MCAI Lex Vision: How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In

A Synthesis Analysis Using MindCast AI Frameworks: Installed Cognitive Grammar, Field-Geometry Reasoning, and Predictive Institutional Economics

Companion publications: Federal Inaction Has Elevated State Authority on Consumer Protection, Antitrust, and Market Integrity, Briefing for State Attorneys General (Jan 2026), Federal Political Market Failure and State Substitution as a Free‑Market Corrective, When Federal Inaction Distorts Markets, States Restore Competition (Jan 2026), The Stigler Equilibrium- Regulatory Capture and the Structure of Free Markets, Why Enforcement Must Compete to Keep Markets Free (Jan 2026), Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria, Live Nation as Anchor, Compass–Anywhere as Validation (Jan 2026).

Executive Summary

Antitrust enforcement has not collapsed; it has shifted in time. Formal legal authority to block mergers and pursue monopolization remains intact. Clayton Act Section 7 stands. The 2023 merger guidelines establish 30% market share as presumptively illegal. Career antitrust staff continue to recommend investigations and litigation. Yet the effective point of constraint has moved downstream—from pre-merger gatekeeping to post-merger correction. Sophisticated firms have adapted accordingly: close first, capture coordination advantages, price later enforcement as manageable risk.

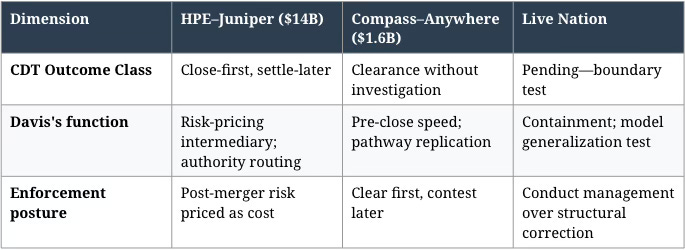

Attorney Mike Davis functions as a visible node in that adaptation. His repeated appearance across unrelated, high-stakes antitrust matters—Hewlett Packard Enterprise’s $14 billion acquisition of Juniper Networks, Compass’s $1.6 billion merger with Anywhere Real Estate, and Live Nation-Ticketmaster’s monopolization defense—does not prove corruption. It reveals institutional learning. Firms now behave as if political-authority routing dominates evidentiary sequencing inside federal antitrust enforcement. Clearance signals delay, not safety.

Three MindCast AI frameworks explain the structural shift, leveraging proprietary Cognitive Digital Twin (CDT) foresight simulations.

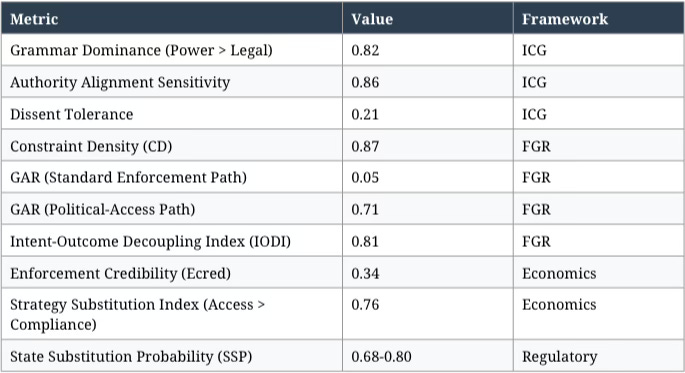

Installed Cognitive Grammar (ICG) identifies the regime transition: decision authority has migrated from actors operating under acquired legal grammar to actors operating under native power grammar. CDT foresight simulation registers Grammar Dominance (Power > Legal) at 0.82 and Authority Alignment Sensitivity at 0.86—quantifying why career staff recommendations systematically fail to predict outcomes. Installed Cognitive Grammar, A Unifying Framework for Behavioral Explanation Across Music, Institutions, and Artificial Intelligence (Jan 2026)

