MCAI Lex Vision: Washington’s SB 6091 and Private Real Estate Market Control

Post Compass-Anywhere Consolidation Developments

Companion study to: The Compass Astroturf Coefficient at the Washington State Senate (Jan 2026), Windermere and Compass, Two Philosophies of Real Estate (Jan 2026), Compass–Anywhere, When Scale Becomes Liability (Jan 2026), Compass vs. SB 6091, Narrative Pre-Installation and the Infrastructure of Exception Capture (Jan 2026), HB 2512 and the Collapse of Compass’s Coordinated Opposition (Jan 2026), How Compass’s State Legislative Testimony Undermined its Federal Antitrust Claims (Jan 2026), The Collapse of Compass’s Co-Conspirator Theory (Jan 2026), Compass vs. Competition: The Case for SB 6091 / HB 2512 Without an Opt-Out Exception (Feb 2026).

Executive Summary

The analysis explains why states may shift from antitrust enforcement to behavioral market design after large platform mergers like Compass-Anywhere.

Three days after the Compass–Anywhere merger closed—the largest consolidation in the history of U.S. residential brokerage—Washington State introduced Senate Bill 6091. The bill would prohibit brokers from marketing residential properties to exclusive or limited groups unless the property is concurrently marketed to the general public and all other Washington licensees. Violations trigger Department of Licensing discipline and, through a parallel amendment to Washington’s Law Against Discrimination, constitute civil rights violations with private enforcement remedies.

SB 6091 is not merely a real estate transparency bill. It is the blueprint for Post-Consolidation Containment—the regulatory response to market structure that cannot be unwound. The bill accepts that Compass–Anywhere controls unprecedented scale. It then writes the rules for how that scale must be used.

Series Context. This is Part V of MindCast AI’s series on the Compass–Anywhere merger.

Part I (Compass–Anywhere, When Scale Becomes Liability) analyzed the merger as coordination-architecture shock using Chicago Law and Behavioral Economics.

Part II (How the Compass–Anywhere Merger Reshapes Broker Bargaining Power) applied Lemley’s labor-antitrust framework to architectural monopsony through CRM lock-in, non-portable analytics, and clawback provisions.

Part III (Compass’s Technology Trap) documented how IPO narrative became antitrust liability—SEC disclosures describing platform stickiness became admissions of exit barriers.

Part IV (From Open Market to Private Governance), commenting on the pre-merger Warren-Wyden letter, modeled coordination capture dynamics and predicted that structural intervention prior to consummation would be substantially more effective than post-hoc conduct remedies—a prediction now confirmed as the merger closed without challenge.

Together, those pieces established a core premise: once brokerage scale crosses a coordination threshold, the relevant policy question shifts from whether consolidation should be blocked to how the market will be governed afterward. Part V documents that governance mechanism: market design through licensing law.

Critically, NWMLS is the strict outlier among Washington MLSs—other markets already allow private listings under NAR’s Clear Cooperation rules. SB 6091 extends NWMLS-level protection statewide, closing the gap that currently lets Compass operate Private Exclusives outside the Puget Sound region while suing to eliminate the one MLS that prohibits them.

The Tech Trap Closes. For Compass, SB 6091 represents the final closure of what Part III identified as the Documentation Trap. The company spent a decade telling investors that its platform was essential infrastructure—sticky, integrated, indispensable. Regulators have now agreed. Essential infrastructure gets regulated. The more Compass’s platform is seen as critical market infrastructure, the more likely the state is to govern it through licensing law. Compass cannot disclaim platform essentiality without undermining its valuation thesis, and it cannot maintain platform essentiality without accepting utility-style behavioral regulation.

Foresight Thesis. When antitrust enforcement is uncertain and private governance is legally vulnerable, regulators migrate toward statutory behavior-standardization that freezes market architecture without relitigating the merger itself. SB 6091 is the first major instance of this pattern in residential brokerage. The phase of structural competition is ending. The phase of behavioral standardization has begun.

The Policy Spectrum Is No Longer Theoretical. Wisconsin enacted AB 456 in 2025—a disclosure-based opt-out model effective January 2027. Washington's SB 6091 represents the opposite approach: concurrency without opt-out. The two states have created a natural experiment in post-consolidation market design. Which model preserves coordination when a dominant platform has structural incentives to maximize private-listing volume? The answer will shape legislation in California, New York, Texas, and beyond.

Market-Preserving, Not Market-Restricting. SB 6091 is pro-competition legislation. Private listing networks allow a dominant platform to control which buyers see which homes and when—converting information asymmetry into competitive advantage that has nothing to do with service quality. The bill restores the conditions under which brokers compete on merit: responsiveness, local knowledge, negotiation skill, client service. When all brokers see all inventory simultaneously, competition happens on the factors that actually benefit consumers. Compass's dual litigation-acquisition strategy—attacking MLS coordination rules as anticompetitive while acquiring competitors to consolidate market share—is the threat to free markets. SB 6091 is the defense.

Methodology. This analysis applies Cognitive Digital Twin (CDT) Foresight Simulation to model how institutions, firms, and regulators adapt once market consolidation becomes irreversible. Rather than predicting outcomes based on intent or stated positions, the simulation reconstructs each actor’s incentives, constraints, and available decision paths under current legal and political conditions. CDT outputs are integrated throughout the analysis, appearing at the conclusion of each relevant section to answer the question: given the constraints now visible, what is the rational next move for each actor?The outputs are forward-looking assessments of likely behavior, policy diffusion, and constraint hardening—not advocacy or normative judgment.

System-Level Synthesis. The CDT Foresight Simulation converges on a single conclusion: post-consolidation discretion is no longer negotiated through contracts or courts but allocated by statute. Actors who adapt early by internalizing behavioral constraints preserve influence; actors who resist publicly accelerate rule hardening. SB 6091 is not an endpoint but a calibration moment—the first instance of a pattern that will recur as other states observe Washington’s outcome and apply similar logic to their own markets.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. Please see recent publications: How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In (Jan 2026), Foresight on Trial, The Diageo Litigation, How MindCast AI Predicted Institutional Behavior—Before the Courts Acted (Jan 2026), The Federal-State AI Infrastructure Collision, Validation of MindCast AI Foresight When Federalization Meets Federalism (Jan 2026), Private Equity, NIL, Antitrust, and the Firm-Formation Phase of College Athletics, Capital Reorganization Under Regulatory Stasis (Jan 2026), The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (Dec 2025).

I. From Merger Review to Market Design

Traditional antitrust tools are designed to prevent consolidation or remedy its effects after the fact. When consolidation proceeds unchallenged, a different question emerges: how will the consolidated market be governed? SB 6091 represents the institutional answer—a shift from structural intervention to behavioral standardization through licensing law.

I.A. The Limits of Post-Closing Antitrust Remedies

The Compass–Anywhere merger closed on January 10, 2026. The Hart-Scott-Rodino waiting period expired without challenge. DOJ staff raised concerns warranting deeper investigation, but senior leadership allowed the merger to proceed without a Second Request. Expiration was not approval—post-close enforcement authority remains intact—but the structural intervention window closed.

Traditional antitrust remedies struggle to address coordination power rooted in timing, access, and sequencing rather than price or output. Injunctions require proving imminent irreparable harm. Divestitures require identifying discrete assets whose separation restores competition. Conduct remedies require ongoing monitoring and enforcement. All three presume that competitive harm manifests through observable outputs that can be measured and corrected.

Coordination capture operates differently. When a firm internalizes control over listing visibility, agent routing, and transaction timing, competitive harm emerges from architectural design rather than discrete exclusionary acts. No single listing decision triggers antitrust liability. The aggregate effect of thousands of sequencing choices—each individually defensible as “seller choice”—reshapes market access in ways that disadvantage competitors and consumers without producing the price signals that enforcement agencies track.

The Compass–Anywhere merger presents exactly this enforcement gap. Combined market share exceeds 30% in multiple metros. The merged entity controls the Agent Operating System through which 340,000 agents access listings, leads, and transaction tools. Private Exclusive programs enable pre-market circulation within the network before MLS submission. Yet commission rates face downward pressure from Sitzer/Burnett, housing prices reflect macroeconomic factors beyond brokerage structure, and no single act of refusal-to-deal or predatory pricing triggers clear Section 2 liability.

