MCAI Lex Vision: Compass’s Coasean Coordination Problem Part IV- Platform Routing, Portal Power, and the Zillow Litigation

A Modern Chicago School Diagnosis of Why a Plausible Antitrust Claim Requests an Anticompetitive Remedy

MindCast AI Compass’s Coasean Coordination Problem series is part of our Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs (December 2025) framework, with sub-series:

Part I How Private Exclusives Reshape Competition and Threaten MLS Stability

Part III Coordination Costs, MLS Governance and the Compass Litigation

Part IV Platform Routing, Portal Power, and the Zillow Litigation

I. Executive Summary

Compass, Inc. is suing Zillow Group in the Southern District of New York, seeking a preliminary injunction that would compel Zillow to display listings that Compass intentionally withheld from the Multiple Listing Service during earlier marketing phases. The case presents itself as an access dispute—a brokerage demanding distribution through a dominant portal. Coordination-cost analysis reveals a structural problem that this framing obscures: Compass seeks to compel a high-integrity coordination actor to transmit inventory that bypassed coordination infrastructure.

Zillow’s Listing Access Standards, announced in April 2025 and implemented in May, operationalize a simple principle: a listing marketed to any buyer should be marketed to every buyer. Listings that bypass the Multiple Listing Service(MLS) during public marketing phases cannot later demand MLS-fed distribution through Zillow. Compass frames this standard as anticompetitive exclusion. The coordination-cost framework reveals the opposite: Zillow’s standards preserve the focal-point architecture that enables forty-five trillion dollars in residential real estate to match efficiently.

The relief Compass requests is the coordination harm. Compelling Zillow to distribute Private Exclusives institutionalizes opacity by forcing coordination infrastructure to relay inventory that deliberately bypassed the coordination system. The remedy does not restore competition—the remedy degrades the institutional architecture that makes competition possible.

What Compass Is Actually Asking the Court to Do

Compass’s antitrust theory proceeds in three steps. First, Compass defines the relevant market as online home search platforms nationwide. Second, Compass alleges that Zillow holds monopoly power in this market through its dominant share of buyer traffic. Third, Compass claims that Zillow’s Listing Access Standards constitute exclusionary conduct that forecloses Compass from competing effectively.

The specific injunction Compass requests would:

Prohibit Zillow from enforcing its Listing Access Standards against listings that were publicly marketed off-MLS before syndication.

Require Zillow to display Compass listings once submitted to MLS, regardless of prior marketing history.

Prevent Zillow from conditioning portal display on whether a listing was first routed through MLS.

In practical terms, the injunction would compel Zillow to distribute listings whose visibility was previously controlled by Compass through its Private Exclusive network—listings that deliberately bypassed the MLS during initial marketing phases.

The antitrust theory is facially coherent. The problem is what the remedy does. Zillow’s Listing Access Standards condition portal display on prior MLS submission. This means that all listings on Zillow have passed through the same coordination infrastructure before reaching the aggregation layer. Buyers searching Zillow can trust that they are seeing MLS-sourced inventory, not a curated subset reflecting brokerage-specific routing decisions.

The requested injunction would sever this link. Portal display would no longer require MLS routing. Aggregation would become available without coordination compliance. This is the structural harm. It does not depend on Compass’s intentions or Zillow’s motivations. It follows from what the remedy would do to the relationship between MLS systems and portal distribution. The requested injunction is the coordination harm.

The Admission That Collapses the Narrative

Compass’s complaint contains an admission that, properly understood, defeats its own antitrust theory. The company alleges that Private Exclusives can yield approximately 2.9 percent higher prices for sellers. This figure also appears in the NWMLS complaint. Compass presents it as evidence that Private Exclusives provide seller value.

Under Ohio v. American Express Co. (2018), platforms operating in two-sided markets cannot demonstrate antitrust injury by showing harm to one side alone. The court must evaluate net effects across both sides of the market. Real estate portals are quintessential two-sided platforms: they connect sellers (through listings) with buyers (through search). Any analysis of competitive effects must account for impacts on both groups.

The 2.9 percent figure is legally dispositive. Higher seller prices are, by mathematical identity, higher buyer costs. On Seattle’s median home price of approximately $850,000, the premium represents roughly $24,650 transferred from buyers to sellers—and, through increased double-ending rates, to Compass’s commissions. The admission establishes buyer harm as a matter of law.

The structural mechanism deepens this harm. Private Exclusives remove the market signals that discipline price discovery: days on market, price reduction history, comparable exposure. Buyers cannot know whether a property’s price reflects market clearing or information asymmetry. The pricing premium is not incidental; it is structural. Private Exclusives are designed to extract value by suppressing competition among buyers—the same competition that would otherwise discipline seller pricing.

The structural pricing premium creates a fiduciary conflict on the buyer side. Agents representing buyers have duties to act in their clients’ interest. Steering clients toward Private Exclusive listings—which Compass’s own data shows carry a 2.9 percent premium—serves agent compensation, not client welfare. The coordination-cost framework reveals that Compass is not challenging conduct that harms consumers; Compass is challenging conduct that prevents Compass from harming consumers through systematic information suppression.

The Approach

MindCast AI is a predictive cognitive intelligence firm specializing in law and behavioral economics. The methodology integrates Chicago School principles—Coase on transaction costs, Schelling on focal points, Becker on incentive response—with quantified behavioral metrics that traditional legal analysis leaves implicit.

Cognitive Digital Twin (CDT) methodology models institutional actors through measurable signatures: Causal Signal Integrity (CSI) measures consistency between stated positions and observed behavior; Focal-Point Integrity Score (FIS) captures whether an actor preserves or distorts coordination architecture; Coordination Welfare Contribution (CWC) assesses net contribution to market matching efficiency. These metrics feed into scenario probability distributions, generating falsifiable predictions about litigation outcomes, regulatory pathways, and market structure evolution.

The framework does not tell courts who should win. It explains why the remedy matters more than the theory—and provides the analytical vocabulary that transforms intuitions about “procompetitive conduct” and “coordination preservation” into economically rigorous, legally actionable arguments.

Series Chronology and Chicago School Foundation

The MindCast AI series The Chicago School of Law and Economics Accelerated applies a refined Chicago School framework that distinguishes between transaction costs—frictions arising within bargaining once parties are already matched—and coordination costs, which determine whether dispersed buyers and sellers can find each other and form efficient matches at all. Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs (December 2025). Ronald Coase won the Nobel Prize for demonstrating that private parties bargain to efficient outcomes when transaction costs are low. The coordination-cost extension recognizes that efficient bargaining also requires coordination capacity—the ability of dispersed parties to find each other, establish common expectations, and converge on efficient matches.

