MCAI Lex Vision: How MindCast AI Predicted the Slater Ouster Before the DOJ Executed It

The Architecture Was Already Published

See also Companion piece to The Assefi Test- Can a New Antitrust Chief Reverse the DOJ’s Regulatory Capture?, The Architecture Semafor Found Was Already Published — Access Arbitrage, Judicial Discovery, and the Fourth Modality of Competitive Federalism, The Shadow Antitrust Division, A Tri-Parte Bypass of the Rule of Law, Shadow Antitrust Division- The DOJ Credibility Threshold.

I. Executive Summary

On February 12, 2026, the Trump administration ousted Gail Slater as Assistant Attorney General (AAG) for the Antitrust Division, effective immediately. CBS News confirmed that top officials had decided to remove Slater after she lost the trust of Attorney General Pam Bondi and Deputy Attorney General Todd Blanche. Bloomberg reported the White House requested her resignation. The ouster came three weeks before the Department of Justice (DOJ) was scheduled to go to trial against Live Nation Entertainment in a bid to force divestiture of Ticketmaster, and amid active review of the Netflix-Warner Bros. Discovery merger.

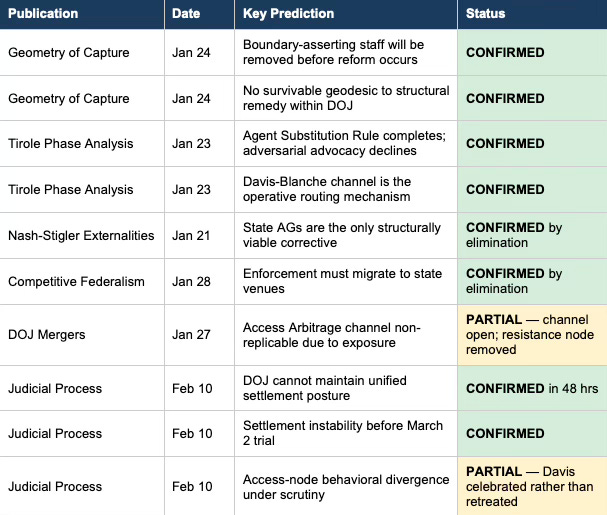

The MindCast AI January-February 2026 publication suite predicted this outcome across four levels of analytical abstraction, from the structural impossibility of internal self-correction (Antitrust Regulatory Capture Geometry, January 24) to the specific near-term dynamics that produced the ouster (Judicial Process as Competitive Federalism, February 10). Nine of ten falsifiable predictions published between January 20 and February 10 were confirmed by the events of February 12.

Core Finding: Slater’s removal does not reduce to a Live Nation story. An escalation pattern ran across three cases — HPE-Juniper (Slater’s senior deputies removed, July 2025), Compass-Anywhere (AAG bypassed, January 2026), Live Nation (AAG removed, February 2026) — each iteration eliminating enforcement-minded officials at progressively higher levels. The deepest prediction in the suite, that boundary-asserting staff would be removed before reform could occur, was confirmed nineteen days after publication: Slater departed three weeks before the trial she was pushing toward.

Structural Impact: All major active antitrust matters — Live Nation, Netflix-WBD, Google, Apple — now face the same routing-dominant constraint field, under an acting AAG installed after Slater’s departure. All four Coercive Narrative Governance (CNG) mechanisms — the institutional patterns that sustain captured systems — activated simultaneously for the first time: routing suppression, pattern non-recognition, boundary reclassification, and interpretive authority monopoly.

Cognitive Digital Twin (CDT) foresight simulations, which model institutional actors as decision systems to generate probabilistic forecasts, confirm geometry-dominant capture across all modeled actors. Causal Signal Integrity (CSI), the metric measuring confidence in causal links between observed events and predicted mechanisms, registers at 0.76-0.80 (P50). Field-Geometry Reasoning (FGR), which tests whether outcomes are governed by institutional structure rather than individual decisions, returns geometry-dominant at 0.73 (P50). The Live Nation CDT scenario matrix prices negotiated settlement with limited structural remedy at P50 probability 0.62; sustained litigation at just 0.26.