The result: regulators who waited for traditional antitrust signals found that those signals would not arrive until coordination capture was already irreversible.

I.B. Why Licensing Law Becomes Attractive

Licensing law offers what antitrust enforcement cannot: prospective behavioral standardization that operates without intent findings, market-definition disputes, or protracted litigation.

Every residential real estate broker in Washington holds a license issued by the Department of Licensing under RCW 18.85. That license is a privilege, not a right. The state can condition licensure on compliance with professional standards, disclosure requirements, and conduct rules. Violations trigger administrative discipline—warning, fine, suspension, revocation—through procedures far faster than federal court litigation.

When regulators infer that structural reversal is unlikely, licensing discipline becomes the available lever. The state cannot unwind the merger. The state can write rules for how merged entities must behave. Those rules bind individual licensees rather than corporate entities, shifting compliance risk onto the professionals who execute transactions rather than the platforms that coordinate them.

SB 6091 operationalizes this insight. The bill does not challenge Compass’s market position. It does not require MLS membership. It simply mandates that any marketing must include public marketing—embedding the coordination norm that NWMLS enforces through private contract into state licensing discipline that reaches all brokers regardless of MLS affiliation.

The transition from merger review to market design reflects institutional learning about enforcement limits. Antitrust tools that require proving intent, defining markets, and litigating for years cannot address coordination capture that hardens in months. Licensing law offers what antitrust cannot: prospective behavioral standardization that binds all market participants without relitigating structural questions.

II. The Current Washington Baseline: Private Rules, Not Public Law

Understanding what SB 6091 changes requires understanding what currently exists. Washington’s public-marketing norms are enforced through private MLS governance, not state law. NWMLS rules approximate the bill’s requirements, but those rules bind only members and face active legal challenge. The bill would convert contested private ordering into mandatory public standard.

II.A. Northwest MLS as a Private Coordination Regime

Northwest MLS operates the dominant listing coordination infrastructure in Washington State. NWMLS rules already approximate the public-marketing mandate that SB 6091 would codify: mandatory submission within one business day of marketing, prohibition on office exclusives, restrictions on pre-marketing that bypasses the shared database.

These rules solve a coordination problem that decentralized actors cannot solve independently. Without a shared visibility layer, buyers face fragmented search, sellers face fragmented exposure, and agents face fragmented matching. MLS reciprocity ensures that inventory circulates broadly, that price discovery reflects full market information, and that agents compete on service rather than access.

But NWMLS rules bind only NWMLS members through contractual governance. Brokers who decline MLS membership—or who join MLSs with looser policies—face no legal obligation to market publicly. The coordination norm is enforced through private ordering, not public law.

Compass’s litigation against NWMLS challenged precisely this private ordering. The lawsuit frames mandatory submission as an anticompetitive restraint—a horizontal agreement among competitors that artificially limits seller choice. Pre-merger, that argument had coherence when Compass was an insurgent challenging incumbent rules. Post-merger, the argument inverts: if the dominant firm is the one avoiding transparency, MLS rules look less like incumbent protection and more like necessary safeguards for smaller competitors and consumers.

II.B. The Statewide Gap: NWMLS as the Strict Outlier

NWMLS is not representative of Washington MLS governance. It is the strict outlier.

NWMLS requires listings to be entered before any public promotion and prohibits pre-marketing and office exclusives outright. The organization has taken a public, fairness-and-disparate-impact stance against private listing networks. These rules are more restrictive than both NAR’s Clear Cooperation Policy and portal standards like Zillow’s.

Other Washington MLSs operate differently. Spokane Association of REALTORS MLS, for example, follows NAR’s “Multiple Listing Options for Sellers” structure: it permits “Office Exclusive” and “Delayed Marketing” exempt listings with a signed seller waiver. Office Exclusives must not be publicly marketed—no signs, social media, website postings, or email blasts—but the listing can circulate privately within the brokerage indefinitely. If the seller later chooses public marketing, MLS submission is required within one business day. This is the standard Clear Cooperation model, not the NWMLS “no pre-marketing if you ever want MLS” model.

The result is a patchwork. In the Puget Sound region, NWMLS rules prohibit private-listing strategies. In Spokane, Eastern Washington, and other markets operating under Clear Cooperation, those strategies are permitted with disclosure and timing constraints. Statewide, no public law mandates that residential listings reach the general public before or concurrent with any private marketing.

This asymmetry is precisely what SB 6091 addresses. The bill extends NWMLS-level concurrent public-marketing requirements to all Washington licensees through state licensing law—regardless of which MLS covers their market or whether they belong to one at all.

III. Senate Bill 6091: Ensuring Public Availability of Residential Listings

The bill’s design reflects careful attention to enforcement mechanics and political durability. Rather than mandating MLS participation—which would invite challenges on association-freedom grounds—the bill mandates behavioral outcomes while remaining platform-neutral. The dual-track enforcement structure ensures accountability through both administrative discipline and civil litigation.

Senate Bill 6091 was introduced on January 13, 2026—three days after the Compass–Anywhere merger closed—and referred to the Senate Housing Committee. The bill carries bipartisan sponsorship: Senators Marko Liias (D-21), Chris Gildon (R-25), Jessica Bateman (D-22), Emily Alvarado (D-34), and John Braun (R-20). House companions are sponsored by Representatives Strom Peterson (D-21) and April Connors (R-8). Washington Realtors has announced support.

III.A. Core Prohibition and Scope

The bill’s operative language adds a new section to Chapter 18.86 RCW:

“A broker may not market the sale or lease of residential real estate to a limited or exclusive group of prospective buyers or brokers, or any combination thereof, unless the real estate is concurrently marketed to the general public and all other brokers, except as reasonably necessary to protect the health or safety of the owner or occupant.”

Scope. The prohibition reaches all residential listings for sale or rent handled by Washington-licensed brokers, regardless of MLS affiliation. The bill applies whenever a broker engages in any marketing—the trigger is the act of marketing, not MLS submission.

Concurrency requirement. The word “concurrently” is operative. There is no grace period, no private-first window, no sequencing advantage. If a broker markets a property at all—to any buyer, to any other broker, through any channel—the broker must simultaneously market to the general public and all other licensees.

Exception. The sole exception is where public marketing would “unreasonably endanger the health or safety of the owner or occupant.” This is a narrow carve-out for genuine security concerns—domestic violence situations, celebrity privacy, witness protection—not a general seller-choice opt-out.

III.B. Platform-Neutral Public Marketing

SB 6091 does not mandate MLS entry. The bill requires that marketing be accessible to the general public and all licensees through some public-facing channel. As Washington Realtors’ 2026 President Ryan Beckett explained: “Publicly marketing could be as simple as putting it on your website. We’re not telling you you have to have it in the MLS. We’re not giving parameters other than saying it does need to be publicly available to the community.”

Platform neutrality is strategically significant.

The bill also resolves Washington's internal patchwork. NWMLS prohibits private listings; other Washington MLSs operating under Clear Cooperation allow them. SB 6091 establishes a uniform standard that does not depend on which MLS covers a given market.

The bill sidesteps the MLS governance disputes that Compass has litigated. It does not take sides on whether NWMLS rules are reasonable or whether NAR’s Clear Cooperation Policy should survive. It simply mandates the behavioral outcome—public visibility concurrent with any marketing—while leaving the platform choice to the broker.

The practical effect, however, converges toward MLS-equivalent exposure. A broker who markets privately must simultaneously maintain public marketing through another channel. The coordination benefit of private-first sequencing—reaching network insiders before the general market—disappears when concurrency is required.