Field-Geometry Reasoning (FGR) maps the constraint field: statutory walls remain formally intact but enforcement geodesics have collapsed. CDT foresight simulation shows Geodesic Availability Ratio through the standard enforcement path at 0.05 versus 0.71 through the political-access path—authority-routing is the path of least resistance when pre-merger gatekeeping walls have been warped by political gravity. Field-Geometry Reasoning, A Unifying Framework for Structural Explanation in Law, Economics and Artificial Intelligence (Jan 2026)

Predictive Institutional Economics Architecture (PIEA) models the rational response: firms substitute political-authority access for evidentiary contest once enforcement timing shifts downstream. CDT foresight simulation registers Enforcement Credibility (Ecred) at 0.34 and declining, Strategy Substitution Index (Access > Compliance) at 0.76. Mike Davis functions as a risk-pricing intermediary in that equilibrium—his involvement signals that the temporal-arbitrage pathway is open and the access fee has been paid. Predictive Institutional Economics Architecture, The National Innovation Behavioral Economics, Strategic Behavioral Coordination, Cognitive Digital Twin Framework (Jan 2026)

The comparative record confirms a consistent pattern. In each case, career antitrust staff raised substantive concerns. In each case, senior political leadership intervened or was appealed to directly. In two cases, transactions closed rapidly with limited or no conditions. In the third—Live Nation—an active monopolization suit now tests whether the same pathway extends beyond mergers into conduct enforcement. Live Nation becomes the falsification case: CDT foresight simulation assigns 55-65% probability to political resolution or weakened case, 25-35% to full litigation with structural remedy. If the suit proceeds to structural remedies despite Davis’s involvement, the temporal-shift model is bounded; if weakened or dropped, the pattern generalizes to conduct enforcement.

The foresight implication is structural: unless ex-ante constraint geometry is restored, authority-routing will become a standard input for high-risk mergers and monopolization defense. Courts and state attorneys general—particularly in California and New York, where market concentration effects are most acute—will increasingly substitute for weakened federal gatekeeping. CDT foresight simulation estimates State Substitution Probability at 0.68-0.80 with Median Post-Merger Lag of 12-26 months. Post-merger conflict will replace prevention as the dominant antitrust mode.

Methodology — Cognitive Digital Twin Foresight Simulation for Law and Behavioral Economics

MindCast AI produces foresight through Cognitive Digital Twins (CDTs)—structured simulations that model how institutions, regulators, firms, and markets adapt under legal, political, and economic constraints. Rather than predicting outcomes from stated intent, public messaging, or formal rules alone, a CDT foresight simulation reconstructs each actor’s available decision paths, constraint geometry, and behavioral grammar, then simulates how those elements interact under stress. In law and behavioral economics, this approach captures a central reality: legal authority can remain formally intact while enforcement outcomes systematically diverge due to institutional incentives, authority routing, and timing effects.

The MindCast AI objective is not to forecast a single outcome, but to identify which constraints bind in practice, when they bind, and for whom.

This analysis deploys three MindCast AI frameworks because each isolates a distinct causal layer that standard legal or economic models conflate.

Installed Cognitive Grammar detects which decision grammar governs outcomes under load—distinguishing evidentiary, legal reasoning from authority-aligned, closure-oriented decision making.

Field-Geometry Reasoning evaluates whether legal constraints remain behaviorally binding by measuring constraint density, viable enforcement paths, and intent–outcome decoupling.

Predictive Institutional Economics)models how firms and regulators rationally adapt once enforcement timing shifts, capturing demonstration effects and strategy substitution across markets.

Foresight simulation predictions emerge where these layers converge: when authority grammar dominates, enforcement geodesics collapse ex ante, and market actors update expectations accordingly. The resulting predictions—about downstream enforcement, state substitution, and regime persistence—are falsifiable, time-bounded, and anchored in observable institutional behavior rather than narrative or ideology.

Thesis

Antitrust enforcement in the United States has entered a temporal-arbitrage regime in which sophisticated firms rationally prioritize speed and scale at closing, then manage enforcement risk downstream through political-authority routing. Mike Davis’s recurring role across major cases—$14 billion at HPE-Juniper, $1.6 billion at Compass-Anywhere, untold billions in Live Nation’s market position—makes that regime legible.

