. Enforcement Lag Index (ELI) measures the delay between harm emergence and corrective intervention. Avoider Capacity Ratio (ACR) measures the ability of harmed parties to prevent harm at reasonable cost.

Posner Vision explains why legality and market health diverge—and why institutions often mistake courtroom success for systemic vindication.

Chicago School Composite Output

The integrated Coase-Becker-Posner sequence produces a closed causal loop. Coordination degradation (Coase) enables incentive exploitation (Becker). Enforcement lag (Posner) allows exploitation to harden. Each framework amplifies the others. CDT simulation results for Compass confirm this dynamic:

The Chicago composite output confirms: System Coordination Integrity is low. Exploitability Index is high. Correction Feasibility Score is low. Predicted equilibrium is exploitative, path-dependent, and vulnerable to sudden confidence loss.

V. Coercive Narrative Governance Simulation

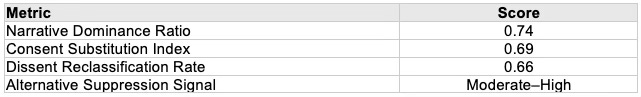

Coercive Narrative Governance occurs when narrative coherence substitutes for consent and coordination. Initially, narrative aligns behavior by providing shared meaning and direction. Under stress, narrative governs behavior by filtering feedback, delegitimizing alternatives, and reclassifying dissent. The CDT simulation analyzes Compass leadership signaling, public litigation framing, agent-facing internal narratives, and recruiting and branding outputs to assess narrative governance intensity.

Compass’ reliance on image transforms narrative into infrastructure. The firm’s brand positioning—modern, tech-enabled, agent-centric—functions as both competitive differentiator and behavioral governance mechanism. Resistance to Compass initiatives is reframed as obstruction or incumbency defense. Alternatives to Compass’ approach are delegitimized rather than competed against. Escalation becomes inevitable because retreat signals narrative failure.

The pattern is visible in public positioning. When MLS systems enforce cooperative rules, Compass frames enforcement as anti-competitive restraint rather than coordination maintenance. When competing brokerages retain agents, Compass frames retention as lock-in rather than value delivery. When regulators inquire, Compass frames scrutiny as misunderstanding innovation rather than evaluating conduct. Each reframe follows the same logic: external resistance reflects the resistor’s deficiency, not Compass’ conduct. The narrative does not merely describe—it governs perception, channels interpretation, and forecloses alternative explanations.

Dissent receives the same treatment. Agents who leave are recast as misaligned with the firm’s vision rather than as rational actors responding to altered incentive structures. Industry critics are recast as defenders of an outdated status quo rather than as observers of coordination harm. The reframing is not cynical—it is structurally necessary. Once narrative coherence becomes load-bearing, acknowledging that critics might be correct threatens the infrastructure that secures listings, retains agents, and sustains valuation. Dissent cannot be engaged; it must be reclassified.

Narrative increasingly substitutes for coordination consent. Narrative coherence filters feedback, delaying recognition of coordination harm. The system defends identity rather than outcomes.

Karenina Vision: Moral Architecture Under Pressure

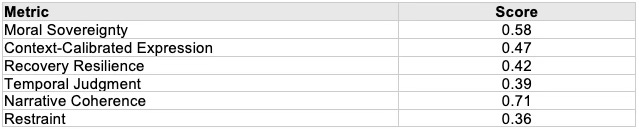

The Karenina Vision draws its name from Tolstoy’s observation that happy families are all alike while every unhappy family is unhappy in its own way. Applied to institutions, the insight is that successful organizations share common patterns of moral coherence while failing organizations fail in characteristic, idiosyncratic ways. The CDT simulation analyzes Compass institutional posture, executive decision patterns, and high-visibility conflicts with MLS systems, Zillow, and consolidation targets.

