MCAI Investor Vision: Modeling Capital Cognition in the AI Market

A Cognitive Simulation of Investor Logic Under Narrative Pressure

See also Executive Summary of AI Investment Series (Sep 2025), and follow up companion studies:

Legacy, Institutional Innovation, and the Future of Capital Stewardship applies these tools to wealth stewardship archetypes, showing how trust preservation has overtaken performance as the central benchmark.

Archetypes in AI Investment explores how institutional DNA translates into AI bets, revealing instincts and vulnerabilities in adoption.

AI Investment Institutions and Public Trust examines credibility under pressure, defining trust as survival capital and highlighting archetype-specific vulnerabilities.

The Investor Guide to AI Investment Allocation synthesizes the prior insights into practical frameworks for due diligence, portfolio design, and implementation.

Executive Summary

In a market flooded with noise, narrative saturation, and low-friction hype, the greatest edge for both investors and startups is not speed—it’s cognitive fit. Using the MindCast AI (MCAI) framework, this study introduces InvestorVision, a cognitive simulation model that reveals how different investors perceive signal, filter founders, and allocate capital in the chaos of the early-stage buzz market. By modeling five high-profile investors—Cathie Wood, Peter Thiel, Ray Dalio, Chamath Palihapitiya, Masayoshi Son—alongside a baseline Standard VC Cognitive Digital Twin (CDT), we demonstrate how investment decisions are shaped by worldview, narrative fluency, and internal coherence. This study offers startups a practical map to improve capital alignment, and gives investors a mirror to assess whether their behavior matches their thesis—or their fear.

I. Introduction

In today’s hyper-saturated startup ecosystem, the early-stage investment market—particularly in AI—is defined more by narrative velocity than by technological substance. Startups launch, fundraise, and collapse within 12-month cycles. Investors face an increasingly difficult task: filtering real signal from performative hype in a Buzz Market that rewards charisma over clarity. The purpose of this study is to reframe early-stage investing not as a financial transaction, but as a cognitive alignment problem. Using the MCAI system, we introduce InvestorVision, a cognitive modeling framework that simulates how different investors perceive risk, interpret traction, and act on conviction. By understanding the mental architecture behind capital allocation, both startups and investors can improve their decision quality, alignment, and long-term outcomes.

Contact mcai@mindcast-ai.com to partner with us on AI market foresight simulations.

Defining InvestorVision

InvestorVision is a CDT-driven framework that models investor behavior as a function of identity, narrative posture, and strategic consistency. It simulates not just what an investor might fund, but why—capturing the cognitive filters that shape investment logic under uncertainty. InvestorVision maps how investors evaluate founders, timing, narrative credibility, and traction signals across stages of innovation. It incorporates two core metrics:

Action-Language Integrity (ALI): How closely an investor’s public thesis aligns with their actual capital behavior.

Cognitive-Motor Fidelity (CMF): The consistency between what an investor believes, what they say, and how they execute across time.

Together, these metrics create a high-resolution simulation of investor pattern recognition, bias exposure, and narrative discipline—allowing us to model the invisible structures behind portfolio strategy.

MCAI’s Cognitive Simulation Approach

MCAI is a cognitive modeling system designed to simulate decision-making under complexity, ambiguity, and narrative pressure. At its core is the CDT—a structured model of how a real-world actor (e.g., investor, founder, regulator) interprets the world and makes decisions. MCAI builds CDTs by integrating behavioral economics, law and economics, emotional signaling, and pattern-based reasoning. Each CDT undergoes a recursive simulation loop that tests decision integrity across moral, strategic, and reputational stressors. For this study, MCAI is applied to six investor profiles, including five public figures and one Standard VC archetype. The goal is not to replicate financial models, but to simulate cognitive decision structures—so that startups can speak to them more effectively, and investors can see themselves more clearly.