III.C. Dual-Track Enforcement: Licensing Discipline and Civil Rights Liability

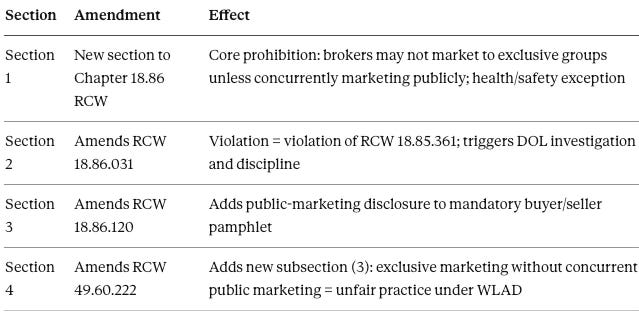

SB 6091 creates two parallel enforcement mechanisms.

Licensing discipline. Section 2 of the bill amends RCW 18.86.031 to provide that a violation of the public-marketing requirement “is a violation of RCW 18.85.361.” This triggers Department of Licensing investigation and discipline. Individual brokers—not just firms—face professional consequences for non-compliance: warning, fine, license suspension, or revocation.

Civil rights violation. Section 4 of the bill adds a new subsection (3) to RCW 49.60.222, Washington’s Law Against Discrimination:

“It is an unfair practice for a real estate licensee to market the sale or lease of residential real estate to a limited or exclusive group of prospective buyers, prospective tenants, or real estate licensees, or any combination thereof, unless the real estate is concurrently marketed to the general public and all other real estate licensees, except as reasonably necessary to protect the health or safety of the owner or occupant.”

The civil-rights amendment is analytically significant. The bill does not merely create a licensing violation—it creates a civil rights violation under Washington’s antidiscrimination statute. The fair-housing hook provides:

Private cause of action. Aggrieved parties can sue directly without waiting for DOL enforcement.

Statutory remedies. WLAD violations carry actual damages, injunctive relief, and potentially attorney’s fees.

Fair-housing framing. The amendment positions private-listing restrictions as fair-housing protections—ensuring equal access to housing information regardless of which broker or network a buyer uses.

The dual-track structure multiplies enforcement surface. DOL can pursue administrative discipline. Private plaintiffs can pursue civil litigation. State attorneys general can enforce WLAD through their consumer protection authority. The bill creates overlapping accountability mechanisms rather than relying on any single enforcement pathway.

III.D. Disclosure Integration

Section 3 of the bill amends the mandatory buyer/seller pamphlet (RCW 18.86.120) to include:

“Brokers who represent a seller must market residential property to all members of the public and all other brokers and may not market the property to an exclusive group of buyers or brokers only, unless the health or safety of the owner or occupant requires.”

The disclosure requirement ensures that every residential real estate transaction in Washington includes written notice of the public-marketing obligation. Sellers cannot claim ignorance. Buyers cannot claim they were unaware of their right to see all marketed inventory. The pamphlet becomes a compliance checkpoint at every transaction.

SB 6091’s architecture reflects sophisticated regulatory design. The concurrency requirement eliminates sequencing strategies without mandating specific platforms. The dual-track enforcement creates overlapping accountability through both licensing discipline and civil rights litigation. The disclosure integration ensures universal awareness. Together, these mechanisms create a self-reinforcing compliance structure that does not depend on any single enforcement pathway.

IV. What SB 6091 Actually Does Structurally

Beyond its operative provisions, SB 6091 effects three structural transformations in how residential brokerage markets are governed. The bill converts private coordination rules into public mandate, standardizes timing and access across all market participants, and reallocates compliance risk from firms to individual licensees. Each transformation has implications that extend beyond the bill’s immediate requirements.

IV.A. Conversion of Private Governance into Public Mandate

The coordination norm that NWMLS enforces through membership rules becomes, under SB 6091, a statewide legal requirement enforceable through licensing discipline and civil rights law. This conversion has three structural effects.

Antitrust insulation. Private coordination rules—even procompetitive ones—face antitrust exposure as horizontal agreements among competitors. Compass’s litigation against NWMLS frames mandatory submission precisely this way. Statutory mandates face no such exposure. When the state requires public marketing, the requirement is sovereign regulation, not private agreement. SB 6091 insulates the coordination norm from the antitrust challenge that Compass has mounted against NWMLS.

Extended reach. NWMLS rules bind NWMLS members. SB 6091 binds all Washington licensees. Brokers who declined MLS membership to preserve private-listing flexibility—or who joined MLSs with looser policies—now face the same public-marketing obligation. The coordination norm extends from voluntary association to universal professional standard.

Shifted enforcement. NWMLS enforces its rules through membership discipline: fines, suspension, expulsion from the MLS. SB 6091 shifts enforcement to the state. The Department of Licensing investigates complaints, conducts audits, and imposes sanctions. The civil rights amendment enables private litigation. Enforcement no longer depends on trade-association governance; it operates through public law.

IV.B. Standardization of Timing and Access

SB 6091 eliminates sequencing strategies. Under current practice, brokers can create informational advantage through timing:

Private Exclusives circulate within a brokerage network before MLS submission, giving network agents first-mover advantage on buyer matching.

Coming Soon programs generate buyer interest before official market entry, allowing brokerages to capture both sides of transactions.

Delayed submission creates windows where network insiders see inventory that outsiders cannot access.

The concurrency requirement collapses these strategies. If any marketing occurs, public marketing must occur simultaneously. There is no private-first window. There is no sequencing advantage. The playing field flattens: all brokers see all marketed inventory at the same time.

For Compass, this eliminates the operational logic of Private Exclusives. The program’s value proposition—exclusive early access for Compass agents and their buyers—depends on a window of private visibility before public marketing. SB 6091 closes that window by mandate.

IV.C. Restoring Competition, Not Restricting It

SB 6091 is not a constraint on market activity. SB 6091 is the preservation of market activity.

Open markets require open information. When a single firm controls listing visibility—deciding which buyers see which properties and when—that firm converts information asymmetry into market power. Competitors cannot compete on service quality if they cannot access the inventory their clients want to see. Buyers cannot make informed decisions if available homes are hidden from them based on which broker they chose.

Private listing networks are the market distortion. The sequencing advantages they provide have nothing to do with better service, superior technology, or greater efficiency. They exist because one firm controls the flow of information that other market participants need. That is not competition. That is coordination capture.

Broker Competition. SB 6091 restores the baseline condition for competition: all brokers see all marketed inventory at the same time. Brokers then compete on what should matter—responsiveness, local expertise, negotiation skill, marketing quality, client relationships. The bill does not pick winners. The bill ensures that winners are picked by consumers based on merit, not by platforms based on information control.

Private Listings and Price Distortions: Private listings don't just restrict access—they distort prices. When 18-22% of luxury inventory is withheld from competitive bidding, sellers receive offers from a constrained buyer pool rather than true market demand. The 'exclusive' positioning exploits scarcity bias, making properties appear more valuable through artificial unavailability. But the beneficiary is the platform, not the seller: faster double-ends at higher commission rates, not higher sale prices from broader competition. Empirical research on off-market transactions consistently shows that sellers net less than comparable publicly-marketed properties—the 'privacy premium' flows to the broker, not the client.

Seller Choice. Compass frames the bill as restricting seller choice. The opposite is true. Sellers in a market with hidden inventory face reduced buyer pools, distorted price discovery, and dependence on whichever network their broker belongs to. Sellers in a market with universal visibility reach all qualified buyers, receive offers reflecting true market demand, and can choose any broker based on service quality rather than network access. SB 6091 expands seller optionality by eliminating the information bottleneck that constrains it.

Subsidized Scale, Not Earned Scale. Compass did not achieve platform scale through superior service or organic growth. Compass achieved scale through approximately $1.5 billion in SoftBank Vision Fund capital that subsidized agent compensation at unsustainable levels, funded acquisitions of regional competitors (Pacific Union, Alain Pinel, Stribling, and others), and allowed years of operating losses that no traditional brokerage could match. Independent brokers and regional firms competing on sustainable economics could not offer equivalent splits without going bankrupt. Compass bought market share with investor money.

Now Compass seeks to convert that artificially-acquired scale into permanent information control through private listing networks. SB 6091 prevents subsidized market entry from becoming durable market exclusion.

The Luxury Market Problem. Private listing networks create structural barriers to entry, particularly in luxury segments where relationships and access determine market position. A new broker—or an established broker attempting to break into the $2M+ market—cannot show clients homes circulating in networks they don't belong to. The client concludes the broker lacks market knowledge or connections; the broker loses the client; the dominant network captures both sides of the transaction.

