MCAI Economics Vision: A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice

The Advocacy Arbitrage: Access and Inaction

See related studies by MindCast AI: The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets (Jan 2026) Defines the Enforcement Capture Equilibrium and institutional competition as the structural response; Federal Antitrust Breakdown as Nash-Stigler Equilibrium, Not Accident (Jan 2026) Formalizes the “Harm Clearinghouse” model and externality mapping; How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In (Jan 2026): Documents authority-routing patterns and Access Arbitrage intermediaries; Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 2026): applies these frameworks to a single, time-locked enforcement event, demonstrating how identical economic conduct produced opposite legal outcomes through corporate structure and political routing rather than consumer-welfare analysis.

I. Executive Summary

Federal antitrust enforcement has crossed an irreversibility threshold. The predecessor MindCast AI publication, Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria (Jan 2026), established a $22 billion deadweight-loss baseline, identifying Live Nation as the criminal-antitrust anchor and Compass–Anywhere as the validation case for Post-Consolidation Containment—the regime in which behavioral standardization substitutes for structural unwind once merger closure renders divestiture infeasible.

Federal antitrust enforcement has entered a terminal transition: the Tirole Advocacy Arbitrage Phase. Access Arbitrage—the marginal payoff of off-docket lobbying access relative to docketed adversarial advocacy—now determines regulatory outcomes. Private access channels bypass neutral discovery, override career-staff findings, and collapse merit-based enforcement. Structural competition erodes as statutory standard-setting expands into the vacuum created by federal non-action.

Capture Theory and non-cooperative game theory explain why the transition stabilizes rather than self-corrects. Stigler’s theory of economic regulation describes how enforcement authority is systematically acquired by regulated interests. Nash equilibrium logic explains why enforcers and firms rationally converge on weak conduct outcomes once the costs of structural litigation exceed institutional risk tolerance. The equilibrium is durable inaction, not episodic enforcement failure.

State Transition Logic (Phase Model)

State 0: Pre-closure enforcement contestability (structural risk active)

State 1: Nash–Stigler equilibrium (capture-stable following irreversibility)

State 2: Post-Consolidation Containment (behavioral standardization substitutes for structural unwind)

Overlay: Tirole Advocacy Arbitrage Phase (advocacy markets reprice off-docket)

Exit Condition: Distributed enforcer density exceeds threshold (State AG coalitions, independent peer review, look-back mandates)

Phase Exit Explained.

A "phase" in this framework is a stable equilibrium state—like ice versus water—where the system remains locked in a particular configuration until external conditions force a transition. The Tirole Advocacy Arbitrage Phase is the current state: enforcement outcomes are determined by access rather than evidence, structural remedies are unreachable, and the system cannot self-correct through internal reform.

"Phase exit" means transitioning out of this captured equilibrium into a state where adversarial advocacy is restored and structural remedies become achievable—in practical terms, where antitrust enforcement can actually break up anticompetitive consolidations rather than rubber-stamp them with weak conduct settlements. The Exit Condition specifies what forces that transition: distributed enforcer density (State AG coalitions operating with litigation autonomy) must exceed the threshold at which the federal settlement attractor weakens and adversarial truth-discovery re-emerges. Below that threshold, state action is absorbed into the existing geometry; above it, phase transition becomes possible.

Live Nation defines the criminal-antitrust irreversibility boundary; Compass–Anywhere validates the same logic under ordinary civil and labor-market conditions. Administrative inertia creates an enforcement void that statutory behavioral regimes—such as Washington Senate Bill 6091—partially fill. Washington’s SB 6091 and Private Real Estate Market Control (Jan 2026). Structural competition collapses while conduct-based oversight expands, marking the end of structural antitrust and the onset of advocacy-driven behavioral containment.

The Tirole study is designed as a Cognitive Digital Twin (CDT) foresight simulation. It provides DOJ career professionals with a diagnostic map of how off-docket access truncates investigation; lawmakers with causal evidence for drafting behavioral standards under irreversible consolidation; and researchers with quantified primitives—such as Access Arbitrage Intensity and the Agent Substitution Rule—for measuring consumer harm generated by advocacy-driven inaction.