Clayton Act Section 7, Hart-Scott-Rodino premerger notification, and the 2023 merger guidelines remain formally operative. Market concentration thresholds that would trigger presumptive illegality were exceeded in transactions that nonetheless cleared. The statutory architecture persists; the enforcement geodesic has shifted. CDT foresight simulation quantifies the shift: Constraint Density remains high (0.87) while Geodesic Availability through standard paths has collapsed to 0.05. Firms traverse the shortest available path: consummate transactions, lock in coordination infrastructure, and confront enforcement later.

Davis does not create the temporal shift; his presence exposes it. Each matter he touched was already controversial on the merits. His involvement correlates with procedural compression, staff override, and settlement-over-litigation outcomes. He functions as a risk-pricing intermediary—a bridge between corporate strategy and the native power grammar of DOJ political leadership. His fee prices access to the temporal-arbitrage pathway. His success updates corporate expectations system-wide, with CDT foresight simulation showing Demonstration Propagation Rate at High and Early-Consolidation EV Dominance at 0.83.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. See recent projects: The Chicago School Accelerated, Posner and the Economics of Efficient Liability Allocation, Why Behavioral Economics Transforms the Lowest-Cost Avoider Calculus in AI Hallucinations (Dec 2025), H200 China Policy Validation, How MindCast AI’s Six-Publication Series Predicted the “Gate Without Fence” Architecture—Before the Policy Was Announced (Jan 2026), The Crypto ATM Regulatory Convergence, Why Federal Inaction Necessitates State Crypto-ATM Consumer Protection (Jan 2026).

I. Installed Cognitive Grammar: The Translation Failure

Installed Cognitive Grammar identifies the enforcement failure as fundamentally a translation problembetween two distinct reasoning systems operating within the same institution. Career antitrust staff and political leadership speak different cognitive languages. When stakes rise, the language of power overrides the language of law—not because law has changed, but because decision authority has migrated to actors who process information through a different grammar.

CDT foresight simulation quantifies the grammar dominance:

Grammar Dominance (Power > Legal): 0.82

Closure Bias Under Load: 0.78

Authority Alignment Sensitivity: 0.86

Dissent Tolerance: 0.21

These metrics explain why outcomes track authority alignment rather than record development once routing to senior leadership occurs. Low dissent tolerance (0.21) predicts staff override, reassignment, or exit following resistance—exactly the pattern observed with Alford and Rinner.

Acquired Legal Grammar (Type II)

Career antitrust staff operate under acquired legal grammar: cognitive architecture internalized through legal education, DOJ institutional culture, and repeated engagement with statutory frameworks. Legal grammar exhibits high ambiguity tolerance (year-long investigations are normal), evidentiary sequencing (conclusions follow evidence), procedural legitimacy (process integrity validates outcomes), and institutional loyalty (allegiance to office mission rather than current leadership).

AAG Gail Slater, Principal Deputy AAG Roger Alford, and Deputy AAG William Rinner exemplify acquired legal grammar. Slater—a Trump appointee—nonetheless recommended extended investigation of Compass-Anywhere. Alford and Rinner refused to sign the HPE settlement despite pressure. Their resistance was grammar-consistent behavior: legal grammar does not permit signing documents that contradict evidentiary analysis.

Native Power Grammar (Type I)

Senior political appointees operating the bypass pathway exhibit native power grammar: cognitive architecture installed through political socialization. Power grammar shows low ambiguity tolerance (closure bias dominates), authority sequencing (outcomes are authorized by power; records document decisions already made), relationship validation (”MAGA friend” status substitutes for expertise), and principal loyalty (allegiance to appointing authority).

Alford’s characterization of Chad Mizelle documents the grammar: Mizelle “accepts party meetings and makes key decisions depending on whether the request or information comes from a MAGA friend.” The description is diagnosis—Mizelle processes information through native power grammar, where relationship credential is the relevant input.