The anti-competitive dynamic is self-reinforcing: private listings lock out competitors, which concentrates market share, which makes the private network more valuable, which increases the incentive to route more listings through it. In King County's $2M+ residential market—approximately $18 billion in annual transaction value—post-merger Compass-Anywhere controls roughly 25% of luxury dollar volume. New entrants and independent brokers competing in this segment face an information asymmetry that has nothing to do with their service quality, local expertise, or client relationships.

SB 6091 eliminates this barrier to entry by ensuring all brokers see all marketed inventory simultaneously. Competition then occurs on the factors that should matter: responsiveness, negotiation skill, marketing quality, and client service—not network membership.

IV.D. Risk Reallocation from Firms to Licensees

Traditional antitrust enforcement targets firms. SB 6091 targets individual licensees.

A broker who markets a property privately without concurrent public marketing commits a licensing violation—regardless of whether the brokerage firm directed that behavior. The individual broker’s license is at risk. The individual broker faces potential civil liability under WLAD. The compliance burden falls on the professional executing the transaction, not merely the platform coordinating it.

Risk reallocation has behavioral implications. Agents may resist firm-level pressure to use private-listing programs if participation exposes their personal licenses. Top producers with established reputations have the most to lose from licensing discipline. The structure creates internal friction against private-listing strategies even if firm leadership prefers them.

The structural effects of SB 6091 extend well beyond transparency requirements. By converting private governance to public mandate, the bill insulates coordination norms from antitrust challenge while extending their reach. By standardizing timing, the bill eliminates the sequencing advantages that private-listing programs provide. By reallocating risk to individual licensees, the bill creates compliance incentives that operate independently of firm-level strategy. The cumulative effect is a fundamental shift in how coordination norms are established, enforced, and maintained.

V. Post-Merger Containment, Not Pre-Merger Prevention

SB 6091 did not emerge from abstract policy deliberation. The bill appeared three days after the Compass–Anywhere merger closed, backed by bipartisan sponsors and the state’s dominant trade association. The timing reveals institutional logic: when federal antitrust enforcement does not prevent consolidation, state licensing law provides an alternative governance mechanism. The bill represents Post-Consolidation Containment—regulatory response to market structure that cannot be unwound.

V.A. The Chronology of Institutional Response

The timing is not coincidental:

December 16, 2025: Senators Warren and Wyden send letter urging DOJ and FTC to scrutinize the Compass–Anywhere merger, warning that the transaction “could raise barriers to entry for smaller firms, and threaten the transparency of real estate listings by allowing a dominant brokerage to dictate how listings are shared and with whom.”

January 10, 2026: Compass–Anywhere merger closes. Hart-Scott-Rodino waiting period expires without Second Request. DOJ staff concerns do not translate into enforcement action.

January 13, 2026: Washington introduces SB 6091. The bill is referred to Senate Housing Committee with bipartisan sponsorship.

Three days separate merger consummation from legislative response. The proximity signals institutional learning: when federal antitrust enforcement does not prevent consolidation, state licensing law provides an alternative governance mechanism.

V.B. Why This Design Emerges Now

SB 6091 did not emerge from abstract policy deliberation. It emerged from a specific enforcement gap that the Compass–Anywhere transaction exposed.

Antitrust uncertainty. Federal enforcers allowed the merger to close despite documented concerns. Post-close enforcement remains possible but uncertain—civil investigative demands, conduct remedies, and state attorney general coordination all operate on timelines measured in years, not months. The merger’s coordination-capture effects may harden before enforcement arrives.

Private governance vulnerability. NWMLS faces active litigation from Compass challenging its coordination rules as anticompetitive restraints. Even if NWMLS prevails, the litigation creates uncertainty about whether private MLS governance can durably maintain public-marketing norms against a scaled challenger.

Political salience. Housing affordability is a populist issue. The Warren-Wyden letter elevated the merger to federal attention. Washington legislators face constituent pressure on housing costs. A bill framed as protecting equal access to listings—ensuring all buyers see all homes—aligns with popular concern about housing market fairness.

The convergence produced SB 6091: a mechanism to lock in coordination norms through licensing law when neither antitrust enforcement nor private MLS governance can reliably maintain them.

V.C. Institutional Learning After Consolidation

The pattern is generalizable. When structural intervention fails—whether through enforcement discretion, litigation delay, or political constraint—institutions adapt by standardizing behavior directly.

SB 6091 does not attempt to undo the Compass–Anywhere merger. It accepts consolidation as fact. It then writes rules for how consolidated entities must behave. The state cannot restore structural competition. The state can mandate behavioral outcomes that approximate what structural competition would produce.

Post-Consolidation Containment represents a distinct phase of market governance. When structural intervention fails—whether through enforcement discretion, litigation delay, or political constraint—institutions adapt by standardizing behavior directly. SB 6091 freezes coordination architecture through licensing discipline, ensuring that scale cannot be leveraged into sequencing advantages regardless of who controls the platform. The bill does not reverse consolidation; it constrains how consolidation can be used.

V.D Competition Protection Through Coordination Infrastructure

Markets do not regulate themselves into existence. The infrastructure that enables competition—property rights, contract enforcement, information transparency—requires institutional support. MLS coordination is that infrastructure for residential real estate. It solves a problem that decentralized actors cannot solve independently: ensuring that buyers see available inventory and sellers reach qualified buyers without bilateral negotiation among thousands of firms.

When a dominant firm internalizes that coordination function—controlling listing visibility, timing, and access—the firm does not compete within the market. The firm controls the market. Other brokers become supplicants, dependent on the platform’s willingness to share information. Buyers become captives, seeing only what the dominant network chooses to show them. Sellers become dependent, their market exposure determined by their broker’s network affiliation rather than their property’s merit.

SB 6091 prevents this capture. The bill does not restrict competition. The bill preserves the conditions under which competition can occur. Compass’s framing—that public-marketing requirements limit seller choice and restrict innovation—inverts reality. Private listing networks limit buyer choice by hiding inventory. They restrict competition by converting information control into market power. They benefit the platform, not the consumer.

The free-market position supports SB 6091. Open information enables competition. Coordination infrastructure serves all participants. Dominant platforms that capture coordination infrastructure threaten markets more than any regulation could. The bill is not the state overriding market outcomes. The bill is the state preventing a private actor from overriding market coordination for its own benefit.

V.E Market Concentration Data: King County

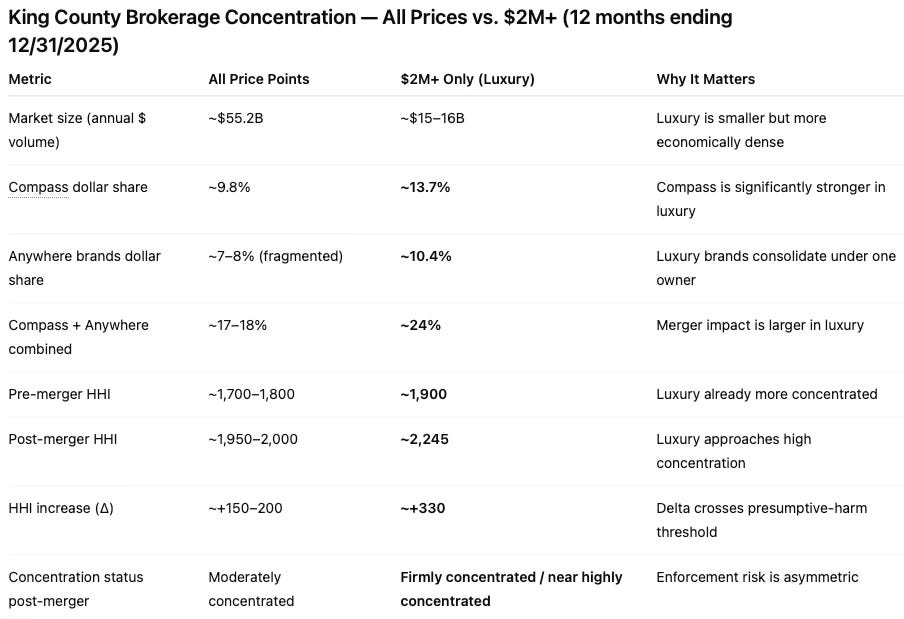

The Compass–Anywhere merger materially increases concentration in King County's $2M+ residential real estate market, pushing the luxury segment toward the highly concentrated range and triggering presumptive competitive harm under federal enforcement standards.