II. Why Focus on the Buzz Market

The Buzz Market as the Pressure Point

The Buzz Market is the entry layer of innovation—a volatile, overpopulated frontier where capital, attention, and ambition collide. It is where most AI startups begin and where most will end. Yet despite its instability, the Buzz Market shapes perception, sets funding patterns, and primes narratives that influence the entire investment stack. For investors, this layer represents both the greatest opportunity for outsized returns and the highest risk of narrative-induced misallocation. For startups, it is the battleground for initial visibility, belief formation, and the first injection of institutional trust. The goal of this study is to simulate how different investor minds process this chaos—and how cognitive fit determines who escapes the churn.

Buzz Market Characteristics

The Buzz Market is defined by five core attributes:

• Low Barrier to Entry: Open-source models, no-code tools, and abundant accelerators mean that anyone with a pitch deck and a demo can be labeled “AI.”

• High Churn Rate: Startups emerge and dissolve in 12–18 month windows; many never survive beyond their first funding round.

• Founder Instability: Job-hopping leadership, inflated LinkedIn credentials, and little product discipline make founder risk difficult to assess.

• Astroturfing: Manufactured virality through PR firms, influencer endorsements, and synthetic traction often mask deeper fragility.

• Capital Swarm Behavior: Investors cluster around media cycles rather than first-principles analysis, compounding narrative distortion.

InnovationVision Tier 1 Profile

According to the InnovationVision Tier Ladder, the Buzz Market is classified as Tier 1: Buzz: Visibility without validation. Hype without behavioral anchoring. At this stage, startups may demonstrate compelling demos or generate media attention, but they lack:

• Consistent user feedback loops

• Repeat behavior from customers

• Structural enablement of new workflows, decisions, or markets

The key danger at Tier 1 is false signal interpretation—mistaking noise for market fit.

Narrative Volatility vs Actual Enablement

In Tier 1, narrative volatility outpaces functional enablement. A company’s story, branding, or founder persona may surge in influence before a product ever meets its user. This creates distortion across three levels:

1. Investor decisions may over-index on social proof rather than internal logic.

2. Startups optimize for perception instead of product.

3. Markets shift valuation too early, creating unrealistic expectations at later tiers.

This dislocation creates fragility, making Buzz Market investing a test not of timing, but of cognitive filtering.

Challenges in Extracting Signal

Extracting signal from the Buzz Market is less about data volume and more about cognitive discrimination. Challenges include:

• Noisy traction metrics (e.g., downloads without retention)

• Founder mimicry (e.g., language borrowed from successful pitch decks)

• Narrative laundering (e.g., hype reframed as thought leadership)

• Short-cycle survivorship bias

InvestorVision addresses this by simulating how investors interpret traction, team credibility, and timing through their cognitive lens, revealing not just what they fund—but why they believe.

III. MCAI Framework: Building the InvestorVision Cognitive Digital Twin (CDT)

In the context of investment modeling, a CDT is a structured representation of how an investor makes decisions under uncertainty. Rather than mimicking outputs or projecting generic preferences, CDTs reflect how specific investors interpret founders, assess timing, filter narrative, and allocate risk. Each CDT is constructed using public signals—investment history, portfolio themes, timing patterns, and thesis statements—to simulate decision posture.

InvestorVision applies this framework not to financial forecasting, but to behavioral consistency analysis. For example, an investor whose recent bets conflict with their stated thesis would register a lower Thesis-Adherence Index, while one whose investments consistently coincide with narrative apexes might show elevated Timing Deviation Scores. These structured measurements allow both founders and capital allocators to anticipate how investors behave—not just at their best, but under narrative distortion.

Integrity and Consistency as Strategic Differentiators

InvestorVision emphasizes two dimensions that often determine capital effectiveness: consistency of principle and coherence under stress. These are measured, respectively, by:

Thesis-Adherence Index (TAI): Evaluates how well an investor’s actual funding activity aligns with their publicly stated investment themes.

Conviction Deviation Metric (CDM): Captures shifts in strategy, entry timing, or sector focus triggered by market hype or public pressure.

These metrics help separate investors who operate from durable conviction from those who drift under momentum. Crucially, they also allow startups to identify investor alignment beyond branding—choosing backers whose behavioral patterns match their growth model.