The termination of Alford and Rinner was grammar enforcement—eliminating Type II carriers who could not translate their analysis into power-grammar outputs. Mike Davis’s value lies in his bilingual function: he speaks native power grammar with political leadership while translating corporate objectives into that grammar. He is a grammar intermediary, bridging corporate clients and DOJ political leadership.

Framework reference: Installed Cognitive Grammar, A Unifying Framework for Behavioral Explanation Across Music, Institutions, and Artificial Intelligence (Jan 2026)

II. Field-Geometry Reasoning: The Warped Enforcement Landscape

Field-Geometry Reasoning models the antitrust enforcement landscape as a field with curvature. The geodesic is the path of least resistance: the route a rational actor will take given the field’s shape. The central insight: pre-merger gatekeeping walls have been warped by political gravity. The statutory barriers remain formally intact, but the enforcement geodesic no longer runs through those walls.

CDT foresight simulation quantifies the constraint field:

Constraint Density (CD): 0.87 (High—multiple formal constraints exist)

Geodesic Availability Ratio (GAR), standard enforcement path: 0.05 (Near-zero—path is effectively non-viable)

Geodesic Availability Ratio (GAR), political-access path: 0.71 (High—clear, repeatable route)

Intent-Outcome Decoupling Index (IODI): 0.81 (Extreme—stated intent fails to predict outcome)

Structural Persistence Threshold (SPT): Exceeded (System stable absent external shock)

The Standard Geodesic (Blocked)

Through the standard enforcement pathway, no survivable geodesic exists. Each step encounters a veto point controlled by political leadership: career staff recommend investigation → political leadership overrides; Division prepares litigation → settlement authority sits above Division; staff refuse to sign deficient settlement → staff terminated. The GAR of 0.05 quantifies what the case record shows: the path is blocked not by legal change but by authority reallocation.

The Authority-Routing Geodesic (Open)

Through the Davis pathway, a clear downhill geodesic runs: corporation faces exposure → retain politically-connected intermediary → intermediary activates power grammar credentials → access to Mizelle/Blanche/Woodward → political leadership authorizes favorable outcome → career staff objections overridden. The GAR of 0.71 quantifies the pathway’s viability. Political gravity pulls decisions toward rapid closure and relationship validation.

Constraint curvature has steepened after closing, not before. The DOJ spokeswoman’s statement—”nothing precludes the department from taking an enforcement action in the future”—reveals the field geometry explicitly. Legal possibility persists downstream. Firms rationally internalize this: consummate first, manage enforcement later. The IODI of 0.81 confirms that stated enforcement intent systematically fails to predict outcomes when political routing activates.

Framework reference: Field-Geometry Reasoning, A Unifying Framework for Structural Explanation in Law, Economics and Artificial Intelligence (Jan 2026)

III. Predictive Institutional Economics Architecture: The Risk-Pricing Equilibrium

Predictive Institutional Economics Architecture predicts firm behavior once enforcement probability moves downstream. Firms rationally substitute political-authority access for evidentiary contest once the expected value calculation shifts.

CDT foresight simulation quantifies the market adaptation:

Enforcement Credibility (Ecred): 0.34 (Low and declining)

Demonstration Propagation Rate: High

Strategy Substitution Index (Access > Compliance): 0.76

Early-Consolidation EV Dominance: 0.83

Mike Davis as Risk-Pricing Intermediary

Mike Davis functions as a risk-pricing intermediary in the temporal-arbitrage equilibrium. His signal function indicates that the authority-routing geodesic is open. His pricing function (approximately $1 million in success fees for HPE) allows firms to calculate: cost of Davis engagement versus expected cost of prolonged evidentiary process. His translation function bridges native power grammar with corporate transactional grammar. His coordination function provides access to pre-built political networks, reducing corporate coordination costs.