Compass maintains narrative coherence under pressure but at the expense of restraint and temporal judgment. Public values remain intact—innovation, agent empowerment, consumer benefit—while operational behavior diverges. The NWMLS litigation attacks cooperative infrastructure while claiming to defend agent interests. The Private Exclusives program reduces transparency while claiming to protect seller choice. The Anywhere acquisition concentrates market power while claiming to expand consumer access.

Moral consistency degrades asymmetrically: high narrative coherence coexists with low restraint and poor temporal judgment. Compass is unhappy in its own way—a classic Karenina failure mode where the specific pattern of divergence between stated values and operational conduct becomes the signature of institutional decline.

VI. Institutional Cognitive Plasticity Simulation

Institutional Cognitive Plasticity measures an organization’s capacity to update beliefs, revise strategies, and reorganize structures in response to feedback. High plasticity enables adaptive learning. Low plasticity produces doubling-down behavior where escalation replaces learning and accumulation replaces pruning. The CDT simulation analyzes Compass leadership decision patterns, strategic responses to resistance, and pre- and post-litigation decision architecture.

Feedback absorption at Compass is low. Signals are filtered through identity defense rather than structural revision. The NWMLS litigation response to the National Association of Realtors settlement illustrates this pattern: rather than adapting to new commission transparency requirements, Compass escalated by attacking the underlying cooperative infrastructure. The Anywhere acquisition response to competitive pressure illustrates the same pattern: rather than improving organic coordination capacity, Compass escalated by acquiring scale.

The non-plasticity threshold has likely been crossed. Once institutional plasticity collapses, doubling-down behavior becomes rational within the organization’s internal logic even as it accelerates external decline. Defense becomes destiny.

VII. Factual Anchoring: Documented Conduct

The CDT simulation metrics derive from observable conduct, not speculation. Four categories of documented behavior anchor the analysis: litigation posture, coordination capture mechanisms, consolidation strategy, and historical exploitation patterns. Each category independently supports the coordination-degradation thesis.

Litigation Posture

Compass’ NWMLS litigation attacks mandatory MLS submission rules—the cooperative infrastructure that enables efficient matching in residential real estate. The lawsuit challenges the requirement that listings be submitted to the MLS within a defined window, arguing that agents should have unlimited discretion to withhold listings. In practice, unlimited discretion enables Private Exclusives and off-MLS inventory gatekeeping that degrades focal-point integrity and information completeness for all market participants.

The Zillow disputes extend the same pattern. Compass has publicly clashed with Zillow over data access, listing distribution, and competitive positioning. Each dispute positions Compass as defender of agent interests while operationally concentrating control over information flows.

Coordination Capture Mechanisms

Three exploitation levers documented at Compass anchor the Becker Vision analysis. Clawbacks and commission deferrals render earned income conditional on continued affiliation, inflating switching costs and suppressing agent mobility. Inventory gatekeeping through Private Exclusives reduces listing portability and degrades agent outside options. Lead and routing control substitutes firm-mediated access for open coordination, concentrating information asymmetry advantage with the firm.

California lawsuits filed between 2018 and 2022—years before the current antitrust litigation—independently document these same mechanisms: bait-and-switch compensation promises, clawbacks of earned commissions, commission deferrals functioning as firm financing, and standardized contract terms suitable for class treatment. The allegations pre-date current disputes and establish historical pattern evidence.

Consolidation Strategy

The Compass-Anywhere merger converts localized exploitation tactics into durable national infrastructure. Anywhere provides scale—340,000 agents across 120 countries, 1.2 million annual transactions—plus franchised enforcement channels, standardized agent agreements, and downstream routing through title, escrow, and relocation businesses. The disclosed synergy target of $225–255 million in annual cost savings quantifies the extraction budget. In a brokerage merger with minimal operational overlap, labor-side compression is the primary savings source.