Investor Inputs and Comparative Modeling

Each InvestorVision CDT is defined through publicly observable behaviors, not internal mechanisms. Core inputs include:

Stated Investment Thesis: Pulled from interviews, fund materials, and public letters.

Pattern Filters: Inferred from prior investments, founder selection trends, and timing behavior.

Exit Logic: Analyzed based on liquidity events, follow-on participation, and holding duration.

Signal Selectivity Ratio (SSR): Compares early-stage entry count to downstream success, capturing noise tolerance and signal discipline.

These inputs allow InvestorVision to simulate how each investor CDT would engage with high-uncertainty environments like the Buzz Market—mapping their likely response to founder types, traction signals, and narrative shifts.

Quantifying Cognitive Behavior in InvestorVision

To ensure that this is more than qualitative modeling, InvestorVision applies a suite of behavioral indicators, including:

Thesis-Adherence Index (TAI)

Timing Discipline Score (TDS)

Signal Selectivity Ratio (SSR)

Conviction Deviation Metric (CDM)

Each metric is calibrated using publicly available information—deal history, media signals, and portfolio outcomes—and does not rely on internal algorithms, confidential investor strategies, or private data. This allows the system to function as a non-invasive mirror: reflecting how consistent, disciplined, or reactive each investor is, without requiring disclosure or speculative inference.

IV. Investor Profiles and CDT Characterizations

Every investor brings more than capital—they bring cognition. How they filter founders, interpret traction, and respond to narrative pressure varies not just by fund size or stage, but by internal logic. The InvestorVision CDT frameworksimulates this logic by modeling six investor archetypes, each with a distinct behavioral fingerprint. By applying structured metrics—Thesis-Adherence Index (TAI), Timing Discipline Score (TDS), Signal Selectivity Ratio (SSR),and Conviction Deviation Metric (CDM)—we can assess how each investor behaves under conditions of hype, ambiguity, and momentum. This section profiles five high-profile investors and one standard VC archetype, revealing how their cognitive patterns shape decision funnels in the Buzz Market—and what that means for the startups pitching to them.

1. Cathie Wood – Thematic Evangelist

Cathie Wood is a conviction-driven investor who adheres tightly to thematic innovation narratives—particularly in AI, genomics, energy, and automation. She exhibits a high Thesis-Adherence Index (TAI), reflecting alignment between her capital and her public thesis. However, her Timing Discipline Score (TDS) and Signal Selectivity Ratio (SSR) are moderate, as she frequently enters markets at narrative peaks, exposing herself to valuation volatility.

In the Buzz Market, Wood operates as a signal amplifier, funding startups that align with her vision even if they lack early traction. She overweights thematic fit relative to operational validation, which can accelerate exposure for founders—but also inflate pressure to deliver under shallow foundations.

InvestorVision Funnel: Theme → Vision Match → Sector Alignment → Founder Fluency → Future Impact

2. Peter Thiel – Contrarian Philosopher

Peter Thiel’s CDT is marked by high ideological coherence and anti-herd thinking. He scores high across all core metrics, including Conviction Deviation Metric (CDM) and Signal Selectivity Ratio (SSR), indicating that he resists short-term hype and filters for contrarian insight. His funding decisions are shaped by worldview consistency rather than market timing.

In the Buzz Market, Thiel plays the role of a narrative resistor. He avoids polished pitch decks and trend-mimicking founders, instead seeking ideas that invert prevailing consensus. Startups hoping to attract Thiel’s capital must demonstrate asymmetric knowledge and philosophical depth—not simply buzz traction.

InvestorVision Funnel: Contrarian Thesis → Founder Intensity → Secret Insight → Narrative Reversal → Market Fragility

3. Ray Dalio – Macro Systems Architect

Ray Dalio operates on an entirely different axis than the other investors modeled here. His CDT reflects perfect or near-perfect scores in Thesis-Adherence Index (TAI) and Timing Discipline Score (TDS), but his approach is systemic, not transactional. He doesn’t engage the Buzz Market as an allocator, but as a forecaster.

Dalio observes early-stage overinvestment as a signal of broader systemic distortion. In this context, he is a meta-observer—modeling narrative cycles, liquidity shocks, and geopolitical misalignment rather than startup-by-startup performance. His CDT is instructive for understanding second-order consequences of Buzz Market capital flows.