Enforcement Credibility Decay

Ecred has entered a self-reinforcing decay spiral. Each successful bypass (HPE → Compass → AmEx GBT) further reduces perceived enforcement probability, which updates corporate CDTs, which increases bypass attempts, which produces more successful bypasses. The 2025 enforcement record quantifies the decay: DOJ and FTC sued to block three mergers versus six annually under the prior administration. The Strategy Substitution Index of 0.76 confirms that political-access investment now dominates legal compliance investment for large transactions.

Framework reference: Predictive Institutional Economics Architecture, The National Innovation Behavioral Economics, Strategic Behavioral Coordination, Cognitive Digital Twin Framework (Jan 2026)

IV. Case Study: HPE–Juniper ($14 Billion) — The Proof of Concept

The HPE–Juniper matter established the temporal-arbitrage pathway as viable. A merger that DOJ sued to block—alleging a 70%+ market duopoly—settled on narrow terms eleven days before trial. Career staff who objected were terminated. The transaction closed. CDT foresight simulation classifies the outcome as Close-first, settle-later with post-merger enforcement priced as cost.

A. Initial Enforcement Posture

DOJ sued to block HPE’s $14 billion acquisition of Juniper Networks in January 2025, alleging the merger would result in “two firms controlling over 70 percent” of the enterprise wireless networking market. AAG Gail Slater led the challenge. The government’s case was strong on the merits: clear market definition, high concentration, documented competitive effects.

B. Political-Authority Routing

HPE retained Mike Davis, Arthur Schwartz, Will Levi, and Nick Iarossi—none primarily antitrust specialists, all with Trump political connections. Davis took the engagement “as a personal challenge” after career enforcers questioned his involvement. The team received approximately $1 million in success fees. HPE also made job-creation commitments “not disclosed in court papers.”

C. Settlement and Grammar Enforcement

Eleven days before trial, DOJ proposed a settlement requiring HPE to divest its “Instant On” business—a market segment separate from the enterprise market at issue. Principal Deputy AAG Alford and Deputy AAG Rinner refused to sign. Both were terminated in late July 2025. Former FTC Chairman Kovacic called the dismissals “unprecedented.”

Alford publicly characterized the pattern as corruption in his August 2025 Aspen speech, naming Mizelle and Woodward as having “perverted justice.” He stated: “If you knew what I knew, you would hope so too... Someday I may have the opportunity to say more”—signaling willingness to testify under oath.

Sources: Dave Michaels, “Top Justice Department Antitrust Officials Fired Amid Internal Feud,” Wall Street Journal, July 29, 2025,; Dave Michaels, “Bondi Aides Corrupted Antitrust Enforcement, Ousted DOJ Official Says,” Wall Street Journal, August 18, 2025.

V. Case Study: Compass–Anywhere ($1.6 Billion) — Replication Confirmed

The Compass–Anywhere merger confirmed pathway replicability. CDT foresight simulation classifies the outcome as Clearance without investigation with coordination gains captured early and retrospective scrutiny likely via states or private suits.

A. Transaction and Market Context

Compass and Anywhere announced their $1.6 billion merger in September 2025, projecting at least nine months to clearance. The combined entity would control approximately 20% of national home-sales volume and exceed 30% in Chicago, New York, and San Francisco—above the 2023 guidelines’ presumptive illegality threshold. Anywhere’s portfolio includes Century 21, Coldwell Banker, and Sotheby’s International Realty.

B. Staff Recommendation and Override

AAG Slater recommended extended investigation. Compass retained Mike Davis. The company appealed directly to Deputy AG Blanche’s office, bypassing the Antitrust Division. Blanche’s office agreed. The deal closed in early January 2026—under four months, “at least nine months” ahead of the original timeline. The temporal arbitrage was explicit: Compass captured nine months of market position that extended investigation would have delayed.

C. Preserved Downstream Enforcement

A DOJ spokeswoman noted “nothing precludes the department from taking an enforcement action in the future if anticompetitive effects are found.” The statement confirms the temporal shift: enforcement possibility persists downstream. Compass accepted post-merger enforcement as a priced risk.