Using observed King County $2M+ residential closing data for the 12 months ending December 31, 2025, the luxury segment accounts for roughly $15–16 billion in annual transaction value. Compass controls approximately 13.7% of $2M+ dollar volume, while legacy Anywhere Real Estate brands (Coldwell Banker and Sotheby's) account for approximately 10.4%. Combined, the merged platform controls roughly 24% of luxury dollar volume—and concentration metrics understate the full competitive risk in a platform-driven market.

Observed $2M+ HHI ≈ 1,900 pre-merger (already concentrated)

Post-merger $2M+ HHI ≈ 2,245 (+~330 points)

A >300-point increase in a concentrated market is presumptively harmful under federal standards

Labor-intensive, platform-dependent dynamics amplify competitive and mobility harms beyond price effects

The King County data confirms what the structural analysis predicts. The Compass–Anywhere merger does not merely increase market share—it concentrates control over listing access in a segment where information asymmetry already determines competitive position.

At 24% combined luxury dollar volume, the merged platform approaches the threshold at which private listing networks become self-reinforcing: enough scale to make Private Exclusives valuable to sellers, enough inventory to make network membership essential for buyer agents, enough market presence to normalize opt-outs if disclosure-based models permit them. The data explains why SB 6091's concurrency requirement—rather than a disclosure-based opt-out—is the appropriate regulatory response. Disclosure constrains behavior in fragmented markets. In concentrated markets, disclosure documents the behavior it was designed to prevent.

VI. The Litigation Interaction: How SB 6091 Collapses Compass’s Remedy Space

The relationship between SB 6091 and Compass’s pending litigation against NWMLS reveals the deeper logic of Post-Consolidation Containment. The bill does not merely regulate listing behavior—it collapses the remedy space that Compass is actually fighting for. Even a litigation victory would not restore the conduct the lawsuit seeks to protect. The state does not defeat the antitrust claim; it makes the claim irrelevant going forward.

VI.A. What Compass Is Actually Fighting For

Compass’s lawsuit against NWMLS is nominally about antitrust liability—whether mandatory MLS submission rules constitute an unlawful horizontal restraint. But the lawsuit is not really about damages for past conduct. The lawsuit is about future optionality.

The litigation target is strategically chosen. NWMLS is the one Washington MLS that prohibits private listings outright. Other Washington MLSs—Spokane, Eastern Washington, and markets operating under NAR's Clear Cooperation Policy—already allow office exclusives and private listings with disclosure and timing constraints. Compass isn't seeking parity with prevailing Washington practice; it's attacking the strictest constraint while benefiting from looser rules elsewhere in the state. A victory against NWMLS would eliminate the last robust barrier to private-listing strategies in Washington's largest market.

The conduct Compass seeks to protect includes:

Pre-marketing windows that allow network circulation before public visibility

Private Exclusives that keep listings within the brokerage indefinitely

Phased exposure strategies that sequence visibility to maximize double-end probability

Proprietary network advantages that differentiate Compass from MLS-dependent competitors

A victory against NWMLS would establish that private MLS governance cannot prohibit these strategies. Compass could then market listings through whatever sequencing its platform enables, constrained only by seller preference and competitive pressure—not by trade-association rules.

VI.B. How SB 6091 Drains the Litigation Upside

SB 6091 collapses this remedy space entirely.

If the bill passes, the strategies Compass seeks to protect become state-prohibited—not merely MLS-restricted. The behavioral outcomes that NWMLS enforces through membership rules would be mandated by statute for all Washington licensees. Even a complete Compass victory against NWMLS would not restore the conduct.

The bill also closes the intra-state gap that Compass currently exploits. Today, Compass can run Private Exclusives in Spokane and Eastern Washington markets where Clear Cooperation rules permit office exclusives—while simultaneously suing to break open the Puget Sound market where NWMLS prohibits them. SB 6091 eliminates this arbitrage. The concurrent public-marketing requirement applies statewide, regardless of local MLS rules. Compass cannot win against NWMLS and then operate freely in the Puget Sound; the conduct is state-prohibited everywhere.

Consider the practical implications:

Pre-marketing requires concurrent public marketing under SB 6091. A Compass win against NWMLS does not change this.

Private Exclusives violate the bill’s core prohibition unless concurrently marketed publicly. A Compass win against NWMLS does not change this.

Phased exposure is eliminated by the concurrency requirement. A Compass win against NWMLS does not change this.

Proprietary network advantages based on sequencing disappear when all marketing must be simultaneous. A Compass win against NWMLS does not change this.

The litigation upside drains away. Compass could prevail on every legal theory—establishing that NWMLS rules are per se unlawful horizontal restraints—and still be prohibited from the conduct the lawsuit was designed to enable. The state has written into licensing law precisely what NWMLS wrote into membership rules.

VI.C. The Strategic Pivot: From Reopening the Market to Preserving the Record

Post-SB 6091, the NWMLS litigation shifts purpose. The lawsuit stops being a vehicle for reopening the market to private-listing strategies. Instead, it becomes about:

Establishing narrative: Creating a judicial record that frames MLS coordination as anticompetitive, even if the conduct is now state-mandated

Preserving precedent: Securing holdings that could apply in jurisdictions without similar legislation

Positioning for preemption arguments: Building a record for future claims that state licensing law is preempted by federal antitrust policy

Influencing statutory interpretation: Shaping how courts and regulators interpret the bill’s exceptions and enforcement

None of these objectives restore the operational flexibility Compass originally sought. The strategic value shifts from market access to legal positioning—a fundamentally different return on litigation investment.

VI.D. The State-Action Shield: How SB 6091 Strengthens NWMLS Prospectively

The bill creates a second-order effect that benefits NWMLS and aligned incumbents.

Once the legislature adopts the same behavioral standard that NWMLS enforces through private rules, future NWMLS governance looks less like private restraint and more like implementation of public policy. The state-action doctrine immunizes private conduct that implements clearly articulated state policy and is actively supervised by the state.

SB 6091 provides:

Clear articulation: The legislature has expressed a policy favoring public marketing of residential listings

Active supervision: DOL enforcement and WLAD liability create state oversight of compliance

NWMLS rules that align with statutory requirements gain prospective protection. Private governance that mirrors public mandate is not private restraint—it is coordinated implementation of state policy.

The immunity does not cure past conduct. Compass’s claims regarding pre-SB 6091 NWMLS enforcement remain viable on their own terms. But the forward shield hardens. Future rule enforcement becomes categorically harder to challenge when the rules implement statutory policy rather than trade-association preference.

VI.E. Why This Makes SB 6091 Attractive to Incumbents

The litigation-interaction dynamic explains why SB 6091 attracts support from constituencies that might otherwise resist new regulation.

Washington Realtors gains statutory protection for coordination norms that members have maintained through voluntary governance. The association’s policy positions become state law rather than contestable trade-association rules.

NWMLS-aligned brokerages gain competitive protection. The sequencing advantages that Compass sought become unavailable to any competitor—leveling the playing field by eliminating the strategy rather than competing against it.

Regulators gain clarity. Rather than adjudicating complex antitrust disputes about whether MLS rules are procompetitive or anticompetitive, the state simply mandates the behavioral outcome. The regulatory question shifts from “are these rules lawful?” to “are licensees complying?”

The bill offers something to each constituency: protection, clarity, and—most importantly—finality. The private-listing debate ends not through litigation resolution but through legislative preemption of the conduct at issue.