Part I introduced the analytical framework and applied it to Compass’s Private Exclusive strategy. Multiple listing services exist to reduce coordination costs by creating a visible focal point where buyers and sellers converge. Each withheld listing degrades the system for all participants—a negative externality Compass imposes on competitors and consumers alike. Part I established baseline predictions: coordination fragmentation accelerates through 2027, produces measurable harm by 2028, and forces conceptual reconsideration by 2030. Part I, How Private Exclusives Reshape Competition and Threaten MLS Stability (December 2025).

Part II applied the framework to the Compass–Anywhere merger, demonstrating how acquisition-driven expansion magnifies coordination degradation that may appear marginal at local levels. The analysis introduced the litigation–acquisition monopolization strategy: three coordinated prongs through which Compass seeks to disable coordination architecture. The NWMLS lawsuit (prong one) removes internal MLS constraints. The Anywhere acquisition (prong three) provides national scale. Part IV addresses prong two. Part II, The Litigation–Acquisition Monopolization Strategy (December 2025).

Part III turned to active litigation, analyzing the NWMLS case. The analysis identified eight gaps in NWMLS’s Reply brief where correct conclusions lacked compelling explanations. Part III provided the coordination-cost vocabulary that transforms the defense from ‘we did not do anything wrong’ to ‘Compass is attacking the infrastructure that enables competition, and this Court should recognize that attack as the antitrust violation.’ Part III, Coordination Costs, MLS Governance and the Compass Litigation (December 2025).

Part IV (what you’re reading) completes the litigation analysis by examining the Zillow case—the second prong of the monopolization strategy. Compass seeks to compel portal distribution of Private Exclusives, legitimizing the alternative visibility channels necessary for coordination capture at national scale. The NWMLS lawsuit asks courts to invalidate mandatory MLS submission as a legal category. The Zillow lawsuit asks courts to force portals to transmit inventory that bypassed mandatory submission. Together, the lawsuits construct an end-run around coordination architecture.

Key Findings

Cognitive Digital Twin (CDT) analysis reveals a structural paradox at the center of this litigation. Compass is suing a high-integrity coordination actor to compel transmission of low-integrity inventory. Zillow’s Causal Signal Integrity (CSI) score of 0.77 reflects an institution whose stated positions align with observed behavior. Compass’s CSI of 0.23 reflects an institution generating contradictions faster than it resolves them. The 3.3:1 ratio quantifies the structural asymmetry: Compass demands that a coordination-aligned actor become a transmission mechanism for coordination-degrading conduct.

Zillow’s procompetitive justifications—’broad exposure,’ ‘prevent fragmentation,’ ‘preserve trust’—are coordination-cost arguments without the vocabulary. The Listing Access Standards preserve focal-point integrity by conditioning portal access on prior MLS submission. This is not exclusionary conduct; this is coordination architecture maintenance. Zillow has the right economic intuition. Part IV provides the analytical framework that makes that intuition legally actionable.

The 2.9 percent admission is legally dispositive. As detailed above, Compass’s own pleading establishes buyer harm under Ohio v. American Express two-sided market analysis. The admission also creates cross-case vulnerability: Compass cannot argue in NWMLS that Private Exclusives benefit consumers while arguing in Zillow that preventing Private Exclusives harms consumers.

Predictions

If the preliminary injunction is granted: Coordination collapse probability rises from baseline 48% to approximately 58%. Private Exclusive volume expands as portal distribution legitimizes opacity. Competing brokerages adopt defensive withholding strategies, accelerating fragmentation. MLS focal-point degradation becomes observable in major metros by Q3 2026.

If the preliminary injunction is denied: Coordination architecture stabilizes. Zillow’s standards establish de facto market norm. Compass strategic reversal probability increases as opacity-routing becomes economically unviable without portal distribution. Collapse probability drops to approximately 38%.

If the case settles: Outcome depends on settlement terms. Partial distribution requirements create hybrid architecture with ongoing monitoring needs. Settlement without structural remedies delays but does not resolve coordination tension.

Critical litigation window: Expert testimony phase determines outcome. Transaction-cost models cannot explain why Zillow’s standards preserve consumer welfare despite reducing Compass’s distribution options. Coordination-cost models demonstrate that focal-point integrity generates matching efficiency gains that exceed any distribution friction.

Who This Analysis Serves

The coordination-cost framework provides decision-making insight for federal judges evaluating platform access claims under antitrust standards that were designed for transaction-cost analysis; for Zillow’s counsel seeking economic vocabulary to translate procompetitive intuitions into legally actionable arguments; for regulators monitoring the interdependence between the NWMLS, Zillow, and merger proceedings; for institutional investors assessing whether Compass’s litigation strategy reflects sustainable competitive positioning or short-term arbitrage that degrades market infrastructure; and for policy analysts evaluating whether platform curation standards should be analyzed through access-denial or coordination-preservation frameworks.

Roadmap

Section II establishes series continuity, explaining how Part IV shifts the analytical focus from MLS rules to platform routing authority.

Section III introduces the aggregation-routing distinction—the conceptual pivot that reveals why Zillow’s conduct is coordination-preserving rather than exclusionary.

Section IV presents the full CDT profile for Zillow as coordination actor, contrasted with Compass’s profile to expose the forced-transmission paradox.

Section V analyzes Compass’s antitrust theory through coordination-cost economics, demonstrating why the theory fails on its own terms.

Section VI reframes Zillow’s procompetitive justifications as coordination architecture defense.

Section VII reveals the structural integration of prong two within the broader monopolization strategy.

Section VIII presents the scenario lattice with probability distributions across regulatory pathways.

Section IX provides litigation timeline predictions with observable indicators.

Section X addresses expert testimony dynamics and Daubert considerations.

Section XI develops the cross-case outcome matrix showing interdependencies between NWMLS and Zillow litigation.

Section XIIanalyzes policy and precedent spillover.

Section XIII provides strategic recommendations.

Section XIV concludes with synthesis and Part V preview.

Insight: The Zillow litigation presents itself as an access dispute. The coordination-cost framework reveals a structural problem: the requested injunction would require coordination infrastructure to distribute inventory that deliberately bypassed coordination requirements.

Contact mcai@mindcast-ai.com to partner with us on antitrust law and behavioral economics foresight simulations. See Letter to State Attorneys General on Compass-Anywhere Merger (September 2025), Compass Strategic Forum Shopping Analysis (July 2025), Compass’s Strategic Use the Co-Conspirator Narrative in Antitrust Litigation (Jul 2025), Brief of MindCast AI LLC as Amicus Curiae in Support of Defendant NWMLS (May 2025), Brief of MindCast AI LLC as Amicus Curiae in Support of Defendant Zillow (June 2025).

II. Series Continuity: From Conduct to Capture

Earlier installments established the analytical spine that Part IV extends. Part I separated transaction costs from coordination costs and demonstrated why markets fail when parties cannot reliably find each other. Part II showed how scale transforms marginal coordination degradation into systemic risk. Part III demonstrated that litigation survival is procedurally cheap and economically meaningless, with coordination harms emerging only under discovery and expert scrutiny. Part IV moves the locus of coordination control from MLS rules to platform routing authority.