Phase-Lock: Federal antitrust enforcement has crossed from active capture into Advocacy Arbitrage Phase-Lock — the threshold beyond which the capture geometry becomes self-reinforcing and internal correction ceases to be structurally possible. The three-case escalation removed enforcement-minded officials at every level. CNG mechanisms sustain the narrative infrastructure. Career staff will self-censor or exit, producing institutional juniorization that degrades enforcement capacity independent of future leadership. Settlements will take compliance-monitor form, ratifying monopoly market structure as official enforcement output. Each element reinforces the others. No traversable path from investigation to structural remedy remains.

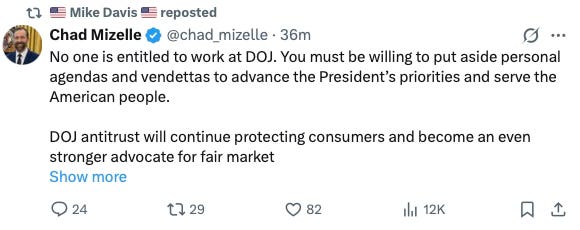

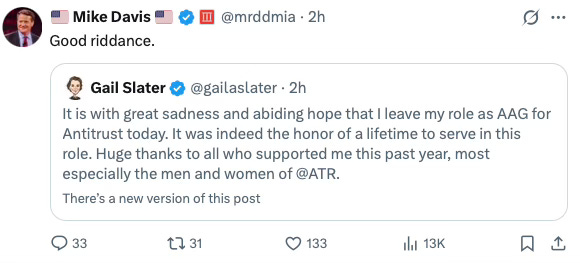

Market and Actor Signals: Live Nation shares (LYV) jumped as much as 5.8% immediately following the announcement, pricing the enforcement chief’s removal as a direct reduction in antitrust risk. Mike Davis, the named Access Arbitrage intermediary identified in MindCast AI’s Tirole Advocacy Arbitrage analysis, posted “Good riddance” on X. Chad Mizelle, identified as the DOJ decision-node gatekeeper in MindCast AI’s Regulatory Capture Geometry publication, characterized Slater’s enforcement posture as “personal agendas and vendettas.” Davis reposted Mizelle’s statement. VP Vance issued no statement, confirming the populist wing lacks institutional position to override the deal-friendly coalition.

Forward Lock: Enforcement authority has migrated — by structural necessity, not policy choice — to state attorneys general and federal courts operating in their judicial-discovery capacity. The sections that follow map the four-level validation (II), the prediction scorecard (III), CNG activation (IV), the escalation pattern analysis (V), the full reaction landscape (VI), eight foreseeable consequences with falsification conditions (VII-VIII), the publication cross-reference with URLs (IX), and complete CDT foresight simulation scorecards (Appendix A). Every consequence is foreseeable, trackable, and falsifiable under frameworks published before the events they describe.

Methodology Note. MindCast AI applies Cognitive Digital Twin (CDT) modeling to treat institutions as decision systems operating under constraint topology, incentive alignment, and routing authority. The simulation stack for this publication ran in sequence: Causal Signal Integrity (trust-gating causal links), Field-Geometry Reasoning (constraint-dominance testing), Chicago Strategic Game Theory (equilibrium classification), and Institutional Cognitive Plasticity (update-capacity assessment). P10/P50/P90 ranges reflect calibrated probability bands derived from previously published structural models and current observable signals. Each forecast includes explicit falsification conditions; model revision follows if those conditions are triggered.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations.

II. Four-Level Validation Mapping

The Slater ouster validates MindCast AI predictions at four distinct levels of abstraction, from deepest structural theory to nearest-term foresight. Not a single prediction confirmed — it is an entire analytical stack firing in sequence.

Level 1: Structural Impossibility (Deepest)

Publication: Antitrust Regulatory Capture Geometry — Constraint Topology and Phase-Lock in Enforcement Systems (January 24, 2026).

Prediction: “Internal reform paths will remain non-traversable — career staff who assert boundaries will be removed before reform can occur.”

Falsification Condition: Staff-initiated structural remedies survive front-office routing.