SB 6091’s interaction with pending litigation reveals the full scope of Post-Consolidation Containment. The state does not defeat Compass’s antitrust claims on the merits. The state makes those claims irrelevant by prohibiting the conduct they seek to enable. Even a litigation victory leaves Compass unable to execute the strategies the lawsuit was designed to protect. The remedy space collapses; the upside drains away; the case becomes about narrative and precedent rather than market access. Meanwhile, the bill strengthens the forward shield for NWMLS and aligned incumbents, converting contested private governance into implementation of articulated state policy. The litigation continues, but its strategic purpose has fundamentally changed.

CDT Foresight:

Compass. The Cognitive Digital Twin simulation identifies Compass’s rational adaptation path. Continued emphasis on antitrust litigation yields diminishing marginal returns once behavioral rules are codified through licensing law. The optimal pivot is from litigation-centered strategy to compliance-optimized differentiation within statutory rails—redirecting platform advantage toward speed, analytics, pricing intelligence, and agent productivity afterconcurrent public exposure, rather than before it. Compass is no longer deciding whether to comply; it is deciding how visible resistance will be interpreted by regulators and legislators. The simulation flags reputational drag and adverse legislative spillover if Compass frames SB 6091 as an innovation ban rather than an infrastructure rule. The model favors quiet compliance paired with narrative repositioning as a best-in-class public-market executor.

Predictions: Litigation against NWMLS continues but shifts from remedy-seeking to record-building. Product roadmaps de-emphasize private exclusives within 12–18 months. Investment increases in post-listing optimization tools rather than access control.

VII. Early Institutional Alignment: The Coalition Map

Legislative outcomes depend on coalition dynamics, not just policy merit. SB 6091’s bipartisan sponsorship, trade-association endorsement, and rapid introduction signal that the public-marketing mandate has moved from conceptual proposal to coordinated institutional execution. Understanding who supports and opposes the bill—and why—reveals the political economy that will determine its fate.

VII.A. Bipartisan Sponsorship as Institutional Signal

SB 6091’s sponsorship pattern signals that the public-marketing mandate has moved from conceptual alignment to coordinated institutional execution.

Senate sponsors: Marko Liias (D-21), Chris Gildon (R-25), Jessica Bateman (D-22), Emily Alvarado (D-34), John Braun (R-20). The bipartisan composition—three Democrats, two Republicans—indicates cross-caucus support. Liias chairs relevant committees; Braun is Senate Republican Leader. The bill has leadership buy-in from both parties.

House sponsors: Strom Peterson (D-21), April Connors (R-8). Companion legislation in both chambers signals coordinated advancement rather than single-chamber exploration.

Washington Realtors support. The state REALTOR association has publicly endorsed the bill. As their spokesperson stated: “The intent of the proposed legislation is to promote transparency, fairness and equal access in the residential real estate market by requiring all listings to be marketed publicly and be available to all brokers.”

VII.B. Implications of Incumbent Support

Public endorsement by Washington Realtors and alignment with NWMLS-member brokerages indicates that statutory public-marketing mandates are being internalized as industry-stabilizing rather than disruptive.

For established brokerages that have built their business models around MLS coordination, the bill protects the infrastructure they depend on. For agents who compete on service rather than access, the bill ensures they can serve buyers without informational disadvantage. For MLSs themselves, the bill converts their governance rules into statutory mandate—insulating those rules from antitrust challenge while extending their reach.

The political economy favors passage. The supporting coalition includes the dominant industry trade association, the region’s largest MLS, bipartisan legislative leadership, and consumer-access advocates. Opposition centers on a single firm—Compass—and the seller-choice framing that firm has promoted.

VII.C. Coalition Map: Supporters and Opponents

SB 6091 is now a coordination fight, not a drafting exercise. The lines are drawn.

Supporting camp:

Washington Realtors (state trade association)

NWMLS-aligned brokerages (Windermere, John L. Scott, regional independents)

Bipartisan legislative sponsors

Consumer-access and fair-housing advocates

Agents who compete on service rather than network access

Opposition camp:

Compass (and post-merger Compass International Holdings)

Seller-choice advocates who frame private listings as consumer preference

Agents whose business models depend on private-listing differentiation

Brokerages with phased-exclusive or Coming Soon programs

Compass has already staked its position. A company spokesperson called the legislation “a veiled attempt by NWMLS and Zillow to preserve their market dominance by restricting homeowner choice and limiting competition, to the detriment of sellers and agents alike.”

The framing reveals the strategic stakes. Compass argues the bill protects incumbent coordination infrastructure rather than consumers. The supporting coalition argues that coordination infrastructure is consumer protection when the alternative is coordination capture by a dominant platform. Your series has documented why the latter argument is analytically correct—but the political outcome will depend on which framing resonates.

Coalition dynamics favor passage. The supporting coalition includes the dominant industry trade association, bipartisan legislative leadership, and consumer-access advocates. Opposition centers on a single firm and the seller-choice framing that firm has promoted. The asymmetry matters: diffuse industry support versus concentrated firm opposition typically resolves in favor of the broader coalition, particularly when that coalition can frame its position as consumer protection.

CDT Foresight:

NWMLS. Once concurrency rules are statutory, NWMLS’s comparative advantage lies in implementation fidelity, not rule innovation. The simulation indicates that aggressive MLS-specific restrictions beyond the statute increase antitrust exposure without increasing regulatory protection. The optimal posture is administrative humility: present MLS rules as mirrors of state law, not independent coordination mandates. This reduces private-litigation risk and strengthens future state-action immunity arguments.

Predictions: NWMLS revises rule commentary to cite SB 6091 explicitly. Enforcement language becomes more procedural and less normative. MLS litigation risk plateaus rather than escalates post-enactment.

CDT Foresight:

Washington Realtors. The simulation shows Washington Realtors’ highest payoff comes from keeping SB 6091 framed as consumer-access and licensing coherence, not as a rebuke of Compass. Over-targeting a single firm risks converting institutional learning into factional conflict. Washington Realtors are functioning as system integrators rather than interest advocates. The optimal path is neutral compliance guidance, pamphlet language, and educational materials that normalize the rule quickly after passage.

Predictions: WR publishes standardized compliance toolkits within one rulemaking cycle. Messaging shifts from fairness rhetoric to operational clarity post-passage. WR becomes a template source for other state associations.

VIII. Comparative Signal: Washington Versus Other Jurisdictions

Policy design exists on a spectrum. Washington’s proposal represents the strict end—near-absolute concurrency with no opt-out. Other jurisdictions have adopted or considered softer approaches that preserve seller choice through formal waiver mechanisms. Understanding where Washington falls on this spectrum clarifies both the bill’s ambition and the range of regulatory responses that may emerge elsewhere.

VIII.A. Washington’s Near-Absolute Concurrency Mandate

Washington’s proposal represents the strict end of the policy spectrum. SB 6091 would effectively eliminate broker-driven private listings whenever any marketing occurs:

No private-first window. If a broker markets a property at all, public marketing must occur concurrently. There is no interval for private circulation.

No opt-out. Sellers cannot waive the public-marketing requirement. The sole exception is health-or-safety necessity, which is a narrow carve-out for genuine protection concerns rather than a general preference mechanism.

Platform-neutral but outcome-determinative. The bill does not mandate MLS entry, but the concurrency requirement eliminates the sequencing advantages that private-listing programs provide.

VIII.B. NAR Clear Cooperation and Its Uncertain Future

NAR’s Clear Cooperation Policy requires MLS entry within one business day of public marketing but permits limited exceptions: office exclusives where the listing is never publicly marketed, and “Coming Soon” designations with defined time limits. NAR is currently reconsidering Clear Cooperation, with industry debate about whether to relax, eliminate, or strengthen the policy.

SB 6091 operates independently of NAR policy. The bill would apply to all Washington licensees regardless of their MLS’s rules. If NAR weakens Clear Cooperation, Washington’s statute would maintain the public-marketing norm within the state. If NAR strengthens Clear Cooperation, Washington’s statute would provide parallel enforcement through licensing discipline.

VIII.C. The Illinois Model: Opt-Outs and Their Scale Limitations

Illinois-style approaches preserve formal seller opt-outs while establishing public marketing as the default. In fragmented markets with dispersed market share, such defaults function as intended: most sellers follow the default, and the minority who opt out do not distort market coordination.