The phase shift in Part IV is conceptual, not merely jurisdictional. MLS rules remain formally intact. The focal point erodes indirectly as routing authority over visibility migrates to platforms. Compass’s NWMLS lawsuit challenges coordination architecture from within by contesting mandatory submission rules. Compass’s Zillow lawsuit challenges coordination architecture from without by seeking portal distribution for inventory that bypassed the focal point. The two lawsuits are not contradictory—they are complementary. Together, they constitute a two-front strategy affecting coordination infrastructure.

CDT metrics signal this phase shift quantitatively. The Coordination Authority Concentration Index (CACI) rises as platforms assert routing control. The Focal-Point Integrity Score (FIS) declines as alternative visibility channels emerge. This divergence—rising CACI paired with falling FIS—predicts welfare loss even when exposure counts and price metrics remain stable. Coordination does not disappear under platform routing; coordination is reassigned. The reassignment degrades welfare because platforms lack the governance obligations, dispute resolution mechanisms, and trust enforcement infrastructure that MLS systems provide.

The coordination-cost framework treats platform routing as the current fault line. Where Part I diagnosed the disease (Private Exclusives eroding focal-point visibility), Part IV models the epidemic: what happens when that disease acquires distribution infrastructure through compelled portal transmission. The answer is coordination capture—routing authority migrating from rule-bound institutions to discretionary actors with misaligned incentives.

Insight: Parts I through III established that coordination costs determine welfare outcomes. Part IV shows that platform routing determines coordination costs. The focal point remains nominally intact while governance transfers to parties whose incentives diverge from coordination preservation.

III. The Aggregation–Routing Distinction

Aggregation reduces search costs. Routing determines whether coordination occurs at all. This distinction—invisible to transaction-cost analysis—is the conceptual pivot that reveals why Zillow’s conduct is coordination-preserving rather than exclusionary. Zillow’s Listing Access Standards operate at the routing layer, not the aggregation layer. Understanding this distinction transforms the antitrust analysis.

Aggregation is a transaction-cost function. Search costs fall when inventory concentrates on fewer platforms. Consumers benefit from reduced friction: instead of checking multiple sources, buyers visit one portal and see comprehensive listings. Transaction-cost analysis evaluates aggregation favorably because aggregation reduces the mechanical barriers to finding and comparing properties. By this logic, more aggregation is always better, and any conduct that reduces aggregation is presumptively harmful.

Routing is a coordination-cost function. Routing determines not whether listings appear, but which institutional pathway they follow to reach visibility. A listing can be aggregated without being routed through coordination infrastructure. Zillow’s standards condition aggregation on prior routing—listings must flow through MLS before Zillow will display them. This conditionality is what Compass challenges. Compass wants aggregation without routing: portal display without MLS submission.

The coordination-cost framework reveals why aggregation without routing degrades welfare. When listings bypass MLS and reach portals directly, the focal point fragments. Buyers cannot know whether their search is complete because some inventory circulates through portal-specific channels while other inventory circulates through MLS. The aggregation count may rise—more listings on more platforms—while coordination capacity falls. Visibility becomes discretionary rather than rule-bound. Trust erodes as participants cannot verify whether they are seeing all relevant inventory or merely the inventory that listing agents chose to expose through particular channels.

Zillow’s Listing Access Standards preserve the routing-before-aggregation sequence. The standards announce: if a listing is marketed to any buyer, it must be submitted to MLS within one business day, and only then will Zillow display it. This sequence ensures that aggregation reinforces rather than undermines coordination architecture. The portal becomes a distribution mechanism for MLS-routed inventory, not an alternative to MLS routing. The focal point remains intact because all publicly marketed listings flow through the same institutional pathway before reaching aggregation channels.

Chicago School economics has always emphasized institutional role clarity. Gary Becker’s framework shows that actors maximize private benefits even when collective costs exceed collective gains. When platforms can route listings without coordination obligations, Becker-rational actors exploit the gap—capturing distribution advantages while externalizing governance, trust enforcement, and dispute resolution to MLS systems. Zillow’s standards prevent this arbitrage by conditioning distribution on coordination compliance. The standards assign institutional roles clearly: MLS governs routing; portals provide aggregation. Role clarity preserves the coordination architecture that enables efficient matching.

Insight: Aggregation without routing is coordination capture by another name. Compass wants portal distribution for listings that bypassed MLS submission—aggregation benefits without routing obligations. Zillow’s standards prevent this arbitrage by conditioning aggregation on prior routing through coordination infrastructure.

IV. Zillow as Coordination Actor: CDT Profile

Cognitive Digital Twin analysis positions Zillow as a coordination stabilizer rather than a coordination degrader. Zillow’s metric profile diverges sharply from Compass’s profile across all four measurement dimensions: system integrity, coordination architecture, national throughput, and behavioral dynamics. This divergence exposes the forced-transmission paradox at the center of the litigation: Compass seeks to compel a high-integrity actor to distribute low-integrity inventory.

System Integrity Metrics

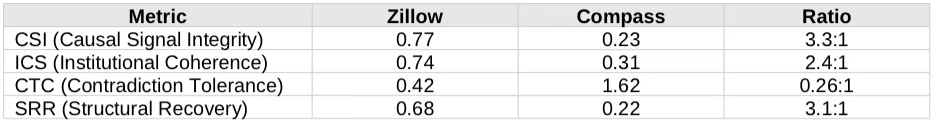

System integrity metrics determine whether an entity stabilizes or destabilizes coordination architecture. Four metrics capture this dimension: Causal Signal Integrity (CSI) measures consistency between an actor’s claims and observed behavior; Institutional Coherence Score (ICS) captures internal alignment between strategy, operations, and messaging; Contradiction Tolerance Coefficient (CTC) gauges how much internal inconsistency an institution can carry without correcting; and Structural Recovery Rate (SRR) reflects how quickly an entity corrects after shocks.

Table 1: System Integrity Comparison

Zillow displays strong structural integrity. Its CSI of 0.77 indicates an institution whose stated positions substantially align with observed behavior—the Listing Access Standards implement the principle Zillow articulates (’if a listing is marketed to any buyer, it should be marketed to every buyer’). Compass displays weak structural integrity. Its CSI of 0.23 indicates an institution generating contradictions faster than it resolves them—suing to invalidate MLS rules while simultaneously suing to force portal distribution of MLS-fed inventory.