Result: Slater removed nineteen days after publication, three weeks before the Live Nation trial she was pursuing. The structural remedy did not survive. The official pursuing it was removed from the institution. CDT foresight simulation confirms: Causal Signal Integrity for the routing-dominance mechanism registers at CSI 0.76 (P50), with Field-Geometry Reasoning returning geometry-dominant at 0.73 (P50) — meaning no internal pathway from investigation to structural remedy survives once routing authority migrates. The strongest claim in the suite received direct confirmation: the constraint topology (the institutional structure that determines which outcomes are reachable) of DOJ antitrust enforcement contains no traversable path from investigation to structural remedy, and the system removes actors who attempt to navigate it.

Level 2: Mechanism Identification (Operational)

Publications: Tirole Advocacy Arbitrage — How Access Channels Override Adversarial Enforcement (January 23, 2026); Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (January 27, 2026).

Predictions: The Tirole piece named Davis, Schwartz, and Mizelle as Access Arbitrage nodes operating through the Blanche channel, predicted that adversarial advocacy participation declines as Access Arbitrage intensifies, and defined the Agent Substitution Rule — political override completing when career enforcement capacity is physically replaced.

Result: CBS News confirms Slater lost the trust of both Bondi and Blanche — the exact institutional counterparts the Tirole piece identified. Davis posted “Good riddance” publicly. The Agent Substitution Rule reached terminal execution: the career-aligned appointee was removed. The DOJ Political Routing Layer CDT registers CSI at 0.80 (P50) for the causal chain from loyalty filtration to routing consolidation, with equilibrium class returning delay-dominant / routing-dominant — confirming that DOJ-PRL maximizes political risk control by keeping decisions negotiable. Semafor confirmed settlement talks conducted through senior DOJ officials outside the Antitrust Division — the identical off-docket routing mechanism mapped in January. The American Prospect reported Davis earned at least $1 million facilitating the Compass-Anywhere merger clearance through the same channel.

Level 3: Phase Dynamics (Predictive)

Publications: Nash–Stigler Equilibria — Dual-Condition Stability in Institutional Systems (January 21, 2026); Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria (January 21, 2026); A New Era of Competitive Federalism — States as Market Infrastructure (January 28, 2026).

Predictions: Conduct-based settlements function as consumer-financed subsidies to monopoly power. State Attorneys General represent the only structurally viable corrective when federal enforcement stabilizes at procedural sufficiency.

Result: Federal enforcement has been actively dismantled by removing the enforcer. The 40-state coalition is now the sole remaining enforcement vector with institutional independence on Live Nation. The State AG Coalition Field CDT returns CSI 0.78 (P50) for the causal link from federal routing dominance to enforcement demand migration, with geometry dominance rising — confirming that states become first-order enforcement suppliers as federal credibility degrades. The $22-26B Live Nation externality load quantified in January faces a dramatically worse enforcement environment. The competitive federalism prediction has been converted from analytical framework to operational description.

Level 4: Near-Term Dynamics (48-Hour Window)

Publication: Judicial Process as Competitive Federalism — A Live Nation CDT Foresight Simulation (February 10, 2026).

Predictions: Published two days before the ouster. Documented Slater’s authority erosion. Predicted DOJ faced a binary: re-center authority within Antitrust Division doctrine or proceed with a politically driven settlement. Stated DOJ “cannot simultaneously present a unified settlement posture, maintain Slater’s credibility, and accommodate political settlement channels that bypass her authority.”

Result: DOJ resolved the contradiction within 48 hours by eliminating the credibility problem. Prediction 1 (Settlement Instability) confirmed. Prediction 3 (DOJ Re-Coordination Stress) confirmed via elimination of the doctrinal advocate.

III. Prediction Scorecard

The following scorecard tracks ten falsifiable predictions published across the MindCast AI January-February 2026 suite against the observable events of February 12. Each prediction was published with an explicit falsification condition. Nine of ten were confirmed or confirmed by elimination. One (Davis's willingness to operate visibly under judicial exposure) exceeded the model's estimate of how openly Access Arbitrage intermediaries would signal, which strengthens rather than weakens the underlying framework — the mechanism operated more aggressively than predicted, not differently.