The financial structure converts extraction from strategic option to contractual obligation. Compass has arranged a $750 million committed debt facility from Morgan Stanley with a disclosed leverage target of approximately 1.5x net debt to adjusted EBITDA by 2028. The synergy savings must materialize to service debt and delever on schedule. The deal’s financial viability assumes the Coase and Becker dynamics succeed.

VIII. Agent-Level Behavioral Evidence

The Becker framework generates testable predictions about agent behavior. If coordination capture and incentive exploitation are real, agents should update expected payoffs ex ante before integration completes, actually move rather than merely express dissatisfaction, and cite the specific variables the framework identifies—compensation, coordination, support—rather than cultural factors. Evidence across all three dimensions confirms the predictions.

Survey Evidence: Ex Ante Updating

Zillow surveyed 122 verified, active Anywhere agents (each closed at least one sale in the prior year) during October–November 2025. Results show 18% would definitely leave if the Compass-Anywhere merger closes, 35% would consider leaving, and 53% total are open to defection. Additionally, 23% expect a negative impact on their business and approximately 70% believe private listing networks are not in sellers’ best interest.

Agent responses reflect expected-value updating before integration—not sentiment. Agents anticipate reduced autonomy and bargaining power. Zillow’s litigation posture creates sponsor incentives, but the relevant question is whether agent responses are incentive-consistent. Baseline churn data and observed exits corroborate directionality. The Becker framework predicts exactly this sorting pattern: high-autonomy agents signal exit early while locked-in agents remain.

Observed Mobility: Actual Departures

Survey responses could reflect cheap talk or temporary anxiety rather than genuine expected-value updating. The test is whether agents actually move—and whether their stated reasons align with coordination and compensation dynamics. Media-documented departures from Compass confirm the pattern:

A Massachusetts mega-team moved to eXp in October 2025, citing brokerage model and flexibility. A 25-agent Denver team moved to Your Castle in April 2025, citing better commission structure and support. Seattle agents moved to Windermere in July 2025, citing transparency, collaboration, and fair-housing alignment.

Agents cite the specific variables Becker identifies as defection drivers—compensation, support, and coordination quality—not cultural fit or brand preference. The observed departures validate the framework’s sorting predictions.

Baseline Labor Market Conditions

Baseline labor-market conditions determine how severely the merger’s incentive shock will propagate. Real estate brokerage is a high-churn, high-mobility labor market. Industry data shows 10–13% of agents switch brokerages annually across large MLSs. Recruiting pressure is constant: 74% of agents report being recruited within two months, and 21% report being recruited weekly.

Coordination is already weak. Outside options are salient. Labor responds quickly to expected-payoff changes. A labor market this elastic will amplify any incentive shock the merger introduces.

IX. Public Perception Analysis

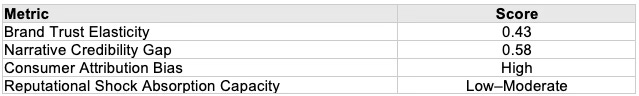

Public perception of Compass shapes the vulnerability surface for trust collapse. Consumers, sellers, and media do not track coordination economics or legal nuance; they respond to perceived motive. The CDT simulation analyzes brand trust elasticity, narrative credibility gaps, consumer attribution bias, and reputational shock absorption capacity.

Public perception of Compass remains superficially positive but increasingly fragile. Litigation against MLS infrastructure and Zillow reframes Compass from modern facilitator to defensive incumbent. Image amplifies this effect: high polish increases downside when credibility gaps appear. Trust loss, if triggered, will be abrupt rather than gradual because the gap between narrative and conduct has already accumulated.

X. Regulatory Perception Analysis

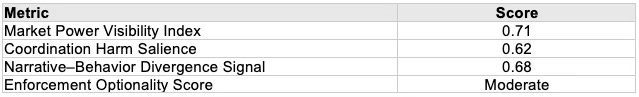

Federal and state regulators evaluate Compass through a different lens than public consumers. Department of Justice (DOJ) Antitrust Division, Federal Trade Commission (FTC), and State Attorneys General focus on market power visibility, coordination harm salience, narrative-behavior divergence, and enforcement optionality. The CDT simulation models regulator perception and enforcement trajectory.