Four falsifiable predictions anchor the foresight simulation:

structural antitrust is replaced by behavioral statutes within 18 months;

adversarial advocacy participation declines as Access Arbitrage intensifies;

State Attorneys General coalition activity increases within 24 months; and

consumer and market deadweight losses continue to accumulate monotonically following federal enforcement termination, absent structural market reopening.

Section IX specifies the observable conditions under which each prediction is negated.

Insight Statement: Irreversibility in federal antitrust enforcement locks in a rising deadweight-loss trajectory and forces a pivot from structural competition toward utility-style regulation of private monopolies.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. Recent works: China’s H200 Import Block and the Reordering of National Innovation Control, The Two-Gate Game (Jan 2026), Federal Inaction Has Elevated State Authority on Consumer Protection, Antitrust, and Market Integrity, Briefing for State Attorneys General (Jan 2026), Foresight on Trial, The Diageo Litigation, How MindCast AI Predicted Institutional Behavior—Before the Courts Acted (Jan 2026).

How to read the theory sections. This study does not require readers to master Stigler, Nash, or Tirole as standalone academic theories. Each framework is used instrumentally within the CDT foresight simulation: Stigler explains why enforcement supply collapses; Nash explains why inaction stabilizes; Tirole explains why advocacy markets fail and access replaces merit. Readers can treat these frameworks as operational components rather than background literature.

II. Theoretical Framework: The Stigler-Nash-Tirole Synthesis

Modern regulatory analysis requires a synthesis of Nobel-winning scholarship to map institutional decay. George Stigler (1982), John Nash (1994), and Jean Tirole (2014) provide the necessary theoretical architecture for the advocacy arbitrage model. Combined works of these three Nobel Laureates expose the transition from structural enforcement to behavioral management.

1. The Nash–Stigler Equilibrium: Defining the State of Capture

George Stigler’s Theory of Economic Regulation (1971) posits that regulation is “acquired by the industry and is designed and operated primarily for its benefit.” Capture Theory establishes the structural baseline for the equilibrium by explaining how private interests secure the power of the state. John Nash’s Equilibrium describes a state where no player improves their outcome by changing strategy alone. The Nash-Stigler Equilibrium occurs in antitrust when both enforcer and firm find it optimal to settle for weak conduct rules rather than engage in costly litigation.

How the equilibrium functions in the simulation. Stigler explains why enforcement supply collapses once concentrated beneficiaries face diffuse victims. Nash explains why that collapse stabilizes rather than self-corrects. Together, the two frameworks govern equilibrium persistence: Stigler determines why capture emerges; Nash determines why neither regulators nor firms deviate back toward structural enforcement once procedural sufficiency becomes the dominant stopping rule.

2. The Tirole Advocacy Arbitrage Phase: The Operating Logic

Jean Tirole identifies the behavioral mechanisms that allow capture to persist. Administrative Friction (Tirole, 1994) explains why regulators default to a Harm Clearinghouse—accepting a settlement that clears the firm’s legal liability without fixing the market’s structural harm—to avoid the high effort costs of litigation. Advocacy as Information(Dewatripont & Tirole, 1999) demonstrates that truth discovery depends on adversarial competition between partisan “Advocates.” The Tirole Advocacy Arbitrage Phase begins when lobbyists secure private access while public advocates face exclusion, nullifying the information-revelation function of the law.

What changes in the Tirole phase. Stigler and Nash explain why enforcement collapses and stabilizes; Tirole explains why truth disappears. When adversarial advocates are excluded or intimidated, the information-revelation function of law collapses. Regulatory outcomes are no longer shaped by evidentiary contestation but by access-controlled narratives. The Advocacy Arbitrage Phase names this transition from adjudication to persuasion as the dominant decision mechanism.