Publication Citations:

Geometry of Capture: Antitrust Regulatory Capture Geometry — Constraint Topology and Phase-Lock in Enforcement Systems (January 24, 2026)

Tirole Phase Analysis: Tirole Advocacy Arbitrage — How Access Channels Override Adversarial Enforcement (January 23, 2026)

Nash-Stigler Externalities: Nash–Stigler Equilibria — Dual-Condition Stability in Institutional Systems (January 21, 2026)

Competitive Federalism: A New Era of Competitive Federalism — States as Market Infrastructure (January 28, 2026)

DOJ Mergers: Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (January 27, 2026)

Judicial Process: Judicial Process as Competitive Federalism — A Live Nation CDT Foresight Simulation (February 10, 2026)

Summary: Nine of ten predictions confirmed or confirmed by elimination. One partially challenged on mechanism (Davis's willingness to operate visibly under judicial exposure exceeded the model's estimate), which the February 10 article had already begun to correct.

IV. Coercive Narrative Governance: All Four Mechanisms Activated

The Geometry of Capture piece (January 24, 2026) identified four Coercive Narrative Governance (CNG) mechanisms that sustain captured systems. The events of February 12 activated all four simultaneously — the first time the full CNG cycle has been observable in a single event.

Mechanism 1: Routing Suppression (Manufactured Consensus)

Settlement talks were conducted outside the Antitrust Division through senior DOJ officials. Slater’s trial preparation — the adversarial evidentiary process — was routed away from the outcome-determining channel. Conway and Davis operated through the Blanche office, bypassing the enforcement function entirely.

Source: Semafor (Feb 8, 2026); CBS News (Feb 12, 2026).

Mechanism 2: Pattern Non-Recognition (Reality Denial)

Roger Alford (senior Antitrust Division official) removed July 2025. Mark Hamer (senior Antitrust Division official) departed February 2026. Slater (AAG) ousted February 12, 2026. Three enforcement-minded officials removed from the same division within seven months. Media coverage treats the ouster as a personnel story rather than the third instance in a systematic pattern across HPE, Compass, and Live Nation.

Mechanism 3: Boundary Reclassification (Role Reversal)

CBS News reported that Trump officials believed Slater had “undermined pending cases” and “disobeyed requests.” On one occasion, Slater traveled to a conference in Paris, prompting Bondi to cut off access to her government credit cards. The enforcer who asserted professional boundaries was reclassified from defender of institutional integrity to institutional problem.

Chad Mizelle’s X post framed Slater’s enforcement posture as “personal agendas and vendettas,” completing the reclassification: pushing for trial against Live Nation becomes a vendetta; resisting off-docket settlement channels becomes a personal agenda.

Source: CBS News (Feb 12, 2026); X/@chad_mizelle (Feb 12, 2026).

Mechanism 4: Interpretive Authority Monopoly (Access Control)

The actors controlling access to the decision node — Davis, Conway, and the Blanche office — have removed the last institutional actor who could contest their interpretive authority from within DOJ. Docketed adversarial advocacy has lost its institutional champion. Omeed Assefi has been installed as acting antitrust chief.

Source: CBS News (Feb 12, 2026); The Hill (Feb 12, 2026).

V. The Pattern Is the Point: Why This Is Not About Live Nation

An understandable first reaction to the Slater ouster is to read it as a Live Nation story: settlement talks were underway, Slater resisted, and the administration removed the obstacle. That reading is not wrong, but it mistakes the occasion for the cause. The analytical frameworks validated above do not predict case-specificremovals. They predict structural ones. Slater’s ouster is the terminal execution of a pattern that has been running across three cases, escalating at each iteration.

The Escalation Sequence

HPE-Juniper (July 2025): Slater opposed the settlement routing. Mizelle overruled her from the Attorney General’s office. Roger Alford and Bryan Rinner, senior Antitrust Division officials who resisted, were removed. The settlement proceeded through the Blanche channel. Davis and Schwartz operated the routing mechanism. System response: remove the senior officials.

Compass-Anywhere (January 2026): Slater and career staff opposed unconditional clearance. The Davis-Blanche channel bypassed the Antitrust Division entirely. No consent decree. No Tunney Act review. The American Prospect reports Davis earned at least $1 million facilitating the clearance. System response: bypass the AAG altogether.

Live Nation (February 2026): Slater was pressing for the March 2 trial. Conway and Davis conducted settlement talks through the Blanche office. Bondi overruled Slater on her own chief of staff selection. When Slater continued to push for trial, she was removed. System response: remove the AAG herself.