Regulators are unlikely to accept Compass’ self-framing as a pro-competitive innovator at face value. Litigation posture and consolidation increase market-power visibility and elevate scrutiny, even absent near-term enforcement. Regulators focus on coordination harm, foreclosure risk, and narrative-behavior divergence. Compass’ actions place the firm within a familiar pattern: firms that claim innovation while weakening shared infrastructure.

Regulatory Enforcement Trajectory

Enforcement incentives are re-optimizing toward optionality rather than immediate action. Regulators benefit from information gathering, theory-of-harm development, and signaling restraint while preserving future leverage. Delay is strategic, not passive. CDT simulation results show Perceived Coordination Degradation Index at 0.64, Infrastructure Foreclosure Salience at 0.61, and Market-Wide Spillover Visibility at 0.58.

Regulators increasingly perceive Compass-related disputes as implicating shared coordination infrastructure rather than bilateral commercial conflict. MLS litigation and consolidation activity elevate foreclosure and spillover salience, crossing the threshold where coordination harm becomes a legitimate regulatory lens. Once Compass becomes categorized within a known pattern of coordination foreclosure, reclassification becomes unlikely even absent immediate enforcement.

Scrutiny trajectory points upward. Enforcement timing is delayed but path-dependent. Regulatory posture favors quiet accumulation with low reversal probability once escalated.

XI. Integrated Findings

Across all CDT simulations—Chicago School of Law and Behavioral Economics, Coercive Narrative Governance, Karenina Vision, and Institutional Cognitive Plasticity—results converge on a unified pattern. Seven integrated findings emerge from the analysis:

Finding 1: Coordination degradation precedes financial distress. The Coase Vision metrics show coordination capacity, focal-point integrity, and trust density already below stability thresholds. Financial indicators will lag coordination indicators. By the time financial distress becomes visible, coordination harm will have locked in.

Finding 2: Incentives re-optimize toward extraction once trust density falls. The Becker Vision metrics show behavioral drift toward exploitation accelerating. Elite agents preserve optionality while locked-in agents face systematic extraction. Cooperative surplus declines as defection becomes rational.

Finding 3: Legal remedies lag systemic harm and may entrench it. The Posner Vision metrics show institutional update velocity below threshold while enforcement lag exceeds threshold. Courts and regulators cannot correct coordination harm within the damage window. Legal victories risk legitimizing rather than repairing degradation.

Finding 4: Narrative governance substitutes for adaptive learning. The Coercive Narrative Governance metrics show narrative dominance and consent substitution at high levels. Feedback is filtered through identity defense rather than structural revision. The system defends narrative rather than outcomes.

Finding 5: Institutional non-plasticity converts defensive strategy into fate. The Institutional Cognitive Plasticity metrics show update velocity, pruning efficiency, and adaptive throughput at critically low levels. Once plasticity collapses, doubling-down behavior becomes internally rational even as it accelerates external decline.

Finding 6: Public trust loss manifests suddenly due to image amplification. The Public Perception metrics show brand trust elasticity at low levels while narrative credibility gap has accumulated. High polish increases downside when credibility gaps appear. Trust loss, when triggered, will be abrupt rather than gradual.

Finding 7: Regulatory scrutiny increases before formal enforcement. The Regulatory Perception metrics show market power visibility and coordination harm salience at elevated levels. Regulators favor information gathering and optionality preservation over immediate action. Scrutiny trajectory points upward with low reversal probability.

The integrated pattern explains why Compass’ trajectory is path-dependent: each finding reinforces the others. Coordination degradation enables exploitation. Exploitation triggers narrative governance. Narrative governance suppresses learning. Learning collapse converts defense into destiny. Image amplification converts gradual erosion into sudden collapse. Regulatory accumulation converts present conduct into future constraint.