Synthesizing these theories reveals the structural permanence of the current capture state. Causal models identify the exact mechanics through which firms secure institutional non-action. Enforcement becomes a transaction rather than an obligation.

Insight Statement: Capture is not a temporary failure but a stable equilibrium reached when enforcers find administrative ease more valuable than public welfare.

III. Retrospective: Comparative Externality Costs and the May 2025 Baseline

Understanding the present simulation requires a review of the primary publication, Comparative Externality Costs in Antitrust Enforcement. The earlier study quantified the initial fallout of federal inaction following the closure of major platform mergers. Key findings established the empirical floor for the “Advocacy Arbitrage” currently observed in the market.

Researchers quantified a $22 billion deadweight loss resulting from the “Harm Clearinghouse” effect in the real estate and live entertainment sectors. The primary study identified Live Nation as the criminal-antitrust anchor, where the collapse of structural remedies served as the upper bound of irreversibility. Compass–Anywhere served as the civil validation case, demonstrating that ordinary market consolidations could trigger the same capture-stable states. The findings proved that federal conduct-based settlements—swapping divestitures for weak behavioral promises—effectively subsidize monopoly power at the consumer’s expense.

Consumer welfare losses identified in the Jan 2026 MindCast AI publication have now stabilized into permanent market features. Establishing this history ensures that the current analysis of lobbyist-driven “Access Arbitrage” is understood as a consequence of prior enforcement failures. The study remains the essential baseline for all current foresight flows.

Insight Statement: The $22 billion externality is the quantified price of trading structural competition for administrative convenience.

IV. Structural Primitives for Cognitive Digital Twin Foresight

Establishing a rigorous causal map requires defining the measurable boundaries of institutional capture. Four structural primitives govern the Cognitive Digital Twin foresight simulation, providing the data points for phase transition analysis. Metrics track the velocity of regulatory drift and the displacement of legal merit.

1. Irreversibility Threshold (Phase Shift Condition)

The simulation triggers a state transition to Post-Consolidation Containment when a merger closes without structural remedy or HHI deterioration exceeds the window for a judicial unwind.

2. Agent Substitution Rule — Measurement Interface

When professional enforcement capacity is overridden (Tirole’s “Supervisor Capture”), advocacy shifts from docketed argument to private channels. Measurement requires tracking the share of decisive inputs from non-docket sources and staff-process truncation markers such as unexplained Second Request non-issuance.

3. Access Arbitrage Intensity — Measurement Interface

The Access Arbitrage Intensity variable measures the marginal payoff of off-docket access relative to docketed advocacy. Measurement tracks override frequency—specifically front-office reversals of career staff findings—and the docket displacement ratio derived from reported off-docket meetings.

4. Post-Consolidation Containment

Post-Consolidation Containment represents the observable policy output, such as Washington Senate Bill 6091, where statutory behavior-standardization substitutes for structural antitrust enforcement.

Quantifiable signals replace subjective speculation regarding agency intent. Structural primitives reveal the hard geometry of market closure. Defining these interfaces allows the simulation to track capture in real-time.

Insight Statement: Measurement interfaces transform abstract political influence into observable causal signals.

V. Empirical Mapping: Lobbyist Influence and Forecast Matrix

Lobbying networks now function as the primary circuit for regulatory decisions in the United States. Empirical data from the 2025–2026 cycle maps the specific lobbyists and executive counterparts driving current market outcomes. Forecast matrices provide the expected downstream behavior of these captured systems.