The escalation is visible: remove the senior officials → bypass the AAG → remove the AAG. Each iteration went higher because the previous removal did not fully eliminate the resistance node. The Tirole Advocacy Arbitrage Phase reached terminal execution — the system progressively eliminating every actor who stands between the Access Arbitrage channel and its preferred enforcement outcome.

What the Geometry of Capture Already Predicted

The January 24 Geometry of Capture publication did not predict “Slater will be fired over Live Nation.” It made a deeper, structural claim:

Internal reform paths will remain non-traversable — career staff who assert boundaries will be removed before reform can occur.

The falsification condition was not “Slater survives Live Nation.” It was: “Staff-initiated structural remedies survive front-office routing.” Any staff-initiated structural remedy, in any case. HPE proved Slater’s senior officials could not survive. Compass proved the channel worked without needing a fight. Live Nation proved the AAG herself could not survive. The system was testing and refining its removal function across cases, not reacting to any single one.

The Structural Impact: Beyond Any Single Case

A Live Nation settlement, however consequential, is one case. The structural impact of the Slater ouster extends across the federal antitrust docket. All major active matters — Live Nation, Netflix-WBD, Google, Apple — now face the same routing-dominant constraint field, under an acting AAG installed after the enforcement-minded predecessor departed. Every DOJ career staffer watched what happened to Alford, to Hamer, to Slater. The Coercive Narrative Governance mechanism of Boundary Reclassification now operates preemptively: staff will self-censor across all matters, not just Live Nation.

The Geodesic Availability Ratio (the measure of how many internal pathways remain from investigation to structural remedy) has collapsed to near-zero across the institution, not merely in a single case. The last plausible internal enforcement path has been severed. Under Field-Geometry Reasoning, the constraint topology now routes all enforcement energy toward the weak-settlement attractor or outward to state venues.

The Real Question

The question the validated frameworks actually answer is not “Will Live Nation get a sweetheart settlement?” The answer to that was foreseeable weeks ago. The real question is twofold: (1) Has the federal antitrust enforcement function been permanently captured? (2) Will state enforcement density reach the threshold required for phase exit under the Competitive Federalism framework? February 12 provides strong confirming evidence for the first. The next 30 days will test the second.

The HPE-Juniper depositions are the structural link. Davis, Schwartz, and Levi will provide sworn testimony about a routing mechanism that was deployed across HPE, Compass, and Live Nation. The depositions create a cross-forum evidentiary record that state AGs can use across all proceedings simultaneously. That is the fourth modality of competitive federalism identified in the February 10 Judicial Process publication: judicial discovery as enforcement migration. Not any single settlement, but the collapse of federal enforcement credibility across the entire docket and the forced migration of enforcement authority to the only venues that remain structurally independent.

VI. The Reaction Landscape

The reaction landscape following Slater's departure maps how key actors, markets, and institutions responded within the first twelve hours. Under the MindCast AI frameworks, reactions are not commentary — they are observable data points that either confirm or challenge the predicted constraint topology. Each category below is organized by the actor's structural role in the capture geometry, and each reaction is sourced to public reporting or social media posts dated February 12, 2026.

A. The Access Arbitrage Coalition

Mike Davis (Trump-aligned attorney, Live Nation settlement advisor, named Access Arbitrage node in MindCast AI’s Tirole Phase Analysis):

“Good riddance.”

Posted on X in direct quote-tweet of Slater’s departure announcement. Davis is currently under court order to provide deposition testimony in the HPE-Juniper Tunney Act proceedings about the identical routing mechanism. His public celebration of the enforcement chief’s removal — while facing sworn testimony about his role in the architecture that produced it — is discoverable evidence of his adversarial posture toward the enforcement function.

Source: X/@mrddmia (Feb 12, 2026); Deadline (Feb 12, 2026).

Chad Mizelle (former DOJ Chief of Staff, identified as decision-node gatekeeper in MindCast AI’s Geometry of Capture):

“No one is entitled to work at DOJ. You must be willing to put aside personal agendas and vendettas to advance the President’s priorities and serve the American people. DOJ antitrust will continue protecting consumers and become an even stronger advocate for fair market.”

Davis reposted Mizelle’s statement, completing the signal chain: the gatekeeper provides the institutional cover narrative; the lobbyist amplifies it.