Coordination Architecture Metrics

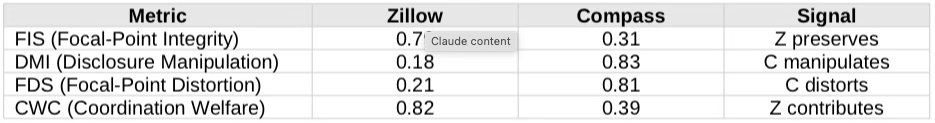

Coordination architecture metrics determine how instability propagates through market systems. Focal-Point Integrity Score (FIS) indicates how well an entity preserves or distorts MLS visibility norms; Disclosure Manipulation Index(DMI) measures selective, delayed, or strategic withholding of information; Focal-Point Distortion Score (FDS) captures whether an entity introduces alternative visibility channels that fragment MLS coherence; and Coordination Welfare Contribution (CWC) assesses net contribution to market coordination capacity.

Table 2: Coordination Architecture Comparison

Zillow operates as a coordination architecture reinforcer. Its Listing Access Standards condition portal visibility on MLS submission, which preserves the focal point rather than fragmenting it. Compass operates as a coordination architecture degrader. Its Private Exclusive strategy systematically introduces alternative visibility channels that fragment the focal point while extracting value from MLS data access.

The Forced-Transmission Paradox

The CDT profiles expose a structural asymmetry. Compass is suing an actor whose coordination metrics substantially exceed its own, seeking to compel that actor to transmit inventory that bypassed coordination infrastructure. The relief Compass seeks would alter Zillow’s coordination contribution—the platform would begin distributing listings that did not follow the MLS pathway it otherwise requires.

If Compass prevails, Zillow’s CSI would decline as the gap between stated principles (’broad exposure’) and required conduct (’distribute selectively withheld listings’) widens. Zillow’s FIS would decline as the portal begins transmitting inventory that bypassed coordination infrastructure. Zillow’s CWC would decline as the platform’s net contribution shifts from coordination reinforcement to coordination degradation. The injunction would transform Zillow’s institutional profile in the direction of Compass’s profile—lower integrity, higher distortion, reduced coordination welfare contribution.

The injunction-induced transformation is the coordination capture mechanism. The focal point does not disappear; it is hollowed out. MLS remains nominally operational while routing authority migrates to platforms and brokerages that lack MLS governance obligations. Coordination does not collapse catastrophically; coordination erodes gradually as the distinction between MLS-routed and non-MLS-routed inventory becomes invisible to market participants.

Insight: The forced-transmission paradox quantifies what the litigation record implies: Compass seeks to degrade Zillow’s coordination function by compelling Zillow to distribute coordination-degrading inventory. The remedy is the harm.

V. Compass’s Antitrust Theory Under Coordination-Cost Analysis

Compass frames its claims under Sherman Act Section 2 (monopolization and attempted monopolization) and Section 1 (agreement or concerted action with Redfin). The Section 2 claim is the center of gravity. Compass defines the relevant market as online home search platforms nationwide and alleges that Zillow’s Listing Access Standards constitute exclusionary conduct that forecloses Compass from competing. Coordination-cost analysis reveals why this theory fails on its own terms.

Market Definition Critique

Compass’s market definition conflates aggregation and routing. Compass argues that brokerages with consumer-facing portals (including Compass.com) compete with Zillow, Realtor.com, Redfin, and Homes.com for buyer attention and traffic, and that ‘unique inventory’ is the key competitive dimension. This framing treats portals as substitutes competing on inventory differentiation.

Coordination-cost analysis reveals a different market structure. Portals compete on aggregation—the comprehensiveness and usability of their inventory display. MLS systems govern routing—the institutional pathway through which inventory reaches aggregation. Compass’s Private Exclusive strategy does not introduce inventory competition within the aggregation layer; it introduces routing competition between MLS and non-MLS channels. The relevant market is not ‘online home search platforms’ but ‘listing visibility routing’—and in that market, MLS systems hold the coordination infrastructure that Compass seeks to bypass.

Zillow’s Listing Access Standards do not exclude Compass from the aggregation market. Compass listings that flow through MLS appear on Zillow like any other MLS-sourced inventory. The standards exclude only listings that Compass chose to route through non-MLS channels before seeking MLS-fed distribution. Compass is not excluded from competition; Compass is excluded from having it both ways—bypassing coordination requirements while capturing coordination benefits.

The 2.9% Admission and Two-Sided Market Analysis

Compass’s own allegations establish buyer harm. The company claims that Private Exclusives can yield approximately 2.9 percent higher prices for sellers—the same admission that appears in the NWMLS complaint. Under Ohio v. American Express, platforms operating in two-sided markets cannot demonstrate antitrust harm by showing injury to one side alone. Compass must demonstrate net harm across buyers and sellers.

The 2.9 percent figure is dispositive. Higher seller prices are buyer costs. On Seattle’s median home price of approximately eight hundred fifty thousand dollars, 2.9 percent represents roughly twenty-four thousand six hundred fifty dollars transferred from buyers to sellers (and to Compass commissions through increased double-ending). Compass alleges that Zillow’s standards harm competition by preventing this wealth transfer. The admission inverts the antitrust theory: Compass is not challenging conduct that harms consumers; Compass is challenging conduct that prevents Compass from harming consumers.

The 2.9 percent admission appears in both the NWMLS and Zillow proceedings, creating cross-case vulnerability. Compass cannot argue in one forum that Private Exclusives benefit consumers while arguing in another that preventing Private Exclusives harms consumers. The coordination-cost framework reveals that both courts will eventually confront the same question: does restricting Private Exclusives protect buyers from a 2.9 percent price premium, or does it harm sellers by eliminating a valuable marketing option? The framework answers clearly: coordination-preserving rules benefit both sides by enabling efficient matching; coordination-degrading conduct benefits one side (sellers, agents) at the expense of the other (buyers).

Why the Requested Relief Is the Coordination Harm

Compass seeks a preliminary injunction that would prohibit Zillow from enforcing its Listing Access Standards against listings that were publicly marketed off-MLS before syndication, and require Zillow to display Compass listings once submitted to MLS regardless of prior marketing history. In practical terms, the injunction would compel Zillow to distribute listings whose visibility was previously controlled by Compass, even if those listings deliberately bypassed MLS during earlier phases.

The requested injunction is the coordination harm. Compelling Zillow to transmit Private Exclusives does not restore coordination; it institutionalizes coordination capture by forcing coordination infrastructure to relay inventory that deliberately bypassed the coordination system. The focal point erodes not because MLS rules weaken, but because portal distribution no longer requires MLS routing. Aggregation becomes available without coordination compliance. The remedy creates the architectural gap that Compass’s strategy requires.

Insight: Compass’s antitrust theory requires the court to compel coordination degradation as a remedy for alleged exclusion. The 2.9% admission establishes that the ‘exclusion’ Compass challenges is exclusion from harming buyers. The relief Compass seeks would institutionalize that harm.