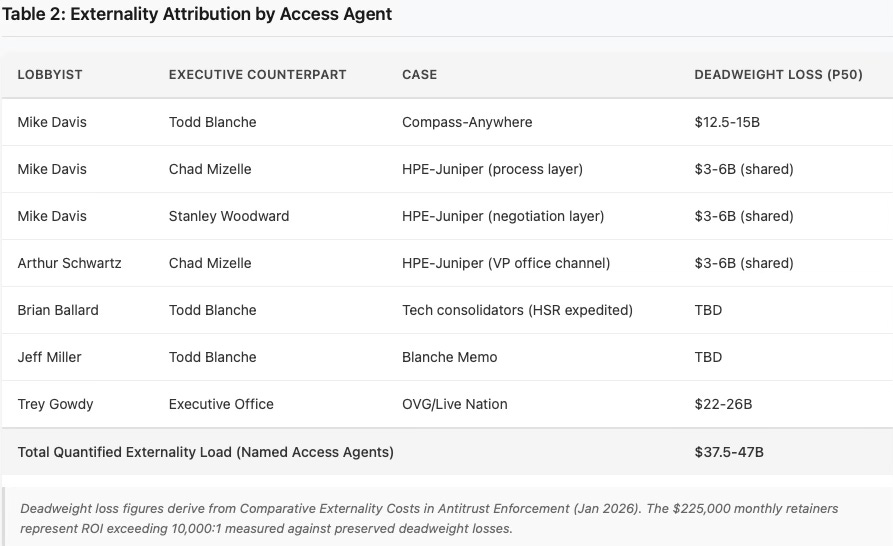

The preceding table identifies the actors executing Access Arbitrage. The following table quantifies the consumer harm attributable to each intervention. Deadweight loss figures derive from the predecessor study, Comparative Externality Costs in Antitrust Enforcement (Jan 2026), which established median five-year externality loads under the Nash-Stigler equilibrium. Linking named lobbyists to specific enforcement failures converts abstract capture theory into accountable cost attribution.

Total quantified externality load tied to named Access Arbitrage agents: $37.5–47B (P50 range). This figure represents the consumer welfare transferred to monopolists through off-docket lobbying interventions that bypassed career-staff findings and truncated structural enforcement. The $225,000 monthly retainers documented in Section VIII represent a return on investment exceeding 10,000:1 when measured against the deadweight losses preserved by successful Access Arbitrage. Regulatory outcomes now correlate with lobbying spend rather than legal merit or market metrics.

Chad Mizelle, DOJ Chief of Staff, functions as the process gatekeeper—controlling agenda routing, memo timing, and staff escalation pathways. The Alford testimony identifies Mizelle as the mechanism through which access converts to outcome without written reversal, enabling front-office decisions to bypass the evidentiary record. Arthur Schwartz leveraged ties to the Vice President's office to short-circuit Antitrust Division review on HPE-Juniper, reportedly omitted from Tunney Act disclosures required for consent decree transparency. Trey Gowdy, former prosecutor and lobbyist, secured direct presidential access through a golf outing (November 16, 2025); the simulation forecasts this channel as the pathway for a preemptive pardon for OVG/Live Nation—which would be the first preemptive pardon in criminal antitrust history.

Mapping these relationships exposes the systematic bypass of professional antitrust staff. Access Arbitrageurs provide the critical bridge between corporate consolidate-and-capture strategies and executive-level clearance.

Insight Statement: Lobbying retainers function as the market price for bypassing neutral discovery.

VI. Cognitive Digital Twin Foresight Simulation Report

Having identified the actors and quantified the harm, the following section executes the Cognitive Digital Twin foresight simulation to model how institutional behavior stabilizes under these conditions.

Foresight simulations execute MindCast AI vision function to model institutional behavior under post-closure constraints. Simulations activate once structural remedies become foreclosed, identifying the path of institutional rerouting. Outputs forecast the decline of adversarial participation and the rise of behavioral substitution.

Chicago Law & Behavioral Economics Composite: Coordination failure is structural and irreversible. Firms re-optimize toward access-based strategies once litigation risk collapses. Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (December 2025): Outputs: System Coordination Integrity: Degraded; Exploitability Index: High.

Causation Vision + Causal Signal Integrity (CSI): Institutional routing and constraint geometry dominate outcomes rather than intent or evidentiary merit. Outputs: Authority Routing Dominance: Confirmed; Intent–Outcome Decoupling: High.