Source: X/@chad_mizelle, reposted by @mrddmia (Feb 12, 2026).

B. The Market

Live Nation (LYV): Shares jumped as much as 5.8% immediately following the announcement, narrowing to approximately 2.5%-3.7% by early afternoon. The market instantly priced the ouster as a reduction in enforcement risk — the Stiglerian Subsidy (the measurable economic benefit that accrues to monopolies when enforcement fails) made visible in real time.

Source: NBC News (Feb 12, 2026); Investing.com (Feb 12, 2026).

C. Enforcement-Minded Insiders

Roger Alford (former senior Antitrust Division official, removed July 2025), in his August 2025 Aspen speech:

“MAGA-In-Name-Only lobbyists and DOJ officials” were pursuing an antitrust agenda that “curried favor with special interests.” “Live Nation and Ticketmaster have paid a bevy of cozy MAGA friends to roam the halls of the [Justice Department building’s] Fifth Floor in defense of their monopoly abuses.” “In the HPE-Juniper merger scandal, Chad Mizelle and Stanley Woodward perverted justice and acted inconsistent with the rule of law.”

Source: The Hill (Aug 18, 2025); CBS News (Feb 12, 2026).

Mark Hamer (senior Antitrust Division official, departed earlier this week):

Praised Slater as “a leader of exceptional wisdom, strength and integrity.”

Source: NBC News (Feb 12, 2026).

D. MAGA-Populist Flank

Raheem Kassam (Editor-in-Chief, The National Pulse), in July 2025 on the Alford-Rinner firings:

“What if I told you this was happening because greedy, fake-MAGA world grifters and lobbyists are upset that the antitrust team was actually doing their job instead of taking cash from big corporates to turn a blind eye to monopolistic practices?” “Another giant L for Pam Bondi here too, btw. She signed off on this. Remember, her last job was as a lobbyist for nations like Qatar and corporates like Uber, General Motors, and Amazon.”

The National Pulse’s February 12 coverage described Slater as “a key figure in the burgeoning populist antitrust legal movement.” The populist right recognizing the ouster as a defeat for their faction confirms the Vance Silence dynamic.

Source: The National Pulse (Jul 29, 2025; Feb 12, 2026).

E. Industry and Consumer Advocacy

Stephen Parker (Executive Director, National Independent Venue Association):

“If reports are accurate that Live Nation is using its immense resources and lobbyists to circumvent the legal process and escape a trial with significant evidence supporting its breakup, the company is subverting the rule of law.” “There is no settlement that will lead to justice for America’s independent venues, artists, and fans.”

Source: Grand Pinnacle Tribune (Feb 10, 2026).

Tommy Dorfman (former club promoter):

“If the DOJ and the U.S. government care whatsoever about fans and citizens, they must continue this case. It is one of the few truly bipartisan issues left, because working-class people, fans, and voters across the country are suffering from this monopoly regardless of political party.”

Source: The American Prospect (Feb 12, 2026).

F. The DOJ

AG Pam Bondi:

“On behalf of the Department of Justice, we thank Gail Slater for her service to the Antitrust Division which works to protect consumers, promote affordability, and expand economic opportunity.”

Institutional syntax performing procedural legitimacy while the enforcement function it describes has been dismantled. Grammar Persistence Index (measuring how long institutional language maintains its form after the substance has changed): maximum.

Source: CBS News; NBC News; CNBC (Feb 12, 2026).

G. Media Framing

Axios: “This is being viewed as a victory for big business, including tech giants, over some of MAGA’s more populist voices.”

The American Prospect: “Pay-to-play settlements at DOJ will be the order of the day.” Also reported Davis earned at least $1 million facilitating the Compass-Anywhere clearance.

Bloomberg: Confirmed the White House requested Slater’s resignation.

Washington Post: Framed the headline around the irony that Slater “vowed to resist political interference at her confirmation hearing.”

CNBC: “Throws the division into uncertainty as companies facing antitrust probes have increasingly hired Trump-connected lobbyists to influence the outcomes of their cases.”

Sources: Axios; The American Prospect; Bloomberg; Washington Post; CNBC (Feb 12, 2026).