Wisconsin enacted this model in 2025. Assembly Bill 456, effective January 1, 2027, requires listing firms to publicly market residential properties within one business day of the agency agreement—unless the seller completes a disclosure and opt-out form. The disclosure must include the seller’s written acknowledgment that: (1) licensees and prospective buyers may not be aware the property is available; (2) the property will not appear on public listing platforms; (3) reduced exposure may result in fewer offers and a lower sale price; and (4) the opt-out may negatively affect the seller’s ability to sell at favorable terms. The disclosure requirements are extensive. The opt-out still exists.

Wisconsin’s AB 456 illustrates how disclosure fails to constrain behavior at platform scale. The bill’s requirements are designed to ensure informed seller consent—sellers must initial acknowledgments about reduced exposure and potentially lower prices. But disclosure does not prevent the behavior; it documents it. A platform with 25% market share can train agents to present the opt-out as a premium service, normalize the disclosure as routine paperwork, and route inventory through internal networks while technically complying with the statute. The disclosure becomes evidence of consent, not a barrier to coordination capture.

At platform scale, opt-outs function differently.

Opt-outs become distribution levers. For a high-volume platform like Compass, seller opt-outs are not exceptions—they are standardizable processes. Opt-out language can be embedded in listing agreements. Agent scripts can normalize private phases as “premium choice.” The formal mechanism designed to preserve seller autonomy becomes an operational lever for routing inventory through internal networks first.

Scale converts choice into steering. Once opt-outs exist at volume, the platform can normalize private-first sequencing as a service offering, route listings through proprietary networks before public exposure, and rely on sheer transaction volume to recreate private-listing dominance—legally. The behavioral constraint dissolves into a compliance formality.

Washington eliminates sequencing discretion; Illinois preserves it. The critical difference is not disclosure but timing. Illinois-style defaults still permit a private window before public exposure. Washington’s concurrency requirement collapses that window entirely. Illinois preserves time as a competitive variable; Washington eliminates it.

The distinction matters precisely because of what Part II documented: the Compass–Anywhere merger consolidated platform scale sufficient to convert opt-outs into systematic steering. Illinois-style opt-outs function in fragmented markets. At platform scale, they reconstitute exclusivity rather than constrain it—making concurrency the only durable control.

Strategic implication. Illinois represents a transitional or test-bed model appropriate for markets below platform-concentration thresholds. Washington represents the lock-in model required once consolidation crosses those thresholds. Compass’s rational amendment strategy would be to push Washington toward Illinois-style opt-outs, thereby regaining the sequencing power that SB 6091 is designed to eliminate.

VIII.D. Why the Divergence Matters

The Washington proposal signals that states are not waiting for national trade association governance to resolve the private-listing debate. When federal antitrust enforcement is uncertain and NAR policy is contested, individual states can act through licensing law to lock in coordination norms they consider essential.

The result is patchwork risk for national brokerages. A firm operating across multiple states may face different public-marketing obligations in different jurisdictions. Compliance complexity increases. The operational simplicity of uniform private-listing programs erodes when some states mandate concurrency and others do not.

Washington itself illustrates the patchwork problem. NWMLS prohibits private listings outright; Spokane and Eastern Washington MLSs allow them under Clear Cooperation with opt-out. A broker operating across Washington already faces different rules depending on geography. SB 6091 resolves this internal inconsistency by establishing a uniform statewide standard through licensing law. The bill does not pick sides in MLS governance disputes—it renders them moot by codifying the strictest standard as the baseline for all licensees.

Wisconsin and Washington now represent opposite ends of the policy spectrum. Wisconsin chose disclosure-based opt-out; Washington chose concurrency without opt-out. The contrast is instructive: Wisconsin trusts informed consent to protect market coordination; Washington concludes that consent mechanisms become exploitable at platform scale. Both states responded to the same post-consolidation market dynamics. They reached different conclusions about whether disclosure can substitute for prohibition.

For Compass, the strategic concern is diffusion. If Washington passes SB 6091 and the model spreads to California, New York, and Texas—the other major concentration markets post-merger—the Private Exclusive business model becomes unworkable at national scale.

VIII.E. Compass’s Implicit Amendment Strategy: Spotlight

The analytical framework above reveals Compass’s rational legislative strategy with precision. Making it explicit serves the public interest.

The play: Push Washington toward an Illinois-style opt-out model during the amendment process. Frame this as “preserving seller choice” and “avoiding government overreach.” Argue that consumers deserve the right to control how their homes are marketed.

Wisconsin provides the template. AB 456's disclosure-based opt-out is precisely what a "compromise" amendment to SB 6091 would look like. The seller signs a form acknowledging the consequences of private marketing. The form creates a paper trail of informed consent. The behavior continues—legally, documented, at scale. Washington legislators considering amendments should understand that Wisconsin's approach is not a middle ground; it is the mechanism through which concurrency requirements are neutralized.

The mechanism: Once opt-outs exist, Compass’s platform scale converts formal choice into systematic steering. Listing agreements can embed opt-out language as a default. Agent scripts can normalize private-first marketing as a premium service. The opt-out rate at a 35% market-share brokerage will not resemble the opt-out rate at a 3% brokerage. Volume creates its own gravity.

The outcome: Private Exclusives reconstitute—legally. The behavioral constraint dissolves into a compliance checkbox. SB 6091 becomes a disclosure rule rather than a market-design rule. Compass regains the sequencing power the bill was designed to eliminate.

Why this matters now: Compass has already signaled opposition to SB 6091, calling it “a veiled attempt by NWMLS and Zillow to preserve their market dominance.” The seller-choice framing is the obvious rhetorical vehicle for amendment advocacy. Legislators considering “compromise” language should understand that opt-outs at platform scale do not preserve choice—they transfer it from individual sellers to the dominant platform’s operational defaults.

The concurrency requirement is not an aggressive policy design. It is the minimum viable constraint once market share crosses the threshold where opt-outs become exploitable. Weakening the bill to include opt-outs does not soften the regulation; it nullifies it.

Washington’s strict concurrency mandate represents the post-consolidation endpoint on a policy spectrum. Illinois-style defaults with opt-outs function in fragmented markets but become exploitable at platform scale—where opt-outs convert from seller-choice mechanisms into brokerage distribution levers. The bill’s significance lies in recognizing that once consolidation crosses coordination thresholds, concurrency without discretion is the only durable behavioral control. States are not waiting for national trade-association governance or federal antitrust enforcement to resolve the private-listing debate. Licensing law offers a faster, more certain path to behavioral outcomes—and different states may choose different points on the spectrum based on whether their markets have crossed the platform-scale threshold that makes concurrency mandatory.

IX. Generalizing the Pattern: Why Other States May Follow

Washington’s bill emerged from specific conditions: large-scale consolidation, contested MLS governance, and politically salient fair-housing narratives. Those conditions are not unique to Washington. Identifying where similar conditions exist reveals the jurisdictions most likely to follow Washington’s lead—and the mechanisms through which policy diffusion occurs.

IX.A. Required Preconditions

The conditions that produced SB 6091 exist elsewhere. Three structural ingredients are necessary for similar legislation to emerge:

Large-scale brokerage consolidation. The Compass–Anywhere merger created the template. Combined market share exceeds 30% in multiple major metros: Manhattan, Los Angeles, San Francisco, Seattle, Boston, Washington D.C. Where a single entity controls dominant transaction volume, coordination-capture concerns become politically salient.

Contested MLS governance. Compass’s litigation against NWMLS is not unique. The company has challenged MLS coordination rules in multiple jurisdictions. NAR’s Clear Cooperation debate creates uncertainty about whether national policy will maintain public-marketing norms. Where private MLS governance is contested, statutory alternatives become attractive.

Politically salient fair-housing narratives. Private-listing programs can be framed as access barriers: certain buyers (those working with network-affiliated agents) see inventory that other buyers cannot. In housing markets where affordability is a political issue, equal-access framing resonates. The fair-housing hook provides narrative power that pure market-structure arguments lack.