InvestorVision Funnel: System Modeling → Capital Flow Distortion → Risk Signals → Strategic Forecast

4. Chamath Palihapitiya – Narrative Opportunist

Chamath blends moral vision with high responsiveness to public attention cycles. His CDT scores moderately on TAI and SSR, but lower on CDM, reflecting inconsistencies between stated values and portfolio actions—particularly during SPAC-era overextension. He excels at framing companies in narratives that gain traction with public and retail investors.

In the Buzz Market, Chamath behaves as a narrative projector. He invests in companies that carry a public mission, sometimes regardless of operational substance. Startups that align with current public discourse—equity, sustainability, mental health—can attract his support even if their infrastructure is still developing.

InvestorVision Funnel: Social Narrative Fit → Founder Persona → SPAC/IP Narrative → Impact Story → Funding Momentum

5. Masayoshi Son – Vision Maximalist

Masayoshi Son is a high-volatility investor who seeks transformative potential above all else. His CDT scores low on TDS, SSR, and CDM, reflecting a pattern of capital overexposure to charisma and unproven scale. He aims not to detect signal but to create it, often by writing enormous checks into category narratives.

In the Buzz Market, Son acts as a capital magnifier. He injects energy into stalled or speculative narratives with late-stage funding, which can lift startups onto global stages—but also create distortion if product foundations are weak. Founders must be prepared for aggressive scale expectations and limited tolerance for strategic pivots.

InvestorVision Funnel: Vision Statement → TAM Promise → Founder Energy → Vertical Dominance → Blitzscale Thesis

6. Standard VC CDT – The Pattern Matcher (see *appendix)

The Standard VC CDT represents the median behavior of early-stage institutional investors. It is characterized by low Thesis-Adherence Index (TAI) and moderate Signal Selectivity Ratio (SSR), indicating tactical agility and short-term optimization. This archetype is not driven by ideology, but by traction optics, credential signaling, and exit timing.

In the Buzz Market, this investor operates as a momentum rider—entering early, helping generate valuation lift through PR and demo days, and exiting before the signal decays. It funds startups that look fundable, not necessarily those that are resilient. While easy to pitch, this capital often lacks strategic staying power.

InvestorVision Funnel: Founder Resume → Demo/Deck Appeal → Upmarket Validation → Buzz Momentum → Convertible Exit

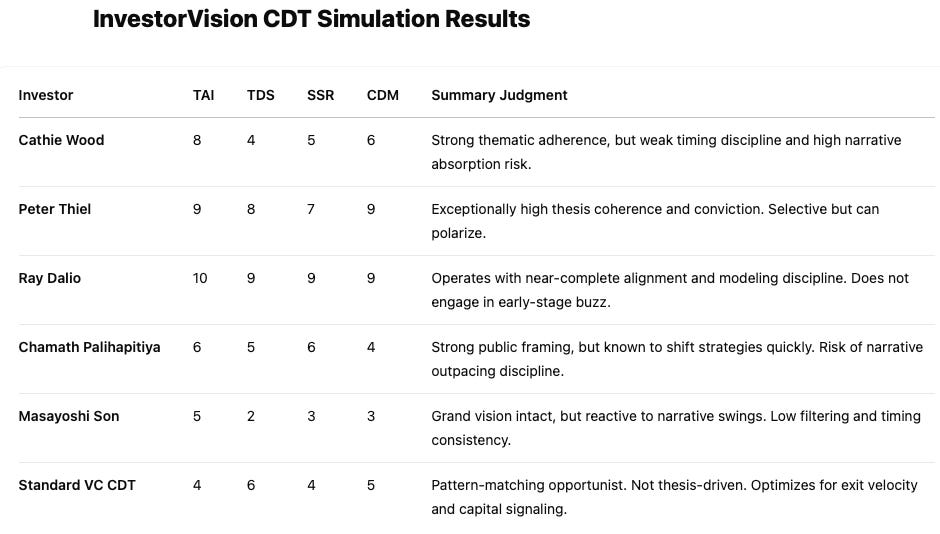

Running the InvestorVision CDT Flow for the six investors—Cathie Wood, Peter Thiel, Ray Dalio, Chamath Palihapitiya, Masayoshi Son, and the Standard VC CDT—using four structured behavioral metrics:

• Thesis-Adherence Index (TAI)

• Timing Discipline Score (TDS)

• Signal Selectivity Ratio (SSR)

• Conviction Deviation Metric (CDM)

Each is scored on a 0–10 scale, where: 10 = Highly consistent, disciplined, and aligned; 0 = Reactive, opportunistic, or incoherent under stress.

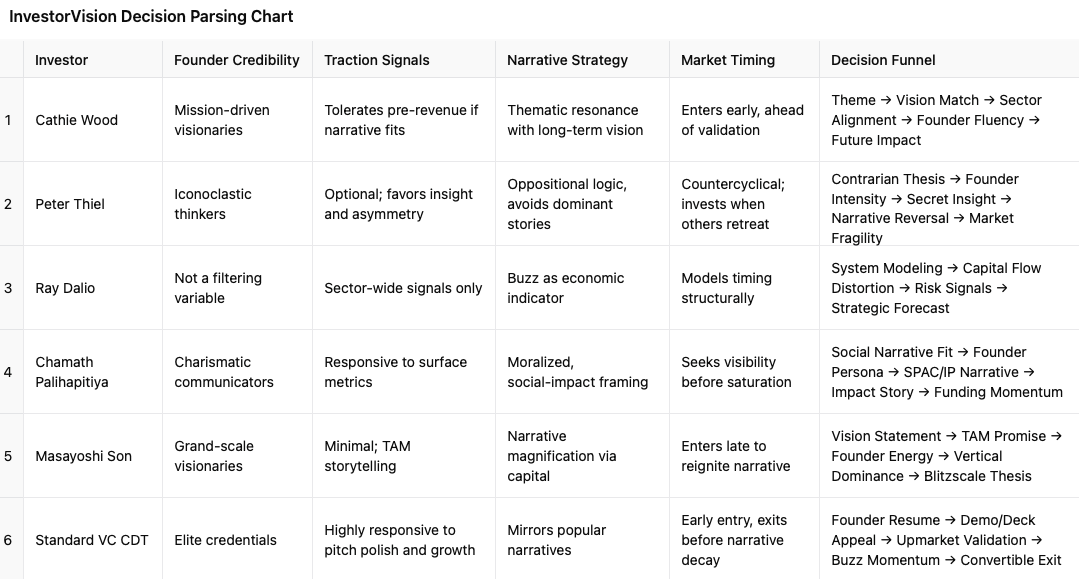

V. Buzz Market Decision Simulation

The Buzz Market floods the early-stage landscape with charismatic founders, social-driven traction, and narrative surges that often outpace real enablement. Each investor filters this environment through a unique cognitive lens. The InvestorVision CDT framework simulates how six distinct investor types assess early-stage opportunities across four key domains: founder credibility, traction signals, narrative strategy, and market timing. These filters form the basis of the investor’s decision funnel—and determine who gets funded, why, and at what stage of hype or validation.

Conclusion: Parsing as a Strategic Signature

These decision funnels demonstrate that early-stage investment is not driven by consensus, but by cognitive diversity. Thiel and Dalio anchor in deep conviction and strategic frameworks; Chamath and Son ride narrative energy or deploy capital as force multipliers. Meanwhile, the Standard VC CDT optimizes for speed, pattern recognition, and tactical exits. In the noise of the Buzz Market, these funnels don't just reflect preference—they reveal strategy under pressure. For startups and investors alike, understanding these parsing systems is the key to building aligned relationships—and distinguishing scalable momentum from fleeting attention.