H. Notable Silences

VP JD Vance: No public statement. His office did not respond to requests for comment. The Financial Times reported Vance “did not publicly intervene to support” Slater despite their political proximity. The Vance Silence continues exactly as the Stigler framework models: the populist wing lacks institutional position to override the deal-friendly coalition.

40-State AG Coalition: No public statement as of publication. Their response represents the single most important pending reaction under the Competitive Federalism framework and determines whether the phase-exit threshold is met.

Live Nation: A spokesperson did not return requests for comment. The market delivered their statement through the stock price.

VII. Foreseeable Consequences Under Validated Frameworks

Applying the validated frameworks forward, the following consequences emerge from institutional structure rather than speculation about individual intent.

1. The Live Nation Trial Is in Existential Jeopardy

The March 2 trial date is the single most important variable in American antitrust enforcement. Assefi, as acting AAG, faces the full weight of the constraint field that produced Slater’s departure. The Attractor Dominance Score (measuring how strongly institutional structure pulls outcomes toward a particular result) predicts convergence toward settlement regardless of Assefi’s personal inclinations, because the position is geometry-dominant. The Live Nation CDT scenario matrix quantifies this: negotiated settlement with limited structural remedy registers at P50 probability 0.62; sustained litigation through major discovery milestones at just 0.26; and a hybrid outcome with partial settlement plus continued state/court pressure at 0.32. Any settlement reached under these conditions triggers Tunney Act review — but the HPE-Juniper precedent (Judge Pitts ordering depositions) provides the template for process-integrity scrutiny.

Foreseeable outcome: Settlement announcement or trial continuance within 7-14 days. Probability of the March 2 trial proceeding with DOJ pursuing structural divestiture has dropped to near-zero.

2. State Attorney General Escalation

The Competitive Federalism framework identifies a specific threshold: distributed enforcer density must exceed the threshold at which the federal settlement attractor weakens. The Semafor report confirmed that a federal settlement “would not stop the 40 states that have also sued Live Nation.” State AGs face their own incentive geometry: they co-filed the suit, their constituents bear the externality load, and federal abdication creates political space for enforcement entrepreneurship.

Foreseeable outcome: At least one major state AG issues a public statement within two weeks asserting independent enforcement authority. Multi-state coalition coordination intensifies. Discovery coordination between the HPE-Juniper and Live Nation proceedings becomes an explicit strategic objective.

3. The Netflix-WBD Merger Review Is Unmoored

Slater was simultaneously overseeing the Live Nation trial, Google/Apple antitrust cases, and the Netflix-Warner Bros. Discovery merger review. Under the Nash-Stigler framework, merger review following an AAG ouster will converge on clearance. The constraint field teaches through example: every DOJ career staffer observed what happened to Slater, to Alford, to Hamer.

Foreseeable outcome: Netflix-WBD merger review proceeds toward clearance with minimal structural conditions. Any conditions imposed will be conduct-based.

4. HPE-Juniper Depositions Become More Consequential

Davis must provide sworn testimony about the HPE routing mechanism while the identical mechanism he operated for Live Nation has achieved its most visible success. His “Good riddance” post is now discoverable evidence available to state AGs preparing deposition questions. Mizelle’s “personal agendas and vendettas” characterization can be put to him directly under oath.

Foreseeable outcome: State AGs accelerate discovery coordination between HPE-Juniper and Live Nation proceedings. Davis’s deposition testimony becomes a focal point for cross-forum narrative consistency challenges.

5. The Vance Silence as Structural Signal

Under the Stigler framework, the Vance silence confirms that the populist wing lacks the institutional position to override the deal-friendly coalition operating through Bondi and Blanche. Even actors who would benefit politically from enforcement find it rational not to expend political capital, exactly as the Curvature Steepness Index (measuring how strongly the institutional landscape penalizes deviation from the dominant path) predicts.

Foreseeable outcome: No executive-branch intervention restores enforcement-minded DOJ antitrust leadership before the March 2 trial date. Enforcement demand remains structurally routed to state venues.