XII. Foresight Simulation Predictions: 12–36 Month Horizon

The integrated CDT simulation generates time-sequenced predictions tied to observable indicators. Each prediction follows from the framework logic and can be verified against external evidence. Six primary predictions span the 12–36 month horizon:

Prediction 1: Regulatory information gathering continues without early litigation. Regulators will continue accumulating information, developing theory-of-harm documentation, and signaling restraint while preserving enforcement optionality. DOJ, FTC, and State Attorneys General will coordinate through interagency channels without filing formal complaints in the near term. Observable indicator: absence of formal enforcement filings combined with continued civil investigative demands, subpoenas, or voluntary information requests.

Prediction 2: Compass remains within a growing scrutiny set even absent adverse rulings. Regulatory categorization of Compass as a coordination-capture risk will persist independent of litigation outcomes. Once established, scrutiny rarely fully recedes. Observable indicator: continued regulatory references to Compass in speeches, guidance documents, or policy statements concerning real estate coordination or platform competition.

Prediction 3: Media framing shifts toward infrastructure and foreclosure narratives. Press coverage will increasingly emphasize coordination harm, MLS infrastructure disputes, and foreclosure risk rather than consumer pricing or service quality. Observable indicator: frequency analysis of media mentions showing increased use of infrastructure, coordination, and foreclosure terminology relative to pricing and commission terminology.

Prediction 4: Seller confidence shocks precede any formal enforcement action. Consumer trust metrics will decline before regulatory enforcement materializes. Public perception will shift from viewing Compass as innovative disruptor to defensive incumbent. Observable indicator: consumer sentiment surveys, Net Promoter Score changes, or listing volume shifts in Compass-concentrated markets.

Prediction 5: Once regulatory narrative stabilizes, reversal probability drops sharply. After regulators publicly characterize Compass within a coordination-capture framework, reclassification becomes institutionally costly. The regulatory narrative will lock in. Observable indicator: consistency of regulatory characterization across multiple agency statements and absence of rehabilitative framing.

Prediction 6: Any eventual enforcement targets structural conduct, not commission pricing. If formal enforcement occurs, theories of harm will focus on coordination architecture, foreclosure of MLS infrastructure, and labor-market effects rather than consumer pricing effects. Observable indicator: complaint allegations emphasizing coordination, infrastructure, and labor rather than commission rates or consumer prices.

These predictions are time-sequenced: regulatory information gathering (Prediction 1) precedes scrutiny persistence (Prediction 2), which precedes media framing shift (Prediction 3), which precedes seller confidence shocks (Prediction 4), which precedes narrative lock-in (Prediction 5), which precedes structural enforcement (Prediction 6).

XIII. Falsification Contract

A framework that cannot be falsified is not a framework—it is rhetoric. The integrated CDT simulation specifies conditions under which the analysis would be wrong. Explicit falsification criteria distinguish predictive foresight from post-hoc rationalization.

Primary Falsification Condition: The simulation would be falsified if regulators visibly downgrade coordination-harm salience, close inquiry channels, and Compass demonstrates verifiable increases in cooperative infrastructure engagement and institutional learning within four fiscal quarters.

Observable Falsification Indicators:

Regulatory downgrade: DOJ, FTC, or State Attorneys General publicly characterize Compass as outside the coordination-capture risk category, close pending inquiries, or issue clearance statements.

Cooperative infrastructure engagement: Compass withdraws or settles NWMLS litigation on terms that preserve mandatory MLS submission, reduces Private Exclusive inventory share below 5% of listings, or enters cooperative agreements with MLS systems that restore focal-point integrity.

Institutional learning indicators: Compass Institutional Update Velocity rises above 0.55, Legacy Inertia Coefficient falls below 0.60, and Adaptive Throughput Quotient rises above 0.50—sustained across four consecutive quarters.