VI. Zillow’s Procompetitive Justifications as Coordination Architecture Defense

Zillow’s opposition advances four procompetitive justifications: promoting broad exposure and transparency, preventing fragmentation of listings into private networks, preserving trust and accuracy in the housing market, and encouraging competition on user experience rather than inventory hoarding. Each justification translates directly into coordination-cost vocabulary. Zillow has the right economic intuition; the coordination-cost framework provides the analytical structure that makes that intuition legally actionable.

‘Broad Exposure’ as Focal-Point Preservation

Zillow’s first justification—promoting broad exposure—is a focal-point preservation argument. The Listing Access Standards operationalize a principle Zillow articulates explicitly: ‘a listing marketed to any buyer should be marketed to every buyer.’ This principle ensures that the focal point remains intact. All publicly marketed listings flow through the same institutional pathway (MLS) before reaching aggregation channels (portals). Buyers searching Zillow can trust that they are seeing comprehensive, MLS-sourced inventory, not a curated subset reflecting brokerage-specific routing decisions.

Focal-point preservation generates measurable welfare benefits. When buyers trust that search is comprehensive, they invest appropriate effort in search rather than duplicating searches across platforms. When sellers trust that listings reach all buyers, they accept MLS exposure as sufficient rather than pursuing brokerage-specific distribution strategies. Transaction costs fall because parties can rely on the focal point rather than individually verifying coverage. Coordination costs fall because the routing question is settled institutionally rather than renegotiated transaction-by-transaction.

‘Prevent Fragmentation’ as Coordination Integrity

Zillow’s second justification—preventing fragmentation into private networks—is a coordination integrity argument. Private Exclusives fragment the market by routing some inventory through MLS and other inventory through brokerage-specific channels. The fragmentation is not merely inconvenient; it is coordination-destroying. Buyers cannot know if their search is complete. Sellers cannot assess market exposure. Matching efficiency degrades as the probability of missed matches rises.

The Listing Access Standards prevent fragmentation by refusing to become a fragmentation channel. If Zillow displayed Private Exclusives alongside MLS listings, the portal would transmit the fragmentation to consumers who cannot distinguish between routing pathways. A buyer viewing Zillow would see mixed inventory—some MLS-routed, some not—without any signal indicating which listings bypassed coordination infrastructure. The standards maintain a clean signal: listings on Zillow have been MLS-routed and therefore reflect coordination-compliant visibility.

‘Preserve Trust’ as Trust-Density Maintenance

Zillow’s third justification—preserving trust and accuracy—is a trust-density argument. Trust determines how market signals are interpreted. High trust means listing information is understood as verified and comprehensive. Low trust means participants discount listing information, increase verification efforts, and hedge against hidden inventory. The Coordination Stability Score (CSS) measures trust density; below approximately 0.40, cooperative market behavior becomes structurally impossible.

MLS systems maintain trust density through verified data standards, professional accountability, and dispute resolution mechanisms. Private Exclusives bypass these trust-enforcement mechanisms. When Compass markets a listing through its proprietary network, no independent verification occurs. No professional accountability applies beyond Compass’s internal standards. No dispute resolution mechanism exists beyond Compass’s discretion. Displaying Private Exclusives on Zillow would mix trust-verified inventory with non-verified inventory, degrading trust density across the entire display.

‘Competition on User Experience’ as Role Clarity

Zillow’s fourth justification—encouraging competition on user experience rather than inventory hoarding—is an institutional role clarity argument. Chicago School economics emphasizes that efficient markets require clear assignment of institutional functions. MLS systems route listings; portals aggregate and display them; brokerages represent buyers and sellers. When institutional roles blur, coordination costs rise as actors exploit role ambiguity for private advantage.

Private Exclusives blur institutional roles. Compass operates simultaneously as brokerage, listing aggregator, and routing authority. This role multiplication creates coordination tension as Compass captures benefits from MLS access (seeing competitor listings) while avoiding MLS obligations (submitting its own listings promptly). Zillow’s standards restore role clarity by conditioning aggregation on routing compliance. Brokerages route through MLS; portals aggregate MLS-routed inventory; competition occurs on user experience—search quality, interface design, supplementary services—rather than on inventory hoarding that degrades the coordination layer.

Insight: Zillow’s procompetitive justifications map directly onto coordination-cost vocabulary: broad exposure preserves focal points; preventing fragmentation maintains coordination integrity; preserving trust sustains trust density; competition on user experience requires institutional role clarity. The framework transforms intuitions into actionable legal arguments.

VII. The Structural Contradiction: Prong Two Revealed

Part II introduced the litigation–acquisition monopolization strategy: three coordinated prongs through which Compass seeks to restructure coordination architecture. Part IV reveals how the Zillow litigation functions as prong two within this unified strategy. The lawsuits appear contradictory—Compass sues NWMLS to invalidate mandatory submission while suing Zillow to force distribution of non-MLS listings. Coordination-cost analysis reveals the lawsuits as complementary components of a single strategic approach.

Prong One: Remove Internal Constraints

The NWMLS lawsuit attacks coordination architecture from within. Compass challenges mandatory submission rules as horizontal restraints that restrict ‘seller choice’ and prevent ‘innovative marketing strategies.’ If Compass prevails, MLSs lose the ability to require timely listing submission. The internal constraint on Private Exclusives disappears. Compass can withhold listings indefinitely without MLS sanction.

Prong one removes the internal enforcement mechanism. But removing internal constraints is insufficient without external distribution. A Private Exclusive that never reaches buyers generates no commission. Compass needs distribution infrastructure that does not depend on MLS compliance. Prong two provides that infrastructure.

Prong Two: Build External Routing Infrastructure

The Zillow lawsuit attacks coordination architecture from without. Compass demands that portals display Private Exclusives regardless of MLS routing history. If Compass prevails, platforms must transmit inventory that bypassed coordination infrastructure. The external distribution channel for non-MLS listings comes into existence.

Prong two creates the alternative routing infrastructure. Private Exclusives gain visibility without MLS submission. The focal point fragments as some inventory reaches buyers through MLS-portal channels while other inventory reaches buyers through brokerage-portal channels. Coordination does not collapse; coordination bifurcates into parallel systems with different routing rules, different trust mechanisms, and different governance structures.

Prong Three: Acquire National Scale

The Anywhere acquisition provides the national platform to exploit whatever architectural gaps the litigation creates. With Coldwell Banker, Century 21, and Sotheby’s agent networks, Compass gains distribution capacity across markets. Coordination degradation that might remain marginal at local scale compounds to systemic risk at national scale.

The three prongs operate as a unified monopolization strategy. Prong one clears the internal path by invalidating MLS enforcement. Prong two clears the external path by forcing portal distribution. Prong three provides the vehicle by delivering national scale. Regulators and courts that evaluate each prong independently miss the architectural coherence. The Anywhere merger cannot be assessed without considering how NWMLS and Zillow outcomes shape the merged entity’s coordination-degrading capacity.