Source: Dave Michaels and Nicole Friedman, “Real-Estate Brokerages Avoided Merger Investigation After Justice Department Rift,” Wall Street Journal, January 9, 2026.

See also:

Washington’s SB 6091 and Private Real Estate Market Control (Jan 2026) assess market distortion of Compass-Anywhere platform leveraging private listings to harm competition and consumers.

Compass–Anywhere, When Scale Becomes Liability (Jan 2026) analyzed the merger as coordination-architecture shock using Chicago Law and Behavioral Economics.

How the Compass–Anywhere Merger Reshapes Broker Bargaining Power (Jan 2026) applied Lemley’s labor-antitrust framework to architectural monopsony through CRM lock-in, non-portable analytics, and clawback provisions.

Compass’s Technology Trap (Jan 2026) documented how IPO narrative became antitrust liability—SEC disclosures describing platform stickiness became admissions of exit barriers.

From Open Market to Private Governance (Dec 2025) commenting on the pre-merger Warren-Wyden letter, modeled coordination capture dynamics and predicted that structural intervention prior to consummation would be substantially more effective than post-hoc conduct remedies—a prediction now confirmed as the merger closed without challenge.

VI. Case Study: Live Nation–Ticketmaster — The Falsification Test

Live Nation–Ticketmaster differs from HPE and Compass in one critical respect: it is not a merger-review case but an active monopolization and conduct enforcement action. That distinction strengthens the analysis. Merger cases test ex-ante gatekeeping integrity. Monopolization cases test the system’s capacity for ex-post correction once harm is alleged and a record exists. If authority-routing influences even active conduct litigation, the regime shift cannot be confined to merger enforcement alone.

A. Existing Enforcement Posture

DOJ sued Live Nation in May 2024, alleging the company leveraged its dominant position—approximately 80% of major venue ticketing—to maintain an illegal monopoly and retaliate against competitors. Thirty state attorneys general joined as co-plaintiffs. The lawsuit seeks structural remedies including potential Ticketmaster divestiture.

B. Political-Access Strategy

President Trump issued an executive order in April 2025 on live entertainment practices, focused on scalpers rather than structural market power. Live Nation hired Mike Davis and added Richard Grenell to its board. The multi-vector political access strategy mirrors HPE’s approach.

C. CDT Foresight Simulation Prediction Bands

CDT foresight simulation assigns the following outcome probabilities:

Political resolution / weakened case: 55-65%

Full litigation with structural remedy: 25-35%

Hybrid conduct settlement: 40-50% (overlapping scenarios reflect correlated paths)

D. Falsification Conditions

Live Nation presents clear falsification conditions:

If the suit proceeds to structural remedies despite Davis’s involvement: The temporal-shift model is bounded to merger clearance.

If the suit is weakened (settled for behavioral remedies without structural change): The model partially generalizes.

If the suit is dropped: The model fully generalizes to conduct enforcement.

Sources: Dave Michaels and Annie Linskey, “MAGA Antitrust Agenda Under Siege by Lobbyists Close to Trump,” Wall Street Journal, August 6, 2025.

VII. Comparative Pattern and Systemic Analysis

A. Structural Recurrence

Across all three matters, identical structural elements recur: controversial on merits before Davis; career staff resistance; political-authority intervention; favorable defendant outcomes; preserved downstream enforcement. CDT foresight simulation confirms the pattern is stable (SPT Exceeded) and self-reinforcing (High Demonstration Propagation).

B. Mike Davis: Systemic Function Table

C. The Broader Access Network

Davis operates within a broader network: Brian Ballard (AmEx GBT, UnitedHealth, Thoma Bravo); Arthur Schwartz (HPE); Will Levi (HPE); Nick Iarossi (HPE); Richard Grenell (Live Nation board). The network creates redundancy, reducing single-point-of-failure risk in political routing.