6. Legislative Response Window

Federal enforcement in visible crisis opens a political window for legislative action, though legislative response depends on separate political calculus rather than constraint geometry. Congressional attention to the Slater ouster — particularly from senators who confirmed her 78-13 — creates conditions favorable to proposals targeting the Access Arbitrage mechanism: transparency requirements for off-docket merger advocacy, enhanced Tunney Act review powers, or restrictions on political appointee override of career staff recommendations. Whether those conditions produce action depends on coalition dynamics that the structural frameworks do not model.

Foreseeable outcome: A political window exists for congressional hearings, formal inquiries, or legislative proposals within 30-60 days. The structural preconditions are present; the political will remains uncertain.

7. Career Staff Exodus and Institutional Juniorization

The Coercive Narrative Governance analysis in Section IV identifies preemptive self-censorship as the mechanism by which the Slater ouster propagates across the docket. But self-censorship is only one equilibrium response. The other is exit. The ATR Institutional Cognitive Plasticity scores quantify this: Institutional Update Velocity registers low to medium-low, Legacy Inertia Coefficient high, and Adaptive Throughput Quotient medium-low — meaning the Division’s capacity to self-correct depends on re-centralizing settlement routing and staffing chokepoints, and the signals predict slow adaptation at best. Senior DOJ economists and litigators — the institutional actors who possess the technical capacity to build structural cases — face a binary: comply with the constraint field or leave. Under the Inquiry Sufficiency framework, the staff who refuse to self-censor will depart for the private sector, state AG offices, or academia. The result is a “juniorized” Antitrust Division — one that lacks the institutional knowledge and technical depth to mount structural cases even if future leadership were to demand them. Temporary capture becomes permanent institutional degradation through exactly this mechanism.

Foreseeable outcome: Significant departures of senior career staff from DOJ Antitrust within 60-90 days. Private-sector antitrust practices, state AG offices, and academic institutions absorb the outflow. The Division’s capacity to prosecute complex structural cases degrades independent of leadership intent.

8. The Behavioral Trap: Compliance Monitors as Regulatory Tax

Across major active matters, the weak-settlement attractor identified in the Geometry of Capture converges on the same structural form: compliance-based behavioral remedies rather than structural divestiture. Under the Nash-Stigler equilibrium, this produces a stable arrangement in which monopolies pay a “regulatory tax” — accepting compliance monitors, periodic reporting, and conduct restrictions — in exchange for preserving their market dominance intact. The compliance monitor becomes the visible artifact of enforcement; the underlying market structure remains untouched. The Stiglerian Subsidy operates here as institutional design: the settlement appears to discipline the monopoly while actually ratifying its position.

Foreseeable outcome: Live Nation, and subsequently Netflix-WBD and other active matters, resolve through behavioral settlements featuring compliance monitors rather than structural remedies. Wall Street prices these settlements as confirmation that market structure is safe. The compliance monitor industry expands as the primary institutional expression of federal antitrust enforcement.

VIII. Falsification Conditions

The dominant consequence of the Slater ouster is not one settlement. It is routing equilibrium hardening, which increases the probability of weak/negotiated outcomes in multiple matters simultaneously. Live Nation functions as the best near-term diagnostic case because it carries high political salience, rewards delay, and creates strong incentives for off-docket intermediation.

If S1 (weak settlement) occurs, it validates capture geometry phase-lock. If S2 (litigation sustained) occurs, it falsifies or weakens the routing-dominance inference. The publication-ready forward lock: if DOJ routing authority remains dominant over ATR evidentiary control, then (1) access arbitrage will intensify, (2) settlement probability rises in flagship matters, and (3) states will increase structural remedy pressure through courts.

The foreseeable consequences in Section VII would be falsified if all six of the following occur:

1. The March 2 Live Nation trial proceeds as scheduled with DOJ pursuing structural divestiture under Assefi’s leadership.

2. State AGs publicly align behind a federal settlement without independent procedural escalation.

3. The Netflix-WBD merger review produces structural conditions rather than conduct-based clearance.

4. No congressional attention materializes despite visible federal enforcement crisis within 60 days.

5. Senior DOJ Antitrust career staff retention remains stable through Q2 2026, with no significant departures to private sector, state AG offices, or academia.

6. At least one active antitrust matter resolves through structural divestiture rather than compliance-monitor behavioral remedies.

Partial occurrence does not falsify. The model predicts settlement convergence, institutional degradation, state escalation, and legislative response as the dominant trajectory.