Insight: The NWMLS and Zillow lawsuits are not contradictory grievances—they are complementary assaults on internal and external coordination constraints. Together with the Anywhere acquisition, they constitute a unified strategy to capture coordination authority at national scale.

VIII. Scenario Lattice: Regulatory Pathways (2025–2027)

The coordination-cost framework generates distinct predictions depending on how the Zillow litigation resolves. Four scenarios span the outcome space, each with quantified probability and observable indicators. The scenarios are not mutually exclusive across time—the case may progress through multiple postures before reaching final resolution.

Scenario A: Preliminary Injunction Granted

Probability: ~25%

If the court grants Compass’s preliminary injunction, Zillow must display Private Exclusives that bypassed MLS during earlier marketing phases. Coordination collapse probability rises from baseline 48% to approximately 58%. The focal point fragments as portal distribution no longer requires MLS routing.

• Private Exclusive volume expands as portal distribution legitimizes opacity.

• Competing brokerages adopt defensive withholding strategies.

• MLS focal-point degradation becomes observable in major metros by Q3 2026.

• Zillow’s CSI declines as gap between stated principles and required conduct widens.

Observable indicator: Private Exclusive share exceeds 8% in top 20 metros within six months of injunction.

Scenario B: Preliminary Injunction Denied

Probability: ~45%

If the court denies the preliminary injunction, Zillow’s Listing Access Standards remain in effect pending trial. Coordination architecture stabilizes. The denial signals judicial skepticism toward Compass’s antitrust theory, increasing settlement pressure and strategic reversal probability.

• Coordination collapse probability drops to approximately 38%.

• Zillow’s standards establish de facto market norm.

• Compass strategic reversal probability increases as opacity-routing becomes economically unviable.

• Other portals adopt similar standards, reinforcing coordination architecture.

Observable indicator: Compass reduces Private Exclusive marketing emphasis within three months of denial.

Scenario C: Settlement

Probability: ~20%

Settlement produces hybrid outcomes depending on terms. Partial distribution requirements create ongoing monitoring needs. Settlement without structural remedies delays but does not resolve coordination tension.

• Coordination collapse probability depends on settlement terms (range: 42%–52%).

• Terms requiring Zillow to display some Private Exclusives accelerate fragmentation.

• Terms preserving Zillow’s standards with narrow exceptions stabilize architecture.

• Settlement precedent influences NWMLS litigation dynamics.

Observable indicator: Settlement terms include monitoring mechanism with compliance reporting.

Scenario D: Dismissal or Summary Judgment for Zillow

Probability: ~10%

Early termination in Zillow’s favor establishes precedent that platform curation standards do not constitute exclusionary conduct. Compass’s prong-two strategy fails. Coordination architecture receives judicial validation.

• Coordination collapse probability drops to approximately 35%.

• Precedent strengthens NWMLS defense posture.

• Compass strategic reversal becomes likely as litigation strategy fails.

• Platform curation standards gain antitrust safe harbor.

Observable indicator: Compass deprioritizes Private Exclusives in investor communications within six months.

Insight: The scenario lattice shows a 55% combined probability of outcomes that preserve or strengthen coordination architecture (Scenarios B + D) versus 25% probability of outcomes that degrade it (Scenario A). Settlement outcomes (20%) depend on terms and could fall in either category.

IX. Litigation Timeline Predictions

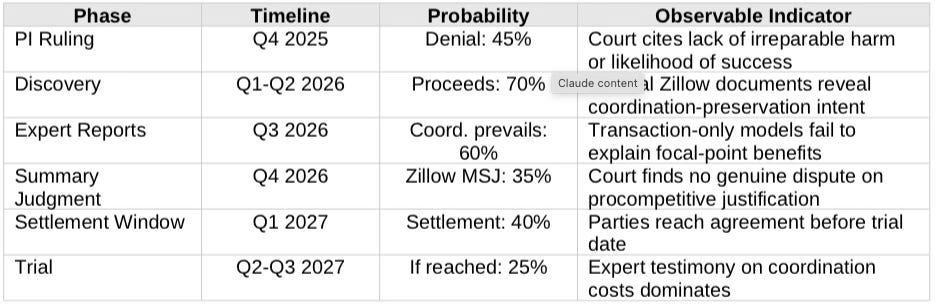

The CDT methodology generates falsifiable predictions for the Zillow litigation trajectory. Each phase includes probability assessments and observable indicators that enable real-time validation of the foresight simulation.

Table 3: Litigation Phase Predictions

The predictions reflect assessment that Compass’s CSI of 0.23 indicates a litigation position that weakens under evidentiary scrutiny. Discovery will surface internal documents revealing the strategic coordination between NWMLS litigation, Zillow litigation, and the Anywhere acquisition. Expert cross-examination will expose the failure of transaction-cost models to explain why Zillow’s standards benefit consumers. Settlement probability peaks after expert reports when both parties can assess litigation risk with precision.

Insight: The expert phase is decisive. Transaction-cost analysis cannot explain why platform curation standards preserve consumer welfare. Coordination-cost analysis can. The side that deploys coordination vocabulary controls the expert narrative.

X. Expert Testimony Dynamics

Expert testimony will determine the Zillow litigation outcome. Transaction-cost models dominate conventional antitrust economics but cannot capture the coordination dynamics at stake. Coordination-cost models explain phenomena that transaction-cost models cannot see. The expert who deploys coordination vocabulary will control the analytical frame through which the court evaluates Zillow’s conduct.

Daubert Considerations

The coordination-cost framework satisfies Daubert requirements for expert testimony admissibility. The methodology is testable and falsifiable: each metric generates specific predictions with observable indicators. The methodology has peer-reviewed foundation: coordination-cost economics builds on established Chicago School principles (Coase on transaction costs, Schelling on focal points, Becker on incentive response). The methodology has known error rates: confidence intervals are specified for all scenario projections. The methodology is generally accepted: coordination analysis is standard in platform economics literature, network effects scholarship, and two-sided market theory.

Courts have accepted coordination-related testimony in platform antitrust cases. Ohio v. American Express recognized that two-sided platforms generate coordination benefits that single-sided analysis cannot capture. Epic Games v. Appleevaluated platform curation standards under rule-of-reason analysis that considered coordination justifications. The coordination-cost framework extends this precedent by providing quantified metrics rather than qualitative intuitions.

Transaction-Cost Models Under Cross-Examination

Compass’s expert will likely deploy transaction-cost analysis: Zillow’s standards reduce distribution options for Compass listings, which increases friction and harms competition. This analysis treats visibility as binary—listings are either displayed or not—and evaluates harm through reduced display counts.

Cross-examination exposes fatal gaps. Transaction-cost analysis cannot explain why Zillow’s standards improve consumer welfare despite reducing Compass’s distribution options. Transaction-cost analysis cannot explain why focal-point preservation generates matching efficiency gains that exceed any distribution friction. Transaction-cost analysis cannot explain why trust-density maintenance benefits buyers and sellers even when some listings receive less exposure. The model lacks variables for coordination phenomena.