VIII. Institutional Substitution and Remaining Constraints

As federal pre-merger gatekeeping weakens, enforcement load shifts to alternative institutions. CDT foresight simulation quantifies the substitution dynamics:

State Substitution Probability (SSP): 0.68-0.80

Median Post-Merger Lag (MPL): 12-26 months

Coalition Formation Probability (CFP): 0.60-0.78

Federal Re-entry Probability (FRP): 0.35-0.55 (catalyzed by state-built records)

A. State Attorneys General as High-Pressure Pockets

State attorneys general retain independent enforcement authority. CDT foresight simulation identifies likely high-pressure jurisdictions:

California: Large market, activist AG tradition, Compass-Anywhere concentration acute in San Francisco (30%+ share)

New York: Major market, aggressive enforcement history, Compass-Anywhere concentration acute in metro (30%+ share), Live Nation venue exposure

Multistate coalitions: Thirty states joined the Live Nation suit—enforcement can proceed even if DOJ withdraws

B. Tunney Act and Judicial Oversight

Judge Casey Pitts in San Jose retains Tunney Act oversight of the HPE-Juniper settlement. Four Senate Democrats requested additional disclosure. Alford signaled willingness to testify. The court can compel documentary discovery exposing the authority-routing pathway.

C. Senate Oversight

On September 5, 2025, ten Senate Democrats demanded document production including all Mike Davis communications regarding HPE-Juniper or Live Nation. Enforcement depends on Republican cooperation absent subpoena authority.

Source: Senate Judiciary Committee, Letter to Attorney General Bondi re Antitrust Politicization, September 5, 2025.

Conclusion

Antitrust enforcement has not vanished; it has slipped in time. That shift rewards firms that understand institutional grammar and constraint geometry. Mike Davis’s role makes explicit what sophisticated actors already assume: clearance marks a phase change, not vindication.

CDT foresight simulation confirms a stable temporal-arbitrage regime: Grammar Dominance at 0.82, GAR (standard path) at 0.05 versus GAR (political path) at 0.71, Ecred at 0.34 and declining, Strategy Substitution Index at 0.76. The equilibrium favors rapid consolidation, normalizes political-access investment, and substitutes courts and state attorneys general for weakened federal gatekeeping.

Structural persistence: The configuration exceeds the threshold for self-correction. CDT foresight simulation shows Institutional Update Velocity at 0.22 and Legacy Inertia Coefficient at 0.79. Career staff objections failed. Internal dissent was punished. The pattern will self-reproduce absent geometry-altering intervention.

Remaining leverage: Tunney Act judicial authority; state AG enforcement (SSP 0.68-0.80); post-merger enforcement by future administrations; private litigation.

Falsification test: Live Nation. CDT foresight simulation assigns 55-65% to political resolution, 25-35% to structural remedy. If structural remedy proceeds despite Davis’s involvement, the model is bounded. If weakened or dropped, the pattern generalizes to conduct enforcement.

The foresight predictions are falsifiable and time-bounded. If within the current administration DOJ blocks a major merger despite access lobbying, or a court rejects a settlement citing political interference, or a post-merger action imposes structural relief piercing the access defense, the simulation fails. Until then, the CDT flows converge: authority-routing dominates, legal constraints fail to bind ex ante, and firms adapt rationally. Post-merger conflict will replace prevention as the system’s organizing principle.

Appendix: CDT Foresight Simulation Technical Summary

Flow Order: CSI gate → ICG → FGR → PIEA→ ICP → (optional) Regulatory Vision

Targets: DOJ Antitrust Division (career staff layer); DOJ political leadership (DAG/AG authority-routing layer); Corporate defendants: HPE–Juniper, Compass–Anywhere, Live Nation–Ticketmaster

Core Metrics Summary

Live Nation Prediction Bands

Political resolution / weakened case: 55-65%

Full litigation with structural remedy: 25-35%

Hybrid conduct settlement: 40-50%

Falsification Conditions

The foresight fails if any occur within the current administration:

DOJ blocks or fully litigates a major merger despite access lobbying

A court rejects a settlement citing political interference

A post-merger action imposes structural relief that pierces the access defense