Institutional Cognitive Plasticity: Federal antitrust institutions exhibit low update velocity and high legacy inertia after procedural termination. Outputs: Federal IUV: Low; State AG IUV: Moderate–High.

Strategic Behavioral Coordination: Advocacy markets re-coordinate away from docketed adversarialism toward off-docket access channels. Outputs: Coordination Convergence: Lobbyist + Front Office; Behavioral Drift Factor: High.

Regulatory Vision + Disclosure Vision: Structural enforcement is substituted by behavioral standard-setting. Transparency mechanisms reduce political risk without restoring competition. Outputs: Rulemaking Probability: High; Structural Remedy Probability: Very Low.

Field-Geometry Reasoning: Constraint geometry creates path dependence. Merger closure suppresses conduct-based correction. Outputs: Constraint Density: High; Geodesic Availability: Low.

MindCast AI Foresight: Post-Consolidation Containment stabilizes in the short term but amplifies long-run deadweight loss and innovation suppression. Outputs: PCC Stability Horizon: Medium-term; Long-run System Cost: Increasing.

Vision function foresight simulation validates the degradation of system coordination integrity. Analysis proves that constraint geometry dominates outcomes over individual intent. Simulations conclude that federal capture has reached a stable, non-correctable state.

Insight Statement: Post-closure behavior is a function of institutional geometry, not enforcement intent.

VII. The Real Estate Technology Trap: Documentation as Admission

The preceding simulation confirms that constraint geometry dominates enforcement outcomes. The following section demonstrates how that geometry creates evidentiary opportunities—specifically, how Compass's own SEC disclosures function as party admissions under Professor Lemley's labor-antitrust framework.

Securities laws create a documentation trap where innovation narratives become antitrust liabilities. Compass’s own IPO disclosures provided the evidentiary record required for labor-market monopsony analysis. Regulatory arbitrage in reverse turns competitive positioning into party admissions. Compass’s Technology Trap (January 2026).

Professor Mark Lemley’s 2025 labor-antitrust framework, The Implications of Labor Antitrust for Merger Enforcement (November 04, 2025), explains why IPO narratives are now a Section 7 liability under the Clayton Act. The Lemley scholarship identifies the grammar that converts technology narratives into labor-market evidence. Compass documented exactly what Lemley’s framework makes actionable: the 96.9% principal agent retention despite effective compensation cuts proves the power to suppress labor compensation. Under Federal Rule of Evidence 801(d)(2), statements describing “stickiness” and “higher switching costs” function as party admissions available to plaintiffs without discovery.

Applying the Lemley framework converts “stickiness” into evidence of an exit barrier. SEC filings authenticated the existence of non-portable assets that suppress agent wages. Compliance with financial reporting mandates effectively built the plaintiff’s antitrust case.

Insight Statement: Moats built for investors function as cages for labor.

VIII. The Transparency Deficit: Dark Advocates and Information Rents

The Technology Trap illustrates how public disclosure requirements create evidentiary exposure. The inverse phenomenon—opacity in lobbying channels—creates the conditions for Access Arbitrage to persist unchecked.

Opaque lobbying channels nullify the truth-discovery mechanisms inherent in adversarial legal systems. Dark Advocates operate in private settings, bypassing the Federal Rules of Evidence and adversarial briefing. Information Rents represent the cost of securing a monopoly on the regulator’s attention.

Lobbyists charge Information Rents—specifically the reported $225,000 per month retainers—for a monopoly on the Supervisor’s attention. Under the Dewatripont–Tirole (1999) framework, truth revelation requires adversarial competition. When advocacy moves off-docket, the information-discovery mechanism of the law collapses. Access Arbitrage occurs in private settings where coercive narratives face no cross-examination, creating a non-linear decline in adversarial participation.

Privatizing the advocacy process creates a terminal distortion of the information-revelation model. Merit-based legal research loses all market value when political access dictates outcomes. Information scarcity cements the stable equilibrium of capture.

Insight Statement: Opaque advocacy markets prioritize political proximity over legal merit.