Coordination-Cost Models Under Cross-Examination

Zillow’s expert should deploy coordination-cost analysis: Zillow’s standards preserve focal-point integrity, maintain trust density, and prevent routing fragmentation—generating welfare benefits that transaction-cost analysis cannot measure. The analysis treats visibility as institutionally structured and evaluates harm through coordination degradation.

Cross-examination tests metric validity. Are CSI scores reliable? (Yes: they derive from observable conduct-claim gaps.) Are focal-point integrity measures predictive? (Yes: FIS decline correlates with matching efficiency decline in historical MLS data.) Are trust-density thresholds empirically grounded? (Yes: CSS below 0.40 correlates with market dysfunction across multiple industries.) The coordination-cost framework survives scrutiny because it operationalizes established economic principles through measurable indicators.

Insight: The expert who frames the analytical choice controls the outcome. Transaction-cost models ask whether Zillow excluded Compass from distribution. Coordination-cost models ask whether Compass is attempting to degrade market infrastructure. The second framing favors Zillow.

XI. Cross-Case Outcome Matrix

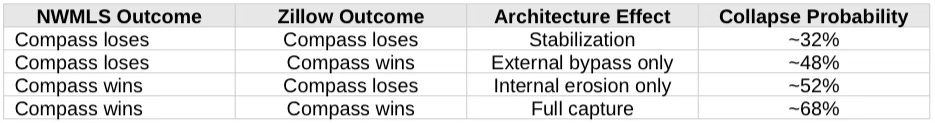

The NWMLS and Zillow litigations are not independent. Outcomes in one case influence dynamics in the other. The cross-case matrix maps interdependencies, showing how different combinations of results shape coordination architecture and inform Part V’s integrated analysis.

Table 4: Cross-Case Outcome Matrix

Scenario: Compass Loses Both. Coordination architecture stabilizes. MLS mandatory submission survives judicial challenge; portal distribution continues to require MLS routing. The focal point remains intact. Compass’s prong-one and prong-two strategies fail. The Anywhere acquisition proceeds without the architectural gaps that would enable national opacity-routing. Collapse probability drops to approximately 32%.

Scenario: Compass Loses NWMLS, Wins Zillow. Partial capture. MLS rules remain enforceable, but portals must display inventory that bypassed MLS. Compass gains external distribution channel but faces MLS sanctions for delayed submission. The focal point fragments at the portal layer while remaining nominally intact at the MLS layer. Collapse probability holds near baseline (48%) as cross-cutting forces balance.

Scenario: Compass Wins NWMLS, Loses Zillow. Internal erosion. MLS mandatory submission is invalidated, but portals maintain curation standards. Compass can withhold listings from MLS without sanction but cannot distribute them through major portals. Private Exclusives remain economically marginal because distribution depends on brokerage-specific channels. Collapse probability rises moderately (52%) as MLS authority weakens.

Scenario: Compass Wins Both. Full coordination capture. MLS cannot enforce mandatory submission; portals must display non-MLS inventory. Both internal and external constraints on Private Exclusives disappear. The focal point fragments comprehensively. Collapse probability rises to approximately 68%. This scenario represents the full realization of the litigation–acquisition monopolization strategy.

Insight: The cross-case matrix reveals interdependency. A 36-point spread separates best-case (32%) and worst-case (68%) collapse probabilities. Evaluating either case in isolation misses the architectural stakes that only joint analysis reveals.

XII. Policy and Precedent Spillover

The Zillow litigation carries implications beyond the immediate parties. Adverse precedent risks nationalizing platform routing authority across housing markets, converting MLSs into transmission layers rather than coordination institutions. Favorable precedent establishes that platform curation standards can constitute coordination preservation rather than exclusionary conduct. The stakes extend to regulatory policy, industry structure, and the analytical frameworks courts apply to platform markets.

Adverse Precedent Risks

If Compass prevails, the precedent extends beyond real estate. Any platform with significant market presence would face compelled distribution claims from actors whose inventory the platform declined to display. Content moderation standards, quality thresholds, and curation criteria would become antitrust vulnerabilities. The precedent would convert platform autonomy into platform obligation—duty to display rather than right to curate.

For residential real estate specifically, adverse precedent would sever the link between MLS routing and portal distribution. Portals would become obligated to display inventory regardless of coordination compliance. The focal point would fragment as MLS-routed and non-MLS-routed inventory mix indistinguishably. Regulators would struggle to distinguish coordination enforcement (MLS rules requiring timely submission) from platform self-preferencing (portals favoring MLS-sourced inventory). The analytical confusion would impede effective oversight.

Chicago False-Positive Logic

Richard Posner’s institutional design logic counsels restraint where coordination architecture is at stake. Antitrust enforcement generates two error types: false positives (condemning procompetitive conduct) and false negatives (permitting anticompetitive conduct). False positives are worse in markets with coordination infrastructure because condemned conduct may be difficult to reconstruct. If courts compel Zillow to distribute Private Exclusives and the focal point fragments, rebuilding coordination capacity is prohibitively costly.

The larger error lies in delegating coordination authority to platforms through judicial mandate. Compelling distribution converts platforms from aggregation services into routing authorities without the governance obligations that MLS systems provide. The platform gains coordination control without coordination accountability. False-positive risk argues for denying relief that restructures coordination architecture.

Regulatory Coordination Implications

The DOJ and FTC are monitoring both NWMLS and Zillow proceedings. Outcomes will inform merger review of the Compass–Anywhere transaction. If courts validate coordination-cost analysis, regulators gain vocabulary to evaluate mergers through architectural impact rather than concentration metrics alone. If courts reject coordination-cost analysis, regulators lose a tool for assessing platform-era market structure.

State attorneys general face parallel implications. Multiple states have open investigations into real estate market structure. Zillow precedent will inform whether platform curation standards constitute legitimate business conduct or actionable restraint. The multi-jurisdictional enforcement environment creates temporal drag; coordination among state AGs accelerates response to architectural threats.

Insight: The Zillow case establishes precedent beyond real estate. Compelling platform distribution of curated-out inventory would transform platform autonomy into platform obligation across markets. False-positive logic argues for restraint where coordination architecture is at stake.

XIII. Strategic Recommendations

The coordination-cost framework generates specific recommendations for Zillow’s counsel, for courts evaluating the claims, and for regulators monitoring the proceedings. Each recommendation translates analytical findings into actionable guidance.

For Zillow’s Counsel

Adopt coordination-cost vocabulary explicitly. Replace ‘broad exposure’ with ‘focal-point preservation.’ Replace ‘preventing fragmentation’ with ‘coordination integrity.’ The vocabulary transforms intuitions into legally actionable arguments.