Partial Falsification: If Compass demonstrates cooperative engagement without regulatory downgrade, or regulatory downgrade occurs without Compass behavioral change, the simulation is partially falsified. Partial falsification indicates incomplete model specification rather than framework failure.

Assessment Window: Primary falsification assessment at 12 months from publication date. Secondary falsification assessment at 24 months. Final falsification assessment at 36 months.

The falsification contract ensures accountability. If the predicted trajectory does not materialize, the framework requires revision. If the trajectory materializes, the framework gains corroboration.

XIV. Conclusion

Compass’ strategic trajectory illustrates a modern institutional failure mode with broad applicability. When an organization monetizes trust and image as primary assets, coordination breakdown triggers narrative reinforcement rather than adaptive learning. The result is a path-dependent loop where defense becomes destiny.

The Chicago School of Law and Behavioral Economics provides the explanatory framework. Coase explains why coordination architecture matters independent of transaction costs. Becker explains why rational actors exploit coordination gaps. Posner explains why legal correction lags systemic harm. Coercive Narrative Governance explains how the system sustains itself past empirical correction. The Karenina Vision explains where moral architecture fails. The Institutional Cognitive Plasticity Vision explains when learning capacity collapses.

Convergent CDT simulation results across all four frameworks predict: Compass will continue to prioritize narrative coherence and scale over coordination repair. Regulatory scrutiny will intensify before formal enforcement. Public trust loss—when triggered—will manifest suddenly rather than gradually. The trajectory is rational, predictable, and avoidable only before plasticity collapses.

Compass is a case study, not an exception. Any trust-dependent platform operating at scale faces the same non-plasticity risk. The frameworks and methodology apply wherever institutions monetize coordination capacity they cannot sustainably maintain.

Appendix: Metrics Reference

All metrics are NAIP200-normalized foresight outputs on a 0–1 scale. Metrics function for threshold detection, interaction analysis, and prediction registration—not point estimation. The following reference provides definitions for all metrics used in this simulation.

Coase Vision Metrics

Coordination Capacity Index (CCI): Composite measure of a system’s ability to coordinate across actors. Values below 0.50 indicate a non-coordinating state in which efficient bargaining cannot reliably engage.

Focal-Point Integrity Score (FIS): Measures the stability of shared reference points such as MLS centrality and routing norms. Low values indicate focal-point collapse and interpretive fragmentation.

Information Completeness Ratio (ICR): Measures the proportion of timely, shared information available to all participants. Low values predict opacity rents and adverse selection.

Trust Density Coefficient (TDC): Measures the probability that actors interpret signals cooperatively rather than adversarially. Values below 0.50 predict breakdown of reciprocal coordination.

Becker Vision Metrics

Behavioral Drift Factor (BDF): Measures the degree to which actors shift from efficiency competition to exploitative strategies. Values above 0.80 indicate exploitative equilibrium dominance.

Incentive Alignment Index (IAI): Measures alignment between stated narratives and actual payoff structures. Low values signal pretextual justification.

Switching-Cost Gradient (SCG): Measures the cost imposed on exit or mobility including financial, informational, and contractual barriers. Values above 0.80 predict durable lock-in.

Expected-Value Sorting Index (EVS): Measures anticipatory exit by high-autonomy actors before harm fully materializes. High values predict early defection.

Posner Vision Metrics

Institutional Update Velocity (IUV): Measures the speed at which courts or regulators adapt frameworks in response to harm signals. Low values indicate lag relative to firm adaptation speed.

Doctrinal Fragmentation Score (DFS): Measures the degree of siloing across legal regimes including antitrust, labor, and contract. High values prevent causal visibility.

Enforcement Lag Index (ELI): Measures the delay between harm emergence and corrective intervention. Values above 0.75 indicate lock-in risk.

Avoider Capacity Ratio (ACR): Measures the ability of harmed parties to prevent harm at reasonable cost. Values below 0.50 indicate non-avoider status.