IX. Foresight Predictions and Falsification Contracts

Cognitive Digital Twin foresight simulations must produce falsifiable, state-dependent predictions to maintain engineering rigor. This study does not re-estimate absolute externality magnitudes; it forecasts changes in the trajectory, accumulation rate, and persistence of consumer and market harm following federal enforcement termination, using quantified externality baselines established in prior MindCast AI CDT studies as anchors.

Four foresight prediction classes define the expected behavior of regulatory, advocacy, and enforcement systems over the next 24 months. Each prediction is paired with an explicit falsification contract specifying the observable conditions under which the forecast is negated.

1. Regulatory Substitution — Falsification Contract

Foresight Prediction: Behavioral regulation (conduct codes, licensing standards, disclosure mandates) substitutes for structural antitrust enforcement within 3–18 months following merger closure or procedural termination.

Externality Implication: Behavioral substitution alters the form of oversight without materially reducing the underlying externality load; consumer and market harm continues to accumulate under Post-Consolidation Containment.

Falsified if: No material behavioral statute or enforceable regulatory standard emerges by month 18 and federal authorities reopen or impose a sustained structural remedy within the same enforcement cycle.

2. Advocacy Market Repricing — Falsification Contract

Foresight Prediction: Adversarial legal advocacy participation declines non-linearly as Access Arbitrage Intensity increases, with regulatory outcomes increasingly determined by off-docket access rather than docketed evidentiary contestation.

Externality Implication: As adversarial pressure collapses, firms face lower marginal resistance to extraction, increasing the slope of consumer and market externalities even in the presence of nominal oversight.

Falsified if: Adversarial filings, staff-driven investigations, and evidence-based enforcement actions increase simultaneously with rising indicators of off-docket intervention and front-office override activity.

3. Federal–State Enforcement Inversion — Falsification Contract

Foresight Prediction: The probability and intensity of State Attorneys General enforcement increases once Post-Consolidation Containment stabilizes federally, producing compensatory state-level intervention within 24 months.

Externality Implication: Absent state intervention, externality accumulation persists unchecked; state enforcement represents the only modeled pathway for partial internalization of federally externalized harm.

Falsified if: Multi-state enforcement coalitions do not measurably increase investigative or litigation activity within 24 months and federal enforcement reasserts durable structural action.

4. Externality Trajectory Persistence — Falsification Contract

Prediction: Following federal enforcement termination, aggregate consumer and market deadweight loss continues to increase monotonically over time, with no endogenous correction mechanism under Post-Consolidation Containment. Behavioral statutes and disclosure regimes do not reverse the externality trajectory; at best, they slow its political visibility.

Scope: This prediction concerns trajectory and persistence, not re-pricing. Absolute cost levels remain anchored to prior CDT externality estimates (e.g., $22B Live Nation baseline).

Falsified if: Within 24 months of enforcement termination:

price dispersion narrows materially, and

entry or switching rates increase measurably, and

consumer surplus improves absent structural divestiture or market reopening.

Explicit falsification contracts ensure that foresight remains a technical forecasting instrument rather than a political opinion. Validation or negation occurs through observable statutory action, enforcement behavior, and advocacy market signals. These boundaries distinguish CDT foresight simulation outputs from narrative or retrospective analysis.

Insight Statement: Falsification contracts convert institutional foresight into an auditable engineering system for predicting how federal inaction reshapes the path—not just the presence—of consumer and market harm.

X. Cognitive Digital Twin Flow Outputs: The Skrmetti Vector

Distributed enforcers provide the only remaining mechanism to break the federal Nash-Stigler stability. The Skrmetti Vector tracks the emergence of State Attorneys General who maintain litigation autonomy despite federal capture. Simulation outputs map the probability of inversion where state-level friction reintroduces adversarial pressure.

For a State AG to trigger the Exit Condition, MindCast AI measures three specific indicators:

Litigation Autonomy Score: The degree of decoupling between State AG strategy and federal conduct settlements.