VI. Takeaways for AI Startups

The InvestorVision framework is more than an investor analysis tool—it’s a strategic compass for founders operating in an early-stage environment where narrative often outpaces substance. In the Buzz Market, where charisma and virality can overshadow product integrity, startups must prioritize cognitive alignment over capital volume. Securing the right kind of investor—one whose decision logic matches the startup’s trajectory—can be the difference between scaling with support or imploding under pressure. Here are four key takeaways for AI founders navigating this landscape:

1. Treat Investor Meetings as Cognitive Diagnostics

Every investor filters the world differently. Some seek thematic resonance (like Cathie Wood), others look for nonconformist insight (like Peter Thiel), systemic alignment (like Ray Dalio), or short-term traction stacking (like the Standard VC CDT). Founders should listen closely to the questions investors ask, the metrics they emphasize, and the language they trust. These cues reveal how each investor thinks—and whether their worldview is built for your roadmap.

2. Customize Your Pitch to the Cognitive Filter

A generic pitch is a missed opportunity. InvestorVision makes it clear: different CDTs prioritize different signals.

Pitching Thiel? Emphasize asymmetry, ideology, and contrarian insight.

Targeting Chamath? Lead with moral urgency and social scale.

Engaging a Pattern Matcher? Stack brand signals, traction metrics, and market buzz.

Aligning your narrative with the investor’s filtering style improves not just your odds of funding, but the quality of the post-investment relationship.

3. Convert Buzz Into Behavioral Signal

Buzz is a useful accelerant—but a poor foundation. Founders must treat virality as a window of leverage, not an end goal. Use that momentum to gather meaningful data, validate user behavior, and build product depth. InvestorVision helps founders frame this transition—from Tier 1 visibility to Tier 2 signal—as a deliberate shift. Momentum can open doors; signal keeps them open.

4. Choose Capital That Matches Your Cognitive Pace

Mismatched capital is more dangerous than no capital. Some investors demand speed when you need stability. Others tolerate ambiguity when you need accountability. In the Buzz Market, the wrong backer can pressure pivots, distort product decisions, or collapse conviction at the first sign of friction. InvestorVision gives founders the language to assess not just how much capital to raise—but who they want riding alongside them.

When AI startups understand how capital thinks, they stop chasing money and start recruiting allies. InvestorVision equips founders to select partners based on shared tempo, worldview, and depth of conviction—building companies that are not only fundable, but built to endure.

VII. Conclusion: Aligning Minds Before $$$

The Buzz Market rewards speed, narrative mastery, and surface traction—but often at the cost of depth, durability, and strategic coherence. In this environment, capital moves fast, but conviction moves few. InvestorVision reframes the startup-investor relationship as a matter of cognitive fit, not just term sheets or trend alignment. By simulating how different investors interpret signal, manage timing, and engage with founders, this study reveals that every check is a reflection of worldview—and every misalignment is a risk multiplier.

For investors, InvestorVision offers a mirror: Are your actions aligned with your thesis, or are you being pulled by momentum you claim to resist? For startups, it’s a roadmap: Who sees the world like you do, and who’s just passing through on the hype cycle? The most resilient companies will be built not by chasing the loudest capital, but by partnering with investors who think in sync—who share your tempo, your filters, and your framing of risk.

The future of early-stage AI is too important to be dictated by short-term optics. The next generation of breakout startups won’t just raise faster—they’ll raise smarter. In a world full of noise, InvestorVision helps both sides tune to signal—and build what lasts.

Prepared by Noel Le, Founder | Architect of MindCast AI LLC. He holds a background in law and economics, and behavioral economics. Noel spent his career developing advanced technologies for intellectual property management.

MCAI conducts complimentary white papers as proof of ROI for select clients. Contact us for more info. MindCast.AI@icloud.com

*Appendix: Defined: Standard VC CDTm The Pattern Matcher

Investment Logic: Chases thematic heat, favors credentialed founders, replicates successful pitch archetypes

Signal Style: Surface traction (user growth, demo virality), media buzz, downstream funding likelihood

Exit Focus: Series A uplift or M&A

Strategic Posture: Low conviction, high agility. Will abandon portfolio companies quickly if signal degrades

ALI Risk: High—often markets itself as “mission-driven” while deploying capital for cyclical returns

CMF Profile: Moderate—operationally consistent but low identity fidelity

Primary filters (signal type, founder bias, narrative threshold)