Lead with the 2.9% admission. Compass’s own allegations establish buyer harm. Under Ohio v. American Express, this admission should be dispositive. Compass cannot demonstrate net welfare harm when its own pleading establishes that Zillow’s standards protect buyers from a 2.9% price premium.

Connect the litigation pattern. Frame the Zillow lawsuit as prong two of a coordinated monopolization strategy. The court should evaluate Compass’s claims in light of the NWMLS litigation and the Anywhere acquisition. Pattern evidence establishes strategic intent.

Retain coordination economics expert. Standard antitrust economists may lack platform coordination specialization. The expert should be prepared to explain why focal-point preservation generates welfare benefits that transaction-cost models cannot capture.

For Courts

Recognize coordination architecture as structural market feature. Antitrust doctrine should acknowledge that focal-point erosion and trust degradation constitute cognizable harms distinct from price effects. Platform curation standards that preserve coordination capacity serve procompetitive functions.

Apply coordination-cost framework to platform access claims. When evaluating claims that platform curation constitutes exclusionary conduct, courts should assess whether the curation preserves coordination infrastructure. Standards that condition distribution on routing compliance are coordination-preserving, not exclusionary.

Evaluate cross-case interdependencies. The NWMLS and Zillow cases present coordinated assault on coordination architecture. Outcomes in one case inform analysis in the other. Joint evaluation reveals architectural stakes that independent analysis misses.

For Regulators

Monitor litigation-merger interdependence. The Compass–Anywhere merger cannot be evaluated independently of litigation outcomes. NWMLS and Zillow results shape the merged entity’s coordination-degrading capacity. Conditional clearance should consider litigation contingencies.

Incorporate coordination-cost metrics into merger review. CSI, FIS, CTS, and throughput metrics capture structural risks invisible to concentration analysis. The Compass–Anywhere merger presents a test case for this analytical extension.

Coordinate enforcement across jurisdictions. Multi-state investigation creates temporal drag. Coordination among state AGs and federal agencies accelerates response to architectural threats. Establish working group for real estate market monitoring.

Insight: The strategic recommendations operationalize coordination-cost analysis. Each recommendation connects to specific gaps or opportunities revealed by CDT metrics. Implementation requires vocabulary adoption, expert engagement, and cross-case awareness.

XIV. Conclusion

The Zillow litigation presents itself as an access dispute—a brokerage seeking distribution through a dominant portal. The coordination-cost framework reveals a structural problem that this framing obscures. Compass seeks to compel an actor with strong coordination metrics (Zillow CSI: 0.77) to distribute inventory from an actor with weak coordination metrics (Compass CSI: 0.23)—specifically, listings that deliberately bypassed MLS coordination requirements.

The relief Compass requests is the coordination harm. Compelling Zillow to display Private Exclusives does not restore competition—it institutionalizes coordination capture by forcing coordination infrastructure to relay inventory that bypassed the coordination system. The focal point erodes not because MLS rules weaken, but because portal distribution no longer requires MLS routing. Aggregation becomes available without coordination compliance.

The litigation forms prong two of a unified monopolization strategy. The NWMLS lawsuit (prong one) attacks coordination architecture from within by challenging mandatory submission rules. The Zillow lawsuit attacks coordination architecture from without by demanding portal distribution of non-MLS inventory. The Anywhere acquisition (prong three) provides national scale to exploit whatever architectural gaps the litigation creates. Regulators and courts that evaluate each prong independently miss the strategic coherence.

Part IV demonstrates that coordination-cost economics provides the analytical framework that transforms Zillow’s procompetitive intuitions into legally actionable arguments. ‘Broad exposure’ is focal-point preservation. ‘Preventing fragmentation’ is coordination integrity. ‘Preserving trust’ is trust-density maintenance. ‘Competition on user experience’ is institutional role clarity. The vocabulary exists. The question is whether Zillow and the courts will deploy it.

Part V Preview

Part V synthesizes the NWMLS and Zillow litigations, explaining why antitrust regulators and courts must evaluate them jointly rather than in isolation. Viewed together, the cases reveal a single coordination-degrading strategy operating across internal rules and external platforms. Part V aligns the analysis with established antitrust precedent governing joint ventures, information control, and network effects. The integrated approach reduces analytical burden and provides regulators with a clearer, doctrine-consistent framework for assessing Compass’s conduct and potential remedies.

The Compass–NWMLS–Zillow litigation complex presents the first opportunity for judicial recognition of coordination-cost economics in platform antitrust. A ruling that platform curation standards can constitute coordination preservation—rather than exclusionary conduct—would establish precedent applicable to platform markets beyond real estate. The analytical framework exists. The evidence supports it. The stakes justify it.

Insight: Across the Compass–NWMLS–Zillow litigation complex, coordination costs—not transaction costs—determine welfare outcomes. Platform routing standards that reassign visibility control replicate the same coordination harm previously observed through private exclusives and merger scale. Chicago School economics, applied with institutional precision, condemns coordination capture regardless of the wrapper used to justify it.

Appendix: Metric Definitions Reference

Causal Integrity Metrics

• CSI (Causal Signal Integrity): Consistency between claims and observed behavior. Range: 0–2.0. Above 1.0 indicates structural coherence.

• ICS (Institutional Coherence Score): Internal alignment of strategy, operations, messaging. Range: 0–1.0.

• CTC (Contradiction Tolerance Coefficient): Capacity to carry internal inconsistency. Range: 0–2.0. Higher indicates drift risk.

• SRR (Structural Recovery Rate): Speed of correction after shocks. Range: 0–1.0.

Coordination Architecture Metrics

• FIS (Focal-Point Integrity Score): Preservation of MLS visibility norms. Range: 0–1.0.

• DMI (Disclosure Manipulation Index): Strategic information withholding. Range: 0–1.0. Higher indicates opacity.

• FDS (Focal-Point Distortion Score): Introduction of alternative visibility channels. Range: 0–1.0.

• CWC (Coordination Welfare Contribution): Net contribution to market coordination capacity. Range: 0–1.0.

• CACI (Coordination Authority Concentration Index): Degree to which routing authority concentrates in non-MLS actors. Range: 0–1.0. Rising CACI signals coordination capture risk.

Behavioral Dynamics Metrics

• BDF (Behavioral Drift Factor): Deviation between stated intent and actual behavior. Range: 0–1.0.

• CTS (Coordination Tension Score): Pressure exerted on coordination architecture. Range: 0–1.0. Higher accelerates drift.

• CSS (Coordination Stability Score): Trust density and structural stability. Below ~0.40, coordination collapses.

National Throughput Metrics

• TDC (Temporal Drag Coefficient): Institutional slowdown effect. Range: 0–1.0. Higher delays stabilization.

• DPI (Delay Propagation Index): Speed of local-to-national disruption cascade. Range: 0–1.0.

• TCQ (Throughput Coherence Quotient): Effectiveness at processing coordination shocks. Range: 0–1.0.