Coalition Density: The predicted threshold of more than 10 states for equilibrium breakage.

Jurisdictional Divergence: Friction created by state licensing or consumer laws, such as SB 6091, that federal Access Arbitrage cannot bypass.

Measuring litigation autonomy and coalition density reveals the potential for equilibrium breakage. State AGs act as the terminal advocates in a captured hierarchy. Distributed enforcement provides the corrective necessary to challenge coercive narrative governance.

Insight Statement: State AG autonomy represents the only functional counter-weight to federal capture.

XI. Conclusion: Institutional Adversarialism

Restoring market integrity requires a shift from centralized federal trust to decentralized institutional adversarialism. Jean Tirole’s blueprint for independent peer review and look-back provisions offers a structural path toward recovery. Re-establishing competition between partisan advocates remains the only way to reveal regulatory truth.

Decentralized enforcement through State AG coalitions provides the most viable mechanism for structural reform. Breaking the capture-stable state requires a rejection of behavioral containment in favor of competition restoration. State Attorneys General, led by figures like Jonathan Skrmetti, act as the primary mechanism to re-establish competitive pressure. Institutional adversarialism serves as the structural cure for regulatory capture.

Structural restoration depends on the successful deployment of these adversarial mechanisms. Jean Tirole’s blueprint for Institutional Adversarialism—distributed enforcers, independent peer review, and reversibility mandates—provides the necessary corrective. Truth discovery remains the ultimate casualty of un-checked Access Arbitrage.

Insight Statement: Institutional adversarialism is the structural cure for regulatory capture.

XII. Comprehensive References

Bibliographic sources provide the evidentiary and theoretical bedrock for the advocacy arbitrage simulation. These works span foundational economic scholarship, contemporary policy memorandums, and investigative reporting on institutional conduct. Synthesis of these diverse inputs ensures the causal integrity of the Cognitive Digital Twin model.

Blanche, T. (2025). Ending Regulation By Prosecution. DOJ Memorandum (April 7, 2025). The memorandum redefines federal digital asset oversight by pivoting from structural regulation to a narrow “willfulness” prosecution standard. Administrative redirection effectively withdraws the DOJ from platform integrity enforcement, providing a primary case study for institutional inaction.

Alford, Roger P. (2025). "Anti-American Antitrust" Testimony, House Judiciary Committee (December 16, 2025). The testimony documents the internal mechanisms of DOJ capture, identifying specific actors—Mizelle, Woodward, Davis, Schwartz—and the firing of career staff who objected to lobbying-driven settlements. Primary evidentiary source for the Agent Substitution Rule and process truncation markers.

Dewatripont, M., & Tirole, J. (1999). “Advocates.” Journal of Political Economy, 107(1), 1–39. The authors establish that complex truth revelation depends on the existence of competing, partisan agents. Suppression of adversarial competition creates an information collapse, which serves as the theoretical catalyst for the “Advocacy Arbitrage” model identified in the simulation.

Michaels, D., & Friedman, N. (2026). Real-Estate Brokerages Avoided Merger Investigation After Justice Department Rift. Wall Street Journal (January 9, 2026). The investigative report documents the U.S. Department of Justice internal rift where senior political officials overruled professional staff to clear the Compass-Anywhere merger. Empirical evidence validates the “Agent Substitution Rule” and identifies the specific mechanisms of off-docket intervention.

Tirole, J. (2017). Economics for the Common Good. Princeton University Press. The text provides a comprehensive framework for aligning economic policy with public welfare while mitigating the risks of industrial capture. Scholarship in this volume informs the “Institutional Adversarialism” blueprint and the proposed structural correctives for captured regulatory environments.

References listed here, and weaved into the study, constitute the complete audit trail for the state-dependent predictions issued in this report. Transparency in source material allows for the independent verification of simulation parameters. Rigorous documentation maintains the engineering fidelity of the foresight process.

Insight Statement: Citations serve as the intellectual receipts for the predictive geometry of institutional capture.