Wisconsin's AB 456 confirms that diffusion is already underway. The bill represents the first legislative response to post-Sitzer/Burnett market restructuring, addressing both public-marketing defaults and commission-disclosure requirements. Wisconsin chose the soft end of the spectrum—default public marketing with seller opt-out. Washington's SB 6091 represents the hard end—concurrency without opt-out. The two bills create a natural experiment: which approach actually preserves market coordination when a dominant platform has incentives to maximize opt-out rates? States observing both outcomes will have empirical evidence to inform their own legislative choices.

IX.B. Priority Jurisdictions

California. The largest antitrust division in any state AG office. Los Angeles approaches 50% combined Compass–Anywhere market share. Attorney General Rob Bonta has made antitrust enforcement a signature priority. California’s UCL provides UDAP authority that parallels Washington’s approach. Housing affordability is intensely political. If SB 6091 passes Washington, California is the most likely second mover.

New York. Attorney General Letitia James has demonstrated willingness to act in real estate markets—the Zillow-Redfin rental advertising lawsuit established the template. Manhattan represents enormous Compass–Anywhere concentration. New York’s GBL § 349 provides consumer-protection authority. The political economy of New York housing makes equal-access framing attractive.

Texas. Dallas-Fort Worth represents significant post-merger concentration. Houston and Austin both exceed coordination thresholds. Attorney General Ken Paxton has pursued aggressive enforcement in other contexts. Texas antitrust penalties are significant. The political alignment is different from Washington, but the structural conditions are present.

Wisconsin (enacted). AB 456 passed in 2025 and takes effect January 1, 2027. The bill establishes public-marketing defaults with disclosure-based opt-out, representing the soft end of the regulatory spectrum. Wisconsin's approach provides a control case: if opt-out rates remain low and market coordination is preserved, the disclosure model may spread. If opt-out becomes normalized at platform scale and coordination degrades, other states will have evidence supporting Washington's stricter approach.

IX.C. Likely Vectors of Diffusion

Trade association learning. State REALTOR associations monitor peer jurisdictions. If Washington Realtors’ support for SB 6091 proves strategically successful—if the bill passes and survives challenge—other state associations will study the model. The bill language becomes template legislation adaptable to local statutory frameworks.

Regulatory coordination. State real estate commissions communicate through national organizations. Licensing-discipline approaches that prove effective in one state become best practices that spread to others. The enforcement mechanism is transferable even if the specific statutory language requires adaptation.

Political imitation. Legislators in competitive housing markets face constituent pressure on affordability and access. A bill that passed with bipartisan support in Washington provides political cover for legislators elsewhere. “Washington did it” becomes an argument for action.

The conditions for policy diffusion are present. Large-scale consolidation exists in multiple major markets. MLS governance is contested nationally. Fair-housing narratives resonate across jurisdictions. The mechanisms of diffusion—trade-association learning, regulatory coordination, political imitation—are well-established. Washington’s outcome will be watched closely; passage would accelerate similar proposals elsewhere.

CDT Foresight:

Other States. The simulation suggests that most states will initially choose softer Clear-Cooperation-plus models with opt-outs, then migrate toward Washington-style hard concurrency if private networks reconstitute around loopholes. Policy diffusion favors gradient adoption: states with active MLS litigation or high platform concentration accelerate faster toward statutory lock-in; others test defaults first.

Predictions: 2–4 additional states introduce concurrency or default-public-marketing bills within two legislative sessions. Early versions preserve opt-outs; later amendments narrow them. Platform-neutral drafting becomes standard.

Wisconsin as Control Case. The simulation now incorporates Wisconsin's enacted legislation as an observable data point. AB 456's disclosure-based opt-out creates a measurable test of whether informed-consent mechanisms constrain platform behavior. Key indicators to track: opt-out rates by brokerage market share, time-on-market differentials between opted-out and publicly marketed properties, and whether high-share brokerages systematically exceed baseline opt-out rates. If Compass-affiliated agents in Wisconsin show opt-out rates significantly above market average within 18 months of implementation, the simulation's platform-scale exploitation hypothesis is confirmed—and Washington's concurrency-without-opt-out design is validated as the minimum viable constraint.

X. Implications for Brokers, Platforms, and Policy

Foresight without practical implication is academic exercise. SB 6091 creates concrete strategic considerations for large brokerages, MLSs, and policymakers. Understanding these implications enables market participants to anticipate and adapt to the regulatory environment that is emerging—regardless of whether any individual bill passes.

X.A. Strategic Implications for Large Brokerages

For Compass and other brokerages with private-listing programs, SB 6091 signals a structural constraint on business-model differentiation.

Operational impact. If the bill passes, Private Exclusives become non-viable in Washington. The concurrency requirement eliminates the sequencing advantage that the program provides. Compass can still offer the technology platform, the agent tools, the marketing infrastructure—but the listing-visibility advantage disappears.

Compliance complexity. National brokerages operating across multiple states face divergent obligations. Private-listing programs that are permissible in Texas may be prohibited in Washington. Compliance requires either state-by-state operational variation or convergence toward the most restrictive standard.

Reputational exposure. The civil-rights framing of SB 6091 creates reputational risk beyond licensing discipline. Being characterized as violating fair-housing norms—restricting access to housing information based on network affiliation—carries brand implications that pure antitrust exposure does not.

X.B. Strategic Implications for MLSs

For NWMLS and other MLSs with strong public-marketing rules, SB 6091 provides statutory reinforcement of governance positions they have maintained through private ordering.

Antitrust insulation. The bill converts MLS coordination norms into state mandate. Compass’s argument that NWMLS rules constitute anticompetitive horizontal agreement becomes harder to sustain when the state independently requires the same behavior. Statutory mandate is sovereign regulation, not private conspiracy.

Extended reach. The bill applies to all licensees, not just MLS members. Brokers who avoided MLS membership to preserve private-listing flexibility now face the same public-marketing obligation. The free-rider problem that undermines voluntary coordination is solved through universal mandate.

Governance validation. Legislative endorsement of public-marketing norms validates the policy positions MLSs have defended. The political process has weighed coordination-infrastructure arguments against seller-choice arguments and sided with coordination.

X.C. The New Phase of Real Estate Regulation

SB 6091 marks a transition in how residential brokerage markets are governed.

From structural competition to behavioral standardization. The phase in which market structure was contested is ending. The Compass–Anywhere merger closed. Consolidation is fact. The new phase is behavioral: states are writing rules for how consolidated entities must operate, regardless of whether structural competition would have produced better outcomes.

From antitrust to licensing law. The enforcement mechanism is shifting. Antitrust cases require market definition, intent findings, and protracted litigation. Licensing discipline requires compliance with professional standards enforced through administrative process. The latter is faster, more certain, and harder to contest.

From private governance to public mandate. MLS coordination rules operated through voluntary association. SB 6091 operates through state sovereignty. The coordination norm no longer depends on industry self-governance; it is embedded in the licensing framework that every broker must satisfy to practice.

The implications extend across the industry ecosystem. Large brokerages face operational constraints on differentiation strategies. MLSs gain statutory reinforcement of governance positions. The regulatory environment shifts from antitrust litigation to licensing discipline. Market participants who understand these shifts can position accordingly; those who do not will find their strategic assumptions invalidated by regulatory change.

CDT Foresight:

Washington DOL / Legislature. The simulation favors early, selective enforcement to establish credibility, paired with narrow interpretations to avoid constitutional or preemption challenges. Over-enforcement increases litigation risk; under-enforcement undermines deterrence. Licensing law is now the state’s control surface. The optimal strategy is to demonstrate seriousness without expanding beyond the statute’s concurrency core. Pamphlet integration is flagged as especially high-leverage because it routinizes compliance.

Predictions: Initial enforcement actions focus on clear private-exclusive violations. Guidance memos precede formal sanctions. Disclosure obligations become the dominant compliance lever.

XI. The Final Closure of the Tech Trap

The series has documented a trap that Compass set for itself through securities disclosure. SB 6091 represents the trap’s final closure: the state has agreed with Compass’s own characterization of its platform as essential market infrastructure. Essential infrastructure gets regulated. The more Compass argued that its platform was indispensable, the more the state concludes that indispensable infrastructure requires public-interest oversight.